In Moneyball, author Michael Lewis discusses the “tools” available to baseball scouts evaluating young players. “A guy who could run had ‘wheels’; a guy with a strong arm had a ‘hose’. Scouts spoke the language of auto mechanics.”

In many ways, the private real estate sector today shares elements with Major League Baseball in the 1990s, when qualitative traits frequently trumped quantitative evaluations. This is especially true when it comes to risk assessment. For example, how much additional yield should an investor demand today for purchasing an office building versus a logistics warehouse?

In our last Public Market Signals report, we argued that private real estate investors are underutilizing the information pouring out of public markets. We pointed out that corporate bond yields and short-term Treasuries could be used to anticipate changes in real estate pricing.

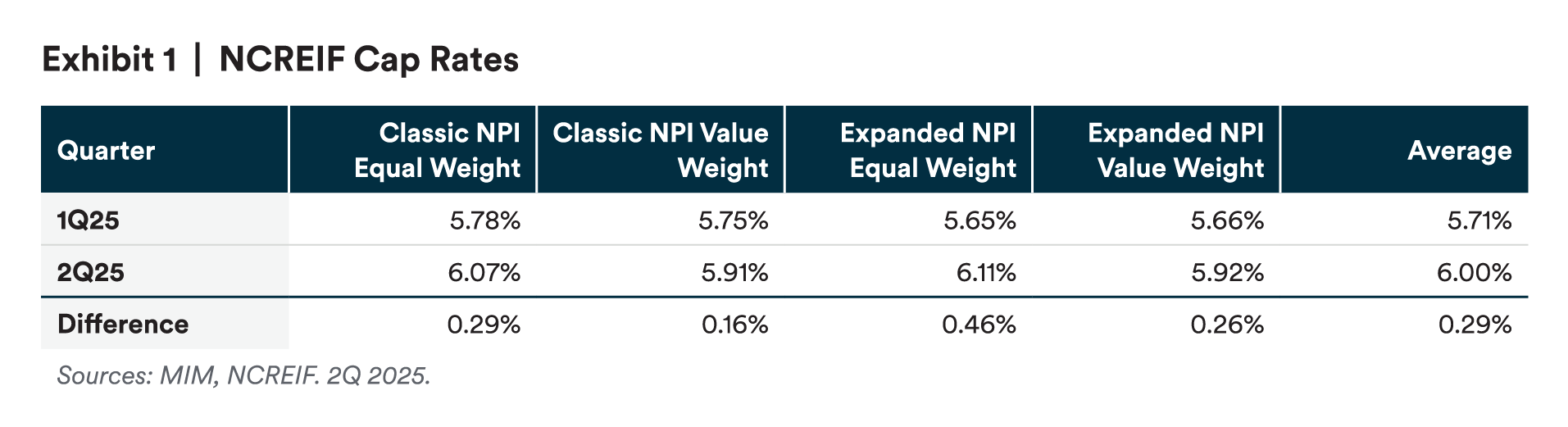

Specifically, we reached the conclusion that private markets were, at the time, priced slightly too aggressively, and that transaction cap rates as measured by the NCREIF Property Index would rise by 30 basis points (bps) during the quarter. While it will take several years to truly evaluate the quality of our cap-rate forecast model, the benchmark 2Q25 NCREIF transaction cap rate did reflect our expected rise (Exhibit 1).

In this follow-up to Public Market Signals, we’ll expand beyond Treasury and corporate bond yields to show how private real estate investors can use REIT Put and Call options pricing to evaluate the riskiness of various property types, and thus, how much extra yield should be required for moving up the property-type risk spectrum. Combined with our cap-rate model, this analysis provides a useful framework for evaluating risk-adjusted returns.

The Capital Asset Pricing Model (CAPM) provides a practical toolkit for sizing how much extra return investors should expect when they step into riskier territory. CAPM suggests that the return from an investment should start with a risk-free rate such as the 10-year Treasury, plus a premium that reflects how much riskier the investment is compared to the market.

The problem real estate investors face is that there is no simple way to estimate relative risk (i.e., the potential range of upside and downside outcomes from base-case underwriting) across property types. There are two primary reasons why this is a difficult exercise:

- A long list of variables determines investment outcomes. Investors must, in theory, forecast 1-, 2-, and 3- standard deviation scenarios for rent growth, occupancy, operating expense growth (including taxes and property insurance) and one time capital expenditures. Forecasting performance is typically done for a base case scenario, but that alone is a full time job. Few investors also have the resources to model the required upside and downside scenarios for a CAPM analysis.

- Emerging institutional property types with limited data availability. Historical performance of sectors like industrial, office, retail and apartments are likely documented enough to be used as a starting point, with NCREIF records dating back 30 to 40 years. But what about data centers, single-family rentals or other segments that have only barely seen a full cycle? There are over 20 institutional property types with meaningful differentiated risk/return profiles, but almost none of them have detailed performance histories dating back to the Global Financial Crisis (GFC), or to periods like the 1970s when inflation was running hot.

To address these challenges, investors can turn to REIT options pricing as a forward-looking proxy for property-type risk. Although the REIT price‑to‑net‑asset‑value (P/NAV) ratio is a commonly used metric, we believe option pricing can be a more useful way to understand volatility and estimate risk‑adjusted returns.

Implied volatility is a key metric derived from options pricing and represents the market’s forecast for the magnitude of future price fluctuations over the life of the option. Unlike historical volatility, which simply records past price swings, implied volatility is embedded within the prices of options contracts and is thus forward looking.

By examining the implied volatilities of REITs that specialize in specific property types, whether office, industrial, retail or newer categories, like data centers and single-family rentals, investors can extract quantitative estimates of risk that capture the market’s anticipation of future turbulence. This approach offers a real-time alternative to the constraints of historical analysis that don’t incorporate new information we know about the future (like how tariffs might impact the industrial sector, how immigration restrictions might impact apartments, or how quickly remote work might be reversing and the subsequent implications for offices).

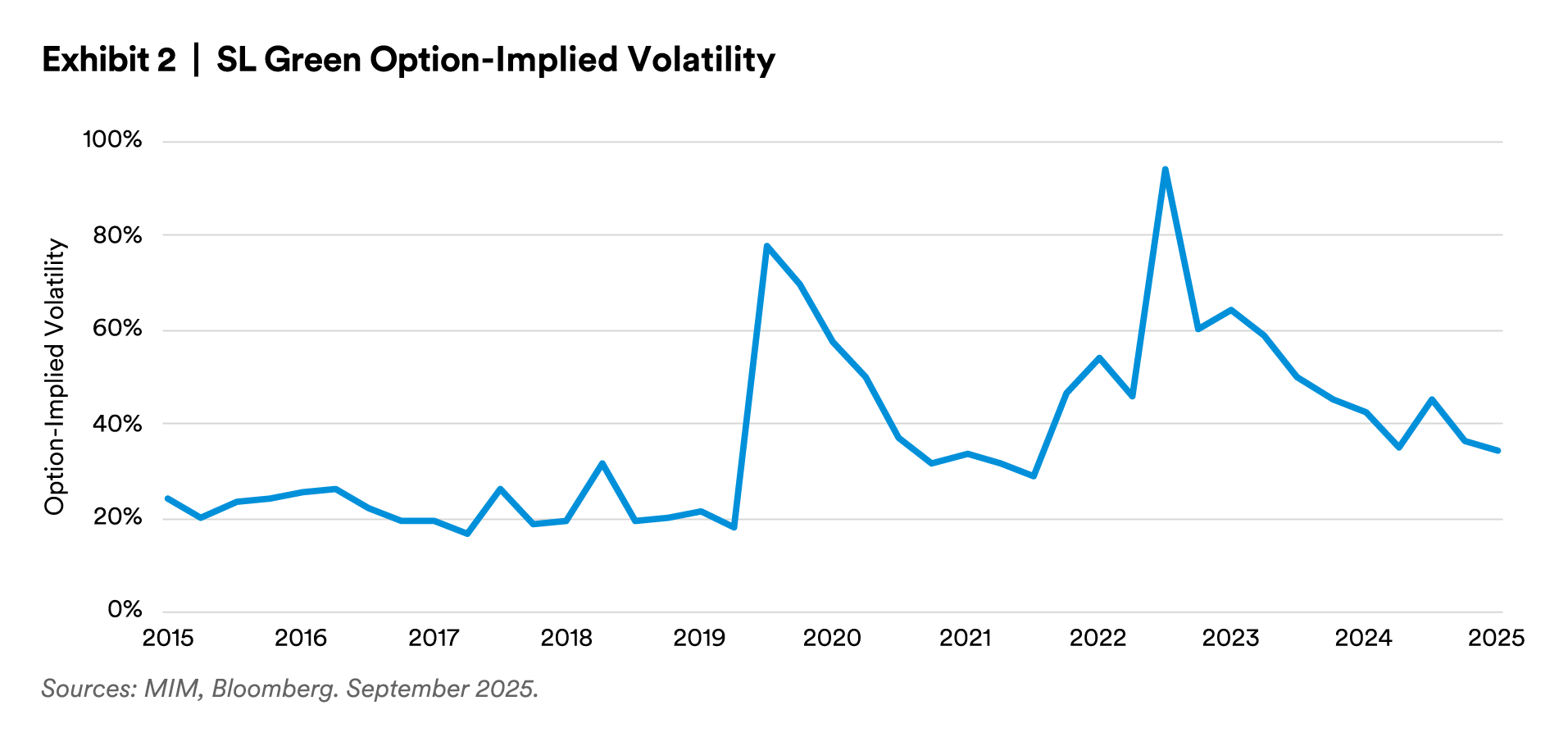

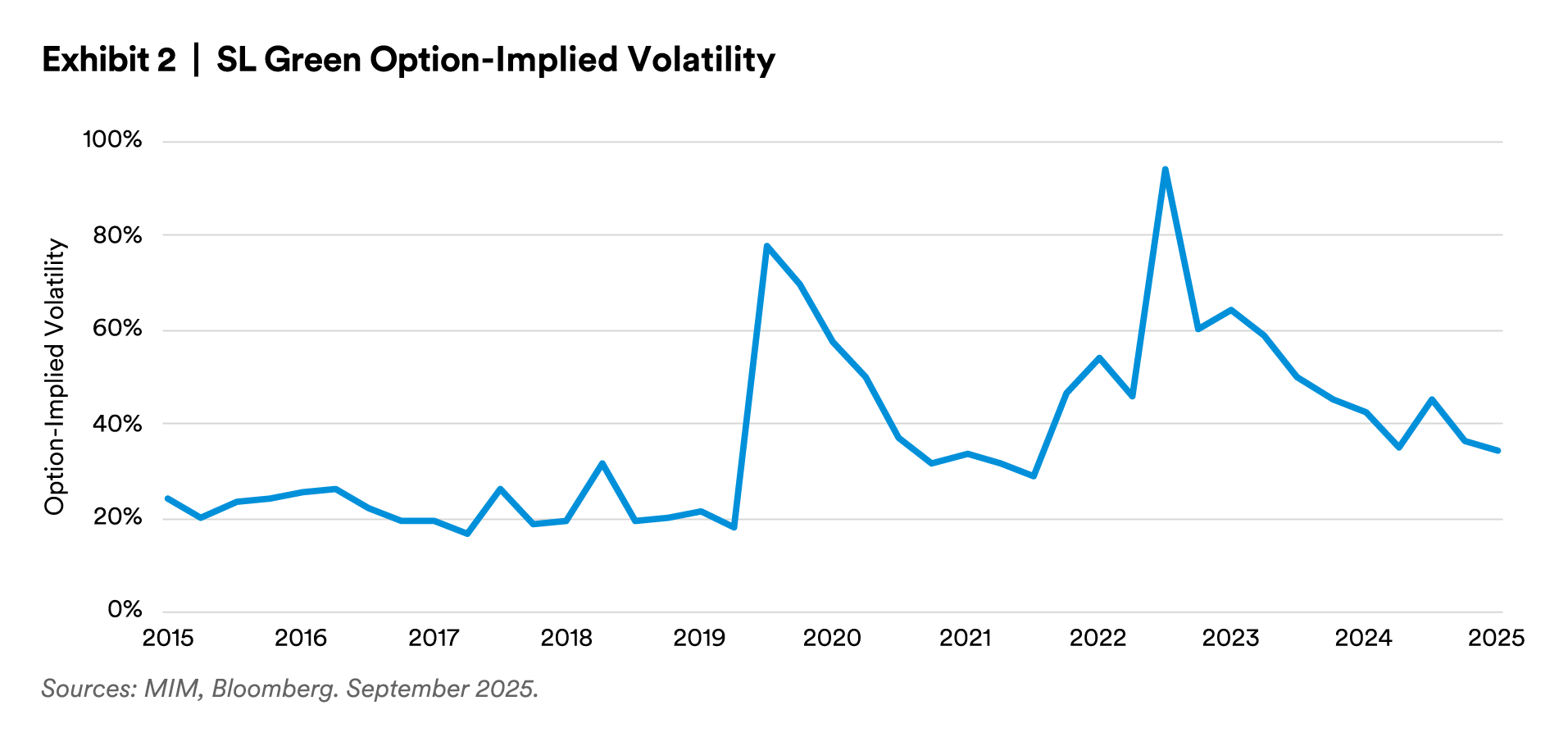

Take, for example, the chart below, which represents the implied volatility for office REIT SL Green. Prior to COVID, SL Green’s implied volatility hovered around 20% (annualized predicted standard deviation of the share price, see Exhibit 2). It rose to 95% during the peak of the work-from-home downturn for the office sector. It has been recovering more recently, reflecting improvements in the office sector, but is still elevated relative to pre-COVID.

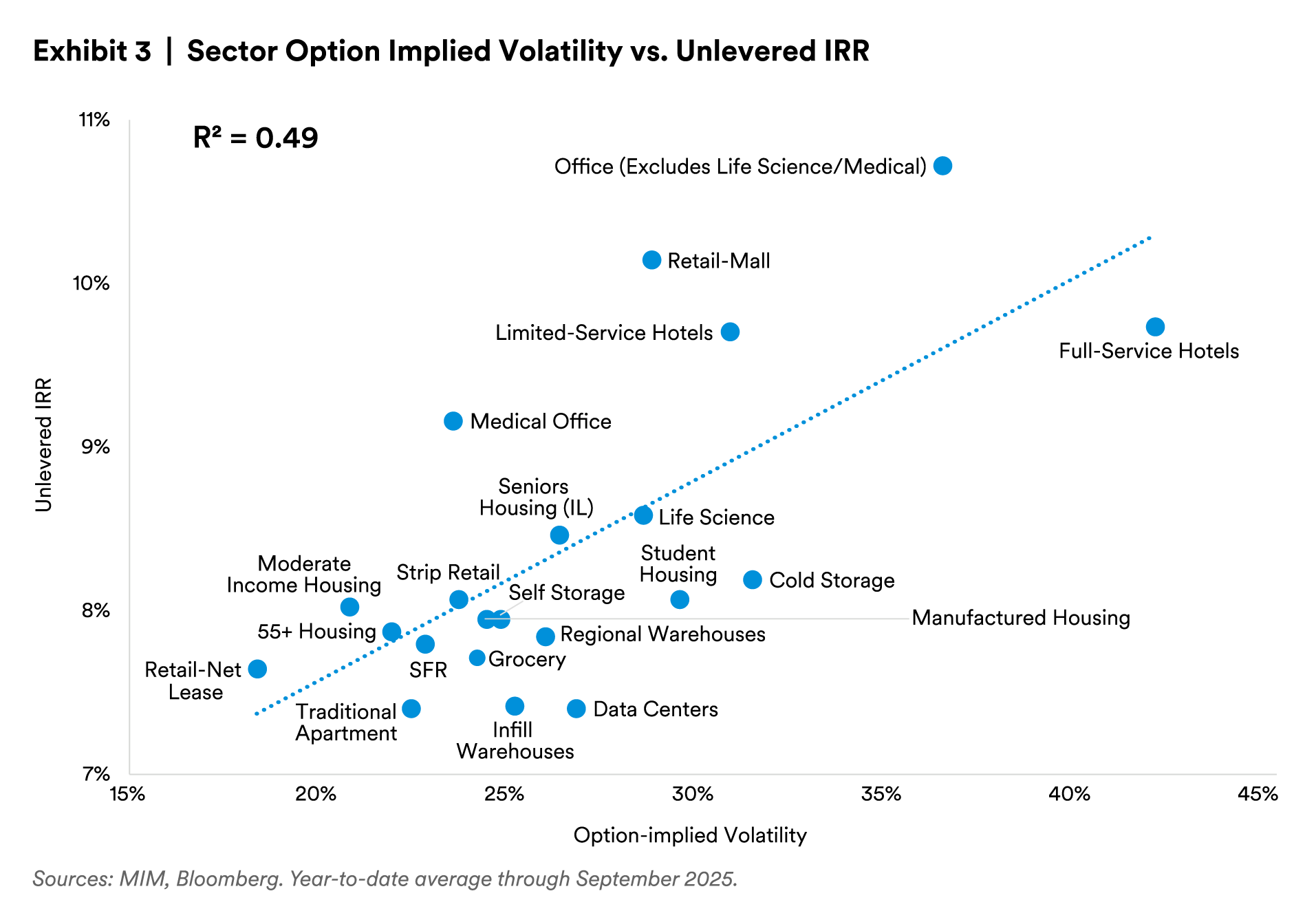

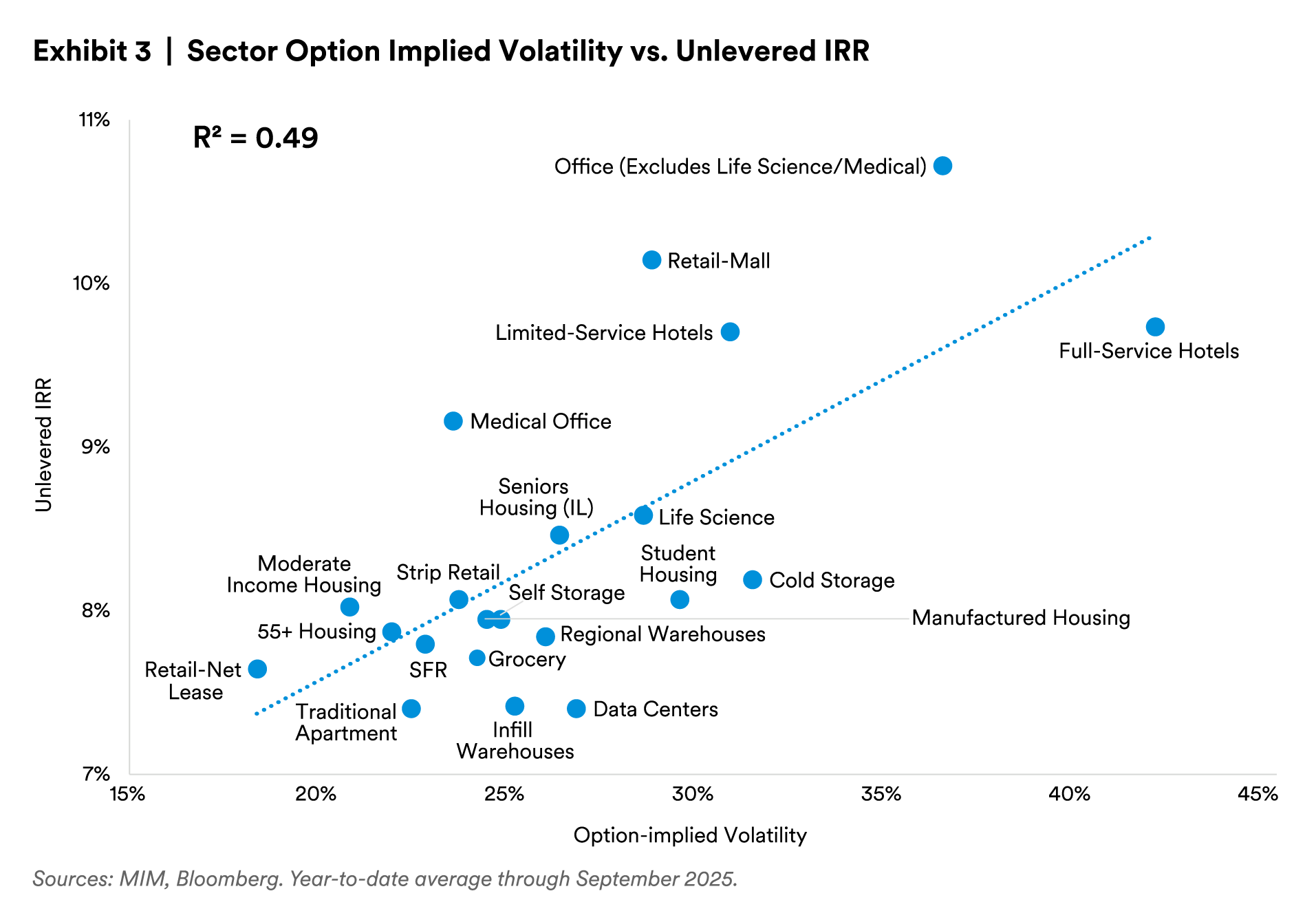

To compare implied volatilities across property types, MIM grouped REITs into 21 property type categories, with boundaries based on where segments may perform materially differently. These definitions do not exactly match those used by industry groups such as CREFC and NCREIF. For each property type, we model volatilities against assets in MIM’s acquisition pipeline, as well as against a monthly yield survey that MIM’s acquisition teams complete. The results of that analysis are below:

Exhibit 3 shows the relationship between private sector yields and public market sector risk as measured by option-implied volatility. Specifically, the analysis implies that one additional percentage point of implied volatility requires 10 bps of unlevered IRR. In other words, moving from an implied volatility of 20% to an implied volatility of 30% should equate to moving from an 8.0% unlevered IRR to a 9.0% unlevered IRR.

This analysis also allows investors to begin making relative value decisions. For example, strip retail centers offer roughly a 40-bp yield premium over traditional apartments today, yet public markets suggest strip retail is slightly less risky.

While option-implied analysis is a powerful tool that investors can use to examine relative value across property types, there are several factors to keep in mind.

- Lack of pure-play REITs in several sectors. MIM’s model makes adjustments to account for sectors like student housing, seniors housing, life science and medical office where there are no pure-play REITs.

- Volatility can imply upside or downside risk. High-growth sectors like data centers may screen riskier if markets are pricing the potential for upside earnings surprises. Analysts can consider evaluating Volatility Skew or Risk Reversal to correct for directional bias, but this data is less accessible and could reduce standardization of measurement across property types.

- REIT prices are not purely a function of their assets. REIT performance primarily changes as a function of asset performance, but management strategies also present upside/downside volatility. Additionally, the use of leverage differs between REITs and can be challenging to adjust for.

The integration of options pricing analysis into private real estate investment strategies provides a distinct and forward-looking perspective on risk. Unlike traditional real estate risk analysis that relies solely on the rearview mirror of historical performance, option-implied volatility stands apart by blending past trends with fresh market intelligence and investor expectations for the future.

While the relationship between implied volatility and private sector yields opens new avenues for decision-making, it is not without caveats. Imperfect correlations and sector-specific limitations mean investors should use this tool in concert with other approaches. As public and private real estate markets continue to evolve, options pricing analysis remains a powerful addition to the investor’s toolkit — one that captures the pulse of markets not only as they have been, but as they are anticipated to become.

Although options pricing is an important tool in MIM’s property-type relative value framework, we only issue overweight recommendations when option-implied signals are corroborated by at least one traditional fundamentals-based indicator and a private market relative value measure. Our current overweight sectors include seniors housing, infill warehouses, net lease retail, medical office and manufactured housing.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

MetLife Investment Management (MIM) is MetLife Inc.’s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world.

This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities and Exchange Commission (SEC) registered investment adviser. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment adviser.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.