The Transmission Mechanisms of Higher Rates

Commercial mortgages are at the intersection of evolving capital market conditions, shifting real estate fundamentals and complex regulatory landscapes. Today’s investment conditions in the commercial mortgage sector are unique, both historically and compared to other institutional asset classes.

Three factors in particular that are driving performance include:

- The rise in interest rates that began in the spring of 2022 caused property values to decline. Although we believe property values (office excluded) are near or past the trough, the valuation reset has caused many real estate investors to need more capital (in many cases a second subordinate mortgage) at maturity.

- The rise in rates has contributed to stress in the banking sector, especially among regional banks. Regulators have been increasing capital requirements and oversight1. This, as well as working through existing distressed loans, has resulted in a sharp pullback in commercial mortgage lending by banks. Banks have historically been an important source of capital for medium and high-risk loans, while other lenders such as commercial mortgage-backed securities (CMBS) and insurance companies have historically focused more on lower-risk financing2. Future regulatory shifts like the implementation of the Basel III Endgame may further weigh on the ability of banks to originate commercial mortgages. In the meantime, debt funds have been partially, but not completely, filling in the gap for high-risk mortgages.

- Since 2020, the surge in remote work has posed challenges for the office sector. While other sectors are stable, the strain from the office sector has led to an increase in risk premiums across the entire commercial real estate landscape. Lenders have bolstered their capital reserves as a defensive strategy to safeguard their portfolios against these pressures. This has reduced liquidity in the market and has caused spreads across the mortgage risk spectrum to widen.

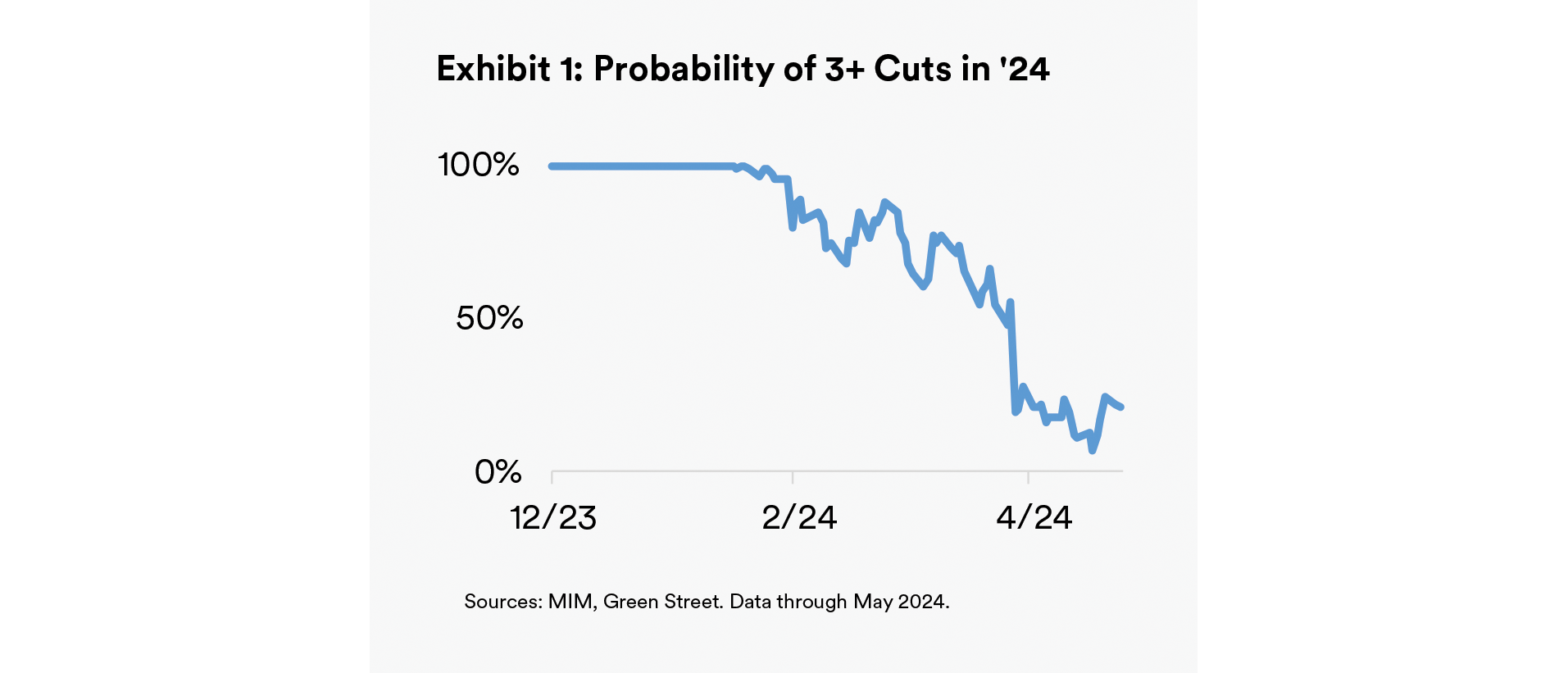

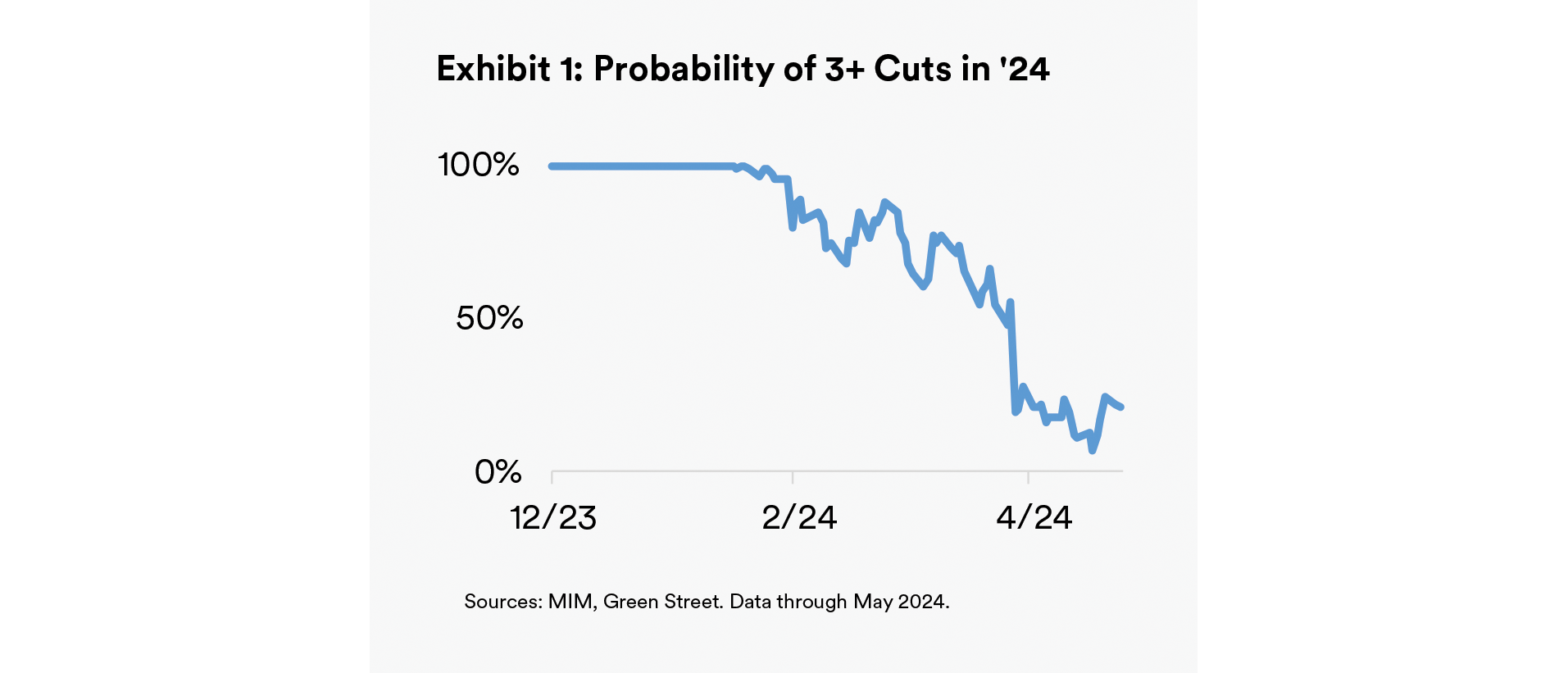

As we look forward to the next several years, we only expect a gradual recovery in real estate capital market conditions as inflation and interest rates normalize. During most of 2023, the Fed Futures Market was pricing 150 to 200 basis points (bps) of rate cuts by the end of 2024, and real estate investors were often delaying financing decisions in the hopes of lower rates. More recently, stickier-than-expected inflation and robust economic growth has reduced expectations to just 25 to 50 bps.

Many market participants have seemingly accepted the new outlook on rates, evidenced by gradually improving real estate transaction volume in recent months.

A Whole New World (for Debt…)

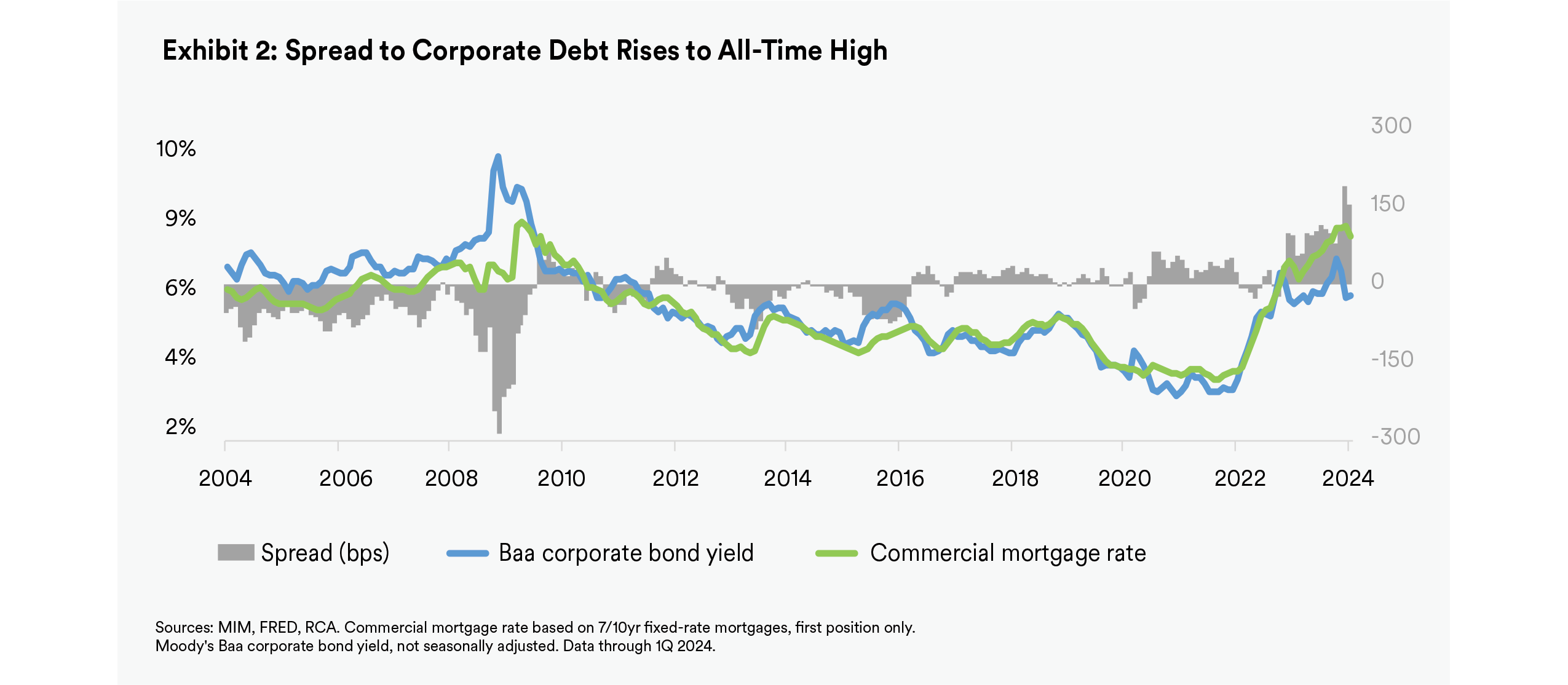

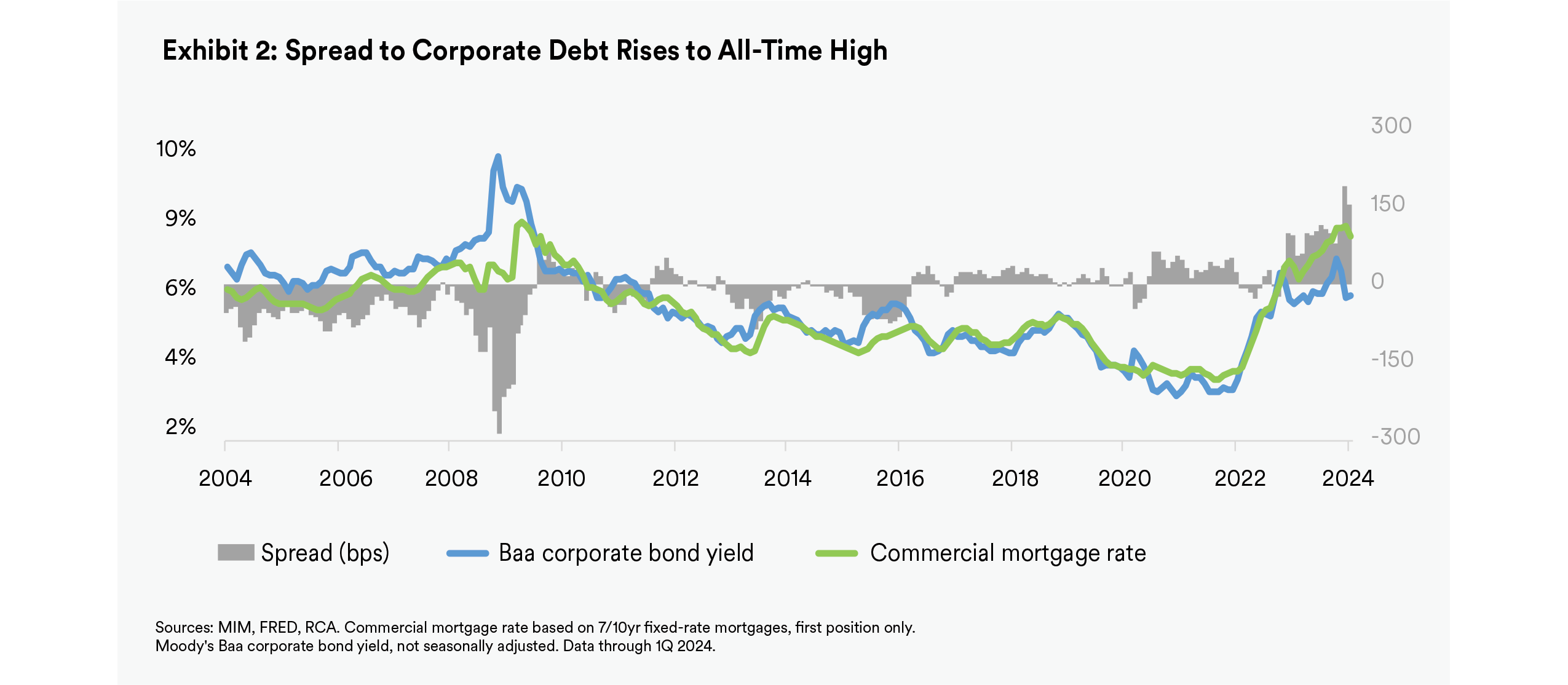

Commercial mortgages have been uniquely impacted by recent macroeconomic conditions, which are now being observed in pricing. The spread between commercial mortgage rates and Baa corporate bonds, which has historically been highly correlated, widened to a level not seen since the GFC (Exhibit 2). However, unlike the GFC, it has remained elevated due to the conditions mentioned above, which we believe are distinct to the mortgage sector.

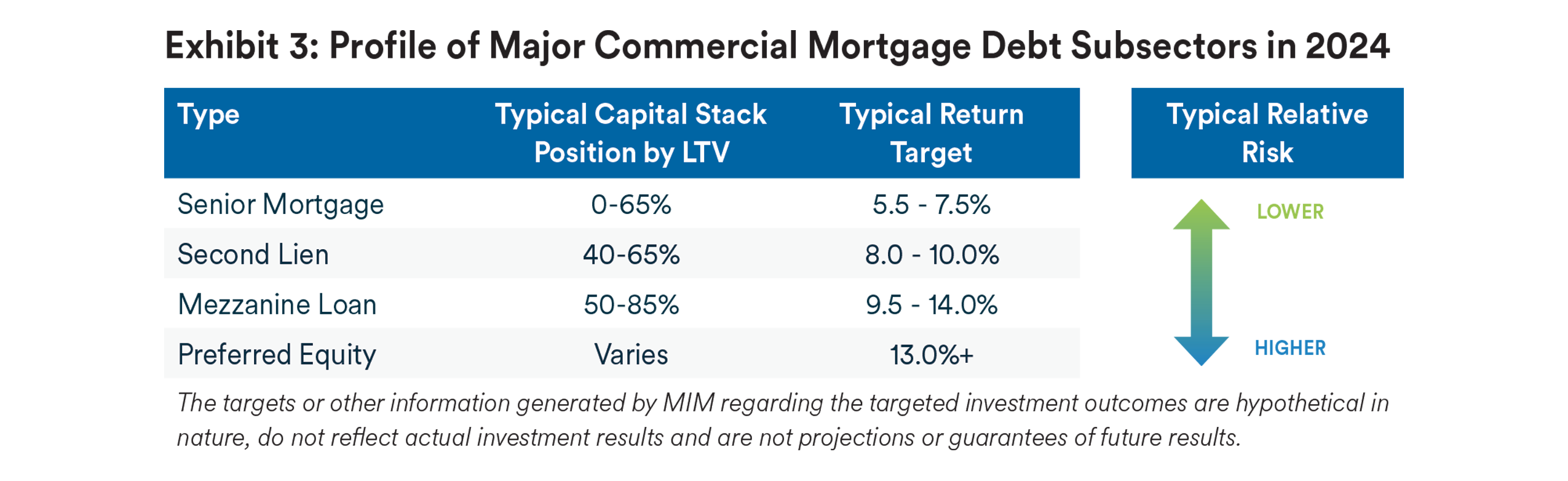

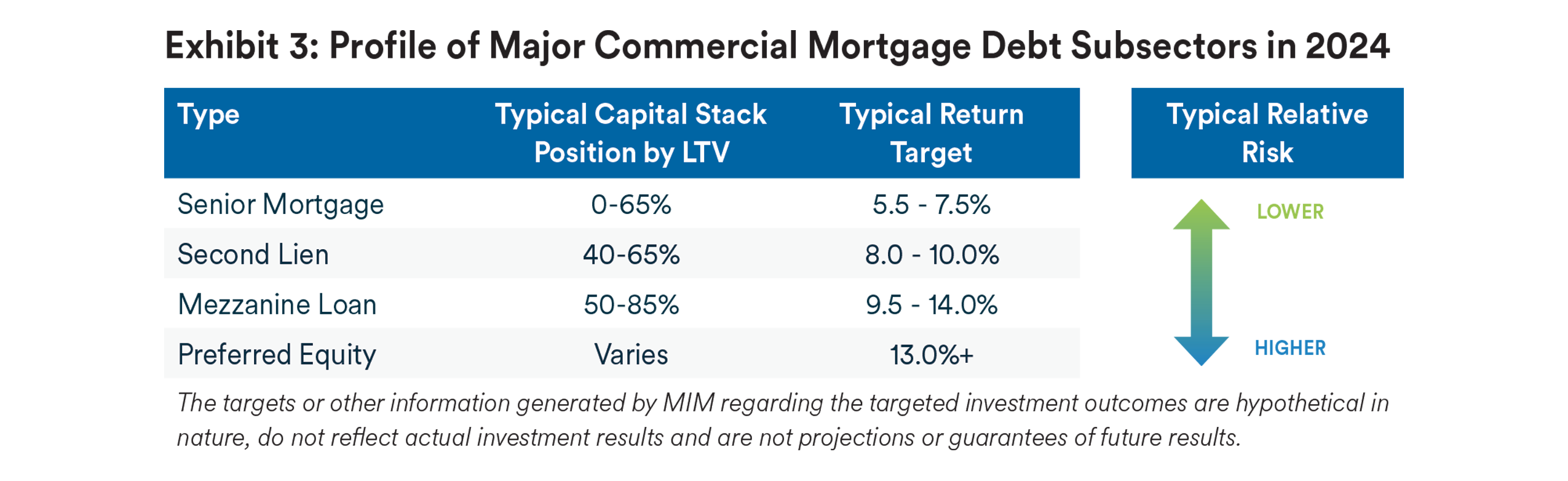

While average yields for commercial mortgages have increased due to a rise in the secured overnight financing rate (SOFR) and treasury yields, spreads have also widened across the mortgage risk spectrum. Throughout much of the past decade, yields on mezzanine and other higher-risk real estate debt structures remained clustered relatively close together in a range of 5.5% to 6.5% with only moderate movements to account for investment-specific factors. In the past 18 months, however, this range widened significantly. Although spreads in the prior decade between senior mortgages and mezzanine loans were often in the range of 200 to 300 bps, today that range is likely closer to 400 bps to 650 bps (Exhibit 3).

We believe the wider spreads are due to the pullback in bank lending, as they have historically been an important source of capital for higher-risk loans. Increased regulations, and the implementation of the Basel III Endgame, are limiting their lending capacity, creating an opportunity for other lenders to step in.

Commercial mortgage investors now have multiple options across the real estate debt spectrum that offer potential returns within or beyond the target return ranges of their real estate allocations. As shown in Exhibit 3, yields range from 5.5%-7.5% for low-risk senior mortgages, to the mid-teens for preferred equity.

Cycle Timing & Systemic Overestimation of Risk After Downturns

Although absolute returns for commercial mortgages have increased, what about risk? Are investors today being compensated for the challenges the sector is facing?

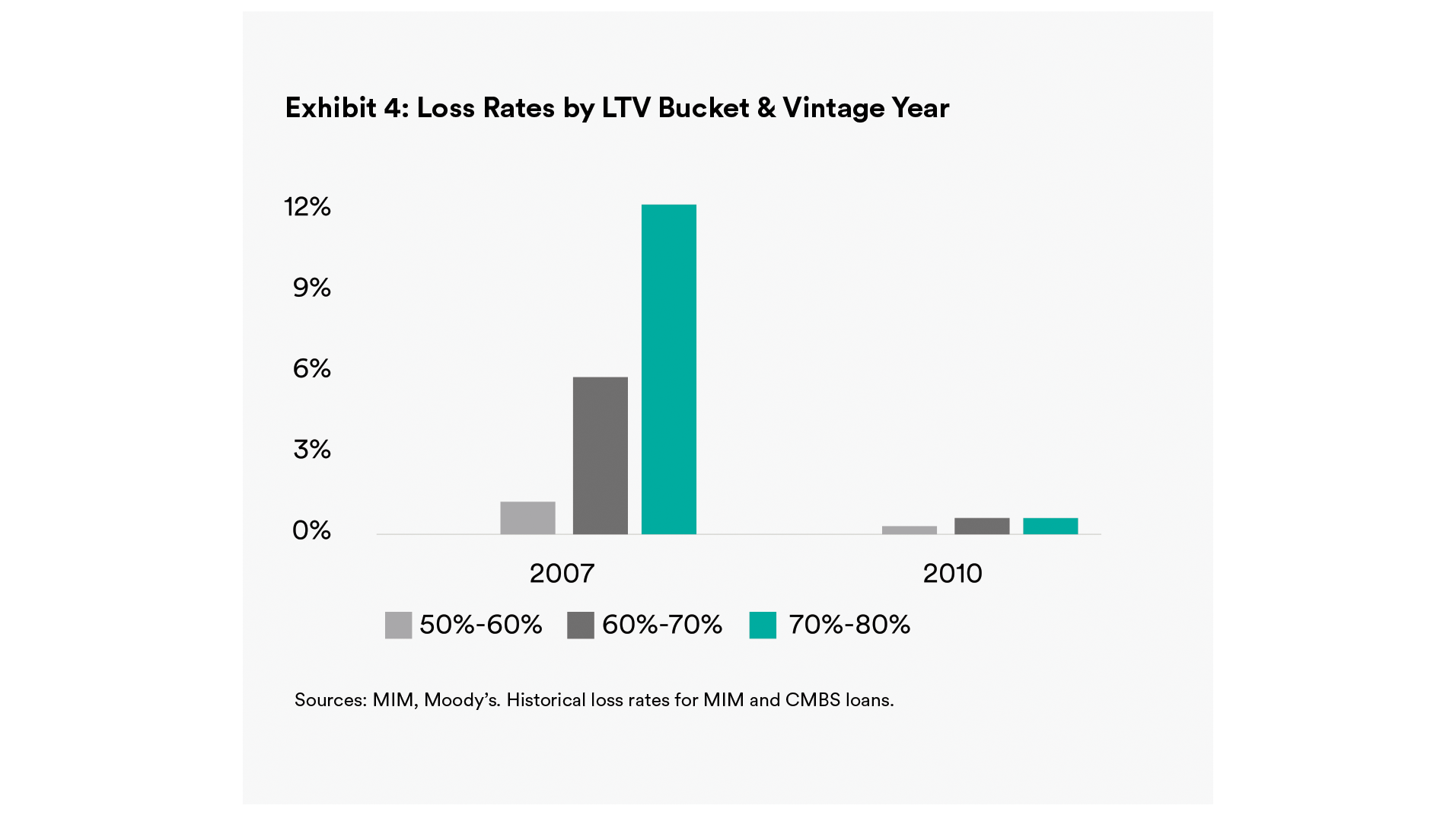

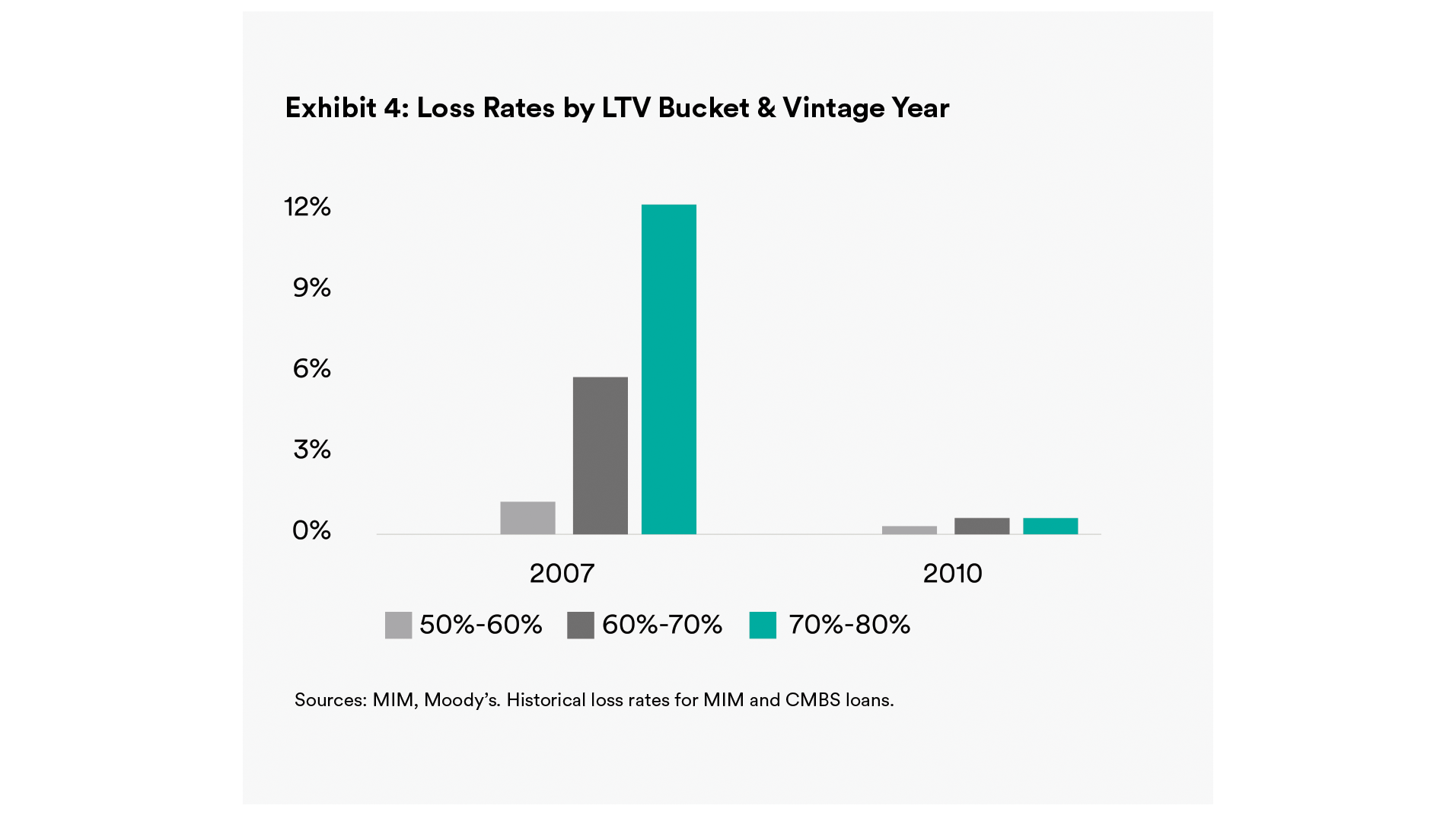

In 2022, we partnered with Moody’s to examine MIM’s historical commercial mortgage loan performance datasets that ranged from 1957 to 2020. The resulting study, which also examined the full CMBS performance history, highlighted how the timing of loan originations within the real estate cycle significantly affects their outcomes. Specifically, loans that are underwritten later in an economic cycle tend to have higher loss rates compared to those initiated at the beginning of a cycle. This trend is not unique to commercial mortgages, and “don’t take credit risk before a recession” is neither a novel finding nor one that can easily be acted upon since downturns are unpredictable. However, what may be unique to commercial mortgages is that the risk measures used by most, if not all, lenders do not adequately capture the changing risk profile across different periods of the economic cycle.

Lenders are focused on three measures when evaluating the credit of commercial mortgage loans: loan-to- value (LTV) ratio, debt service coverage ratio (DCSR) and debt yield. While these factors have established correlations with bond-equivalent ratings, the commercial mortgage market lacks a comprehensive understanding of how loan terms impact loan risk. The primary non-quantified factors include interest-rate caps on floating-rate loans, cash management and escrows for building capital, leasing costs, or other cash flow shortfalls. This gap in understanding leads to an overestimation of risk when loan conditions are more favorable to lenders (such as in 2010-2013) and underestimation of risk when they are not (such as 2005- 2007, or 2021), in our view.

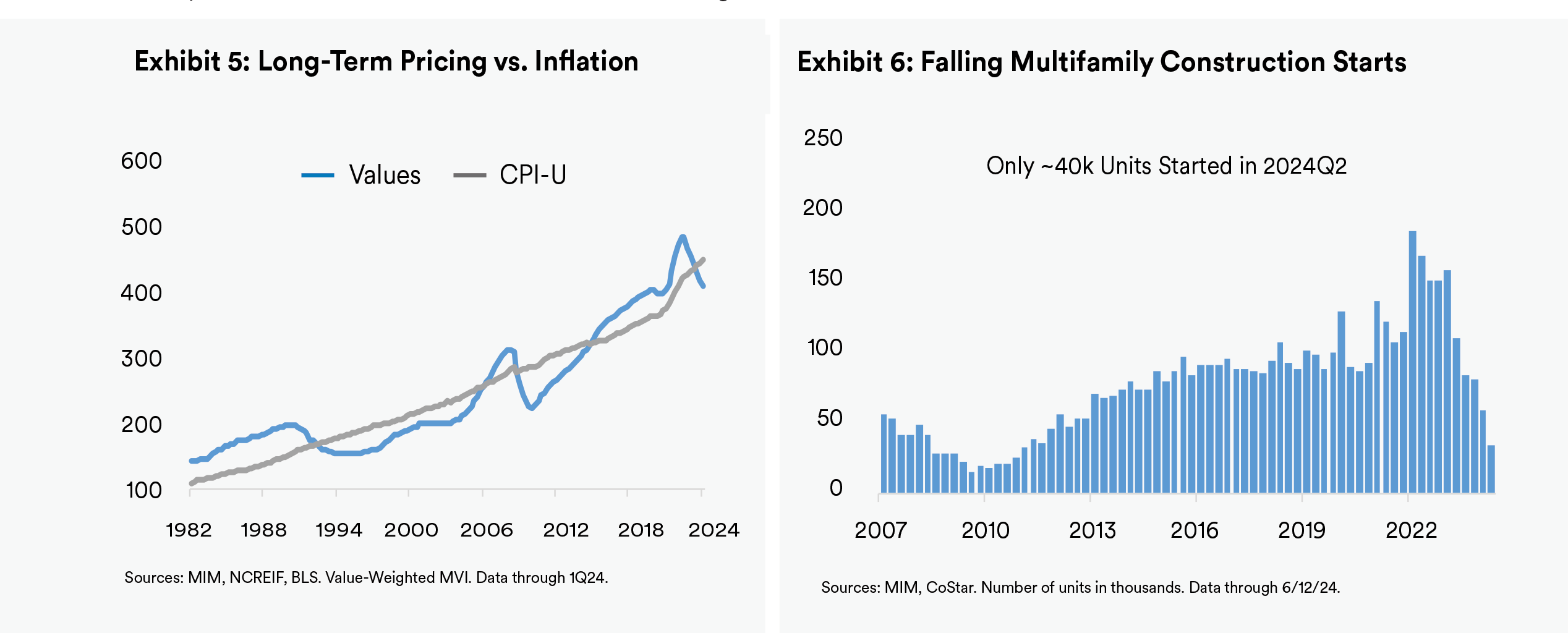

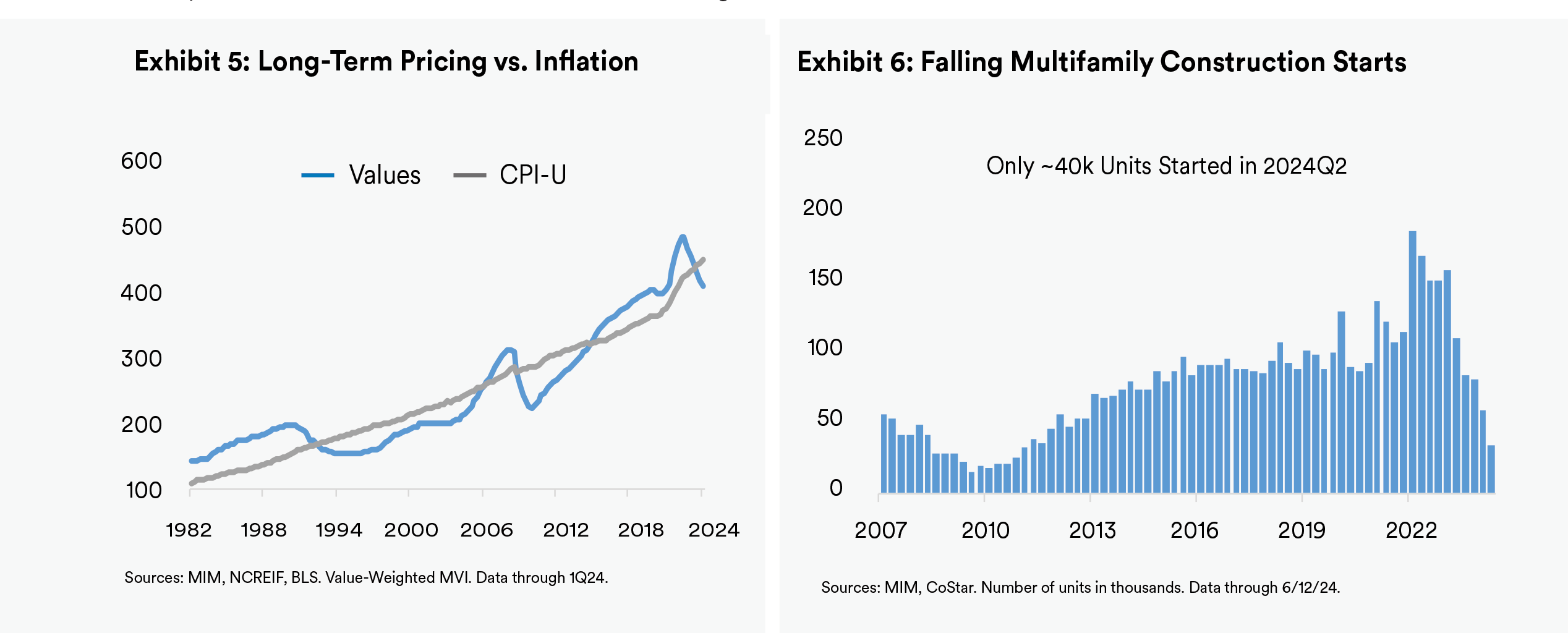

In addition to loan terms, a more complicated but equally important factor is often overlooked: the relationship between real estate values and inflation. Real estate values have tracked inflation closely over long periods of time (Exhibit 5). This is logical, as the cost to build real estate is influenced by commodity prices and labor costs, which move with general inflation. After downturns, such as in 2009/2010 or 2023/2024, new construction starts slow or completely stop for some property types and in some regions of the country. As a result, “construction risk” or “overbuilding risk” is reduced during the initial years or entire term of a commercial mortgage loan. Yet lenders often treat a 65% loan-to-value loan as having the same risk or bond-equivalent-rating regardless of whether new construction is growing (such as 2007 or 2021), or in a period where new construction is contracting (such as 2010 or 2024).

Upon evaluating these two factors today, we believe that loan terms are lender favored, and almost to the level they were during the depths of the Global Financial Crisis. Construction starts are also decelerating at the fastest pace since 2010 (Exhibit 6). Both of these factors suggest that lenders may be overestimateing the risk profile of new originations.

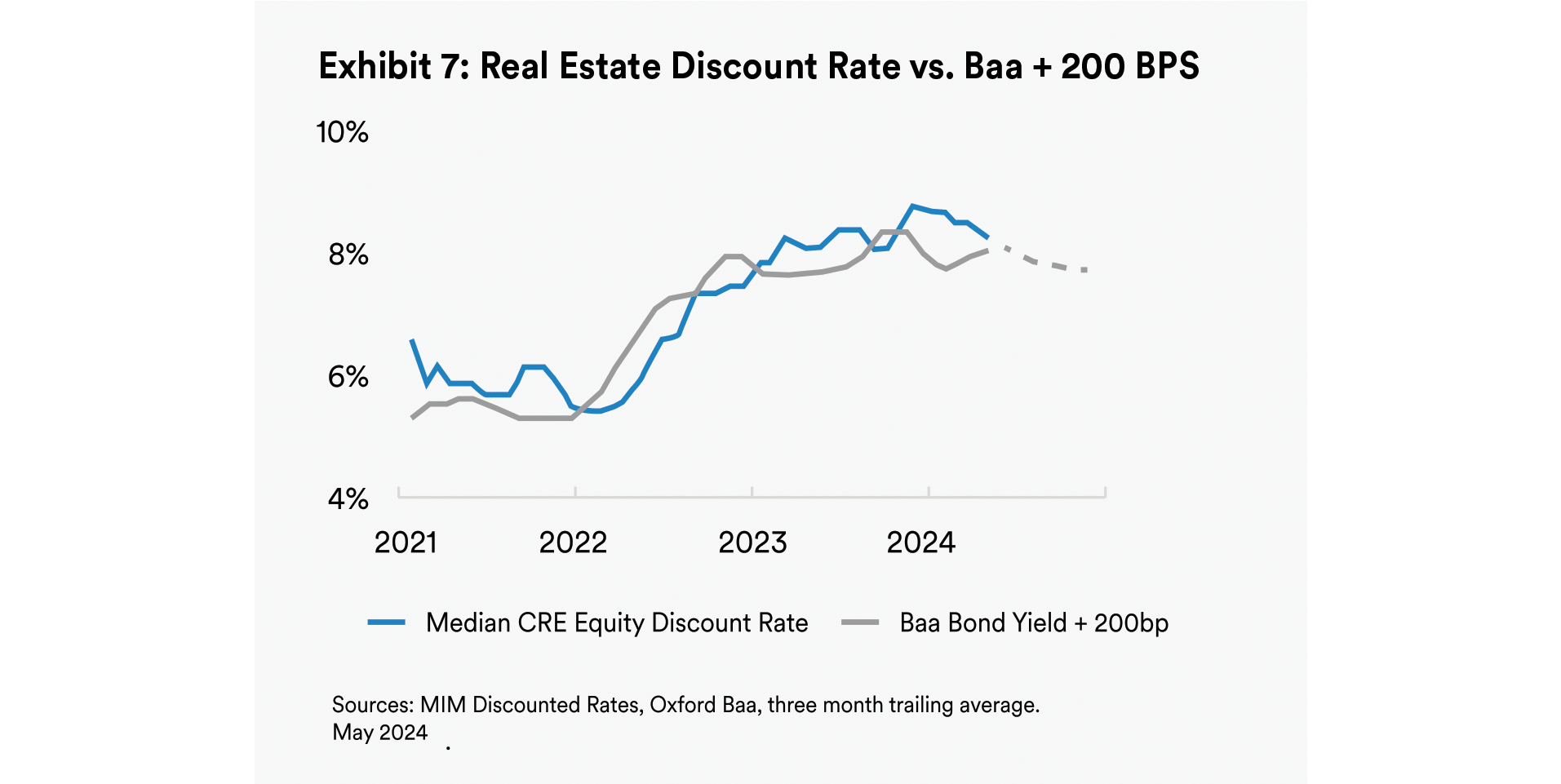

As we look forward, there are signs that the real estate cycle has turned a corner. Within MIM’s equity real estate platform, we generally can’t purchase non-office assets at the prices they were available for in late 2023. Commercial real estate price indexes (which are lagged) have not yet reflected this trough in asset prices, although we anticipate that 2024Q2 readings could represent the trough for values this cycle (to be confirmed when 2024Q3 prices are released later this year). Within the office sector, however, we do not believe prices have found a trough.

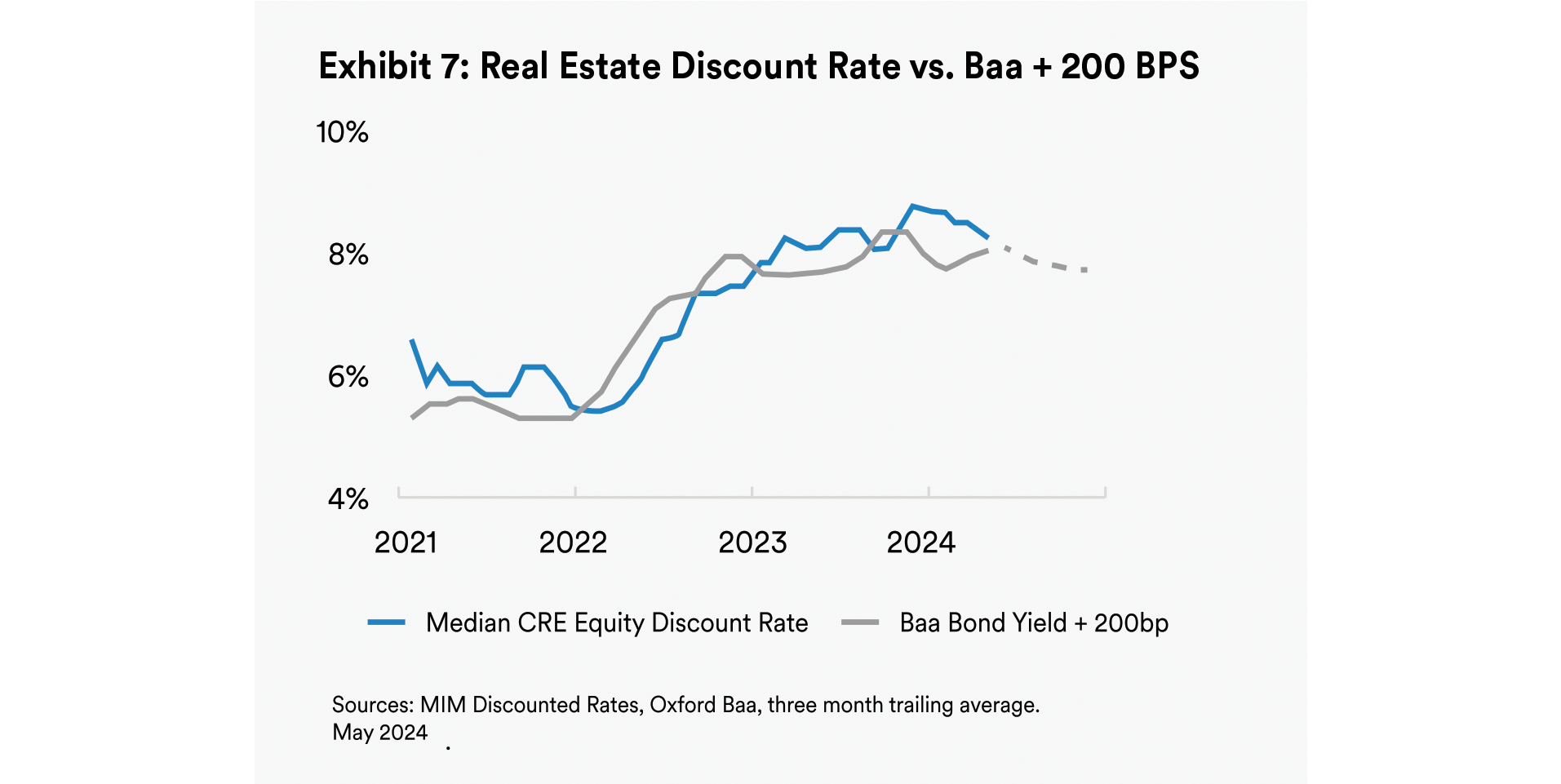

Outside of our direct observation of transaction prices, our relative value benchmark (Exhibit 7) suggests that prices could or should be rising. More details on this analysis can be found in our recent market outlook report (Are We There Yet? The Road to Recovery for CRE). Taking all these factors together, we believe the real estate debt sector, and especially the higher-yielding portion of the mortgage risk spectrum, is worth considering today.

Conclusion

Over the past year, the commercial mortgage sector has experienced its most significant transformation since the Global Financial Crisis. A combination of reduced liquidity, falling property values and regulatory changes have marked the dawn of a new era for mortgage investors, an era that seems set to persist in the near future.

While the past 12 to 18 months have presented challenges, they have also unveiled opportunities. Specifically, current mortgage yields are offering attractive relative value, and it appears investors are being adequately compensated for moving up the risk spectrum. Moreover, pricing data suggest we may be at the start of a new cycle, which our research has shown is a uniquely opportune entry point for mortgage investors.

Endnotes

1 FDIC.

2 Historically, loss experience has varied across banks, CMBS, and LifeCos. LifeCos experienced around 9 bps of annual losses between 2008 and 2023, compared to around 55 bps for banks and around 174 bps for CMBS during the same period. This is due in part to the structure of mortgages in various portfolios, with LifeCos generally offering lower leverage levels and targeting higher quality assets. MetLife’s average annual credit loss during this period was only 4 bps.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services.

The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein.This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.