Since the Pension Protection Act of 2006, many corporate plan sponsors have taken a number of steps to de-risk. Some of these steps have shortened liability duration (e.g., closing the plan to new participants, freezing accruals) while others have lengthened duration (e.g., lump-sum buyouts, retiree only risk transfer). In total, however, these actions and the passage of time have reduced pension liability duration significantly over the past 16 years.

Conversely, Long Credit, the most prevalent LDI hedging strategy, has lengthened in duration as interest rates have dropped and issuance has favored longer tenors. We discuss this transformation of Long Credit in our paper The Evolving Long Credit Universe. The combination of shorter pension liabilities, longer primary hedging assets, and meaningful funded status improvement will likely influence the next phase of liability driven investing whereby higher fixed income allocations will increase the need for key-rate matching to further reduce surplus volatility and refine the hedge.

Which brings us to intermediate corporate credit. We believe adding this strategy offers the following benefits:

- Improved focus on asset allocation with a similar risk and maturity profile as liabilities

- Ability to take advantage of attractive opportunities and new issuance at the belly of the curve

- Access to a broader investment universe with greater diversification

We expect that long duration will remain a staple in most plans’ LDI asset allocation. However, we have noticed a trend of incremental allocations into intermediate credit. In the same way that long duration investment grade strategies tracked pension overall liabilities, intermediate strategies have been a good fit for the first ten-year segment of pension liabilities. Adding intermediate credit is really just a natural extension of traditional LDI strategies as funded status improves.

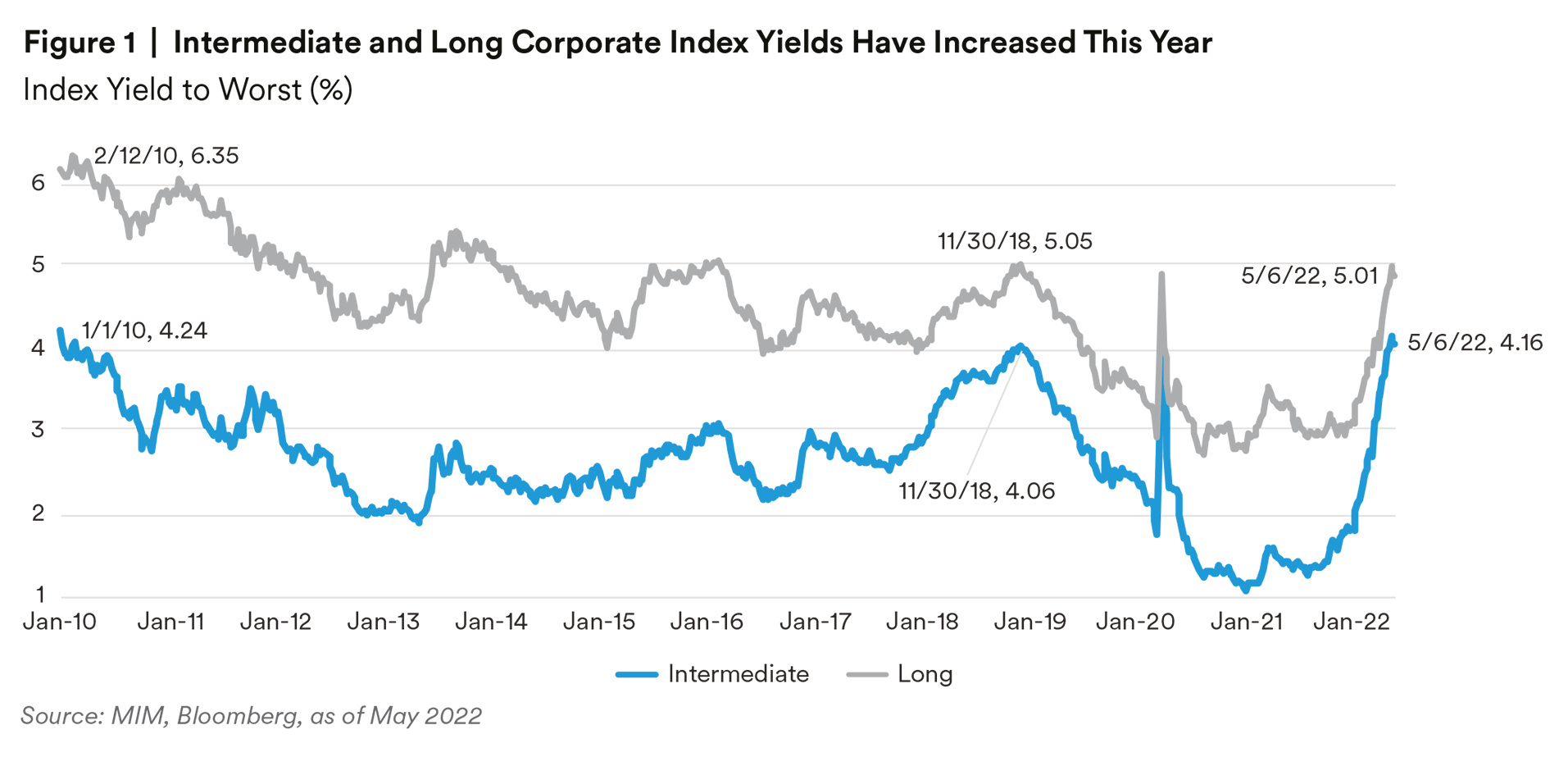

With the shift in the Fed’s monetary policy, we have seen a significant flattening of the US Treasury curve with the 5s30s curve closing April at four basis points after reaching a trough of -12 basis points during the month. The notable bear flattening of the Treasury curve led to a sharp rise in yields on shorter dated corporates, which we feel provides an opportunity for a relatively cheap entry point and attractive carry. In addition, supply and demand technicals have kept corporate credit curves flat, further enhancing the relative value of intermediate corporates. As the April ended, the Bloomberg Intermediate Corporate Index Yield to Worst broke 4% and reached 4.16% in early May. As reflected in Figure 1, the Intermediate Corporate Index yield has surpassed levels not seen since 2010 (with the exception of March 2020), while the current Long Corporate Index yield is just under its 2018 levels and well below 2010 levels.

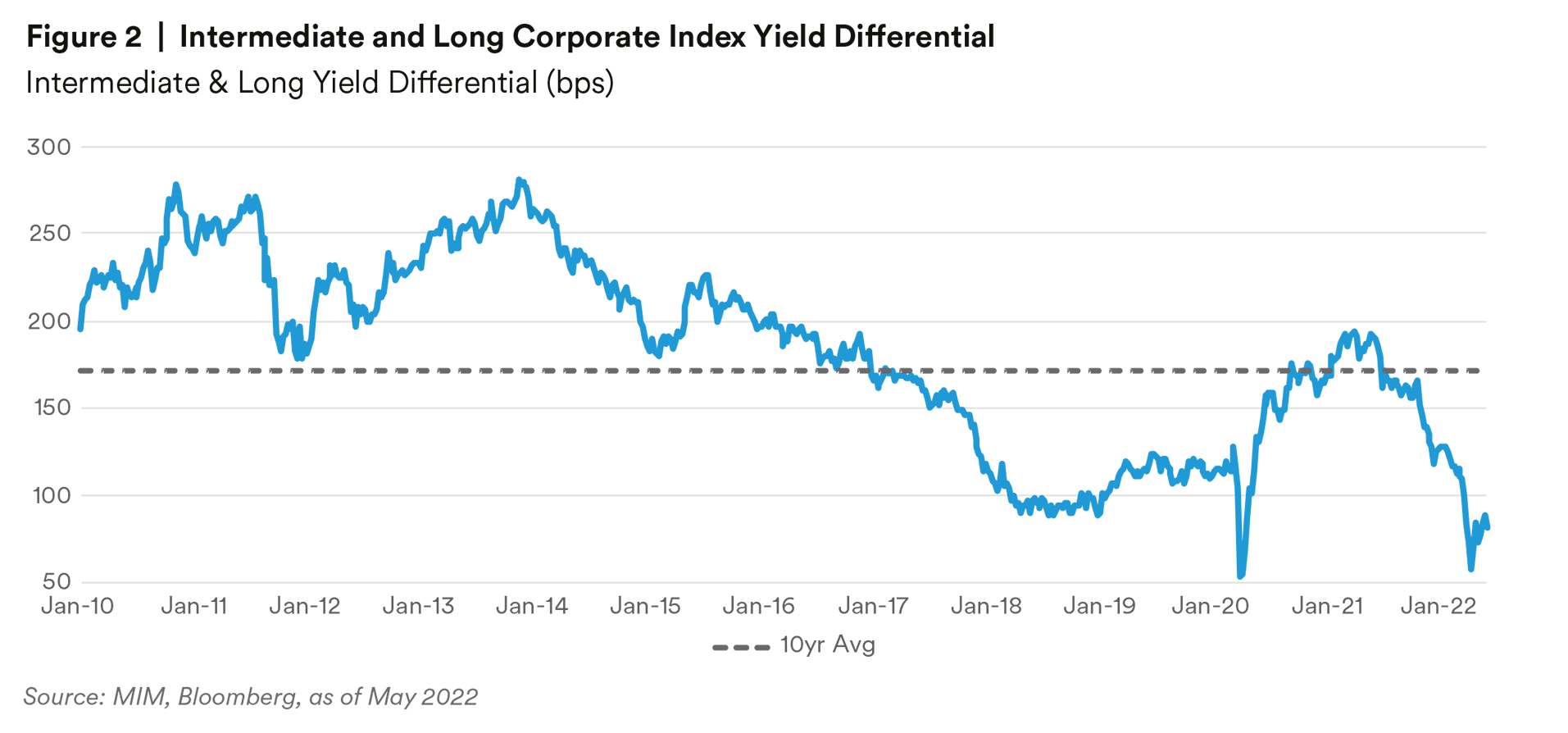

Comparing further, the yield differential between the Intermediate and Long Corporate indices is 85 basis points as of May 6, 2022, which is significantly lower compared to the 10-year average of 173 basis points, suggesting that intermediate corporates have meaningfully cheapened relative to long corporate credit.

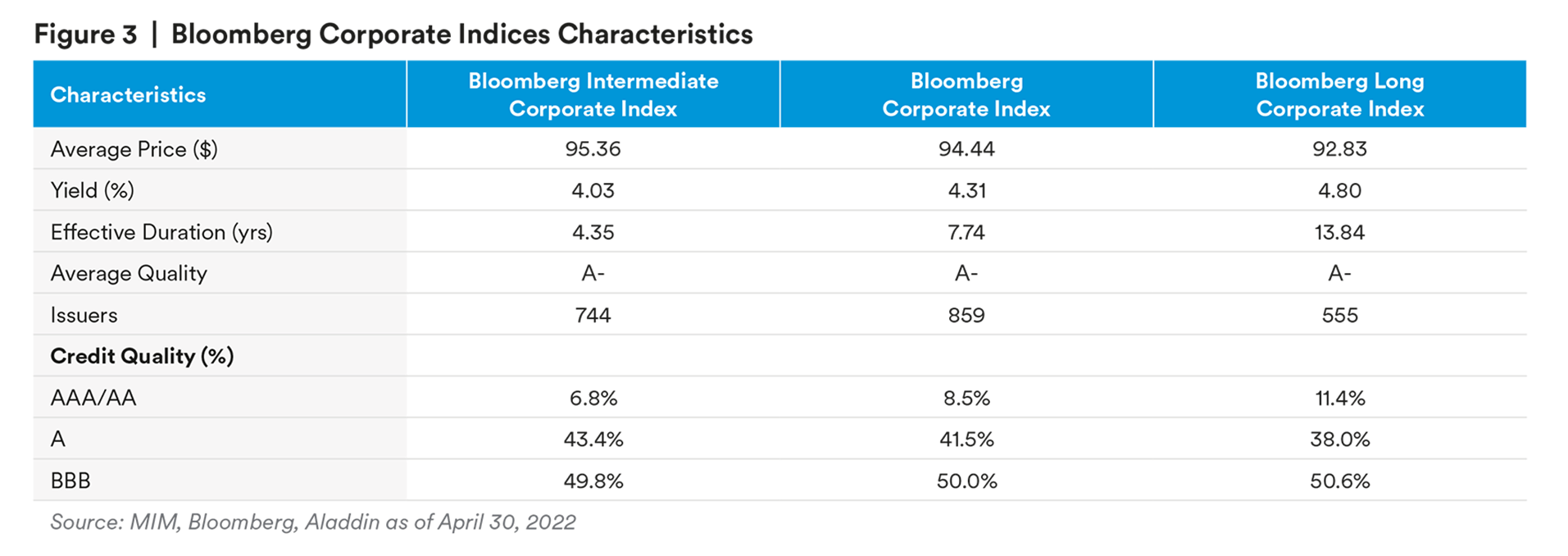

When comparing corporate indices across the curve, we observe a number of similarities, such as average credit quality, but also key differences, notably duration and the number of issuers.

The Bloomberg U.S. Long Corporate Index comprises 555 issuers, while the Intermediate Corporate Index is broader with 744 issuers, enabling investors to access a more diversified liquid universe of bonds. While the overlap between the Intermediate and Long Corporate indices is 439 issuers, there are over 300 issuers unique to the Intermediate Corporate Index as certain issuers are more prone to come to market in the intermediate part of the credit curve.

Drilling into the index components, a key difference between the Intermediate and Long Corporate benchmarks are sector weightings, with a heavier Financials allocation in Intermediate Corporate at 41% versus 17% in Long Corporate. As noted, not all issuers will issue bonds across all tenors, and Banking issuers are often trying to match issuance with their asset profiles with a large proportion of supply residing in the belly of the curve. Financials issuance has been robust in 2022, with the average tenor year-to-date for IG Financials at 7.7 years compared to non-Financials at 14.2 years.1 We believe the large, liquid new issuance in Financials with a bias towards the intermediate tenors has created an attractive opportunity set in that space via both the primary and secondary markets.

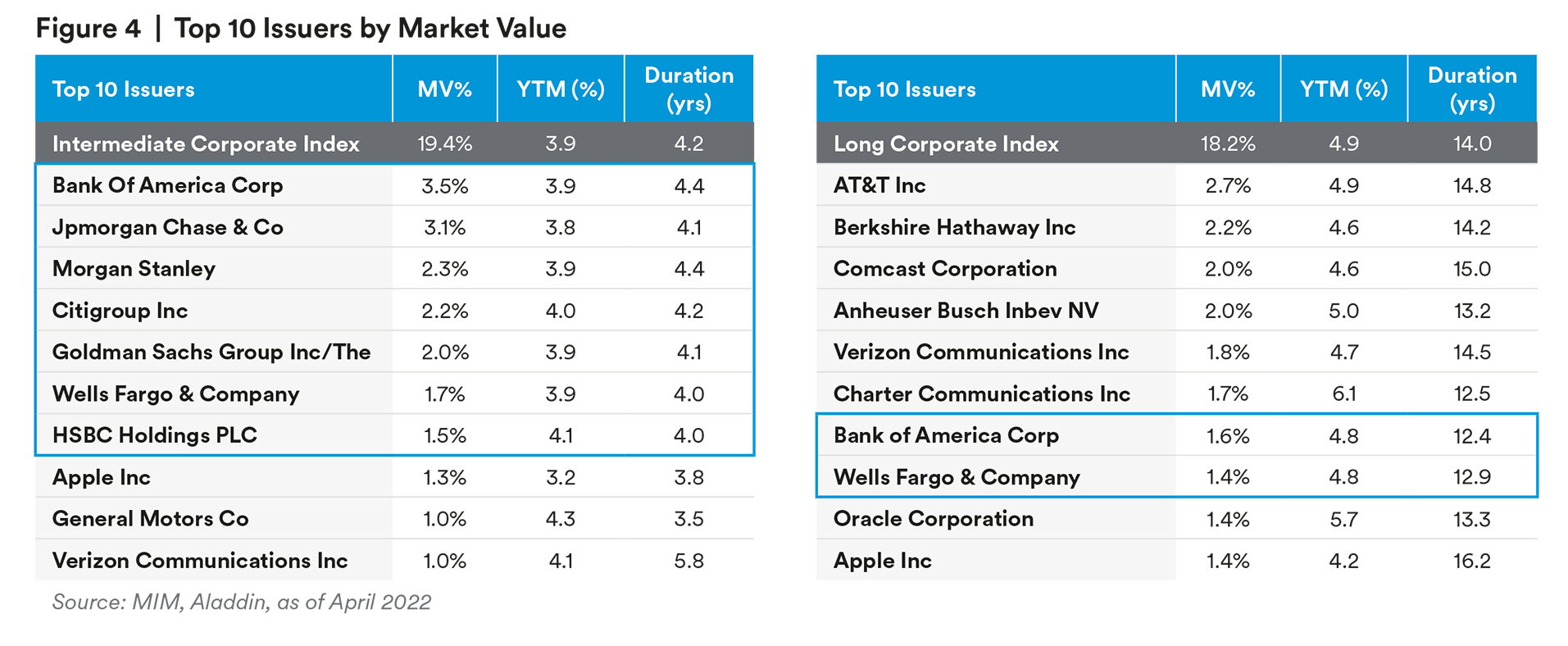

While the Intermediate Corporate Index provides access to a broader array of corporate credit, especially some debut issuers that we have seen surface during the pandemic, it does pose an issue of concentration at the top. Both indices face concentration issues with just ten issuers comprising over 19% and 18% of the Intermediate and Long Corporate indices, respectively. The sector concentration is different however, as Banks represent seven of the top 10 issuers in the Intermediate Corporate Index, but only two of the top 10 in the Long Corporate Index, as shown in Figure 4.

Given over 15% of the Intermediate Corporate Index is concentrated in just seven Banking issuers above, a cap on the sector (e.g., 25%) or issuer (1.5%) could be warranted to help mitigate the overall risk in Financials. While the Financials concentration is much higher in Intermediate, the defensive Utilities sector exposure in the Long Corporate Index is double that of the Intermediate Corporate Index at 11.9% and 5.8%, respectively. Regulated utilities are owners of durable assets that provide a necessary service, and, in many places, operate as a regulated monopoly. The higher-quality Electric issuers tend to issue bonds with longer-dated tenors as investors are comfortable seeking longer maturity investments to match their own longer-maturity liabilities. Similar to Utilities, the Communications sub-sector’s outsized share of the Long Corporate market at ~13% (versus 6.3% for Intermediate Corporate) is largely the result of its ownership of essential long-lived assets including mobile networks (4G/5G) and broadband (cable/fiber). Building out these systems requires large capital outlays to fund infrastructure such as mobile towers, radio equipment, and data centers. Historical M&A is also partially attributable for the sector’s share of long duration maturities given that consolidation results in fewer competing networks with more effective deployment of capital.

The Allocation Decision

As plans continue on their de-risking path, we often get asked whether a blended Intermediate / Long Corporate benchmark or standalone Intermediate Corporate and Long Corporate allocations are the best route. We believe there are merits to each approach and appreciate that each client’s needs are unique to their portfolio.

Recently we have seen a number of our clients also adopt a dedicated Intermediate allocation, and in some cases, a broad IG Corporate strategy, in addition to a standalone Long Duration mandate. Most of these additions have taken place in 2021, coinciding with improvements in funded status and expectations for higher rates.

While we manage portfolios to blended benchmarks, we believe managing mandates on a stand-alone basis offers advantages to plan sponsors. First, stand-alone mandates permit portfolio management specialization with deep expertise and focus on specific market segments. Second, they enable plan sponsors to better compare performance within strategy peer universes. Third, stand-alone mandates simplify liability matching. As plans mature, they can rebalance from long to intermediate to maintain the match. Intermediate mandates can also provide in-kind assets for annuity buy outs of retirees. Segregating intermediate and long allocations provides plan sponsors a lever to fine-tune the key rates in the way that works best for their plan. This ultimately results in not only enhanced precision in refining the hedge, but also when trying to reposition the portfolio over time

Endnote

1 JP Morgan. US Corporate Credit Issuance Monthly: April 2022.

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. An investment in the strategy described herein is speculative and there can be no assurance that the strategy’s investment objectives will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. These risks may include, but are not limited to Interest Rate Risk, Credit Risk, Prepayment Risk, and Counterparty Risk For a more complete list please contact your sales representative. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK. MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such). For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414. For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law. 1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC and MetLife Investment Management Europe Limited.