The economy in any single year is subject to the vagaries of chance and, as such, can be “noisy”. Near-term volatility that exerts short-term stress into markets may be front of mind for most investors, but it is long-term trends that provide us with the best view of the future, especially for those with long investment horizons.

The experience of COVID has substantially warped our understanding of the economy and how it is likely to function in the near term. Similarly, interest rates have not been acting normally for some time, an issue made worse by COVID, and which further warps our understanding of the current economic environment.

After the Great Financial Crisis (GFC) but before COVID, there was a general sense of pessimism in the economy as the possibility of secular stagnation – the hypothesis that U.S. economic growth and interest rates will remain low on average in the long run due to a combination of too much saving and too little investment – and Japan’s inability to stimulate economic activity weighed on expectations. After COVID the economy once again had to contend with inflation and a high degree of volatility around productivity.

Taking a longer view, we find reasons for optimism about potential growth in the United States. Labor force participation rates, a powerful growth driver, are likely to continue to climb as the shock from COVID fades, the statutory retirement age rises, and public pension benefits are reduced. At the same time, technological advances suggest we could be approaching a material acceleration in productivity as we see payoffs from previous investments and technologies begin to become more widely adopted. The low-growth, low-productivity, and low-interest rate environment of the post- GFC days appear to be behind us, at least for now.

Whatever Happened To Secular Stagnation?

After the GFC, there was a concern that the U.S. was experiencing long-term “secular stagnation.” Although many have been quiet on the topic given the strong post-COVID recovery, a vocal contingent maintains that the U.S. is likely to sink back toward slow growth and low rates after the pandemic recovery is completed. We argue that the U.S. economy has broken out of secular stagnation—if that was the correct framework—and we believe it is likely to spend several years on a more positive economic path.

What Is Secular Stagnation?

Secular stagnation is the hypothesis that U.S. economic growth and interest rates will remain low on average in the long run, cyclical swings notwithstanding.

Under secular stagnation, consumer demand is weak while savings—from home and abroad— are excessive. At the same time, there is a lack of promising investment opportunities due to a lack of demand-led growth, weakening labor force participation, and an unfavorable investment environment such as a lack of technological breakthroughs, deteriorating infrastructure or a stagnating workforce.

The result is too much money chasing too few investment opportunities, thereby depressing equilibrium interest rates. Moreover, the situation is self-reinforcing as low rates force people to save more to meet savings goals, and less investment itself creates a less favorable investment environment.

The secular stagnation hypothesis gained currency after the GFC, when U.S. economic growth was weak and there were concerns about the Fed’s inability to properly stimulate the economy, given that rates were at the zero lower bound.

Could Secular Stagnation Still Be a Threat Going Forward?

A key proponent of secular stagnation, Larry Summers, recently declared secular stagnation over. He believes that the massive stimulus packages of the pandemic era had effectively jolted the consumer out of a weak spending, low growth equilibrium and onto a more robust aggregate demand path.

Despite this, and despite current robust economic growth, there are still researchers who argue that secular stagnation may reassert itself after the current pandemic recovery period is over.2

On the side of insufficient consumption and excess savings, the major concern is demographic decline. Persistently high savings may come from an anticipated long retirement: if people spend less today and save more, that reduces demand and can lower yields. Stagnationists also worry about low economic growth from lower labor force growth and a rising share of retired adults.

Another argument on the side of insufficient consumption and excess savings is inequality. Most U.S. households are not actually saving enough for retirement - instead, most of the savings is being done by those with high net worth. Concentrated wealth leads to a few households saving a large amount, while a large number of relatively poor households are constrained from spending on necessities. A more equal distribution would create more aggregate spending as consumers buy necessities without reducing consumption by the highest net-worth households. Excess savings also have global origins—as wealth was built in China and other emerging markets, people who had never been able to save before were able to save, both at home and in global markets. This helped raise the amount of total global savings.

From the perspective of a poor investment environment, an oft-cited concern is the lack of investment in infrastructure. This is seen as constraining future growth and creating a less favorable investment climate. Polling in the U.S. shows people are generally dissatisfied with the country’s national infrastructure—one recurring theme states that trains in the U.S. are much slower than trains in other countries like France, Japan, and China.3 A related argument is that there is poor investment in basic research, which in the past led to brekthrough technologies like personal computing, the internet and GPS.

Another argument against a favorable investment environment is the plateauing of educational attainment in the U.S. Ironically this is because the U.S. increased education for a larger share of its population during the 20th century than other countries in Europe and many emerging market economies, particularly for the female labor force.4 This means that other countries might expect productivity gains from an improving workforce, while the U.S. has already realized many of those gains.

While these are plausible headwinds, we think there is room for greater optimism. In the following sections we point out ways in which productivity, growth, and labor force participation may paint a more promising economic picture.

Capital: Fruits of Past Investment

There is an enormous amount of excitement around artificial intelligence (AI). While we fundamentally share that excitement, in this section we pull back the lens to provide a wider view of the potential for growth-enhancing technological advancements.

Innovative technologies including AI can create opportunities for growth. AI can be considered a general-purpose technology.5 These technologies have the potential of fueling economic growth by catalyzing waves of complementary inventions and innovations.

However, adoption of technologies is an uneven process. These technologies need time to disseminate through the economy in a productivity-enhancing manner. In some cases, general purpose technologies can even produce productivity losses in the short-term as firms have to overcome switching costs and inertia when implementing a new technology that changes operations on a wide scale.6 Furthermore, even though AI can improve the performance of humans in some tasks, in other activities it may actually impede performance.7 Like all new technologies, determining the best use cases is a key part of maximizing its value to the enterprise

Electrification, for example, took over two decades to produce a productivity boom after being introduced to American factories. Factory managers had to reorganize production lines to take advantage of electricity, invest in new machinery, retrain workers, and make large complementary investments before realizing productivity gains.8

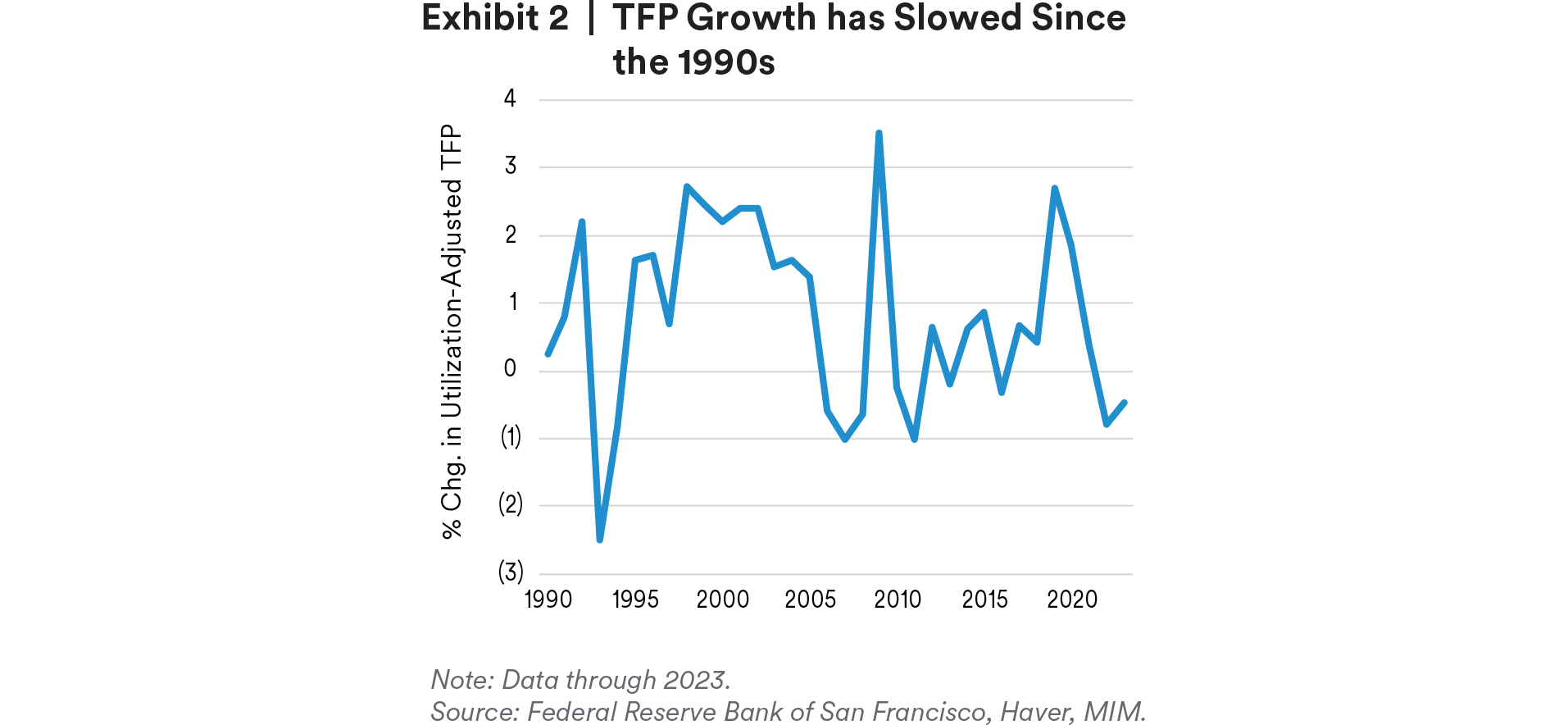

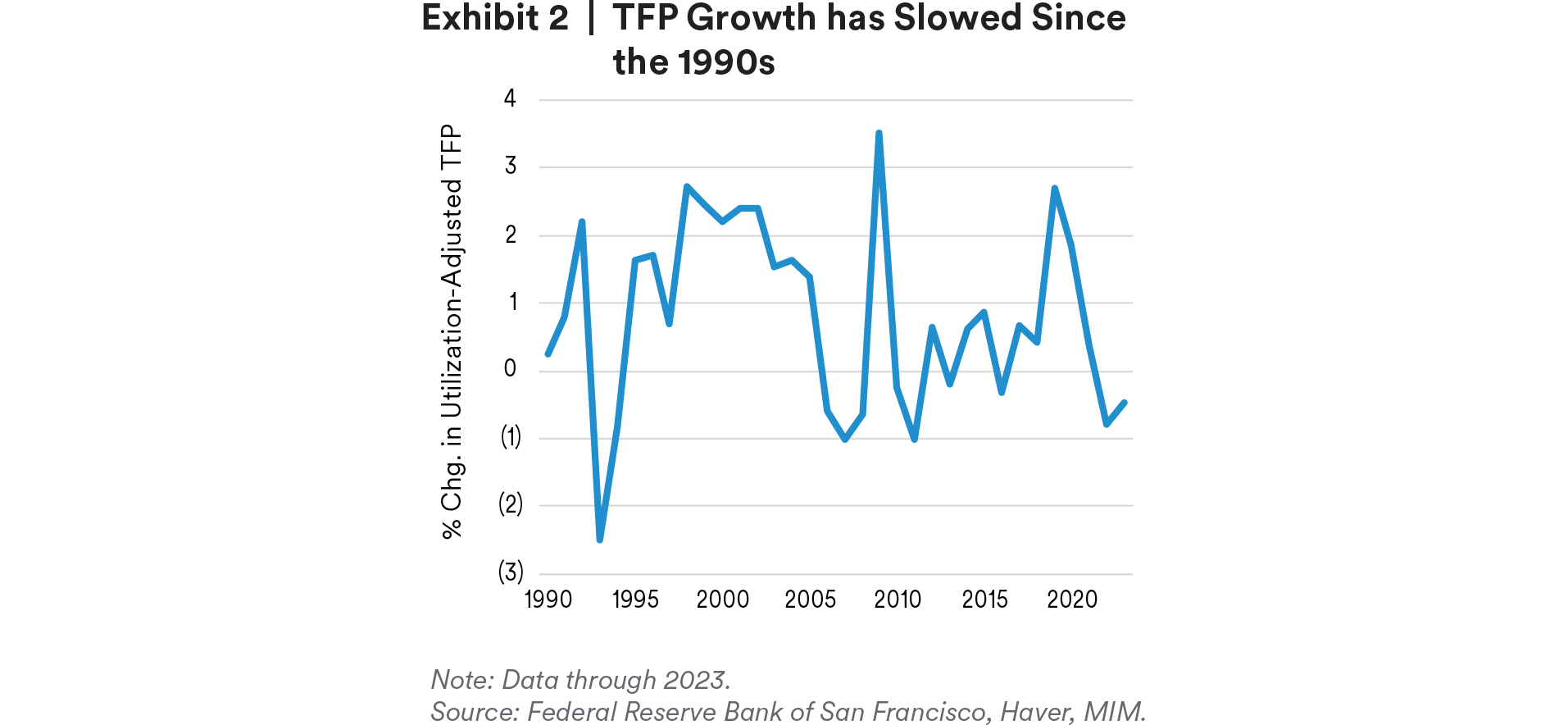

he technology-driven productivity boom of the 1990s and early 2000s, also fueled by an investment cycle, was similar, as the investment stock in computers and research had been building for years. During this period, total factor productivity (TFP) grew rapidly in the technology boom of the late 1990s and early 2000s.9 But once the new computer technology had been adequately diffused throughout the economy, further investment produced only marginal incremental benefits.10

Regarding AI technology, we are likely closer to the middle of that adoption timeline than the beginning, as the ideas and technologies have been developing since the 20th century. Indeed, the recent advances of generative AI that have grabbed the public’s attention are primarily about mass distribution of already-extant capabilities. This may be analogous to the way the creation of the web browser Netscape in 1994 popularized rather than created access to the World Wide Web.

The economy is still figuring out the true capabilities of AI to enhance productivity, with the attendant risks and rewards. We think that there is enormous room for investment growth, as investment in AI is still relatively low. Private investment in AI was just $52 billion in 2021 with increases expected, software and information processing equipment GDP in the same year was approximately $1 trillion.11

We already see evidence of labor saving and boosting benefits from AI technologies. Recent research shows cases where software engineers could program twice as fast with the help of AI tools, and call center employees became 14% more productive with better customer satisfaction and lower employee attrition rates.12

Beyond direct labor-saving effects, AI can also boost TFP. AI technologies can optimize processes to reduce costs. One good example is Google’s use of DeepMind to reduce its datacenter cooling costs by an astonishing 40%.13 These capital-enhancing improvements may not be directly seen in the productivity statistics but will be applied in more use cases as time passes, providing a boost to TFP.

Looking ahead, AI models could augment labor productivity more directly. For example, they may transform the education of the workforce by acting as engaged tutors for students. Studies on the quality of learning based on the teaching structure used (classroom, classroom with homework or one-on-one tutoring) show significant gains to students receiving tutoring. An AI tutor could improve learning for all, while narrowing the variance of learning by improve the test results of the worst students by tailoring the tutoring more precisely toward students’ needs. It would be a “Lake Woebegone” environment for learning where every student is above the (prior) average, with potential significant gains for the quality of the workforce.14

Extending that idea into workforce training, where each worker has an AI mentoring them in their roles, and we could potentially see not only a better-quality workforce but also reduce the need to divert top employees’ time toward training younger workers. The net result could be a sustained boost to productivity. The aforementioned study also noted that “The ones [consultants who participated in the experiment] who are below average [in performance] were actually benefiting much more from AI…”, consistent with the score improvement seen when students were taught via one-on-one tutoring versus a conventional classroom setting.

More broadly, when we consider technological advances that have become commonplace since COVID, such as the extraordinary decline in the price of access to space, the rate of data creation, biotechnology advances, communications and the democratization of artificial intelligence via generative pre-trained transformer AI models it would seem that we are entering a period when the potential for accelerating productivity is rising. Many of these advances are likely to interact, further increasing their potential. For example, a rocket now takes a satellite into space that, because of the lower cost of access, has greater ability to generate data which, in turn, can be used to better train an AI model. Alternatively, AI allows researchers to use the existing trove of data to develop new drugs that are only possible because of advances in biotechnology.

As these feedback loops continue, they would seem likely to boost overall efficiency in the economy and productivity among workers with access to the technology. These workers of course also tend to benefit from extended, healthier, lifespans as well as from an improved ability to communicate and engage with their family, friends, and coworkers.

Labor: Positive Participation Rate Shock

Despite many worries about deteriorating demographics, we believe that the next decade or so has significant upside potential for labor force participation and therefore for the potential rate of growth of the economy.

COVID was notable for the impact it had and continues to have on the labor force participation rate. Overall labor force participation ended 2023 at 62.5%, 0.8pp below the rate seen immediately before the pandemic. Notable is the negative impact the pandemic had on the participation rate among older workers. The labor force participation rate among workers up to age 65 has since recovered. Lower participation in the labor force begins with the 65-69 year-old cohort, who would have been approaching retirement age when COVID’s health impact was at its greatest. Pre-COVID, the participation rate for those aged 65-69 was 34.8%, but at the end of 2023 the rate was 33.2%, a decline of 1.6pp. Even older cohorts also showed a drop in participation, with those aged 70-74 posting a 0.5pp decline and those aged 75+ showing a 1.0pp drop. In other words, it seems as if COVID shocked the participation rate among those approaching retirement and those working during traditional retirement years. These workers are likely permanently out of the labor force while the next set of workers turning that age are unlikely to exit at the same pace. As such, the impact on participation should become less noticeable, resulting in a rising participation rate among older workers over time.

Separately, a secular trend of increased participation among the older workforce is also likely to resume. There are two primary drivers to the participation rate of older workers. The first is life expectancy and health. Increases in life expectancy typically result in increased labor force participation that better health allows. Although life expectancy and healthy life expectancy have both been on the decline, that is likely a temporary phenomenon linked to COVID. Advances in vaccine and drug development appear set to increase life expectancy and improve its quality over the next few years.

The second driver is financial. The primary financial driver will likely be the retirement age at which benefits can be claimed Here, 2020 represented the last year of those eligible to retire at age 66 in the United States under Social Security, and 2027 will be the first year that those workers who are not able to retire until age 67 begin to exit the workforce (workers born in 1960 and later). Relatedly, the size of retirement benefits is likely to also exert a strong influence on workers’ decision to exit the labor force. The more generous the benefits, the lower the number of workers who will continue to participate. Absent changes to funding, we believe Social Security (the primary government pension plan) will have to reduce benefits to those workers born in 1960 and later by an estimated 19 to 27%, a development that would likely result in a higher participation rate among older workers. The retirement age continues to move higher, and the expected benefits are increasingly uncertain.

Finally, there is a generational transition that may provide a labor force boost in the near- to medium-term. Current prime-aged workers—workers from 25-54 years of age, who have the greatest labor force participation rates—include the entire Millennial generation, the 10 youngest Gen X years, and the two oldest Gen Z years. By number of births, Gen Z is 10 million people larger than Gen X (and slightly larger than the Millennial generation). As Gen Z replaces Gen X in the labor force over the next eight years, labor force participation should continue to grow.16

From Secular Stagnation to Cyclical Boom

In addition to the foregoing discussion, other aspects of the state of the U.S. economy are also promising.

Some aspects of inequality eased during the pandemic. The recent, post-pandemic reduction in inequality may be partly responsible for raising consumption. The net worth of households in the bottom 50% of the population by wealth has risen relative to the net worth of the 50th to 90th percentile households. Moreover, each of these groups saw their wealth expand more rapidly during the pandemic than the those in the top 10th percentile.17 The sources of the improvements in inequality likely include direct government stimulus due to the pandemic as well as higher wages gained during the labor market squeeze since 2022. Although these changes are likely to reverse over time, they provide consumption impetus in the near term.

With respect to the investment environment, quantitative evidence on infrastructure is better than perception. Total investment per capita in the U.S. is among the highest in the world.18 The logistics index constructed by the World Bank World Development indicators assessed U.S. infrastructure as 15th best among 51 countries.19 The U.S. is among the strongest countries in technology infrastructure despite its vast physical size.20 With the Infrastructure and Jobs Act, we may even see improvement in these statistics going forward.

Spending on R&D has in fact risen, although the shift has been away from government-funded R&D investment. As a share of GDP, R&D spending is now about as high as it has ever been—partly helped by a COVID-fueled rebound in R&D.21

Finally, we believe that the secular stagnation concerns over lack of investment opportunities is well in the past. In addition to the aforementioned investment needs of AI and biotechnology, we see three additional near- to medium-term needs for investment funds. First is climate change; there has been a sizable increase in climate transition investments in the U.S. in recent years. We expect this to continue to some degree regardless of the 2024 elections. A second investment initiative is the industrial policy/China separation nexus. Regardless of the specifics—reshoring, friendshoring, nearshoring—there are investment needs to reposition and restructure supply chains. And thirdly, the heightened geopolitical pressures may mean that defense investment will ramping up. From Ukraine using up several years’ worth of U.S. missiles in a matter of months22 to Europe needing to shore up its own defense industry, there are numerous reasons why investment in defense is expected to increase.

Higher for Some Time Longer

The current environment is dramatically different from the one before the pandemic. Consumers are spending, excess savings appears to be receding as a problem, demographic problems are in a lull, and there are seemingly endless investment opportunities. Higher growth and higher rates appear to be with us for a while.

Endnotes

1 Peterson Institute for International Economics, “Summers and Blanchard debate the future of interest rates,” unedited transcript, March 7, 2023. Unedited Transcript: Summers and Blanchard debate the future of interest rates (piie.com)

2 E.g. Blanchard, Olivier, “Secular stagnation is not over,” Peterson Institute for International Economics, January 24, 2023; Raffo, Andrea and JeffHorwich, “Are higher interest rates here to stay?” Federal Reserve Bank of Minneapolis, February 20, 2024.

3 Ipsos Global Infrastructure Index 2023; 29% were very/fairly satisfied with U.S. infrastructure, the 10th lowest satisfaction level among the 31countries surveyed. May-June 2023.

4 Gordon, Robert, “The turtle’s progress: Secular stagnation meets the headwinds,” in Secular Stagnation: Facts, Causes, and Cures, a VoxEU.org eBook, eds. Coen Teulings and Richard Baldwin, 2014.

5 The Business of Artificial Intelligence (hbr.org)

6 The Economics of Artificial Intelligence: An Agenda (nber.org)

7 Rosenbush, Steven, “The Best Way to Work with AI? A Study May Reveal the Answer,” Wall Street Journal, February 20, 2024.

8 The coming productivity boom, MIT Technology Review, June 2021 .

9 Total factor productivity is the productivity increases not explainable by increases to labor and capital and generally attributed to technological advancement.

10 The Recent Rise and Fall of Rapid Productivity Growth - San Francisco Fed (frbsf.org))

11 AI investment forecast to approach $200 billion globally by 2025 (goldmansachs.com)

12 Machines of mind: The case for an AI-powered productivity boom | Brookings

13 Burgess, Matt, “Google’s DeepMind trains AI to cut its energy bills by 40%.” WIRED, July 20, 2016.

14 Lake Woebegone is a fictional place where “all the women are strong, all the men are good-looking, and the children are all above average.” From the radio program A Prairie Home Companion created by Garrison Keillor.

15 Source: U.S. Bureau of Labor Statistics

16 National Center for Health Statistics, Pew Research, Haver, MIM calculations.

17 Source: Federal Reserve Board, Haver, MIM

18 Behind Australia, Canada, New Zealand, Japan and France.

19 World Bank World Development Indicators Logistics Performance Index; data accessed January 30, 2024.

20 The International Telecommunications Union’s Information and Communications Technology (ICT) Development Index 2023 assessed only 6 countries as being more connected than the U.S., with all but one (Finland) being exceptionally small geographically.

21 R&D as a share of GDP has been rising since 2014, driven particularly by privately-funded R&D. Source: BEA, Haver, MIM. Data through Q4 2023.

22 Cancian, Mark F., “Is the United States Running out of Weapons to Send to Ukraine?” Center for Strategic & International Studies, September 16, 2022

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.

This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

In the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges hat (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.