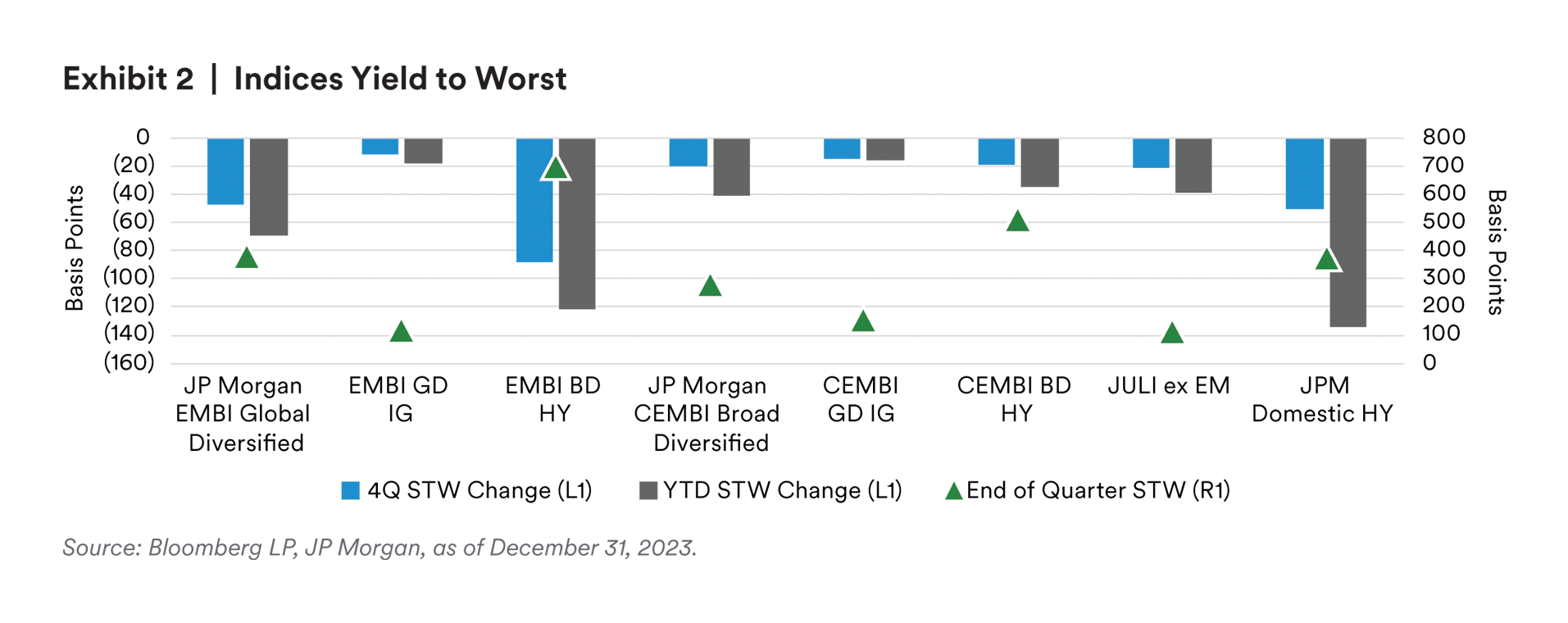

The fourth quarter was indicative of the wild ride investors witnessed in 2023; data released in October kept rates elevated as inflation, payroll, and growth continued to show US economy resilience. Rates continued their march higher, and spreads remained rangebound while total returns suffered. Combined with numerous lingering geopolitical challenges and the conflict in the Middle East, we had plenty to worry about. However, resilient growth, continued encouraging inflation data, a lack of regional contagion from the Middle East conflict and a dovish Fed turned the tide, leading to a massive rally in both global interest rates and spread products. The 10-year US treasury rallied below 4% in rapid fashion, trading below this level for the first time since July, supported by lower inflation and continued confidence in soft landing with the probability of a no landing scenario increasing. The combination of these factors saw a return of investor animal spirits fueling a truly spectacular end-of-quarter absolute return rally from the combination of duration and spreads.

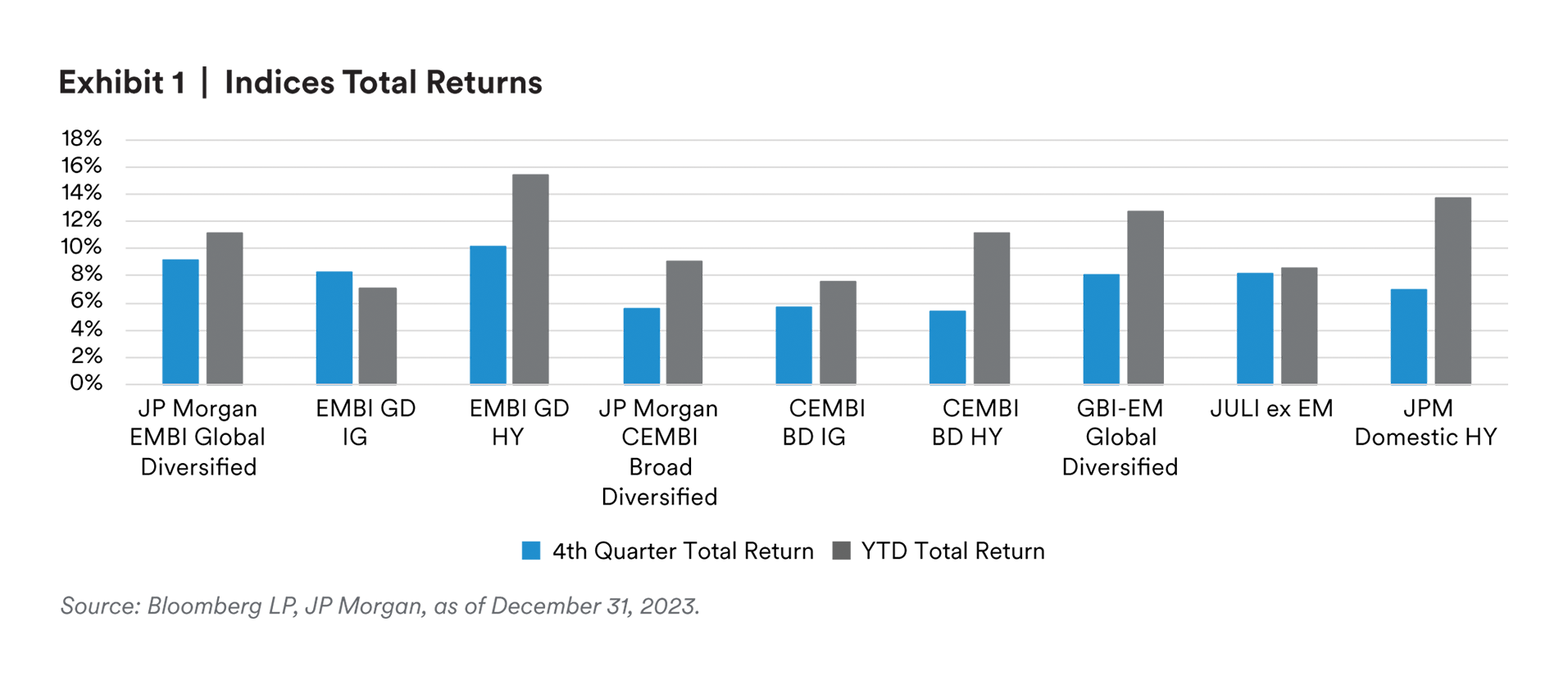

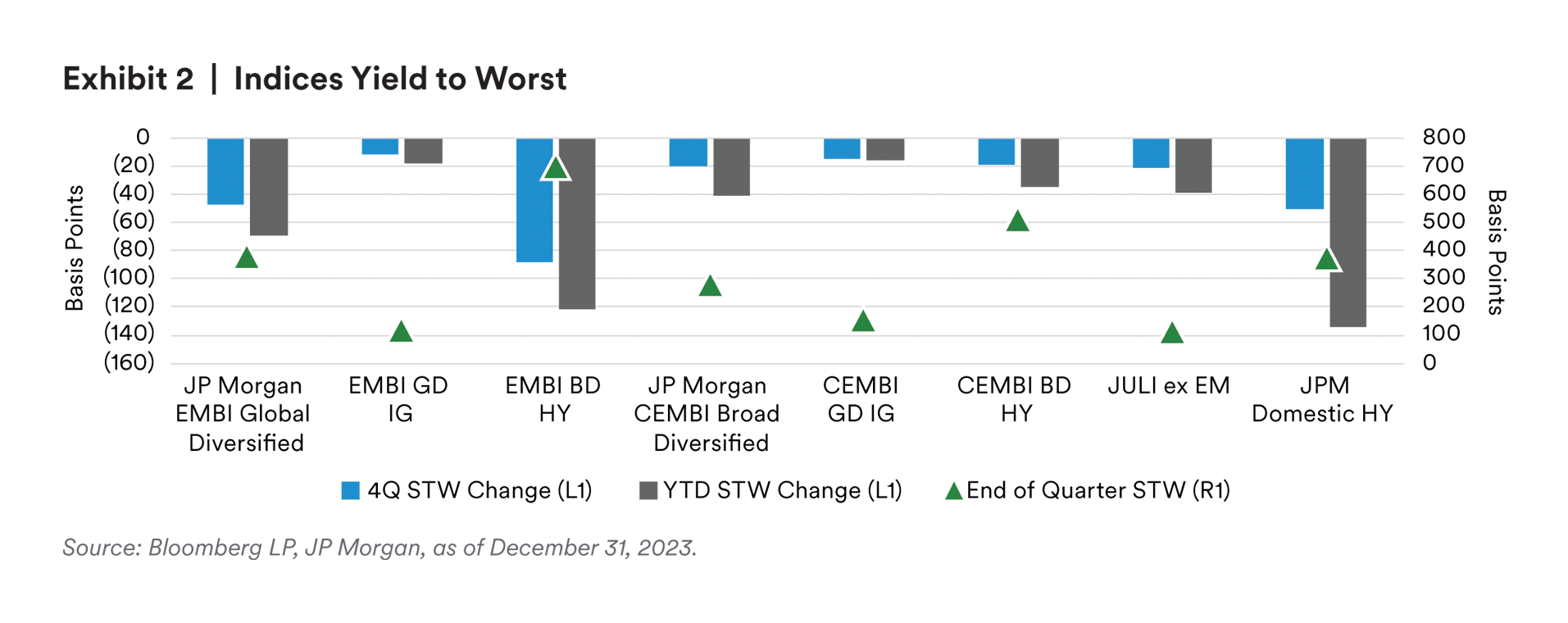

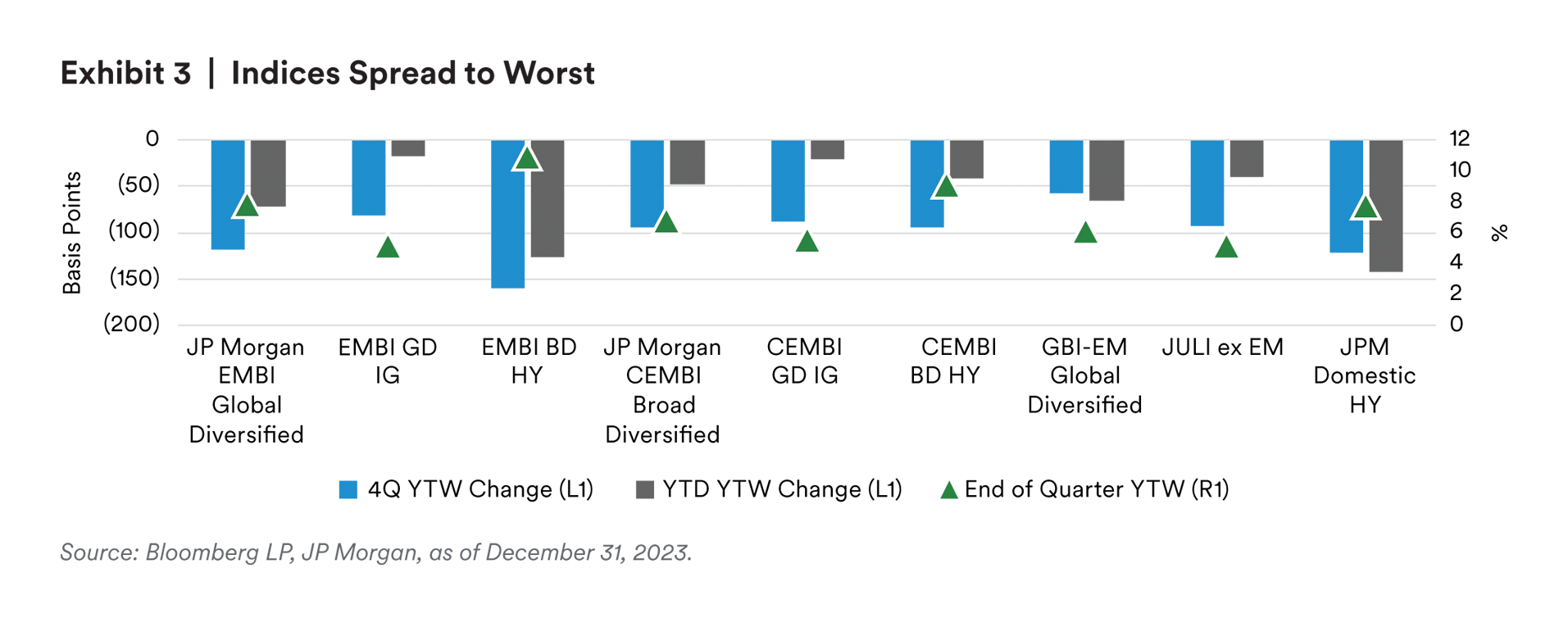

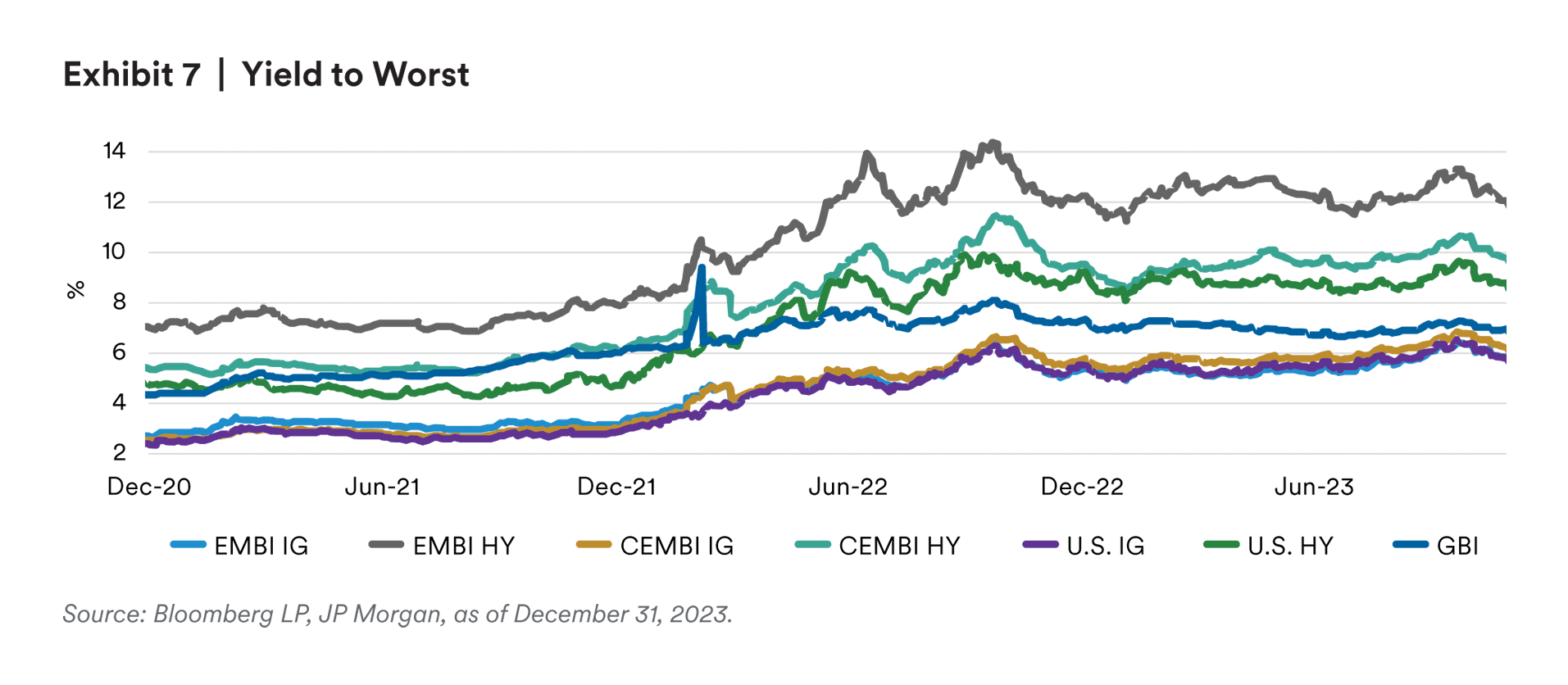

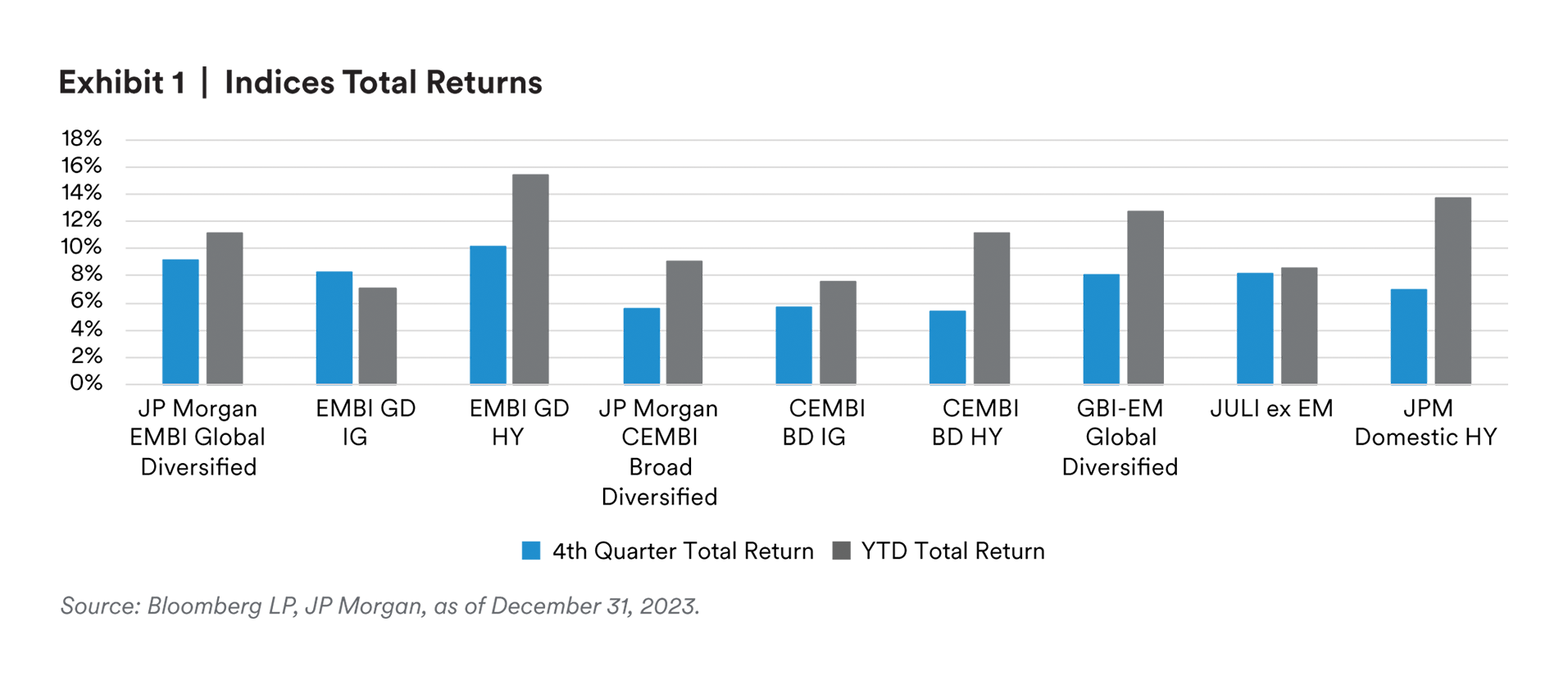

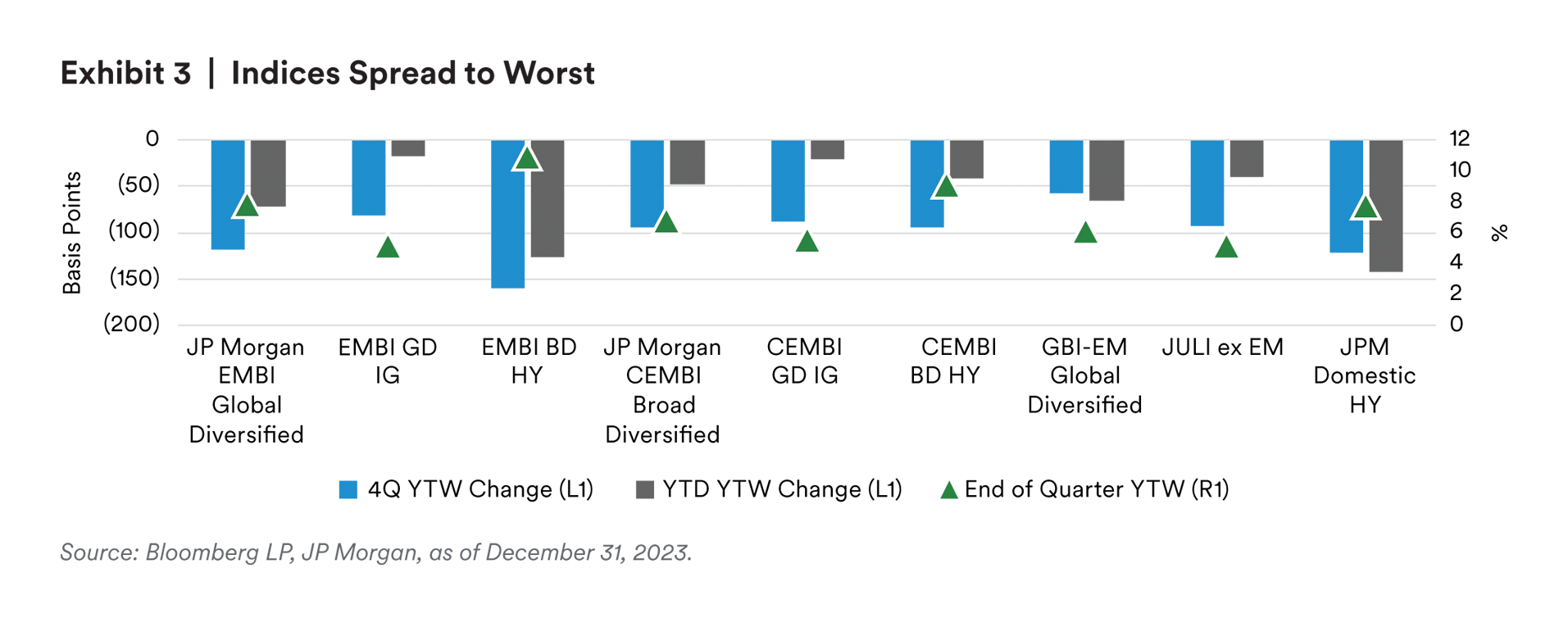

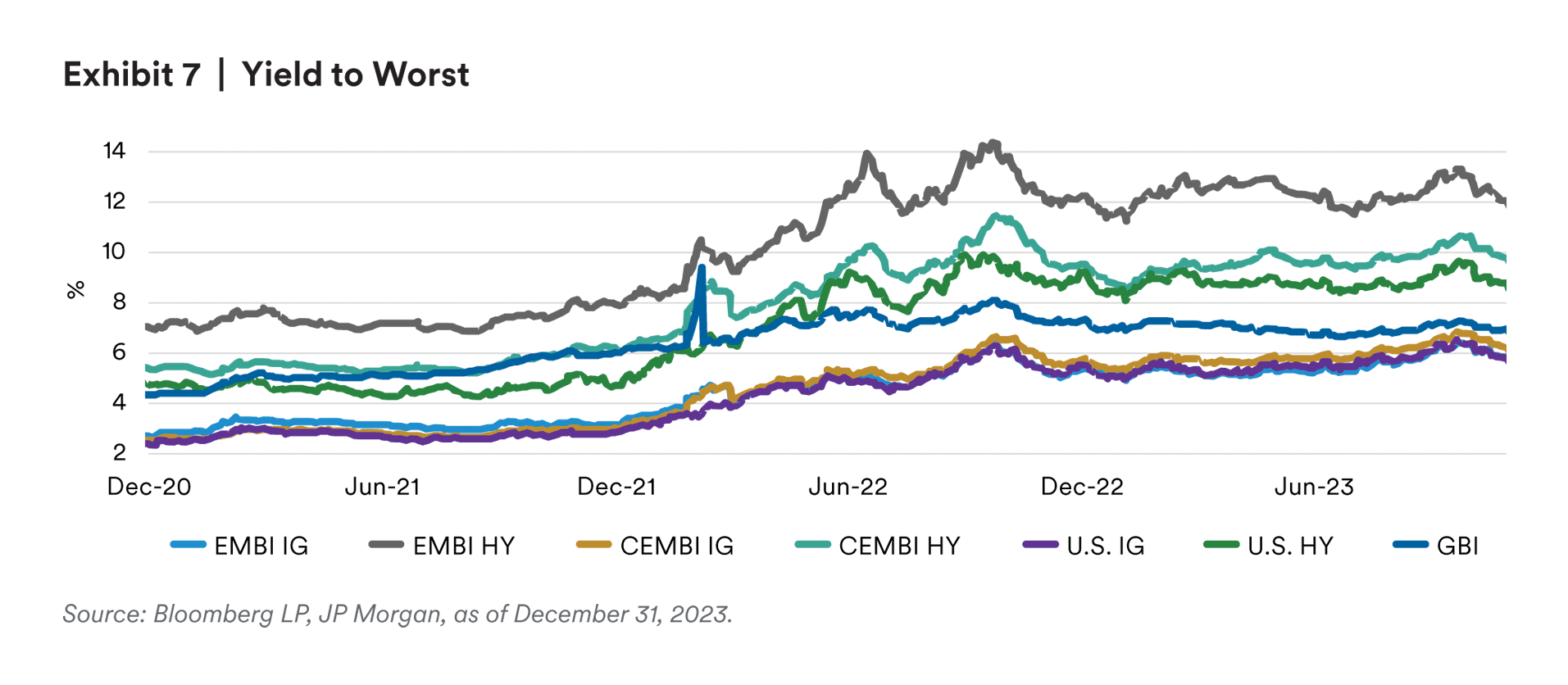

The firmer tone sparked optimism into the markets, and investors once again began the hunt for yield. Assets across the board rallied. High yield spreads outperformed, investors looked for duration, and even longer duration EM risk was able to tighten into a 100-basis point move in US rates. This supported EM’s outperformance relative to US High Yield (HY) given the asset class’s higher rate sensitivity. Largely driven by Q4 strength, the EM HY sovereign and corporate indices recorded double digit returns for full year 2023 as risk appetite was largely supportive and lingering geopolitical concerns were set aside. EM local assets were the best performing segment of the EM universe during the year, driven by a considerably weaker dollar and the proactive responses by EM countries’ central banks. Additionally, the outlook for lower US rates into year-end further supported investor risk sentiment for local currency assets3.

China’s economic woes carry on as Beijing’s talks of support for the property sector have yet to materialize and prove effective in boosting investor sentiment and the lethargic economy. The announcement of awhite list and rumors that we may have seen the worst of the default cycle helped around the edges, but the proof is in the pudding and the market has little patience.

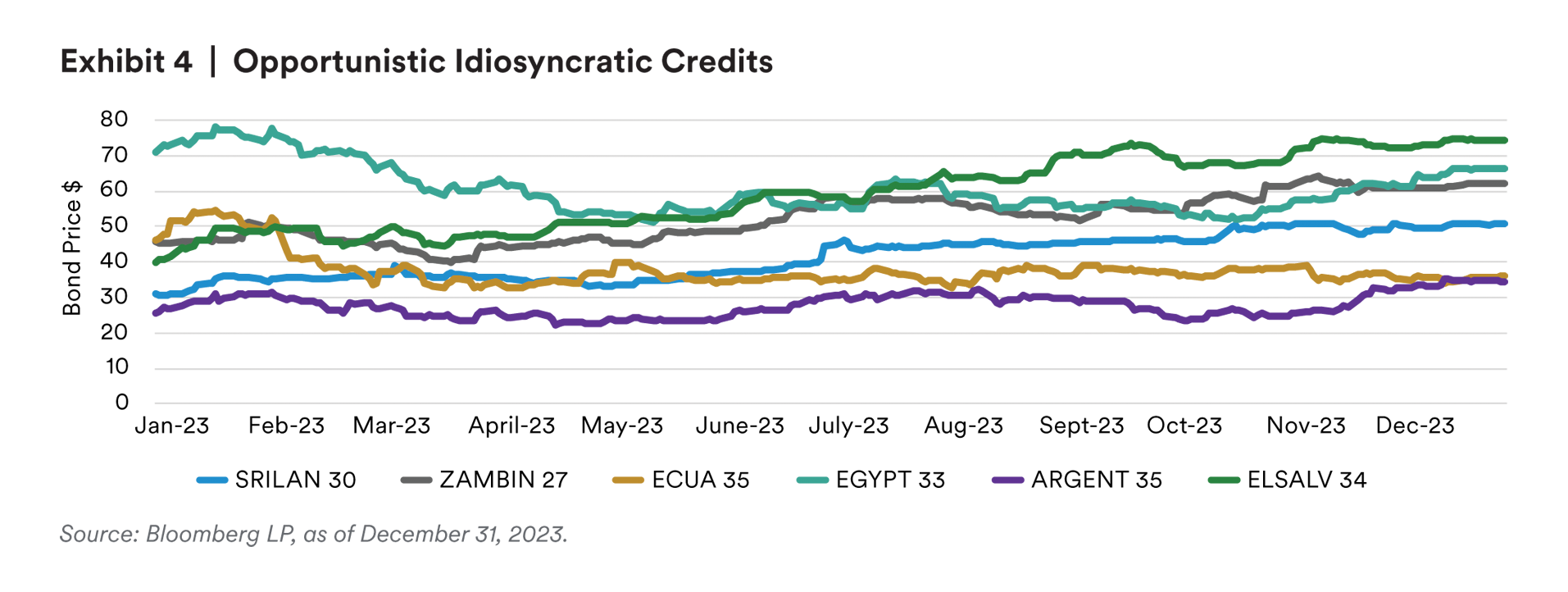

The fourth quarter kicked off a busy 12 months of upcoming elections around the globe. In Argentina, outsider candidate Javier Milei won the presidential election by a larger margin than expected. Investors are optimistic about the new regime, but there are still significant questions about governability and the ability to establish change. His pro-foreign direct investment (FDI) platform caused dollar bonds to rally into year-end with locals buying these assets to get money out of pesos. Sure enough, the economic minster announced a 50% devaluation of the currency. With Egypt in the midst of its worst economic situation in decades and a likelihood of another currency devaluation, Egyptians held their three-day election in December, with Abdel-Fattah El-Sisi winning a third term. El-Sisi should have a bit more latitudeto start working towards the delayed reforms required under the IMF EFF program, including moving to a more flexible exchange rate regime. In Chile, the government unsuccessfully attempted to rewrite the constitution for a second time. While the majority of Chileans are in favor of replacing the current constitution, new language was not able to be moderated enough under Boric’s government. Therefore, the current market-friendly rules will likely remain intact for the duration of Boric’s administration into 2026.

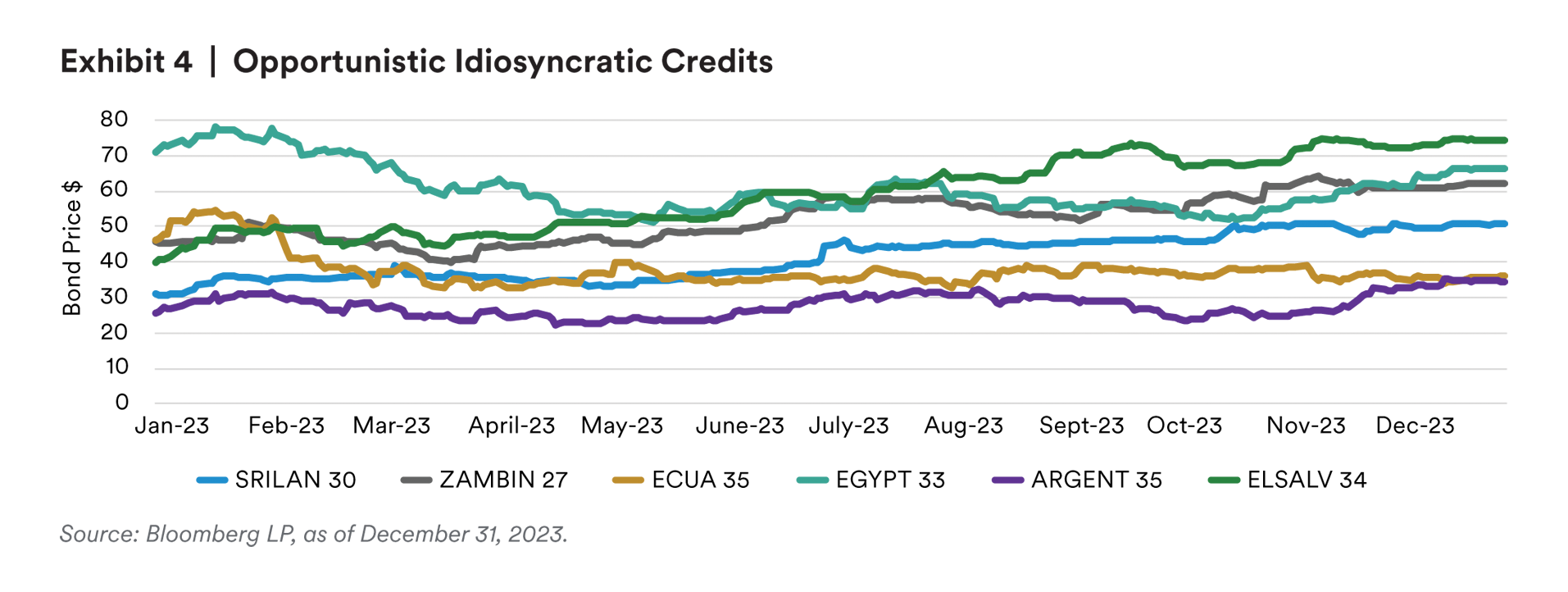

Recovery stories across high beta countries continue to drive high yield sovereign outperformance. On the restructuring side, Suriname was the first country to complete its restructuring. While all on separate paths down the road to restructuring, Sri Lanka, Zambia, and Ghana all continue to make positive progress, and we remain hopeful for the outcomes around these countries. Other higher beta countries including Pakistan, Egypt, Tunisia, Nigeria, Argentina, Turkey, and El Salvador have recently witnessed improved funding outlooks; the IMF has remained supportive, near-term financing concerns have largely mitigated, and bond prices have staged a strong rally. Alternatively, Ecuador has been on a deteriorating trajectory as the public security crisis has worsened. The risks to government stability and fiscal/liquidity issues if the situation persists have put downward pressure on bonds and dampened investor sentiment. Panama’s weakening fundamentals and persistent fiscal pressures have only gotten worse with a lack of rainfall impacting revenue coming from the Panama Canal and the decision to close the First Quantum copper mine weighing heavily on the outlook for economic performance going into a spring election.

A wave of idiosyncratic stories unfolded across corporate issuers during the quarter as investors fundamental opinions continued to be challenged by headlines. The Middle East conflict that escalated in October put a focus on oil & gas companies in the region, with offshore assets underperforming significantly early in the quarter only to claw some of that performance back as we moved closer to year end. A metals & mining company with operations in Panama and Zambia is the target of significant Panamanian public demonstrations despite recently signing a new contract with the government. Given the public pressure, the government reversed course and chose to close the mine, effectively leaving any further decisions to the next government. A Brazilian chemical company underperformed on the evolving environmental situation at their closed salt mines and the unknown financial liability associated with a potential sinkhole forming.

Oil had a volatile but overall weak quarter. After ending September near one-year highs, global demand concerns and mixed data out of China continued to outweigh headlines. The conflict in the Middle East temporarily elevated oil prices given the potential for decreased supply from the region before prices receded once again. Even OPEC+’s surprise oil supply cut was not able to support prices, with the cuts being deemed voluntary and therefore may be more promising on paper than what is achieved. In December, Brent dipped below $75/barrel intra-month before witnessing a slight rebound as tensions remained high over shipping disruptions in the Red Sea following attacks against vessels in the waterway. Yet headlines wereonce again overpowered by 2024 demand concerns, with Brent ending the year at $77/barrel4.

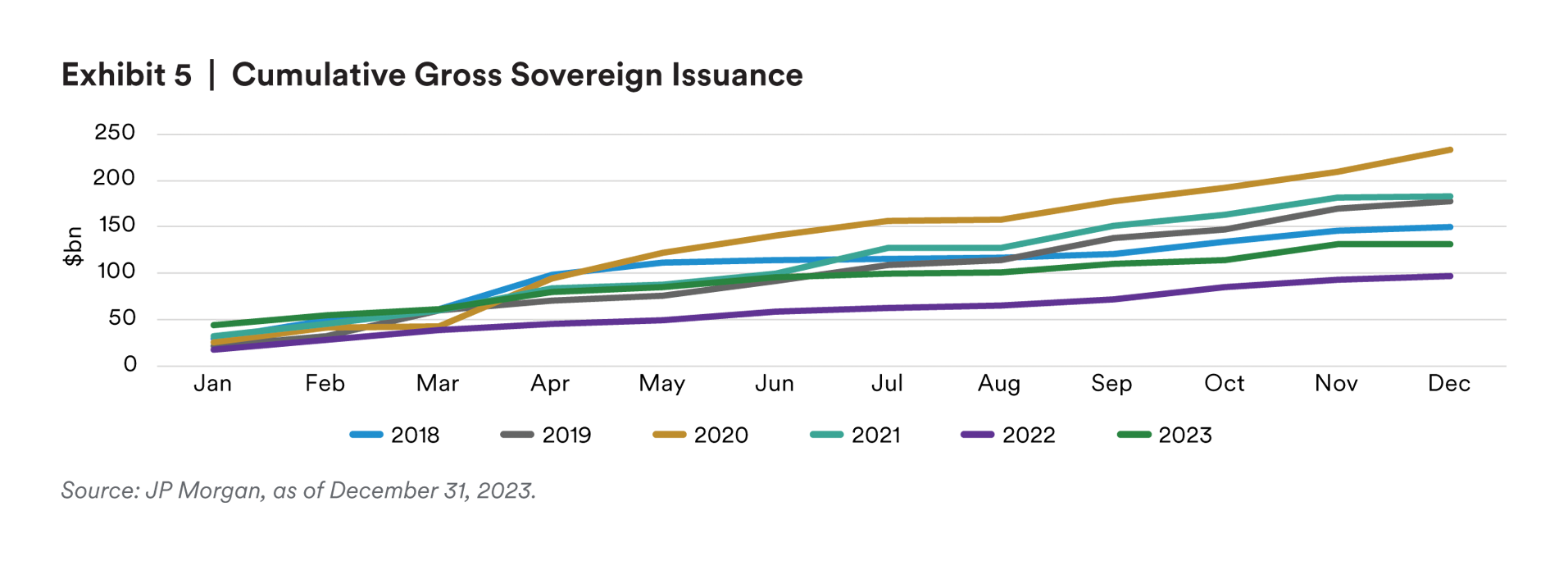

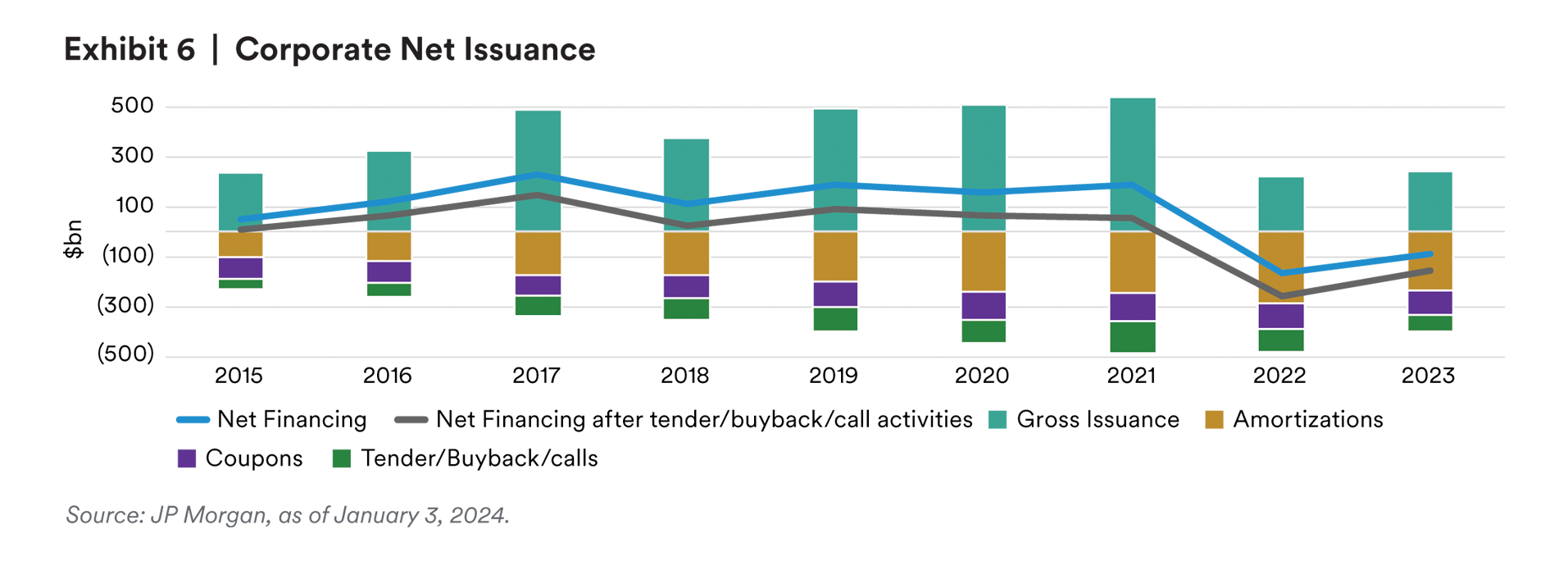

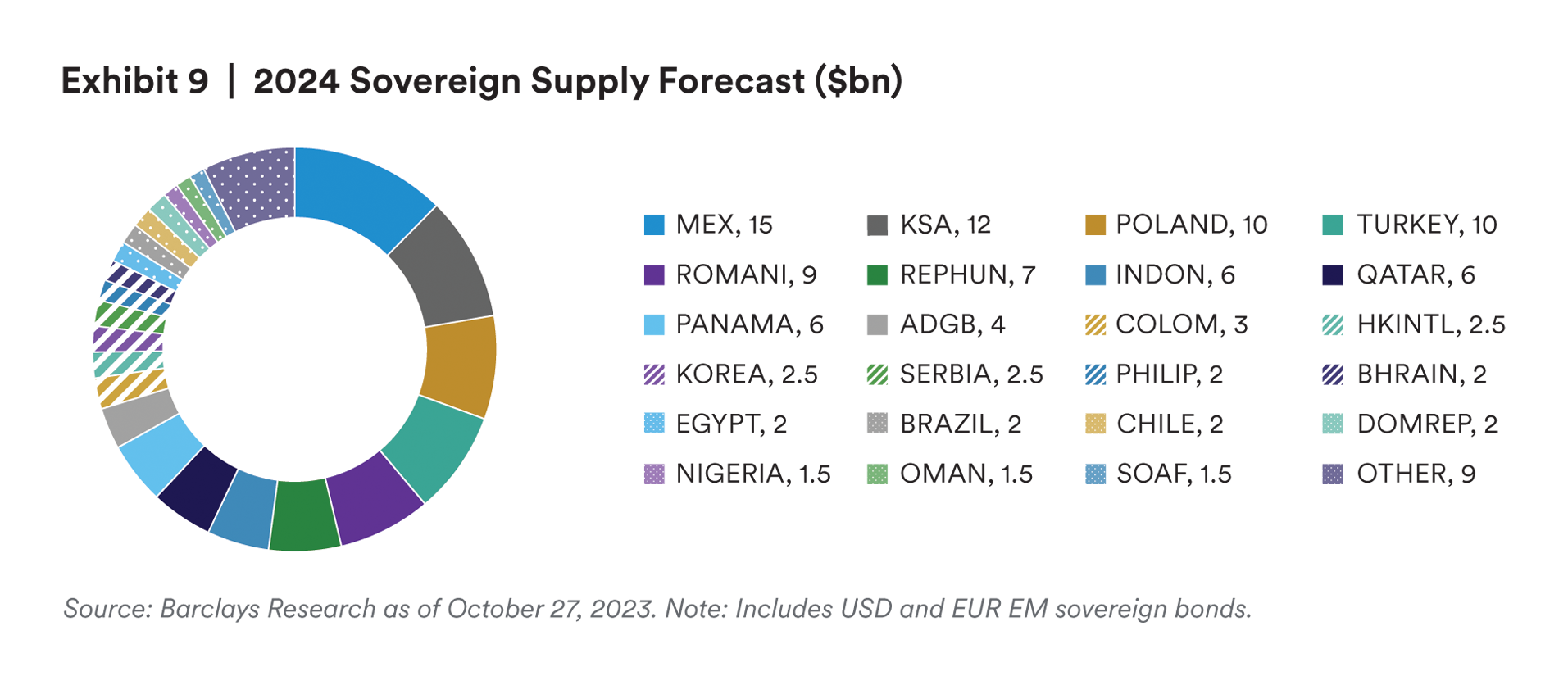

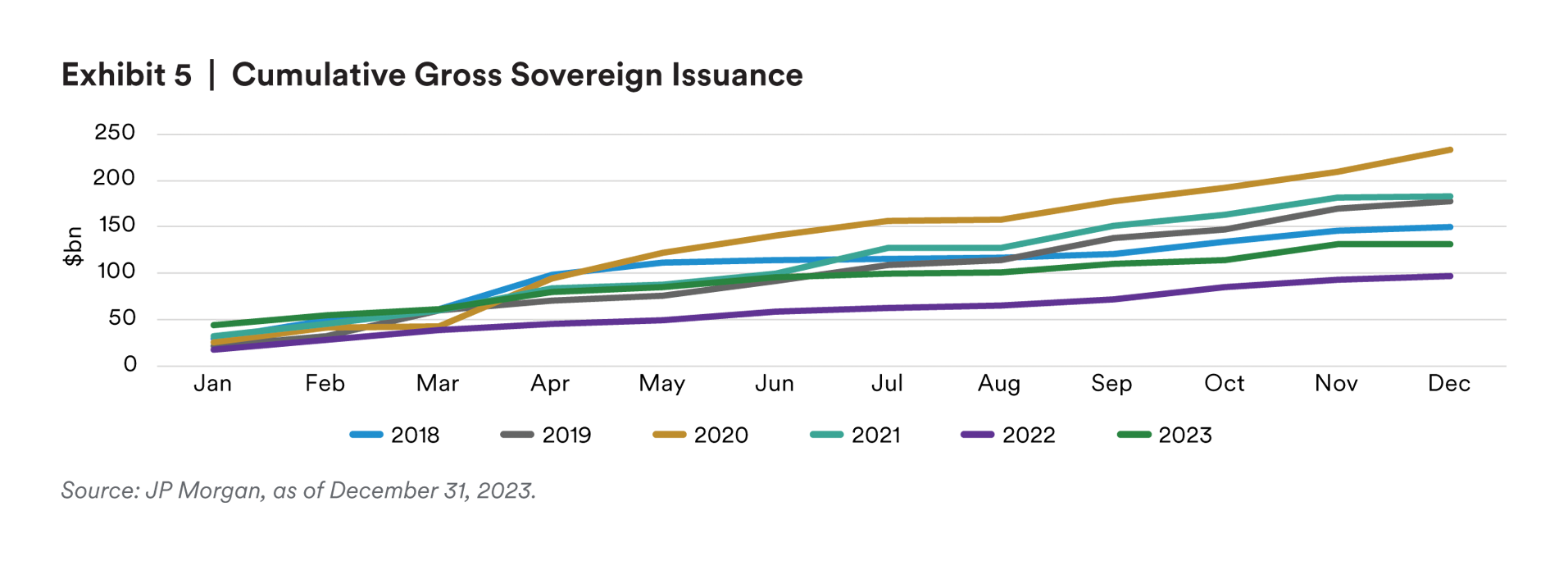

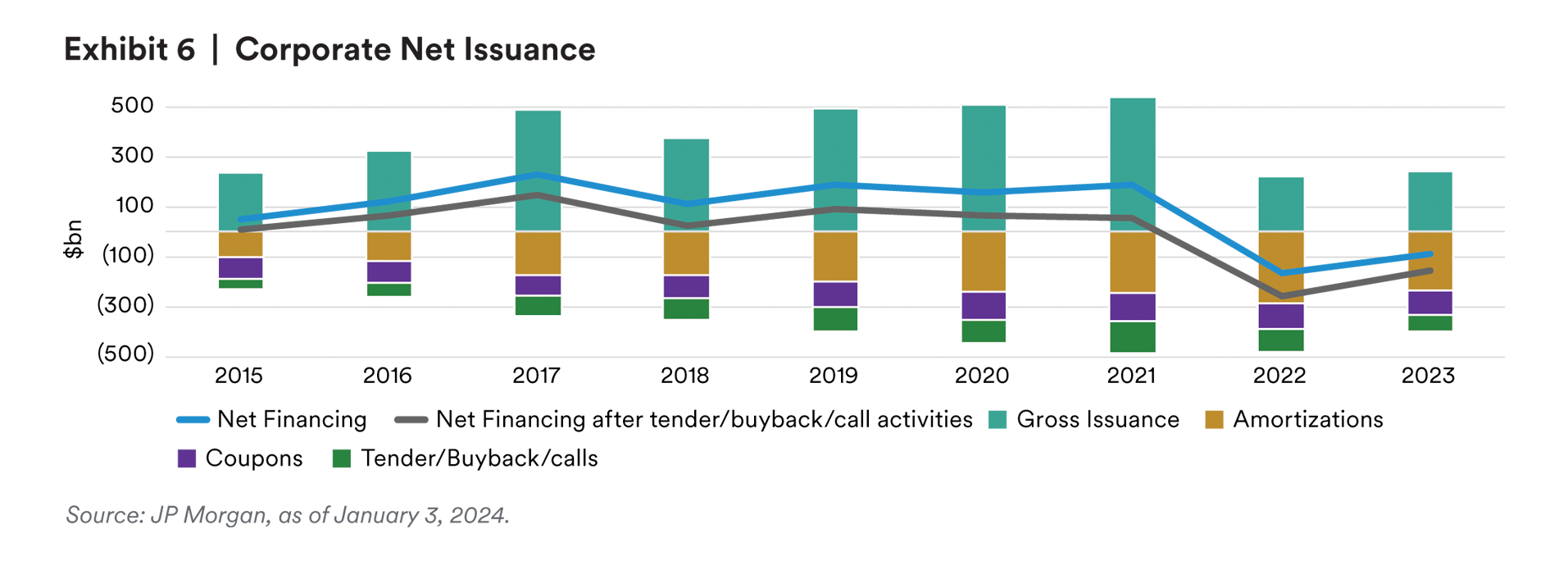

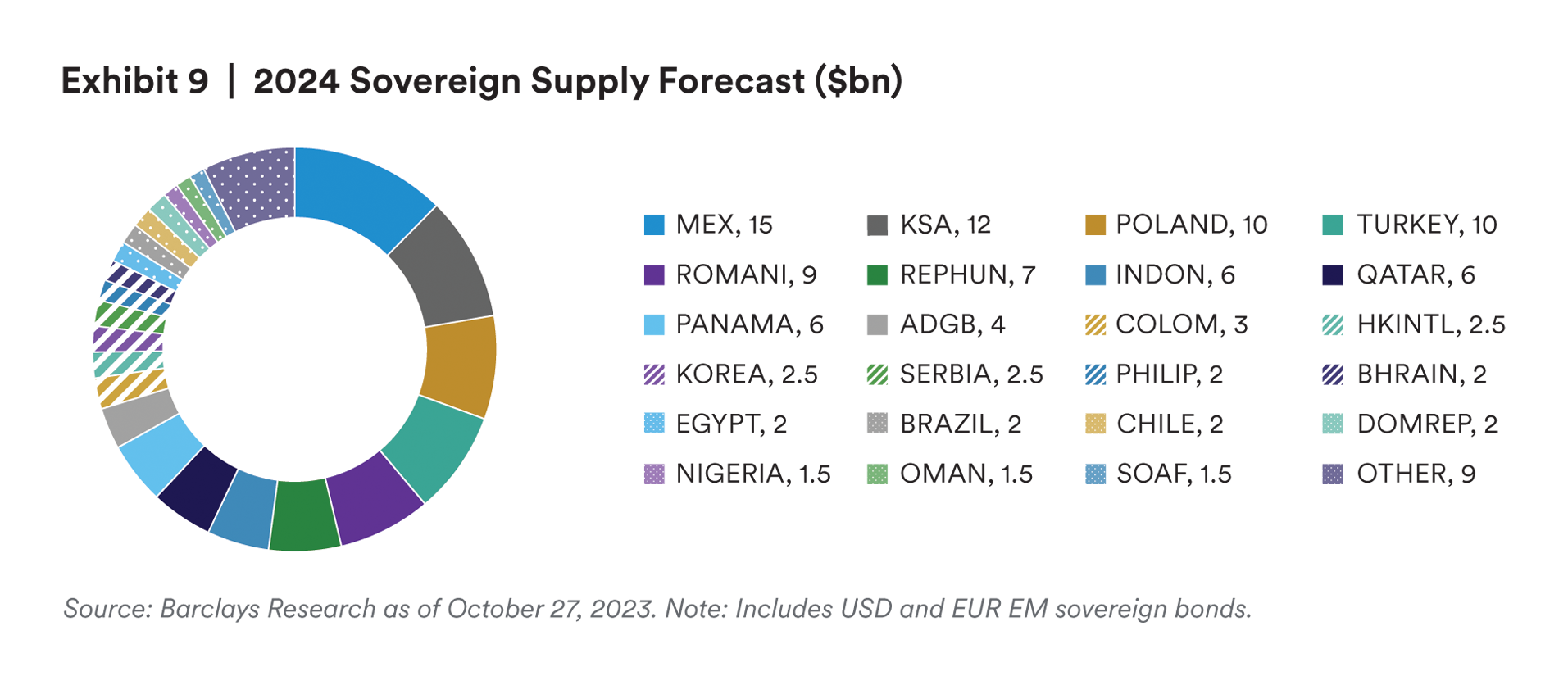

While gross and net supply was underwhelming in 2023, it provided a supportive tailwind to the asset class in the face of outflows. Given the year-end rally in US rates, the market expected pre-funding of issuers that did not materialize. Elevated cash balances coupled with a firmer market tone forced investors to deploy capital in the secondary market. 2023 EM corporate primary market activity of $245 billion was up 11% year-over-year, but represents only 10% of bonds outstanding versus the historical range of 20-30%. Net financing was once again negative for the year (-$157 billion), with higher than expected redemption activity as issuers were able to find alternative sources of funding from local markets and banks. Sovereign issuance increased in November, but otherwise remained largely quiet during the quarter. $21 billion of new deals in Q4 brought year-to-date issuance to $132 billion, largely concentrated in IG issuers willing to absorb higher borrowing costs. Even in the face of ETF outflows, institutional flows were able to remain constructive given all-in yields5.

Outlook

We enter 2024 with a similar sentiment to one year ago- cautiously optimistic but with a greater desire to add risk into spread weakness. As the path of US interest rates has become marginally clearer and remains a large driver of performance and sentiment, we have adjusted positioning accordingly to capture higher beta opportunities in the market. We continue looking for a combination of US inflation slowing and a consistent rebound in China’s economy. Nonetheless, monitoring global growth, inflation, and geopolitical tensions remain critical as the main drivers of EM outlook.

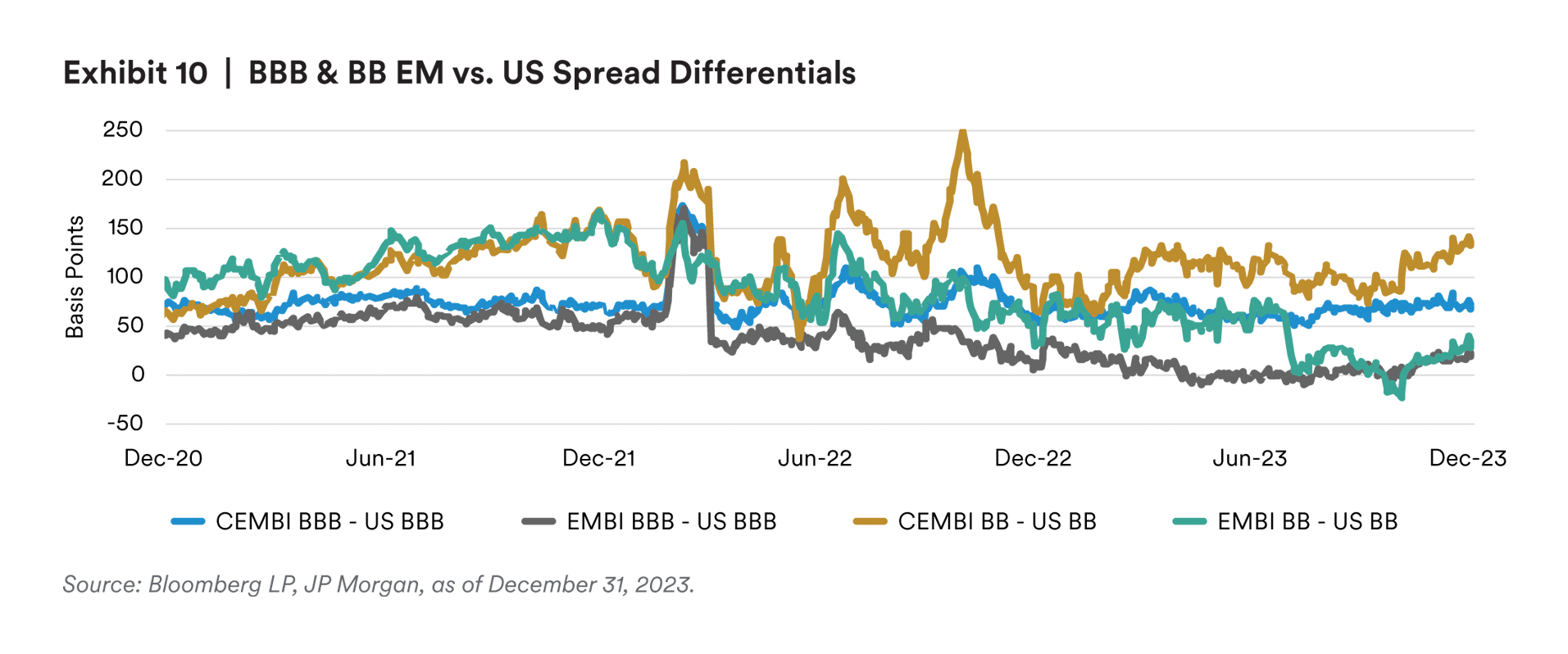

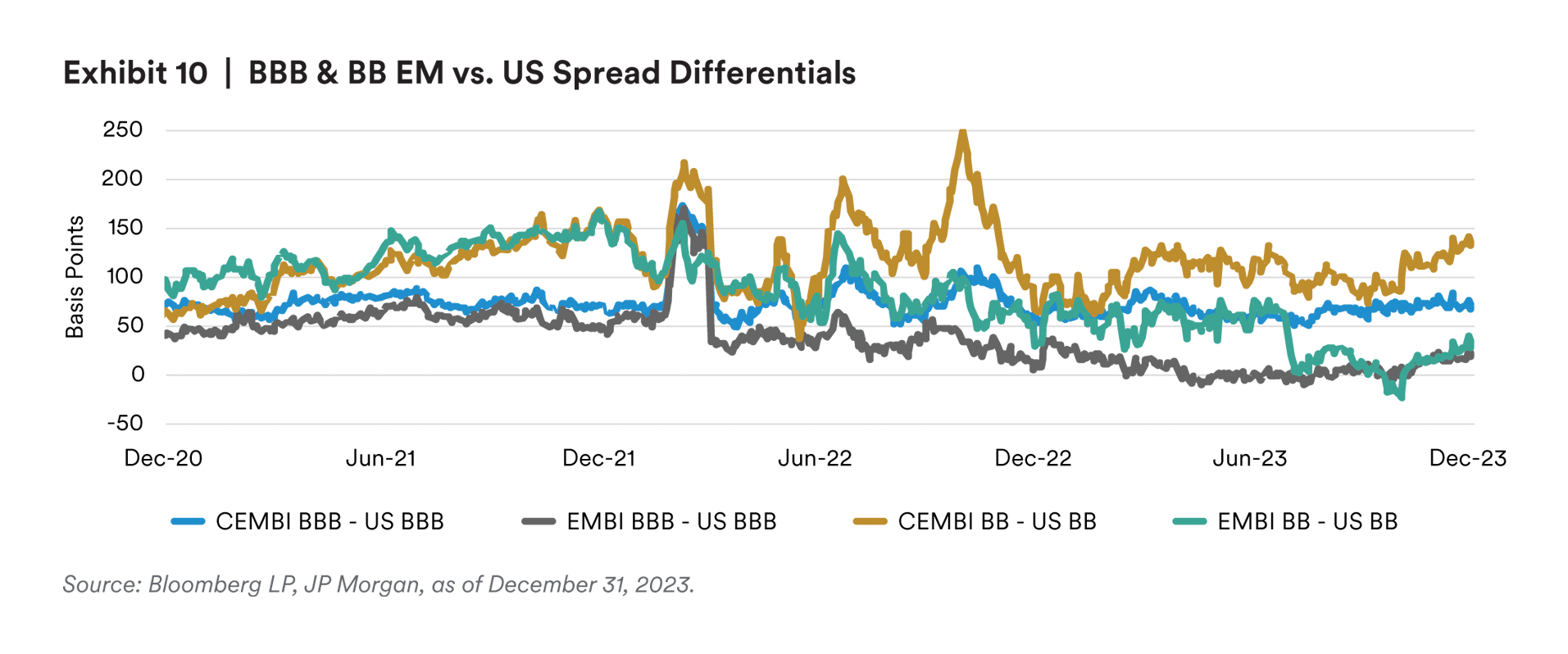

Despite spreads looking fair on an index basis, we see EM opportunities for differentiation at both the sovereign and corporate levels which could lead to a better flow picture in 2024. Issuance continues to be subdued, principal and interest payments remain high, and non-dedicated investors have low exposure to the asset class, leaving room for future demand and positive price reaction. Despite issuance remaining below historical levels, higher quality issuers have been able to access the market during periods of strength, offering attractive new issue premiums relative to secondary levels. Importantly, with the belief that the hiking cycle is over, EM provides investors the ability to gain exposure to the combination of both yield and duration outside of Developed Markets (DM) in a world where rates are falling. This allows for interest rate exposure closer to the investment grade market while receiving income closer to the high yield opportunity set.

EM debt metrics are only expected to deteriorate modestly in 2024 as nominal GDP growth should not slow too much and sovereigns continue to navigate through the higher interest rate environment. China growth remains a major driver of EM economies and will remain in the spotlight given recent soft data. With that being said, we do expect to see some type of additional marginal support/stimulus to help spark the economy. We feel that Beijing has a vested interest in keeping stability at these lower and more realistic growth levels. We believe this support will create selective opportunities in the space as credit differentiation becomes more important.

2024 is a record year for worldwide elections, with over 4 billion people across 60 countries headed to the polls to vote for regional, legislative, and national leaders6. We believe Taiwan’s presidential electionin January will help set the stage for the country’s future relations with China, with candidates having divergent views. El Salvador’s election in February has President Bukele showing a strong likelihood ofre-election as the opposition is unlikely to pose a candidate strong enough to challenge the incumbent. Indonesia’s presidential election should largely be a non-event; however, for some state-owned corporates, increasingly important policy roles to align with the country’s longer-term strategy may lead to higher funding needs. Ukraine’s scheduled election is currently prohibited under martial law; Zelensky is balancing public opposition to holding elections with external pressure as he decides if martial law will be overturned. Later in the year South Africa, Panama, Dominican Republic, Mexico, and Romania are on the docket.

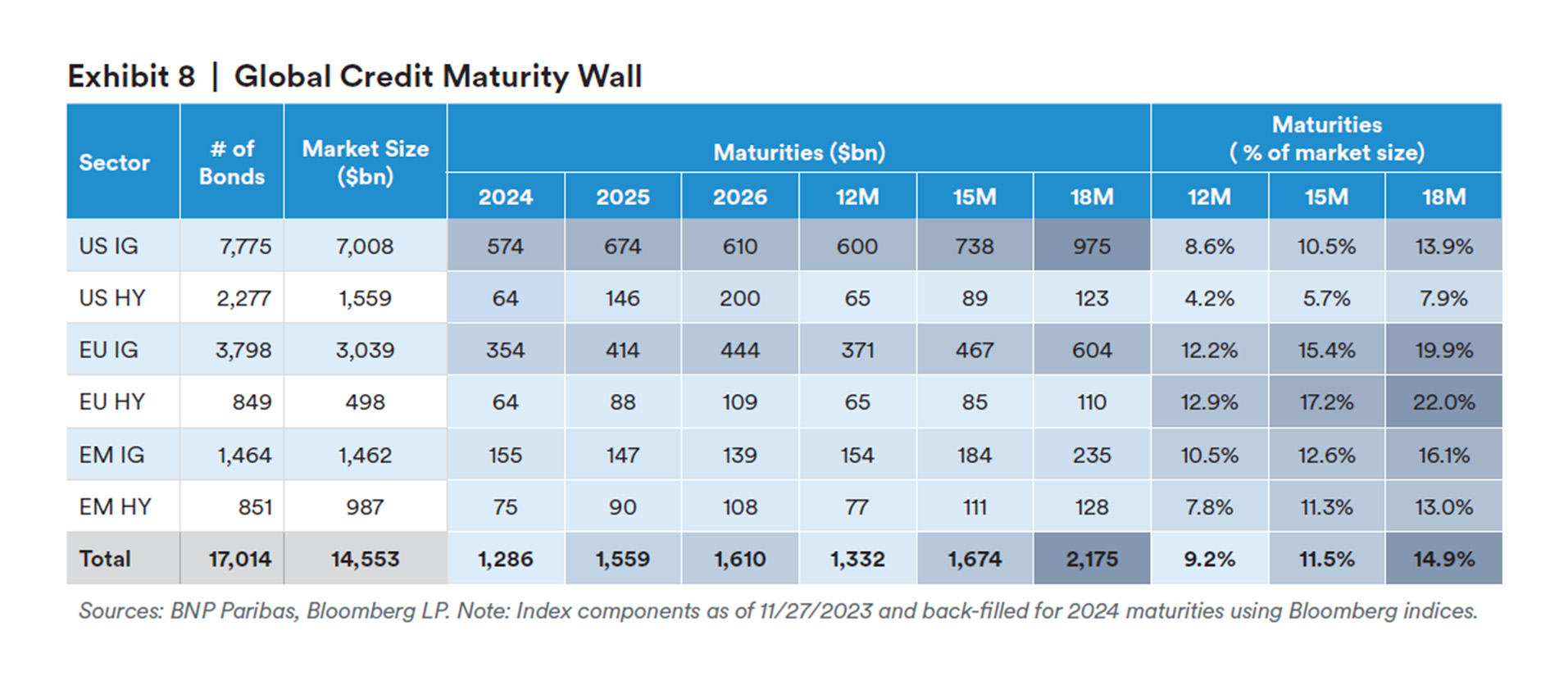

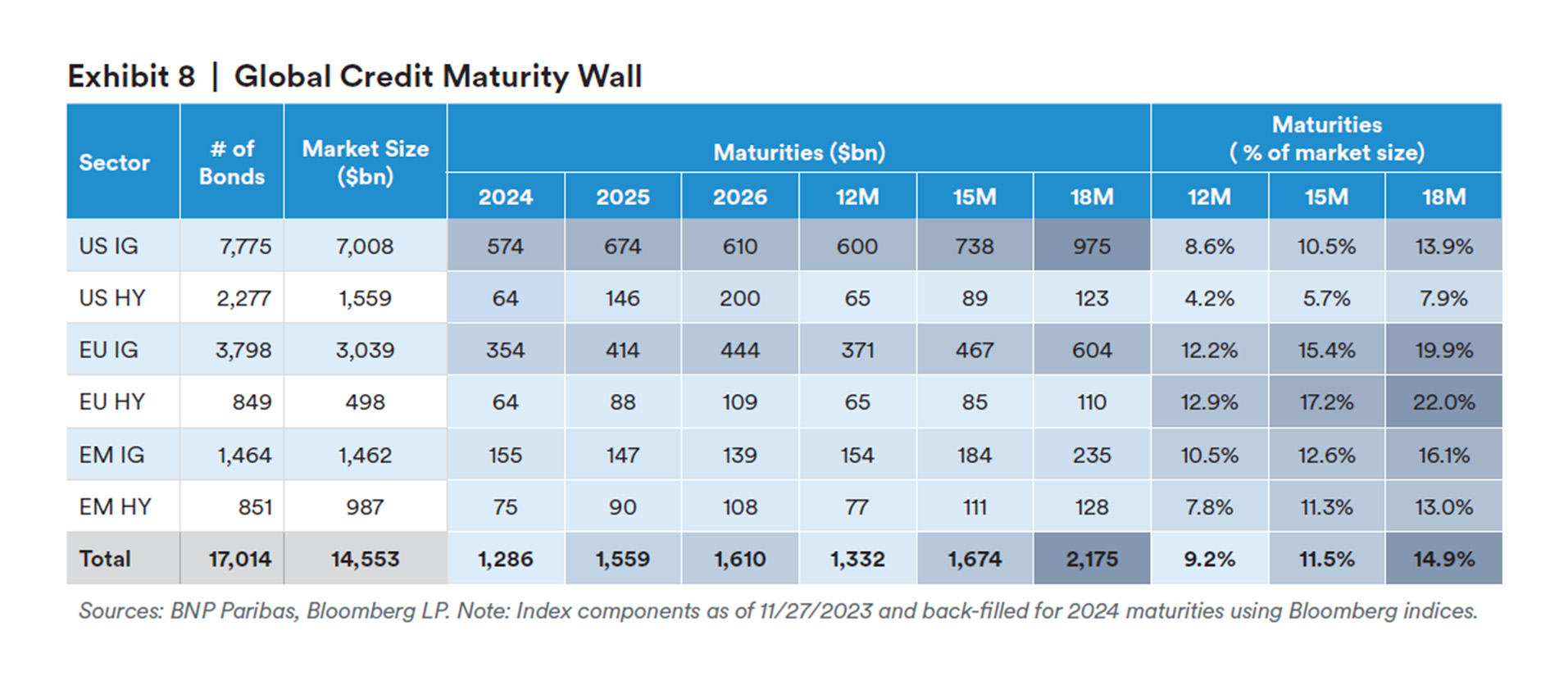

While projections for gross supply next year are relatively flat, high cash flows from the asset class will likely lead to negative net issuance. With attractive interest differentials and increased demand, expect more countries and companies to focus on local market issuance where they can. We believe that corporates have done a particularly good job improving maturity profiles so management teams can bepatient. Despite seeing an increase in the HY sovereign maturity wall, countries will have more access to multi-lateral support and other sources of funding which, in our view, will support risk sentiment.

In the sovereign space, recent market firmness and clarity on Fed actions have us more comfortable adding back some higher beta risk to idiosyncratic, undervalued opportunities. Given the rally into yearendand current valuations, we like stronger high yield credits including low-BB sovereigns in the 10-year part of the curve. Our preference is for countries who face low financing needs or have demonstrated ability to tap the market. The primary market has been a place where we look to opportunistically add exposure, notably within higher quality issuers where existing bonds trade fair. This supply allows us totake advantage of new issue concessions, and we expect issuance early in the year to give us the ability to extend into steeper credit curves.

We see opportunities in BB and BBB corporates, in sectors that generate hard currency revenues or have effective FX liability management. In the utility space, we see value in assets with consistent cashflows that have strong structures. We also like the telecom space where issuers have strong liquidity runways and sponsors with the ability to support the business as needed. Infrastructure projects in the Middle East are enticing, where we can get a pickup of ~100bps over comparable DM credits. We like convexity and dollar price protection where we can get it. Another area of opportunity is within companies that have already priced in weaker ratings and credit metrics, therefore providing better entry points to new investors.

As inflation levels show signs of coming down across the globe, we believe that EM countries’ decisions to proactively raise rates in 2021 will continue to be supportive. EM countries should benefit from elevated premiums for local currencies that look attractive relative to DM. Reduced rates and subsequent reduced volatility would be supportive of local risk assets. A bit of repricing out of the Fed could open up opportunities, and we continue to prefer higher real yield countries.

Endnotes

1 Bloomberg LP

2 JP Morgan

3 Data in this paragraph sourced from JP Morgan

4 Data in this paragraph sourced from Bloomberg LP

5 Data in this paragraph sourced from JP Morgan

6 Business Today

Information has been obtained from sources believed to be reliable but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan prior written approval. Copyright 2024, J.P. Morgan Chase $ Co.

All rights reserved.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or MiddleEast or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.