The cold storage sector was viewed as a non-institutional property type for most of the last century, but that view has changed in the last 15 years. Institutional capital began to gravitate toward the sector in a meaningful way beginning in the early 2010s, and that process has accelerated in recent years. Since 2015, cold storage transactions accounted for only 0.4% of total commercial real estate investment activity in dollar terms. Though a small percentage, 0.4% represents nearly $21 billion in investment activity during the period.1 The share of institutional investors taking part in these sales has increased, particularly over the last five to eight years.

Institutional interest in cold storage will be aided by the introduction of the National Council of Real Estate Investment Fiduciaries (NCREIF) Expanded NCREIF Property Index (NPI). This index has made it easier for institutions to track the performance of the cold storage sector. NCREIF revised their definitions for certain property types and specifications, including for cold storage, for inclusion in core funds. We believe these changes will help accelerate capital flows into cold storage in 2025 and beyond.

Modern cold storage facilities are more expensive to build than traditional dry-flex industrial warehousing, and this cost differential has led to hesitancy toward the sector from new institutional investors. Higher development costs are from specialized freezer and refrigeration systems, insulation, heated flooring and other, similar building improvements that ensure a warehouse will safely and efficiently store perishable items over the building’s economic life. Additional features such as high ceiling heights, custom racking systems, blast freezers and automation can be added depending on the intended use. These additions will push costs even higher.

At these high development costs relative to traditional warehousing, investors often worry about capital expenditures during investment hold periods. Cold storage facilities are expensive to build but typically require minimal maintenance capital expenditure (capex) after delivery. For example, refrigeration systems are a large cost but typically have useful lives of 20 to 25 years. Advancements in refrigeration technology mean that these systems can operate more efficiently and at lower cost than older systems. When investing in older facilities, however, maintenance capex can be material and should be a focal point in underwriting.

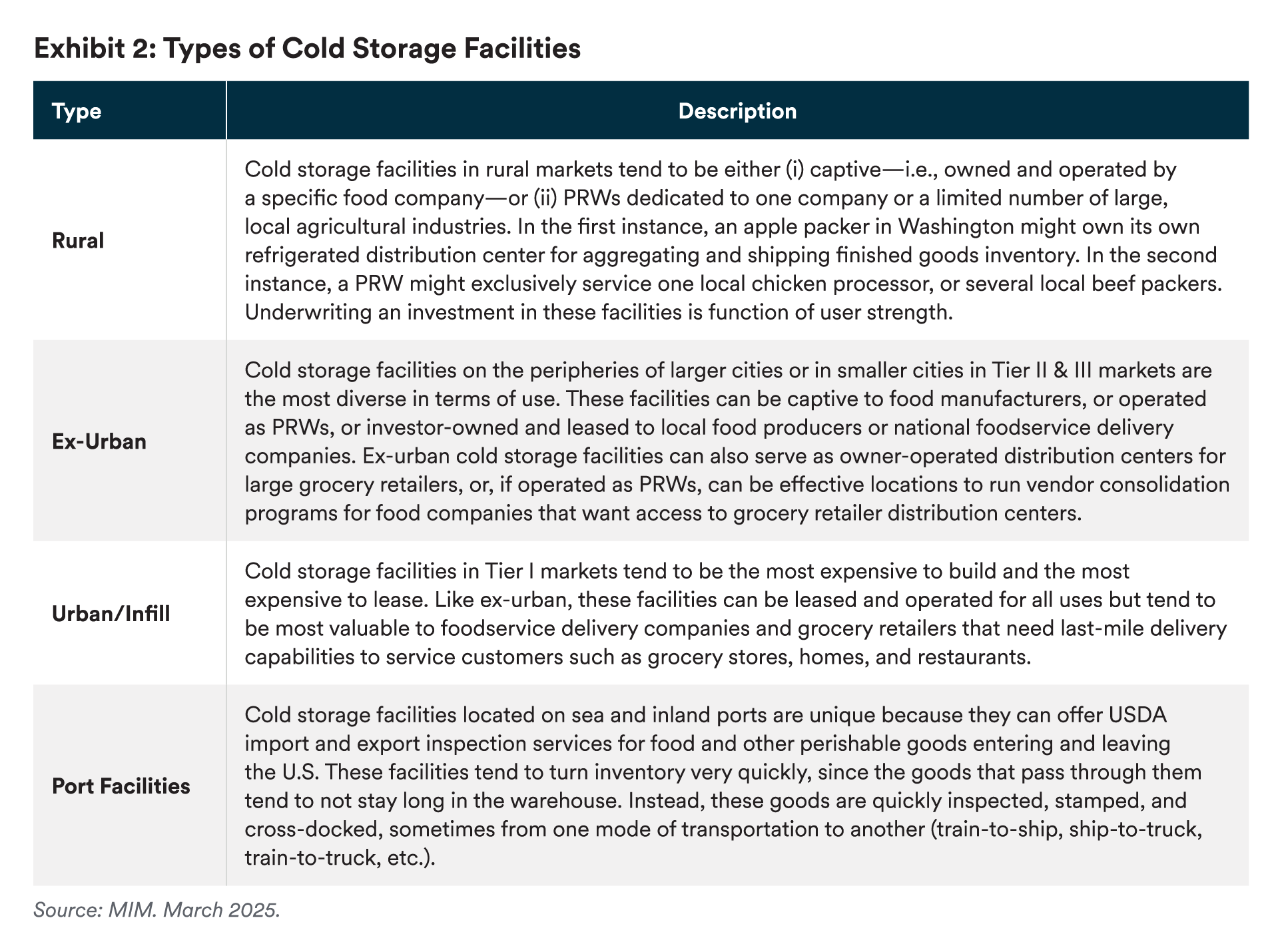

In cold storage, food producers frequently outsource their perishable inventory storage to third parties. These third parties are called public refrigerated warehouses (PRWs). PRWs store food and other perishable goods for one or more customers. The most common way to structure the relationship between a PRW and its customers is through Warehouse Management Agreements (WMAs), which are business services agreements that are not appurtenant to real property, unlike a lease. The typical length of a WMA is one month to three years, although some are longer. WMAs dictate handling and storage fees, as well as expectations around inventory turn times and other key performance indicators (KPIs).

The agricultural sector has been consolidating for a century, continuing to today. To maintain their competitive position on the global stage, American farmers have been relentlessly pursuing efficiency, farming more land and leveraging technological innovations to squeeze as much output as possible from as few inputs as feasible. Between 2017 and 2022, the average farm size grew 5% while the number of farms declined by 7%.2 We expect consolidation in the agricultural sector to continue. These larger farming operations will drive continued demand for cold storage facilities with modern features in rural areas. For example, poultry farms want cold storage facilities with blast freezers to freeze chicken as quickly as possible.

There’s also consolidation in mid- to large-size food companies. As these companies combine, there is a need to accommodate higher volumes and a wider variety of products. Newly consolidated firms will seek to centralize cold storage distribution, replacing a network of small facilities with a large regional cold storage warehouse. A centralized warehouse allows for savings on logistics and transportation costs. Automation in these facilities also leads to savings in labor costs. Over the coming year, it is expected that M&A activity in the food and beverage sector will increase.3 This will boost demand for large, modern cold storage facilities.

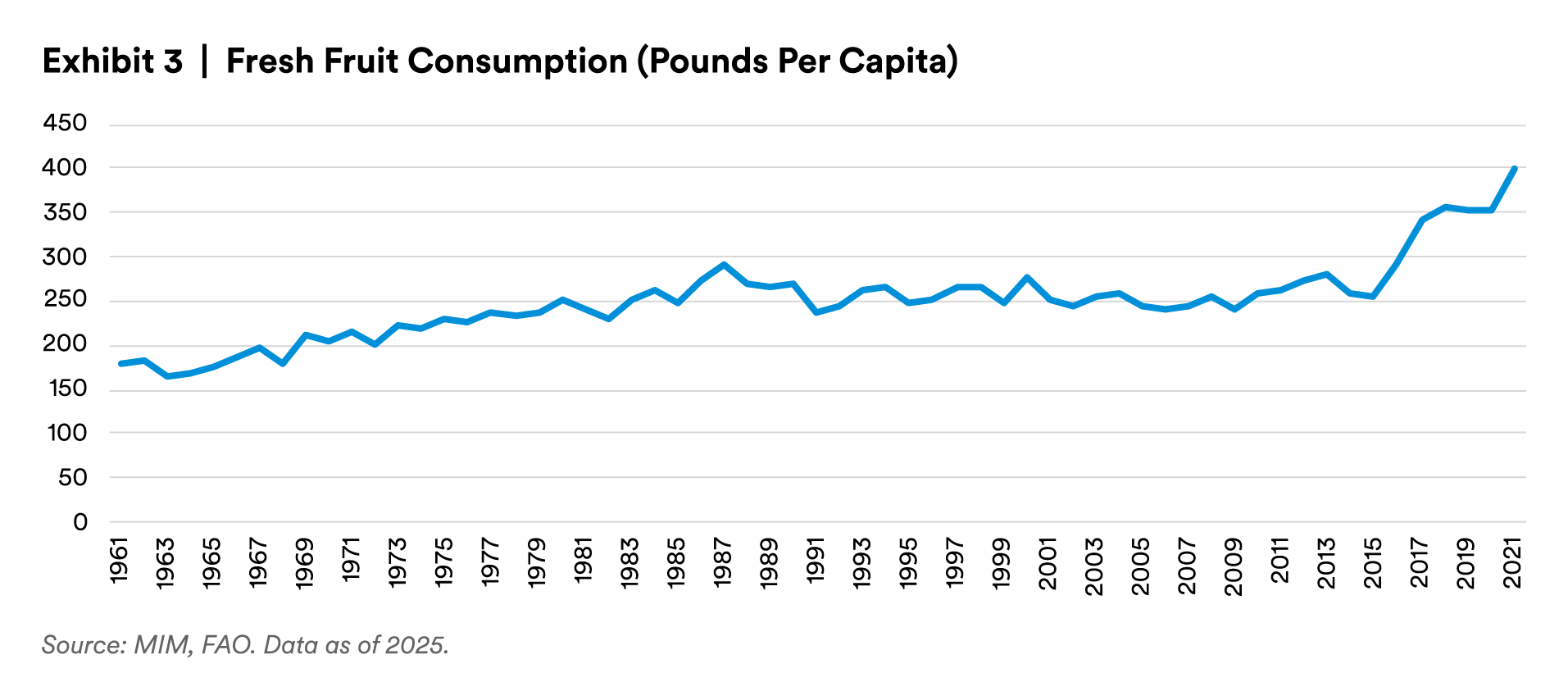

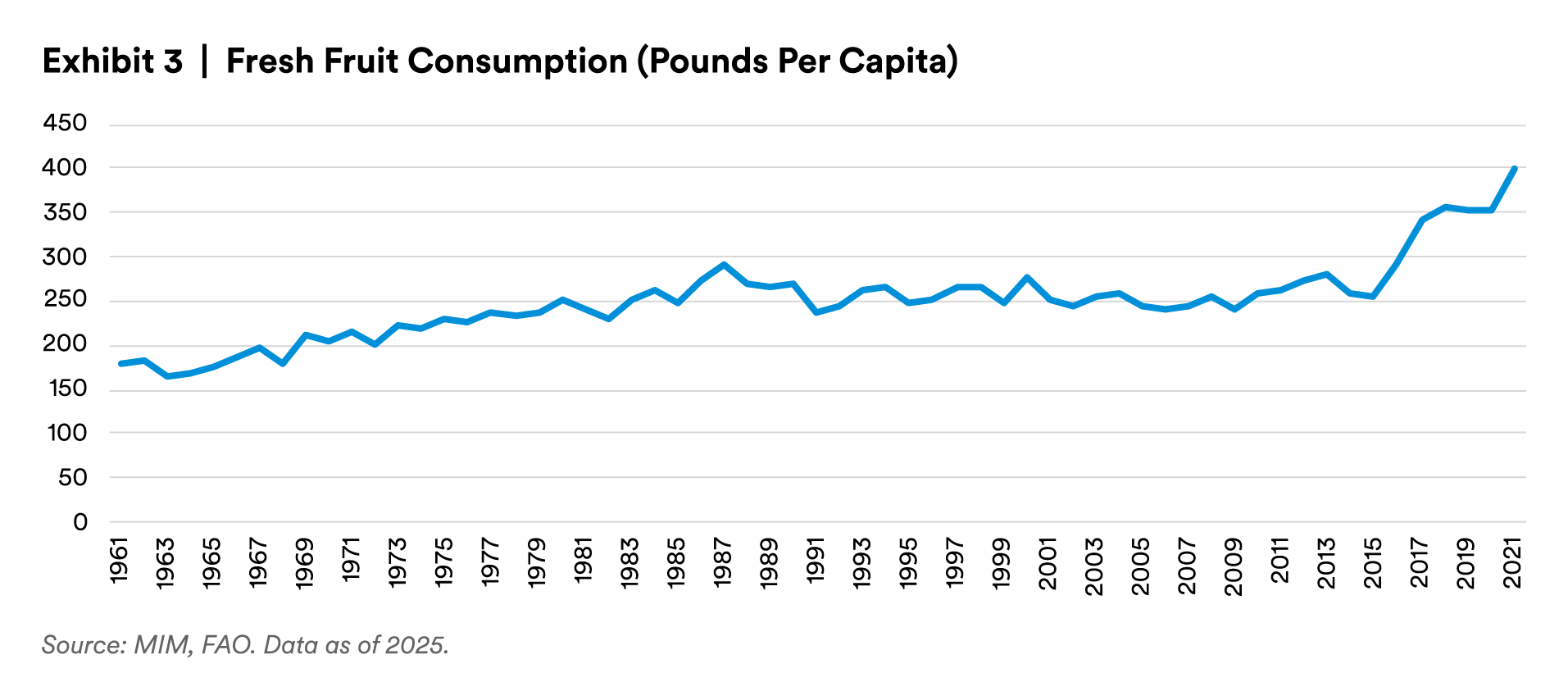

There is a longstanding trend of consumer preferences shifting away from basic ingredients and whole foods toward ultra-processed foods and ready meals.4 In an increasingly fast-paced world, consumers have less time to cook and are purchasing pre-packaged meals and meal kits that require less effort. Many of these increasingly popular ready meals require refrigeration, which will drive cold storage demand. Simultaneously, other consumer segments are becoming increasingly conscious of the nutritional value and health benefits of their foods. Per capita consumption of fresh fruit has increased rapidly over the last several decades (Exhibit 3), and MIM expects this trend to continue. An increasing quantity of fresh fruits and vegetables will require the replacement and expansion of current cold storage capacity.

In addition to changing preferences regarding what they eat, consumers are changing how they get their food. The rise of e-grocery has been driven by increasing demand for e-commerce in general, and e-grocery is expected to become the flagship growth segment of all online shopping by 2030. E-grocery saw a rapid increase in popularity during the COVID-19 pandemic. While at the time, e-grocery delivery was expected to remain popular, e-grocery pickup has become the dominant e-grocery service. Changing the way that consumers shop for something as intimate as their food is a tall order, and it takes time for consumers to overcome their hesitancy. Since time savings is a leading reason for consumers to adopt e-grocery, we expect that e-grocery,5 delivery will become increasingly popular over the next decade. Generations Z and Alpha are already more likely to use e-grocery and delivery services,6,7 and in the next decade we expect that these generations will lead a cultural shift that will have widespread implications for the grocery supply chain and the cold storage industry.

Most e-grocery services currently offered by major retailers are fulfilled by individual employees browsing the aisles of a supermarket, selecting items, bagging items and bringing them to a curbside pickup by the end-customer or a delivery service. The current practice of retailers paying employees to stock shelves and then paying different employees to pick items is inefficient. MIM expects the logistics of e-grocery to fundamentally change over the next 10 years. As e-grocery demand continues to expand, we expect retailers to centralize and streamline their e-grocery picking and delivery processes. Conventional grocery retailers are expected to incorporate the same logistical and technological efficiencies as online retailers, move away from using their existing supermarket spaces to service e-grocery and toward more centralized and automated distribution centers that incorporate cold storage.

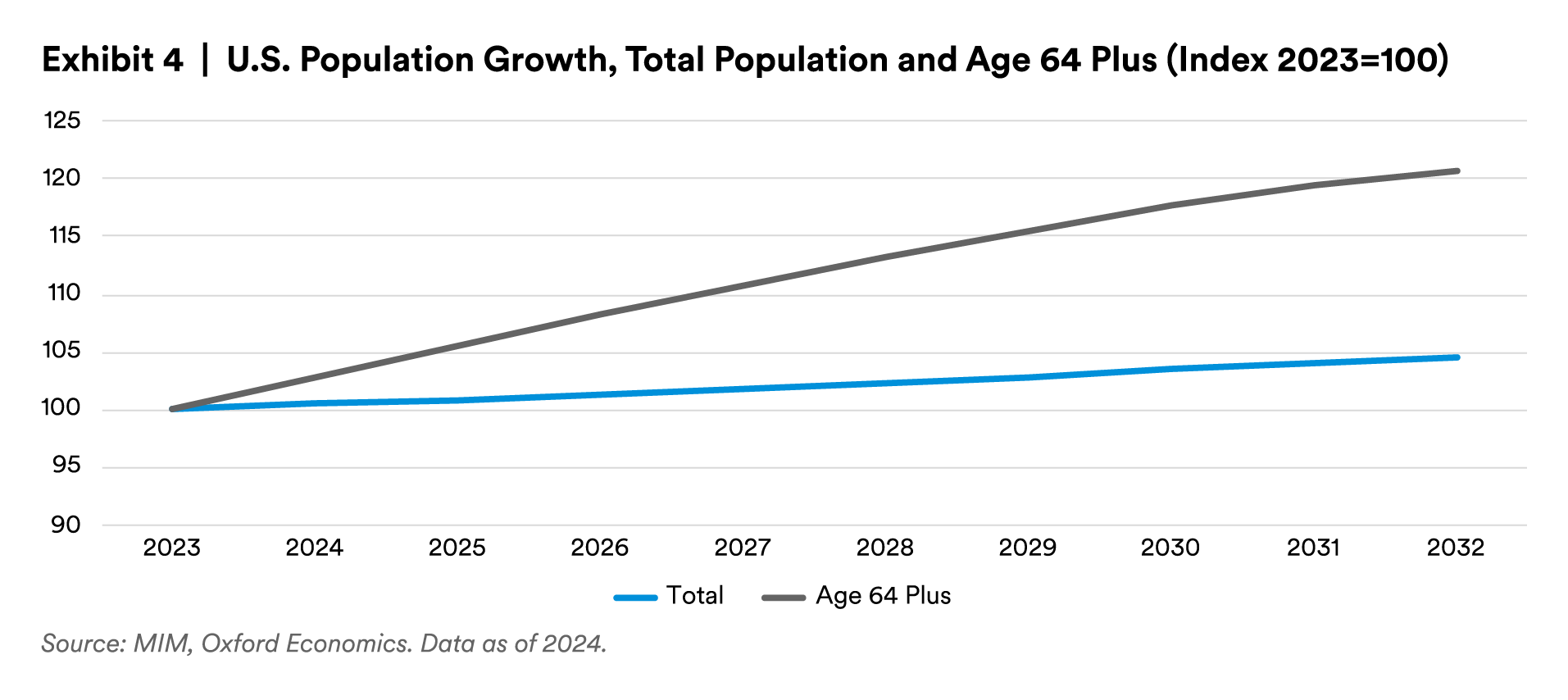

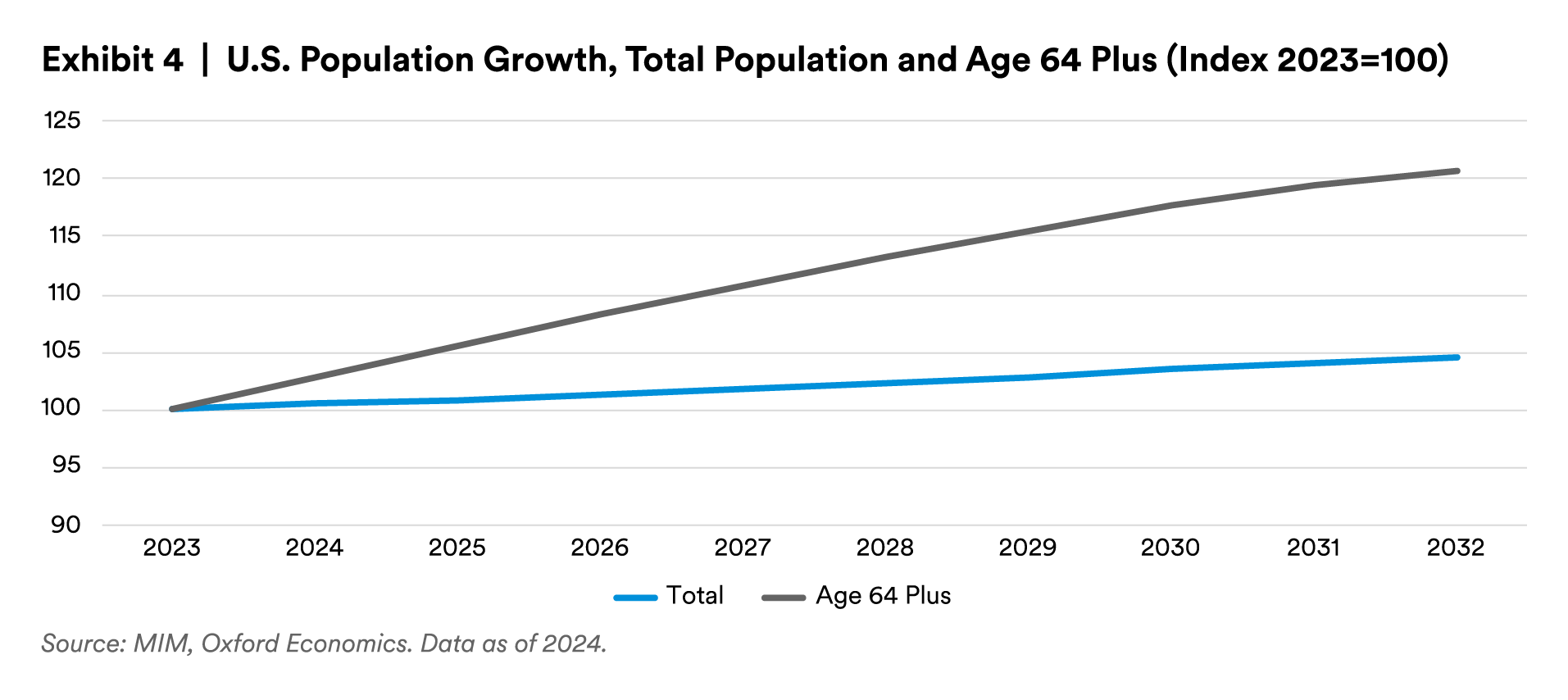

The pharmaceutical industry will be a more immediate driver of cold storage demand due to an aging population in the U.S. and the increasing development and use of new medicines that require cold storage. By 2032, the U.S. population aged 64 and over is expected to grow by 21% (Exhibit 4), leading to higher demand for medications and vaccines. Many medications and vaccines require cold storage for shelf life. As demand for these drugs increases, cold storage will be crucial for their storage and distribution.

Compounding the growth in the pharmaceutical industry to accommodate an aging population, pharmaceutical drugs increasingly require cold storage throughout the logistical chain to ensure their efficacy. Over the next five years, about 50% of new medicines will require cold storage, compared to just 37% of new medicines that were launched from 2013 to 2017.8 The introduction of these new medicines, which must be kept at lower temperatures, will increase the need for cold storage facilities.

Third party logistics companies are already making expansion plans to accommodate rising pharmaceutical demand for cold storage. UPS is looking to achieve $20 billion in annual healthcare revenue by 2026, which is double its 2023 level.9 DHL also launched a cold chain service to support companies like Siemens and Eli Lilly.10 The continuing build-out of cold chain services to support pharmaceutical companies will be a driver of cold storage demand over the next five to 10 years.

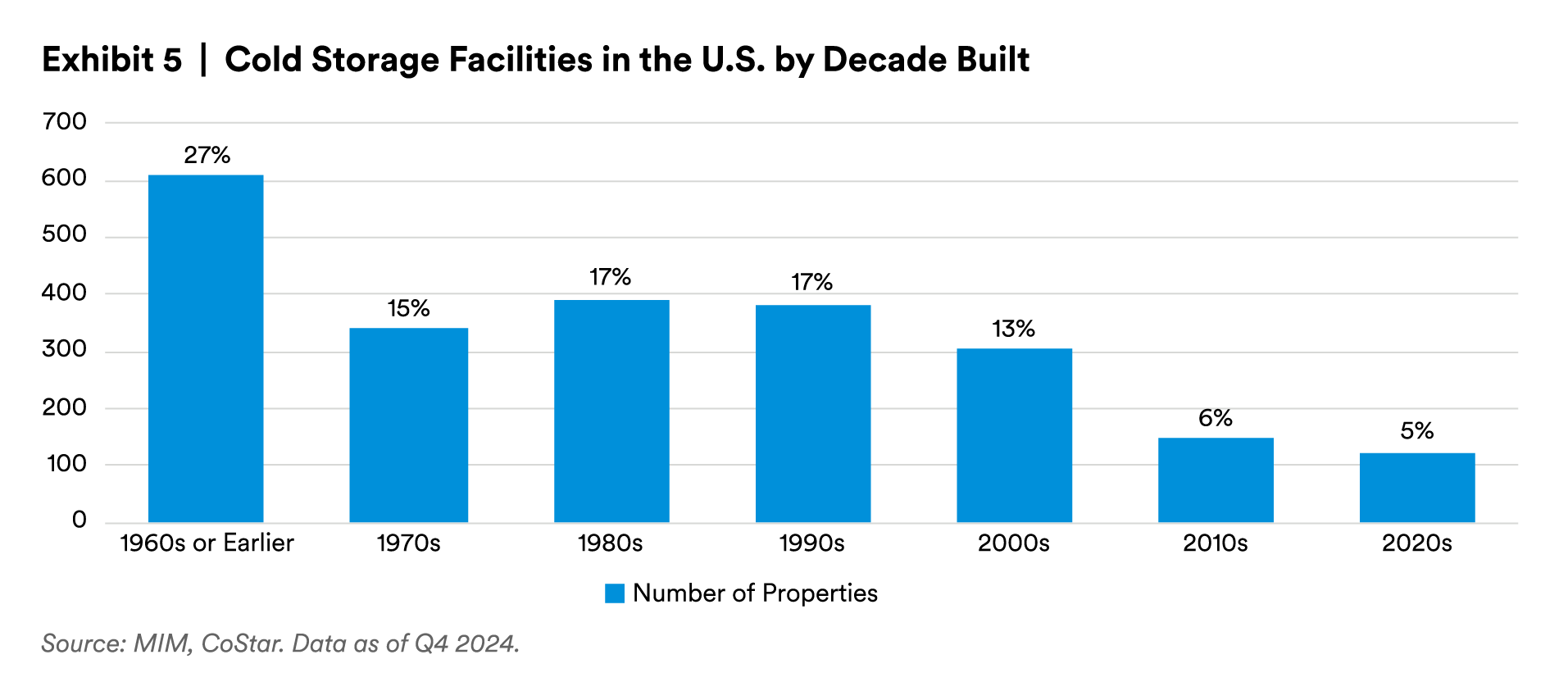

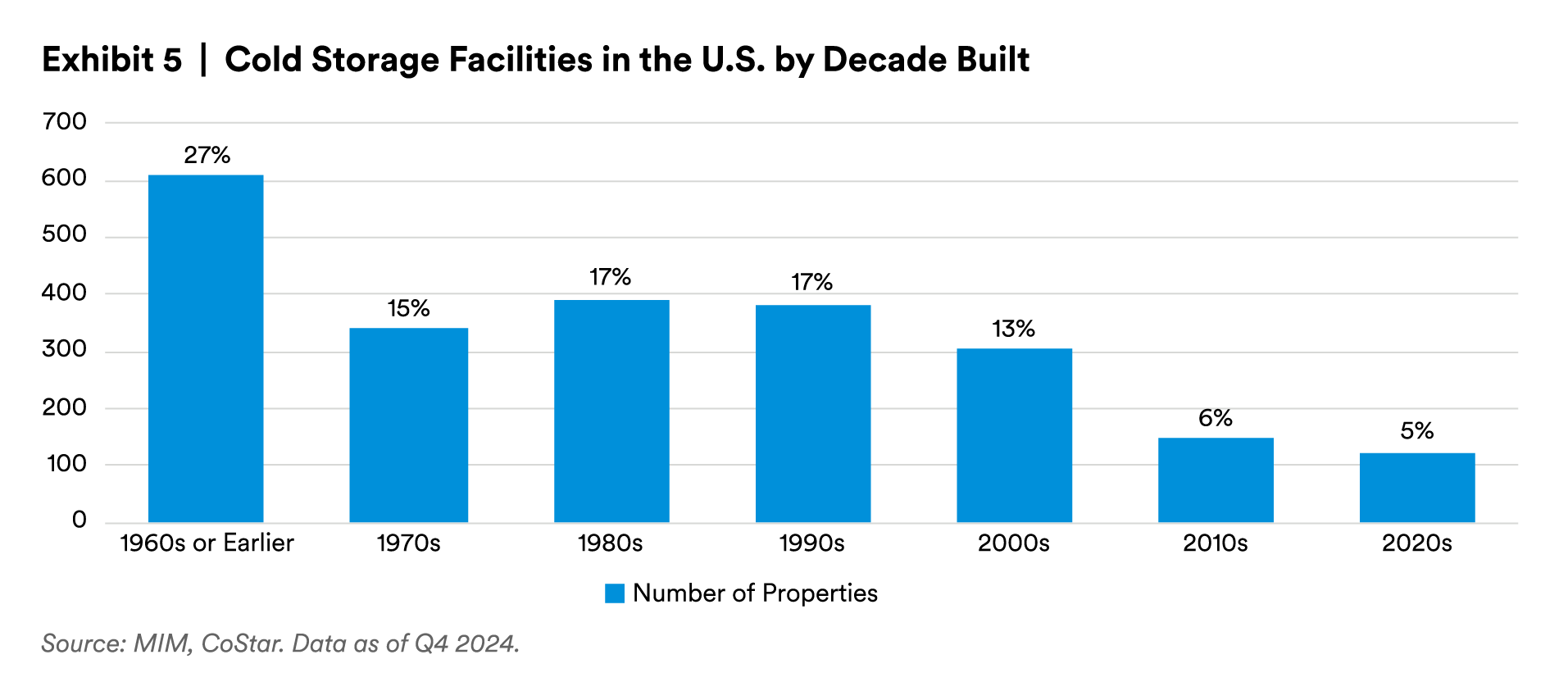

The emerging demand trends for cold storage discussed above will put a premium on space that is newly built. About 75% of all cold storage facilities in the U.S. are more than 25 years old (Exhibit 5), making the sector ripe for consolidation, modernization and new investment.

Warehouse management software in newer facilities can integrate automation, robotics and analytics to enhance efficiency, reduce operational expense and improve food safety protocols. Food companies, PRW providers, foodservice distributors and other players in the cold chain are increasingly leveraging GPS-enabled trucks, fully autonomous Automated Storage and Retrieval Systems (ASRS), advanced temperature and airflow monitoring systems, and other cutting-edge technology.

Older cold storage facilities have features such as wooden roofs and lower-quality insulation, whereas modern facilities benefit from advanced designs and materials that reduce energy use and thus operational costs.11 Lower operational costs make modern cold storage facilities more attractive to prospective tenants and users. Over time, older and less energy efficient cold storage space will become functionally obsolete.

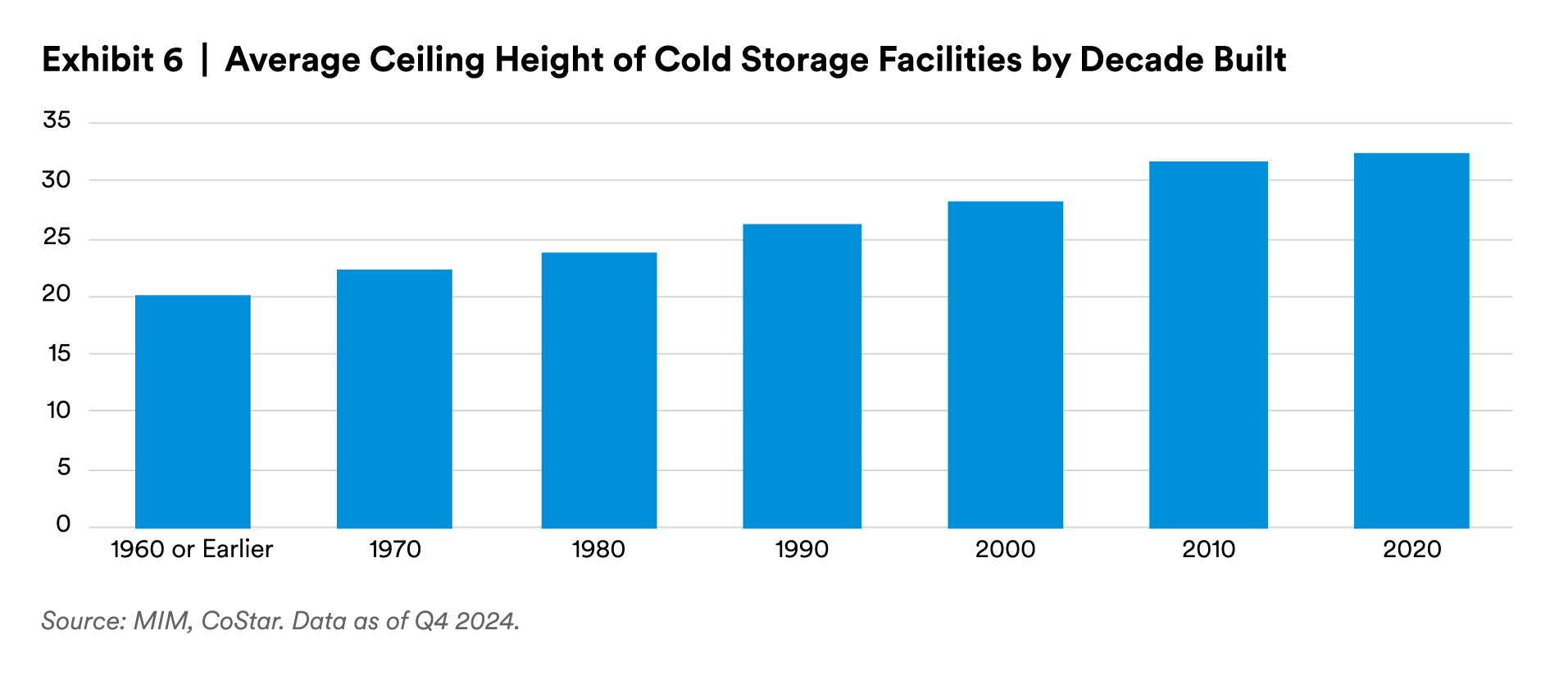

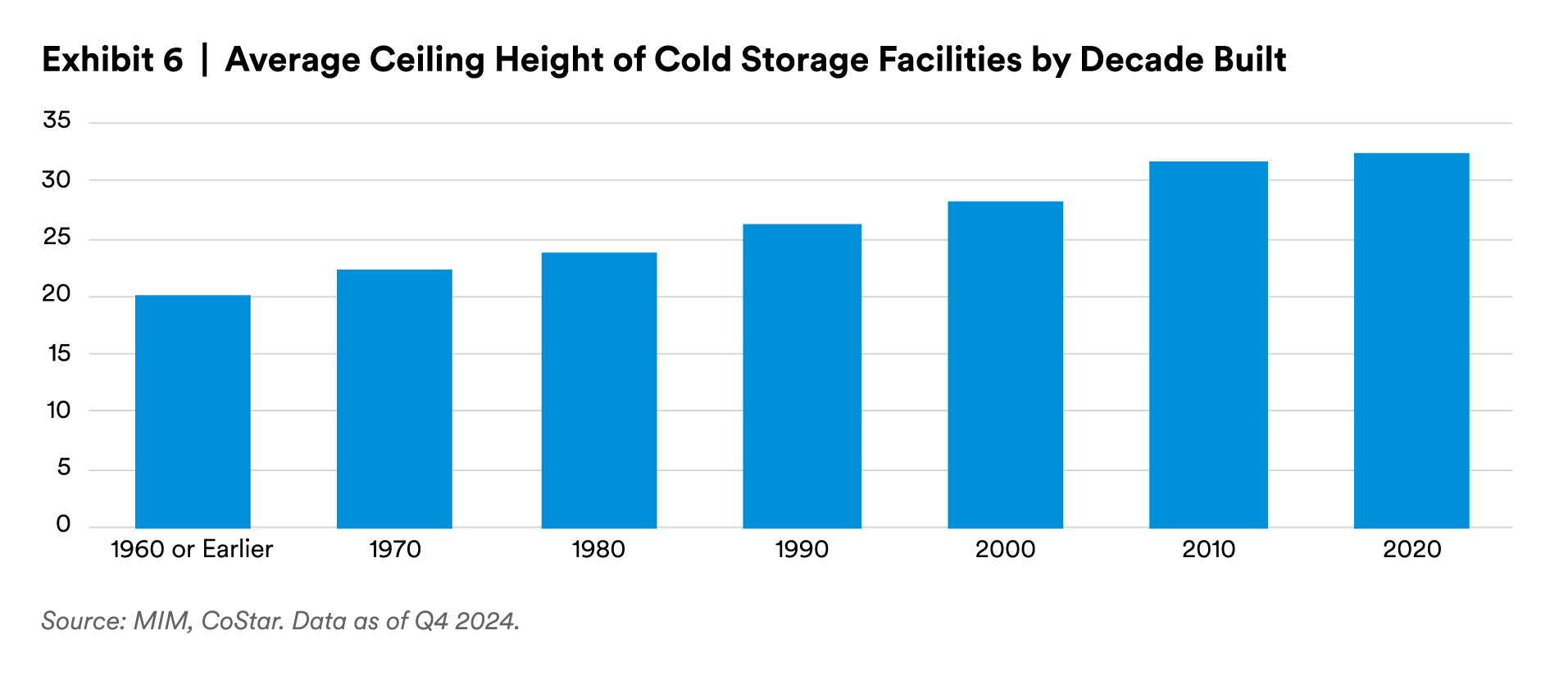

Warehouse ceiling height is also a major driver of efficiency in cold storage facilities. Facilities built before 1990 have an average ceiling height below 25 feet; facilities built since 2010, meanwhile, have an average ceiling height of over 31 feet (Exhibit 6). In the latest, most modern facilities, clear height typically exceeds 50 feet, with some highly automated ASRS facilities reaching clear heights of over 130 feet. Building higher on the same footprint means more volume in which to store pallets and a lower build-cost-per-pallet position. When large, modern warehouses are configured with the right types of racking to service the customers that need the space, these facilities can offer lower storage and handling fees, faster turn times, and improved service levels versus older facilities.

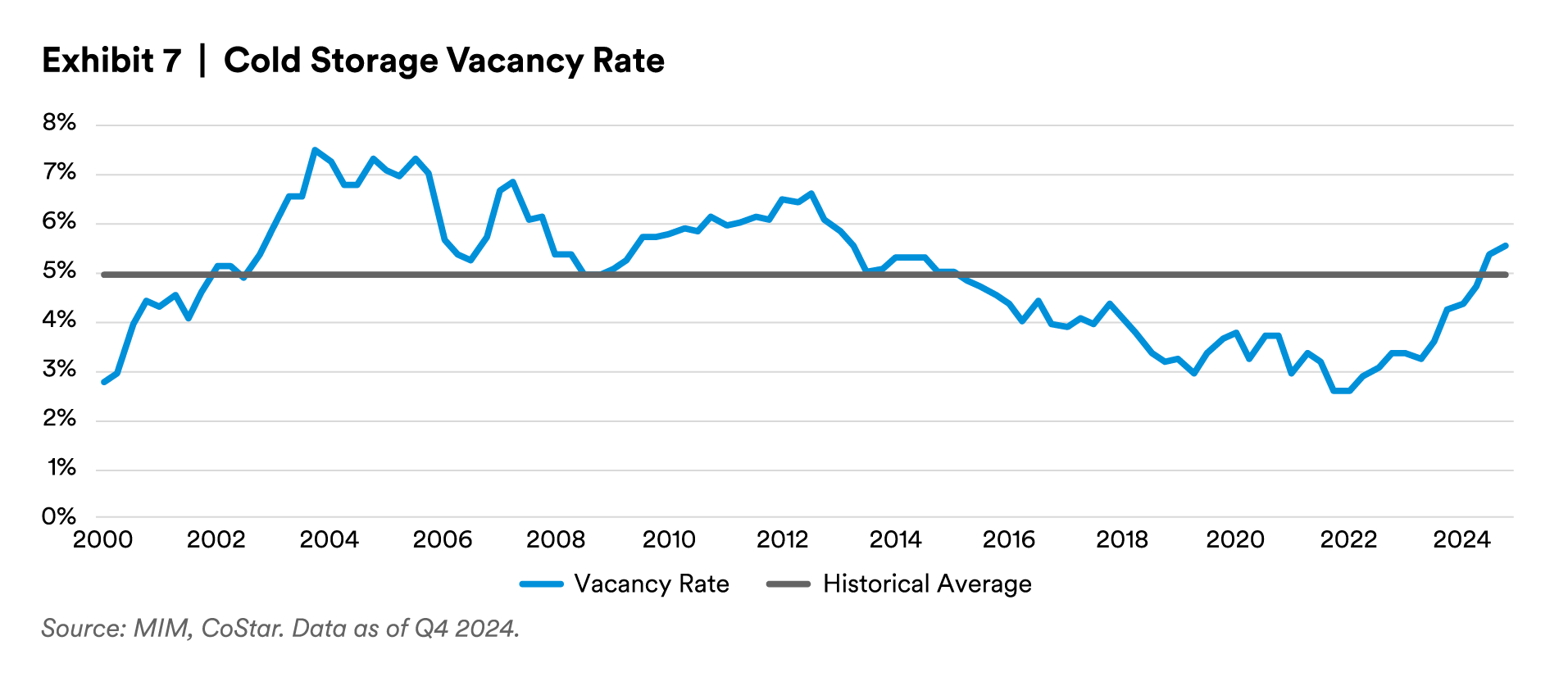

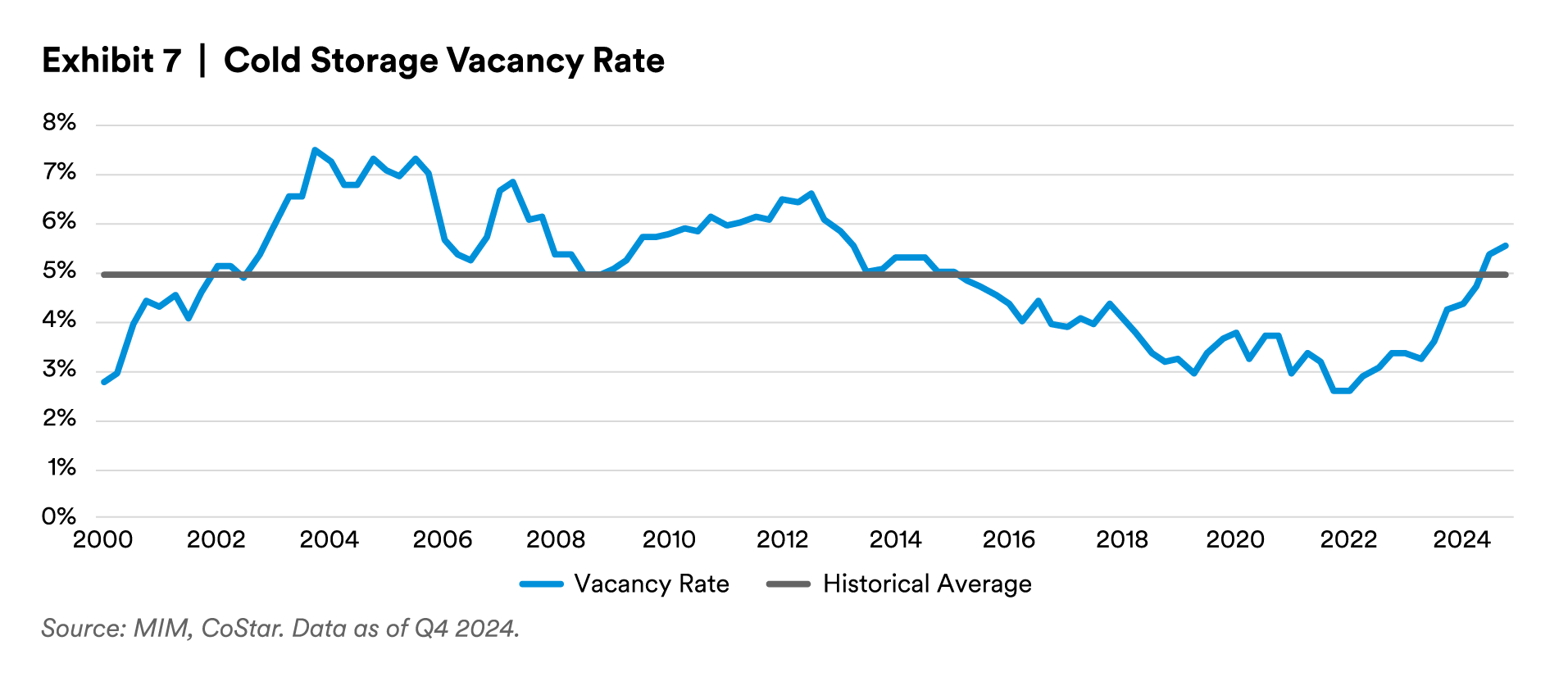

Cold storage vacancy rates have been increasing over the past two years. In the first quarter of 2022, vacancy rates hit a low of 2.6% but have since risen to 5.3% (Exhibit 7). This puts the vacancy rate just above the long-term average. New supply coming onto the market has been the driver of increasing cold storage vacancy, causing a headwind for the sector over the near term.

Upward pressure on vacancy will continue over the next year. There are still elevated levels of cold storage space under construction, which will come onto the market later in 2025 and early 2026. Construction starts are low, however, and as new deliveries slow, we expect vacancy to peak in 2026. Some of the markets with more supply pressures include Dallas, Chicago and Jacksonville.

Demand for newer cold storage facilities has caused rents to increase despite being in a period of rising vacancy. Cold storage asking rents grew at about 6% year-over-year in Q4 2023. At the end of 2024, rent growth fell to around 2%. Our expectation is that annual rent growth will slow to a range of 1% to 2% in 2025 before increasing to around 4% in 2026.

In the short term, we expect pharmaceuticals to be a key growth driver in the cold storage sector. Additional modern cold storage capacity will need to be supplied to match the immediate growth targets of logistics suppliers such as UPS Health. An aging U.S. population, combined with new medicines that require refrigeration, means that the growth in demand from pharmaceuticals will be enduring.

In the long term, we expect the farming and food sectors will continue to consolidate and move out of smaller, older cold storage facilities and into larger, newer ones. We also expect that consumer acceptance and adoption of e-grocery delivery services will increase over the long term as well, and grocery supply chains will move toward dedicated e-grocery delivery fulfillment centers, including cold storage facilities, in the pursuit of efficiencies.

Endnotes

1 MSCI Real Assets

2 2022 Census of Agriculture: Number of U.S. farms falls below 2 million | Economic Research Service

3 FoodDive: Food and beverage M&A activity appears to be picking up

4 Americans Are Eating More Ultra-Processed Foods

5 Who Shops for Groceries Online? | Economic Research Service

6 Specialty Food News | Specialty Food Association

7 Age-Specific Differences in Online Grocery Shopping Behaviors and Attitudes among Adults with Low Income in the United States in 2021 - PMC

8 IQVIA. https://www.iqvia.com/-/media/library/scientific-posters/fip-global-outlook-poster-vertical-orientation_final.pdf

9 Supply Chain Dive. Inside UPS’ push to double its healthcare logistics business | Supply Chain Dive

10 Supply Chain Dive. Why Siemens, Eli Lilly opted to use DHL’s new cold chain service | Supply Chain Dive

11 Coherent Market Insights. https://www.coherentmarketinsights.com/industry-reports/us-cold-storage-market

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For Investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.