The second quarter of 2023 began just as the aftermath of the turmoil in the banking sector started to subside. Despite the lingering risks, the Bloomberg US Credit Index OAS closed the quarter at 114 basis points, grinding 15 basis tighter over the period and 7 basis points tighter since the start of the year.1 From a macro perspective, central banks both domestically and abroad continued their fight on taming stubbornly high inflation at the expense of the known and unknown effects of tightened monetary policy. The Federal Reserve (Fed) hiked rates an additional 25 basis points to 5.25% despite a hawkish pause at their June meeting to gauge the effects of the previous ten consecutive rate hikes. Before the May FOMC meeting, markets were priced for nearly 2 rate cuts by year end. At the end of the 2nd quarter, markets priced were priced for 1 more hike by year end and no cuts. Toward the end of May a tentative agreement was reached raising the debt ceiling for two years, relieving anxiety around potential default on U.S. government debt. This resolution aided a reduction in interest rate volatility evidenced by the MOVE Index declining from 145 to 110 by June 30th. The 2s10s Treasury Curve ended the 2nd quarter 106 bps inverted continuing to signal a weakening economy amid expectations of more rate hikes. The curve inverted 51 basis points since April 1 and we note; it is the greatest inversion in upwards of 40 years. The 2-year treasury climbed 87 basis points, the 10-year by 37 basis points to 3.84% and the 30-year by 21 basis points reaching 3.86%.1 Although the economic data of late for example, Non-Farm Payrolls adding 732k jobs in the Second Quarter and a First Quarter GDP print of 2% has signaled underlying strength, our base case remains that of a mild recession in the second half of the year or early 2024. We witnessed pressures mount through declined earnings, a weakened consumer balance sheet and increased debt service as legacy debt funding matured.

Banks across the spectrum of GSIBs to Regionals took measures to sure up liquidity and rein in credit to quell fears as they adjust to tighter financial conditions. In our view most bank balance sheets still are well capitalized. Early in the quarter First Republic Corp was placed into FDIC receivership only to be purchased by JP Morgan all while the FDIC conducted liquidation of banks’ security holdings, namely mortgage-backed securities. More broadly much of the rhetoric from corporations has come with a sanguine tone, however, many have also disclosed additional rounds of layoffs across a variety of industries which gives us pause on getting hopes high for continued strength amidst tighter financial conditions and a weakening consumer. Despite each sectors challenges, we continue to see strong M&A activity in the Pharmaceutical, Health Care, and other defensive industries. Most notably, Pfizer came to market with a $31 billion primary deal across the broad maturity spectrum in one of the largest debt issuances in the history of capital markets financing their acquisition of Seagen Inc.

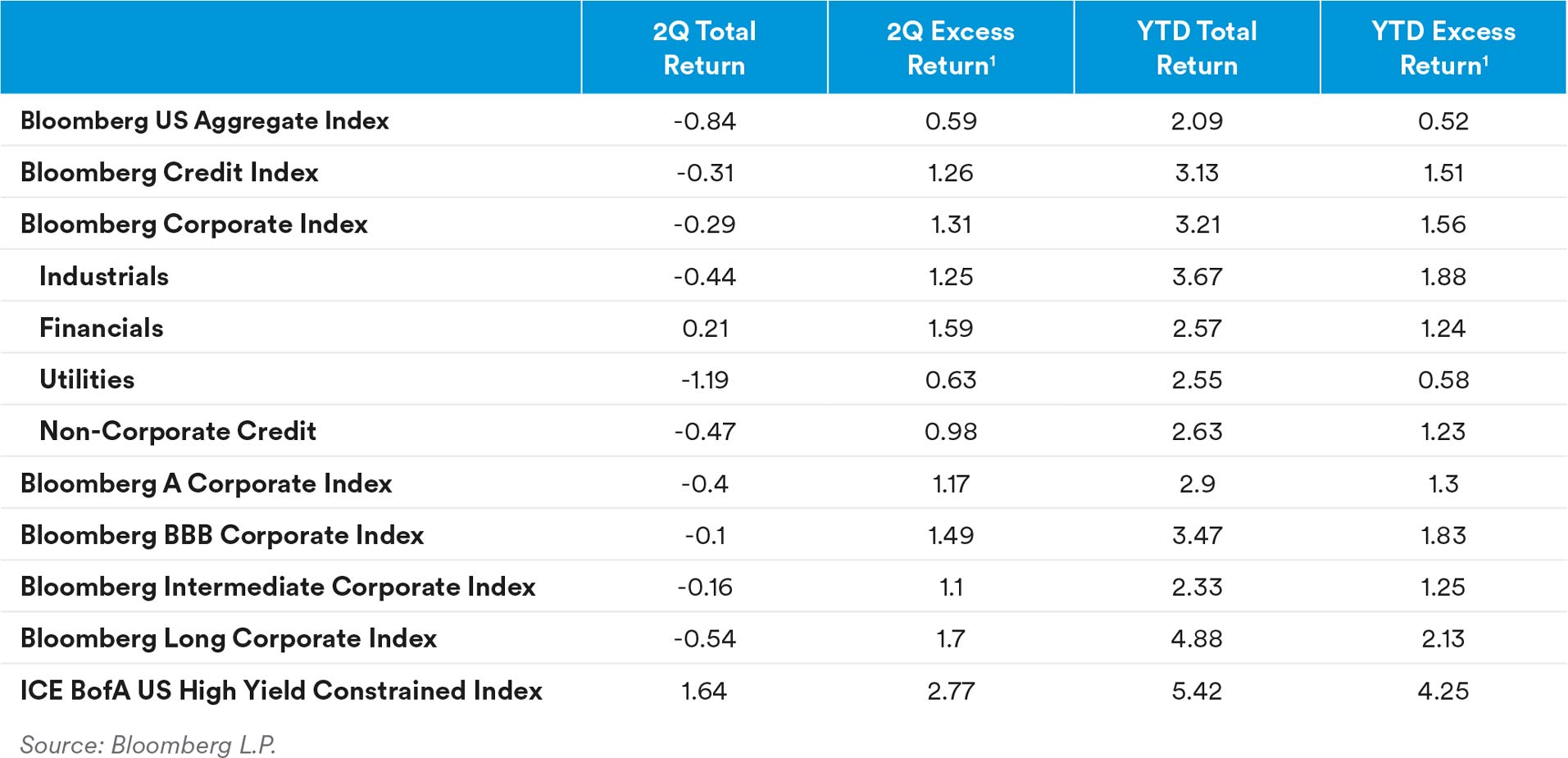

Over the quarter excess returns, while varied across the sub-sectors, were generally supported by a rebound from the Financial sectors as defensive sectors like Utilities and Pharmaceuticals that saw heavy issuance lagged. The recent events in regional banks of the banking sector spilled over broadly into the financing sector and put the spotlight on weaknesses in Commercial Real Estate and REITs. More specifically, Office REITs was a larger turn-around story in spreads as the sector was likely oversold on fears beyond challenges from “return to office” paradigms. The Airlines sector was also a notable performer in the index as passenger statistics have eclipsed 2019 levels and further supported by an optimistic summer travel season riding on pent up COVID demand. This demand is even greater internationally as COVID policies have been relaxed across the globe and especially Asia. The Energy sector and underlying subsectors experienced weakness brought on by a slump in oil prices and fears of slower growth dampening demand for energy. More broadly throughout the course of the quarter, corporate credit outperformed non-corporates. Within the index, the Long Corporate segment (+1.70% excess) underperformed the Intermediate Corporate segment (+1.10% excess) and its shorter-dated counterparts, while BBB spreads tightened two basis points more than single-A credit.1

Total supply in the second quarter was $316 billion, which was marginally higher than the past four years excluding 2020 of $308 billion. May posted the second highest issuance for the month of $155 billion, trailing only 2020. Non-Financials made up 65% of total supply, led by Healthcare and Utilities issuance in May. Participants suggested that May’s large issuance was the result of muted issuance in March and April as a result of the increased market volatility combined with a robust start to the year. In addition to the aforementioned pick-up in M&A issuance a la Pfizer, Amgen etc., in 2023, use of proceeds for M&A activities is 16% in 2023, up 5% versus the prior 4-year average. We also note that while May brought robust supply across the curve, June’s supply was heavily tilted towards the front-end, bringing the average maturity down 5.8 years month-over-month to 8.4 years.2

Market Outlook

Timing is everything. This axiom certainly applies to our risk posture in portfolios, which continues to be skewed conservatively as our conviction remains high that credit valuations remain too frothy given the macroeconomic backdrop. The market has clearly been slower to adopt this view with spreads sitting at almost identical levels to where the year began. We believe this sanguine view on credit is incongruent with a mounting wall of headwinds, including (but certainly not limited to) higher borrowing costs, more debt, and slowing earnings that should ultimately erode the health of corporate balance sheets. These particular inputs are more germane to credit markets, but are likely on a collision course with the continued tightening of global monetary policy conditions that could have unintended consequences for broader risk markets.

Even if we continue to be wrong about the timing of a correction, we are hard pressed to envision a scenario in which we miss out on a significant spread rally. Historically from this starting level of spreads, average forward (12-month) excess returns for the broad credit index are negative (-0.6%). Interestingly, when you decompose those excess returns into the two broad maturity buckets, Long (10+ years) Credit excess returns are materially negative (-2.0%) and are twice as frequent as positive returns, while Intermediate Credit excess returns are nearly flat and are more equally distributed. While each environment is different, we do believe the inverted yield curve offers a compelling opportunity to favor front end credit. An allocation in the front-end allows portfolios to build a yield advantage where the breakevens are far more attractive than out the curve. We are cognizant that a flood of T-Bill issuance will compete for short duration dollars, but with meaningfully tighter levels of spread an unlikely outcome, we believe building this portfolio level yield advantage with front end credit allows us the patience and flexibility to be wrong about the timing of a spread widening event.

A silver lining to frustratingly snug valuations is the opportunity it allows us to further reposition the portfolio for a spread correction. To that end, we maintain our first quarter theme upgrading the quality of portfolio in addition to rotating into sectors that are better positioned for an economic slowdown. For instance, Utilities, Pharmaceuticals, and Healthcare all continue to see above average issuance, and have presented compelling opportunities to rotate out of more cyclical sectors like Chemicals and Midstream. We have also taken advantage of bids for less liquid holdings, as we prefer to give liquidity at more attractive valuations. Admittedly, one of our worst decisions to date has been our aversion to high yield in those portfolios that allow for ‘plus’ sector allocations. We maintain our view that it is nearly impossible to find instances where high yield would outperform investment grade credit in the risk-off environment that we have envisioned this year, but this benign environment has allowed the elevated carry and favorable technical picture for high yield to generate 3x the excess return of investment grade in the first half of the year. Time decay to 2025 maturity walls only further emboldens our call for decompression. Default rates will rise as less resilient business models are pressured by higher interest rates, and that is a not a risk we covet to introduce to investment grade portfolios.

We do not wish to be the subject of the sequel to Waiting for Godot, but we believe our conservative posture to be prudent. Yield remains a powerful tool in the market that we will use to our advantage to clip and wait. As spreads present opportunities we have ample liquidity through our Treasury allocation to add spread duration. Solid carry and positive security selection are dependable tools by which to generate alpha, though we would welcome a back-up in spreads which would provide a far more robust opportunity set.

Endnotes

1 Bloomberg

2 JP Morgan

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.