Introduction

As corporations across the United States make carbon-neutral or net-zero commitments and adopt clean energy strategies, real estate owners, developers and investors are tracking the impacts of a “greening” energy grid. In this paper, we explore the layers of interconnection between a greener grid and renewable resources, and how the challenges and opportunities associated with greening the grid may influence asset managers’ decarbonization strategies. As we outline some of the strengths, weaknesses, opportunities and risks at play—and track their potential implications—we seek to paint the landscape of this transition and identify emerging trends.

As we walk through this landscape, it is important to define a few concepts and terms:

| Greening the grid |

Greening the grid is a term meant to reflect the gradual influx of renewables to the U.S. electricity market.1 “Green power” describes energy generated from sustainable resources including solar, wind, geothermal, biogas, eligible biomass and low-impact hydroelectric sources.2 It is recognized as the opposite of “brown power” generated from fossil fuels and other high-emitting exhaustible resources. |

| Scope 1 emissions |

Scope 1 emissions are direct greenhouse gas (GHG) emissions that occur from sources controlled or owned by an organization, such as the fuel combustion of boilers and furnaces at a building. |

| Scope 2 emissions |

Scope 2 emissions are indirect GHG emissions associated with the purchase of electricity, steam, heating or cooling.3 They are the emissions from purchased energy used to run a business’ operations. |

| Scope 3 emissions |

Scope 3 emissions are indirect GHG emissions associated with activities from assets not owned or controlled by the reporting organization.4 In the case of real estate, this includes GHG emissions generated from tenant activities. |

| Renewable energy certificates (RECs) |

Renewable Energy Certificates (RECs) are often used by organizations to address indirect GHG emissions associated with purchased electricity. RECs are issued when one megawatt-hour (MWh) of electricity is generated and delivered to the electricity grid from a renewable energy resource.5 Tracking RECs is an essential strategy in the market-based method of measuring Scope 2 emissions. RECs are a type of Energy Attribute Credit (EAC). |

| Location vs. market- based emissions |

Location-based emissions accounting is a method of calculating Scope 2 emissions to reflect the average emissions intensity of grids on which energy consumption occurs.6 The emissions intensity of an asset is in part dictated by its geographical location and the grid’s power source. As we green the grid, locationbased emissions will naturally decrease.

Market-based emissions accounting is a method for measuring Scope 2 emissions and “reflects emissions from electricity that companies have purposefully chosen.”7 This method calculates emissions factors from contractual instruments, which can include Power Purchase Agreements (PPAs) and RECs. Market-based emissions accounting can indicate demand for renewable energy and drive supply through accepted accounting standards and reporting frameworks such as the Sustainability Accounting Standards Board (SASB) or the Partnership for Carbon Accounting Financials (PCAF).

An organization generally uses both methods to calculate emissions in order to consider geographic (location-based) and energy procurement (market-based) factors simultaneously. For example, an office property in New York City may purchase RECs as part of the property’s sustainability initiatives. Its locationbased emissions accounting in this case would still reflect the consumption of the actual energy mix that the property is consuming from the grid, and it would not change with the purchase of RECs. The property’s market-based emissions will be lowered by the RECs purchased for that property

|

| Decarbonization |

Decarbonization goes hand-in-hand with net-zero commitments and carbon neutrality, and all three have a focus on reducing emissions and environmental impacts. In a white paper published by MIM in November 2021, we reflected on the role real estate plays in its approach to carbon neutrality. In this paper, we address the impacts of a greening grid on decarbonization strategies. |

| Net energy metering |

Net energy metering (NEM), or net metering, is a metering and billing arrangement designed to compensate distributed energy generation system owners for any generation that is exported to the utility grid.8 Simply put, it is a way to compensate an organization that generates more electricity than what is consumed onsite. |

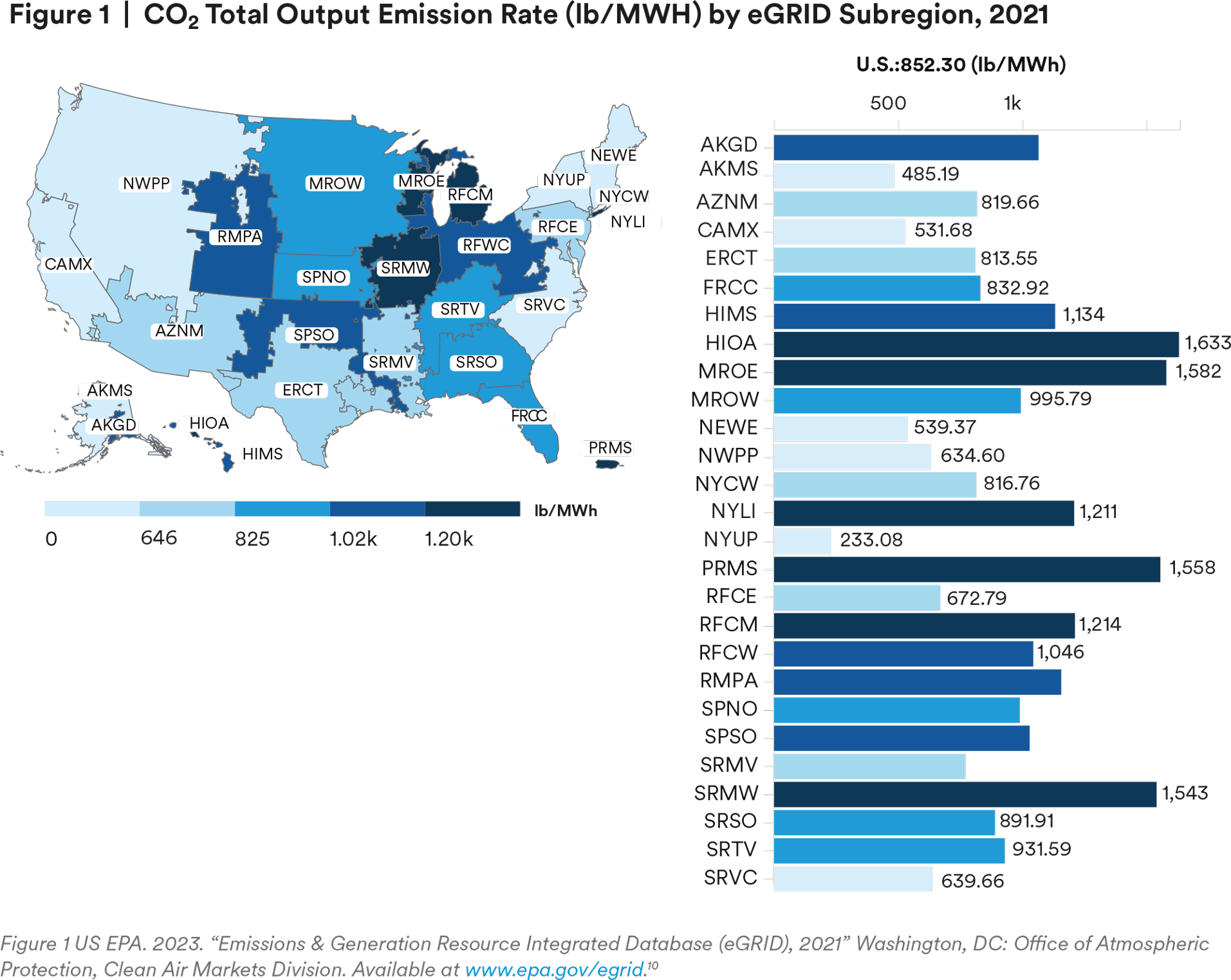

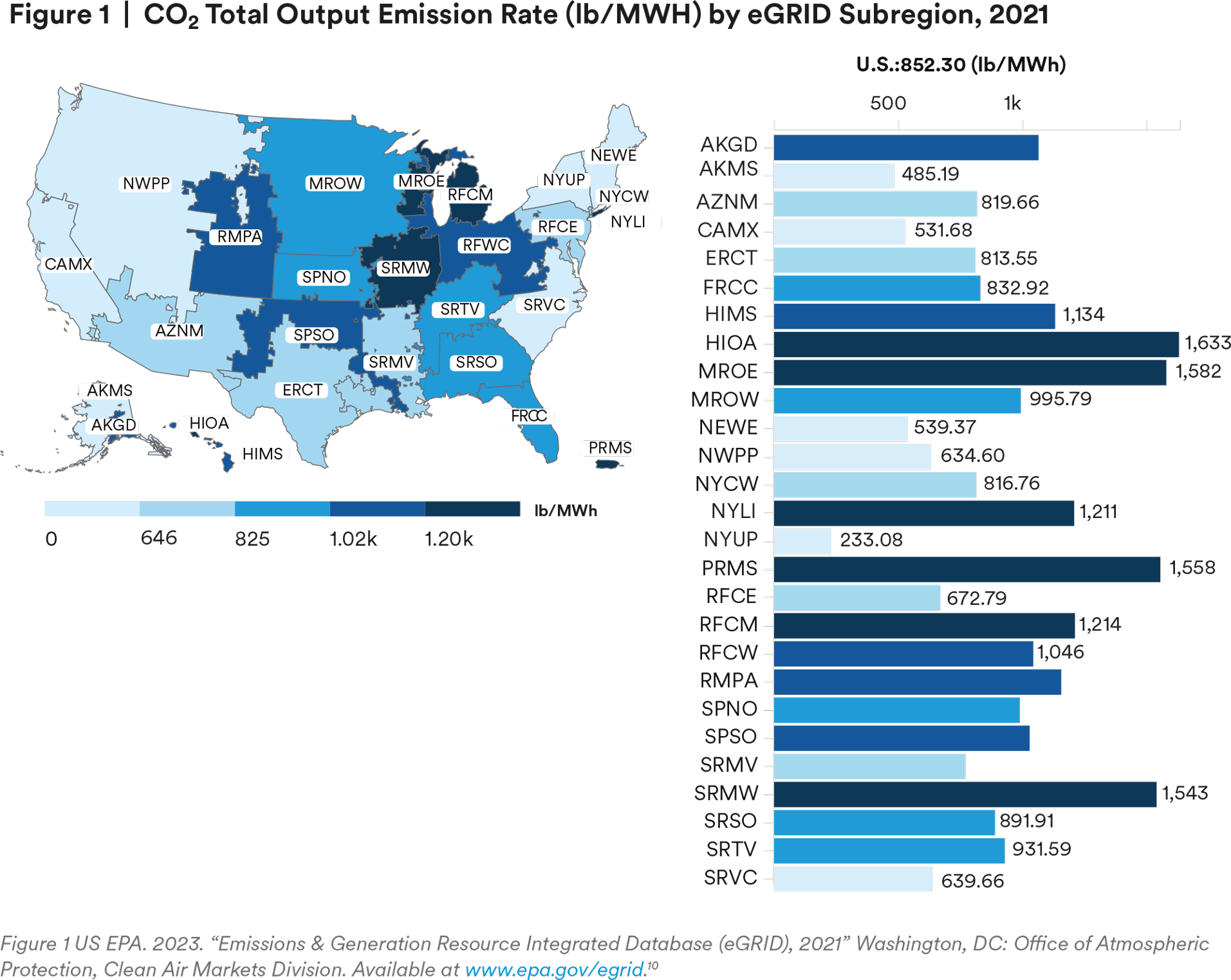

| eGRID |

The Environmental Protection Agency (EPA) maintains the Emissions & Generation Resource Integrated Database (eGRID), a comprehensive inventory of environmental attributes of electric power systems.9 This is the primary source of air emission data for electric power and is based on plant-specific data for all U.S. electricity generating plants that generate at least 1MW of power. This database is commonly used to perform calculations for GHG inventories. The figure below shows some of the data available through eGRID, and how it is measured by specific regions of electric energy production across the country. |

Decarbonization Strategies on a Greening Grid

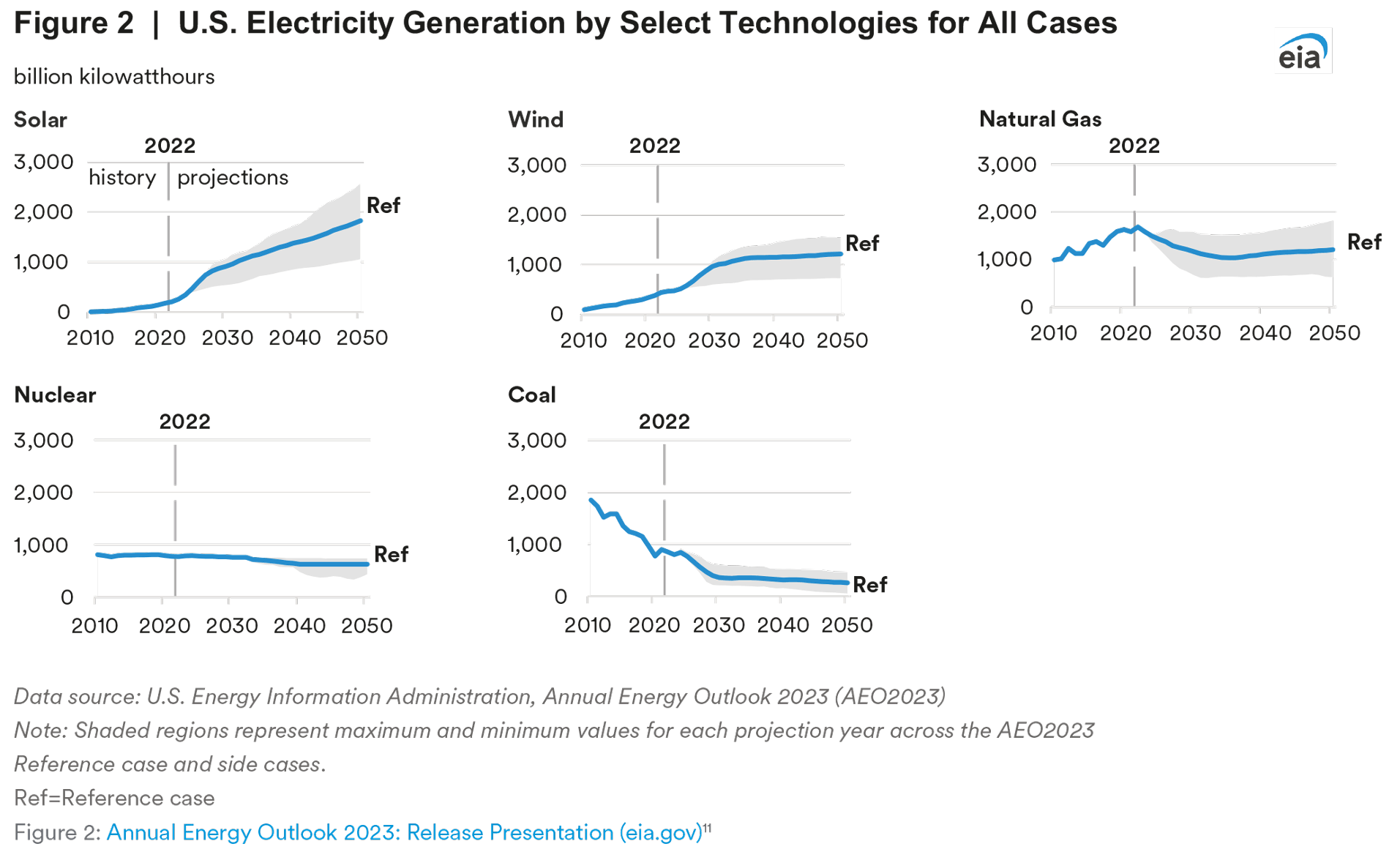

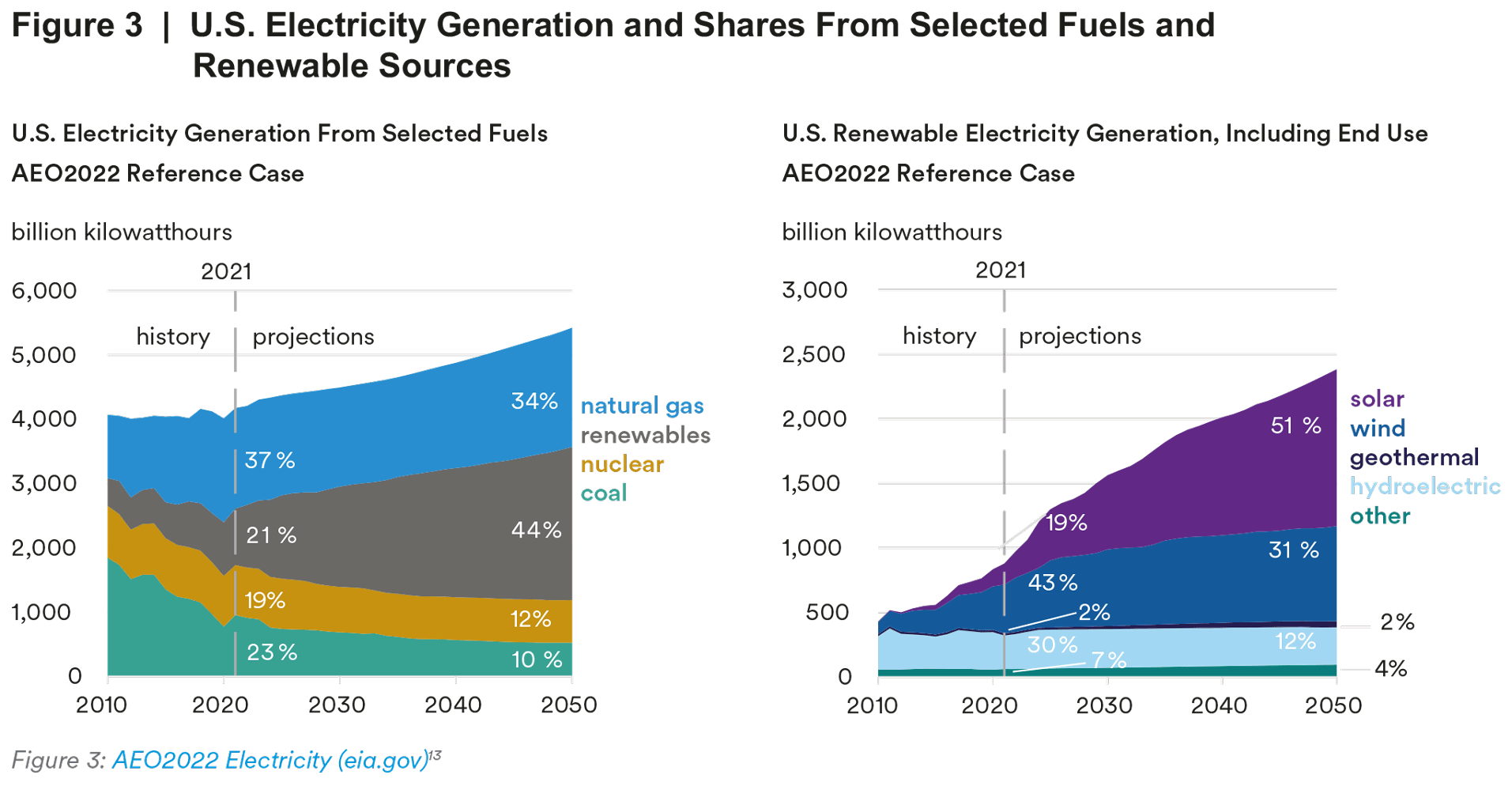

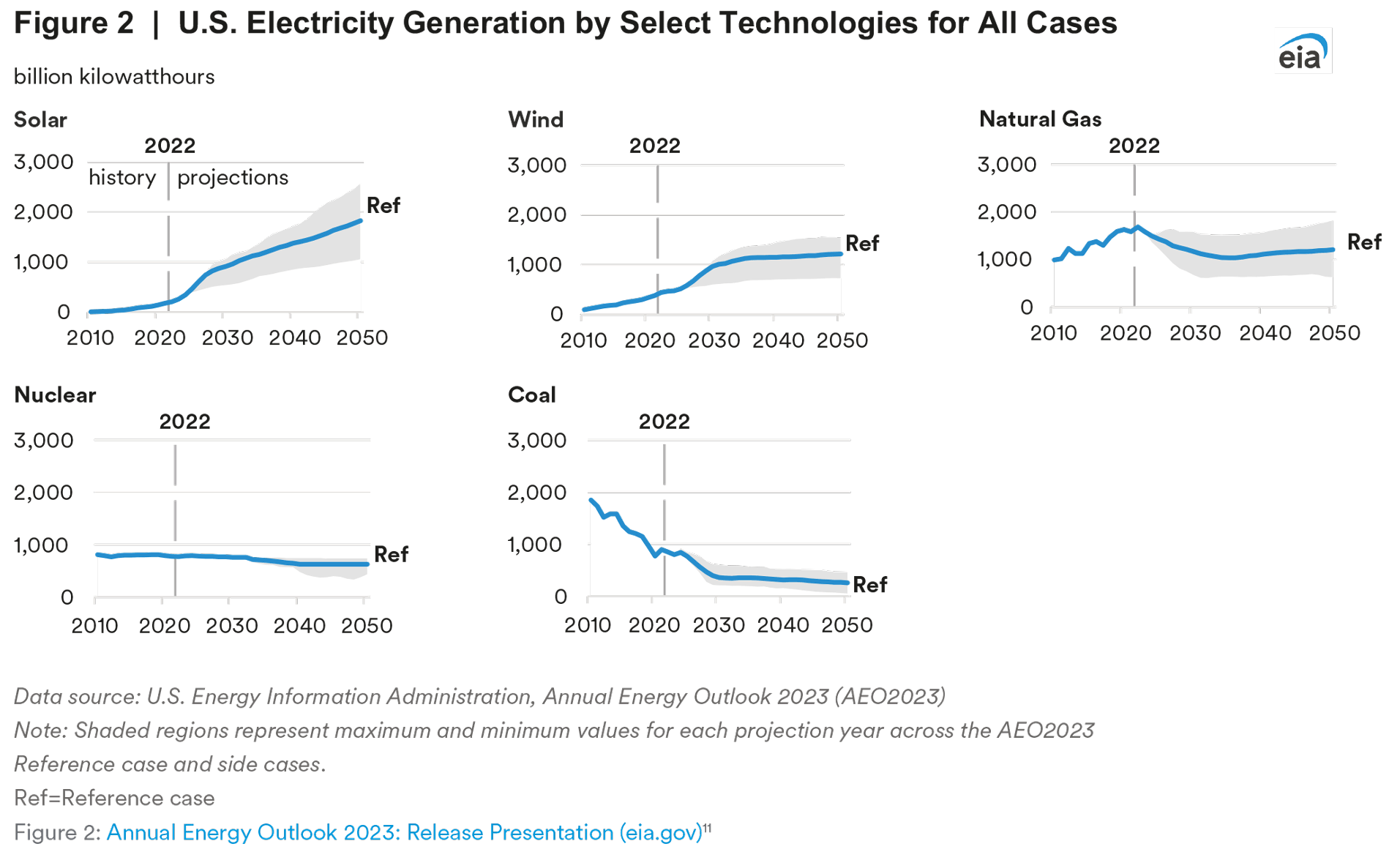

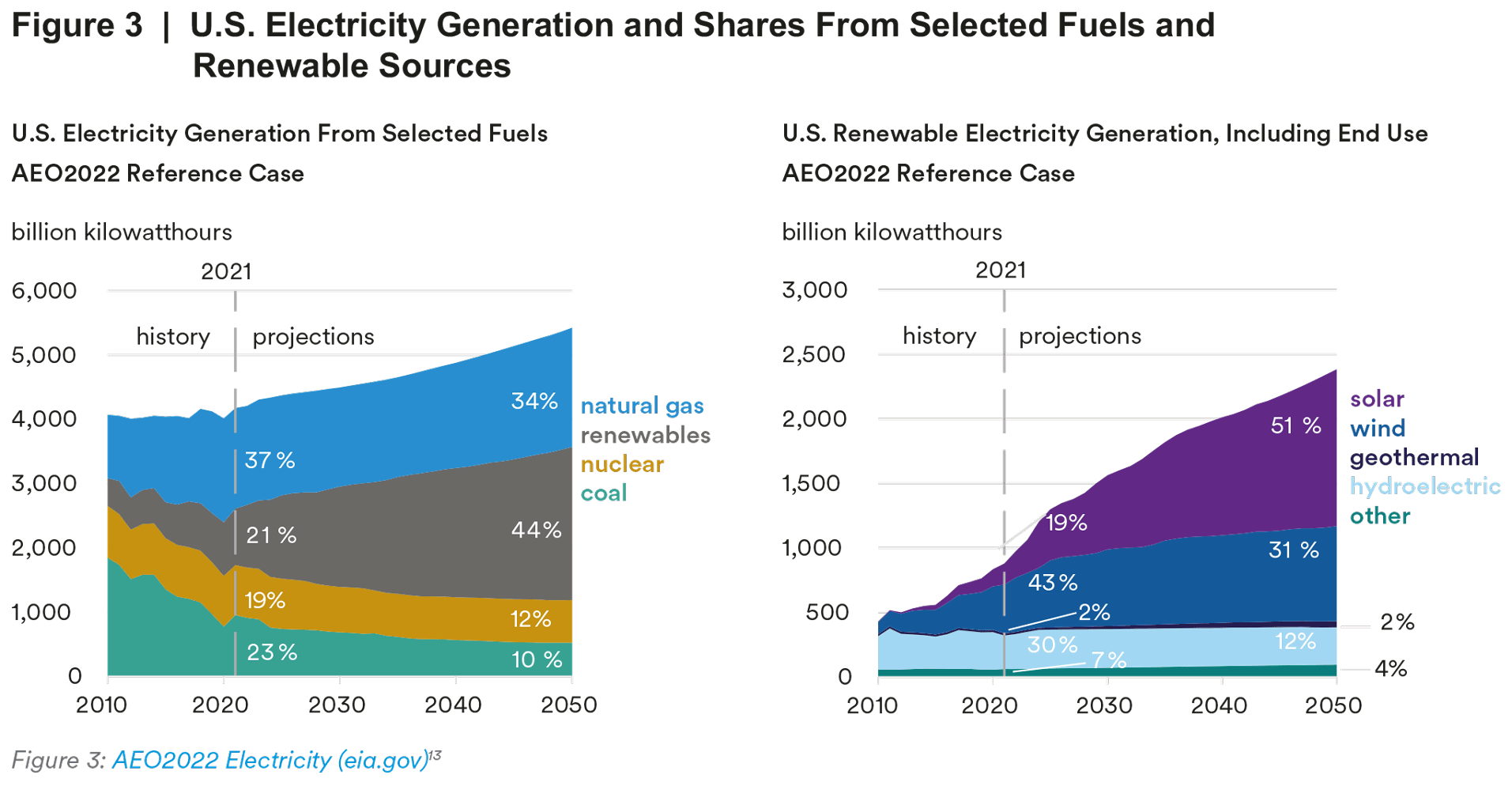

As real estate investors and managers take account of and reduce their assets’ carbon emissions, they are generating more renewable energy onsite, entering into PPAs to secure renewable energy and purchasing RECs to reduce market-based Scope 2 emissions. As shown below, U.S. electricity generation has expanded and is projected to be met by renewables

Buildings account for approximately 40% of global energy consumption and about one-third of GHG emissions.12 Renewable energy consumption is considered one of the most impactful ways to mitigate or avoid these emissions. The Energy Information Administration (EIA) sets out an annual energy outlook to reflect and forecast trends in energy supply. As shown below, there are a mix of renewables set to dominate the electricity market over the next 30 years, which are projected to account for nearly half of all electricity generation by 2050.

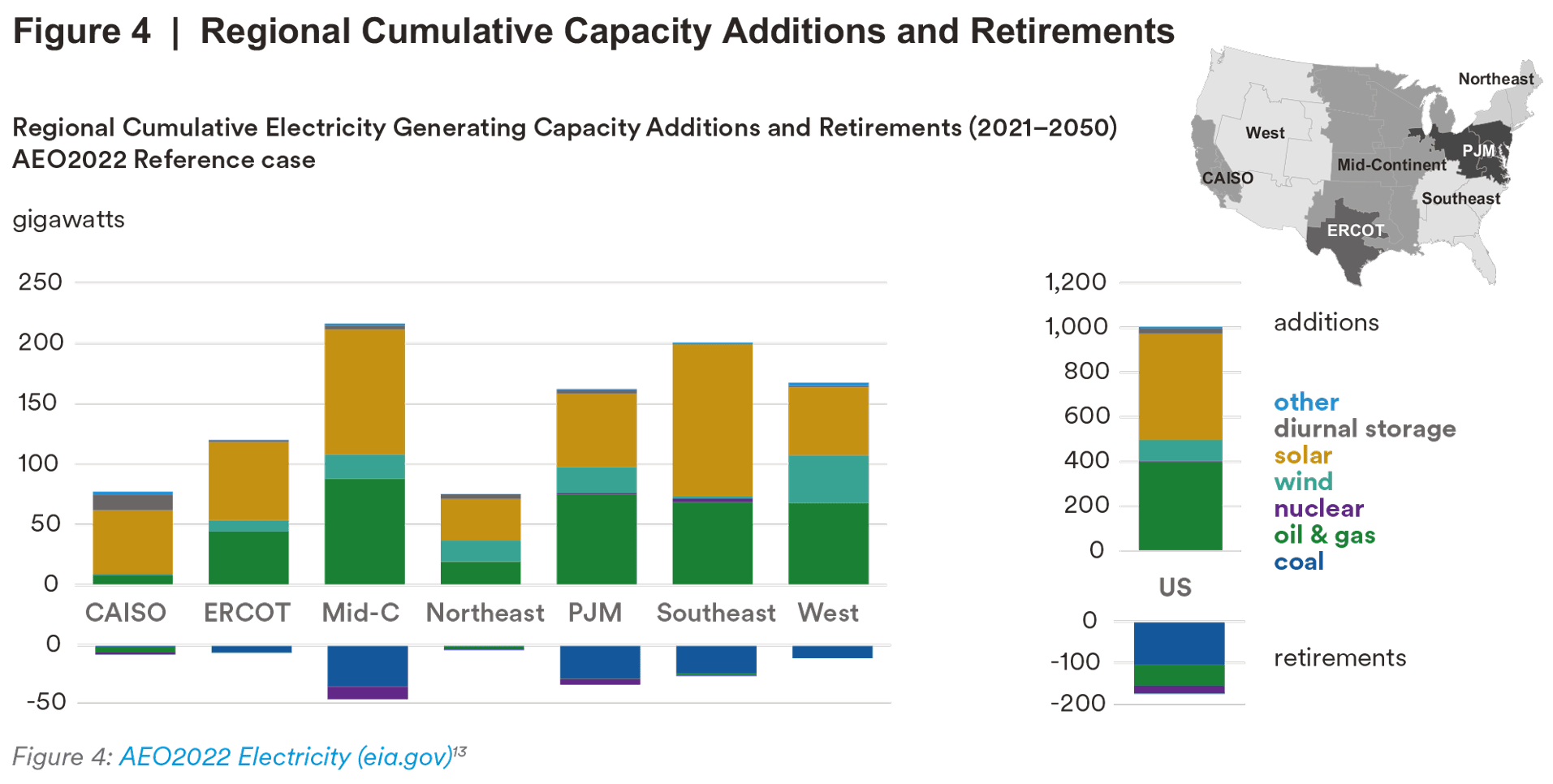

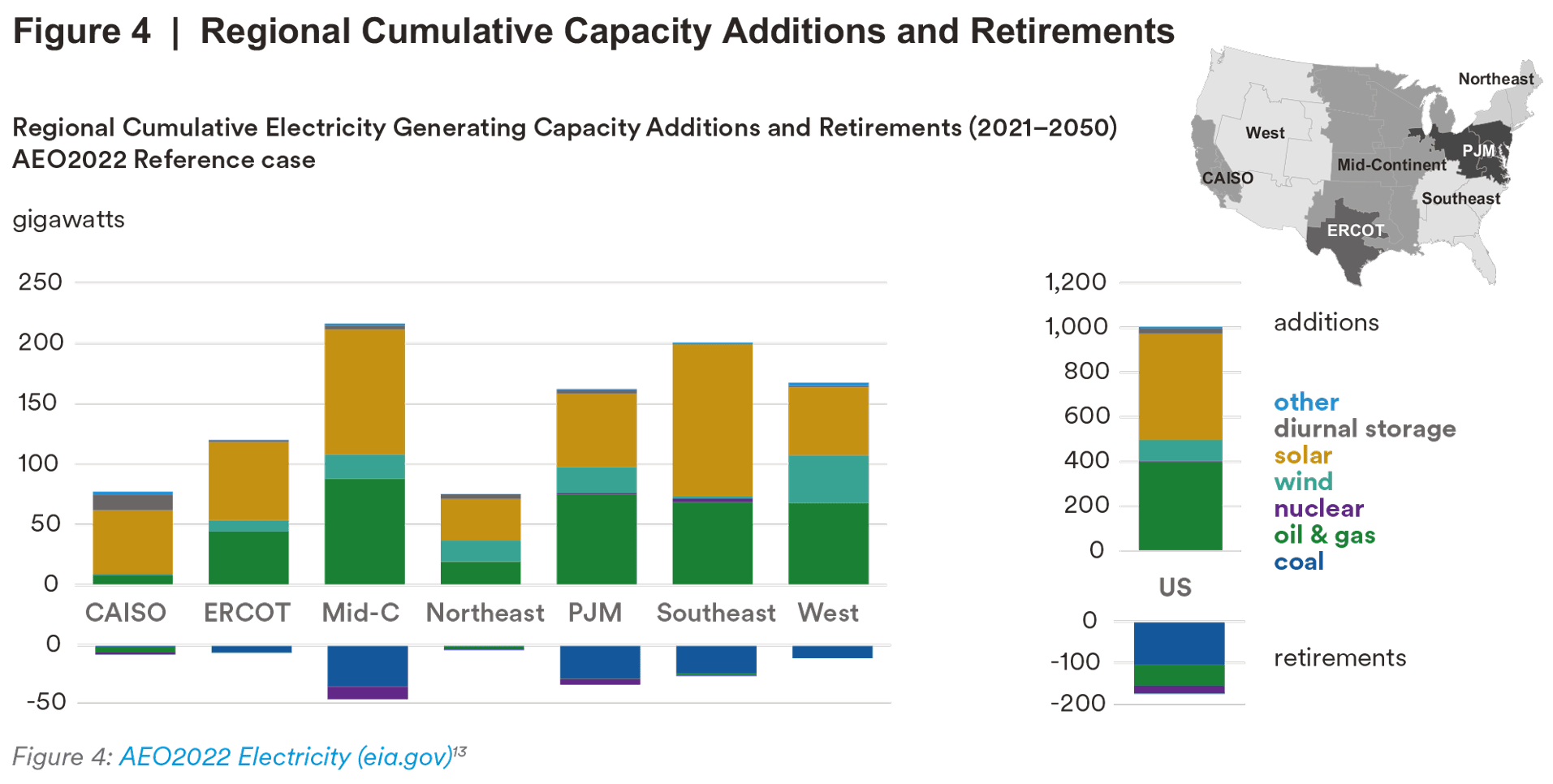

As shown above, renewables, especially solar, are projected to be the leading source of electricity generation by 2050. Utility providers across the country have taken notice and are adding renewables to their existing supply in varying degrees, as shown in the graph below.

In addition to these trends, there is a strong market push for building electrification as a key driver for asset-level decarbonization strategies.14 Replacing fossil fuel systems with electric systems reduces emissions caused by onsite combustion, which are reduced even further due to the greening of the local grid. Some jurisdictions are tapping into this momentum and passing electrification mandates, which will require new buildings to be constructed with electric energy equipment and utilize only electric heating and cooling systems. The States of California and New York, as well as Washington, D.C. and Boston, MA, are among the first to pass legislation limiting the expansion of natural gas infrastructure and appliances in new construction. These trends are converging with existing building performance mandates, which further limit overall emissions and are setting the stage for decarbonization strategies focused on whole-scale building electrification.

Strengths, Weaknesses, Opportunities and Threats of Greening the Grid

To understand the implications of a greening grid, we evaluate some of the challenges and opportunities institutional real estate and asset managers may face. We realize these factors are evolving and will likely change over time; however, the analysis below provides a high-level overview of some of the current factors at play.

Strengths:

The strengths of a greening grid are far-reaching, and they expand beyond some of the more obvious environmental impacts, including reduced risks from the physical impacts of a changing climate, better air quality and a reduced reliance on non-renewable energy sources.

A greener grid can help asset managers meet decarbonization goals by supplying renewable energy to buildings. Further, Renewable Portfolio Standards (RPS), which mandate utilities to develop more renewable energy, may encourage building owners to accelerate the conversion to all electric buildings.

Federal policies and regulations also add to the strengths associated with a greening grid. The Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA) provide incentives for greening the grid, often in the form of tax credits and tax deductions, which help expedite the transition.15

Weaknesses:

Weaknesses associated with a greening grid emphasize inadequate infrastructure, cross-boundary interconnection challenges and ambiguity in emissions accounting. In many markets, utility providers are just now ramping up renewable energy procurement and grid resilience to facilitate peak electricity demand, which is exacerbated by decarbonization strategies focused on electrification. As we’ve seen around the country, utilities are struggling to keep up with the pace of renewables added to the grid that promote renewable energy procurement and grid resilience to facilitate peak electricity demand. If utility providers are not early adopters of renewable energy procurement, end users requesting renewable energy may face higher costs due to inadequate supply or infrastructure. Further, aging infrastructure makes net metering difficult, which is a critical component to maximizing renewable energy output and overall financial viability.16

A lack of clarity in emissions accounting is stagnating the influence real estate investment and asset managers have on accelerating a green grid transition. Since market- and location-based emissions accounting are the primary indicators of green energy demand, the industry may benefit from a more formalized method for measuring the true emissions associated with electricity consumption.17

Opportunities:

As previously noted, the opportunities presented by a greening energy grid are significant and evolving. Real estate investors and asset managers can use capital planning to help green the grid by purchasing RECs or contracting PPAs for projects in specific locations.18 Advances in technology (e.g., battery storage technology) or programs designed to address energy efficiency through smart technology such as the Grid-Interactive Efficient Buildings (GEB) initiative can help utilities meet increased customer demand and help asset managers maximize onsite renewable energy production and increase energy efficiency. Battery storage may also enable owners to arbitrage their onsite renewable production by supplying power to meet peak demand, while GEBs combine energy efficiency and demand flexibility to increase performance. Also key are the development of new energy sources and improvement of existing technologies. An existing technology, nuclear power, can incorporate safer and more efficient advances to produce renewable energy. Fusion is years from energy production at scale; however, recent tests are promising.

Threats:

Factors mentioned above also influence related threats such as higher utility rates, which may occur from investments in grid infrastructure improvements. If utility providers are not early adopters of renewable energy procurement, end users requesting renewable energy may face higher costs due to inadequate supply or infrastructure deficiencies. Likewise, the pace of a greening grid may play a role during due diligence as it may impact hold costs, value implications and subsequent reversion.17 The threat created by political and regulatory inaction is also a factor. Property owners who pursue an electrification strategy, which is outpacing a greening grid, for example, may not realize the reduction in greenhouse gas emissions that they expected.

Threats such as utility providers incurring fines as a result of not meeting renewable energy requirements should not be overlooked. These fines are often treated as a pass-through to utility rate payers resulting in higher utility rates, which are difficult to anticipate, underwrite or budget. These weaknesses require adequate planning and stakeholder engagement from public utility commissions (PUCs), utility providers and consumers.19

Real estate can prepare for these uncertainties by proactively modeling the energy use of any electrified equipment upgrades to assess the future implications of a power grid’s planned renewables updates.

Looking Forward

The energy sector’s transition to renewable energy is increasingly relevant to the real estate industry as asset managers are now better able to evaluate and present investors with practical options to achieve net-zero targets, prioritize resilience and implement various types of risk mitigation. The implications of a greening U.S. energy grid are widespread and present a myriad of strengths, weaknesses, opportunities and threats that property owners, utility providers, governments and businesses will need to navigate. Timing is critical as the real estate industry will need to align its decarbonization plans with the pace of available renewables. If building electrification outpaces the supply of green power, then the best intentions may lead to an inefficient influx of brown power. Effectively timing implementation strategies, all while navigating changing reporting methodologies, will require a holistic view of the interconnected industries, markets and policies involved to inform investment and decarbonization decisions.

As real estate investors, we will continue to track changes and emerging trends in the development of renewables, the impact on various grids around the U.S., and related transmission and regulatory activity. We will also follow advances in carbon accounting, building technologies and ways astute property owners can both benefit from a greening grid and manage risks posed by the aforementioned factors.

Endnotes

1 What is “Greening of the Grid?” | Edison Energy

2 What is green power? | EPA

3 Scope 1 and Scope 2 Inventory Guidance | US EPA

4 Renewable Energy Certificates (RECs) | US EPA

5 Renewable Energy Certificates (RECs) | US EPA

6 Scope 2 Executive Summary | GHG Protocol

7 Scope 2 Guidance | GHG Protocol

8 Net Metering | State, Local, and Tribal Governments | NREL

9 eGRID Questions and Answers | US EPA

10 Data Explorer | US EPA

11 https://www.eia.gov/outlooks/aeo/pdf/AEO2023_Release_Presentation.pdf

12 Buildings are the foundation of our energy-efficient future | World Economic Forum (weforum.org)

13 AEO2022 Electricity (eia.gov)

14 Utility Administrators Share Expertise on Zero Energy Programs - New Buildings Institute

15 Report: The Role of Corporate Energy Procurement in Grid Decarbonization - Green Strategies

16 Surging electricity demand is putting power systems under strain around the world - News - IEA

17 Scope 2 Guidance | Greenhouse Gas Protocol (ghgprotocol.org)

18 US Cities and Companies Can Power the Clean Energy Transition Together. Here’s How. (wri.org)

19 Bill Text - SB-100 California Renewables Portfolio Standard Program: emissions of greenhouse gases.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.