Why Replace LIBOR?

Unsecured borrowings by banks declined following the 2008 global financial crisis, and as a result, LIBOR fixings became increasingly based on expert judgement, rather than actual transactions and were deemed to be prone to manipulation. In June 2012, multiple criminal settlements revealed significant fraud and collusion by member banks connected to the rate submissions, sowing distrust, and calling into question LIBOR’s credibility as a reliable global benchmark. With actual bank borrowing transactions from which to quote LIBOR further declining post the scandal, the International Organization of Securities Commissions created Principles for Financial Benchmarks3 that highlighted the need for benchmarks to be “anchored by observable transactions entered into at arm’s length between buyers and sellers in the market for the Interest the Benchmark measures.” Regulators around the globe established working groups such as the Alternative Reference Rate Committee (“ARRC”) in the United States to identify alternative benchmarks that adhered to these principles in each of their markets. The ARRC is a group of private-market participants that was convened by the Federal Reserve and the Federal Reserve Bank of New York in 2014 to lead the transition away from USD LIBOR.

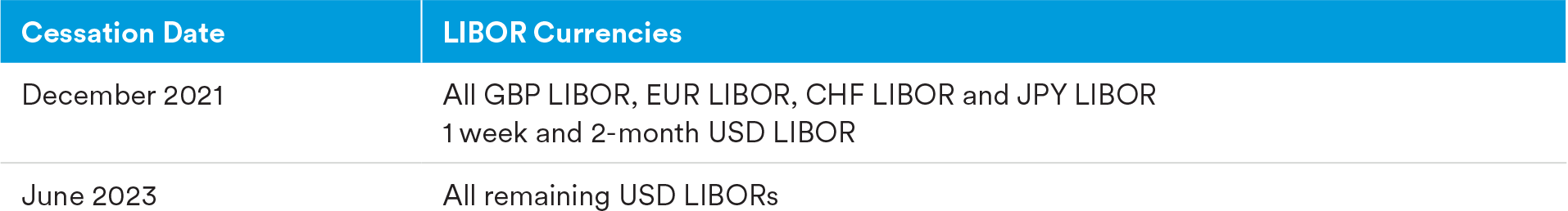

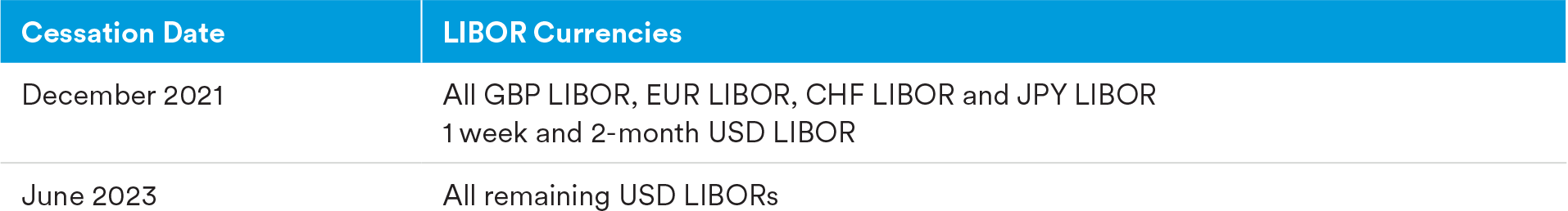

In July 2017, the FCA announced it would no longer compel panel banks to submit LIBOR rates after December 31, 2021. In late 2020, the U.S. Prudential Regulators4 issued Supervisory Guidance5 that encouraged banks to “cease entering into new contracts that use USD LIBOR as a reference rate as soon as practicable and in any event, no later than December 31, 2021.” In March 2021, the FCA officially set the cessation dates for major currency LIBOR settings with June 30, 2023 being a key date for USD LIBOR, the most widely used set of daily LIBOR fixings.

SOFR and Transition Challenges

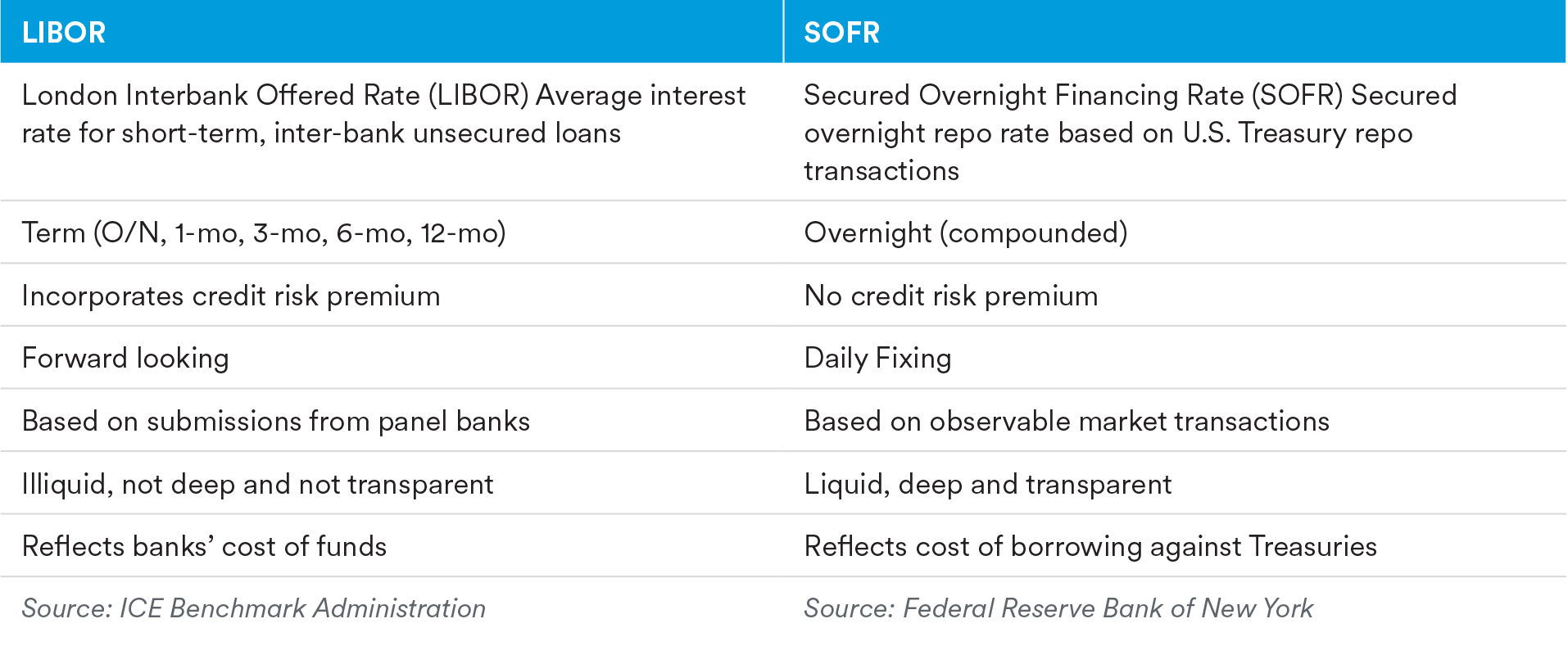

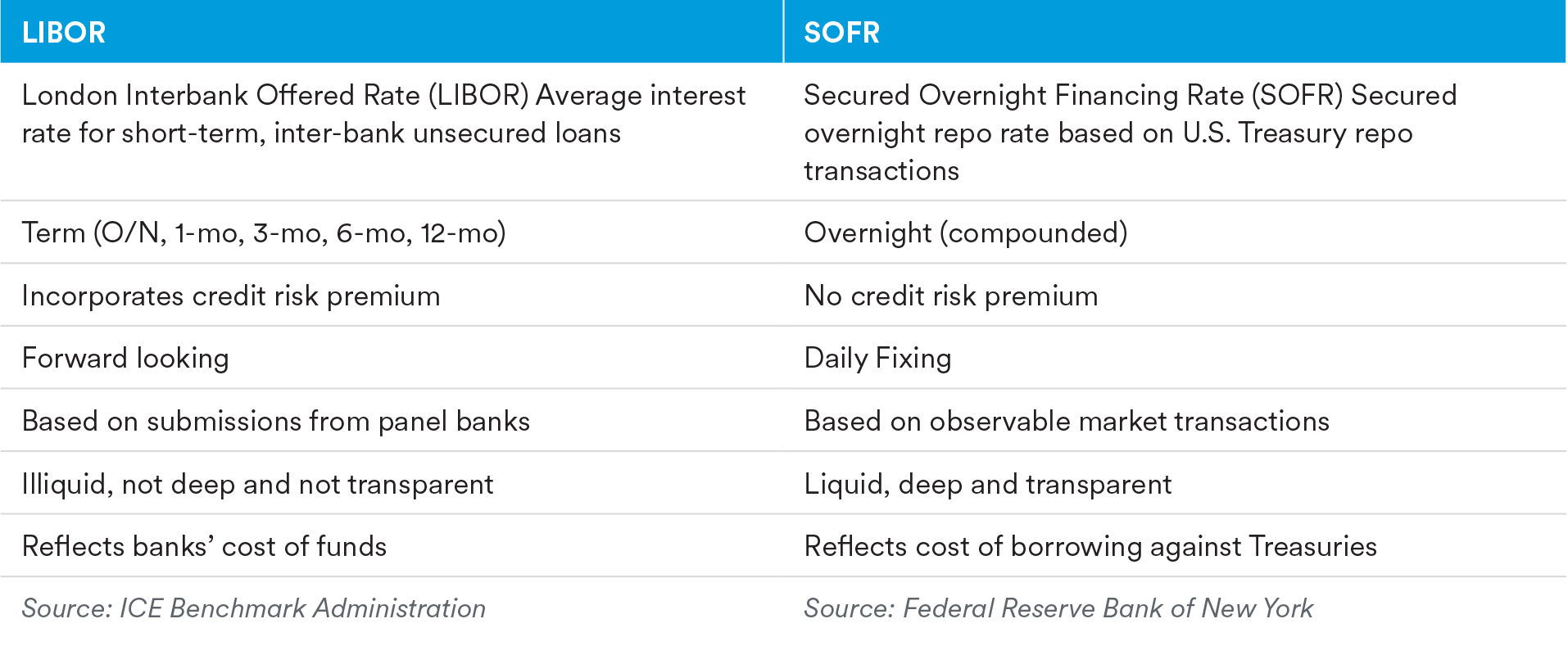

In 2017, the ARRC selected the Secured Overnight Financing Rate (“SOFR”) as the alternative to USD LIBOR. SOFR is derived from roughly $1 trillion in daily transactions that occur in the overnight repo market and is a broad measure of the cost of borrowing funds collateralized by U.S. Treasuries. SOFR differs from LIBOR in two major ways: it is a secured, overnight rate, whereas LIBOR is a term, unsecured, bank lending rate with embedded credit risk and is quoted on a forward basis (e.g. 1-month, 3-month, 6-month, etc.).

With LIBOR being a forward-looking term rate, the rate for an interest period is set at the start of that period, with payment due at the end of the period, thereby providing certainty around funding costs. As mentioned, LIBOR also has an embedded credit risk component while SOFR is a risk-free, backward-looking, overnight rate. These differences have implications for how interest payments may be calculated and have raised concerns regarding SOFR’s effectiveness among certain borrowers, lenders and investors, who may have different needs.

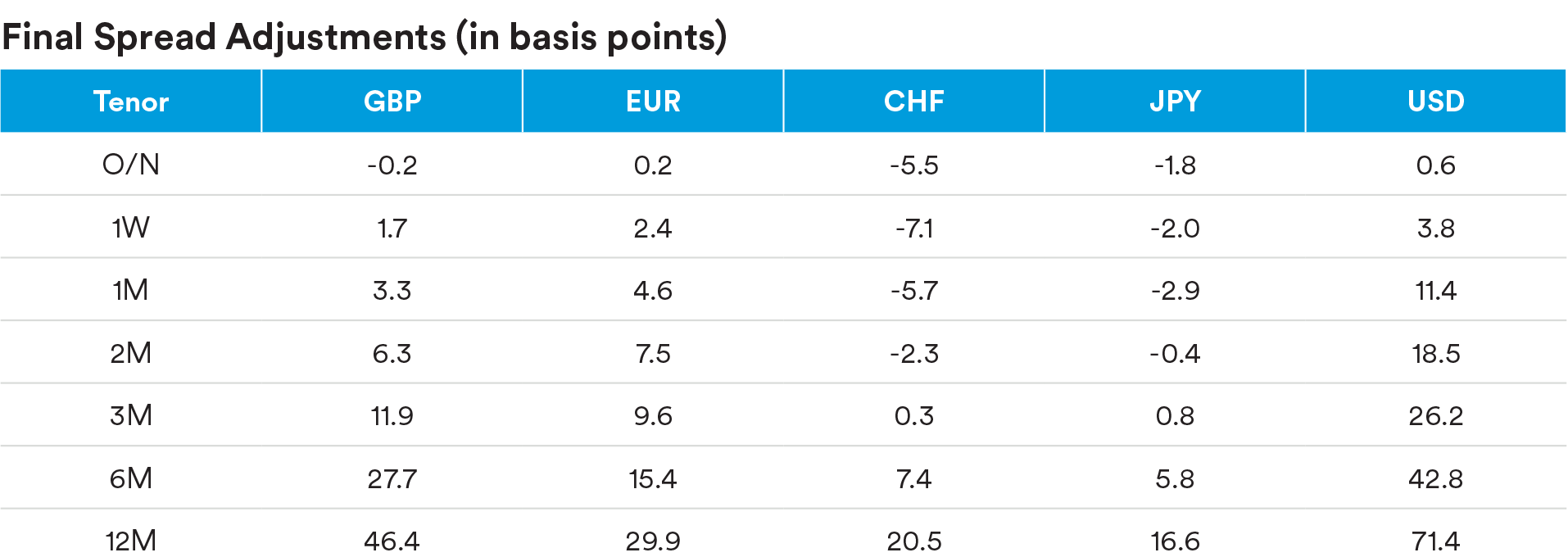

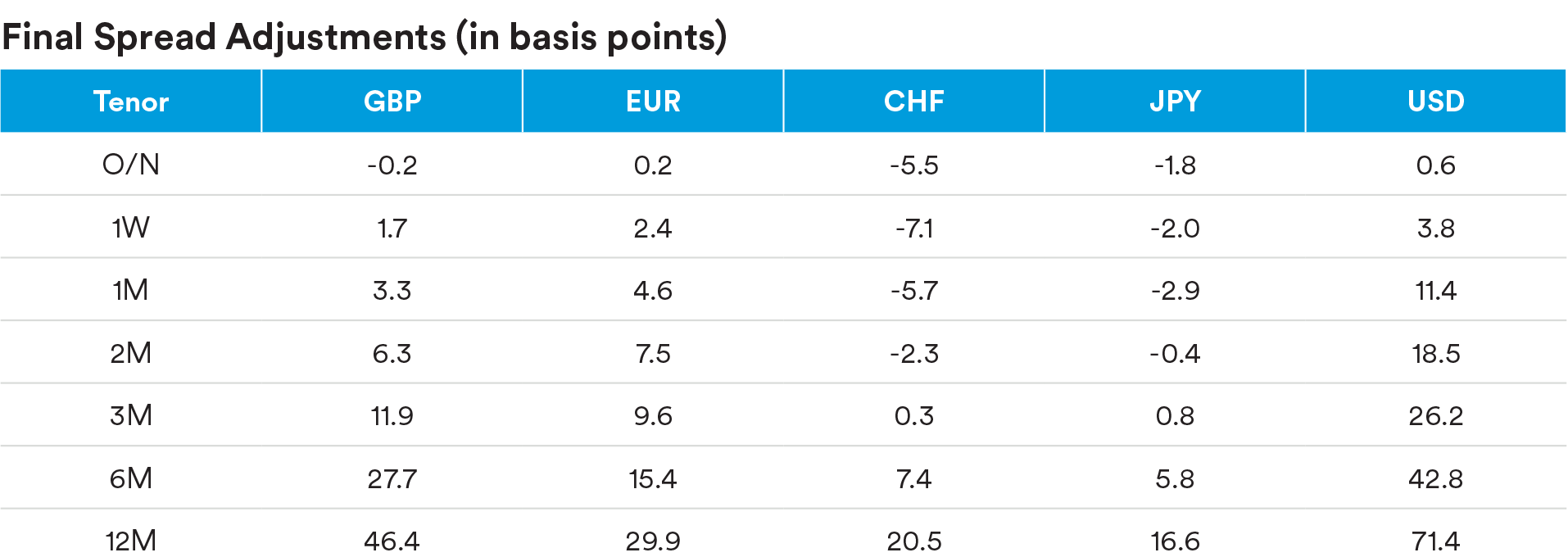

A key consideration in the LIBOR transition has been how to account for the absence of a credit component in SOFR. This is particularly relevant for contracts referencing LIBOR that will subsequently shift to reference SOFR upon LIBOR’s cessation, anticipated to occur in two years. For these contracts, the index rate needs to “fallback” from LIBOR to SOFR in a way that minimizes any potential value transfer among the contract participants to the extent possible. As a result of several industry-wide consultations by the ARRC and the International Swaps and Derivatives Association, standard fallback language was created for many types of financial instruments. In addition, the methodology for calculating the spread adjustment between SOFR and LIBOR was established (a five-year historical median between term LIBOR and SOFR). These spread adjustments have been fixed for all LIBOR tenors as a consequence of the FCA’s official cessation announcement for LIBOR in March 2021. As an example, the spread adjustments to convert from 1-month USD LIBOR and 3-month USD LIBOR have been set at SOFR + 11.4 basis points and SOFR + 26.2 basis points, respectively. The table below details the official spread adjustments announced across various tenors and currencies.

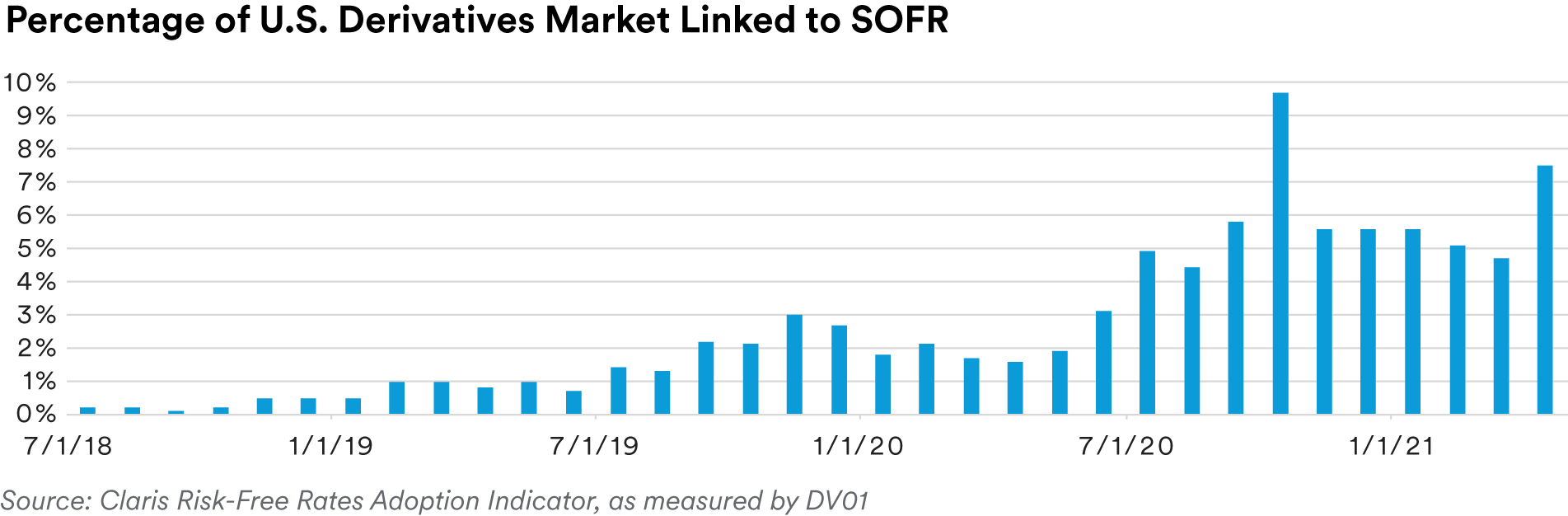

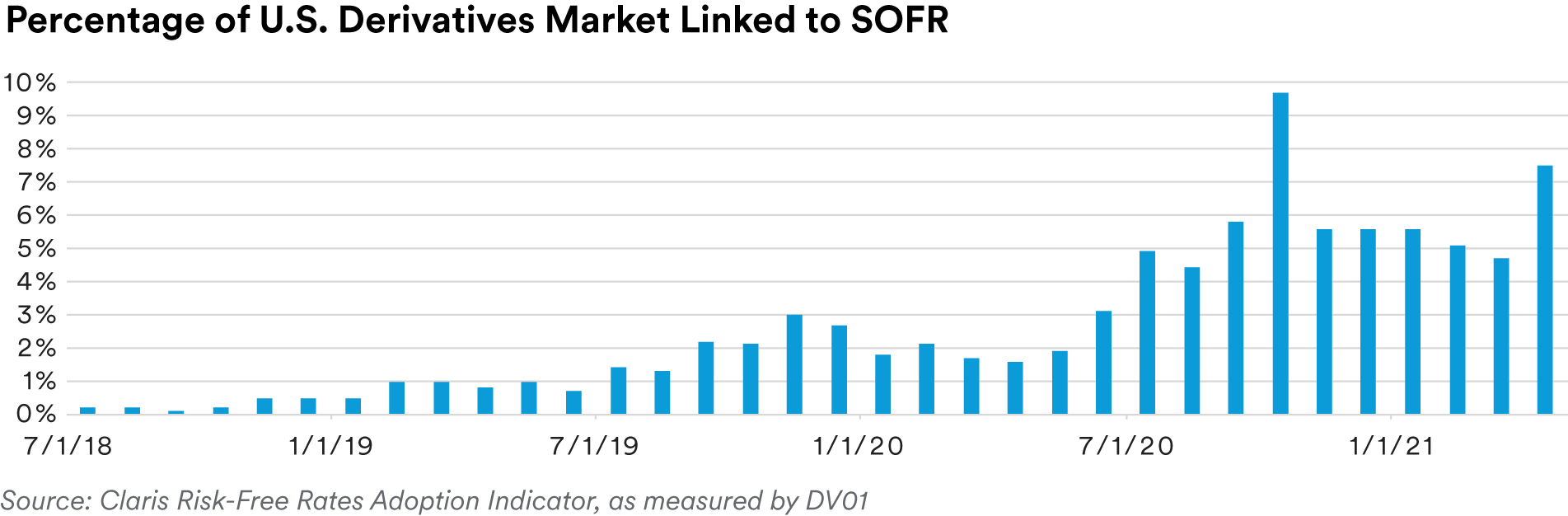

In response to one of the challenges facing the market adoption of SOFR due to the lack of a forward-looking term structure, the ARRC recently announced it will not be in a position to recommend a forward-looking SOFR term rate by the original target date of mid-2021. This delay is due in large part to the lack of volume in the SOFR derivatives markets which is a prerequisite to creating a robust SOFR term structure.

Subsequently, on June 8, 2021, the Commodity Futures Trading Commission’s Interest Rate Benchmark Reform Subcommittee announced a plan known as the “SOFR-First” initiative that recommended July 26, 2021 as the date for interdealer brokers to replace the trading of LIBOR swaps with SOFR swaps. The SOFR-First initiative is designed to increase volumes linked to SOFR in the U.S. derivatives market and is an important development in the USD LIBOR transition process. The plan was concurrently endorsed by the ARRC with New York Fed President Williams commenting, “If you are active in derivatives markets, circle July 26 on your calendar” and Fed Vice Chair for Supervision Quarles noting, “There is now no excuse to delay transition as the path that leads beyond LIBOR could not be clearer.”6

Another perceived challenge is SOFR’s lack of a credit component. Because it is a risk-free rate, it lacks credit sensitivity and therefore does not reflect a typical bank’s borrowing or funding costs. As a result, it can change the nature of the asset-liability match that banks and lenders face between their borrowing and lending costs. Furthermore, there is a concern that SOFR could potentially reduce the availability of credit during periods of market stress. Because SOFR is derived from underlying collateralized U.S. Treasury transactions, SOFR will tend to decline in times of market stress, while LIBOR, as an unsecured rate with an implied credit component, will tend to rise in times of market stress, pushing borrowers’ rate of interest lower in an environment when banks’/ lenders’ funding costs are typically rising. As a result, banks / lenders could become more reluctant to lend, thereby reducing credit availability or increase pricing. Some market participants have advocated for credit-sensitive alternatives to better align their risk by adopting short-term indices that have a credit component which tend to widen during periods of market stress.

In an effort to find another benchmark floating-rate index incorporating a credit component, other alternative credit sensitive rates have been developed including the Bloomberg Short-Term Bank Yield Index (“BSBY”), the American Interbank Offered Rate (“AMERIBOR”), and Bank Yield Index (“BYI”), all of which are forward looking and generally highly correlated to LIBOR. BSBY is administered by Bloomberg Index Services Limited and its objective is to reflect the average rate at which banks borrow unsecured while AMERIBOR is administered by the American Financial Exchange (“AFX”), an electronic exchange for over 1,000 U.S. banks and financial institutions, and its purpose is to reflect member banks’ and financial institutions’ actual unsecured borrowing costs. BYI is administered by the ICE Benchmark Administration and is intended to reflect the rate at which banks can borrow on the AFX. This index is expected to launch in the second half of 2021, while BSBY and AMERIBOR already exist. The extent to which these rates will be adopted in particular markets in the future is an open question as many of these alternatives currently have little activity in either the cash or derivatives markets associated with them.

A third challenge, though partially mitigated, is the ability to legally transition legacy contracts from LIBOR to an alternative rate where inadequate fallback provisions exist. This has been a central focus for the ARRC as part of the overall LIBOR transition. In April 2021, New York Governor Cuomo signed legislation addressing such “hard legacy” contracts governed by New York law. These are contracts that have no LIBOR fallbacks, or fallback to an alternative LIBOR setting, and primarily address contracts that are practically very difficult to remediate for LIBOR transition due to market dynamics such as affirmative consent requirements involving dispersed stakeholders. This legislation established a targeted solution for these contracts to be able to transition from LIBOR to ARRC-recommended fallbacks, potentially avoiding costly litigation for all parties. Importantly, the legislation also provides a safe harbor from liability to any party with the discretion to select a successor rate to LIBOR, provided such party chooses SOFR, the ARRC’s preferred index. Efforts to address “hard legacy” contracts continue in the U.S., with legislation at the Federal level also currently being considered.

We believe that the remediation of legacy contracts will be largely asset class-specific. This will be driven by market participants within each sector, as well as the needs of a multitude of participants including investors, borrowers, trustees, and servicers. As an example, for the Structured Finance sector, the Agencies will continue to take a leading role in setting new conventions. For bilateral business loans, remediation will require direct agreement between the lender and borrower. Broadly syndicated securities with inadequate fallback provisions will likely look to the New York (and potentially Federal) legislation. As part of MetLife Investment Management’s Transition Plan (discussed below), we are tailoring our remediation efforts at the asset class level.

Market Activity/Issuance

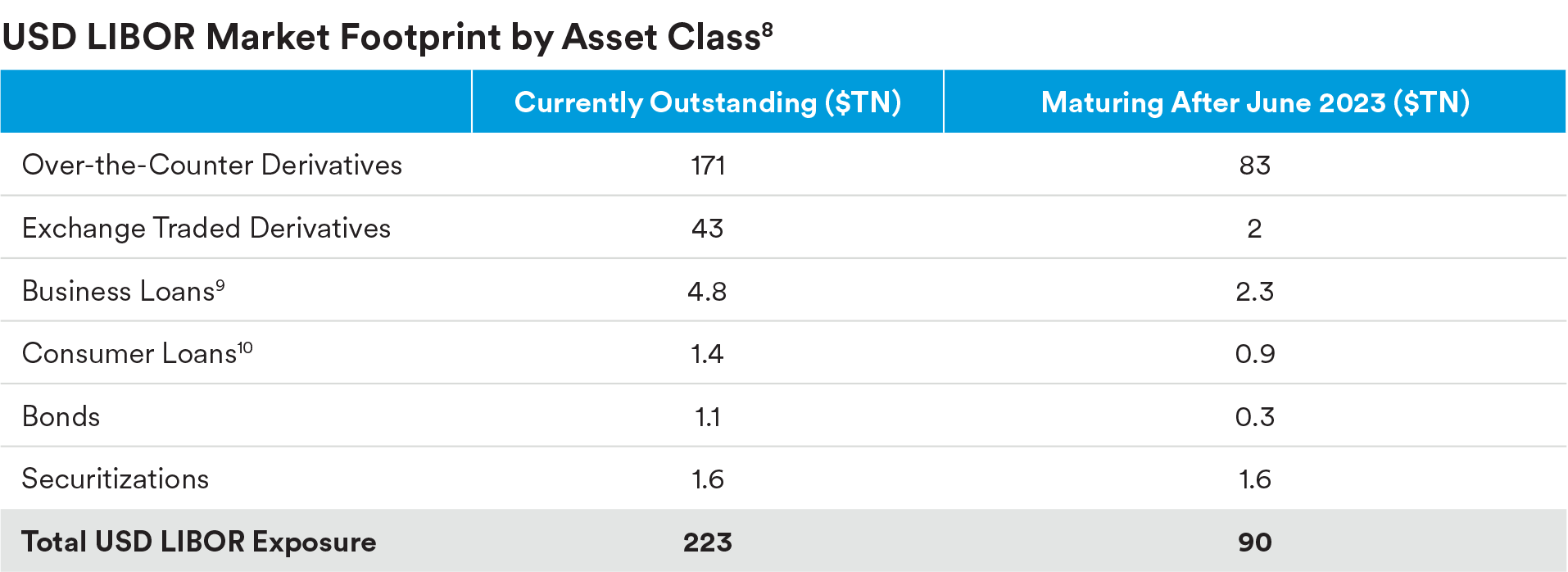

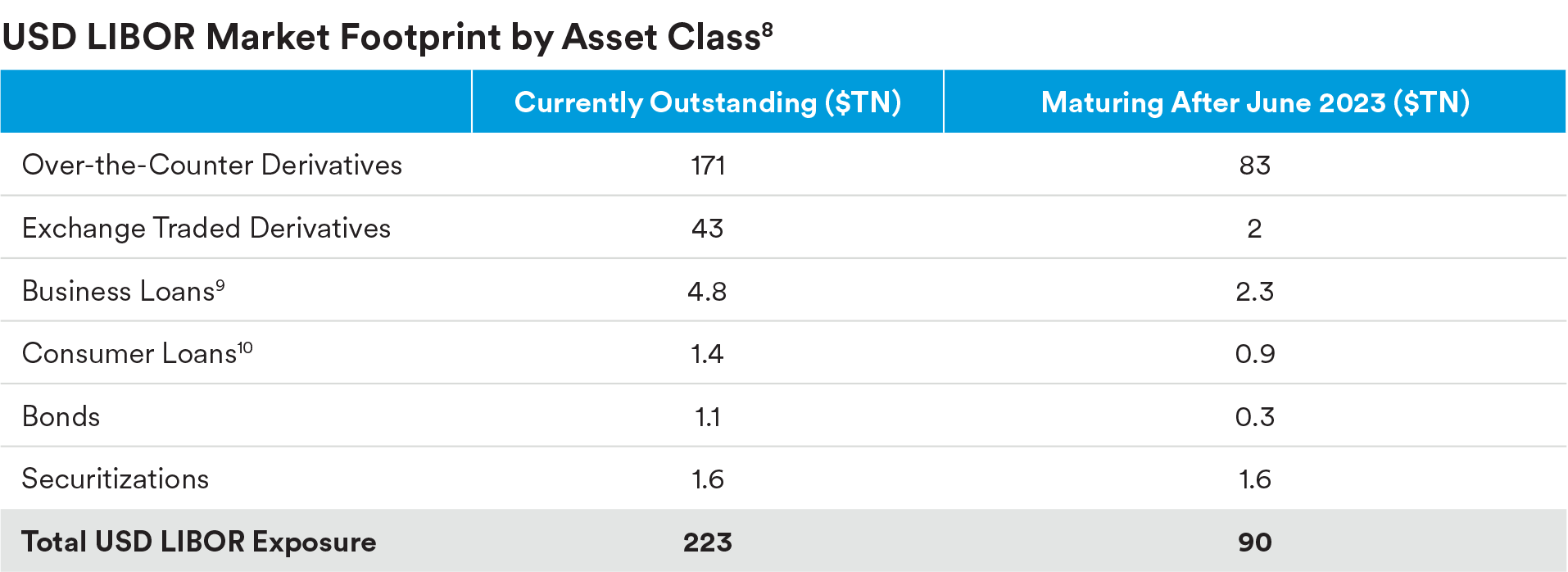

In the ARRC’s most recent Progress Report,7 it is estimated that there are $223 trillion in outstanding exposures to USD LIBOR, with the majority representing derivative exposures. The ARRC also noted in their report that only two-thirds of current LIBOR contracts and instruments are expected to mature before June 2023, leaving a great deal of LIBOR-based contracts that need to be resolved prior to LIBOR’s final cessation date.

By background, Fannie Mae issued the market’s first-ever $6 billion SOFR securities via a three-part deal in July 2018, quickly followed by financial issuers such as MetLife that issued the first-ever $1 billion, two year, SOFR corporate bond deal in August 2018. MetLife has been, and continues to be, an active issuer in the SOFR market, issuing 11 deals totaling over $5.0 billion to date.

Two notable market areas that have been most active in issuing bonds linked to the SOFR index have been the Government and Corporate sectors. In Government, issuance has been primarily driven by issuers such as Federal Farm Credit Banks, the International Bank for Reconstruction & Development and Federal Home Loan Banks, etc., while in Corporates, issuance has been predominately driven by the Financial sector. Over the past several months, however, there has been a pickup in issuance in the Industrial and Utility subsectors.

Recently, potential LIBOR replacement alternatives away from SOFR have been gaining more attention as some market participants question whether SOFR is the best option and believe a multi-rate environment may be warranted. In April, the first swaps trade and bank bond linked to the BSBY benchmark were issued, followed in May by the first nonfinancial company which issued a syndicated loan utilizing the BSBY index. Furthermore, in April, the Loans Syndications & Trading Association included AMERIBOR as a fallback benchmark option for its suggested contract provisions following the discontinuation of LIBOR and provided sample credit-sensitive rate language that can be used as a potential replacement to LIBOR.

MetLife Investment Management Transition Plan

MetLife Investment Management (“MIM”) has developed a program to manage the risks associated with the discontinuance of the LIBOR reference rates via a coordinated, multi-team transition plan (“Transition Plan”). In addition to a central LIBOR Transition Team, multiple areas within MIM are actively involved in the transition program including portfolio managers, individual asset sector specialists, as well as the Legal and Information Technology (“IT”) departments. MIM’s detailed Transition Plan includes:

- an inventory of all existing global IBOR exposures in MIM’s client portfolios

- identification of market, operational, IT, financial and potential regulatory risks

- an assessment of transition dependencies

Execution of the Transition Plans across the globe allows MIM to: (i) evaluate the collective IBOR impact across investment and hedging transactions managed by MIM, (ii) consider all relevant components of the IBOR transition process, and (iii) take appropriate action to address LIBOR transition issues impacting MIM client portfolios. MIM continues to assess current and alternative reference rates’ merits, limitations, risks and suitability for client portfolios in light of evolving market and regulatory developments and risk/return considerations.

Industry involvement has been a central component of MIM’s Transition Plan and provides a forum for MIM to advocate on issues related to the general transition away from LIBOR. MetLife has been a member of the ARRC since 2018 and participates in many of the ARRC’s Working Groups. On the ARRC, MetLife also works with both sell-side and buy-side market participants to facilitate the industry’s move away from LIBOR through the promotion of the ARRC’s Paced Transition Plan. To address LIBOR transition issues for particular asset classes, MetLife works with a number of industry trade organizations including the Structured Finance Association, the Mortgage Bankers Association, the American Council of Life Insurers and the Loan Syndications and Trading Association.

Endnotes

1 https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr667.pdf

2 https://www.iosco.org/library/pubdocs/pdf/IOSCOPD415.pdf

3 Ibid

4 The U.S. Prudential Regulators include the Board of Governors of the Federal Reserve System, the Office of the Comptroller of the Currency, and the Federal Deposit Insurance Corporation

5 SR 20-27: Interagency Statement on LIBOR Transition. https://www.federalreserve.gov/supervisionreg/srletters/SR2027.htm

6 20210608-arrc-release-supporting-mrac-announcement-final (newyorkfed.org)

7 https://www.newyorkfed.org/medialibrary/Microsites/arrc/files/2021/20210322-arrc-press-release-USD-LIBOR-Transition-Progress-Report.pdf

8 Federal Reserve staff calculations, BIS, Bloomberg, CME, DTCC, Federal Reserve Financial Accounts of the U.S., G.19, Shared National Credit, and Y-14 data.

9 The figures for syndicated and non-syndicated business loans do not include undrawn lines. Nonsyndicated business loans exclude CRE/commerical mortgage loans.

10 Estimated amounts maturing after June 2023 based on historical prepayment rates.

Disclaimers:

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default).

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is only intended for, and may only be distributed to, investors in the EEA who qualify as a Professional Client as defined under the EEA’s Markets in Financial Instruments Directive, as implemented in the relevant EEA jurisdiction. The investment strategy described herein is intended to be structured as an investment management agreement between MIML (or its affiliates, as the case may be) and a client, although alternative structures more suitable for a particular client can be discussed.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.