Tariffs and trade policies can produce global growth volatility through direct economic effects and investment decisions, which could then translate into global financial market volatility. This could potentially add consumer stress and even impact consumers in the higher-income cohorts who have been less impacted by ongoing, above-target, inflation.

We see an above-average risk of recession this year but still consider a growth slowdown our baseline forecast. For 2026, the distribution of outcomes widens, with tails expanding on the productivity potential of artificial intelligence and a risk that DOGE generates unexpected, substantive savings. On the downside, inflation remains a worry, as do both trade friction and geopolitics.

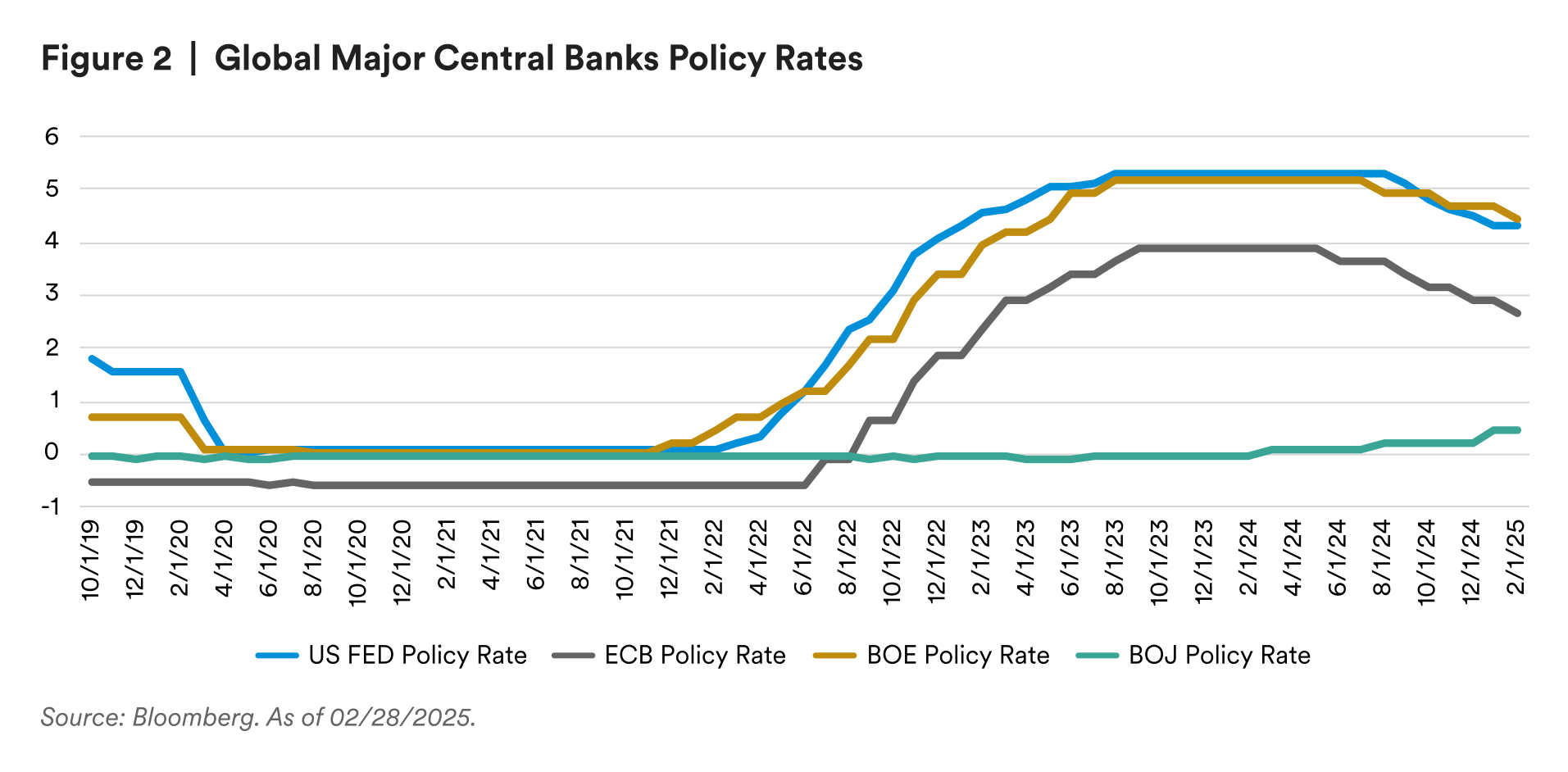

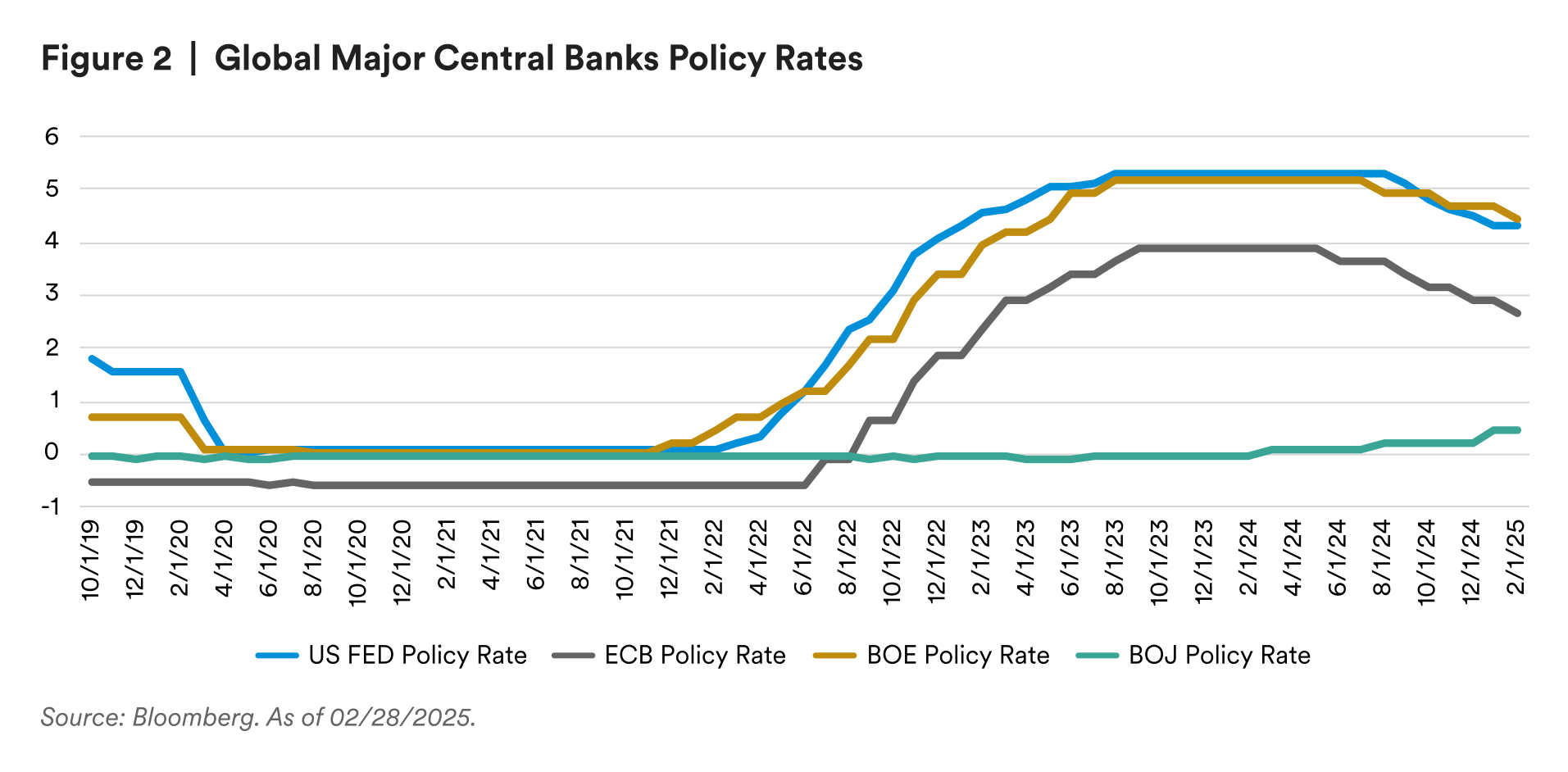

U.S. — Market Strategy looks for U.S. economic growth to slow modestly in 2025, even as inflation remains stubbornly high. As a result, we continue to expect only two rate cuts from the Federal Reserve this year and look for 10-year yields to remain above 4%, ending the year at 4.25%. After stretching to maintain spending in December, boosting spending and credit use, and reducing savings, consumers pulled back in January, cutting spending and boosting their savings rate. Additionally, fear of tariffs led to a jump in imports ahead of the new administration. The result is that the first quarter of the year is off to a soft start.

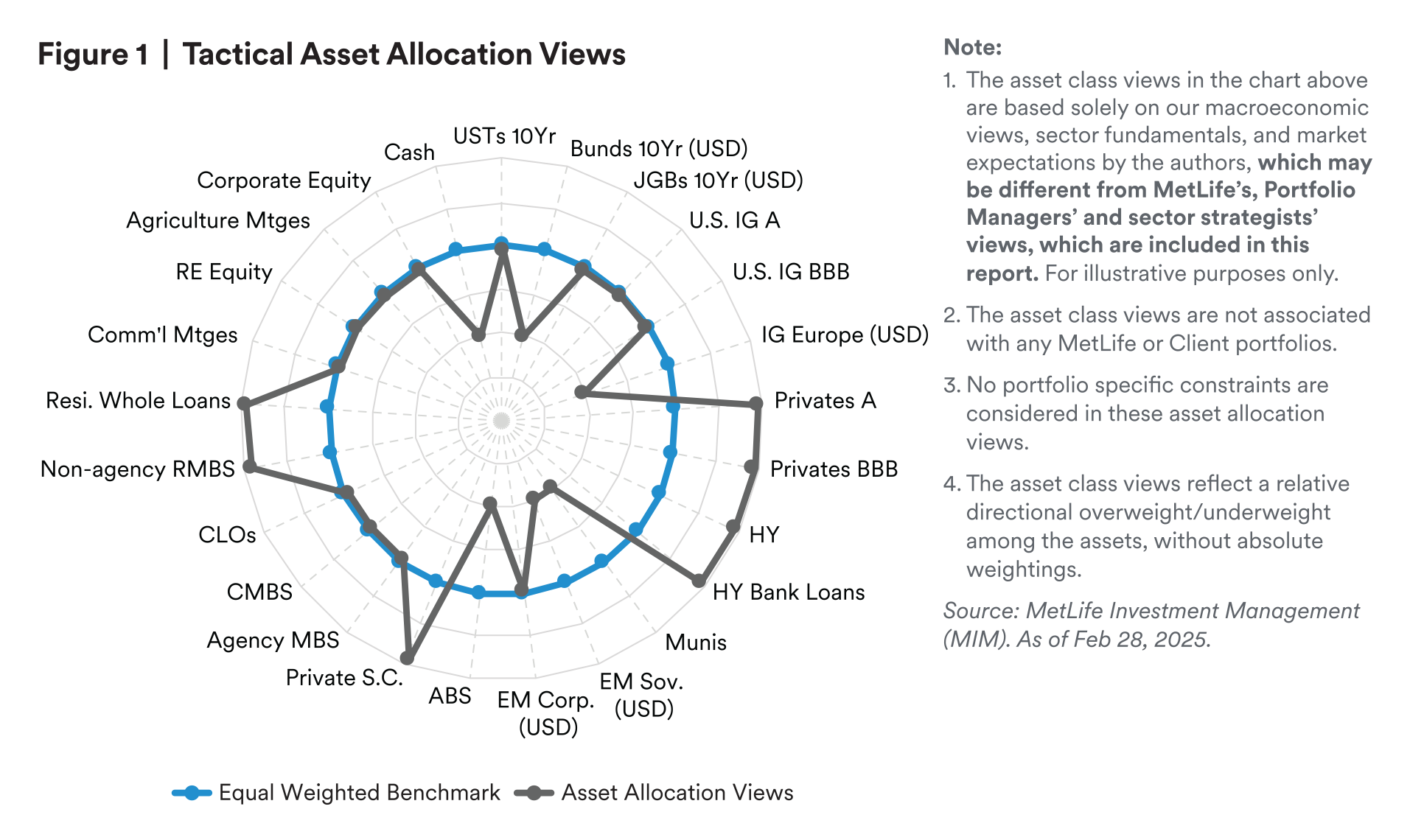

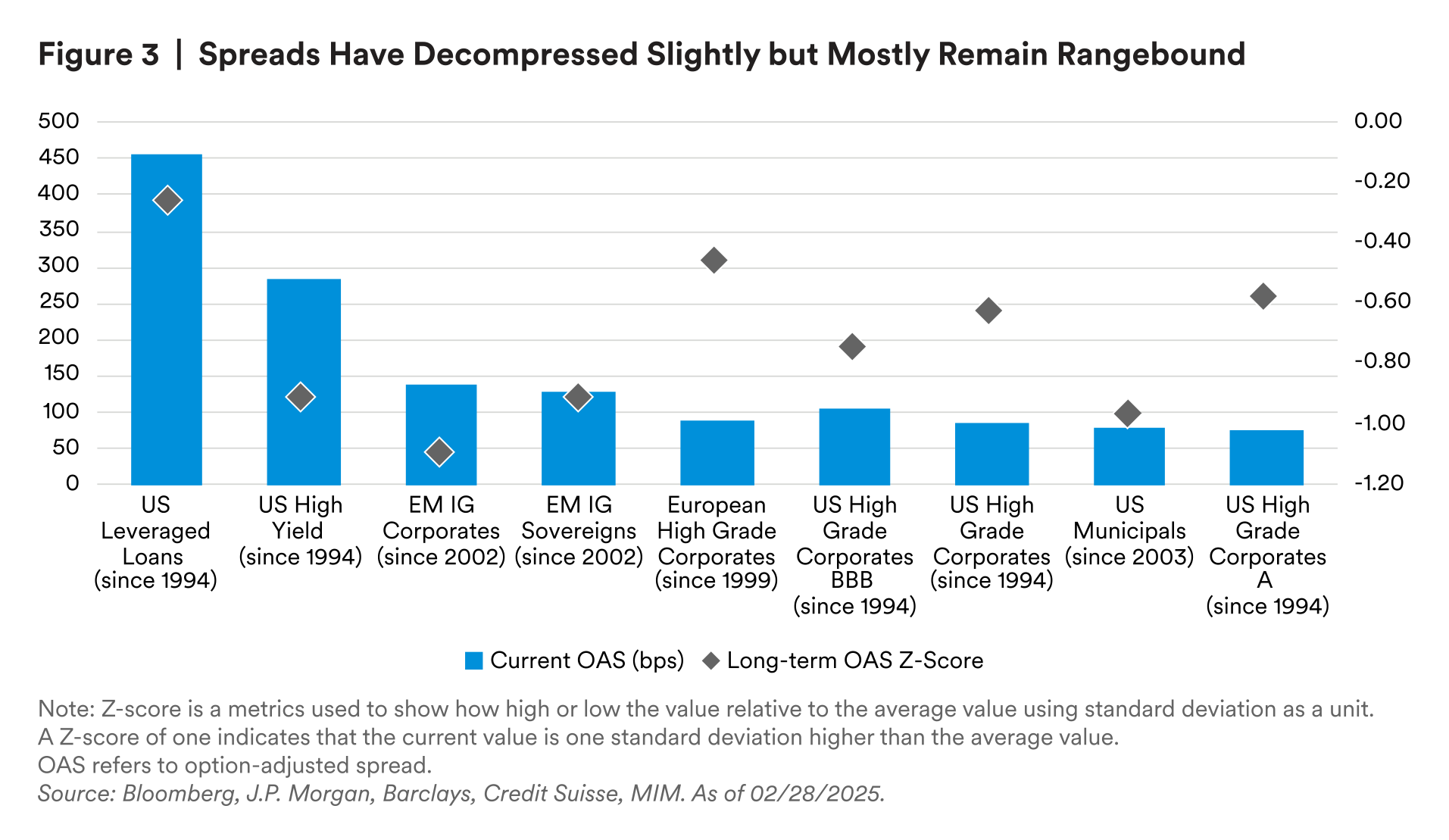

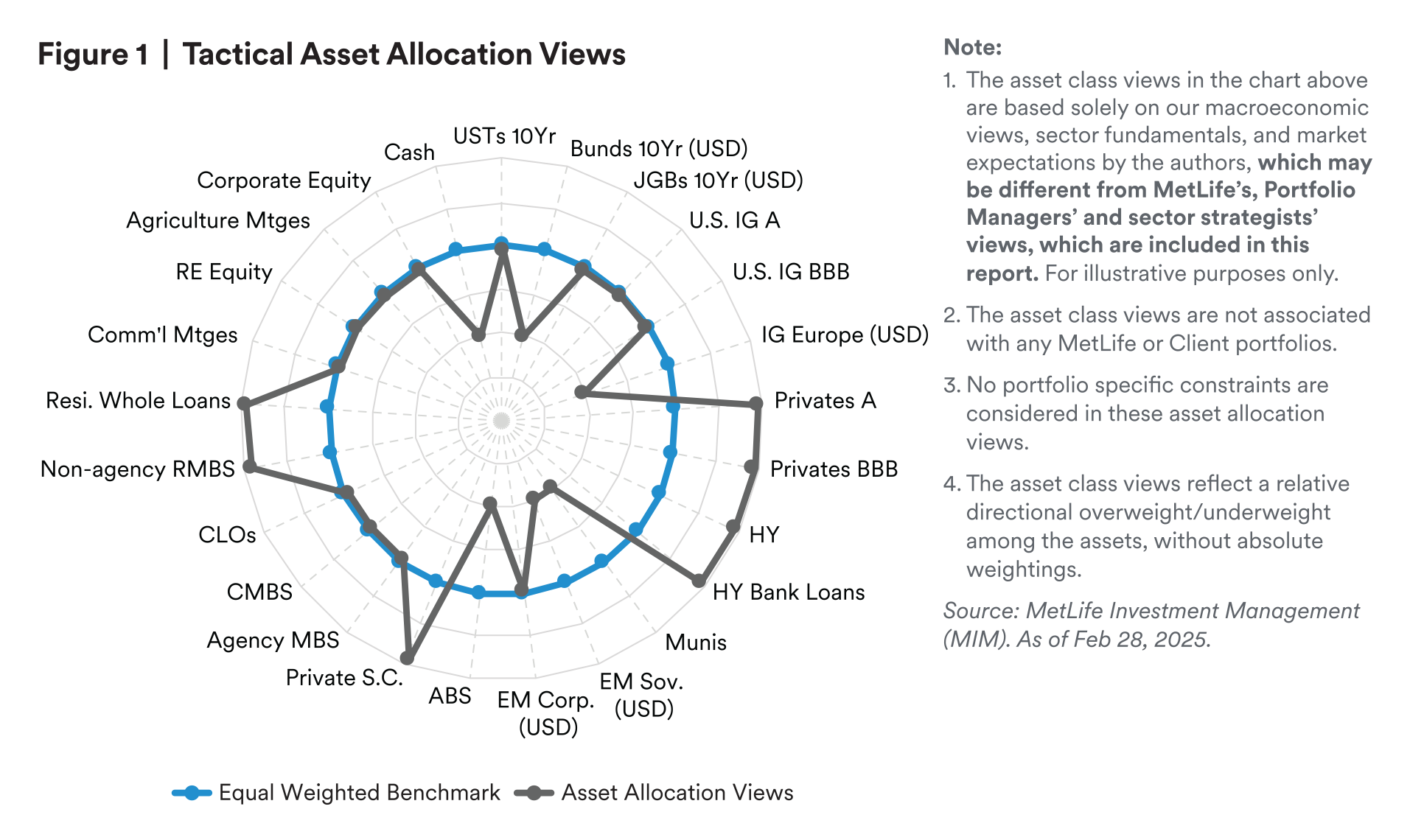

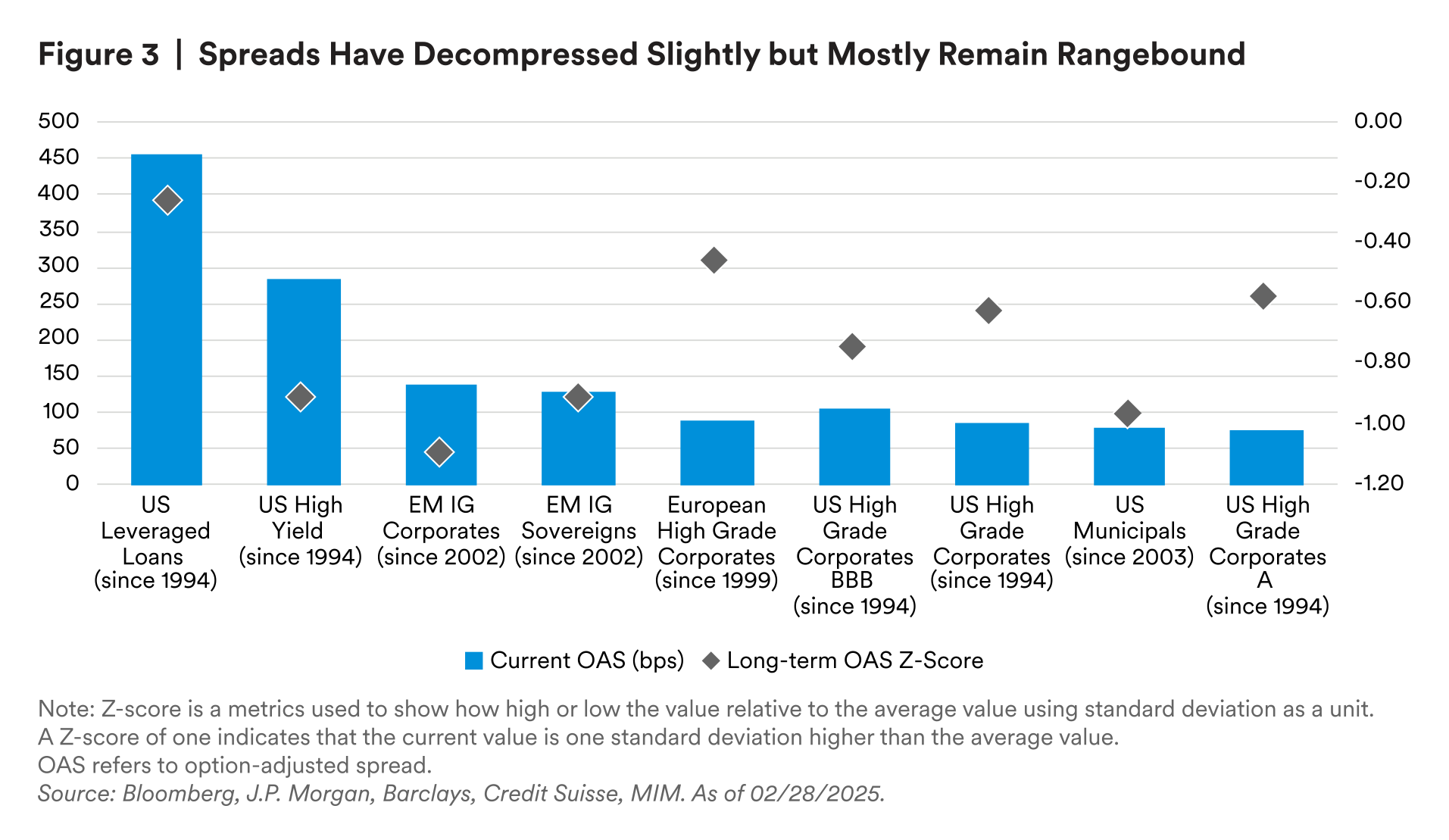

On the surface, this behavior seems odd given generally healthy consumer balance sheets, low levels of unemployment and continued, reasonable job gains. However, under the surface, we can see stress. The growth of average weekly wages is now just above the inflation rate, so the average wage earner is seeing their income only outpace higher prices despite a labor market with an unemployment rate near 4%. In discussing the average, we acknowledge that there is a cohort of consumers who, despite the strong labor market, are seeing their spending power continue to erode. This is likely prompting them to temporarily use credit to make up the difference, but that is not sustainable in the long term. Indeed, the percentage of consumers noting that they will be unable to make their minimum debt payments over the next three months is above 13% versus below 12% pre-COVID. This may also help to explain the deterioration in consumer confidence measures. We continue to look for spreads mostly to remain rangebound, with a low chance of decompressing. Market Strategy is neutral for the back end of the curve, while seeing opportunities for asset classes with short- to mid-durations.

Europe — The eurozone experienced tepid growth at the end of 2024, with GDP expanding just 0.1% QoQ in Q4, down from 0.4% in Q3. Core countries like Germany, France and Italy showed signs of weakness, while Spain continued to outperform. Downside risks to growth persist, primarily due to the potential for higher U.S. import tariffs. Despite these risks, 2025 growth forecasts are largely unchanged, anticipating a 0.6% growth rate. The European Central Bank (ECB) is expected to continue easing its monetary policy, potentially lowering the deposit rate to around 1.75% by the end of 2025. The outlook for the eurozone remains cautious, with downside risks dominating.

UK — The UK’s growth forecast remains unchanged at 1.1% for 2025. While the UK is less exposed to U.S. tariffs, it is vulnerable to weaker growth among its EU trading partners. Looser fiscal policy and higher wages are expected to complicate the Bank of England’s (BoE) outlook, with headline inflation peaking at around 3.7% in Q3 before declining to 2%. The BoE is expected to proceed cautiously with rate cuts, with cumulative cuts of 100 basis points (bps) anticipated for 2025. The risks around this forecast are largely balanced.

Asia — China’s economy remains weak with low consumer and business sentiment, a troubled property sector, and ongoing deflation. The National People’s Congress (NPC) set the 2025 GDP growth target at “around 5%,” and we have revised our growth forecast of 4.3%. As Beijing seems comfortable with the current growth backdrop, monetary easing may be delayed until 2Q25. Regionally, growth is expected to decline due to increased trade tensions impacting business confidence and investment. China is most vulnerable to U.S. tariffs, while other countries that are particularly exposed include Vietnam, Taiwan, Korea, Malaysia and Thailand. In contrast, countries like Japan, India and the Philippines are better positioned. Vietnam's rising trade surplus with the U.S. adds to its vulnerability, while the extent of policy support will vary based on each country's financial stability and fiscal capacity.

Latin America — The past quarter has shown a mixed growth outlook for Latin America, with Mexico and Brazil experiencing a slowdown, while the Andean countries are growing close to trend. Inflation is expected to soften in 2025 but remain above target in most countries. Diverging monetary policies across the region are influenced by U.S. monetary policy, with long-term interest rates affected by U.S. rates, term-premium and fiscal risks. In Mexico, growth is forecasted to slow to 1.0% in 2025, with inflation expected to fall to 4.0% by year-end. Brazil's growth is expected to decelerate to 2% in 2025, with inflation rising to 6.0% by year-end, driven by higher food prices and fiscal stimulus. The Andean countries are expected to stabilize with growth around 2%–3%, supported by lower inflation and interest rates. Inflation in Chile is forecasted to be 4.1% by year-end, while Colombia's inflation is expected to ease to 4.3% by 2025. Monetary policy in the region is varied, with Mexico and Colombia continuing to cut rates, while Brazil is expected to hike rates to contain inflation. Long-term interest rates in the region are influenced by U.S. rates and fiscal policies, with risks of higher deficits and spending pressures. Domestic issues related to fiscal policy and reforms pose significant risks to the forecasts, particularly in Mexico, Chile, Brazil and Colombia. Overall, the sentiment for Latin America is negative due to the mixed growth outlook, inflationary pressures and fiscal risks.

U.S. Treasury (UST) — Market Strategy retains the same view as last quarter: The Federal Reserve will continue cutting policy rates as it transitions toward a neutral policy rate, which Market Strategy would estimate is near 4% by the end of 2025. We expect the UST yield curve to steepen further in the next quarter or two, with short-end interest rates decreasing slightly as the long end holds near 4.25%.

Japanese Government Bonds (JGBs) — MIM expects continued inflation traction in Japan, likely to be supported by a positive outcome at this year’s Shunto wage negotiations. These are supportive for another 25-bp rate hike from the Bank of Japan (BoJ) this year, underpinning the longer end of the JGB curve as well. MIM has moved the year-end 2025 inflation target to 2.3%. MIM maintains our end-year 10-year JGB yield forecasts of around 1.3% by the end of 2025.

Chinese Government Bonds (CGBs) — The economy's fundamentals are relatively positive compared to last year, but policy uncertainty remains both in the domestic and overseas markets. CGBs have experienced a short-term headwind due to tighter-than-expected liquidity and improved equity risk appetite. The absolute yield of CGBs is still at a historical low level. Liquidity remains neutral. MIM expects continued downward pressure on 10-year CGBs, given the sluggish growth backdrop and ongoing disinflationary pressures. That said, the People’s Bank Of China (PBoC) has openly expressed its desire for an upward leaning yield curve, which suggests some yield curve control via purchases and sales of CGBs, as and when needed. MIM expects CGB yields to be around 1.6% by the end of 2025.

German Bunds — German Bunds are supported by strong demand for high-quality, euro-denominated sovereign paper. However, the outlook for fiscal policy has changed following Germany’s February 2025 federal election, with increased spending on defense and infrastructure expected. This could lead to higher government issuance needs and upward pressure on longer-term bund yields. MIM forecasts a year-end 2025 10-year bund yield of 2.55%, reflecting an expectation of higher yields until more information becomes available. MIM finds Bunds less attractive.

Credit Macro — The current credit cycle condition worsened slightly from the last quarter. Although our Fed policy indicator became slightly less restrictive, and the yield curve (3-month – 10-year spread) reversed from inversion, the bank lending standards as of February 28 reverted back to signaling tightening of lending conditions. Market Strategy believes we are still “late cycle.” Credit fundamentals mostly remained stable in the fourth quarter, with strong earnings and stable leverage ratios below the long-term average. Fixed-income markets mostly have seen net positive flows year-to-date (except for investment grade), according to the Investment Company Institute. The focus for credit investors has shifted toward yields rather than spreads, a trend expected to persist through the rest of 2025. Technical dynamics remain supportive, with reduced FX hedging costs boosting overseas demand and a slowdown in net issuance despite rich valuations (see Figure 3). Looking forward, we continue to expect that credit metrics will stay healthy, and that spreads may see some decompression but remain rangebound overall.

U.S. Investment Grade (IG) — Spreads have traded in a narrow range over the past six months, supported by consistent demand from yield-oriented buyers and a generally bullish sentiment. A strong macroeconomic backdrop, with solid GDP figures and non-farm payrolls, has helped limit any weakness in spreads, while inflation concerns remain subdued. However, market uncertainty is elevated due to potential policy changes from Washington, including tariffs, fiscal spending adjustments and global geopolitical concerns. Declines in consumer sentiment and business confidence introduce downside risks to growth and interest rates, which could negatively impact spreads. Despite these challenges, investment-grade credit quality continues to improve, supported by robust credit fundamentals and strong demand. We maintain a defensive posture in portfolios, anticipating that risks are tilted toward spread decompression, although spreads may continue to hover around current tight levels, given the strong economic backdrop. Corporate spreads are currently around 80 bps, significantly tighter than the 20-year average. Revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) growth remain healthy, and leverage has slightly decreased, with coverage ratios improving. MIM remains neutral rating for U.S. investment grade.

European IG — Fundamentals for European corporates remain solid, with the top line moderately up, while earnings were softer. Earnings in Energy and Materials companies were negatively impacted by a combination of falling demand and higher costs, while Industrials and Financials continued to deliver strong growth in revenue and income. The pace of Rising Stars has slowed down, and rating downgrades have started outpacing upgrades, marking a shift from the recent positive ratings trajectory. Option-adjusted spreads (OAS) have rallied in the past two months, as the compression theme continues to play out. The spread between USD IG spread and EUR spread has tightened significantly. Inflows into EUR IG have been relentless, with 15 weeks of consecutive inflows last year, and cash balances remain high, leading to robust demand for new issues. While the threat of tariffs has clouded the macroeconomic outlook, the outline of ceasefire agreements in Gaza and Ukraine created a powerful tailwind. USD hedging costs have increased, and non-U.S. end investors have started redirecting flows away from the U.S. New issue discounts have all but disappeared, and primary supply has been underwhelming, year to date. There is huge demand for duration in euro government bonds, particularly if there’s some yield. As we get closer to cycle troughs in euro and GBP spreads, it’s getting harder to see value.

High Yield (HY) — After declining for two consecutive months, high-yield primary market activity increased in December, a historically weaker month. High-yield new issue volume totaled a healthy $288.8 billion ($70.9bn non-refi) in 2024, compared to $176.1 billion ($59.5bn ex-refi) of issuance in 2023. Refinancing activity dominated the use of proceeds for the year, totaling $217.3 billion, the fifth highest volume on record. This rebound in refinancing activity follows largely muted volumes for the prior two years. Retail demand for high-yield bonds rebounded strongly amid resilient economic growth, a Fed easing cycle, strong capital market conditions, low defaults and elevated yields. High-yield funds reported $20.0 billion of inflows, the sixth largest annual inflow on record. The high-yield market emerged largely unscathed from a consequential quarter in terms of global politics, trading relations and the trajectory of rates and inflation. OAS has tightened 24 bps, quarter to date (01.31.25). High yield continues to be supported by accelerating retail inflows and resilient fundamentals. We expect the market to remain firm throughout the year and overweight U.S. high yield.

Leveraged Loans — MIM maintains our preference for an up-in-quality approach within bank loans, as we expect macro moderation to remain supportive of loans in 2025. While spreads are near two-year tights, the elevated base rate and all-in high yields continue to encourage buyers to chase loan yields. Strategists are calling for a 7%–8% return expectation for 2025, as robust refinancing activity and a revival of animal spirits provide a backdrop for the leveraged loan market to grow again after a modest shrinkage last year. We expect more corporate M&A behavior due to falling debt costs, a rebound in earnings and potential tailwinds from deregulation and lower corporate taxes. This sets the stage for more corporate dealmaking, capital raising and comfort around more balance sheet leverage. MIM continues to overweight leveraged loans and believes that an up-in-quality approach in loan investing continues to mitigate against a trickier second half of 2025, as corporate animal spirits grow, and the range of economic outcomes widens.

Municipals — Although the environment for credit appears favorable through the first half of 2025, we expect taxable municipal spreads to trend largely sideways. The tightening bias will also be supported by limited taxable issuance and robust global demand for yield and duration. However, resistance is expected due to the OAS on the Bloomberg Agg index. The Eligible Taxable Municipal index is near all-time tights, suggesting little room for visible risks, including elevated rate volatility or policy uncertainty from tariffs or tax cuts. MIM favor selling less liquid, non-index callable securities from peripheral issuers at tight spreads and trimming overweight in long taxable housing bonds. In tax-exempts, we will monitor policy developments that could limit the tax exemption, particularly for Private Activity Bonds (PABs). Overall, MIM recommends a higher allocation to other sectors for opportunistic deployment.

Emerging Markets (EM) — The macro environment remains a critical factor for EM credit, particularly as we navigate through 2025. The return of the Trump administration could significantly alter global dynamics, impacting trade, foreign policy and economic growth. Despite this uncertainty, EM sovereigns and corporates have stabilized from past growth and inflation shocks. EM growth is balanced, with commodity exporters facing some challenges. Early central bank actions have helped manage inflation, and the ability to ease policy will support economies. While some EM countries face downgrade risks, others show potential for upgrades. Political risks are low, and recent sovereign restructurings have been positive. MIM remains underweight in EM sovereigns but sees the potential to move to a neutral weight in the following quarters. EM corporates and banks maintain healthy fundamentals, with strong balance sheets and manageable leverage. The U.S. rate-cutting cycle presents opportunities for yield and duration exposure in EM. We favor high-yield over investment-grade sovereigns, with a barbell approach to risk. Opportunities exist in BB and BBB corporates, particularly those with hard currency revenues. Local currency valuations are attractive, and we prefer selective local duration overweights and believe EM corporate credit is comparable to other sectors.

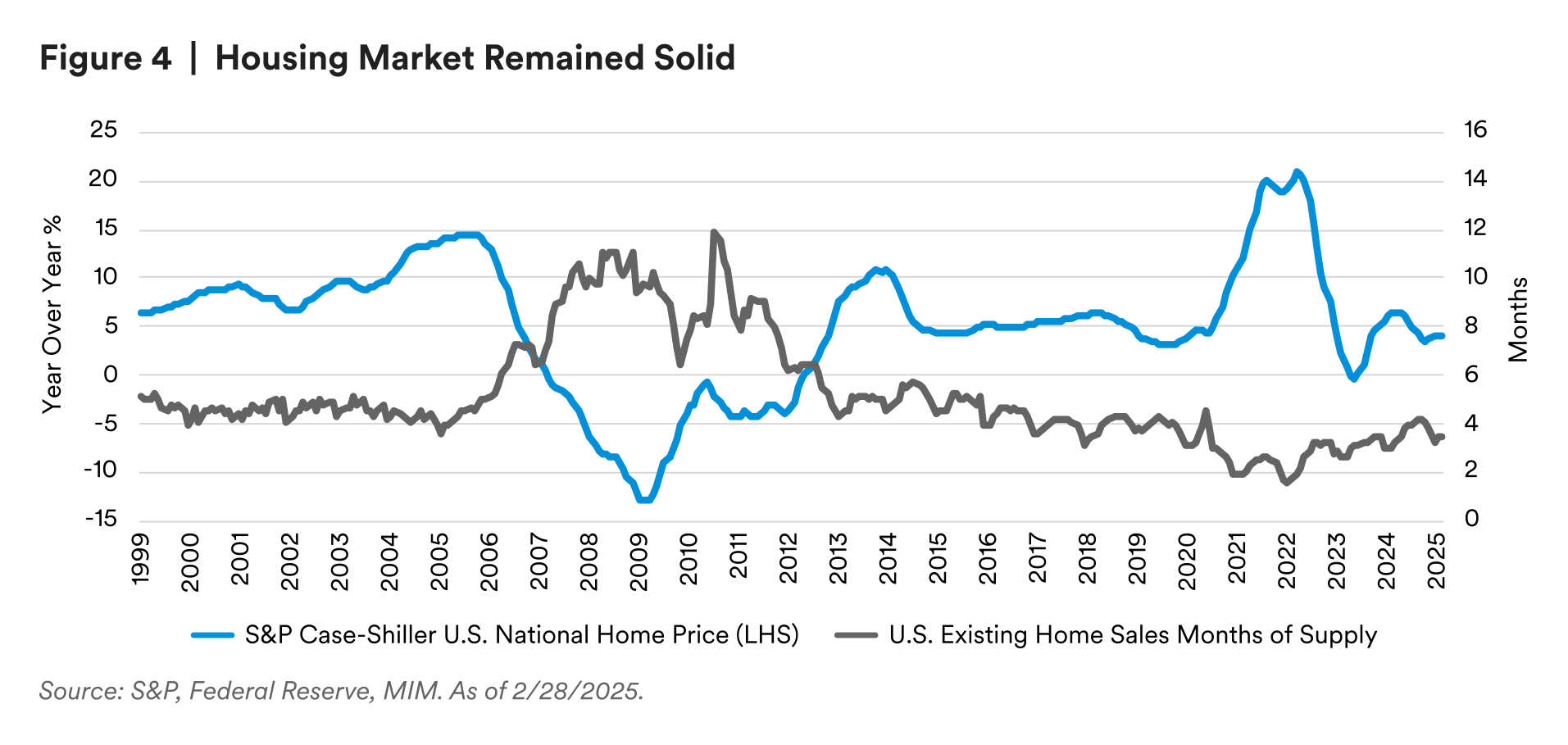

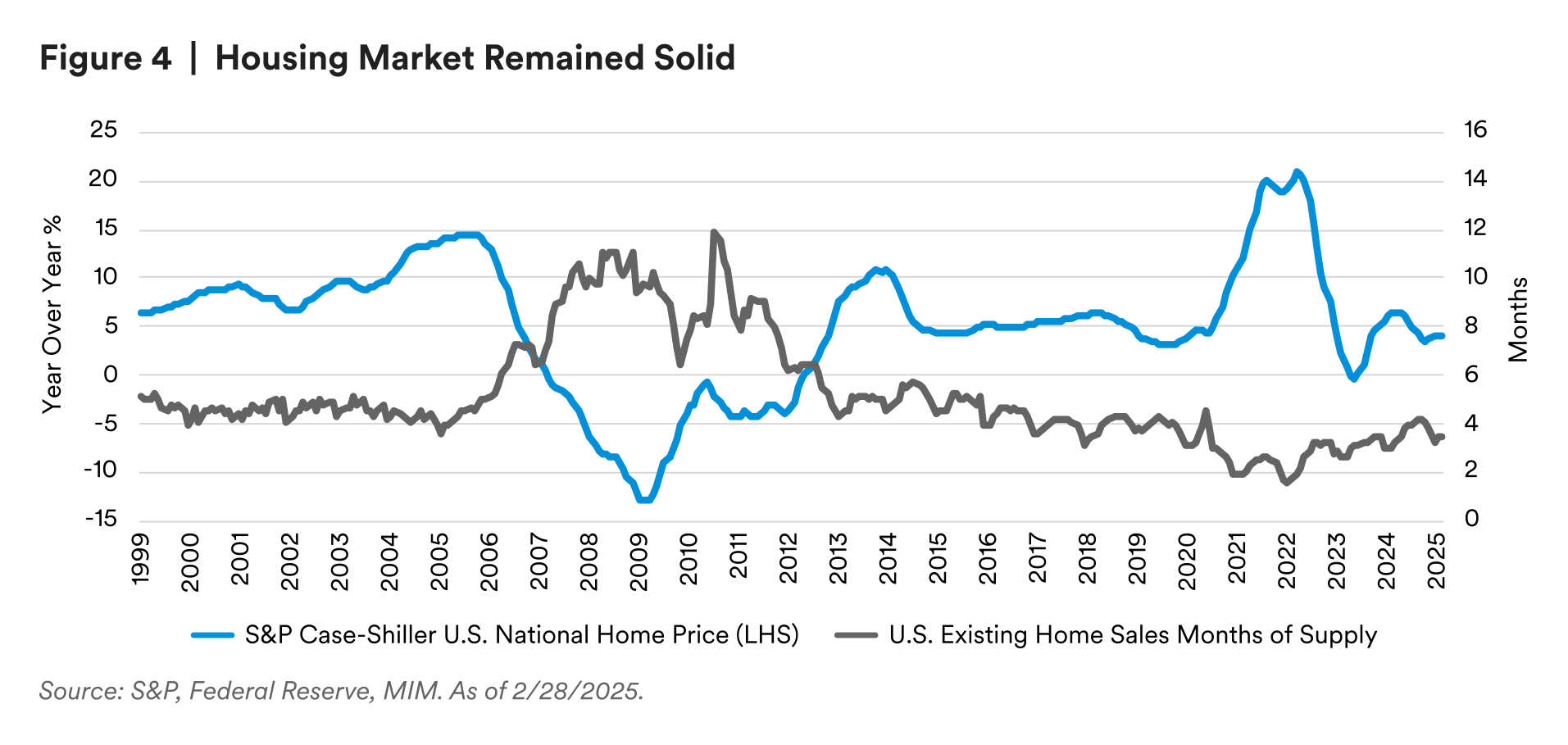

Residential Credit —The housing market continues to grow with limited supply, with a 4.48% year-over-year increase in home prices. (see Figure 4) Affordability remains a significant issue, particularly for first-time buyers and, although improved by the end of 2024, it is still far from the pre-pandemic level. Credit fundamentals in the residential mortgage-backed securities (RMBS) sector are strong, with low delinquency rates among prime borrowers and stable rates among non-prime borrowers.

Asset-backed Securities (ABS) — The ABS market remains neutral regarding technicals, with January supply slightly lower than the previous year, but still robust. Demand remains strong, with deals well subscribed and ample investor capital available. Fundamentals favor corporate over consumer issues. We do see more stress under the surface of wage growth and a strong labor market. The percentage of consumers noting that they will be unable to make their minimum debt payments over the next three months is above 13% versus below 12% pre-COVID. This may also help to explain the deterioration in consumer confidence measures. Valuations are neutral, with spreads at local tights and limited room for further tightening. Data center-related ABS deals have been well received, though commercial mortgage-backed securities (CMBS) spreads have widened slightly. Rate reduction bonds of utilities are seen as attractive despite some widening due to wildfires. Overall, we remain cautious on sectors tied to discretionary spending and favor large, established issuers.

Collateralized Loan Obligations (CLOs) — MIM maintains a neutral stance on CLO technicals, fundamentals and valuations. However, recent trends suggest a slight negative shift in valuations, with AAA spreads in longer non-call new issues trending towards 110 bps. We expect a significant wave of CLO supply in 2025 and continue to favor longer non-call and top-tier shelves. The growth of the ETF space presents a risk that will be monitored.

Commercial Mortgage-backed Securities (CMBS) — Technicals are neutral, with increased issuance expected in 2025, which the market should absorb. Fundamentals have been raised to neutral due to increased commercial real estate (CRE) volumes, though valuations remain tight, leading to a negative outlook. AA conduit spreads are clearing around 115 bps, with AAAs in the 70s. MIM prefers investing in AA and higher on the capital stack and favors 10-year over five-year paper. Office dynamics remain fluid, and we limit exposure to higher office concentrations.

Agency MBS — Supply and demand are balanced, leading to a neutral technical outlook. Fundamentals have been upgraded to positive, with deregulation under the new administration expected to boost bank demand for MBS. Valuations are constructive, with agency MBS spreads appearing cheap relative to competing assets. The corporate index OAS is 45 bps above agency MBS OAS, well below the three- to-five-year average of 70 bps.

Non-Agency MBS — The residential sector backdrop is strong, with relentless demand across subsectors. Technicals and fundamentals remain positive, but valuations have shifted to neutral due to tightening spreads. MIM focuses on top-tier liquid names in the non-qualified mortgage (Non-QM) sector, subordinated tranches in prime jumbo and reperforming loans (RPL). We are bullish on single family residential (SFR), which offers a solid convexity profile, but limit exposure to home equity line of credit/home equity investment (HELOC/HEI) products due to underwriting concerns. Rate volatility and housing demand are key risks. Overall, MIM believes non-agency MBS offers attractive opportunities and recommends an overweight.

Private Structured Credit (PSC) —The private asset-based finance (ABF) market has seen a strong start in 2025, driven by robust demand and significant spread tightening. Increased competition, particularly in the agented private distribution channel, has led to multiple oversubscribed syndicated deals and pricing near multi-year tights. MIM ABF remains focused on direct origination channels to negotiate better deal terms and achieve more attractive pricing and portfolio allocations. Despite the increased competition and spread compression, discipline is maintained to avoid deals with softer relative value and weaker investor protections. Long-standing issuer relationships continue to provide attractive opportunities across various sectors, including residential credit, commercial property assessed clean energy (C-PACE), low-income housing and fund finance.

Residential Whole Loans — The housing market has remained stable over the past quarter, with the higher interest rate environment contributing to a low supply of homes for sale, thereby keeping home prices steady. Delinquency rates are consistent with pre-pandemic levels, indicating stable credit fundamentals. Spreads for residential whole loans and single-family rental debt financing have experienced some tightening but continue to offer strong relative value, with loss-adjusted spreads in the low 200s. Looking ahead to the next quarter, we expect the housing market to maintain its stability, with spreads likely to remain attractive given the current economic conditions.

The commercial real estate sector experienced stable fundamentals over the past quarter, with some variations across different property types. Industrial and multifamily sectors remain generally healthy, although they face supply risks in certain markets. Industrial vacancy rates increased slightly to 8.6%, driven by new construction, but they remain below the historical average. Retail vacancy rates held steady at a record low of 6.5%, supported by limited new construction and demolition of non-competitive stock. Hotel fundamentals are positive, with revenue per available room (RevPAR) growth continuing, albeit slower than inflation. Office fundamentals showed signs of stabilization, with a slight decline in vacancy rates for the first time since Q4 2021. Looking ahead, we expect industrial rent growth to remain healthy, particularly in infill submarkets, and anticipate a 20% increase in transaction volumes for 2025. Despite higher interest rates and stress in the banking sector, debt origination by life insurance companies has increased, indicating a potential recovery in transaction activity later this year.

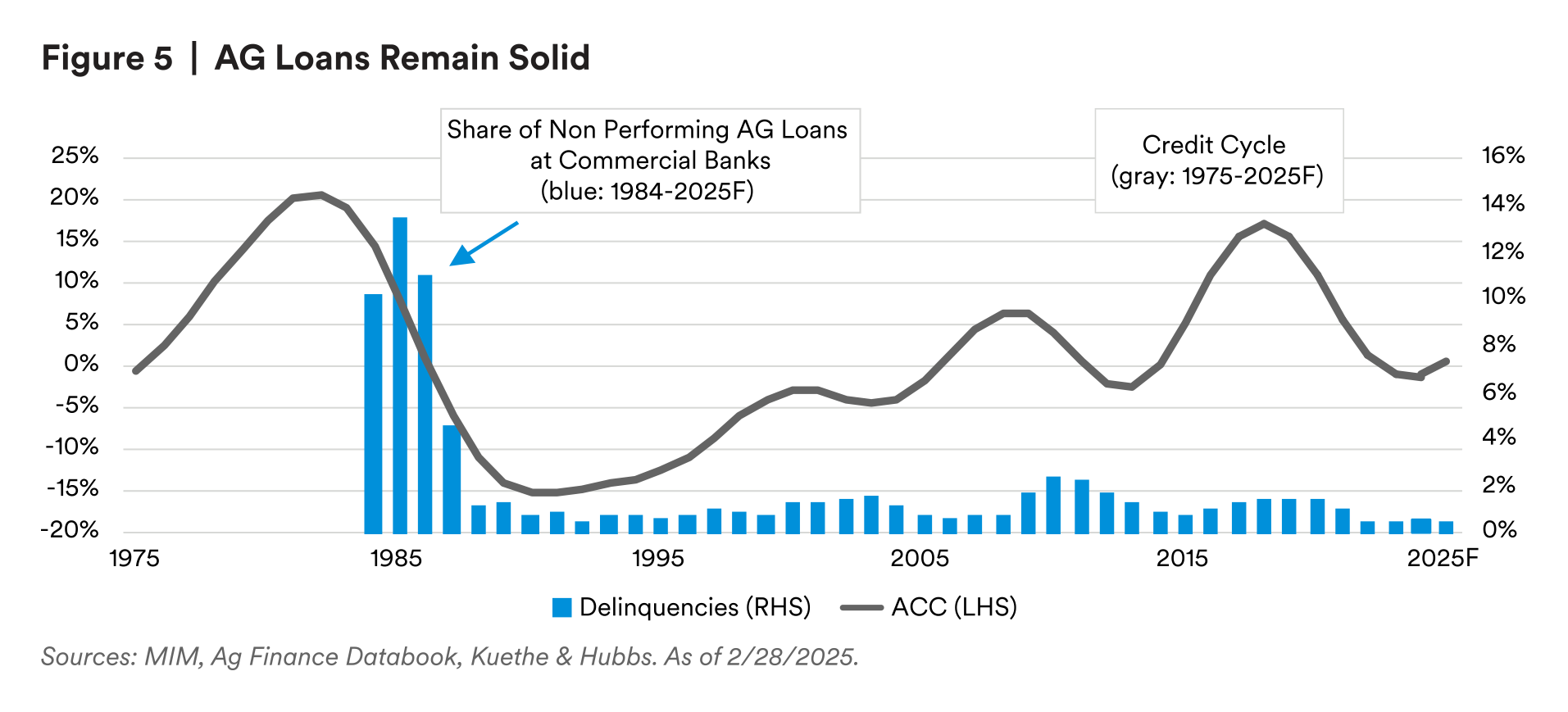

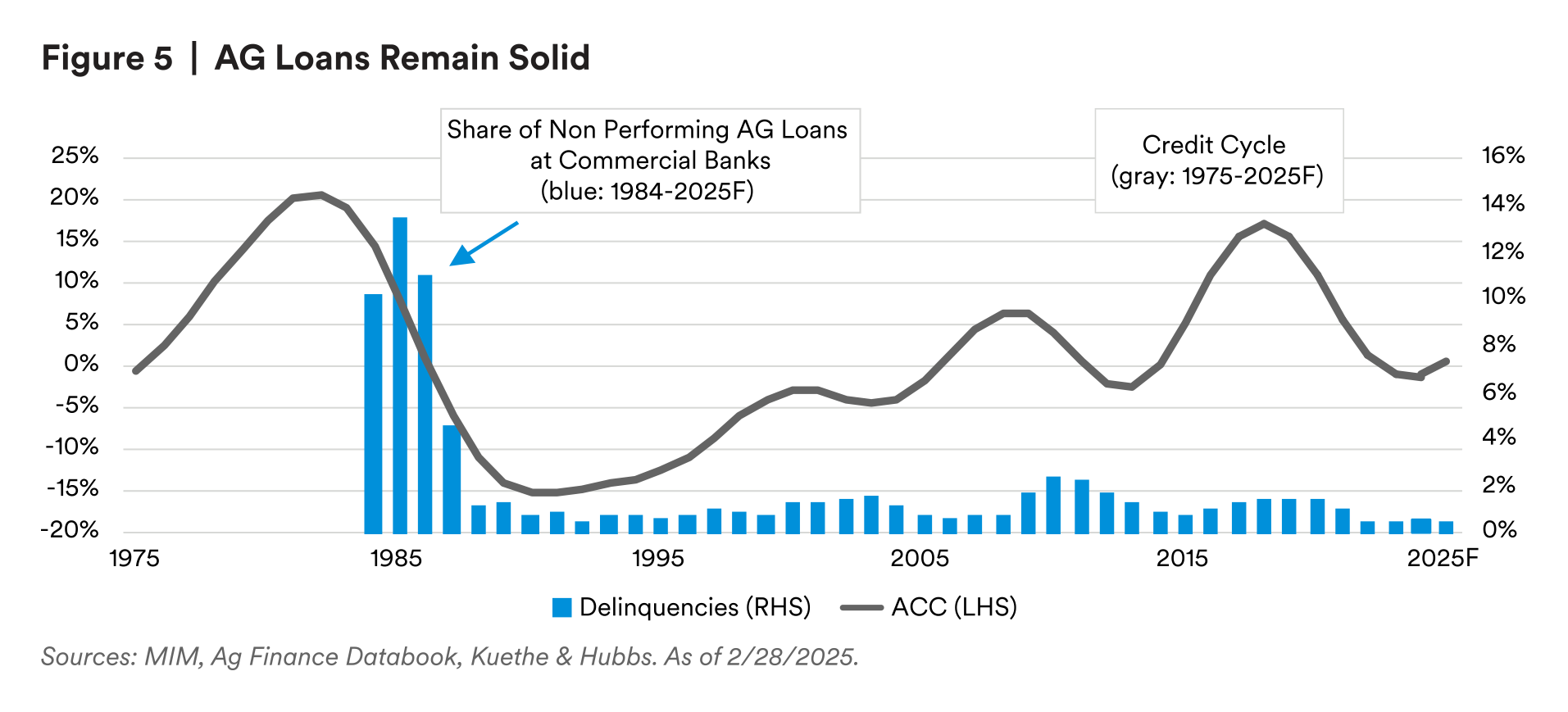

The agricultural sector experienced a significant increase in net farm income (NFI) for 2025, projected to rise by 30% year-over-year to $180 billion, driven primarily by a substantial increase in government payments under the American Relief Act of 2025. Despite this increase, producer margins are expected to improve only modestly due to moderated prices of major row crops and the slow normalization of input expenses. Fertilizer and pesticide expenses are forecasted to decline, contributing to a better crop price/input cost ratio. Livestock producers are expected to maintain high profitability due to tight supplies and lower feed costs. The timberland market saw a modest value increase, supported by strong long-term demand fundamentals and potential reassessment of duties on Canadian lumber. Farmland values remain above the inflation-adjusted trendline but are expected to appreciate more modestly. Agricultural mortgage volumes are rebounding, with growth expected to accelerate as credit demand increases. Overall, the relative value in the agricultural sector remains neutral.

The U.S. equity fundamentals are still strong. In the fourth quarter, S&P 500 earnings positively surprised by about 7.2%, with earnings growing at 13.2% year over year, compared to 7.9% in 1Q2024. U.S. equities generally perform better than their international counterparts, as investors leaned toward technology stocks instead of financials. This trend presents a risk for the largest equity market globally, especially given the recent struggles in the tech sector. The combination of relatively high Treasury yields and a stock market that remains near its peak makes equities seem relatively pricey, regardless of whether or not the Magnificent Seven stocks are included. Even after excluding these high-priced stocks from the S&P 500, the forward earnings yield only rises to 5.1%. While this is 79 bps above the 10-year yield, it still stands at 2.2 standard deviations below the average since 2014. The Magnificent Seven stocks — Apple, Microsoft, Amazon, Nvidia, Alphabet, Tesla and Meta — offer a combined forward yield of just 3.5%, which is 74 bps lower than the 10-year Treasury yield and 1.7 standard deviations below the average since 2015. MIM moves the equity rating from overweight to neutral. On the other hand, after another Fed rate cut in the last quarter, U.S. 3-month Treasury bills yield 4.3% as of February 28, according to Bloomberg, which we found will be less attractive, given Market Strategy expectation of further 50-bp cuts in 2025.

The private equity market experienced a mixed performance in the past quarter, with U.S. buyout activity totaling $276 billion in 2024, marking a significant increase year over year but still below the peak levels of 2021. European deal value and count also grew substantially, while Asia's private equity investment declined. Despite the economic uncertainty impacting return potential, the private equity industry remains well positioned to capitalize on the current market environment. Global exit activity improved, particularly in the second half of the year, with a notable increase in private equity-backed IPOs. However, the backlog of companies seeking exits suggests a gradual release in 2025. Fundraising faced challenges, particularly in Asia and within the venture capital sector, where liquidity issues stifled activity. Nonetheless, the long-term outlook for private equity remains positive, with a focus on high-quality investments and proven managers.

The USD started the year weaker against all G10 currencies and most EM pairs, driven by a lack of tariff follow-through and declining U.S. yields. Recently, the focus has shifted to U.S. economic data, which have been unexpectedly soft, causing relative equity returns to lag behind Europe and China year to date. The America First Trade Policy order signed by President Trump could lead to tariffs on specific countries, potentially strengthening the USD. However, the recent Fed minutes suggest a pause in quantitative tightening, and risks around U.S. government funding ahead of a possible shutdown could keep the USD under pressure. In Asia, the JPY has strengthened due to a repricing of the BoJ rate path and stronger domestic data, while increased inflows into Chinese equities have not supported currencies like CNY, KRW and TWD. European currencies have benefited from ceasefire negotiations between Russia and Ukraine, with the RUB being the biggest benefiter. Central and Eastern European central banks' higher rates and signs of cyclical recovery in European PMIs have supported a stronger EUR. In Latin America, high-beta currencies like BRL and COP have performed well due to short positioning and high carry, despite fiscal deficit issues.

Contributors: David Heslam, David Richter, Felipe Perigo, Brad Gottenberg, Jean-Luc Eberlin, Pierre-Pascal Lalonde, Sara Strauch, Jason Valentino, Paul Carroll, Alfred Chang, Jacob Kurosaki, David Williams, Agata Praczuk, Carrie Biemer, Will Sommer

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For Investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.