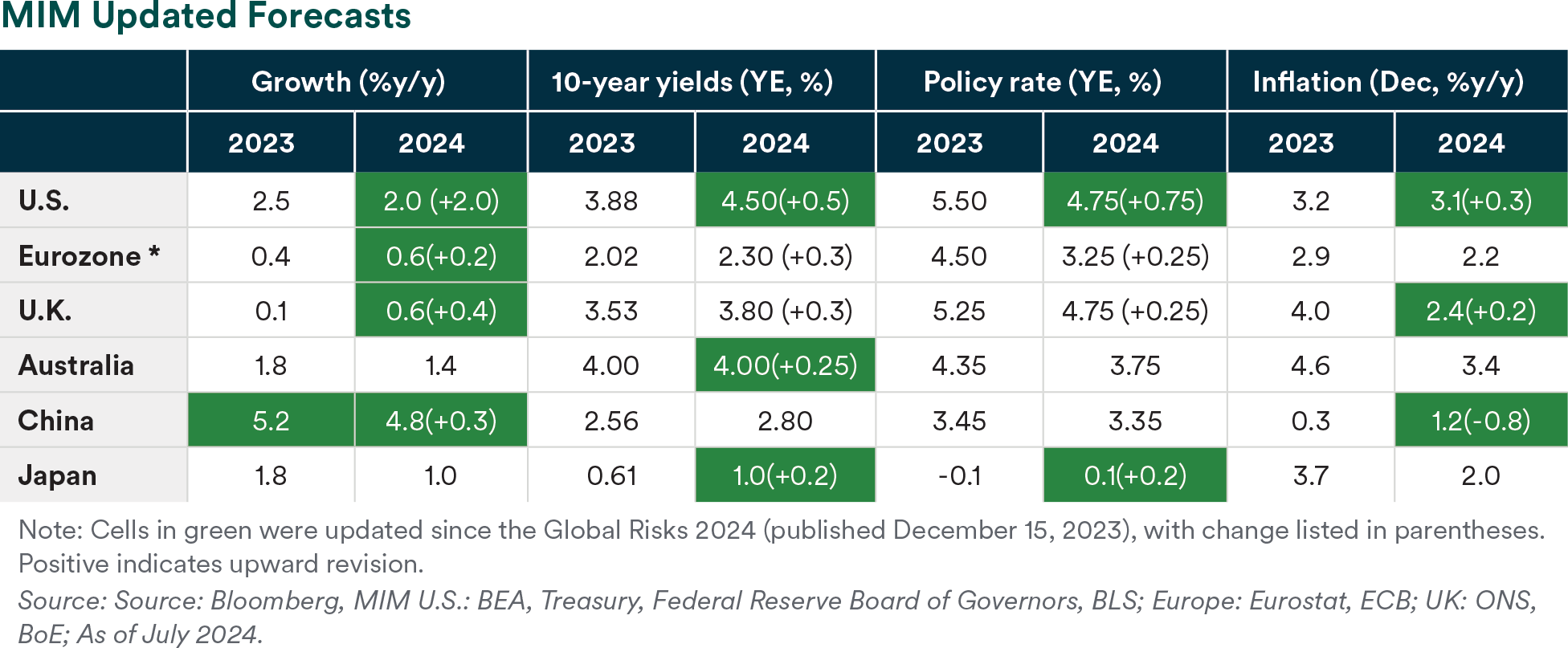

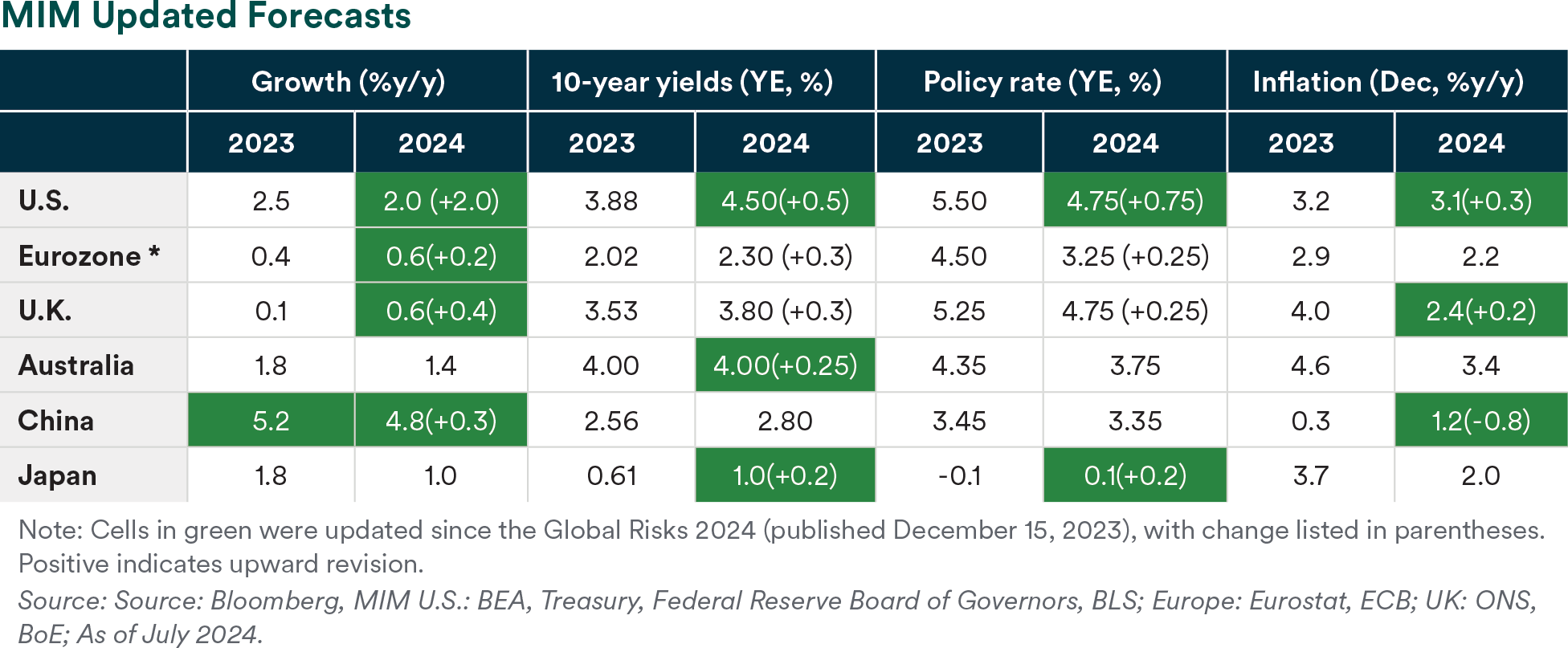

A few risks that concerned us in December did come to pass. We have seen a resurgence of inflation—in the U.S. at least. We have also seen nascent recovery of the manufacturing sector in both the U.S. and EU, and the U.S. business sector’s strengthening over the last few quarters has meant that our base case has shifted from recession for 2024 to no recession.

Our main concerns for the rest of the year are geopolitical and election risks. In the U.S., an expected Trump victory could bring tariffs, import restrictions and a more hawkish Taiwan policy, straining the political relationship with China and putting pressure on U.S. firms doing business there. French and U.K. elections may create some policy changes as well.

Finally, while the Ukraine war is expected to continue at least through year-end, we remain more concerned over an escalation in fighting in the Middle East. We see a substantial risk of the Israel- Hamas conflict broadening by year end, most likely through a new front opening with Hezbollah on Lebanon’s southern border. While the chances of a direct conflict between Israel and Iran are small, especially in the very short term, both countries have demonstrated the ability to strike within each other’s territories, raising the worrying possibility of miscalculation and rapid escalation. Economically, an escalation could have broad energy market implications by disrupting both Iran’s own oil production along with the production of countries that ship their oil through the Strait of Hormuz.

Risk 1: U.S. Debt Troubles

Over the first half of the year: In late 2023, there was much discussion that the pricing of U.S. Treasuries reflected worried about U.S. debt sustainability. Since then, acute concerns about U.S. Treasury debt have receded, and the 10-year Treasury yield declined from its Q4 2023 peak of 5.0%.

Updated risks: Toward year end, the debt ceiling will loom again. On January 1, 2025, the debt ceiling will be reinstated at the level required to accommodate all borrowings until that date. The date at which the debt ceiling becomes a constraint on spending will depend on tax revenues in 2025 as well as on the amount of cash on hand in the Treasury General Account. Toward the end of 2024, we are likely to get a better sense of when the new debt ceiling will begin to bind and the inclination of the newly elected Congress to address the ceiling.

A meaningful credit rating downgrade appears to be a distant concern. With one agency (Moody’s) still rating the U.S. as AAA, a downgrade to single-A—the only downgrade that may materially affect markets—is unlikely to be a danger before year end 2024. We remain concerned about the pace of government spending over the medium term.

Risk 2: Manufacturing Recovery Creates a Soft Landing.

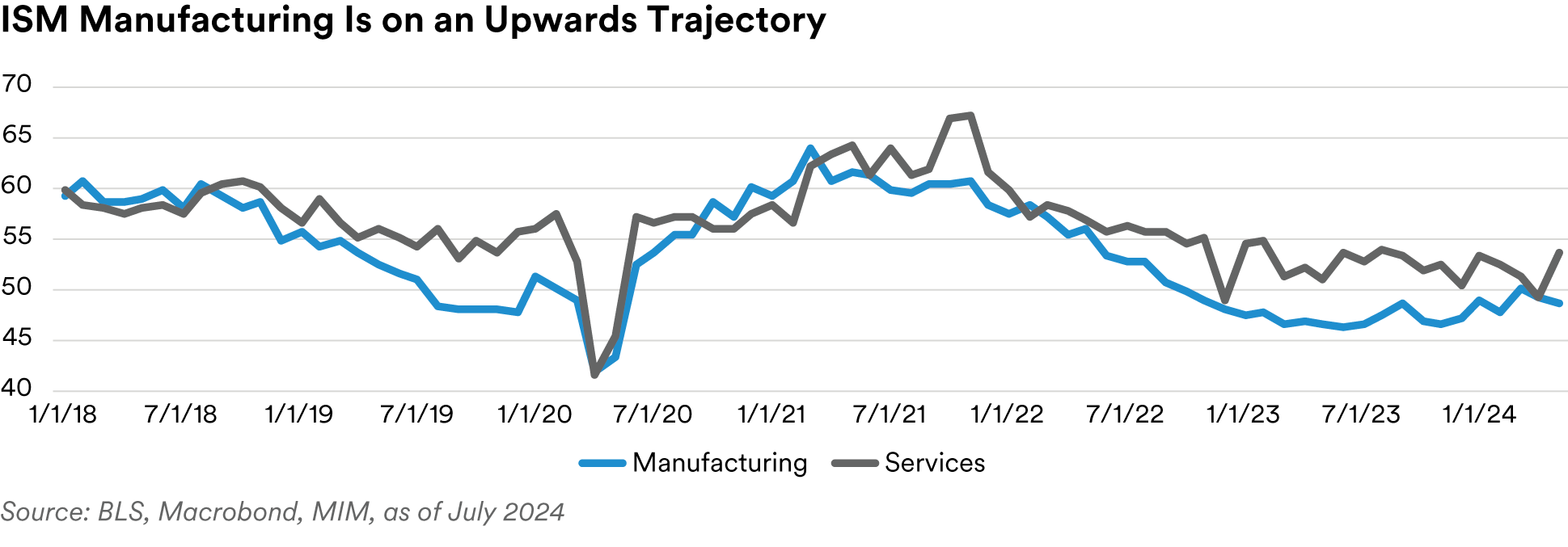

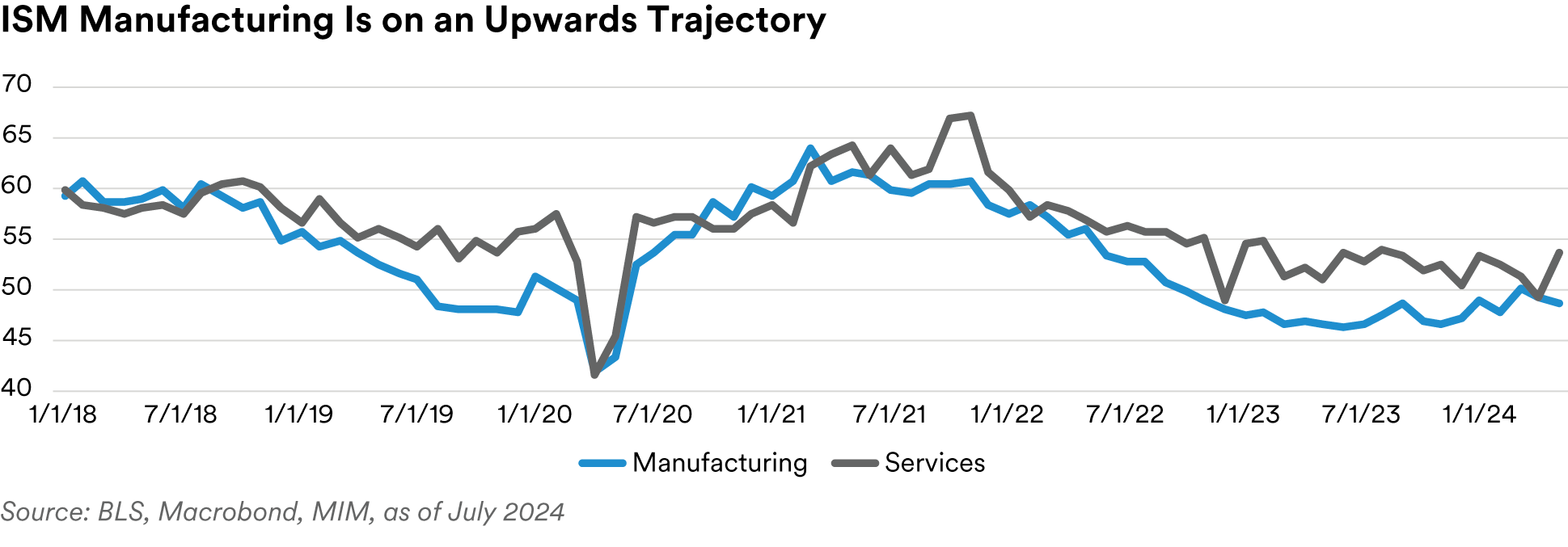

Over the first half of the year, U.S. manufacturing did indeed improve from what was effectively a manufacturing recession in 2023. In our December risks piece, we argued that a plateauing services sector and a recovering manufacturing sector could engineer a soft landing, and the trend of the Institute for Supply Management (ISM) indexes support this theory.

Updated risks: A key risk to our current no-recession scenario is that the services sector continues to decelerate and falls into negative growth. Non-residential private investment overall remains quite cautious despite improving corporate margins—a puzzling development that could stall demand for labor. This may be a result of concerns about the fall elections and the potential changes to government spending and policy, in which case further investment hesitation would continue to be a threat until there is more political clarity.

Risk 3: Resurgence of U.S. Inflation

Over the first quarter of the year, there was indeed a resurgence of inflation in the U.S. The inflation fight, particularly for services, is not over despite the markets and the Fed shifting toward that assumption at the end of 2023.

U.S. Bureau of Labor Statistics (BLS) data show that shelter inflation has come down from its 2023 high of over 8% year over year but remains over 5.5%, a rate last seen in the early 1990s. Medical services prices date chart have accelerated since the beginning of 2024. March’s reading of a 2.6% month-over-month price increase in motor vehicle insurance is the second highest monthly increase since at least 1986, exceeded only by the pandemic. On a year-over-year basis, car insurance prices have soared almost 23%.

Updated risks: If inflation progress continues to be sluggish, or worse, if it accelerates as it did in the first few months of the year, then the Fed would likely keep rates at current levels through year end. We see outright hikes as a remote risk.

The drivers of inflation that worry us particularly are transportation, medical services and homeownership costs, including mortgages and homeowners’ insurance. The risk of goods deflation ending also remains a worry: In our December risks piece, we expressed concerns over the potential end of goods deflation amplifying the effect of services inflation in the aggregate readings. This has not yet been the case, but we expect these to converge toward zero in the near term, which could put upward pressure on inflation.

Geopolitical concerns (which we discuss below) also threaten to increase commodity and transportation prices, while continued government disbursements via the post-pandemic spending packages could also exert inflationary pressure.

Risk 4: Geopolitical Tensions Escalate

Over the first half of the year, tensions in the Middle East continued to simmer, with the ongoing Israel-Hamas conflict, Houthi attacks on cargo ships and the Iranian-Israeli tit-for-tat in April worsening conditions. They have not yet boiled over. The Russia-Ukraine conflict has, as expected, continued without a clear breakthrough by either side. Russia has made some advances this year, stepping up attacks on Kharkiv, Ukraine’s second largest city, and increasing the intensity of drone and missile attacks on Ukraine’s energy infrastructure.

Updated risk: While the U.S. will likely continue to advocate for a ceasefire between Israel and Hamas, we continue to see a substantial risk of Israel’s invasion of Gaza leading to a broadening of the conflict by year end, most likely through the opening of a northern front in the conflict with Hezbollah. Israel’s tolerance for Hezbollah on the southern border of Lebanon has lessened since the outset of the conflict, driven by concerns that Hezbollah could launch an attack several magnitudes more severe than Hamas’ October 7 attack. A much lower probability but higher impact risk would be a direct conflict between Iran and Israel and its allies. The risk of Iran’s involvement is likely lower in the very short term as it sorts out its succession plans for the Presidency. However, both Israel and Iran have recently demonstrated both a willingness and ability to hit each other within their own territories—a concerning development that will increase the risk of an accident or miscalculation triggering a more rapid escalation of the scenario. This would have the worst impact on global energy markets, given the potential for disruption not just to Iranian oil exports but also to the Gulf Cooperation Council (GCC) producers exporting crude through the Strait of Hormuz.

In Ukraine, we expect the Kremlin to continue to take advantage of its relative strength in terms of manpower and ammunition during a period in which there have been delays to the deployment of international support to Kiev. Fighting is expected to intensify over the summer, following U.S. approval of ~$61bn of additional support for Ukraine and lagged delivery of military equipment to bolster its firepower. However, our base-case outlook remains for the conflict to continue without resolution at least through 2024.

Risk 5: 2024 Election Risk Creates Policy Uncertainty

Over the first half of the year: In Europe, MIM’s central expectation that the center ground would generally hold despite an increase of support for far-right populist parties in June’s European Parliament (EP) elections was realized. However, the outcome triggered a surprise call by President Macron for early legislative elections in France, following a strong showing at the EP elections for the far-right National Rally (RN), which repeated its 2019 outcome by coming first and poor results for Macron’s Renaissance group.

In Asia, Taiwan election-related noise appears to have faded following Chinese military drills in the aftermath of President William Lai Ching-te’s inauguration on May 20. The drills illustrate that cross- strait relations are tense; however, Beijing will refrain from measures and actions that could trigger a U.S. military response. In India, Prime Minister Narendra Modi was re-elected with a narrower margin of victory, requiring a coalition government to be formed. Modi retained his cabinet for all key portfolios and core ministries including economics and finance, implying policy continuity.

Updated risks: Election uncertainty will continue through the year in the U.S., and our expectation is that there will be a Republican sweep of the Presidency, the Senate and the House of Representatives. The polling for the presidency is relatively close but consistently indicates victory for President Trump. In our view, the greatest risk to our call is in the House of Representatives, as a split Congress would reduce the probability of extending the Tax Cuts and Jobs Act from President Trump’s first term.

There has been some discussion about a second Trump presidency threatening Fed independence. We place a relatively low probability on a material takeover. First, only two Federal Reserve Board seats are expected to open in the next four years, and nominees would still require Senate approval. Federal Reserve Bank presidents are elected in an even more decentralized and difficult-to-capture process.

Even if President Trump were to successfully find a path toward influence, it is not clear in which direction he would prefer to push rates. Although he had previously advocated for lower rates, a dovish tilt right now could yield serious unintended consequences, given the possibility of inflation reacceleration. Moreover, a conventional Republican pick would generally be more hawkish, and the “Project 2025” document advocates removing unemployment as one of the Federal Open Market Committee (FOMC) mandates, also implying a tighter monetary policy bias. Ultimately, a true Fed capture might be too difficult and messy to be worthwhile, while publicly haranguing the Fed without the responsibility of control could better suit President Trump’s goals.

While further U.S. trade restrictions under President Biden would likely not be material, a second Trump presidency could exacerbate U.S.-China tensions due to significant risk of aggressive tariffs and export controls further disrupting trade and investment between the two countries. We believe these measures would come early in his presidency, despite any potential negative effects on the domestic economy or U.S. firms doing business in China. Trump’s hawkish stance on Taiwan would further undermine U.S.-China relations, particularly if his administration supported President Lai’s pro-independence leanings.

In Europe, the recent French election has raised policy uncertainty in France particularly around the course of fiscal policy.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda- ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.