The key word in sovereign analysis is framework: how to construct an evaluative investment framework that considers the limitations on many lower income economies. How do we evaluate a country that is lower income that relies on the production of fossil fuels or mining as their primary source of revenue? How do we exclude a country that has to choose between electricity for their population or burning coal? The answers to these questions require judgement, transparency and expert-led analysis.

To adequately evaluate the Emerging Markets (EM) debt opportunity set to meet our clients’ goals, we believe we need a research-driven framework that relies on a combination of quantitative screens coupled with a holistic qualitative assessment. At MetLife Investment Management (MIM), we are fortunate to have internal sustainability and credit research teams within Fixed Income who work collaboratively to evaluate sustainability and ESG factors for sovereign issuers. The analysis conducted by our research teams evaluates the effects that these factors have on a sovereign’s rating trajectory and ultimately the performance of the issuer within its rating peer universe, as well as the issuer’s broader commitment to sustainability. This paper will focus on how we at MIM collectively evaluate and incorporate these considerations within an EM sovereign bond portfolio.

The Role of Governments in Responding to Climate Change

Investment, industrial policy and adaptation of vulnerable assets are all important factors affecting our ability to respond to climate change, and across all areas, governments have a critical role to play. This includes providing a supportive policy environment, investing in infrastructure and technology to reduce Greenhouse Gas (GHG) emissions, and building resilience in climate vulnerable assets, industries and natural capital.

A primary means by which governments signal their long-term commitments on climate change is through publication of Nationally Determined Contributions (NDCs). According to the secretariat of the United Nations Framework Convention on Climate Change (UNFCCC), NDCs “are at the heart of the Paris Agreement and the achievement of its long-term goals” to limit global warming to well below 2C by the end of the century.1 The NDCs outline commitments on the part of governments to reduce GHG emissions in line with the Paris Agreement goals, including policies, investments and other measures which will help achieve those commitments.

While there is a wide degree of variation in the ambition and progress countries have made on setting and implementing NDCs, to date, performance has been underwhelming; according to analysis by Climate Action Tracker, current government policies would result in global warming of 2.7C by 2100.2

There are also differentiated responsibilities for financing climate change mitigation and adaptation, and an ongoing debate within the international community regarding the responsibility for financing green growth and adaptation in EM.

Emerging Markets

EM countries face specific challenges with regard to climate risk. Firstly, the need to decarbonise must be balanced with the need to develop infrastructure and industry, raise living standards for a growing population, and deliver economic growth together with the Sustainable Development Goals (SDGs). EM will face growing need for clean, reliable energy to power transport, homes and industry, which will require investment in infrastructure and clean energy solutions. Second, many EM countries are on the frontlines of physical climate impacts, owing to geography, poor infrastructure and low adaptive capacity. Countries will therefore face the twin challenges of decoupling GHG emissions from GDP growth, and investing in climate sensitive industries, in particular agriculture.3

The investment needs are therefore significant. EM countries will in many cases struggle to finance the energy transition without support from developed countries, multilaterals and other international funding sources. Targets set within many country NDCs are therefore structured around conditional and unconditional targets, with the former including needed external financing and support. The financing gap is significant: a recent analysis of funding needs for conditional targets within NDCs indicates this figure could be as high as US$1.6 trillion, far higher than current rates of funding from international sources.4

Framework Thesis

The opportunities for building a sustainability focused sovereign bond portfolio have historically been constrained by two factors:

- The limited pool of issuers, which means the impact of a handful of restrictions will have significantly greater relative impact on portfolio management than it would for corporate bond portfolios.

- The existing frameworks for sovereign ESG scores are highly correlated with income, meaning that rich countries simply come out on top. This is misaligned with the fundamental objectives of the Paris Agreement, in particular the need for private finance to support mitigation and adaptation in developing countries.

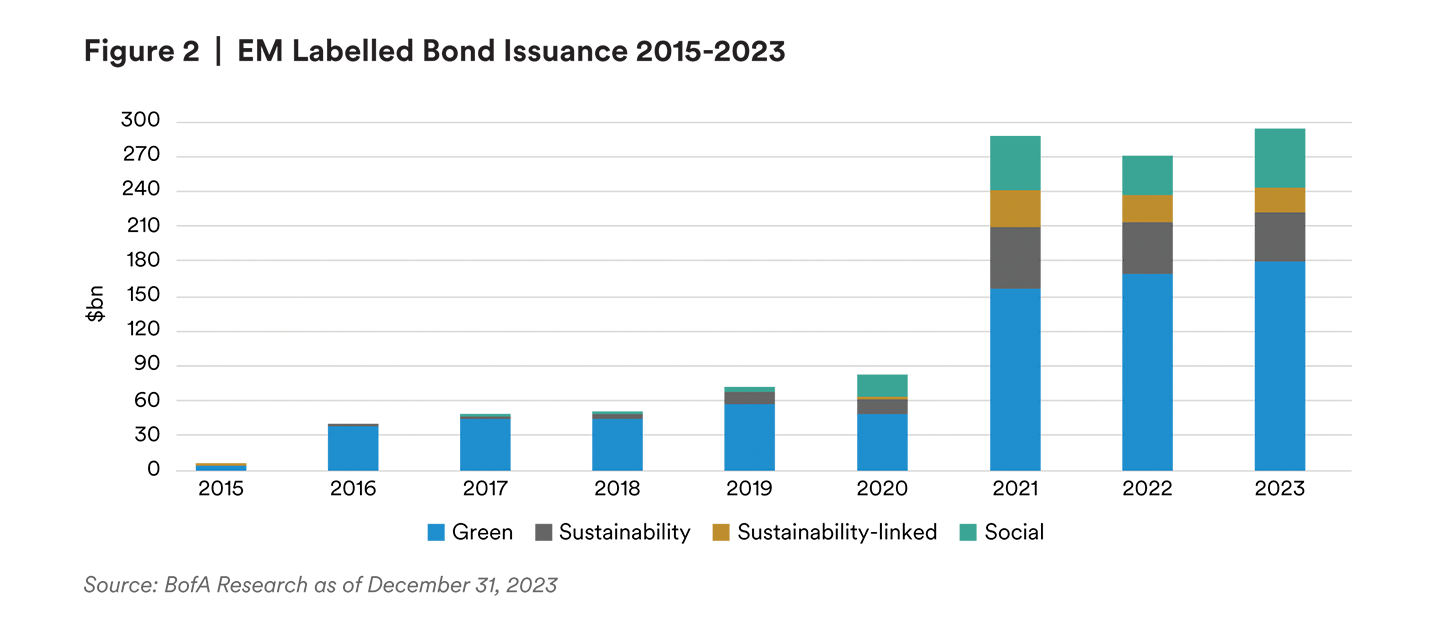

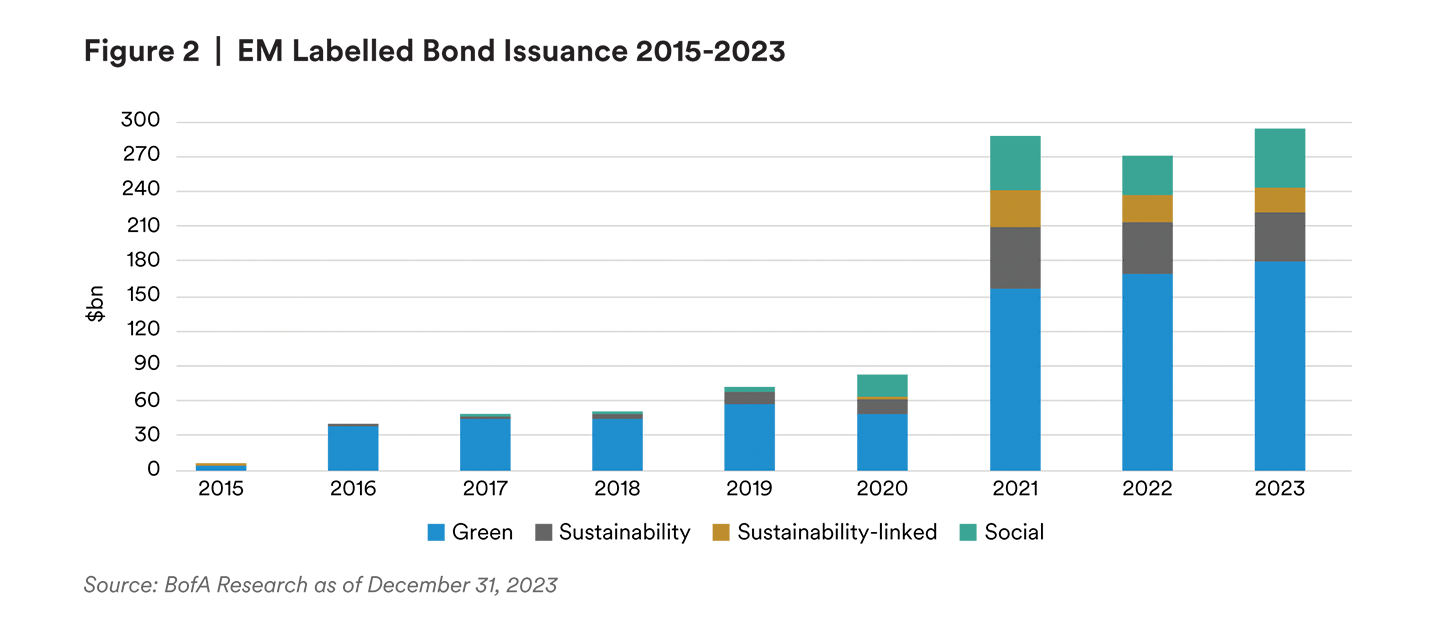

These factors have meant the opportunities for sustainability focused sovereign bond portfolios have lagged behind that of corporate bond strategies. This is a major oversight, because it is exactly at the sovereign level that investors can support sustainable growth broadly within EM. The growth of the sovereign labelled bond market has begun to create opportunities for investors to support sustainability within the sovereign market, but, thus far, issuance has been concentrated making a fully diversified portfolio challenging.

A new approach is needed, which focuses on the UNFCCC principle of equity and common but differentiated responsibilities and respective capabilities for addressing climate change5.

We believe that this requires a framework which 1) leverages comparable, transparent data; 2) integrates analyst expertise and judgement; 3) uses forward-looking analysis; and 4) avoids the bias toward income. To highlight how analysts’ expertise is integrated into our investment process we will walk through two examples with the first focusing on broad screening of transparent third party data and the second highlighting our team’s thoughts on recent labelled bond issuance.

Leverage Comparable Data: Assessing Governance and Social Factors in Sovereign Credit Analysis

Governance issues have always played a central role in sovereign credit analysis as they include political stability, regulatory effectiveness, rule of law, and overall institutional strength. These are considered in sovereign credit assessments as qualitative factors weighting on a country’s financial and economic position. Among the broad array of sustainability factors, governance is the most important for sovereign credit analysis as it broadly captures institutional effectiveness and stability (or lack thereof) and a government´s capacity to address environmental and social issues, as well as economic and financial risks.

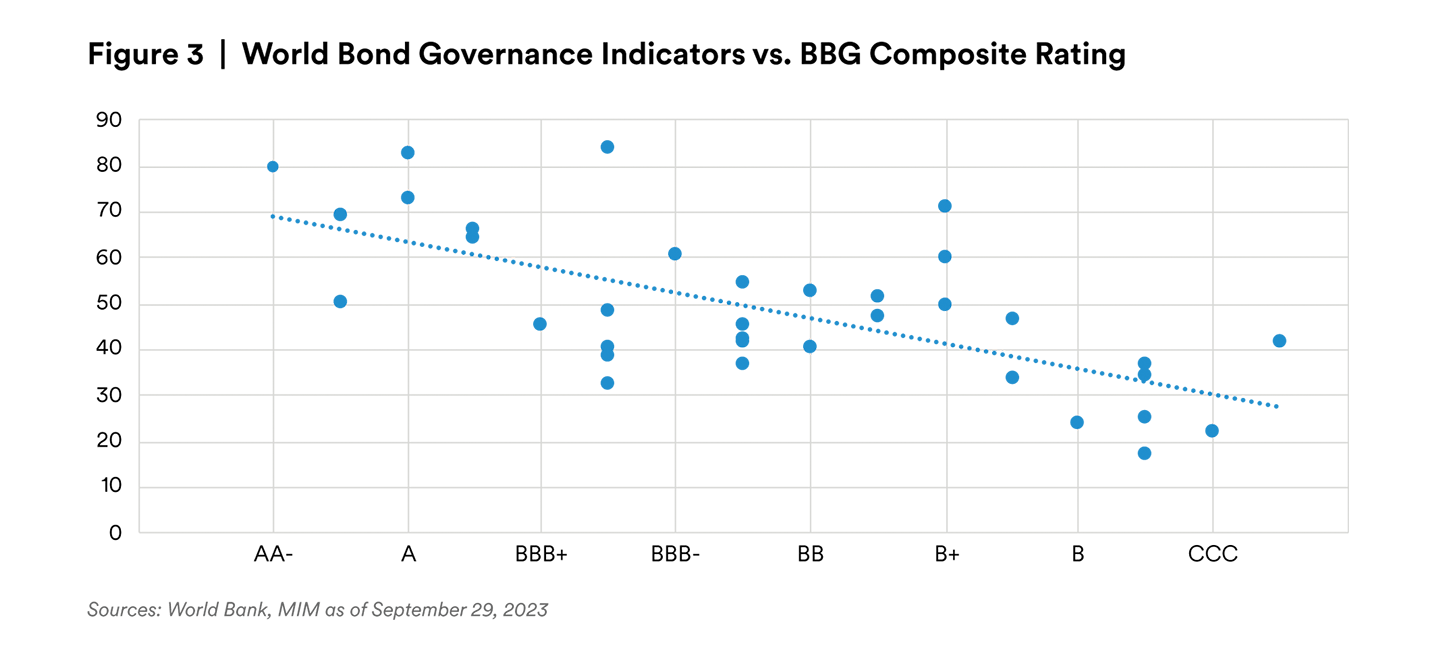

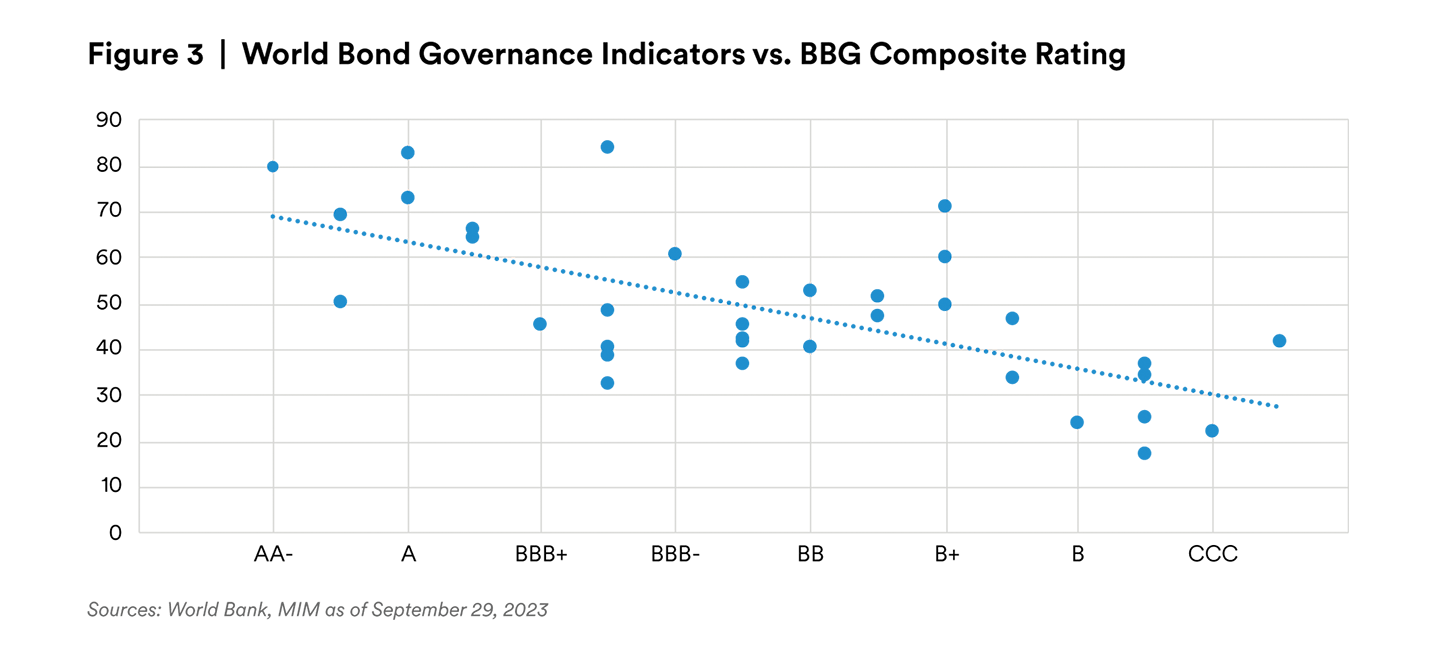

The relationship between sovereign credit quality and governance tends to be very close as attested by the strong correlation between the World Bank´s (WB) governance indicators and sovereign credit ratings. In Figure 3 below, we plotted the average score of the WB Governance Indicators (the highest, the better) and Bloomberg’s composite sovereign ratings of a selected group of 35 EM countries. As expected, there is a very strong correlation as governance indicators have a large weight in sovereign rating models. Governance factors, particularly policy effectiveness and budget management, can influence a sovereign’s capacity to manage a given debt burden.

In sovereign credit analysis we seek to assess how different political scenarios could impact the governance environment. Anticipating the impact of changes in governance on economic conditions help us to better allocate our investments in those countries where governance is strengthening and avoid those where it is deteriorating. Bond prices are highly correlated to governance indicators as illustrated in Figure 4 by the relationship between spreads on dollar sovereign bonds and a country’s average WB governance indicators.

Social Factors

Social Factors

Social factors are harder to assess but have been gaining increasing relevance in the investment process as their impact on economic fundamentals can be significant, which was clear in the COVID pandemic. During that time, MIM designed a Resilience Index to gauge how each EM economy was exposed to the pandemic threat. We classified 60 emerging economies as resilient, cuspy, or troubled (Figure 5). Besides looking at quantitative metrics (e.g., gross national product per capita, human development indicators) and tracking pandemic-related data, we monitored the health and social policies announced by the different governments to gauge how effective their responses to the pandemic could be. As expected, hard currency bonds of resilient countries had the best performance in 2020 (Figure 6), outperforming cuspy countries by almost 70bps on average and troubled countries by almost 1900bps on average.

Cote d’Ivoire

Cote d’Ivoire is a West African country with a population of 28 million people and one of the fastest rates of sustained economic growth in sub-Saharan Africa.6 The country’s economy is heavily dependent on agriculture, and it is a major producer of agricultural export commodities; cocoa alone accounts for some 20% of GDP, and 70-80% of agricultural livelihoods.7 Cote d’Ivoire is less dependent on the energy sector than others in the region, however much of the natural gas which supplies the country’s energy system is sourced domestically.8 9

Cote d’Ivoire published an updated NDC in 2022, with an unconditional target of 30.41% by 2030 vs. business as usual, and a conditional target of 98.95% by 203010. The conditional target is dependent on external financial support to reduce GHG emissions associated with forestry and land management (LULUCF). The external financial support will assist the country’s reforestation and land management programs11. The NDC also highlights the importance of the expected increase in carbon sinks.

The country also has a 2021 – 2025 National Development Plan (NDP)12, with social targets to increase the construction of and access to social housing; improve fundamental health indicator and access to universal medical health coverage; build seven industrial clusters; and increase the completion rate in secondary education by expanding its infrastructure.

In February 2024, Cote d’Ivoire issued its inaugural Sustainability Bond, raising US$1.1 billion to support its broader sustainability goals. The Sustainable Finance Framework13 contains 4 categories (3 social and 1 green) including Access to Basic Infrastructure, Access to Basic Services, Employment and Competitiveness, and Environment and Sustainable Development, with expected allocation of proceeds of this inaugural bond to be allocated to projects and initiatives within the framework’s social categories, supporting the social aspects of the country’s NDP. The bond also contains important provisions on support from multilateral partners on proceeds management, including technical assistance from the Global Centre on Adaptation for the identification of eligible expenditures, and support for impact reporting from UNDP.

Cote d’Ivoire’s sustainability bond is an important step forward for the country to access international capital markets to finance its NDP and NDC commitments and gives investors a unique opportunity to leverage sovereign fixed income portfolios towards achievement of the Sustainable Development Goals and Paris Agreement targets. Another successful example, Chile has been developing its Sustainability-Linked Bond (SLB) Framework since 2020, having issued not only green bonds but also social and sustainable bonds in the domestic and international markets under this framework. The use of proceeds of Chile´s social bonds issued in 2020 and 2021 focused on supporting vulnerable elderly and human rights victims, providing affordable housing, giving access to education, and improving food security, among others. In 2023, Chile updated its SLB framework to account for social sustainability with new social KPIs, such as gender equality (increasing the number of women in corporate boards). Other countries in Latin America have also been developing their SLBs, such as Mexico, Colombia, Brazil, and Uruguay. We expect sustainability-linked bonds to become an increasing share of debt issuance in EM.

Portfolio End State Supported by a more Dynamic Framework

Client expectations and desired impact varies across regions and regulatory environments making a rigid portfolio framework less desirable. Utilizing our approach of integrating 3rd party data, combined with two highly experienced research teams (sustainability and sovereign credit) with a willingness to consider a sovereign’s forward-looking plans and execution confidence allows for a screening process to be more diversified and impactful. We believe this is consistent with the Paris Agreement in that it helps channel capital into the areas which can have the most impact. When we combine analysis of sustainability and ESG factors that impact creditworthiness as well as significant new labelled green bond issuance, we believe we can arrive at a diversified portfolio that delivers superior returns relative to a more discrete less qualitative framework.

Endnotes

1 Nationally Determined Contributions (NDCs) | UNFCCC

2 Global Update - No change to warming as fossil fuel endgame brings focus onto false solutions - Dec 2023 (climateactiontracker.org)

3 https://www.ipcc.ch/report/ar6/wg2/chapter/chapter-9/

4 https://www.wri.org/insights/assessing-progress-ndcs

5 https://unfccc.int/sites/default/files/english_paris_agreement.pdf

6 Côte d’Ivoire - Market Overview (trade.gov)

7 UNSDG | Sustainable cocoa farming in Côte d’Ivoire: UN deputy chief notes significant progress and calls for greater international support

8 https://www.iea.org/countries/cote-divoire

9 https://www.reuters.com/business/energy/eni-begins-oilgas-production-ivory-coast-baleine-field-2023-08-28/

10 https://unfccc.int/NDCREG

11 https://unfccc.int/sites/default/files/NDC/2022-06/CDN_CIV_2022.pdf

12 https://www.gouv.ci/doc/1646221977PLAN-NATIONALDE-DEVELOPPEMENT-PND-2021-2025-DIAGNOSTIQUESTRATEGIQUE-TOME-1.pdf

13 https://www.tresor.gouv.ci/tres/wp-content/uploads/2021/11/Co%CC%82te-dIvoire-Sustainable-Framework-July-2021-vF.pdf

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered 8th Floor, 1 Angel Lane, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined in the UK under the retained EU law version of the Markets in Financial Instruments Directive (2014/65/EU).

For investors in the Middle East:This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.

Social Factors

Social Factors