Coming into the first quarter 2024, fixed income markets expected easier monetary policy would quell fears of pending maturity walls in commercial real estate and high yield corporates following the strong rally in the fourth quarter 2023. Banking challenges were assumed to be largely in the rear view and a dovish pivot from the Fed propelled investor optimism which compressed corporate spreads towards their historical tights. The notion of “higher for longer” was just about retired with markets priced for six quarter-point cuts to the Federal Funds rate beginning as early as March. However, a resilient U.S. economy and “one-off” spikes in inflation measured by CPI continued to signal underlying economic strength. Fourth quarter GDP printed at 3.3% versus an expectation of 2% coupled with an upside surprise in personal consumption as well—registering 3.3% against an expected 3.0%. On the employment front, payrolls remain strong with sufficient levels of job growth (353k gains in January and 275k gains in February). On March 29th, PCE, the Fed’s preferred measure for inflation, was issued for the 12-month period ending in February showing an increase of 2.5%, slightly better than the 12-month increase of 2.4% ending in January, but still directionally on trend. Despite interest rate volatility trending lower, markets remained volatile around data releases. Investors’ assessments of the data dependency of the Fed and the odds of achieving a soft landing influenced sizeable moves in interest rates markets on the aforementioned trading days. Following the strength in data, interest rates crept higher in the first quarter and the narrative of higher rates resurfaced once again. As of the March Federal Reserve Open Market Committee (FOMC) meeting in which Chair Powell leaned dovish, market pricing adjusted inline with the Fed’s Statement of Economic Projections (SEP) of three cuts to the Fed Funds rate (from six, according to federal funds futures) with easing expected as soon as the June 2024 FOMC meeting.1

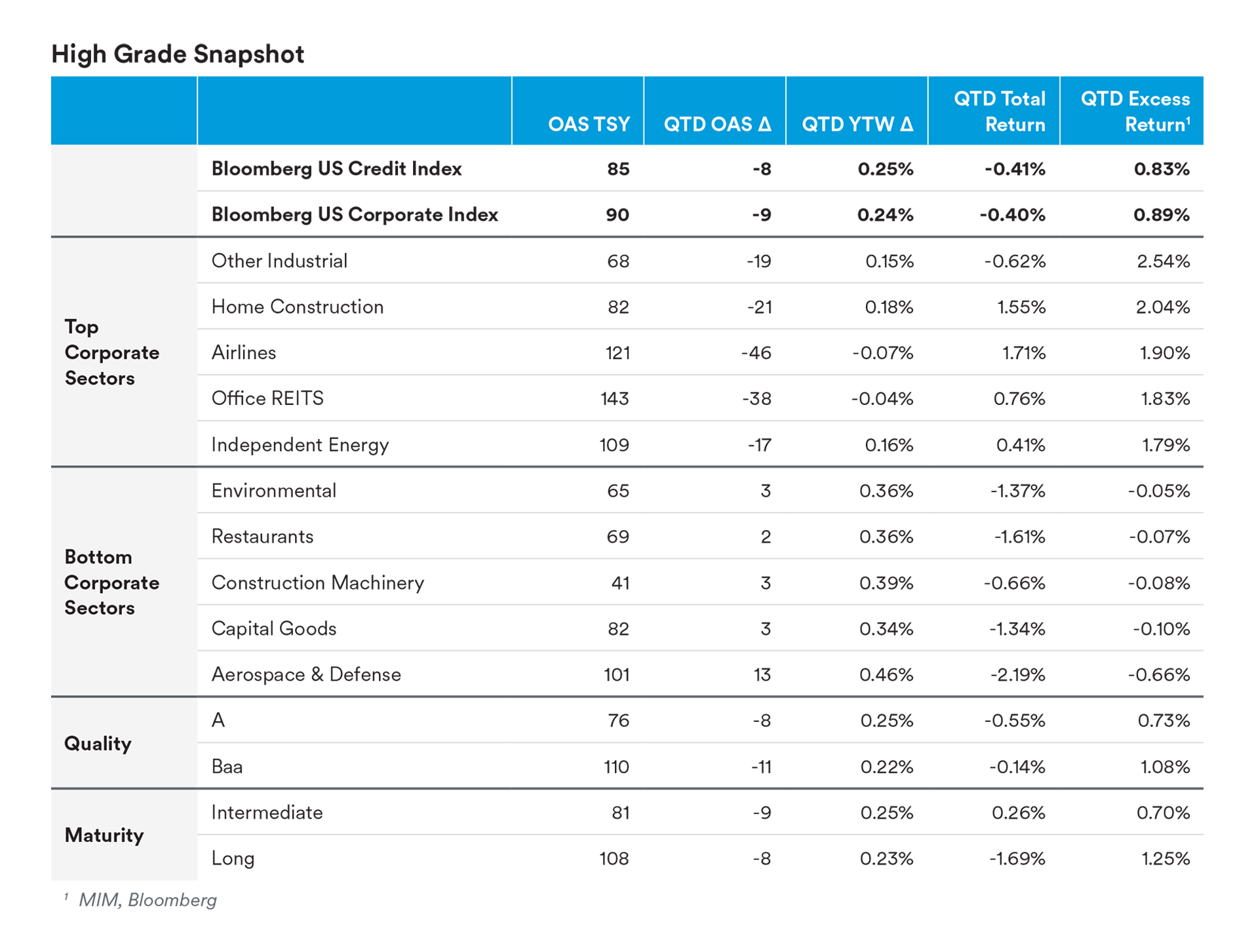

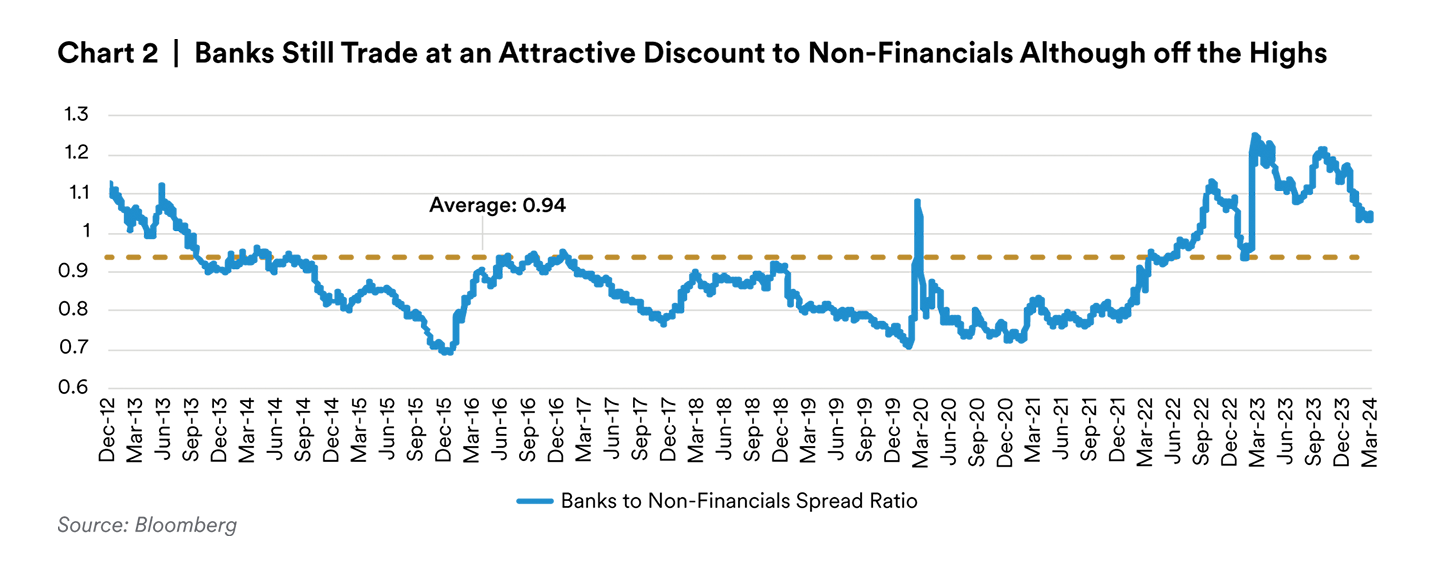

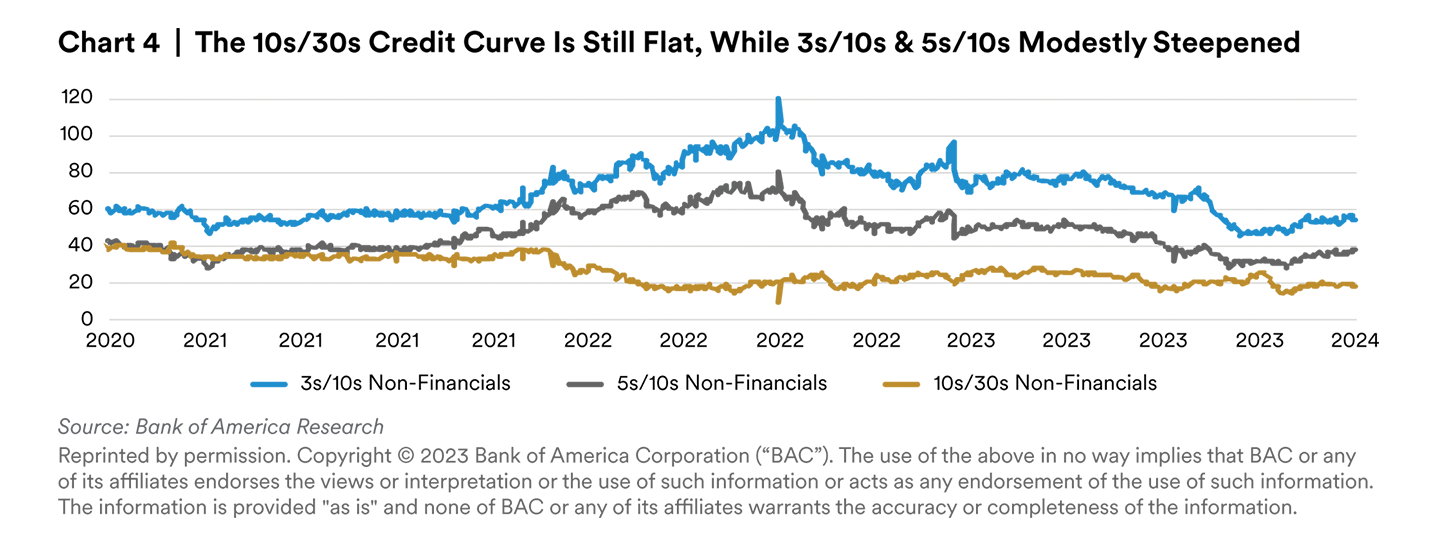

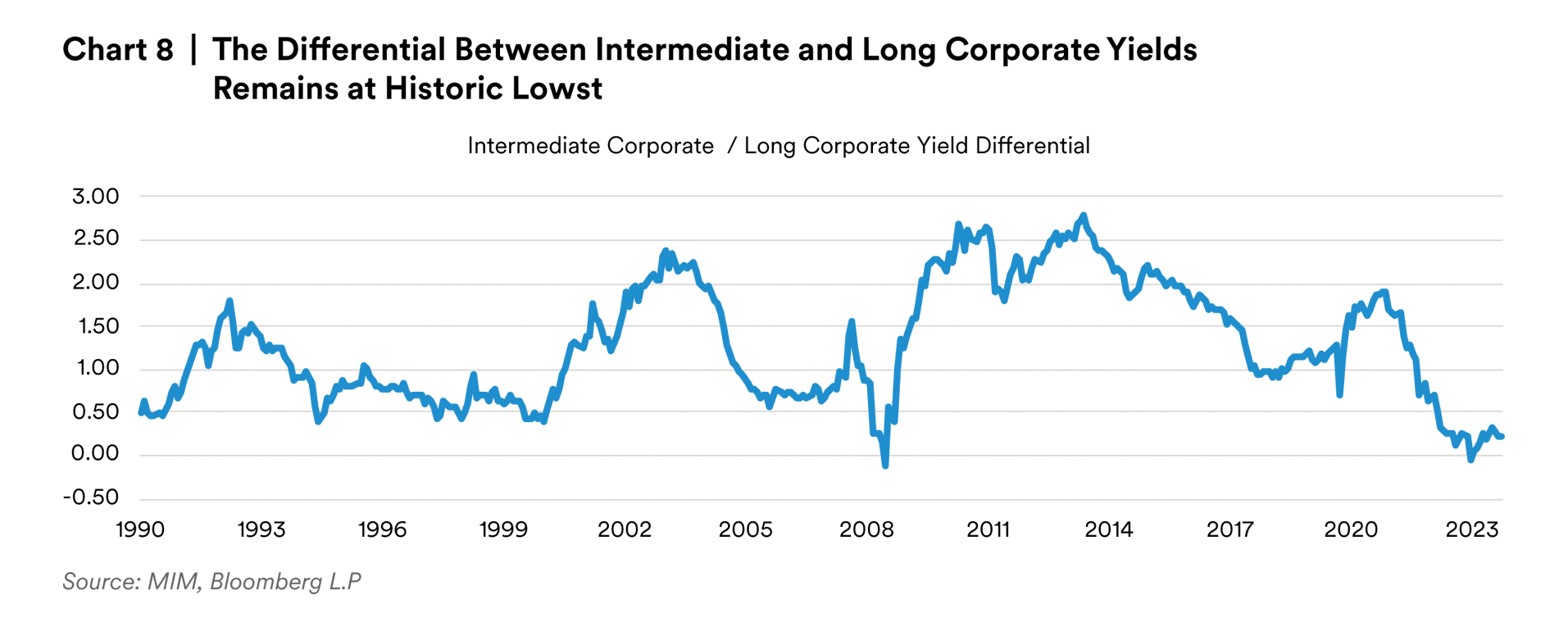

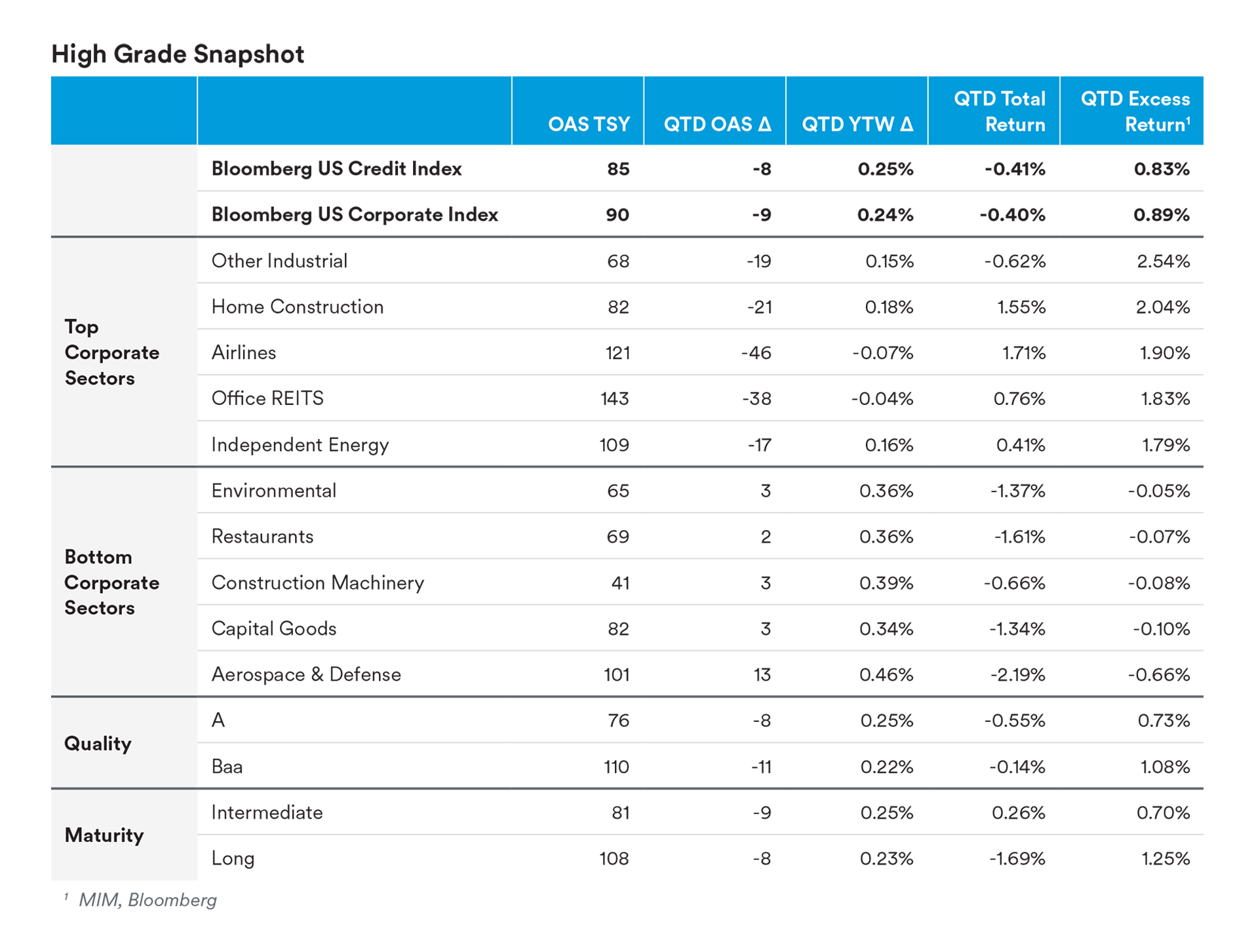

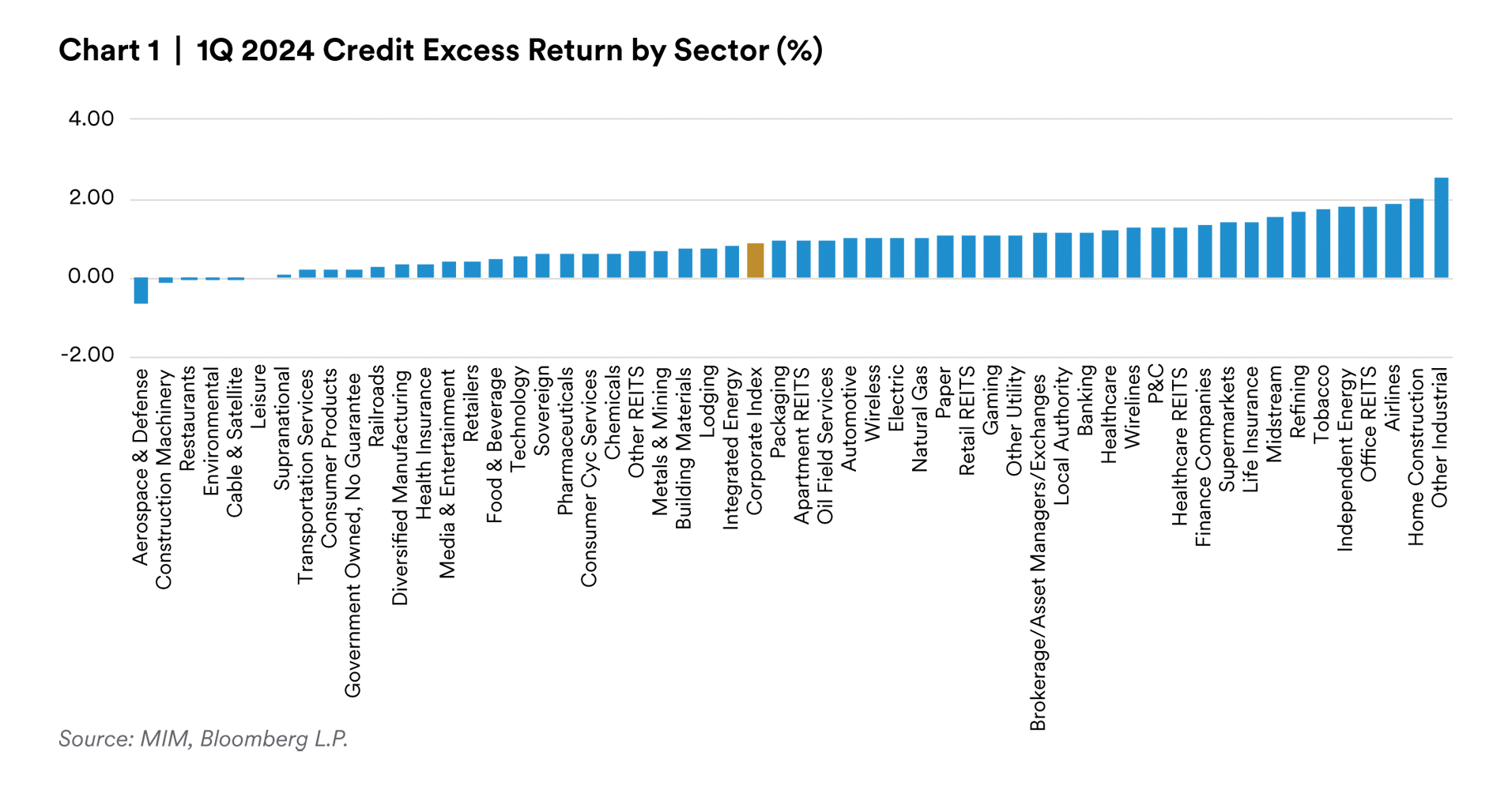

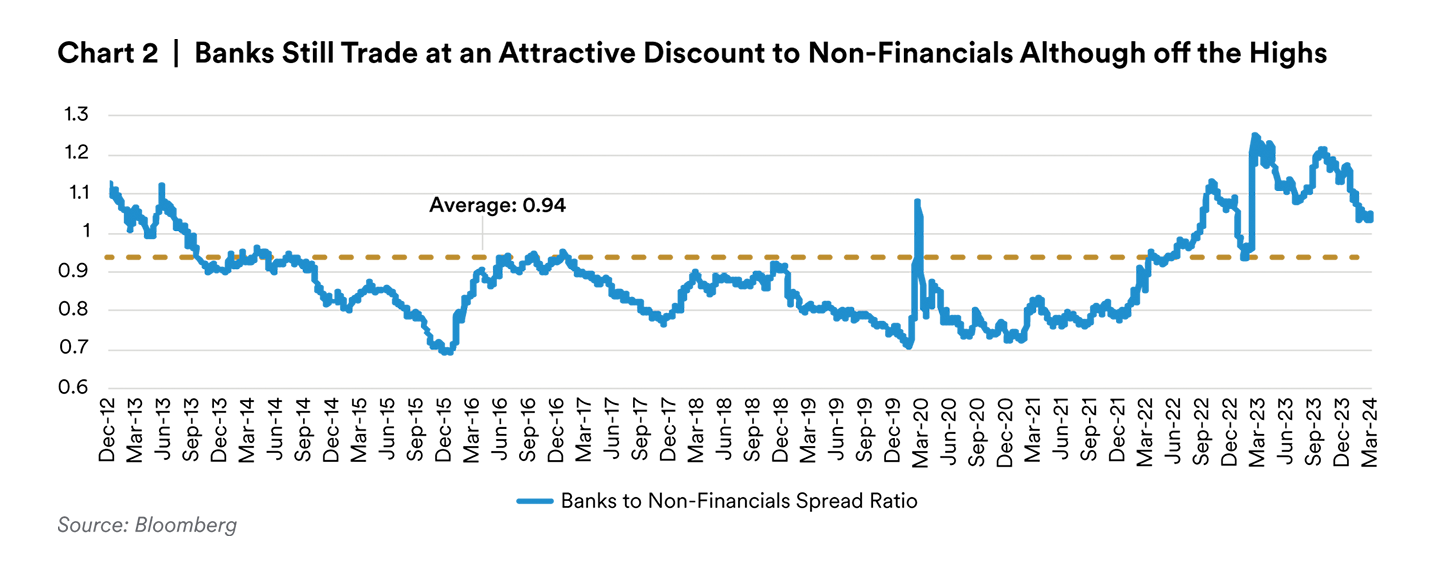

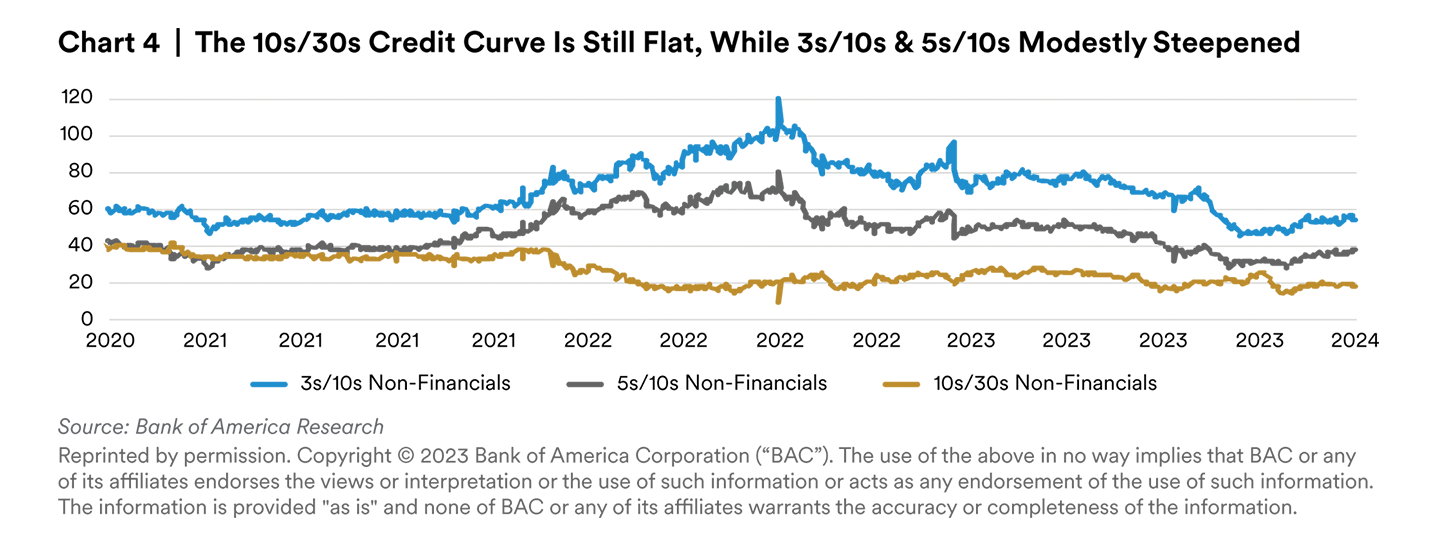

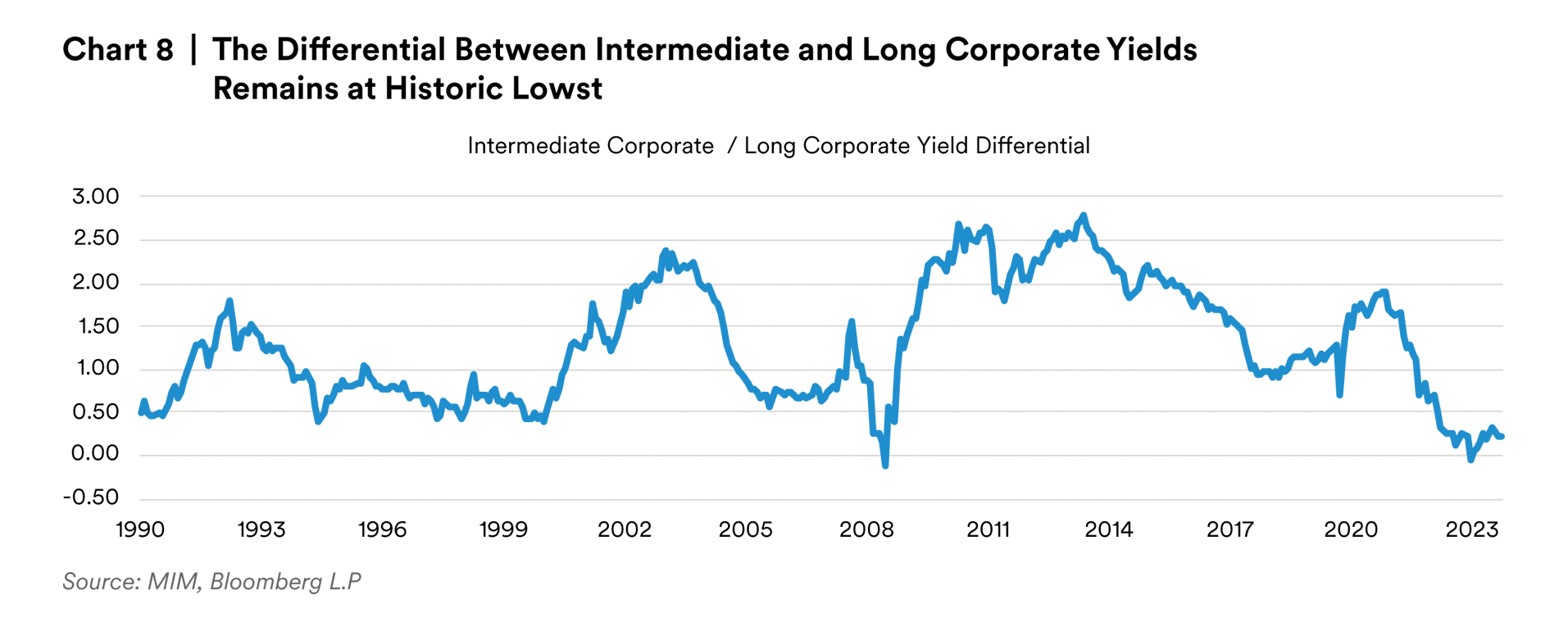

The U.S. 10-Year yield climbed as high as 45 basis points since the start of the year and remains above 4.20% while the 2-Year yield touched 4.73% in mid March, 48 basis points above the level from the start of the year. The 2s10s curve steepened to -16 basis points from -39 basis points in January before retreating to -42 basis points by the end of March.1 The Bloomberg US Credit Index struggled in January and February losing 1.62% with rates pushing higher, but with a rate rally to start March, the Credit Index gained 1.23% partially offsetting the weak start.1 Conversely, positive excess returns of 0.40% in January were only marginally pulled lower in February (-0.06% excess return) closing the first quarter 0.83% over duration matched treasuries.1 In the first quarter of 2024, the Bloomberg Corporate Index option adjusted spread (OAS) peaked on January 3 at 105 basis points, pressured wider by robust new issuance only to grind tighter through the quarter reaching as narrow as 88 basis points. The Corporate OAS closed the quarter at 0.90%, well below it’s 10-year average of 1.24%. 5s10s non-financial corporate credit curves modestly steepened while 10s30s flattened.1 The short-dated 3s5s banking curve flattened by a lesser degree. Overall at the index level, spreads on 10-year non-financials were marginally unchanged while financials tightened by 11 basis points.2

Following the most recent earnings cycle, broad corporate fundamentals remained resilient with some mixed results for both operating performance and credit metrics. Credit metric deterioration was more evident in higher quality AA and A credits rather than lower quality BBBs given the incentives to remain an investment grade issuer. Across sectors, energy and related sectors weighed on fundamentals. For example, year-over- year EBITDA was up just 40 basis points across the Bloomberg Corporate Index, but ex-energy that figure was a positive 4.3%. The gross leverage ratios change quarter-over-quarter was roughly flat while the coverage ratio deteriorated by three-tenths a percent. Outside of the Energy sectors, EBITDA declined the most in the Pharmaceuticals sector led by Pfizer (-$27bn y/y). Conversely, NextEra Energy Inc., a Utility issuer, saw a 45% EBITDA increase year-over-year. At the sector level, Pharmaceuticals saw the largest y-o-y change in leverage which can be attributed to the Pfizer and Amgen debt issues this year while Diversified Media captured some of the largest y-o-y decrease in leverage attributable to Warner Bros Discovery.1

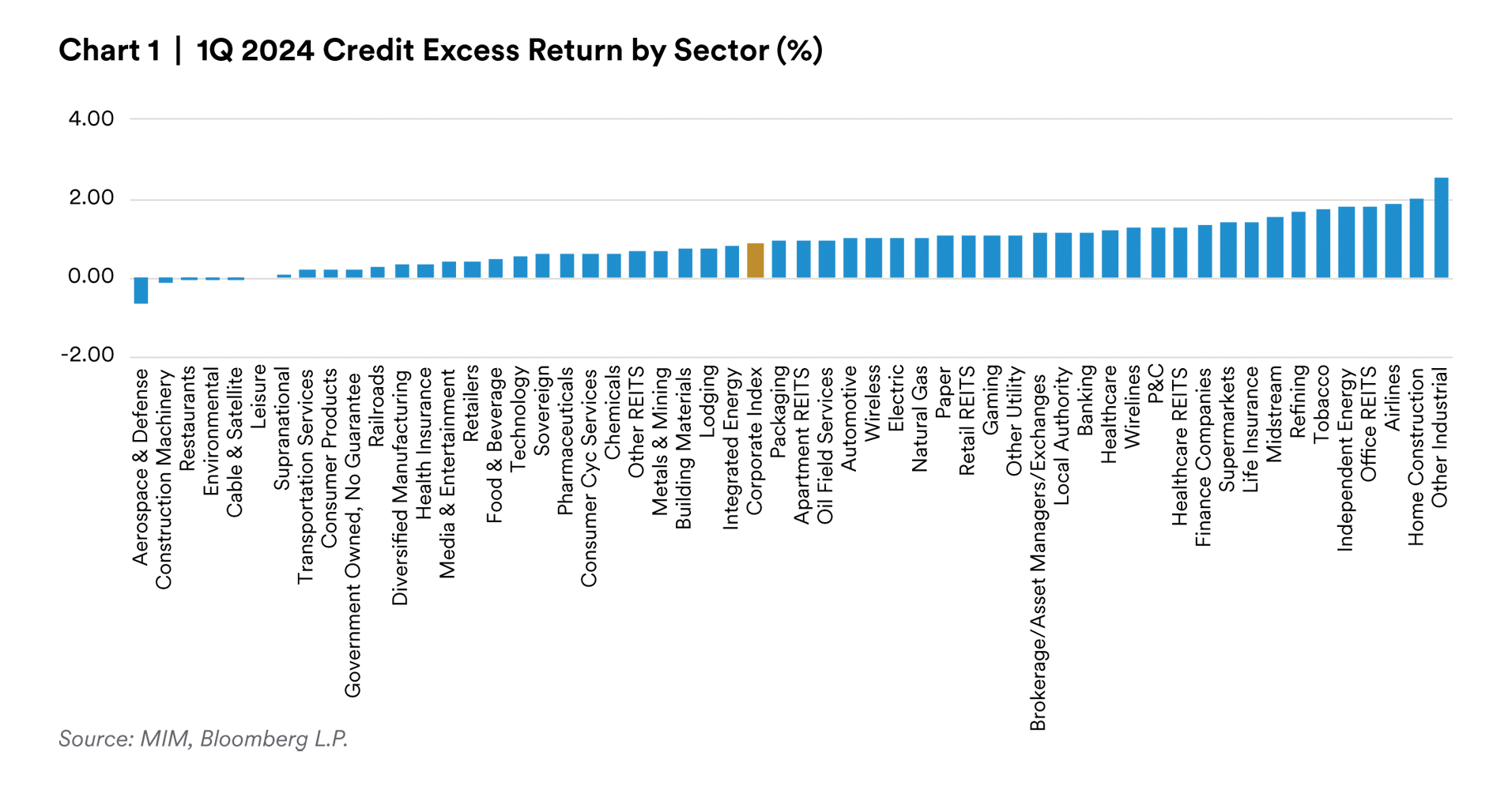

Over the quarter, the Corporate Index returned 89 basis points above duration matched treasuries. However, the move higher in rates over the quarter dragged on Fixed Income returns over the period. In credit, lower quality (BBB, 1.08% excess) outpaced single A (0.73% excess) delivering another 35 basis points in additional excess return over the higher quality components of the index.1 Within Home Construction, MDC Holdings was the main contributor following news of being acquired by Sekisui House Ltd. American Airlines, JetBlue and United Airlines helped boost the performance in the Airlines sector in spite of the negative moves from Boeing within Aerospace & Defense as the conglomerate deals with quality control issues in production following a series of failures in their Max plane. Integrated Energy traded better as the price of oil climbed over the quarter. Away from idiosyncratic stories, a large portion of the move in spreads was attributable to the aforementioned strong technical backdrop with robust demand from investors chasing the historically attractive all-in yields in Investment Grade Credit. Overall, we continue to believe spreads at these levels are not reflective of the looming global risks that could disrupt credit markets. Whether it is the wars in Gaza or Ukraine, escalating tensions amongst global powers, sanctions, or global recessionary fears in Germany, United Kingdom or Japan, valuations are stretched with corporate spreads not far off historical tights.

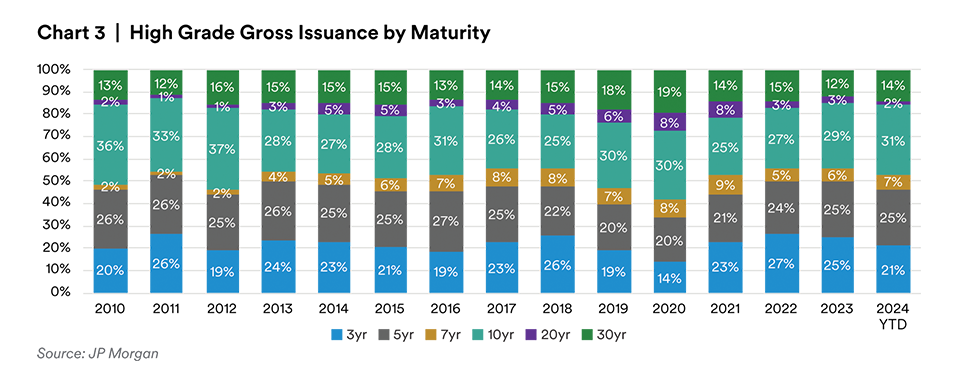

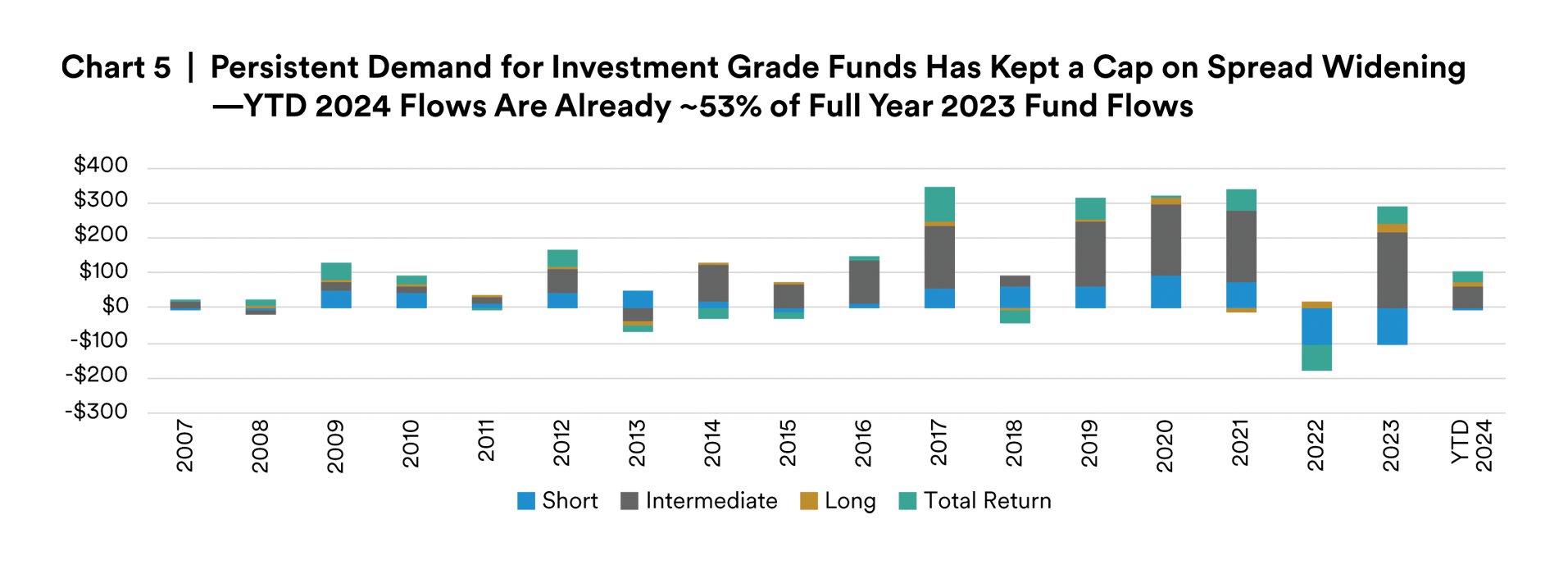

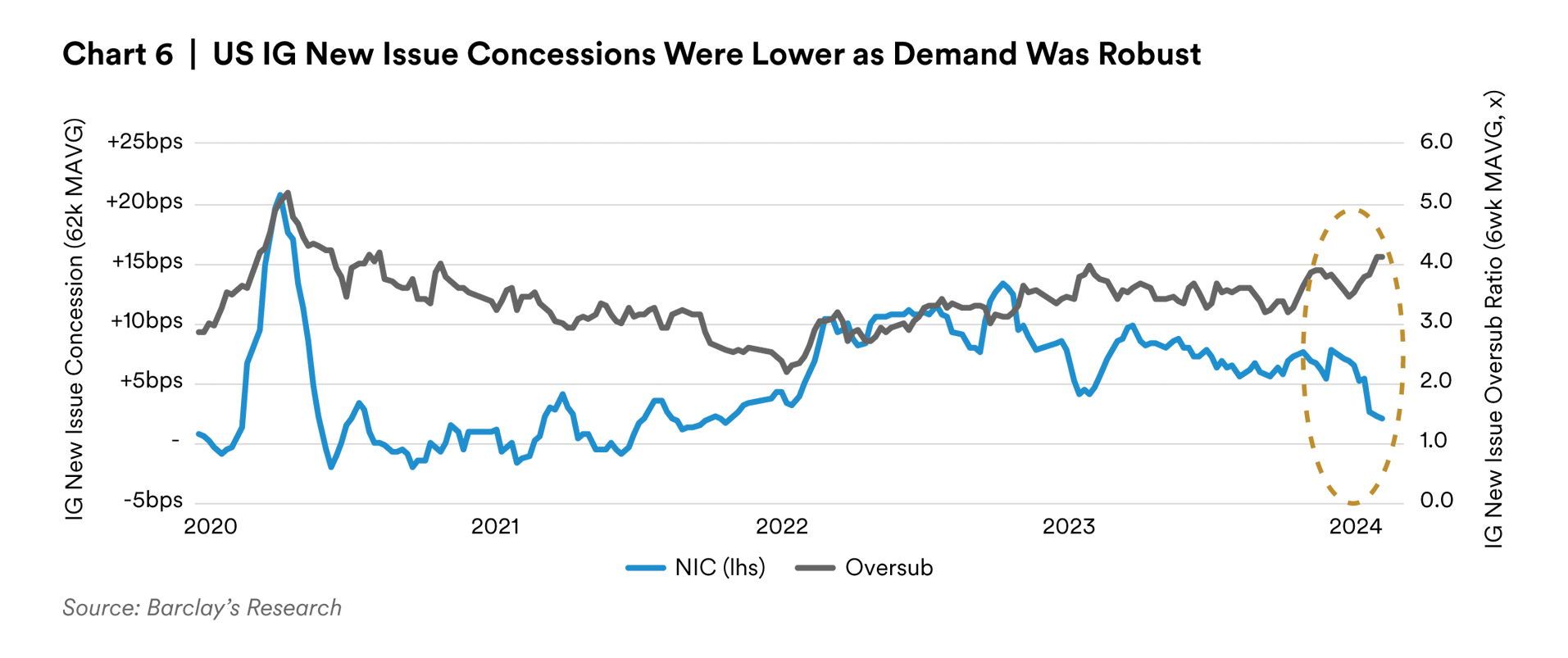

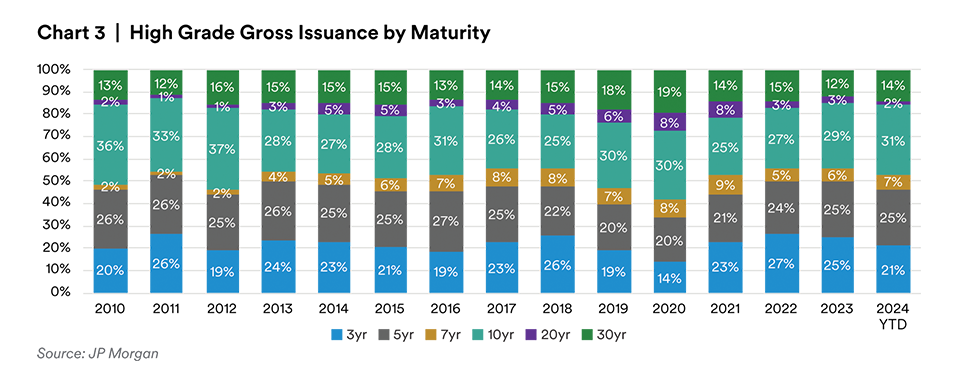

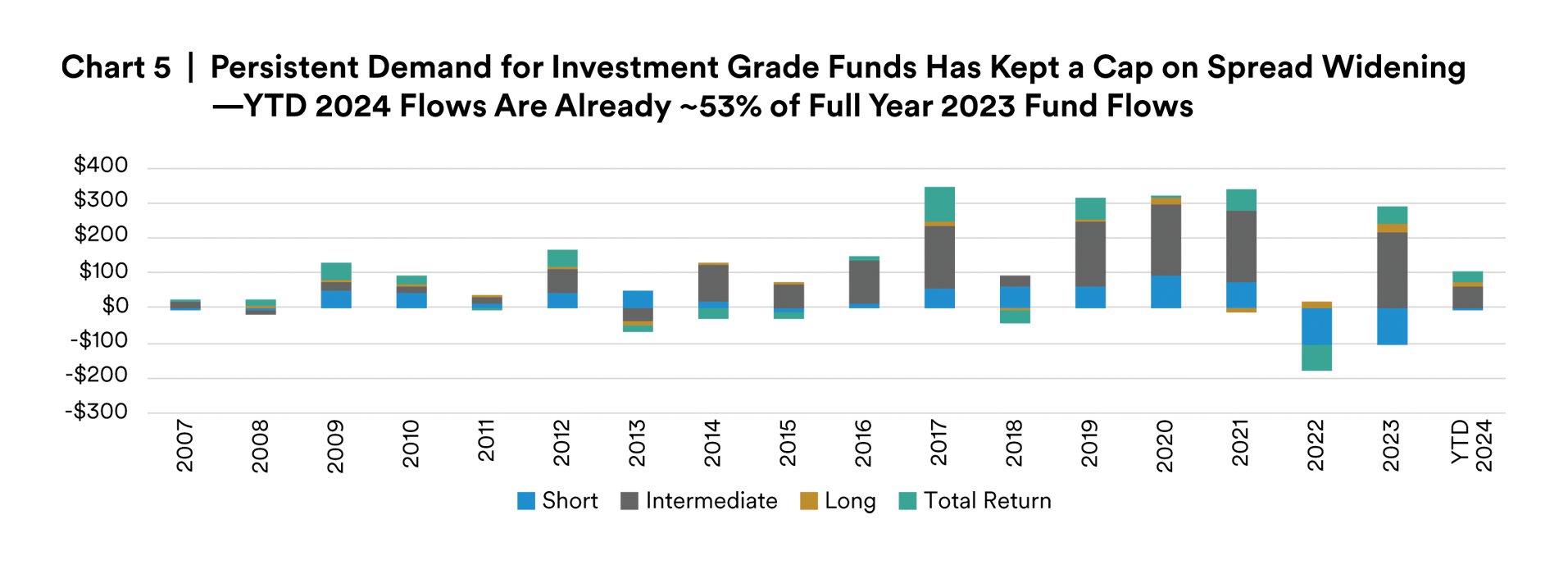

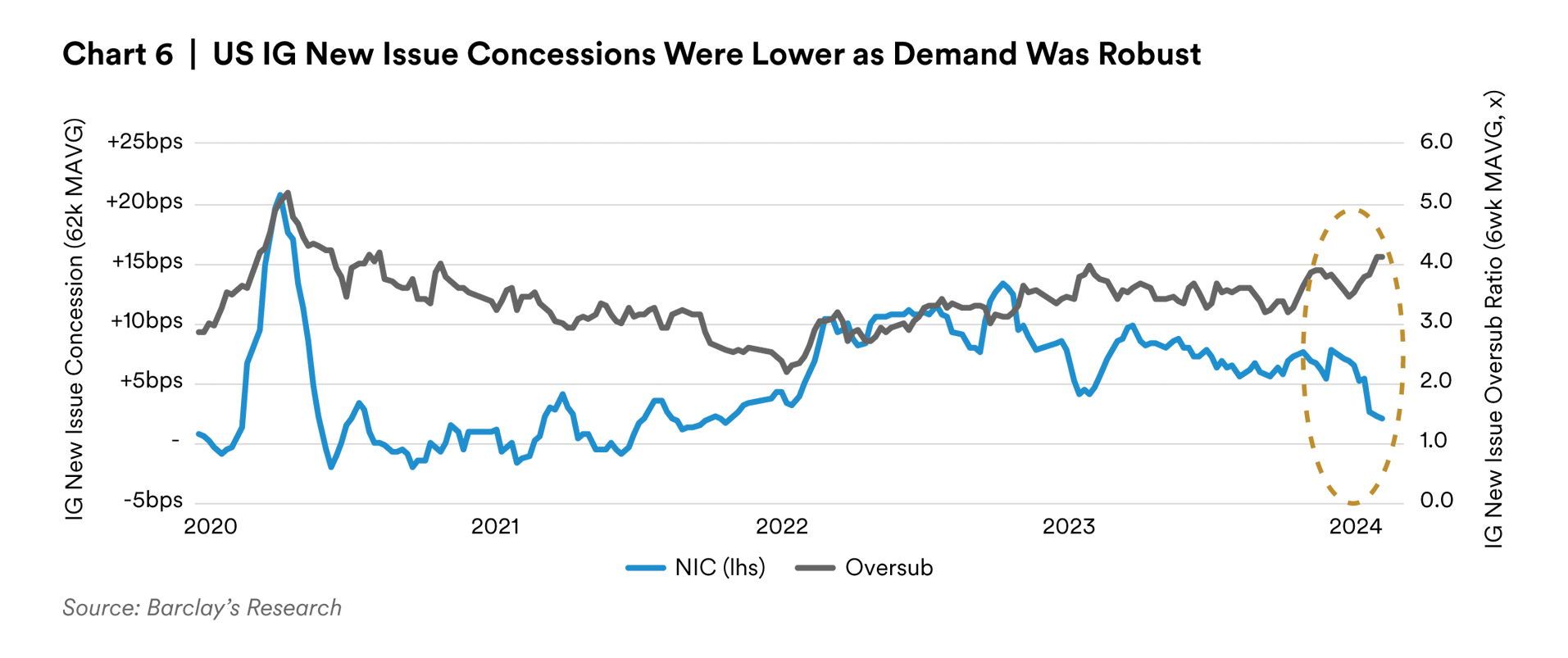

US Corporate supply got off to a hot start in the first quarter. January printed $194 billion in High Grade issuance, followed by a robust February with $196bn and $141bn in March bringing the total to $530.4bn through the first quarter. This figure is a 32% increase relative to the prior 5-year average first quarter issuance. In our view, new-issue concessions were rich and the compensation to extend out the curve was largely squeezed on several of the deals given the interest in the asset class. Across non-financials, Healthcare/Pharma ($73bn) and Utilities ($53bn) were the largest issuing sectors. Within Financials, the largest issuing sector was Yankee Banks ($91bn). M&A related issuance was also a large part of the January and February issuance, slowing down slightly in March. Notable M&A related issues were AbbVie Inc’s $15bn deal, Bristol-Myers Squibb Co bringing $13bn, UnitedHealth’s $6bn offering in March and BAE Systems offering of $4.8bn. Thematically, 2024 largely carried on a technical imbalance we witnessed in the previous year with supply generally biased towards shorter maturities. However, long-end new issues was larger in February and March, accounting for 14% of first quarter 2024 supply. With respect to performance, spreads leaked wider on high volume days but persistent demand capped any further spread widening. While there was an uptick in issuance out the curve (Maturity > 10+ years), strong demand for fixed income across the curve was reinforced by positive retail fund flows in addition to a strong institutional demand base coming from the Asian markets. We would be remiss to not point out that of the current composition in the Corporate index, longer maturity bonds now comprise closer to 34% relative to a pre-covid 30% composition. The change in composition is due to extension of debt in the era of low interest rates, specifically post-covid 2020-2021, and with large ETF flows as of late, the dynamic adds to the demand side of the equation in longer-dated corporates.

Outlook:

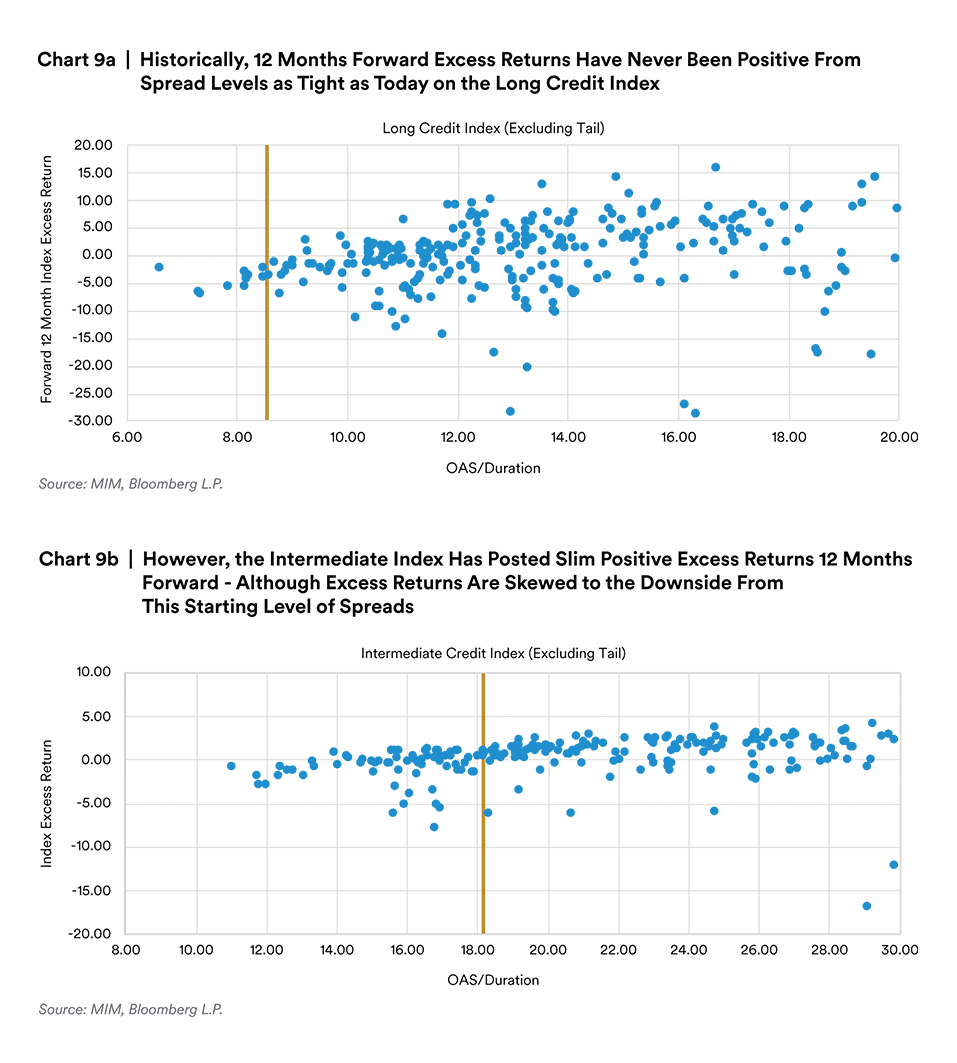

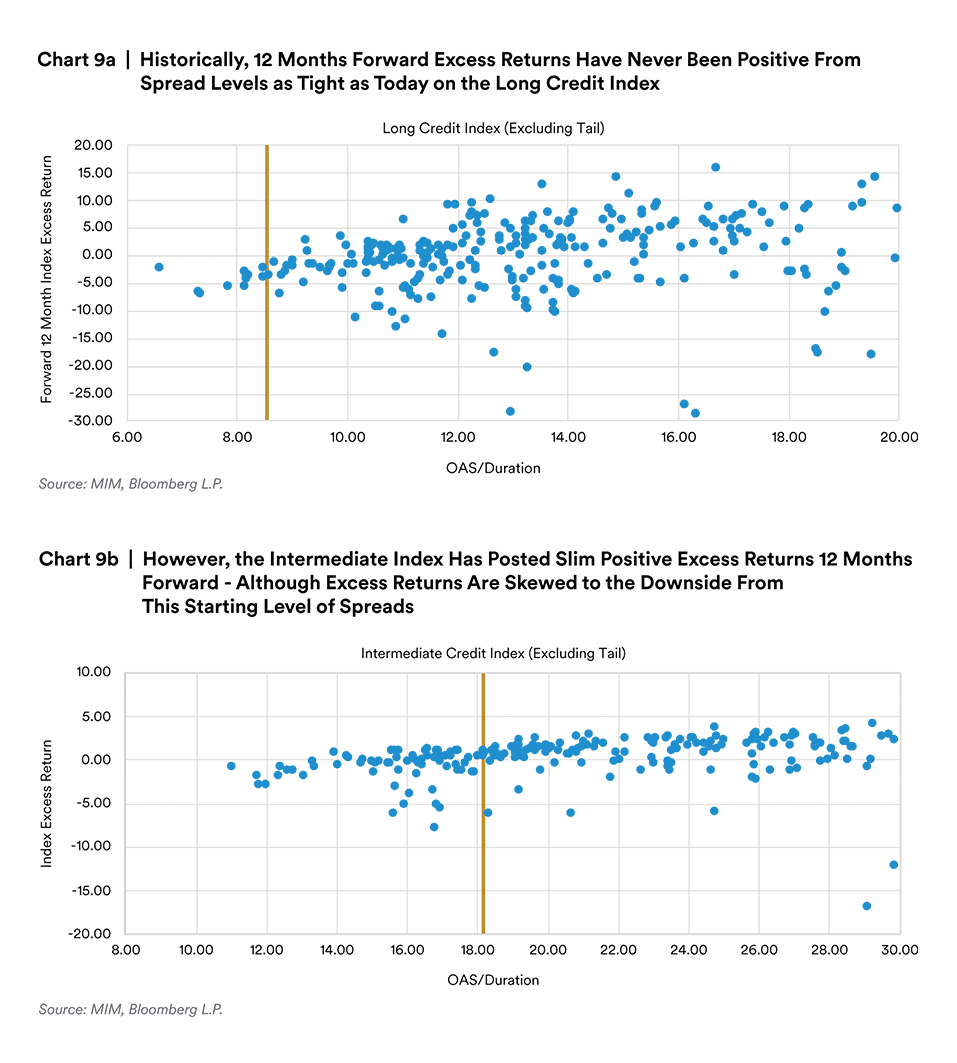

After spending much of 2023 lamenting a spread environment that was too tight compared to the risks on the horizon, the start of 2024 brought more of the same. The overwhelming technical support from yield sensitive buyers was matched with an uptick of issuance to start the year which mitigated the vacuum-like tightening of 4Q23. Nevertheless, spreads moved tighter and credit curves remain historically flat. The investment grade market continues, in or view, to offer attractive yields, but spreads at or near multidecade tights fail to account for even the best economic outcomes moving forward.

We have underestimated the magnitude of liquidity in the post-pandemic economy, but continue to believe high real yields will weigh on economic activity over time. Record borrowing at near zero yields and mountains of stimulus have dampened the effect of restrictive monetary policy. This could spell higher yields for longer than the market previously anticipated, and issuance is up year-over-year as companies come to the realization that long term financing may be as good as it gets for some time. We continue to believe this market is priced to perfection, allowing for no hiccups along the much ballyhooed path to a soft landing. History has proven time and time again that such outcomes are difficult to achieve. We see numerous potential pot holes, but sticky inflation, elevated maturity walls, and geopolitical risks are just a few that have our attention.

We are usually reluctant to make direct comparisons to prior cycles, especially given the size and diversity of the universe today, but current spread action echoes the high yield and tight spread years of 2004 to 2006 that amounted to very muted excess returns. Adjusted for duration and quality, current spreads are even tighter than the 2004-2006 average. While the irrational spread environment we find ourselves in has certainly lasted longer than we expected, we acknowledge the market could very well be in an early innings stretch of low spread volatility. Even so, we will continue to carry a Treasury allocation in anticipation of wider spreads because the tail risks are not reflected in current spread levels. We believe this past quarter exhibits the magnitude that a yield advantage coupled with solid security selection can offset conservative positioning and allow for alpha generation until a more robust opportunity set presents itself. Our move from credit into Treasuries was too early and continues to be wrong – but we will continue to lean on our active management to squeeze what little value exists in today’s market while simultaneously repositioning the portfolio for a turn in the credit cycle.

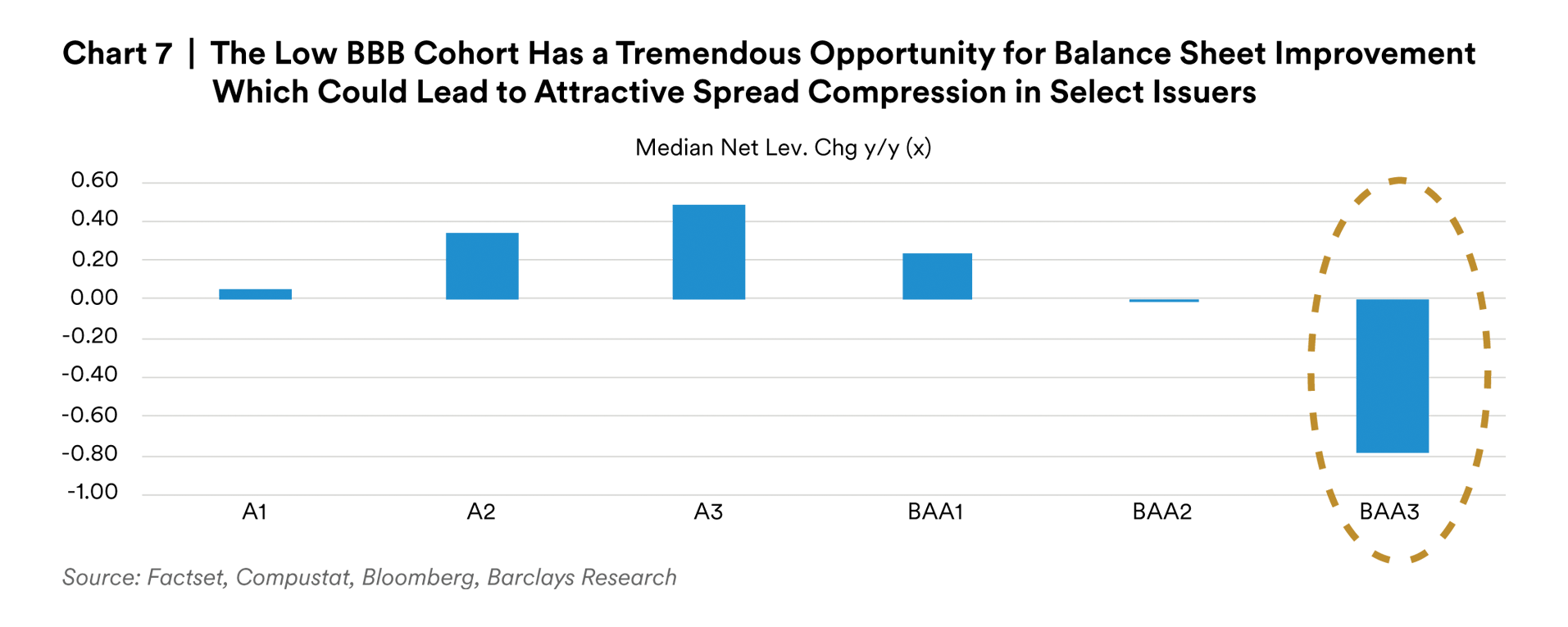

The marginal buyer of investment grade credit is treating the asset class like a commodity. As investors who pride ourselves on security selection, finding value in a market that is both historically tight and compressed is like drawing blood from a stone. Much of our portfolio repositioning is thematically focused on defensive trades at levels we believe only exist due to the compressed spread environment. Whether it be from cyclical to noncyclical credits, repositioning into more attractive parts of the curve, or moving from high to low dollar bonds at minimal spread gives, technical demand for yield has pushed spread relationships to levels that would not persist in a normal credit differentiating market and we believe over time will bear fruit. Right now, fundamentals simply do not matter so long as they warrant an investment grade rating.

For those portfolios that allow for “plus” sector exposure, high yield offers little value relative to higher rated peers and by no means reflects the risk of rising defaults moving forward, which is driving us to continue to whittle down our exposure. Emerging market debt offers a unique relative value opportunity in an otherwise dull spread environment, although we are wary of how the asset class might perform in a risk off market and so our ideas there have been more tactical in nature.

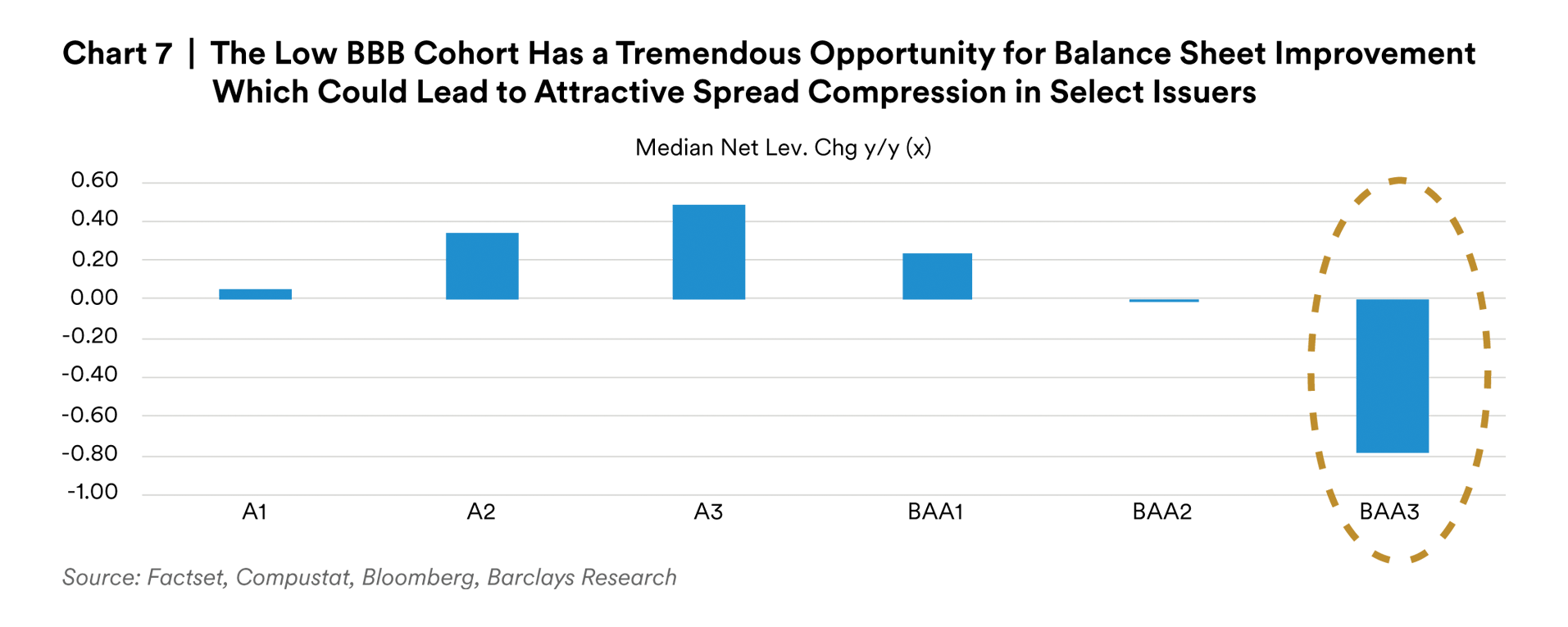

Our playbook is largely consistent with previous quarters. Our yield advantage in portfolios continues to buttressed by high quality front end corporates. We have opportunistically added longer end exposure during temporary periods of curve steepening, but generically continue to favor the intermediate part of the curve where the breakevens are far more attractive. We continue to upgrade the liquidity of our holdings, taking advantage of a collapse in liquidity premiums which will better position the portfolios for a correction in spreads. These higher quality biases are augmented by select overweights in low BBB credits where the fundamentals are supportive of outsized spread compression. Absent a Q4 2023-esque rally, we believe the portfolios are well positioned to continue to generate alpha without taking outsized risks.

Endnotes

1 Bloomberg

2 Bank of America Merrill Lynch

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered 8th Floor, 1 Angel Lane, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined in the UK under the retained EU law version of the Markets in Financial Instruments Directive (2014/65/EU)

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited.