Despite the growing appetite, institutional equity ownership in SFR today is still estimated at only around 2%2 . MIM believes that institutional SFR ownership is likely to grow significantly over the next decade. As a point of reference, while individual investors continue to own a significant majority of single-family rentals, only 14% of multifamily units today are owned by individuals.3 MIM expects that single family rentals will trend toward the multifamily ownership model with institutional owners taking an ever growing piece of the SFR market.

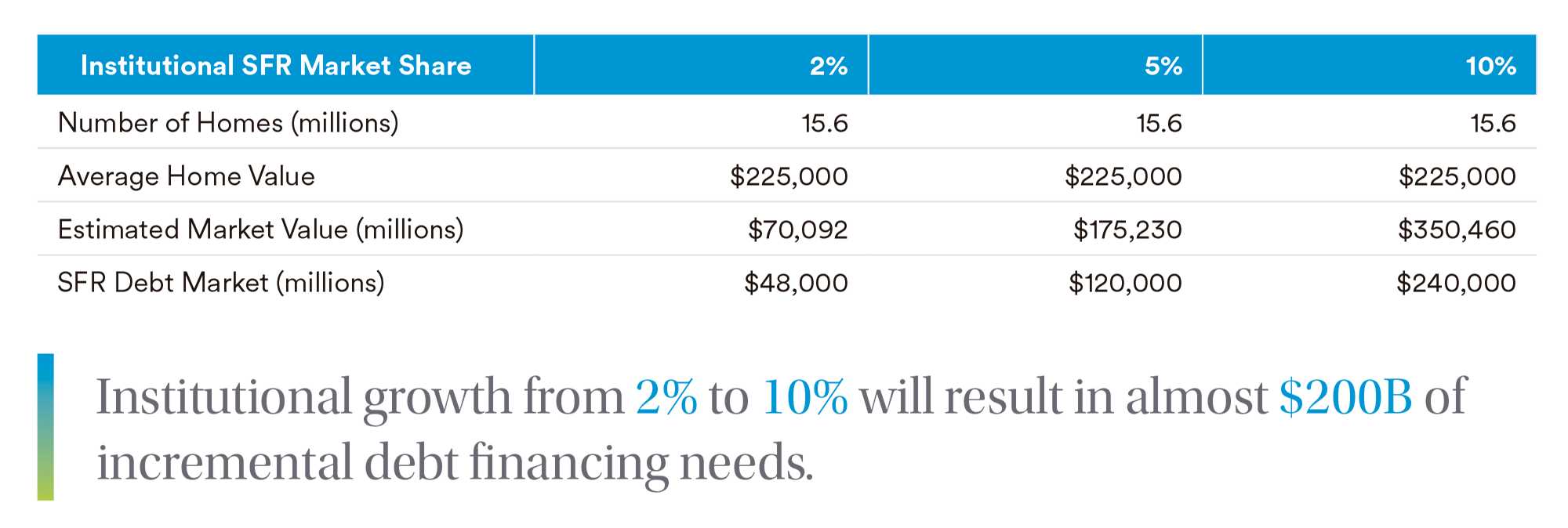

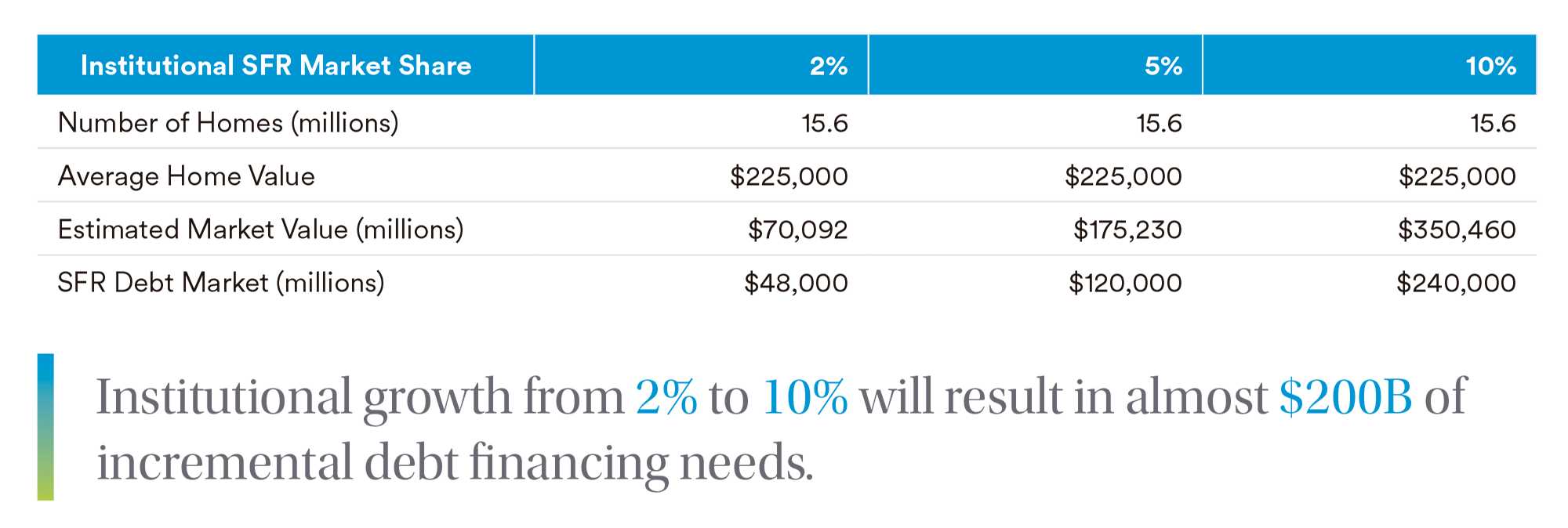

Increased equity investment in the sector will also likely drive a need for significant growth of the institutional debt financing market. MIM’s analysis indicates that simply moving institutional ownership of SFR from 2% today to 10% in the future will result in a need for over $200B in incremental debt financing.

Similar to commercial mortgage sectors, we believe debt funding gap will be filled with a mix of bank lending, securitization funding and the growing use of bi-lateral term lending in the SFR market. Direct term loan financing is likely to be a key piece of this overall financing puzzle. Institutional lenders positioned to participate in this market are likely to see opportunities for attractive deal terms as MIM believes competition in the SFR direct lending space remains more limited than many other lending categories. The rise of SFR lending also presents an opportunity for commercial loan investors to diversify into a new lending category that may be less correlated to other commercial mortgage sectors as well. For example, life insurers today hold almost $600B4 of commercial and multi-family mortgages on their balance sheets and MIM estimates less than $10B in SFR mortgages.5

The increased need for debt financing in a relatively nascent market will require investors to understand how direct, bi-lateral SFR term loans are underwritten and what aspects are most important. MIM underwrote our first direct SFR loan in 2016 and we believe is well-positioned to assist investors in understanding the SFR direct loan market. MIM has helped meet the financing needs of 19 different issuers and provided over $4.0B in financing. This meaningful underwriting history helps MIM provide perspectives into how investors can evaluate risk and opportunity in the sector.

Single Family Rental Debt – Underwriting Fundamentals

MIM believes there are four key aspects of underwriting SFR debt. In the section below, we provide a high-level summary of what MIM considers important in these four areas.

Single-Family Rental Asset Manager

We believe Investors should first understand the asset manager’s strategy and experience. At MIM, we focus on developing a deep understanding of how an asset manager acquires and manages properties as well as ultimately if and how they plan to exit the investment. This starts with a review of the experience and track record of the company’s management team. How extensive is the team’s experience in SFR or in multifamily more broadly? How long has the team worked together? We seek to evaluate management’s historical performance and compare this performance to other managers and strategies in the market. Does management’s articulated strategy match the portfolio composition? How is the Property Manager integrated into the business and is this aligned with the broader strategy of the asset manager? Finally, we feel investors need to evaluate the equity strength of the owner and ensure a meaningful financial commitment to the business.

Property Manager

MIM believes understanding the property manager’s operations is just as important as understanding the asset management approach. Does the owner utilize external property manager(s) or internal property management teams? What is the property manager’s experience and track record in the SFR sector? An in-depth review of the property manager’s operations is performed to understand whether staffing is centralized or dispersed, the property manager’s scale in the asset manager’s target markets, and how operational functions are managed and monitored (i.e., renovation, lease up/marketing, tenant screening, rent collection, repairs & maintenance). A review of the technology used by the property manager is performed to assess where technology is utilized across the operation and how it streamlines different areas of the business to optimize operational efficiency. During COVID, we feel additional attention should be given to understanding the property manager’s eviction procedures for delinquent tenants and their processes for ensuring adherence to all local, state, and federal rules and regulation. When possible, on-site reviews of a property manager can generate significant insights into the platform and we believe are invaluable to a deeper underwriting of the property manager.

Collateral

The secured nature of the lending, often in a bankruptcy remote vehicle, means the loan collateral may be the most important aspect of a loan. At MIM, we feel geographical diversity is a primary risk mitigation factor for SFR loans. With greater geographical diversification comes a lower probability of idiosyncratic risk to any one city or neighborhood. We also evaluate average property values, age of the homes, and the size and condition of homes. What renovations occurred at acquisition of the property or are projected to occur in the future? We consider the markets targeted by the asset manager - the projected demographic trends, forecasted home price appreciation, and affordability of living in those areas. Our analysis includes a review of the asset manager’s underwritten operations and additional MIM developed stress scenarios to try and determine downside protection for our loan. Finally, we analyze gross yields, net yields and NOI margins under both benign and stress scenarios.

Structure

Loan structures can vary significantly based on a borrower’s need and the comfort of the lender with requested term accommodations. The legal structure of SFR loans often consists of an equity pledge of the equity owner’s interest in the special purpose vehicle that is the legal borrower. Depending on the borrower and structure, mortgages on the underlying properties may be recorded at the time the loan is originated or may be “springing” mortgages that are required if performance on the assets begins to deteriorate. Generally, borrowers are looking for terms between 2 and 10 years with most loans between 5 and 7 years. Many of the term loans we evaluate are fixed rate but we will consider and have closed floating rate loans as well. Prepayment protection often exists for most of the loan term with the final one or two years of the term open for prepayment without penalty. MIM generally lends between 60% and 75% of the property value based on the collection of underwriting factors that we consider.

Lenders are also asked to consider a range of loan accommodations that often increase the loan spread the borrower is willing to pay. These potential accommodations include:

- Interest only terms

- Delayed draw structures that reduce future borrowing risk and complexity for the borrower

- Substitution options that enable borrowers to manage their portfolio strategy while maintaining DSCR and LTV limits

Loan Pricing

Based on our review of the underwriting factors described above, MIM will assess what we believe the right pricing on the loan should be and work with the borrower to come to terms. MIM believes that SFR loans offer strong relative value in today’s market along with an opportunity to diversify both portfolio and commercial mortgage exposures in a new asset sector.

Endnotes

1 John Burns Real Estate Consulting, Investor and Capital Transactions October 2021.

2 National Rental Home Council.

3 America’s Rental Housing, 2020. Joint Center for Housing Studies of Harvard University.

4 1Q21 Fed Flow of Funds data tables L.219, L.220.

5 Based on MetLife Investment Management’s knowledge of the overall market for SFR lending.

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default).

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) No. 2414.

For Investors in Hong Kong: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under U.S. law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC