Introduction

President Trump could win the 2024 presidential election. When the incumbent presidential party presides over an improvement in the unemployment rate, it is likely to be returned to power. With unemployment at historic lows, unemployment is likely to get worse, creating headwinds for a Biden re-election.

We examine how a second Trump presidency might affect the U.S. economy, key economic policies, and its relationships with China and Europe.

Mercantilist-in-Chief

In a second presidency, we expect President Trump to step up the trade wars he began in his first term. One of President Trump’s most consistently and strongly held economic beliefs is in mercantilism, in which exports are viewed as a positive and imports are viewed as a negative. This worldview, moreover, dovetails coherently with his views in favor of a U.S. manufacturing renewal and a hardline stance against China.

While on the campaign trail, President Trump has proposed scaling up trade restrictions. To underscore the point that his trade hawkishness has not changed, President Trump has floated suggestions for a 10% tariff on all imports or a 60% tariff on imports from China.1 The goals would be to force more domestic manufacturing production generally—and to wean the U.S. from Chinese production specifically.

Under President Trump’s presidency, trade exposure did not decline materially.2 But there was some evidence of trade diversion, with U.S. trade exposure to China declining by 17% through the start of the pandemic. Interestingly, the slack was mostly taken up initially by Europe rather than Mexico or Canada, despite the signing of the U.S.-Mexico-Canada Agreement on Trade.3

Although they helped make progress toward President Trump’s objectives, the tariffs were costly. Quantitative assessments generally show that the tariffs harmed U.S. economic performance. Inflation rose, with import tariffs passed on to purchases on a nearly one-for-one basis, which raised producer prices by approximately one percentage point overall.4 Employment increases from import protection was by one estimate 0.3%, but was more than offset by higher input prices.5 In addition to self-inflicted pain, tariffs resulted in retaliatory tariffs, which led to further reductions in employment, reduced economic growth, and increased inflation.6

We would expect broadly similar effects from new rounds of tariffs. Relative to recent inflation, we believe the impact would be small but would represent a further impediment to price normalization by the U.S. Federal Reserve.

Either or both tariff actions proposed by President Trump would be plausible—indeed, we would expect an early shot across the bow on trade if he should win another term in office. We would expect similar effects as were found in the prior round of tariffs, with tariff actions likely even more forceful and therefore having larger economic consequences.

Frenemy Europe

Europe is particularly exposed to trade—its trade exposure was 45% in 2022 versus that of the U.S. at 21%—and would be negatively affected by a blanket 10% tariff.7 Even in the case of a tariff focused against China, this would likely have a large effect on Europe, given its close trading relationship with China. Europe would be faced with weaning itself from another major trade partner, China, after spending 2022 and 2023 weaning itself from Russian oil and gas.

From the U.S. perspective, we believe there are more limits to President Trump’s ability and desire to exert power with Europe than there are with China. The U.S. is a much bigger exporter to the EU than it is to China, particularly in relative terms: for every dollar it imports from the EU it exports $0.80. For China, it exports only $0.35 per dollar of imports. In a mercantilist world view, EU is more of a customer, while China is primarily a supplier. Finally, as noted in the section above, U.S. trade with the EU expanded under President Trump. With China high on President Trump’s list of priorities, we would expect him to find common ground again with the EU as he did previously.8

Industrial Policy and China With a Side of Climate Change

Despite President Trump’s well-documented antipathy toward wind turbines, we believe it’s unlikely that he would reverse all the renewable energy initiatives under President Biden. The renewable energy sector is 20% larger than it was when President Trump was elected in 2016, while EV ownership is five times as high.9 More domestic companies are invested in the future of renewables, partly as a result of the Inflation Reduction Act (IRA), and they are unlikely to be keen to do an about-face on their investment direction.10 Moreover, the U.S.’s single largest source of renewable energy remains biomass, which has considerable support from farmers and politicians in the Midwest. To the extent that climate goals coincide with the other goals, it is our view that they are likely to remain intact.

That said, President Trump is likely to prioritize the industrial policy and anti-China components of the Inflation Reduction Act and other existing policies over climate change goals. For example, natural gas—now partly constrained from export by the Biden Administration—would likely be freed from export controls in a second Trump presidency. And we believe President Trump is likely to attempt to minimize the Chinese content of items entering the U.S., regardless of how it would affect climate goals.

Fiscal Policy: I Owe Ya, Iowa

Tax cuts, along with the outsized spending response to the pandemic, pushed the federal deficit to record highs of over $3 trillion in 2020 (see chart below). While the roll-off from pandemic related spending produced some deficit relief, increases in 2023 put the deficit’s upward trend back in line with the pre-pandemic trajectory and the federal debt continues to balloon in size.

President Biden has proposed a variety of tax increases in his 2024 budget, including increases on individual, capital gains, and corporate income taxes. By contrast, a Trump win could mean that previous tax cuts enacted with the 2017 Tax Cuts and Jobs Act for individuals and estates become permanent.11 However, both candidates remain silent on healthcare and social security spending, which would need to be (unpopularly) addressed to make any significant impact on reducing the debt trajectory.

That said, making the 2017 tax cuts permanent would have a material impact. The Congressional Budget Office (CBO) estimates that making the 2017 tax cuts permanent could add $350 billion to the deficit annually, equivalent to roughly 1% of GDP. As we discussed in our paper on Treasury debt, we expect this increase in the deficit to add an additional 1% to public debt-to-GDP in a given year—everything else being equal. While this would raise overall federal debt, some economists expect that increased growth along with higher tariff revenue and new taxes on private university endowments growth can offset the cuts.12

Administrating the State

The likely overturning of the “Chevron deference doctrine” (that is, the doctrine of deferring broadly to federal agencies for the interpretation of ambiguities in legislation) would precede a second Trump Presidency, with a ruling expected in June 2024.13 An overturning of the deference would likely narrow the power of the EPA in certain areas, enabling some states to reduce their focus on renewable energy.

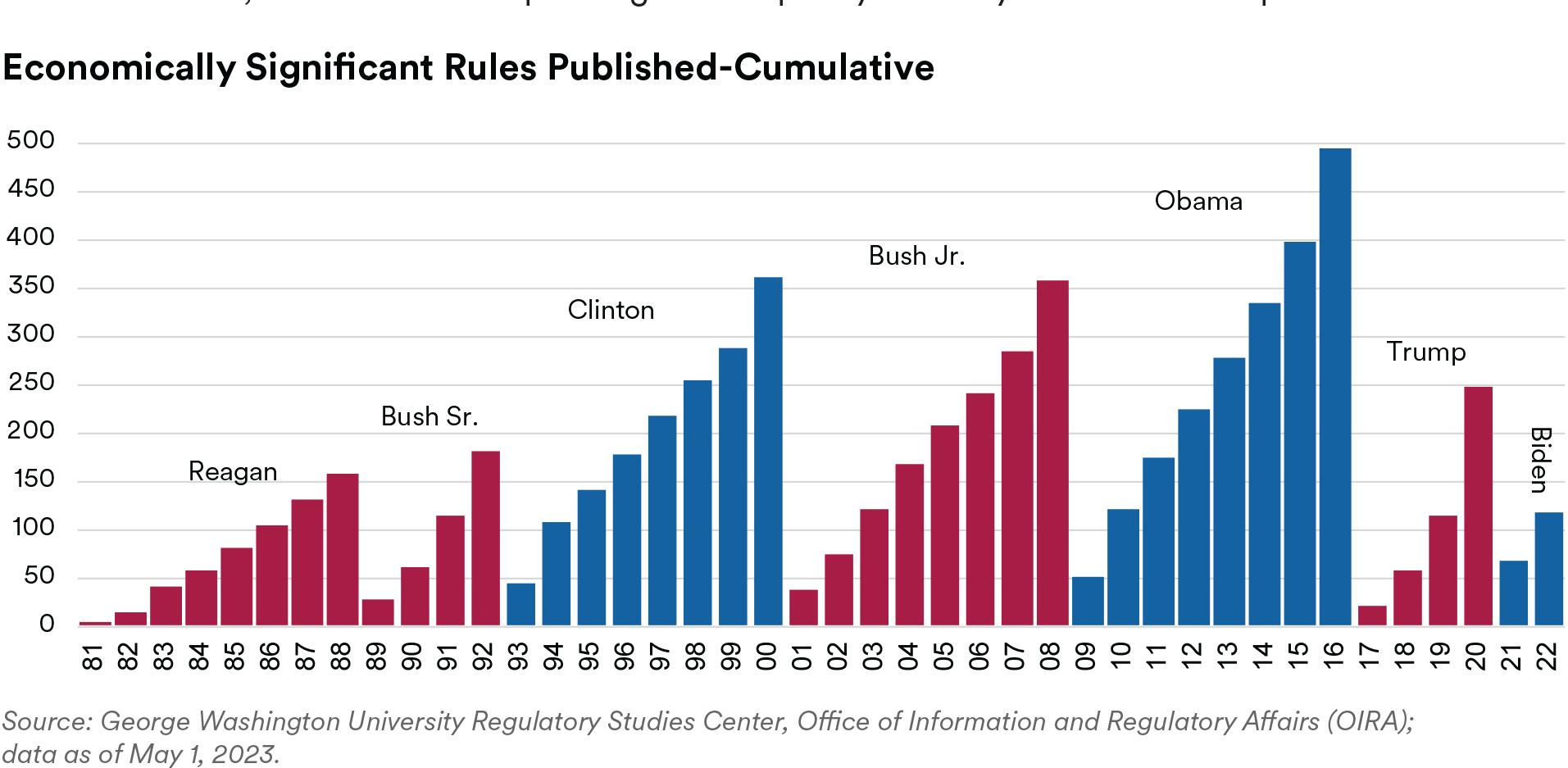

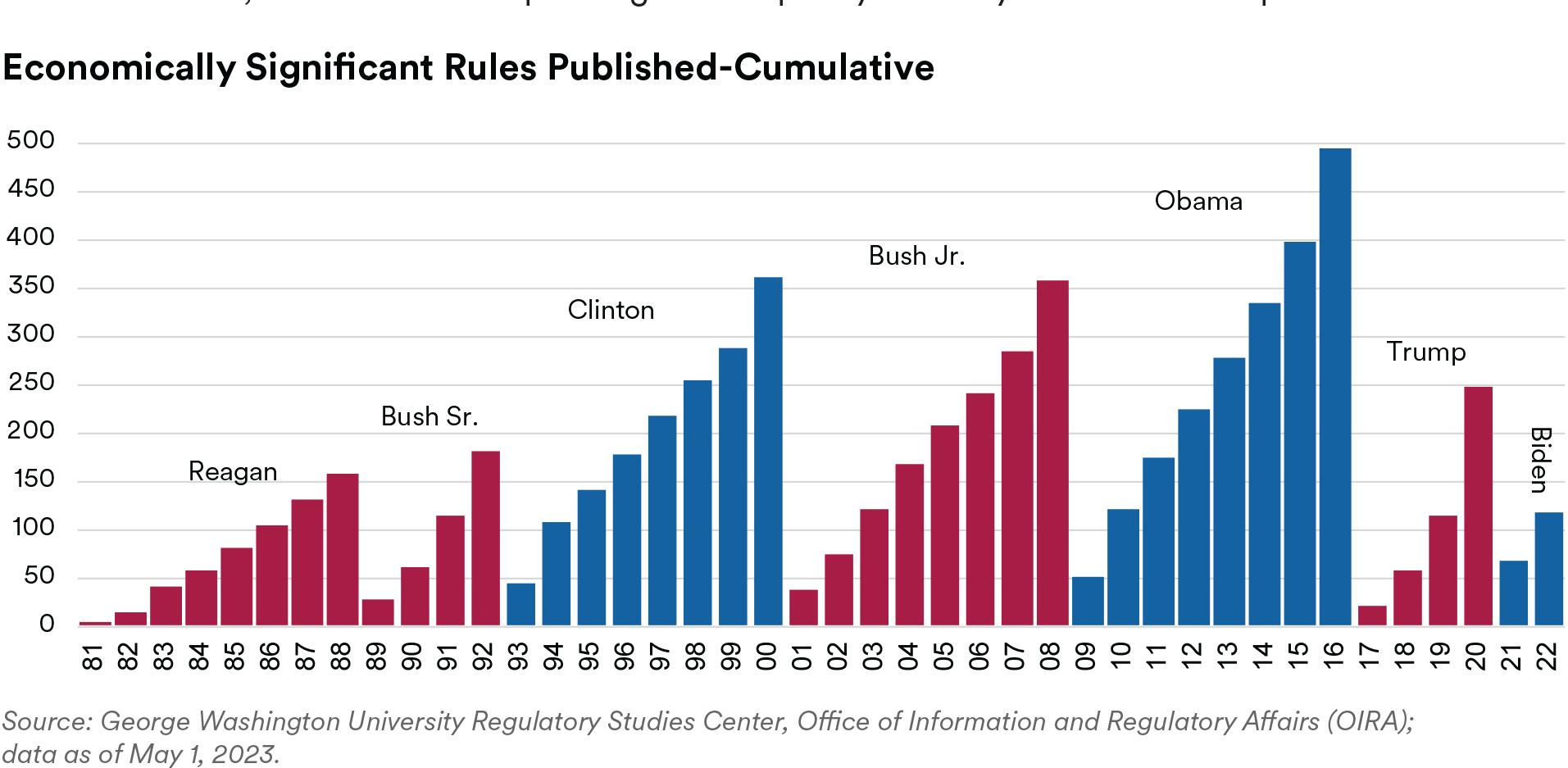

Aside from this, we may see an increase in economically significant rulemaking. There has been a tendency, in the last year of an administration, to publish an unusually large number of economically significant rules14, perhaps as a way of attempting to extend the life of the outgoing administration’s policies.

If President Trump should win another term, we might see changes to rulemaking. If the Biden administration were to see its chance of re-election decline, we could see the number of economically significant rules increase in the waning days of the administration. With an overturning of “Chevron deference,” President Trump might be inclined to take advantage of a weakening of the administrative state particularly with respect to environmental regulations as they are particularly reliant on the “Chevron deference.” Although constrained on some policy reversals as noted above, we would still expect significant policy volatility in the climate sphere.

A Sequel, Not a Remake

There are substantial changes to the economic landscape in 2024 when compared with when President Trump took office in 2016. Some could constrain a second Trump presidency, while others would help further his expected agenda.

The most significant economic difference is the U.S. fiscal situation. The U.S. debt to GDP ratio is expected to be at 100.2 at the end of 2024, while it was at 76.4 at the end of 2016.15 Fitch also downgraded U.S. sovereign credit, leaving only Moody’s rating the U.S. as AAA. President Trump’s hand on deficit spending may be stayed by a likely Republican Senate, and the threat of a further sovereign credit downgrade. Moreover, the higher interest rate environment—there are scant expectations of the yield curve shifting down to 2016 levels—can be expected to create further constraints on government spending.

Another economic difference is the difference in climate-related economics. As noted above, U.S. private investment in climate change technology has risen since 2016, and companies may bring their weight to bear on any sudden changes to climate-related policies. Moreover, climate change itself has manifested itself in economically significant ways, such as through increased property insurance losses16.

By contrast, President Trump’s focus on domestic manufacturing and his push to wean the U.S. from Chinese imports have been furthered by President Biden. We would expect President Trump to push these causes substantially farther, given their broad support among American voters.17

We expect that a second Trump presidency would cause some policy whiplash back toward the pre-pandemic Trump administration policies. These reversals would be mitigated by debt constraints while being assisted by a more unified U.S. view on trade policy and China. Economic effects are likely to be the most pronounced for sectors highly exposed to international trade, while sectors less exposed to international trade may see a quieter stretch, particularly relative to what they have seen since the beginning of the pandemic.

Endnotes

1 Hayashi, Yuka, “Trump is Primed for a Trade War in Second Term, Calling for ‘Eye-for-Eye’ Tariffs,” Wall Street Journal, December 26, 2023.

2 Trade exposure is calculated as exports plus imports as a share of GDP. Data from U.S. BEA.

3 Bureau of Economic Analysis, Table 1.3. U.S. International Transactions and MIM calculations; data as of December 20, 2023.

4 Amiti, Mary, Stephen J. Redding, and David E. Weinstein, “The Impact of the 2018 Tariffs on Prices and Welfare,” Journal of Economic Perspectives, Vol.33, No.4, pp.1187-210, Fall 2019.

5 Flaaen, Aaron and Justin Pierce, “Disentangling the Effects of the 2018-2019 Tariffs on a Globally Connected U.S. Manufacturing Sector,” Finance and Economics Discussion Series, Federal Reserve Board, December 23, 2019.

6 Flaaen, Aaron and Justin Pierce, “Disentangling the Effects of the 2018-2019 Tariffs on a Globally Connected U.S. Manufacturing Sector,” Finance and Economics Discussion Series, Federal Reserve Board, December 23, 2019.

7 Intra-EU trade is excluded from the calculation. Data from U.S. BEA, Census, EuroStat, and Haver; accessed 2/7/2024.

8 A joint statement from the U.S. and EU noted a rapprochement of sorts as the two sides agreed to “launch a new phase” of U.S.-EU relations, enumerating joint trade and security goals including the goal of “protecting” the countries from unfair trade. “Joint U.S.-EU Statement following President Juncker’s visit to the White House,” European Commission Press Statement, July 25, 2018.

9 U.S. Department of Energy, Transportation Energy Data Book, Edition 40, table 6. as of Jun. 21, 2022; U.S. Energy Information Administration, “Monthly Energy Review,” January 2024.

10 Kishan, Jaije, Brian Eckhouse, and Christopher cannon, “Red States to Reap the Biggest Rewards From Biden’s Climate Package,” Bloomberg, April 25, 2023.

11 Election 2024 Tax Plans: Details & Analysis | Tax Foundation

12 Donald Trump’s tax cuts would add to American growth—and debt (economist.com)

13 Relentless and Loper Bright - Oral Argument Postscript: SCOTUS Majority Appears Poised To End the Chevron Doctrine | Snell & Wilmer - JDSupra; Supreme Court to hear major case on power of federal agencies - SCOTUSblog; Noah Daponte-Smith, “Supreme Court cases may reshape administrative lawmaking,” Eurasia Group Daily Brief, June 5, 2023.

14 George Washington University Regulatory Studies Center, Office of Information and Regulatory Affairs (OIRA); data as of May 1, 2023.

15 CBO Historical and Budget Forecast as of June 2023.

16 Fliegelman, Arthur, “Wind, Fire, Water, Hail: What Is Going on In the Property Insurance Market and Why Does It Matter?” U.S. Treasury/Office of Financial Research, December 14, 2023.

17 Chicago Council on Global Affairs, “Free Trade with Exceptions: Public Opinion and Industrial Policy,” January 25, 2023.

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC