Deep Heritage of U.K. Social Housing

The history of affordable housing in the U.K. dates back at least to 1919, when initiatives to provide decent living conditions for troops returning from WWI led to the creation of government-sponsored rental units known as council housing. The construction of council houses accelerated dramatically post-WWII, spurred by the need to replace housing stock destroyed by the Blitz.4

However, “social housing” as it is known today really came into existence in the 1980s, as government policies shifted the development of affordable rental units away from local councils toward housing associations, most of which are now private entities.5 Although social housing in the U.K. continues to enjoy some form of government subsidies, most owners of such housing are so-called Private Registered Providers (PRPs). PRPs mostly consist of not-for-profit entities, although a number of for-profit entities are also present in the sector. In October 2021 it was reported that the social rental housing sector consists of 4.1 million homes, or 17% of all residential dwellings in the country.6 PRPs accounted for 2.5 million homes or 61% of the social housing sector, with local authorities being responsible for the remaining 39%.7

The bulk of the financing for U.K. social housing – approximately 70% – comes from private sources.8 Debt funding accounts for the majority of capital raised by PRPs, although specialist REITs have brought public equity into the sector. There is also some private equity activity, although this capital source is still in its infancy.9 Investors often find it preferable to invest in projects sponsored by not-for-profit entities, as they do not have the same incentive to pull cash out of a project to boost their returns.

Infrastructure-Like Characteristics

For those investors considering where social housing might fit into their portfolios, MIM believes it should be viewed as being more akin to an infrastructure investment, rather than real estate. Like infrastructure, social housing is an essential service, regulated and supported by government authorities. The long (25- 30 year) duration of social housing bonds, as well as their cash flow characteristics, are also similar to infrastructure investments. Depending on the business model of the PRP or REIT, the issuer may also benefit from contracted cash flows, as a result of long term leases with local authorities. Leverage for social housing bonds is typically modest, with debt-to-asset equity ratios near 50% and strong interest coverage.10 As noted earlier, issuers of social housing bonds typically have a credit rating equivalent to single A. The risk of default can also be mitigated by the fact that regulators can intervene to provide financial assistance or effect changes in management in cases of financial stress.

Social housing’s appeal as an investment is also due in part to the predictable rent structure and overall supervision mandated by regulatory entities. The system of annual rent adjustments for regulated housing units ensures that rents remain affordable for tenants while still providing the potential for attractive returns for owners. From 1997-2020, for example, social rents increased by an average of 3.3% annually, although currently the rent adjustment is set at CPI + 1% for the next five years.11 Additionally, the Regulator of Social Housing provides an ongoing assessment of registered housing providers and rates them in terms of governance and financial viability.

Potential for Portfolio Diversification

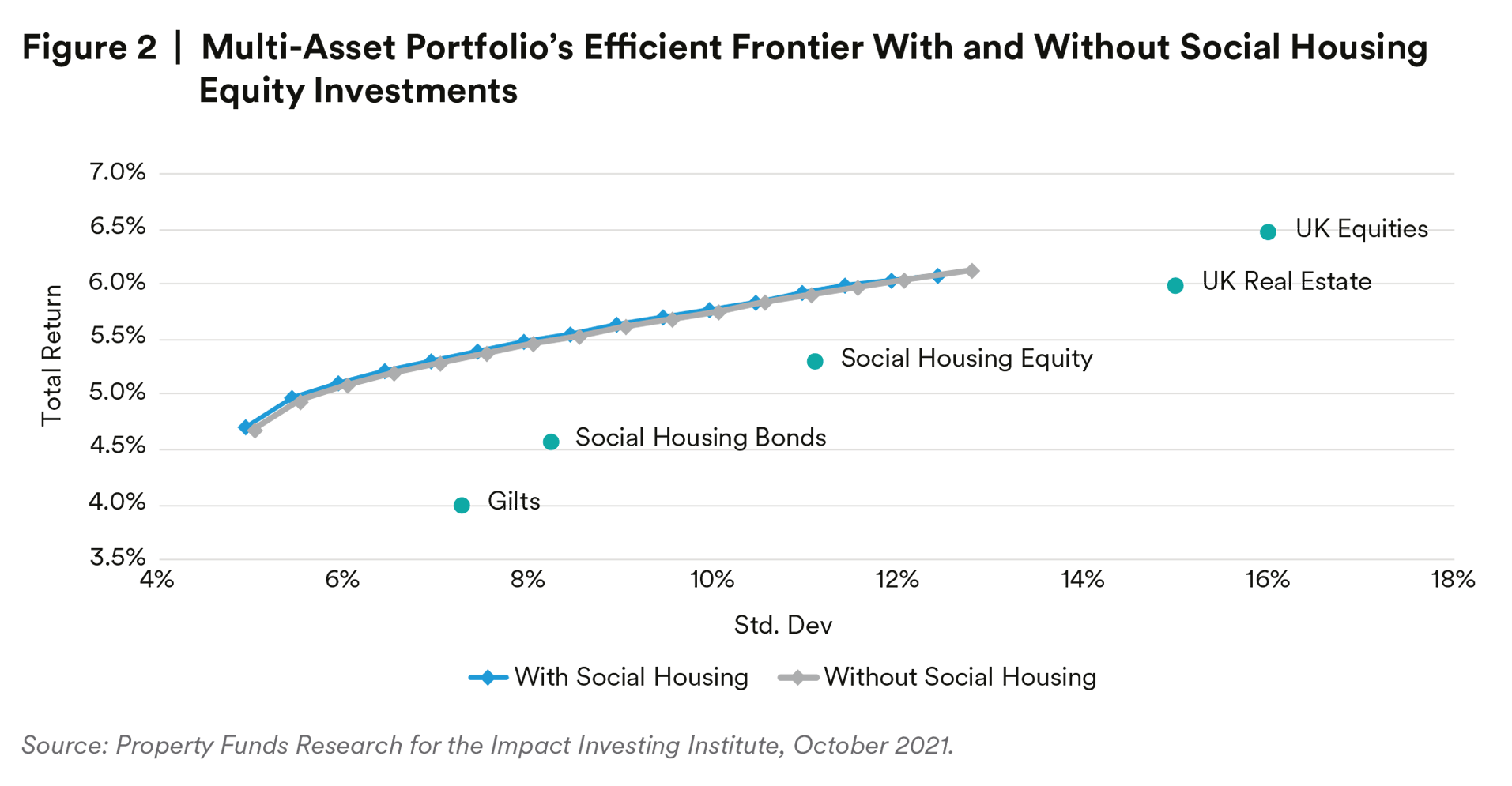

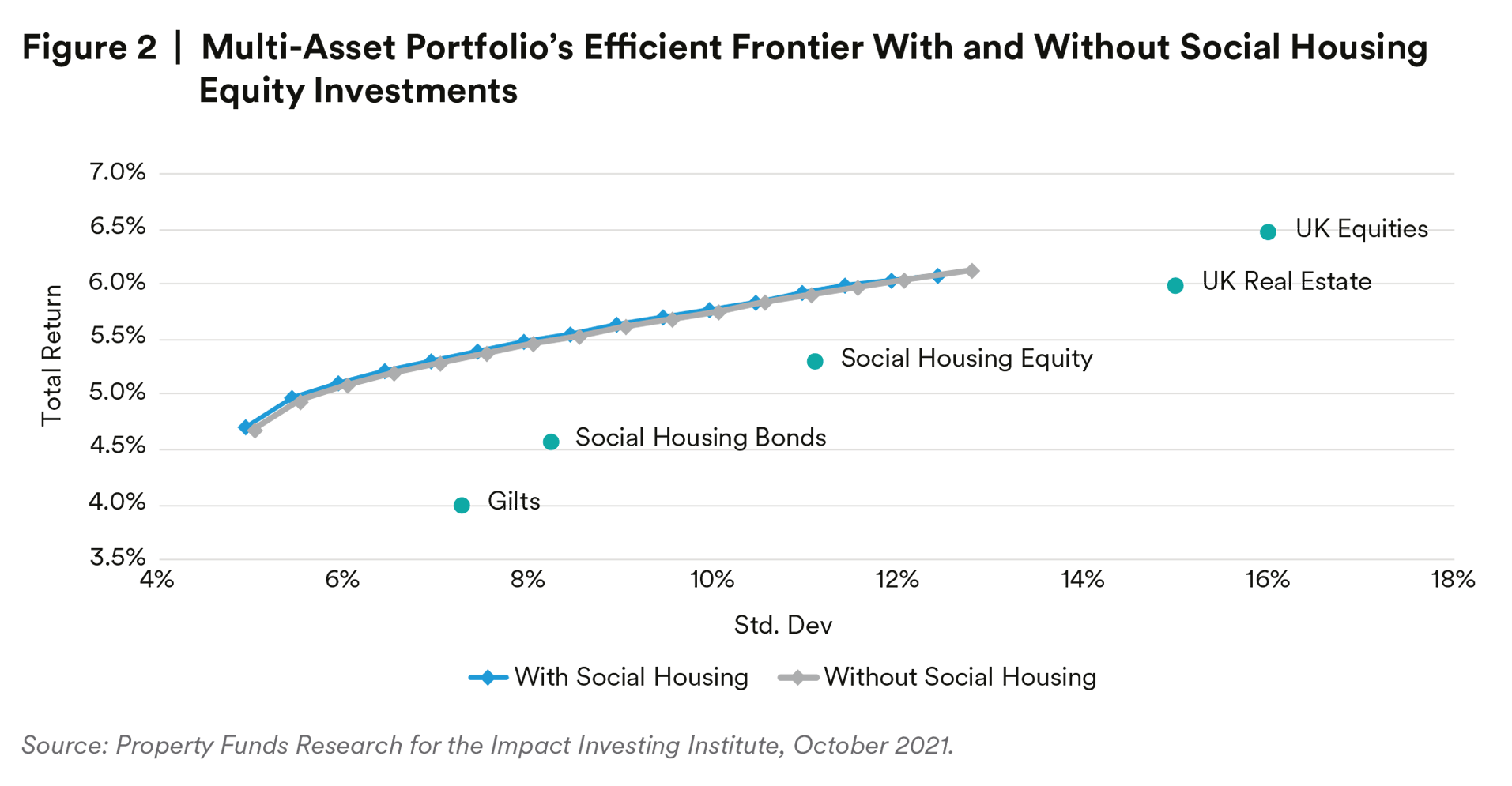

We believe the potential for attractive risk-adjusted returns and reliable cash flows associated with social housing bonds make them well worth considering as vehicles for sector diversification. The following chart provided by Property Funds Research suggests that including social housing in a multi asset portfolio can help improve risk adjusted returns.12

In addition to its return characteristics, as a component of an institutional portfolio, social housing can help provide diversification from other infrastructure investments such as energy, utilities, transportation, water, etc. This may be important for traditional investors in long-duration, fixed income assets, such as insurance companies and pension funds, which typically have higher-than-desirable sector concentrations. For example, the Bloomberg U.S. Long Credit Index reveals that the top five sectors make up more than 65% of the index.13 The Euro Aggregate Corporate 10 Year Index and the Global Aggregate Corporate 10 Year Index are also highly concentrated with the top five sectors comprising 79% and 73%, respectively.14

Potential for Future Investment Opportunities

While the supply of social housing constructed in recent years has been substantial, demand is higher still, which should help lead to future opportunities for investment in the sector. With respect to total demand, there are an estimated 1 million households on local authority waiting lists.15 Social housing is expected to be an important component in closing this vast housing gap. According to a report published by the Housing, Communities and Local Government Select Committee of the House of Commons, England requires more than 90,000 net additional social rent homes per year.16 Significant capital expenditure also will be required to be linked to decarbonization, as well as better safety and fire protection measures. Overall, PRPs forecast that they will need new debt facilities of £41 billion over the next five years to fund social housing development projects.17

There is no mystery as to why the demand for social housing is so large, given that conventional, non[1]subsidized housing is priced beyond the reach of many U.K. households. Affordability varies widely by region. Country-wide, the median house price as a multiple of gross annual earnings was 7.69 times in 2020, up from 6.84 times in 2010.18 In London, the median house costs 11.8 times annual earnings, and in the South East the ratio is 9.92 times.

Income level, of course, is another factor in the need for social housing. The lowest income areas in England were the Midlands, North West, North East and Yorkshire, according to a 2021 report by the Office of National Statistics. That said, while London and the South East had relatively higher incomes, housing costs also ranged higher, as noted above, and thus affordability was more of a problem.19

Potential investors in social housing bonds should note that a key driver of demand, population growth, also varies regionally. Overall, England’s population is expected to grow 5.0% through 2028 (from a 2018 base). But, the East Midlands region is expected to demonstrate the highest growth rate, at 7.0%, followed by the South West at 6.8%. London and environs will be just below the median, at 4.9%, with the South East at the low end of the growth scale at 4.4%.20

Responding to the demand catalysts noted above, there are major social housing development plans across all regions. That said, the COVID-19 pandemic paused many of these development plans, due to lockdowns and supply chain disruptions. In addition, PRPs recognize the need to prioritize expenditures for maintenance, safety and energy-saving improvements – a shift in investment that may lead to delays in delivering new units. In any event, PRPs have the flexibility to implement their development plans at an appropriate pace, and thus can allocate funds either to new units or to maintenance/upgrades as needed.

Social Housing is an ESG-Positive Investment

We believe the fact that U.K. social housing is fundamentally aligned with sound environmental, social and governance (ESG) principles should appeal to many institutional investors. Clearly, this form of housing satisfies a significant societal need for affordable housing, especially for individuals and families with specialized care and support needs. There also is an increasing focus by the U.K. government and owners on energy-efficient projects. For example, in 2021 the government launched its Social Housing Decarbonisation Fund, which allows social housing providers to apply for public subsidies to make major energy upgrades to their units.21 In the first phase of the Fund, £160 million was set aside for energy-saving improvements, with a total of £3.8 billion allocated to be spent over a 10-year period.

Social housing also is eligible for sustainability-linked financing, an increasingly popular structure that offers incentives to investors based on the achievement of certain KPIs. According to Fitch Ratings, public bonds labelled as either “green” or “sustainable” totalled almost £5 billion in 2021, as supply was, “supported by domestic investor appetite and international capital inflows.”22 In this regard, the International Capital Markets Association (ICMA) has established a set of principles for sustainability-linked bonds that may encourage more issuers to link bond pricing to their ability to hit general ESG targets.23

Conclusion: The Role of Social Housing in a Diversified Portfolio

For institutional investors, adding a position in social housing to their portfolios may be a classic example of “doing well by doing good.” Across the U.K., the social housing sector provides more than 4 million homes for those with lower incomes or special care needs.24 In order for the number of social rental units to increase at the level recommended by the government – some 90,000 net new homes annually – it will be essential to tap the resources of the capital markets.

Fortunately, social housing bonds appear to fit the requirements of many institutional investment portfolios, offering potentially attractive risk-adjusted rates of return, credit ratings equivalent to a single A, and cash flows over a long duration25. In addition, given the growing focus on investments with a positive ESG impact, we feel social housing debt instruments that support a valid societal purpose can have a positive impact on investor portfolios.

Endnotes

1 Bloomberg

2 Bloomberg

3 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 45).

4 BBC News, “A History of Social Housing” (April 2015).

5 Social Housing Matters, “History of Social Housing” (March 2022).

6 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 12).

7 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 12).

8 IPE Real Assets, “UK social housing: Investment case stacks up for institutional investors” (Feb. 2022).

9 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 45).

10 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 45).

11 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 46).

12 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 87). This chart was published in October 2021 and it was run in October 2021 based on forward looking estimates rather than using backward looking data from indices.

13 Bloomberg, March 31, 2022

14 Bloomberg, March 31, 2022

15 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 11).

16 Building more social housing - Housing, Communities and Local Government Committee - House of Commons (parliament.uk) (July 2020, Fig. 6).

17 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 45).

18 House price to workplace-based earnings ratio - Office for National Statistics (ons.gov.uk).

19 Mapping inequality in the UK (ons.gov.uk).

20 Subnational population projections for England - Office for National Statistics.

21 https://www.gov.uk/government/publications/social-housing-decarbonisation-fund

22 Green, Sustainable Bonds Increase UK Social Housing Sector Debt (fitchratings.com)

23 ICMA drives ESG bond issuance with new principles | IFR (ifre.com)

24 Social housing sector stock and rents statistics show impact of pandemic - GOV.UK (www.gov.uk)

25 Impact Investing Institute, “Is There an Investment Case for Social and Affordable Housing in the U.K.?” (Oct. 2021, pg. 45).

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs.

The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.