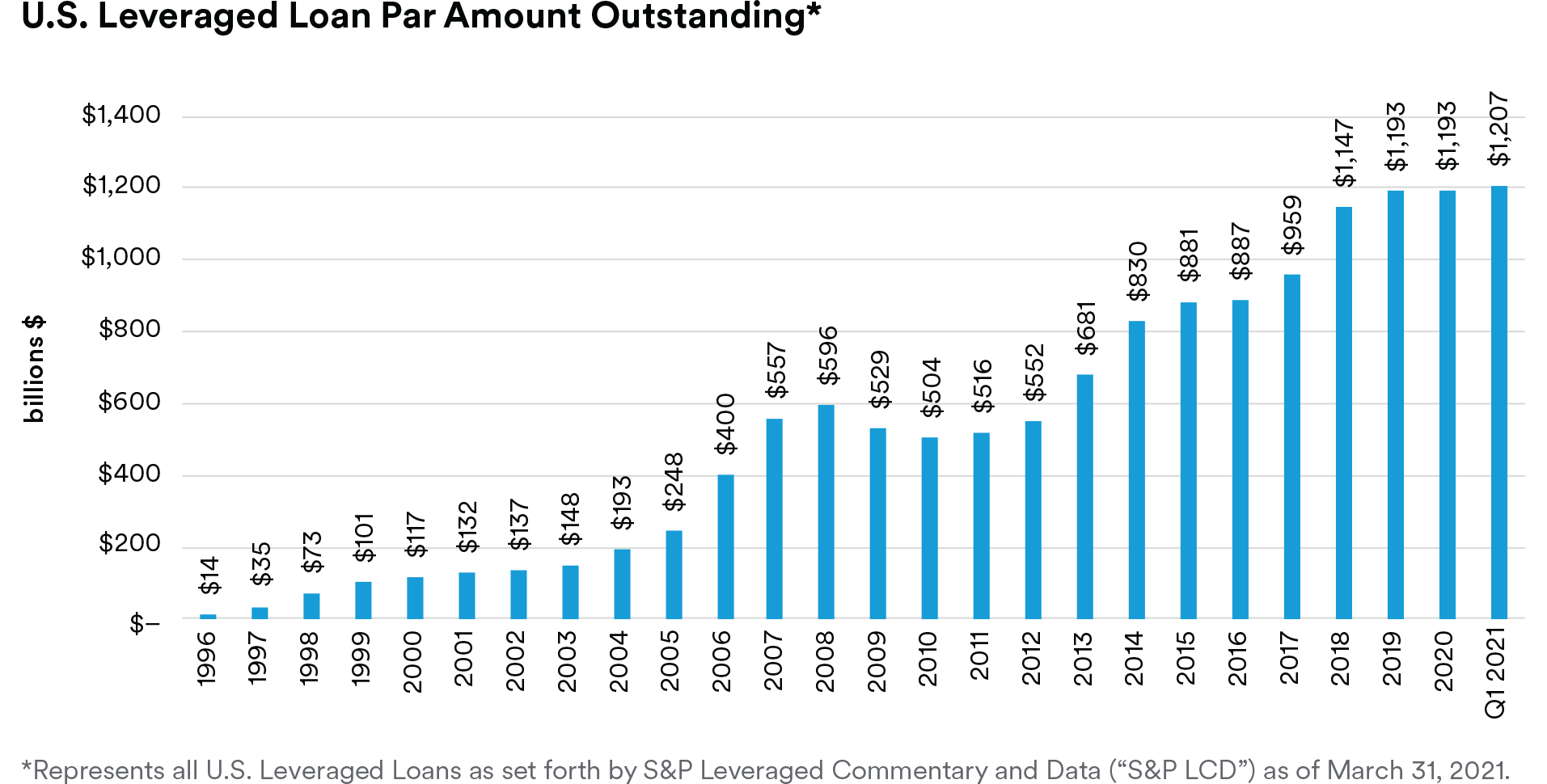

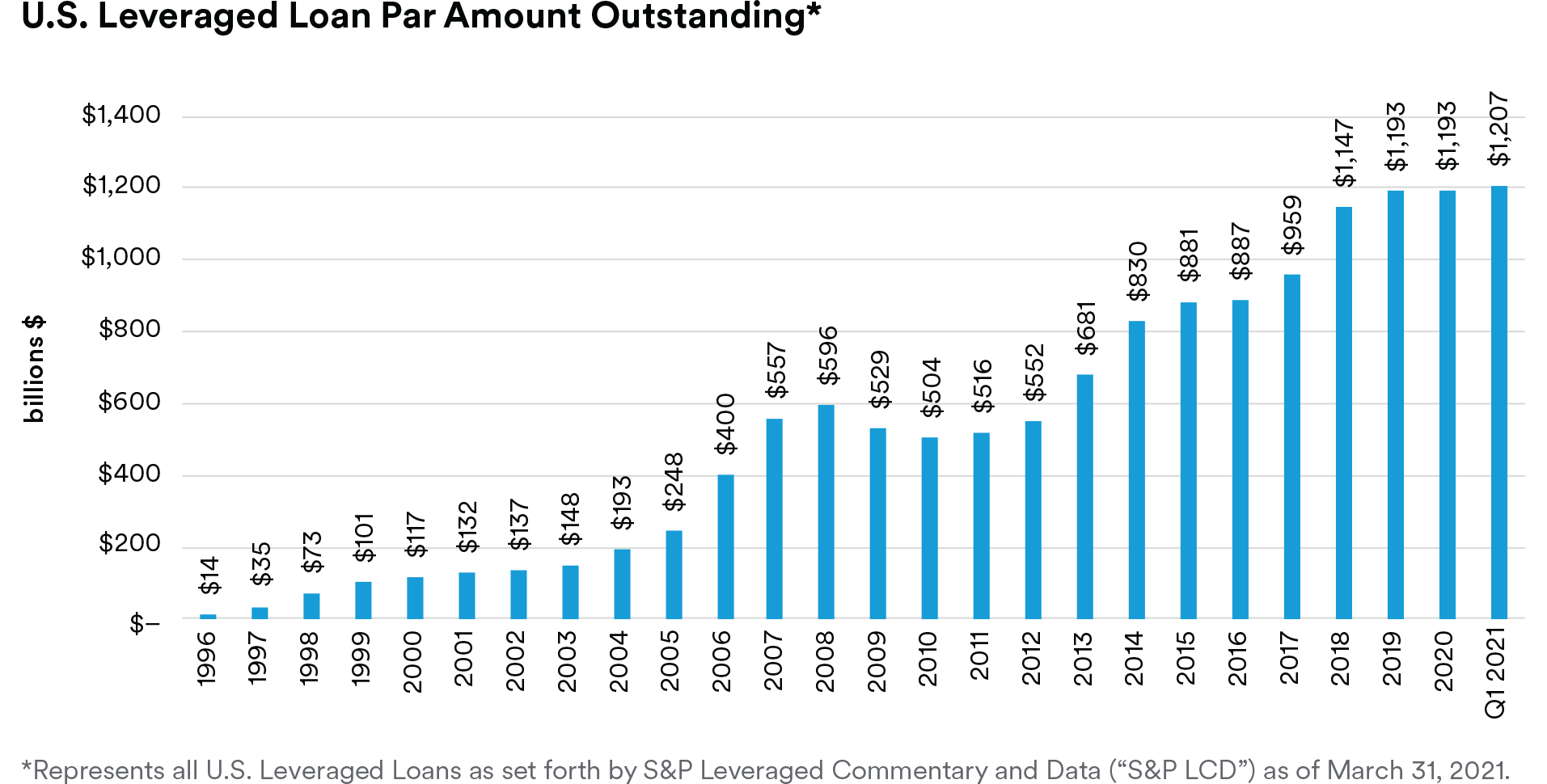

Bank loans represent a large and mature market, standing at $1.1 trillion with over 1,000 issuers. We have seen significant growth in the asset class during the last decade (see chart below). Most recently, the asset class has experienced record primary issuance, with $224.5 billion of institutional loans issued in the first quarter of 2021.2 This number more than doubled the $91.7 billion in the fourth quarter of 2020 and surpassed the previous record of $211.4 billion in the second quarter of 2007.2

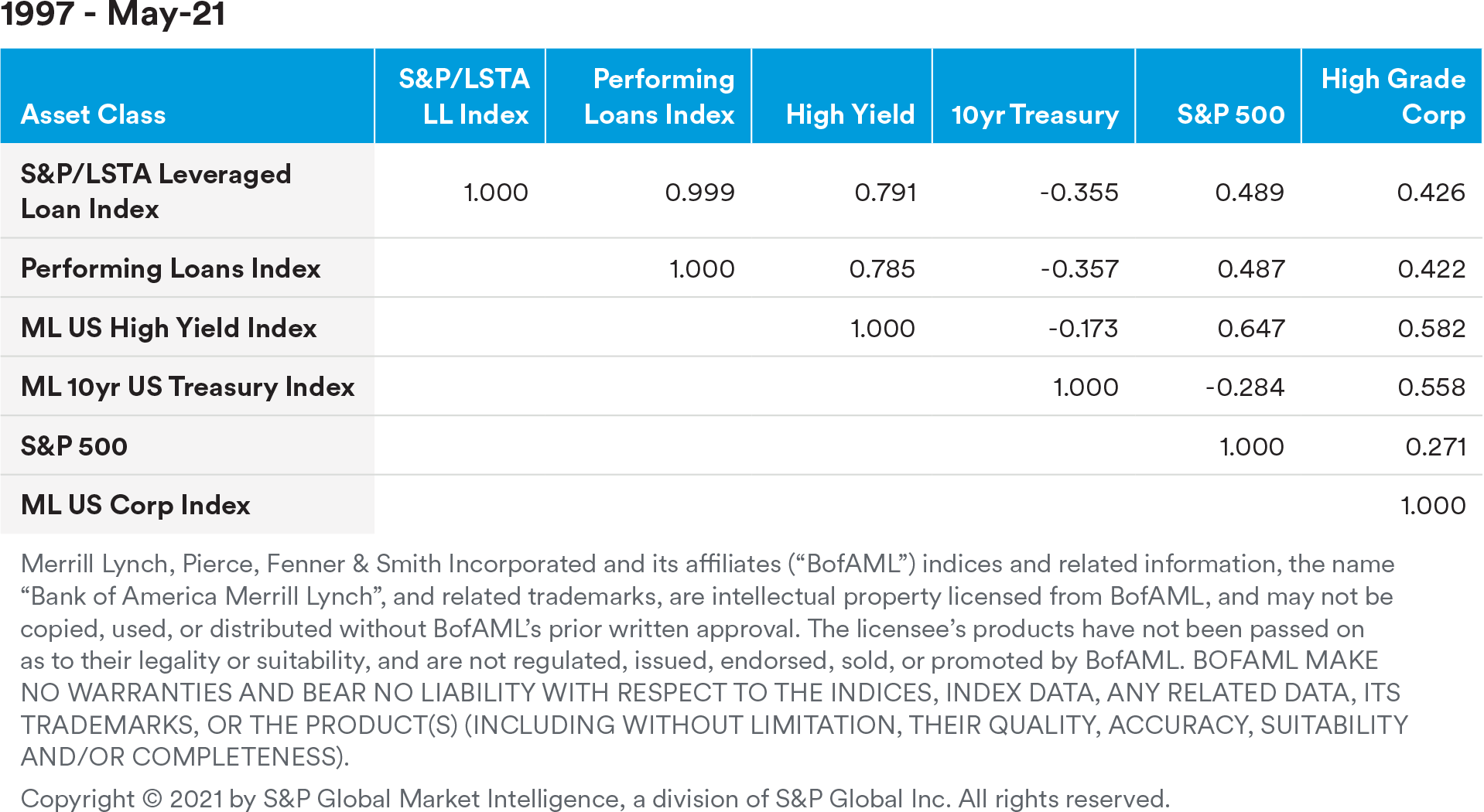

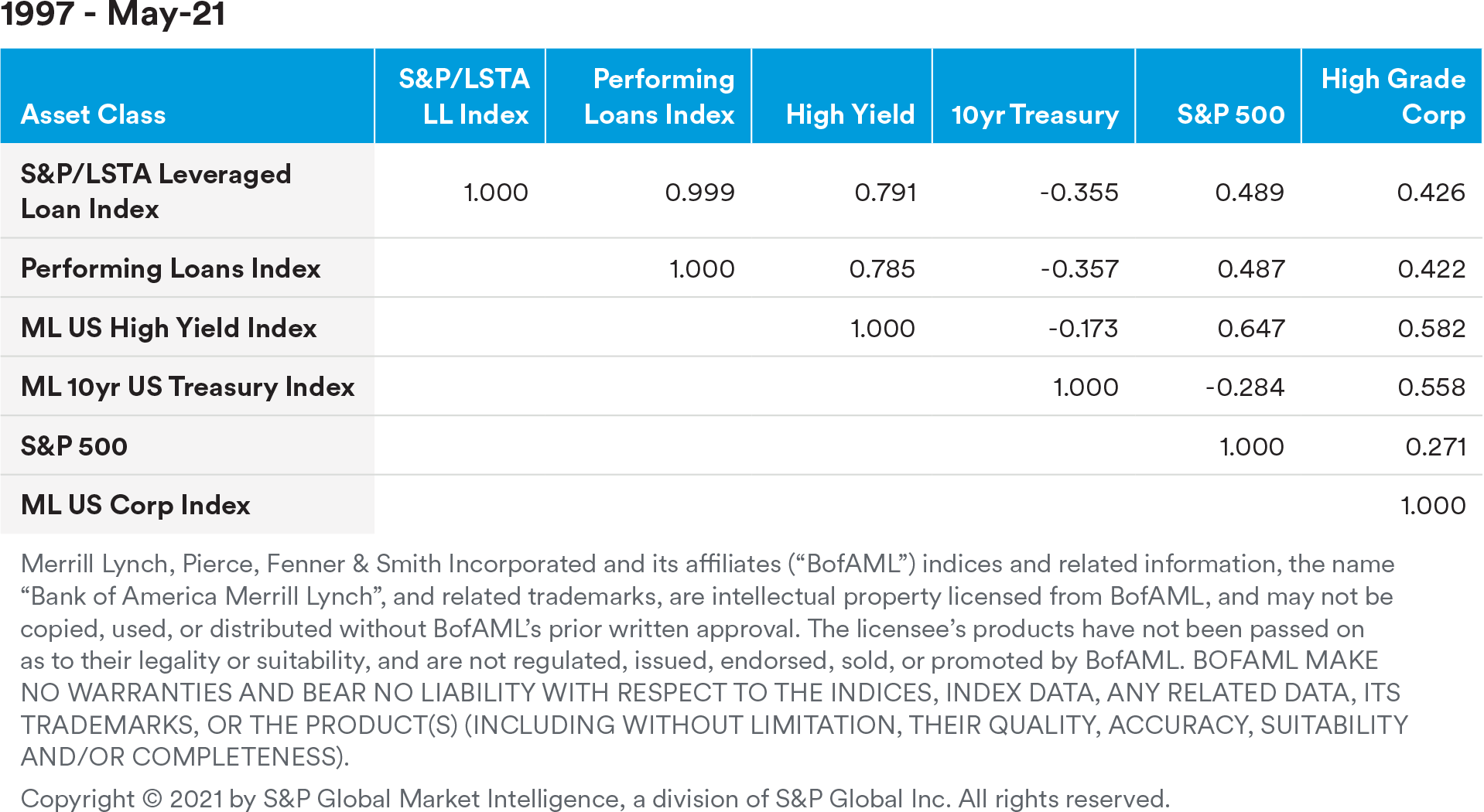

We believe bank loans offer many potential benefits to investors. Investments in bank loans can act as a portfolio diversifier given their historically relatively low correlations with most major asset classes. The correlation between bank loans and IG corporates as well as bank loans and the S&P 500 from 1997 – May 2021 are below 50%, and given that loans are floating rate, they have a negative correlation with the 10-year treasury.2 Bank loans’ low correlation with other fixed-income instruments can be largely attributed to their floating rate structure that differs from that of High Yield and Investment Grade corporate bonds. Bank loans are typically floating-rate instruments that are periodically reset to a spread over LIBOR,3 or the effective base rate.

In this report, we will explore four segments of the underlying bank loan market as well as highlight the attractive potential benefits of the asset class along with some potential risks.

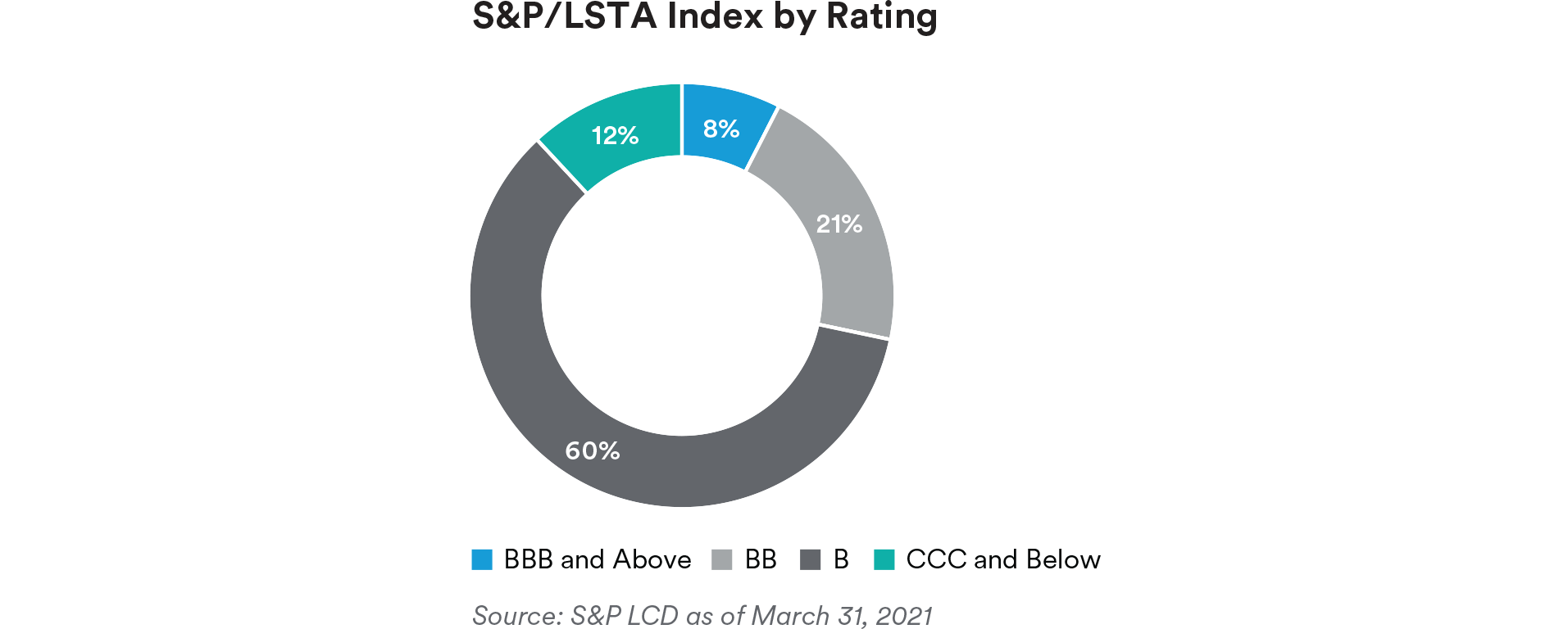

Investment Grade Loans (By Facility Rating)

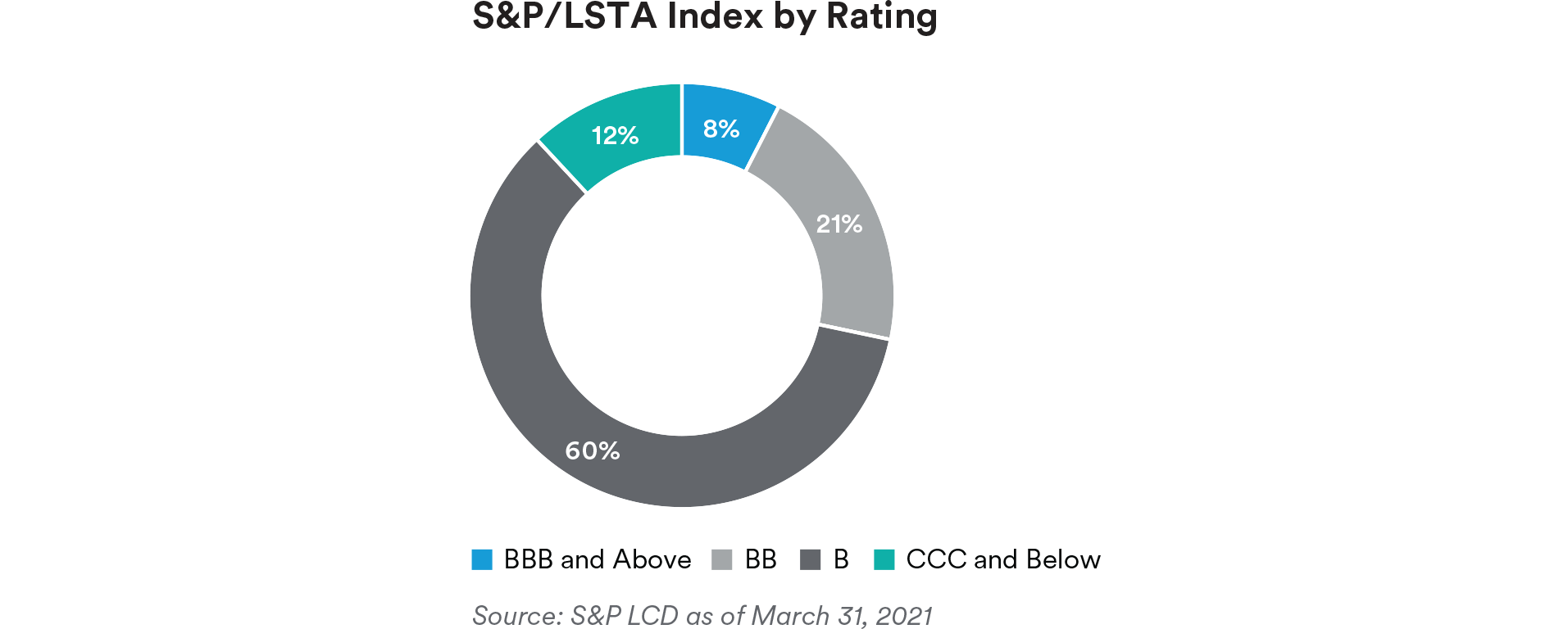

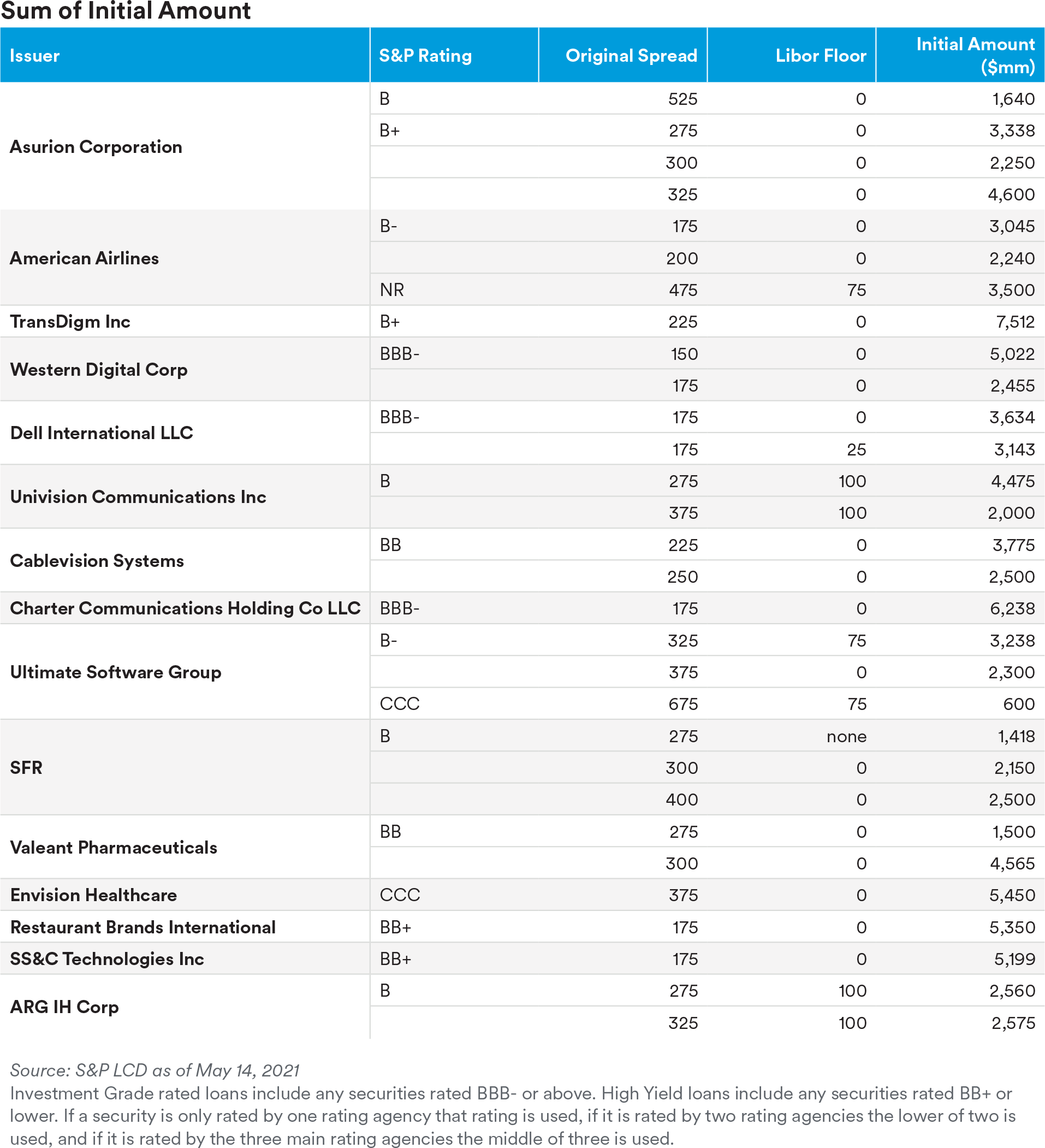

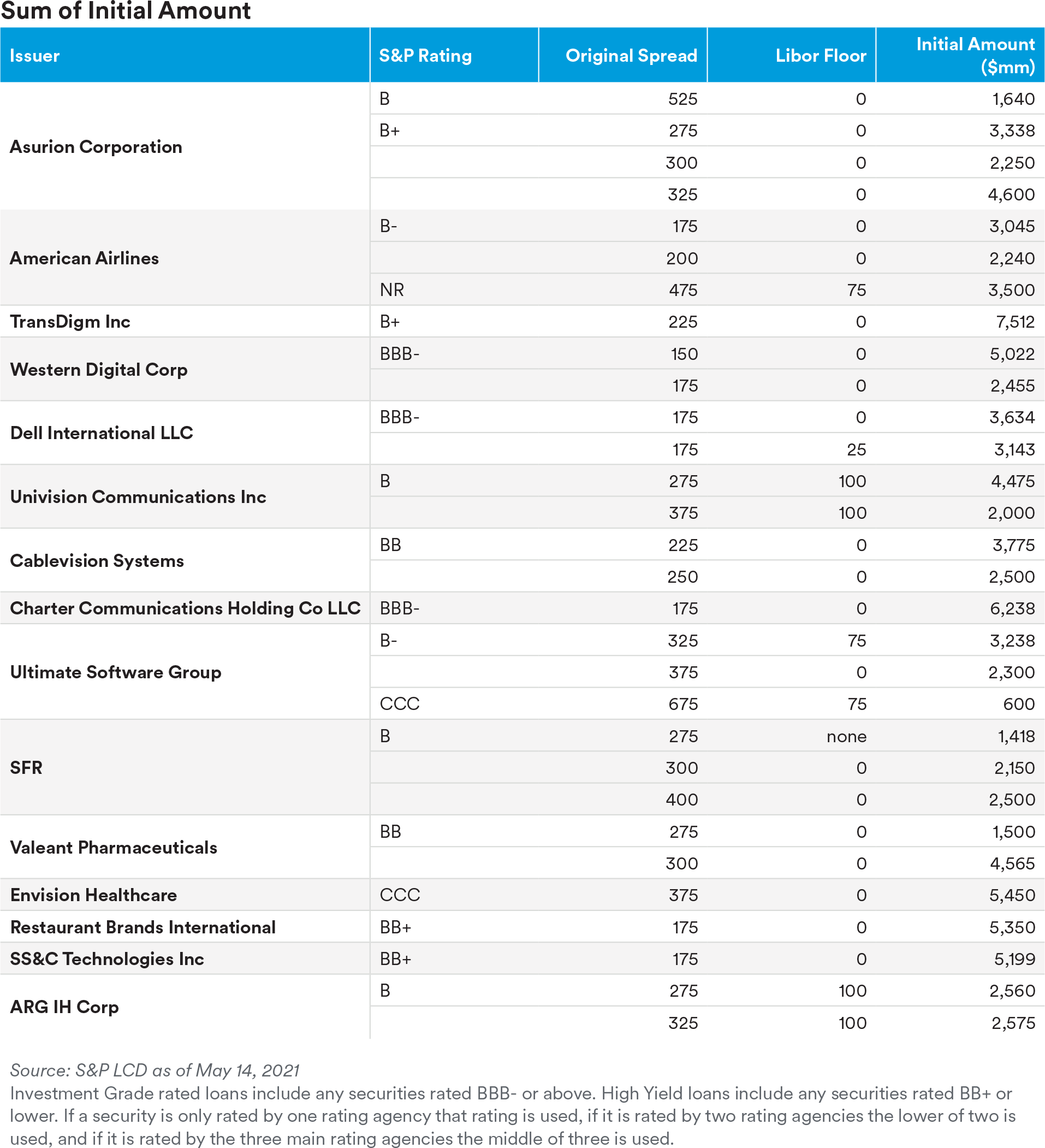

Investment grade (IG) loans, which comprise of securities rated BBB- and above, make up 8% of the total loan market and offer not only diversification but can also provide a significant spread pickup compared to 3 and 5 year BBB unsecured bonds. A typical investment grade loan has a spread of LIBOR (L)+175- 225 with a 0% LIBOR floor, as exhibited by the top 15 issuers by par value in the S&P/LSTA U.S. Leveraged Loan market in Appendix A, which includes three investment grade issuers. The current nominal spread for investment grade loans as of 3/31/2021 is L+200.2

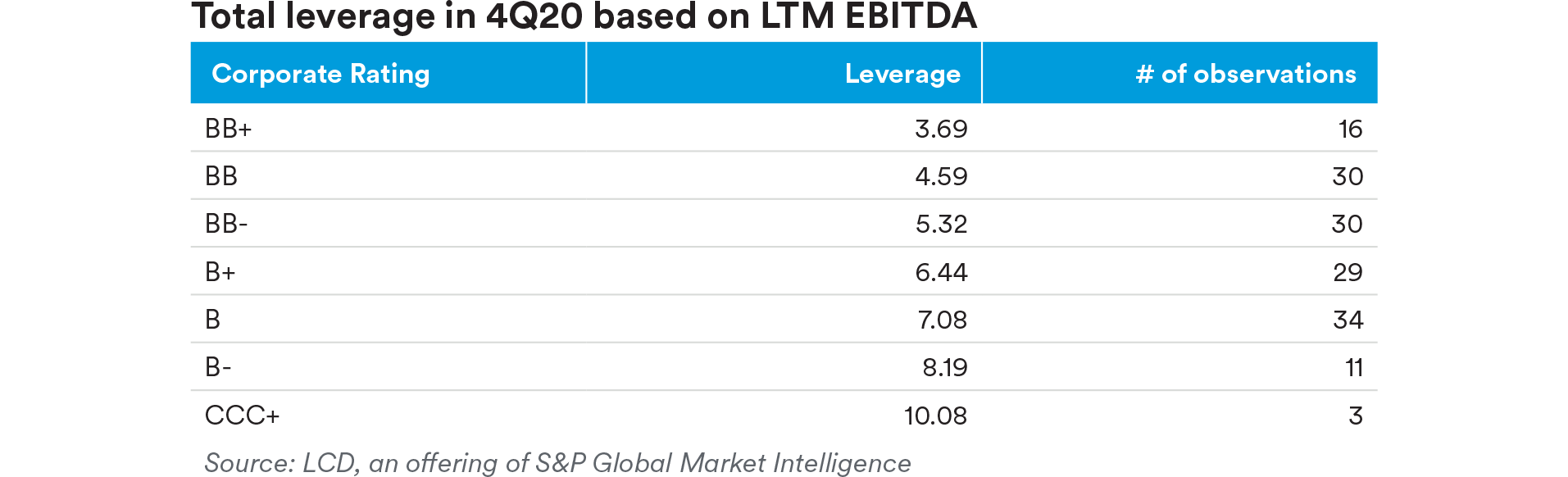

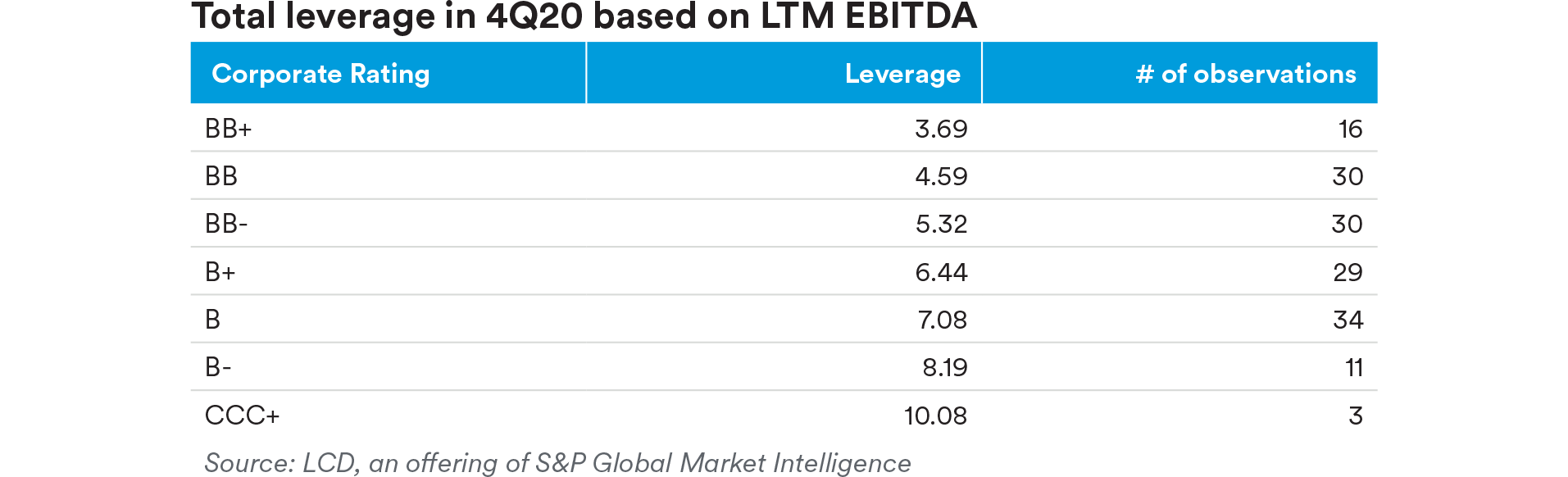

A LIBOR floor implements a guaranteed lowest level for the base rate of a security. We estimate a notable yield pickup over typical IG bonds, such as those in the Bloomberg Barclays Corporate Index, along with being secured in the capital structure. “Secured” means they are structured to include a lien against the assets of the borrower. In the event of a default, the lender has the right to take possession of these assets, which either can be sold or operated for cash. Bank loans are senior secured instruments and generally are at the top of the corporate capital structure. Bank loans may benefit from a number of structural protections, contained in the credit agreement, including negative covenants. Such covenants seek to provide protection for the buyers, such as maintaining minimum leverage ratios, restricting dividend payments and issuing incremental debt. Issuers have lower secured leverage and stronger market positions within the leveraged loan industry as they move up the rating spectrum (Appendix B).

BB Rated Loans

The BB portion of the loan market constitutes 21% of the total loan market and includes a number of bellwether issuers in the loan market.2 Many of these companies have improving credit profiles with a long-term target of getting to Investment Grade on an unsecured basis. This portion of the loan market is popular for corporate merger and acquisition (M&A) activity, to finance growth through expansion projects, corporate spinoffs and general corporate purposes. A typical BB loan ranges from L+200-375 with a 0% LIBOR Floor. The current nominal spread for BB rated loans is L+274.2 The top five sectors by market value weight within the S&P Leveraged Loan BB Rating Index include: Electronics, Cable TV, Utilities, Drugs, and Chemical. In our view, this segment of the loan market is typically a core holding of both High Quality and Total Return portfolios.

Single-B Rated Loans

The single-B portion of the loan market is the largest portion of the loan market with 60% of the total outstanding debt of the asset class.2 This segment of the loan market has been steadily growing as CLOs typically have a weighted average credit rating of B1 or B2. The demand from CLO issuers for new loans rated single-B has encouraged equity sponsors in Leveraged Buyouts (LBOs) to finance the secured debt at a single-B credit rating, with unsecured debt often at low single-B or CCC ratings. A typical single-B loan ranges from L+325 to L+500 and a 50-100 basis point LIBOR Floor, with an average nominal spread of L+401 for loans in the single-B space.2 Within the S&P Leveraged Loan B Rating Index, the largest five sectors by market value weight include: Electronics, Business Equipment and Services, Healthcare, Insurance, and Chemical. Middle market opportunities, which are classified as companies with pre-taxed earnings between $5 million and $250 million, are generally syndicated in the single-B market, with typically wider pricing and higher quality credit agreements. These deals can often be clubbed together with 7-20 buyers and can be an attractive subset of a portfolio’s single-B allocation. Most LBOs are typically financed in the loan market in the single-B portion of the loan market. Having a skilled credit team, in our view, is imperative to investing in this riskier portion of the loan market. With a steady slate of issuers and a strong market, much of credit research’s time is spent underwriting new companies that issue in this portion of the loan market.

CCC & Not Rated (NR) Loans

The CCC and NR portion of the loan market is 12% of the overall market. This segment is a mix of Second Lien loan issuance to finance LBOs and issuers that were downgraded from single-B to CCC.2 For total return mandates that allow for allocations to CCC issuers, participation in this section of the market is typically opportunistic and is focused on high conviction names. In larger deals, the Second Lien loan issuance is a proxy for High Yield (HY) unsecured bond issuance. High yield is any bonds that are rated BB+ or lower. The potential advantage for Second Lien loans is that the call protection is not as onerous as in the high yield unsecured bond market. For example, a typical call protection for Second Lien loans is 102% for the first year, 101% for the second year, and par thereafter. This makes prepaying the debt much easier than in the high yield bond market.

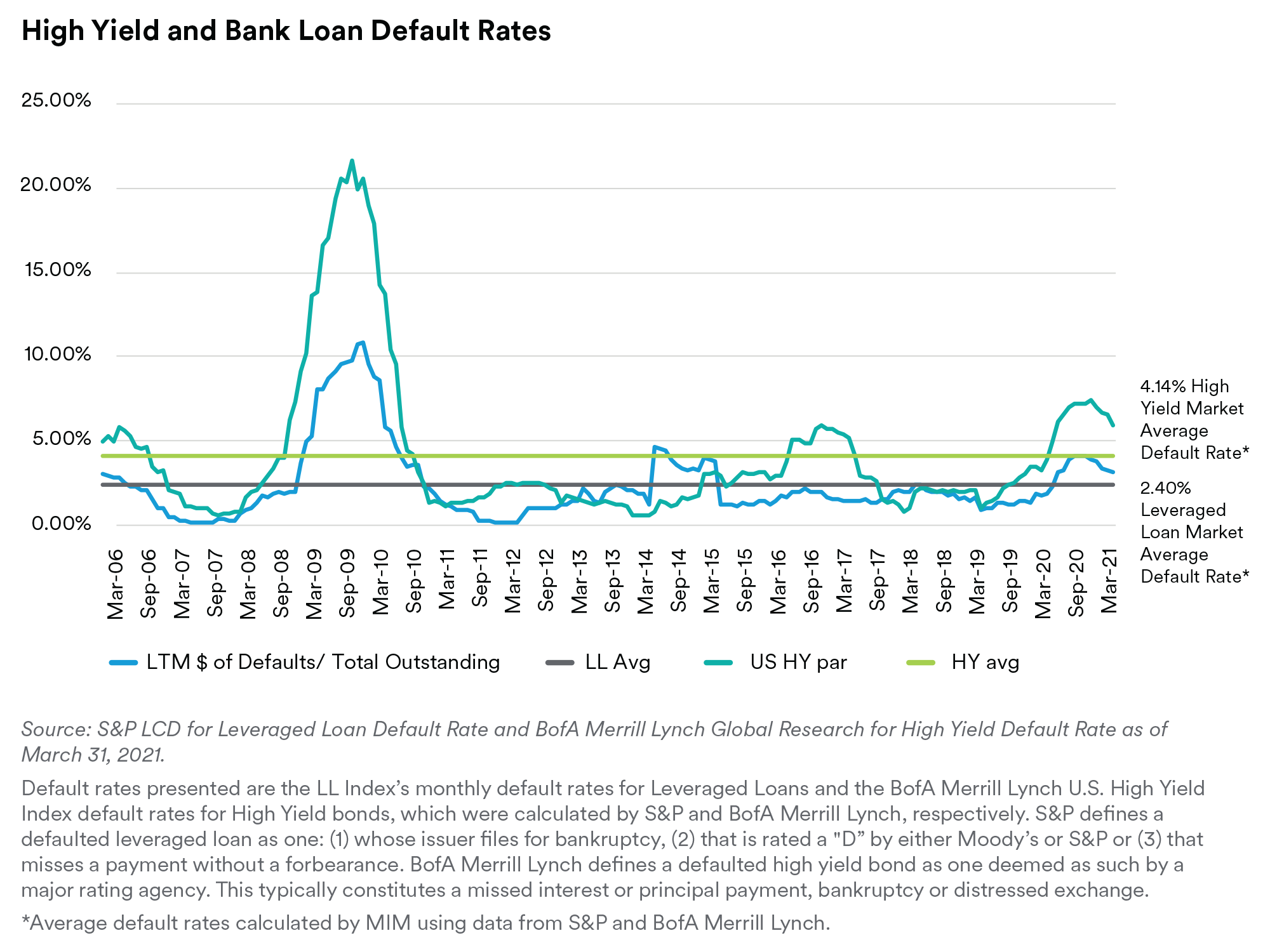

On downgraded names, we often utilize MIM’s special situations team to evaluate if situations are temporary or turnaround in nature versus a permanent loss of value. With low levels of distress, and less than 1.25% of U.S. leveraged loans priced below 80, the market is not expecting a surge in defaults in the near-term.2

The improving economic data is driving investors to be more optimistic about the potential of the global recovery. This rebound should help provide a supportive backdrop for the leveraged loan market. As inflation projections continue to rise and drag up rates, leveraged loans can help offset inflationary risk due to their floating rate structure. The current interest rate environment, along with other factors outlined below, emphasize the potential benefits of investing in the leveraged loan universe.

Potential Investor Benefits and Risks

• Diversification—Loans are a portfolio diversifier given their relatively low correlations with most major asset classes. The floating rate structure of loans is the driver of the low correlation.

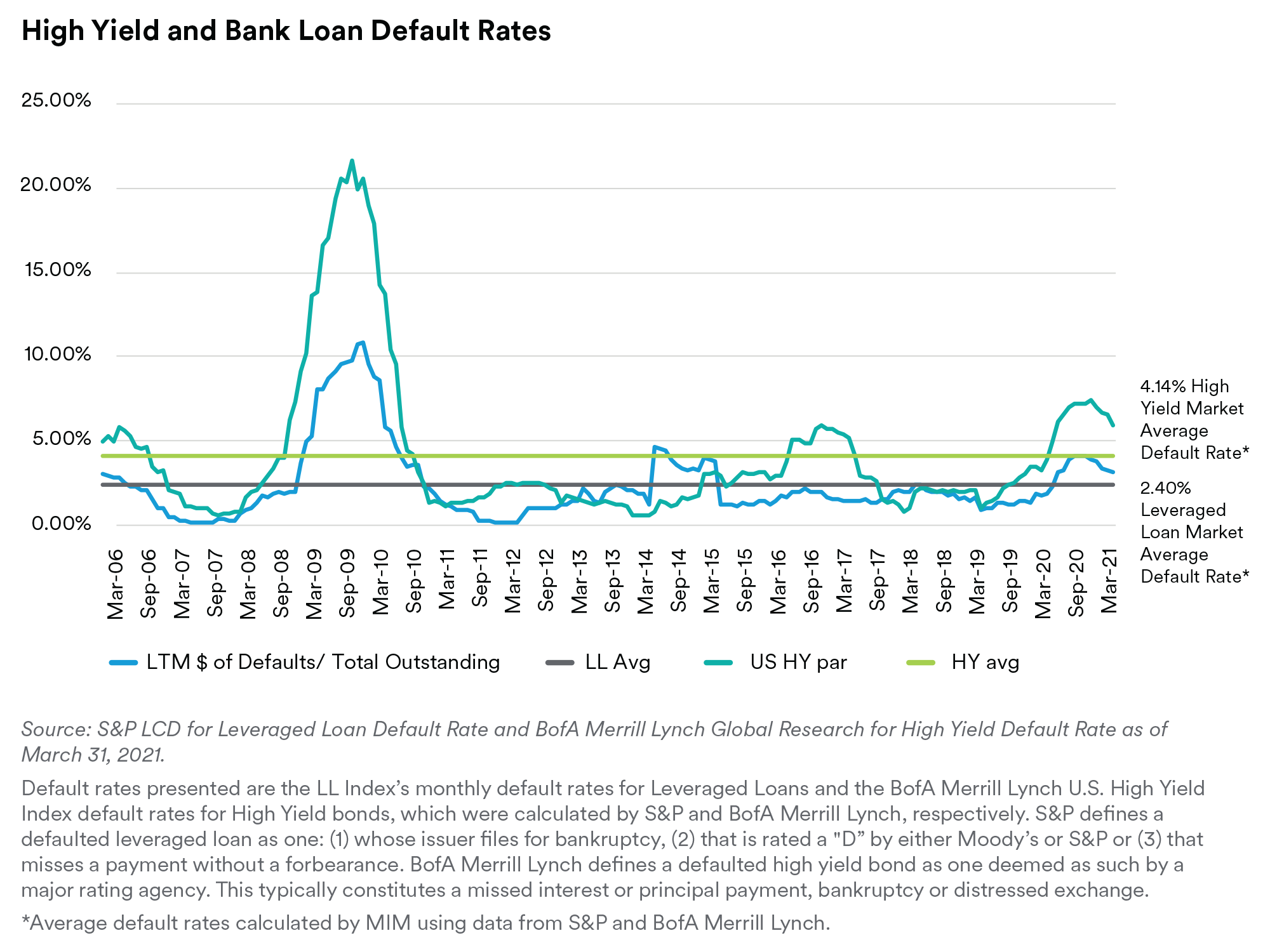

• Lower Volatility—We believe that bank loans generally exhibit lower volatility compared to High Yield Bonds and private mezzanine debt. The low volatility is due to 2 reasons:

- Syndicated bank loans’ total return is primarily from coupon income, which can increase to the extent that underlying interest rates rise.

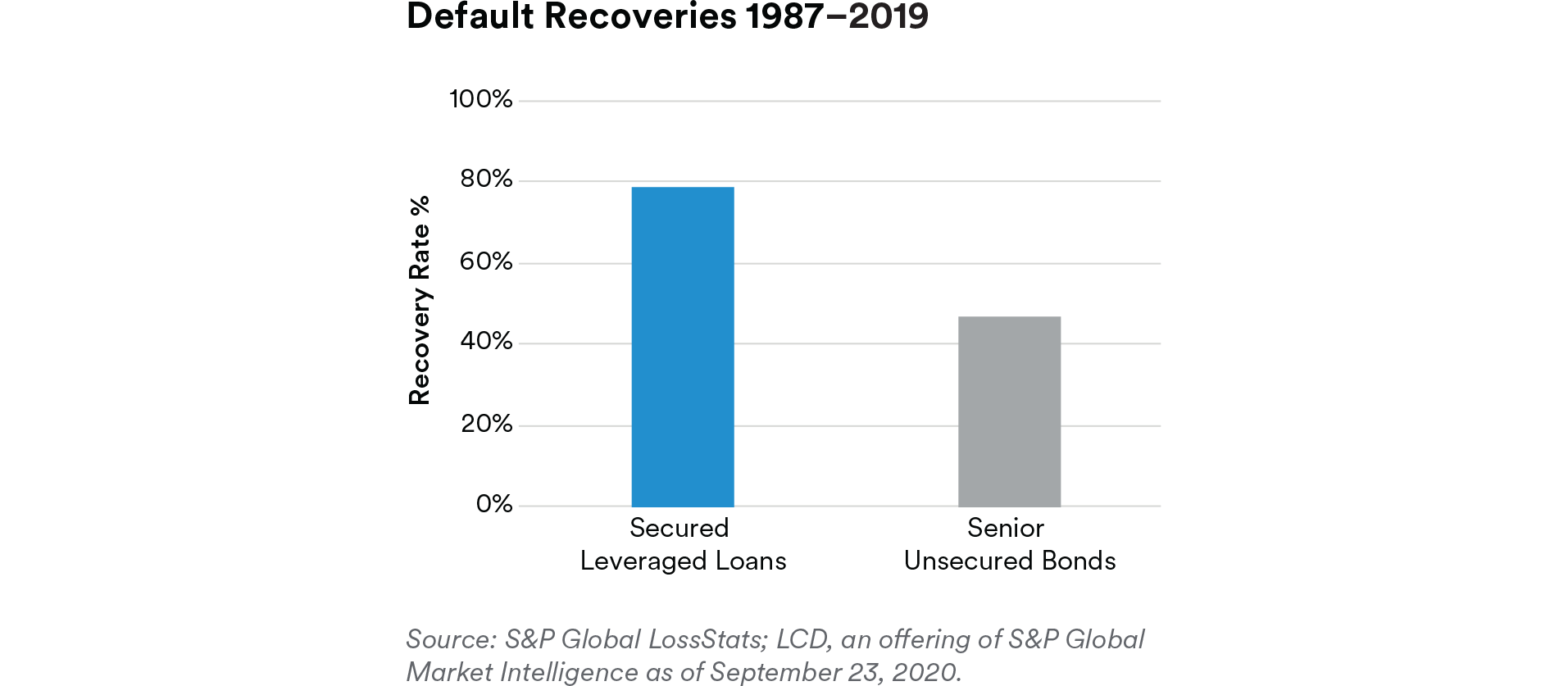

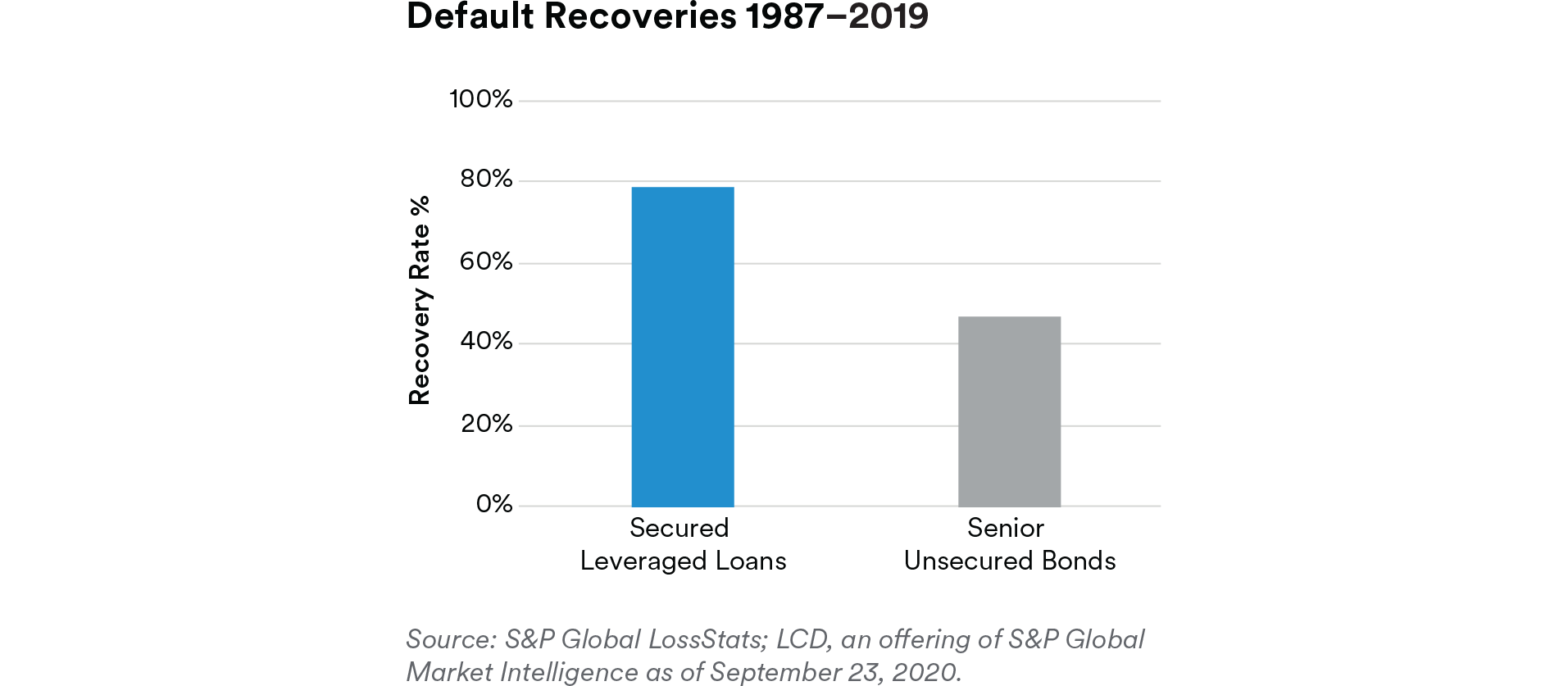

- Syndicated loans have historically tended to have higher recovery rates and lower loss rates relative to high yield bonds, which can serve to reduce volatility.

• Structural Protections—Syndicated loans are senior secured instruments at the top of the corporate capital structure. Loans can benefit from negative covenants and pledged collateral within the Credit Agreement.

• Floating Rate Coupon Structure—Loans are typically floating rate instruments that are periodically reset to a spread over LIBOR or the effective base rate. In a rising rate environment, the floating rate can enable investors to earn higher income over time.

• Downside Protection Features— The LIBOR floor present in many loans may help to mitigate the downside from falling interest rates. As of 3/31/2021, 42% of the Leveraged Loan index had LIBOR floors greater than 0 basis points, with an average floor of 90 basis points.2 Including 0 basis point floors, 98.9% of the index contains a LIBOR floor, with an average floor of 36 basis points.4

• Credit Risk— Below investment grade debt obligations are regarded as predominately speculative with respect to the borrower’s continuing ability to meet principal and interest payments. With 92% of the leveraged loan market in below investment grade securities, investing in the asset class will be more dependent on the Manager’s analysis than would be the case if an investor were investing in higher quality debt obligations in other asset classes. In addition, lower quality debt obligations may be more susceptible to real or perceived adverse economic and individual corporate developments than would investment grade debt obligations.

• Interest Rate Risk—In general, rises in interest rates will negatively impact the value of fixed rate obligations and falling interest rates will have a positive effect on value. Overall, instruments with longer maturities have a greater duration and thus are subject to greater price volatility from changes in interest rates. Adjustable rate instruments also react to interest rate changes in a similar manner although generally to a lesser degree (depending, however, on the characteristics of the reset terms, including the index chosen, frequency of reset and reset caps or floors, among other things).

• Leveraged Loan Risk—Leveraged loans hold senior positions in the capital structure of a business entity, are secured with specific collateral and have a claim on the assets and/or stock of the borrower that is senior to that held by unsecured creditors, subordinated debt holders and stockholders of the borrower. However, the risks associated with below investment grade leveraged loans are similar to the risks of other below investment grade instruments, although leveraged loans are senior and secured in contrast to other below investment grade instruments, which are often subordinated and/or unsecured. Nevertheless, if a borrower under a leveraged loan defaults, becomes insolvent or goes into bankruptcy, investors may recover only a fraction of what is owed on the leveraged loan or nothing at all.

Endnotes

1 A syndicated loan is financing offered by a group of lenders (syndicate) who work together to provide funds for a single borrower.

2 Source: S&P LCD, as of 3/31/2021

3 The U.S. dollar London Inter-Bank Offered Rate (LIBOR) will likely be discontinued beginning June 2023; however, U.S. regulators have indicated that banks should stop using LIBOR in new issue contracts by December 2021. The recommended alternative reference rate to replace USD LIBOR is the Secured Overnight Funding Rate (SOFR).

4 Source: MIM, Blackrock Aladdin

Appendix A

Appendix B: Leverage by Rating

Disclosures:

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is notintended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does notconstitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form partof any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchaseor subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do notnecessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within theMetLife enterprise that provide insurance products, annuities and employee benefit programs.

The information and opinions presented or contained in this document are provided as the date it was written. It should beunderstood that subsequentdevelopments may materially affect the information contained in this document, which none of MIM,its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide,and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy orinvestment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise beinterested in the investments (including derivatives) of any company mentioned herein. This document may contain forwardlookingstatements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, whichare not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

Your capital is at risk. Investing in the strategies discussed herein are subject to various risks which must be considered prior to investing. Alternative investment strategies involve magnified risks, are speculative, are not suitable for all investors, andare intended for experienced and sophisticated investors who are willing to bear the higher economic risks associated with theseinvestments. These risks may include, but are not limited to Liquidity Risk, Interest Rate Risk, Credit Risk, Prepayment Risk, and Counterparty Risk for a more complete list please contact your sales representative.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities ExchangeCommission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management.Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by theUK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E145AA United Kingdom. This document is only intended for, and may only be distributed to, investors in the EEA who qualify as aProfessional Client as defined under the EEA’s Markets in Financial Instruments Directive, as implemented in the relevant EEAjurisdiction. The investment strategy described herein is intended to be structured as an investment management agreementbetween MIML (or its affiliates, as the case may be) and a client, although alternative structures more suitable for a particularclient can be discussed.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is definedin the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority inthe Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance containedwithin it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis tothe addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authorityin the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation ofinvestment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitationwould be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho,Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator(“FIBO”) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and ithas not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial serviceslicense under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC underUS law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name forsubsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC,MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife LatinAmerica Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.