Core real estate equity, with returns composed of both income and appreciation, can offer a mix of benefits that are difficult to replicate with other asset classes. While opportunistic and value-add equity investments can be a source of yield for investors, core real estate equity is a foundational investment for all investors looking to allocate to real estate. As we detail in the following paper, the sector has produced attractive total returns historically, and its risk-adjusted returns are among the highest of any major asset class. It can act as a strong portfolio diversifier, exhibiting relatively low historical correlation with other sectors, and can also help act as a hedge against inflation.

The sector’s challenges lie primarily in the expertise necessary to source and execute individual transactions and manage global portfolios. For real estate investment managers with the expertise to address these challenges with scale, resources, and experience, we believe the rewards of an allocation to core real estate equity can meaningfully outweigh the risks.

Historical Performance

Since 2000, core real estate equity has produced attractive total returns. Unlevered gross returns during this period averaged 9.2%,1 despite the economy enduring recessions induced by the asset bubbles of 2001 and 2008, and the pandemic that began in 2020. (Exhibit 1).

The sector’s historical performance is driven by its income component. Since 2000, approximately 66% of the sector’s total returns were derived from income. The remaining 34% came from appreciation, which was itself partially driven by expectations of future income growth. In addition to historically providing attractive absolute returns, the sector’s flow of income also contributes to attractive risk-adjusted returns.

While more volatile than bonds when measured by standard deviation, core real estate equity has exhibited stronger total returns and experienced fewer years of negative returns. Investors prefer asset classes with low risk, as measured by standard deviations, and high returns, but they must usually accept a trade-off between these characteristics. Debt investors can boast lower volatility and fewer years of negative returns, but at the cost of lower total returns during positive years. Additionally, core real estate equity does not have a maturity and can be held in perpetuity if so desired, eliminating reinvestment risk that is associated with assets that mature. We believe core real estate equity’s combination of historically strong total returns and moderate volatility allow it to effectively straddle the low and moderate risk buckets in a multi asset class portfolio. We believe its greatest contribution to such a portfolio, however, may lie in its diversification benefits.

Benefits of Real Estate in a Multi Asset Class Portfolio

In addition to historically attractive, absolute and risk-adjusted returns, core real estate equity can act as a strong diversifier in a multi asset class portfolio as well as an effective hedge against inflation. Over the last two decades, the sector has exhibited relatively low correlations with direct commercial mortgages, CMBS, stocks, bonds, and private equity investments (Exhibit 3). Its average correlation with these sectors is only 0.07, and its strongest correlation with any single asset class measures only a 0.33. Academic textbooks indicate that lower-correlated assets in a diversified, long-term investment portfolio can increase portfolio efficiency and may generate higher total returns, while decreasing overall risk, because each asset class may react differently to changing market conditions.

Between 1990 and 2021, prices have been volatile year to year, but overall commercial real estate prices increased at roughly the average annual rate of inflation, based on property value changes as tracked by NCREIF. Similarly, same-store net operating income growth approximately matched the rate of inflation. Real estate, therefore, can potentially provide an effective hedge against inflation risks in a portfolio.

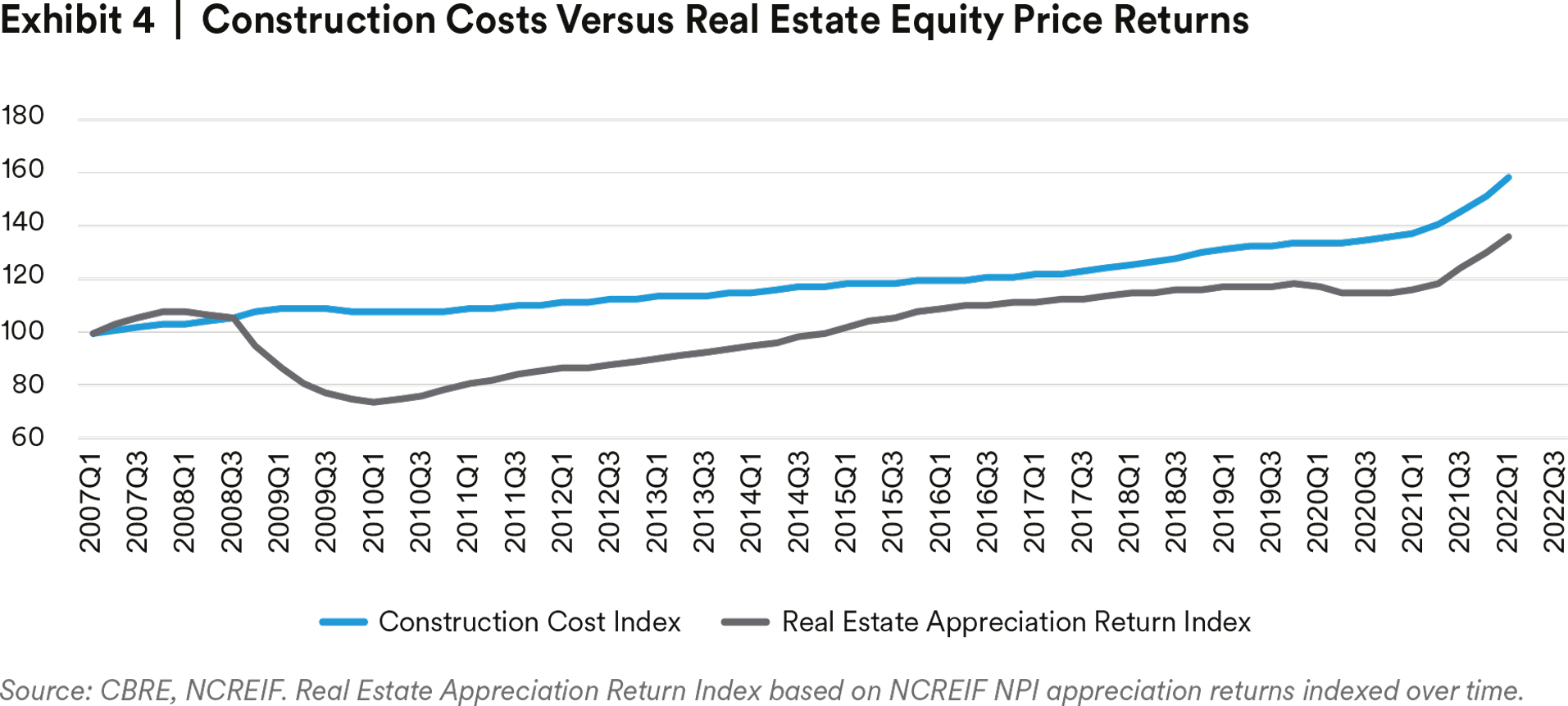

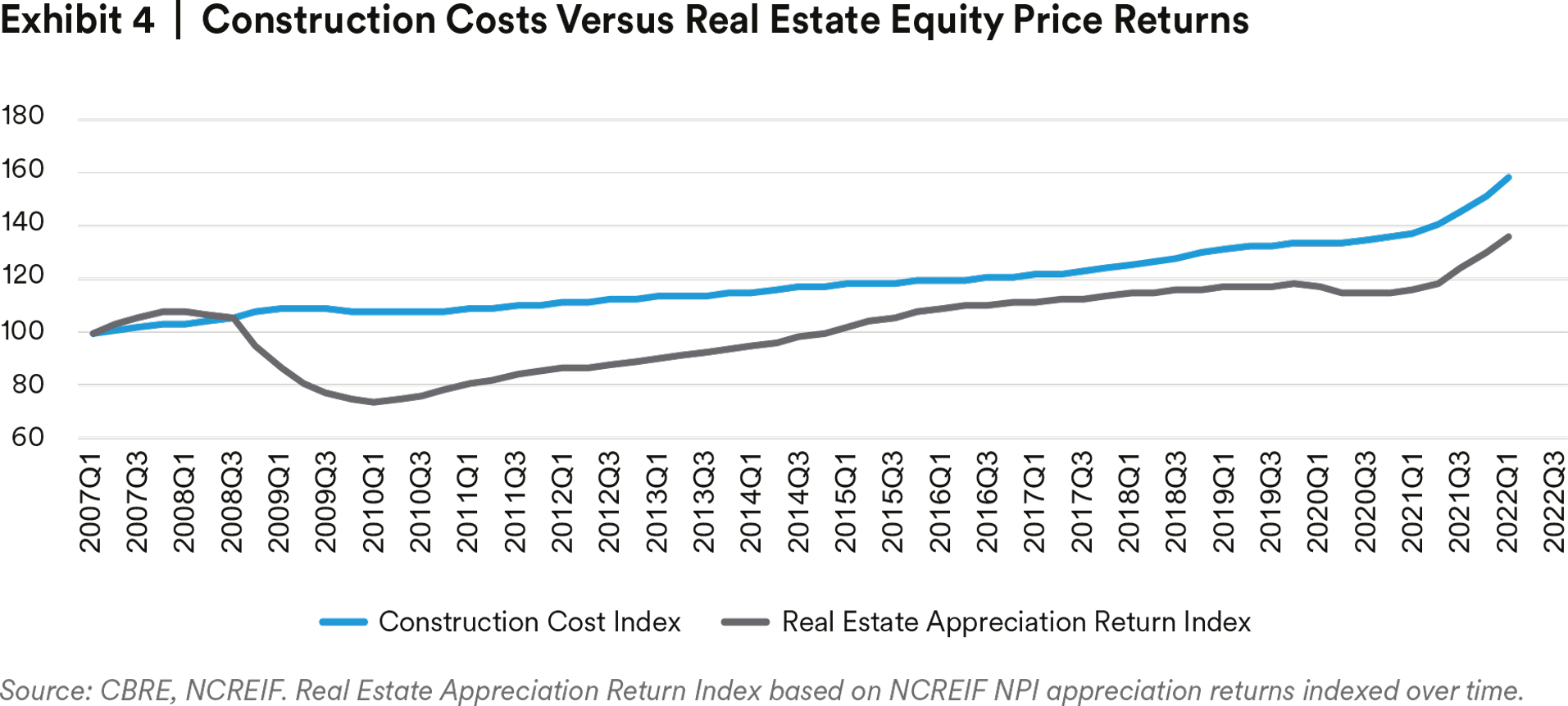

The cost of construction plays a pivotal role in commercial real estate’s relationship to inflation (Exhibit 4). One common real estate valuation methodology is replacement cost. The cost to rebuild an existing building can be viewed as an estimate of current value. As the cost of land, labor, and materials rise with inflation, so does replacement cost. If property price appreciation exceeds inflation, then the premium between current market values and the cost to build will cause construction to increase. If the premium between current market values and the cost to build is low, or negative, then new construction will slow or stop. Thus, current real estate values can adjust according to construction costs, which impact supply and demand, and leads to commercial real estate values tracking replacement cost over time.

Additionally, commercial real estate can help as a hedge against inflation due to the frequent repricing of commercial real estate leases. Commercial real estate assets are typically occupied by multiple tenants who sign leases of varying lengths. As these leases expire, rental rates as well as reimbursements of operating expenses in triple net leases are adjusted to reflect current market rates, which include the effects of inflation.

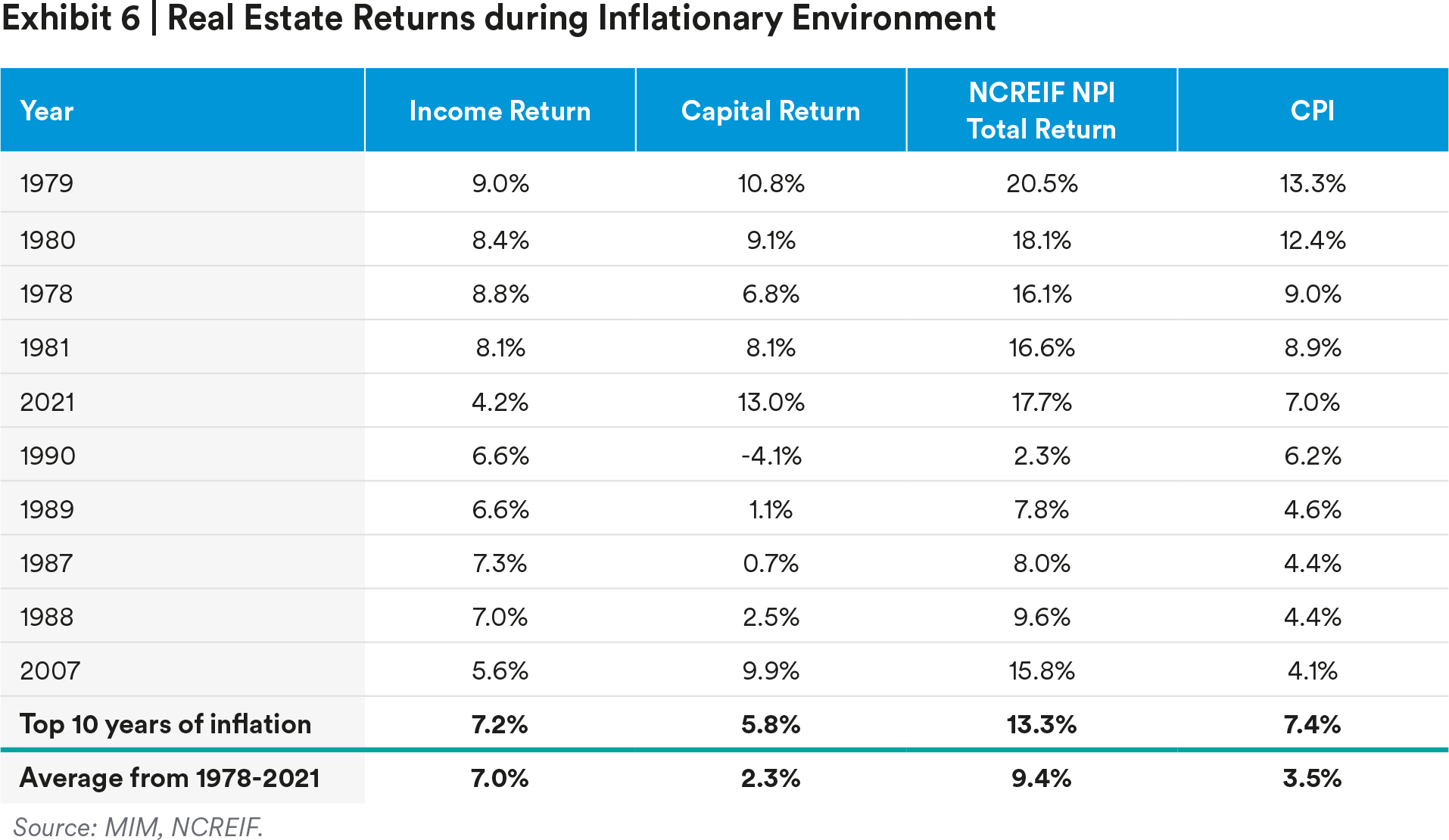

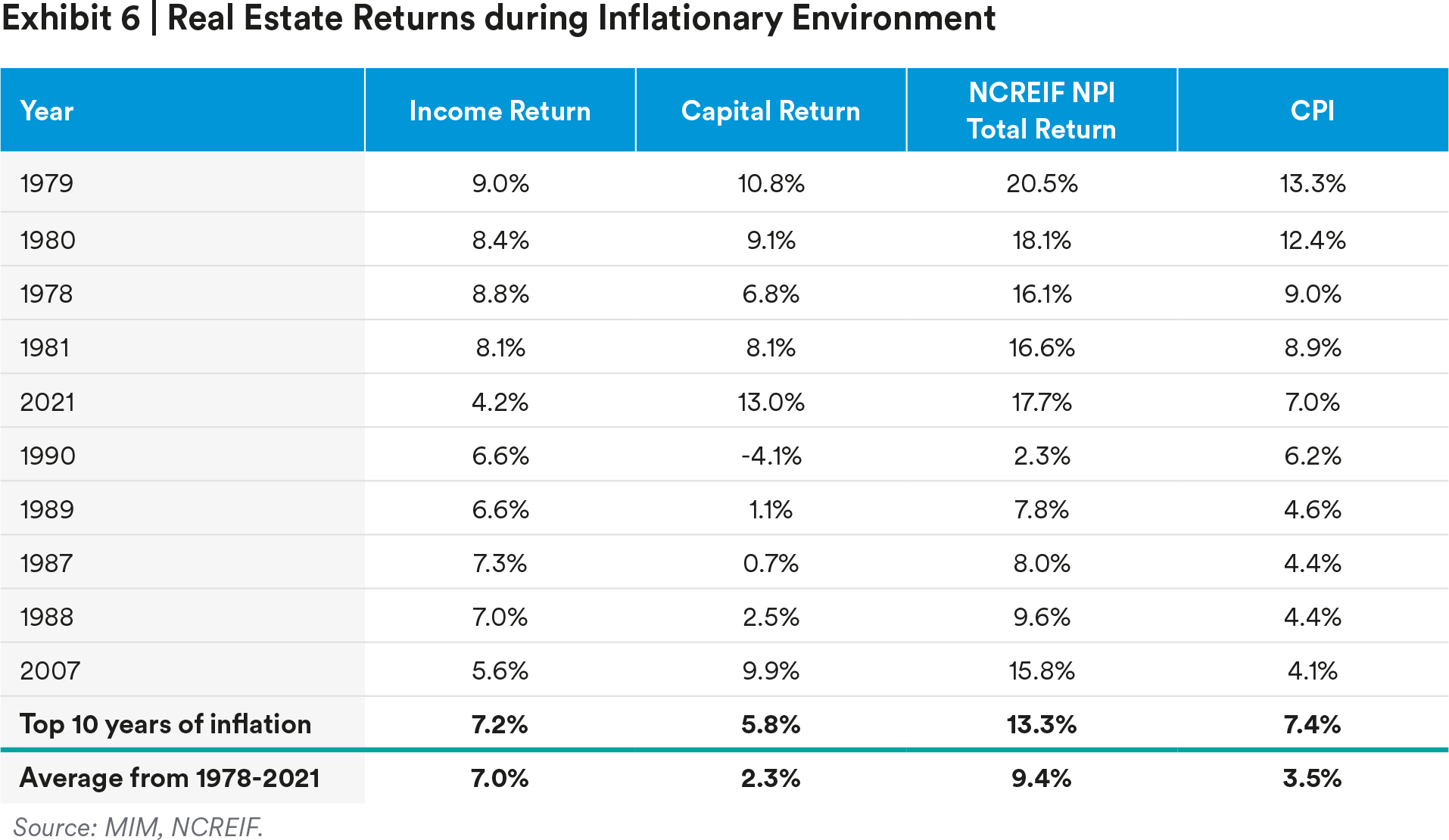

The relationship between commercial real estate values and inflation is further illustrated in Exhibit 5. In this chart, we show how commercial real estate performance can be modeled as a function of inflation over time. Specifically, returns modeled3 as cap rates plus the rate of inflation, were generally in line with actual returns, over the past 25 years. Additionally, Exhibit 6 ranks the ten highest years of inflation over the past 45 years. It is evident that commercial real estate outperforms during inflationary periods, averaging a 13% annual total return during times of high inflation. For investors that think inflation will be elevated going forward, adding core real estate exposure may be warranted.

In summary, we believe commercial real estate can be an attractive option for investors seeking to diversify an investment portfolio or to hedge from rising inflation.

Diversification of a Real Estate Portfolio

In addition to CRE providing diversification of a multi asset class investment portfolio, it is also possible to construct highly diverse portfolios within the real estate sector itself. The four major property types that make up most commercial real estate portfolios are each driven by different economic and demographic factors. The office sector is heavily driven by job growth in officeusing employment sectors. The apartment sector is driven by a combination of employment and demographic trends. The retail sector is fueled by consumer spending and by retail tenants and formats adapting to changes in consumer behavior. The industrial sector today is being driven by consumer spending, population distribution, and consumer demand for faster e-commerce fulfillment.

Depending on the outlook for these and other drivers, the income growth each property type is able to achieve in a given period can vary significantly (See Exhibit 7). During the past 20 years, the apartment and industrial sectors have been the standouts. Apartment investors have benefited from NIMBYism† that has slowed new housing developments. Industrial investors have benefited from structural changes due to the rise of e-commerce. These structural changes have also reduced income from traditional brick-and-mortar retail properties, which saw steep declines during the pandemic of 2020.

Furthermore, even within the individual property types, performance can also vary greatly. The U.S. economy is highly decentralized, and the nation’s tradition of local control results in a lack of consistency between zoning and land use laws at the metro level. With each metropolitan area driven by different industries and demographic drivers, real estate demand growth can vary substantially, as can the development community’s ability to respond to that demand with new construction.

The result is that there is often a low correlation between the income growth of commercial real estate assets across markets with different economic drivers. For example, over the past 20 years, there have been low correlations between apartment markets, depending on the economic drivers of each market. (See Exhibit 8). We chose apartments for this example because the returns in this property type have been the most stable over time and thus less subject to distortions in correlation factors.

As exhibits 8 and 9 illustrate, commercial real estate can allow investors to diversify across property types as well as across the various drivers of the U.S. economy.

Exhibit 8 describes the various market types analyzed and identifies the representative markets included in the correlation estimates.

Lastly, the commercial real estate sector’s potential diversification benefits are often supplemented by tenants in a wide array of industries. As a result, asset-level incomes are often resilient, and high levels of vacancy in properties with diversified and stable tenancy are rare, even in times of slow economic growth.

In summary, core real estate can be a highly attractive option for investors seeking to diversify their portfolios by asset class, as well as those seeking diversification within an asset class. In addition to diversification, commercial real estate can also offer investors options for more tax-efficient investment returns.

Tax Advantages

For institutional investors that own real estate assets directly or via a separately managed account, the tax advantages can be significant. Direct holders of real estate assets can reduce taxable income by depreciating the cost of existing improvements and ongoing capital expenditures. For office, retail, and industrial assets, this depreciation can be taken on a 39-year basis; for multifamily assets, it can be taken on a 27.5-year basis; and for certain building systems, it can be assessed at an even faster rate.4 At the standard corporate tax rate of 21%, a core multifamily asset purchased at a cap rate of 4.0% could be expected to produce a pre-tax yield from net operating income (NOI yield) of 4.2% in the year following acquisition (assuming a 3% annual growth in pretax NOI). However, the depreciation deduction reduces the tax liability and increases the yield of the investment. We estimate the NOI yield, adjusted for the tax benefit of depreciation, would be 4.7%, rather than the 4.2% level achieved without the tax benefit.5 For this example, one year of benefit is estimated by multiplying a year of depreciation times the corporate tax rate of 21%, then adding the result to NOI to imply an “adjusted” NOI yield. (see Exhibit 10).

The adjusted NOI yield, as well as the investment’s total rate of return (including asset value appreciation), has the potential to rise substantially over time. As depreciation deductions are taken, the asset’s book value will decline. Also, as the investment’s leases are renewed, or its rents contractually increased, net operating income can rise. The result is that by year five, the adjusted NOI yield on book value could be expected grow to 5.8%

It should be noted that these returns are calculated on a nominal basis and, as a result, do not reflect the additional benefits depreciation offers via deferred taxation. Deferred taxes on net operating income can be reinvested to seek additional income, and long-term inflation can help reduce the impact of those taxes when depreciation is recaptured in the future. As such, the impact on portfolio-level returns may be even greater than our asset-level income returns suggest.

The potential tax benefits of core real estate also extend to the point of sale. In addition to income returns, investors may also benefit from appreciation driven by net operating income growth and changes in capital market conditions. For insurance companies that are holding real estate assets at book value, unrecognized gains can grow to be substantial over time. The recognition of these gains through disposition can potentially be used to offset losses elsewhere in the portfolio, helping to bring greater stability to portfolio-level returns during volatile periods. If the aforementioned asset grew at a 3% rate for the next five years, the asset would offer not only an income return on book value of 5.8% in year five, it would likely also carry an unrealized gain equal to 15.9% of its original purchase price (see Exhibit 10). A potential side benefit of this unrealized gain is the ability to cushion potential declines in market value during the holding period. If real estate assets are held directly, and thus at book value, the decline in market value required to result in an impairment would need to be in excess of 15.9%, after year five. As a result, directly held real estate equity generally exhibits lower statutory capital volatility than equity investments in other asset classes.

Additionally, a 1031 “like-kind” exchange is a commonly used section in the U.S. tax code that encourages active reinvestment by giving investors the ability to indefinitely defer taxation on a sale as long as the proceeds are exchanged for a like-kind property and subject to other provisions. This tax break grants real estate investors the unique ability to reposition assets without immediately incurring tax liabilities.

Investment Vehicles

The decision on whether to invest in core real estate through a fund or direct ownership rests on a number of different considerations. Unlike fund investments, direct ownership offers institutional investors the ability to craft portfolio strategy, maintain operational control of assets, direct additional capital investment, and make acquisition and disposition decisions. The size of individual core real estate assets can, however, make it difficult to construct a diversified portfolio within the direct ownership without a significant allocation.

By contrast, investments in comingled funds cede the decision-making authority in these areas to fund managers. In return, funds offer a host of potential benefits. Fund structures often provide institutional investors with access to a greater diversification of assets, strategies, and markets at smaller investment sizes. In addition, some of the previously mentioned tax advantages are not applicable for investors in commingled funds.

The largest set of private core real estate funds are benchmarked through the NCREIF Open End Diversified Core Equity (“ODCE”) fund index. As of the second quarter of 2022, the index was comprised of $278 billion in assets, with an average asset market value of $80 million.6 While many core assets can be acquired for lower amounts, this figure illustrates the limits to which even relatively large allocations can be used to construct diversified portfolios.

In addition to diversifying across property types and markets, funds often enjoy a greater flexibility in the use of leverage and potentially modest exposure to non-core investments.

Required Expertise

Core real estate equity offers investors numerous benefits, but that does not mean that they are easy to access. Real estate assets are management intensive, requiring specialized investment, operational, and legal expertise spread across multiple teams. Despite significant advances in information transparency, the sector remains heavily relationship oriented, and we feel experienced players will enjoy advantages over new entrants in access to market information and deal pipelines. While the analysis of global, national, and regional trends remains crucial to developing portfoliolevel strategies, we believe superior asset selection can often only be achieved with extensive local knowledge. We feel that this places investors with a local presence and years of market experience at a significant advantage to those who lack it.

While these challenges can be overcome with a significant investment of time, capital, and human resources, we believe that new investors would be best served by selecting an advisor. We believe that advisors with experienced teams, research-driven strategies, and extensive regional networks are best positioned to successfully invest in the sector.

Conclusion

Core real estate equity offers investors a multitude of potential benefits. Through economic cycles, the sector has historically produced attractive, absolute and risk-adjusted returns while acting as a strong diversifier in multi asset class portfolios. Commercial real estate has also demonstrated an ability to withstand short-term economic shocks and recover long-term value.

However, real estate remains a relationship-driven asset class where local knowledge can be as essential as analysis of macro trends. Most importantly, finding a real estate investment manager with the expertise, scale, resources, and experience is of the utmost importance.

Endnotes

1 National Council of Real Estate Investment Fiduciaries. The figure shown represents unlevered returns for operating assets in the NFI-ODCE Index from 1Q2000 – 2Q2022.

2 The indices used for each asset class are: Commercial Mortgages, Giliberto-Levy Commercial Mortgage Performance Index; Government Bonds, Barclays U.S. Treasury Index; Bloomberg Single-A rated Corporate Bond Index; Core Equity Real Estate, NCREIF Property Index (NPI); Stocks, S&P 500 Total Return Index; Commercial Mortgage-Backed Securities, Barclays Capital U.S. Investment-Grade CMBS Index, Private Equity, Cambridge Associates LLC U.S. Private Equity Index; Hedge Funds, HFRI Hedge Fund Index; International Stocks, MSCI EAFE Index. Data is from 2000Q1-2021Q1.

3 Modeled returns also include a small fixed adjustment (10bps) that accounts for modest asset deterioration with age. Data is based on NCREIF Total Rate of Return and capitalization rate data, as well as Moody’s CPI-U. This model is hypothetical and does not reflect actual investment results. Actual results might differ from modeled results. Hypothetical results are calculated in hindsight, invariably show positive performance, and are subject to various modeling assumptions, statistical variances and interpretational differences. No representations are made as to the reasonableness of the assumptions used and any change in these assumptions would have a material impact on the hypothetical performance results portrayed. Hypothetical results have other limitations including: they do not reflect actual trading and therefore reflect the impact that actual market conditions may have had on the investment manager’s decision making process; regulatory or tax rules that may have existed during the periods modeled; and it also does not take into account an investor’s ability to withstand losses in a down market and assumes the strategy was continuously invested throughout the periods modeled. There is no guarantee that any actual product or strategy that followed any of the hypothetical portfolios modeled herein would have had similar performance. A decision to invest in an investment strategy should not be based off of hypothetical or simulated performance results.

4 Neither MetLife Investment Management nor any of its employees provide tax or legal advice and all investors should consult with their own tax or legal professionals to evaluate their individual circumstances.

5 Assumes a year one stabilized cap rate of 4.0%, improvement value equal to 70% of purchase price, a standard corporate tax rate of 21%, no capital expenditures in the first year, and a depreciable life of 27. 5 years calculated on a straight-line basis. The corporate tax rate could change as the result of new tax legislation, which could also change the value of the hypothetical depreciation benefits.

6 National Council of Real Estate Investment Fiduciaries.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such). About MetLife Investment Management MetLife Investment Management (MIM)1 serves institutional investors around the world by combining a client-centric approach with deep and long-established asset class expertise. Focused on managing Public Fixed Income, Private Credit and Real Estate assets, we aim to deliver strong, risk-adjusted returns by building sustainable, tailored portfolio solutions. We listen first, strategize second, and collaborate constantly to meet clients’ long-term investment objectives. Leveraging the broader resources and 150-year history of MetLife provides us with deep expertise in skillfully navigating markets. We are institutional, but far from typical. For more information, visit: investments.metlife.com © 2022 MetLife Services and Solutions, LLC

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited