We wouldn’t go quite that far, but the economy continues to appear strangely unbothered by monetary policy tightness. The economy is certainly not out of the woods—consumer loan delinquencies are an acute concern—but there are paths to avoiding a recession.

Senior Loan Officer Opinion Survey: SLOOS as She Goes

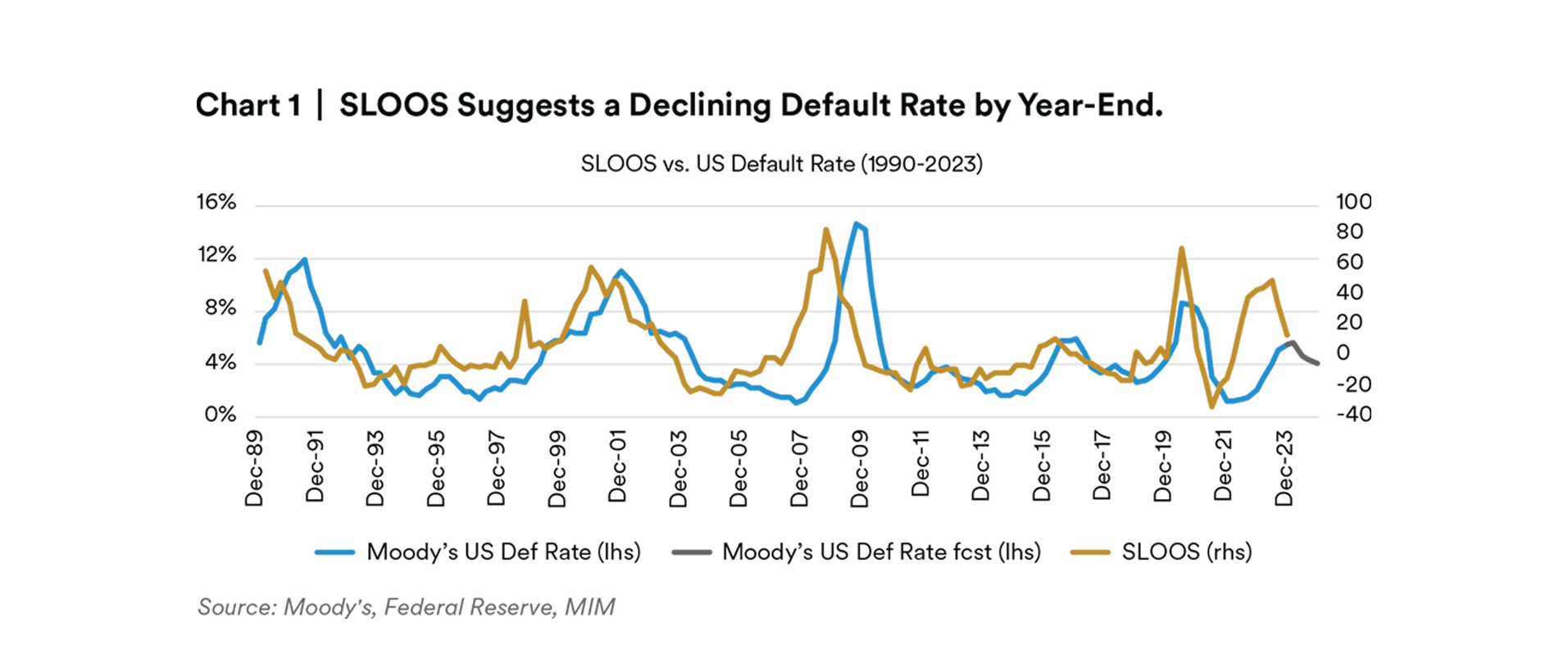

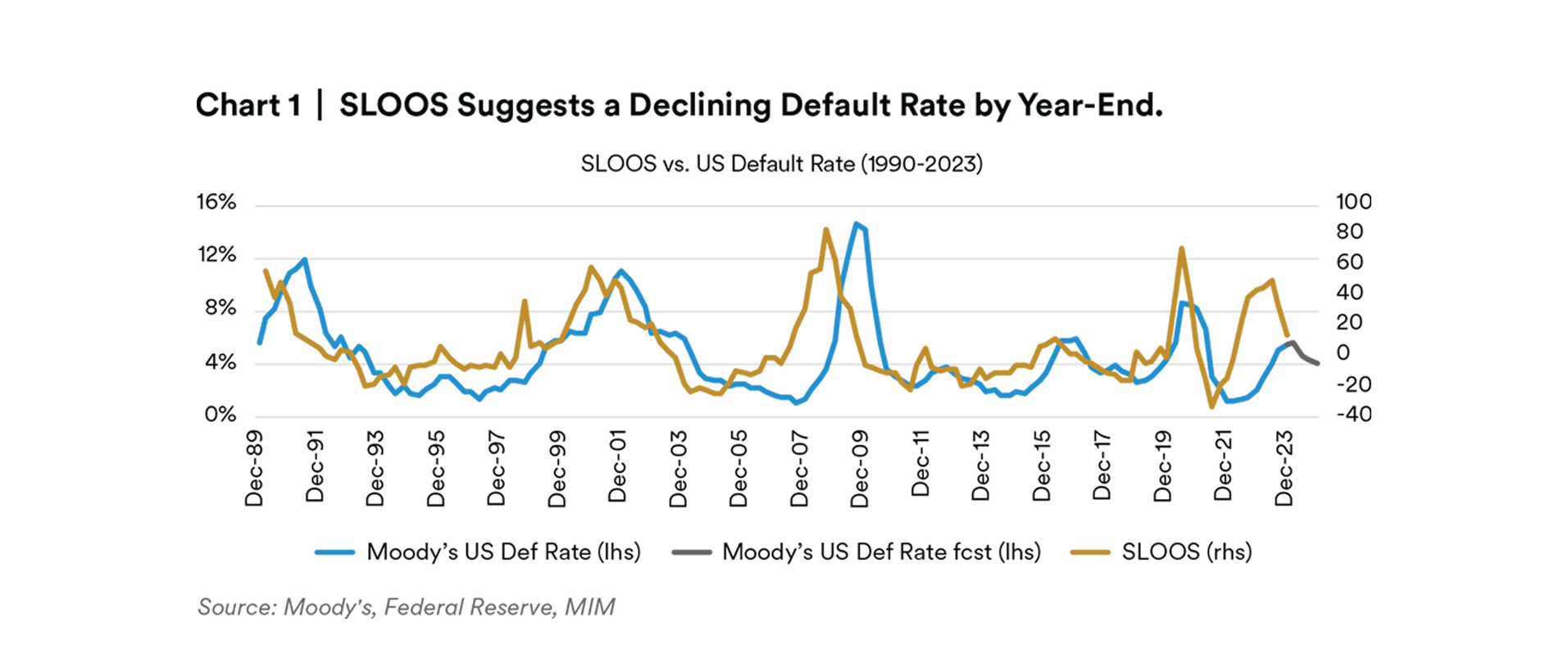

The Federal Reserve’s Senior Loan Officer Opinion Survey (SLOOS) is, we believe, one of the best leading indicators of corporate default rates. The one-year forward default rate implied by SLOOS shows an improvement to 5.2% by year-end 2024. We expect that default rates will be even lower than that. First, high-yield issuers have already extended their maturity wall. Second, the high-yield bonds distress ratio improved throughout 2023 and remained mild in January 2024.

Credit conditions continue to tighten overall, but relatively more banks reported unchanged lending standards than reported tightening standards. The pattern was present across loan types, including commercial and industrial (C&I) loans, commercial real estate (CRE) loans— particularly at smaller banks—and consumer segments such as credit cards and auto loans.

On the demand side, a significant net share of banks reported demand for C&I and CRE lending falling. Falling CRE loan demand was more widely reported by smaller banks than by large banks. Demand for auto and credit card loans was also weaker, but more modestly.

The January 2024 SLOOS also included special questions on banks’ expectations. Looking forward, banks expect lending standards to tighten through the year for consumer categories such as auto and credit card loans, but standards for C&I loans and CRE loans are expected to remain more or less the same. Notably, banks are expecting both stronger loan demand and a deterioration in loan quality across loan types.

Labor Market Revisions Produce Huge Job Growth

February’s Bureau of Labor Statistics employment report1 gave a surprising increase in non-farm payrolls of 353,000. More notably, nine out of the 12 months of 2023 were revised upwards, particularly toward year end. The revisions mean the economy added almost 360,000 more jobs over 2023 than initially thought, or approximately 3 million for the year.

Aggregate numbers aside, job increases were broad based across sectors, and even softer sectors such as construction and hospitality continued to add jobs, although fewer than their recent trends.

A stronger-than-expected labor market reduces the likelihood of a near-term recession. We do not expect rate cuts until at least the May meeting, as the labor market could be strong enough to hamper the decline in inflation. On the flip side, more hikes could be expected if inflation re-accelerates. However, we do not expect more hikes due specifically to labor market strength, as the labor market may not be “too strong.” In 2021 and 2022, the labor market added approximately 7, and 4.5 million jobs respectively, partly due to recovering job losses from the pandemic. Last year was a continuation of that trend towards the longer-run average level of 2 million new jobs per year.

State level data remains a concern. If we assume that the state-level unemployment rates remain the same (as the national level did), then we anticipate three more states (for a total of 22) triggering the Sahm Rule, which indicates a deterioration in their labor markets consistent with a potential recession, as we discussed in our January Monthly. We will continue to monitor state-level unemployment data, as the divergence warrants close attention.

Unclogging the Housing Market

Households moved residences approximately 8.1 million fewer times than usual in 2021 and 2022 combined, according to a study by the U.S. Census Bureau2 . We can assume that 2023 would be similar, given the low transactions in housing, although the data are not out yet. There is a large reservoir of pent-up demand.

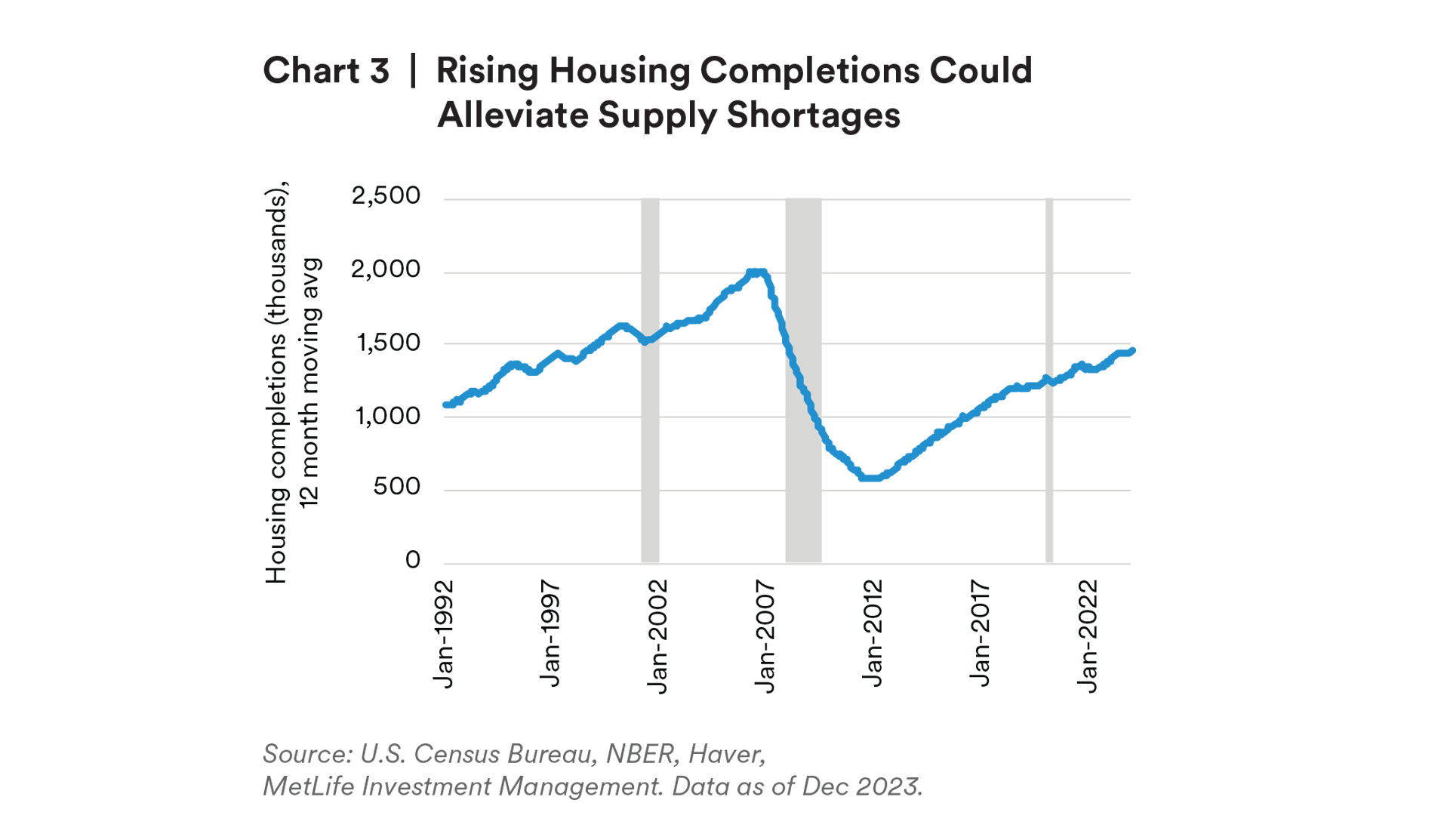

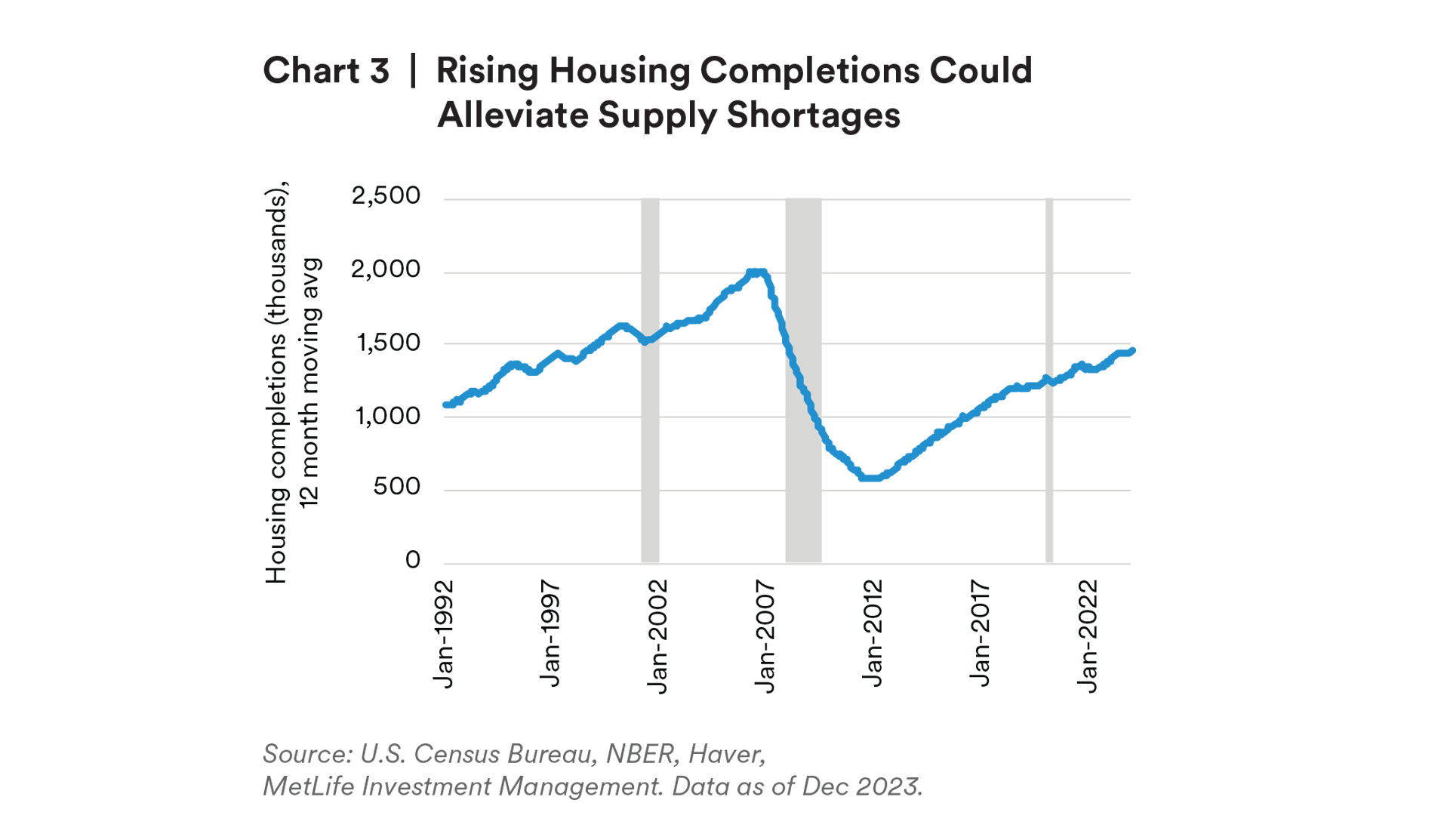

We believe 2024 could see substantially more transactions in the housing market. 2023 saw the fewest number of homes sold since the post-financial crisis stretch from 2008 to 2011. Mortgage rates are expected to fall to the low- to mid-6% range, a modest improvement over the peak in rates of 7.6% in October 2023.3 This represents up to 15% lower monthly payments for buyers and would induce some current homeowners to put their homes on the market. Finally, there has been a substantial increase in housing completions (see Chart 3), meaning an increase in available new homes. Housing completions increased by 5.0% in 2023 according to the U.S. Census, the fastest growth since 2019 and the highest level since 2007.

Housing-adjacent expenditure—appliances, furniture, lawn equipment, renovations—would likely also increase. Households moving into a newly purchased home tend to spend between two and four times as much on such items

than do non-movers, and perhaps surprisingly tend to do so without cutting back on other expenses.4

The unclogging of the housing market is likely to be moderate, however, as rates are still likely to remain high relative to historic—and current homeowners’—mortgage rates and demand pressures mean that housing prices are likely to rise rather than fall.

U.S. Outlook Summary

We revise our outlook up to account for the stronger�than-expected recent data, particularly the annual revision to the payrolls report. We expect GDP to rise by 1.0% in 2024, up from our previous forecast of no growth for the year.

We continue to expect a recession in 2024. A few concerns factor into this view. First, credit conditions remain tight despite recent stabilization. Second, delinquency rates are rising—with consumer loan delinquencies at their highest level in over 10 years and the second-sharpest increase in commercial real estate delinquencies since 2010.

We believe the Fed has finished hiking rates this cycle, given that the core personal consumption expenditure (PCE) deflator moderated to 2.9 percent by year�end. We expect 150bps worth of Fed Funds rate cuts beginning around midyear 2024. Whether or not there is a recession, the Fed is likely to cut as it eases from the current tight conditions.

We expect a particularly mild increase in unemployment relative to prior recessions—these have seen unemployment increase by at least two percentage points—due to this cycle’s unusually tight labor market conditions, although without a recession we believe market expectations of approximately five rate cuts are excessive.

After a wild Q4, the 10-year Treasury fell to 3.82 in the last few trading days of the year. Yields have historically peaked ahead of cuts to the Fed Funds rate; with cuts on the horizon and inflation on a downward path, we expect yields to have peaked for the cycle. Relative to January’s average of 4.19%, we expect the 10-year yield to migrate to 4% by year end; this does not preclude substantial swings through the year especially as the timing and extent of Fed rate cuts remains uncertain.

Risks to the Outlook

We continue to recognize mitigating factors that work against our call for a recession in the first part of 2024. First, labor market robustness could continue to support consumer spending. Consumer confidence continues to improve (while still at surprisingly low levels). Second, the manufacturing sector has shown some signs of recovery and may boost GDP in 2024 as industrial policy spending ramps up. Finally, home starts gradually picked up in 2023, giving some hope to a moderation of shelter inflation.

Endnotes

1 Source: Bureau of Labor Statistics, February 2024. https://www.bls.gov/news.release/empsit.nr0.htm

2 Source: U.S. Census Bureau, November 2023. https://www.census.gov/data/tables/2022/demo/geographic-mobility/ cps-2022.html

3 Forecasts include 6.1% (Mortgage Bankers Association), 6.5% (Realtor.com) and 6.6% (Redfin).

4 From a study by the National Association of Home Builders by Natalia Siniavskaia, “Spending Patterns of Home Buyers”, June 1, 2022, based on the U.S. Consumer Expenditure Survey.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on requestto, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewthan do non-movers, and perhaps surprisingly tend to do so without cutting back on other expenses.4 The unclogging of the housing market is likely to be moderate, however, as rates are still likely to remain high relative to historic—and current homeowners’—mortgage rates and demand pressures mean that housing prices are likely to rise rather than fall.ees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC.