Navigating this complex landscape effectively requires investors to adopt a comprehensive, 360-degree view, considering demand and supply not only with respect to technological and economic drivers, but also environmental, regulatory and community factors. By understanding how these elements intersect, investors can better identify compelling opportunities and mitigate associated challenges in this rapidly evolving space.

Data Centers: AI Drives Explosive Growth

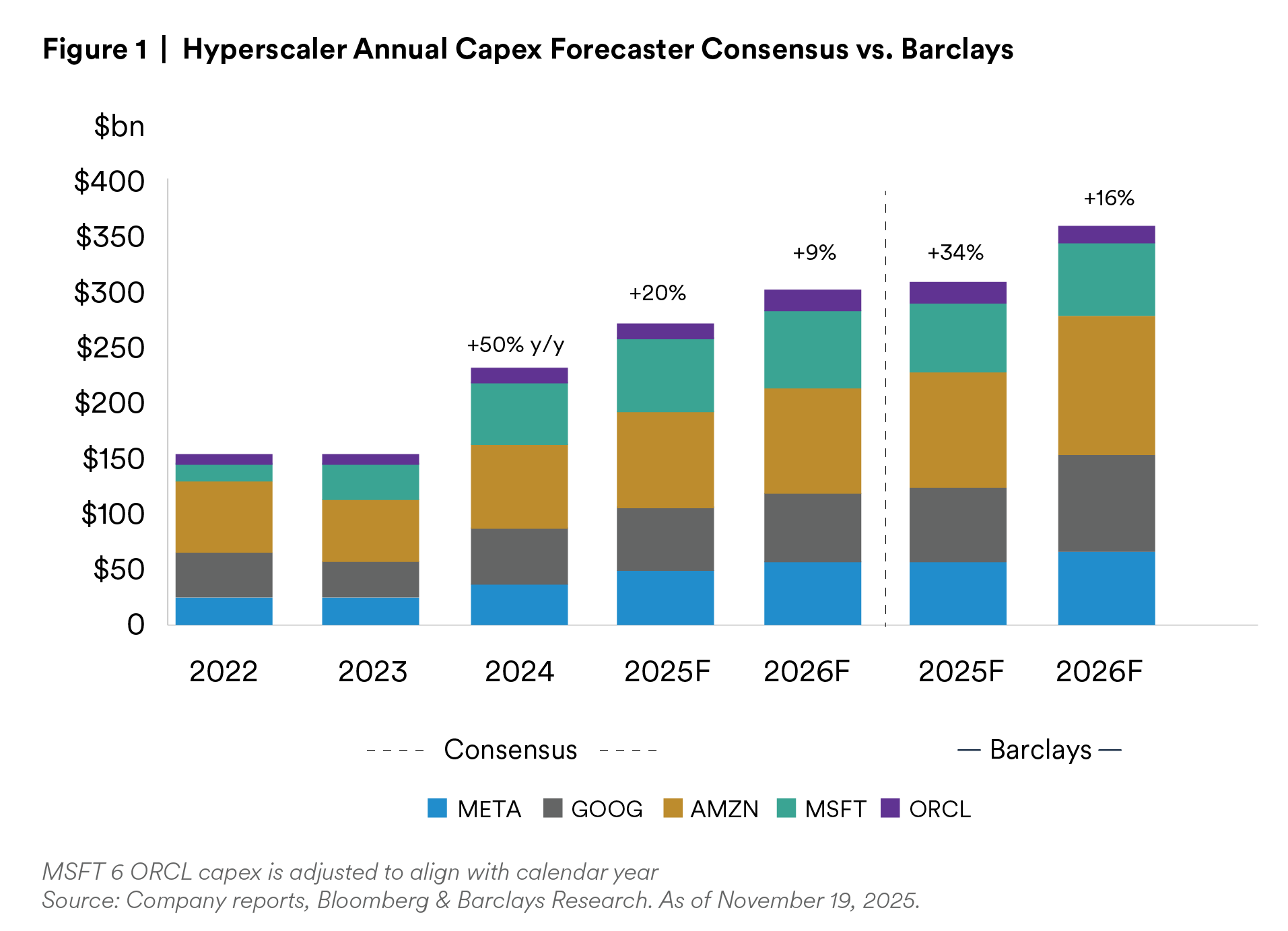

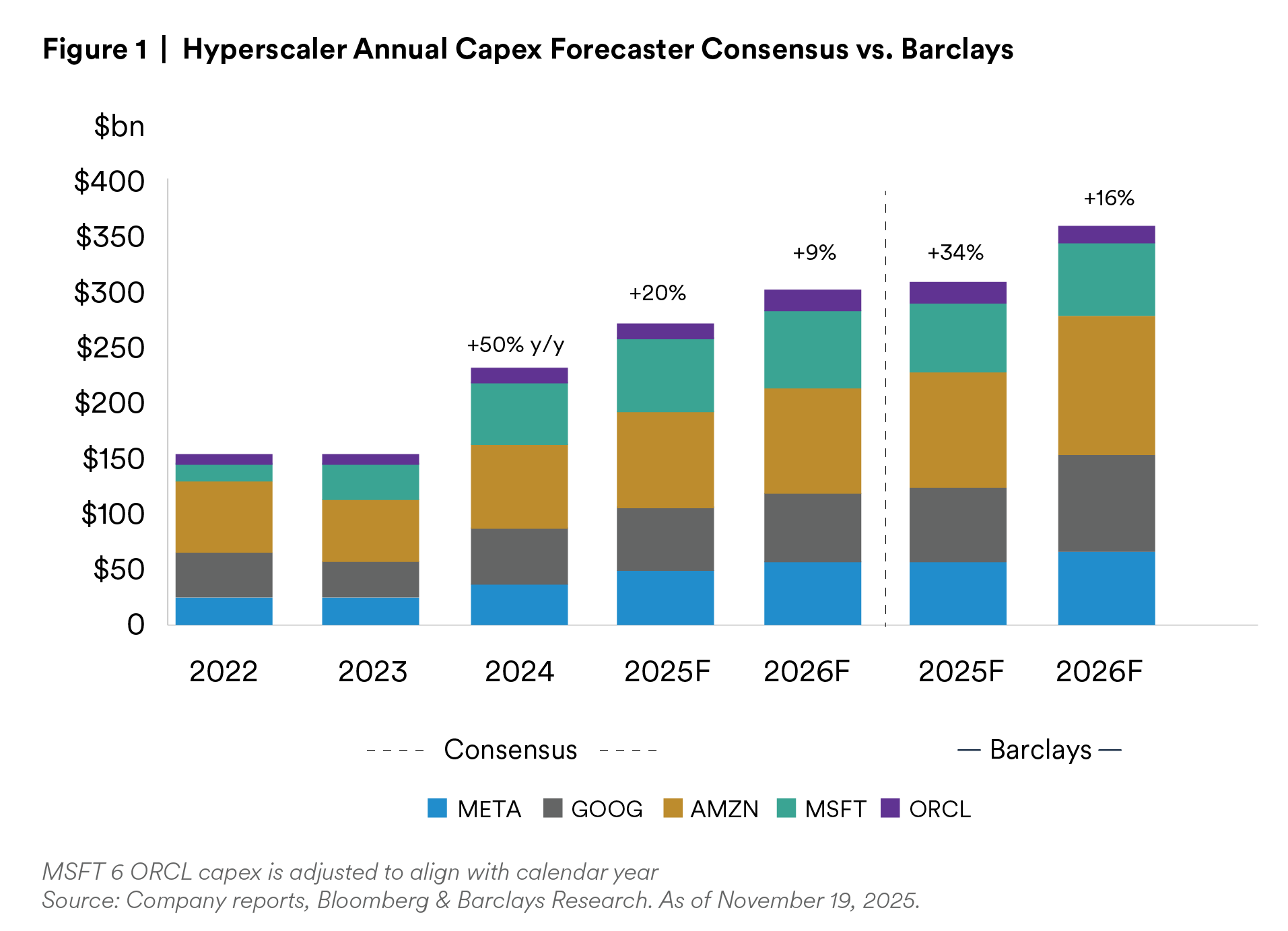

The evolution and mass adoption of generative artificial intelligence has caused demand for data centers to soar. Generative AI uses large language models (LLMs), which require intense computing power and cooling solutions for the training and inferencing stages of development. As a result, capital investment by data center operators has skyrocketed, with the top five hyperscalers spending over $215 billion in aggregate for 2024 (+50% on a year-over-year basis).1 The scale of investment into AI data centers and infrastructure is expected to continue to grow substantially over the coming years.

As AI models become more complex, they require more technologically advanced chips. GPUs are the favored choice for building AI models. They allow for parallel processing across thousands of smaller cores with higher memory bandwidth and better performance per watt than traditional central processing units (CPUs). Additionally, GPUs have grown more and more efficient as top designers and manufacturers fit more transistors on chips and as full-stack software and networking systems allow for greater optimization.

However, technological advancements in AI have also led to increasingly complex models, with the largest LLM parameters (internal variables) and training data sets increasing 3.5 to 4 times per year since 2017, respectively. As a result, GPU computing requirements increased seven times annually during the same period.2

Rising Power Demands

The proliferation of LLMs and corresponding demand for computer processing has also led to rising power demands. For reference, a typical search on ChatGPT consumes between 6 - 10x the power of a standard Google search.3 Even with the GPU performance efficiencies, larger AI data models result in higher power density per server rack compared to non-AI workloads. In just the last two years, the average power density per server rack more than doubled to 17kW. It could rise to as high as 30kW per rack by 2027.4

Greater power draw for AI workloads will come not only from GPUs but also data center infrastructure. AI data centers may require up to three times the power of a traditional cloud facility. Retroactively fitting data centers to handle larger AI workloads won’t be simple, as most AI data centers require liquid-cooling systems. Other non-AI related workloads will still exist and likely require their own separate infrastructure.5

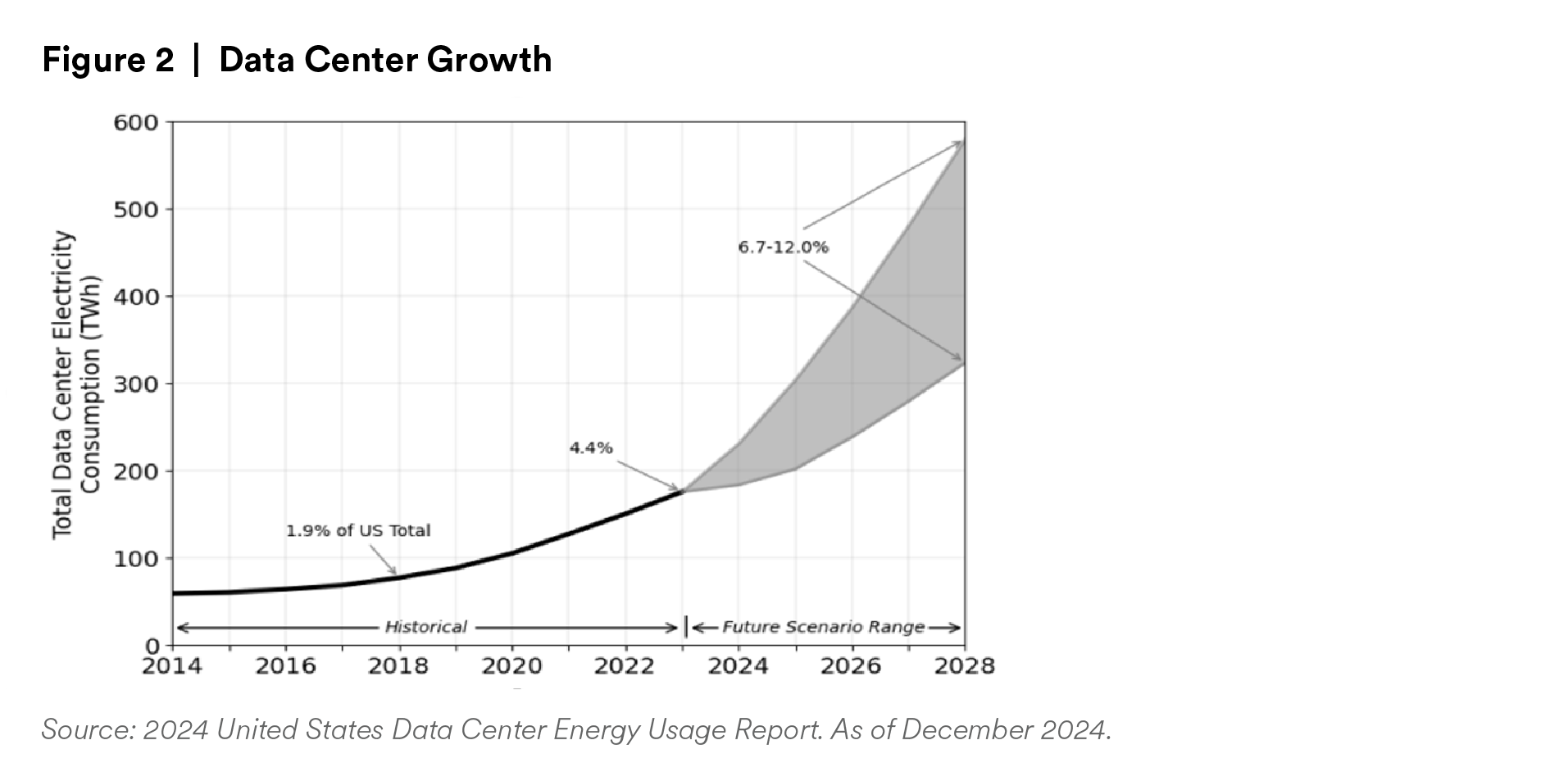

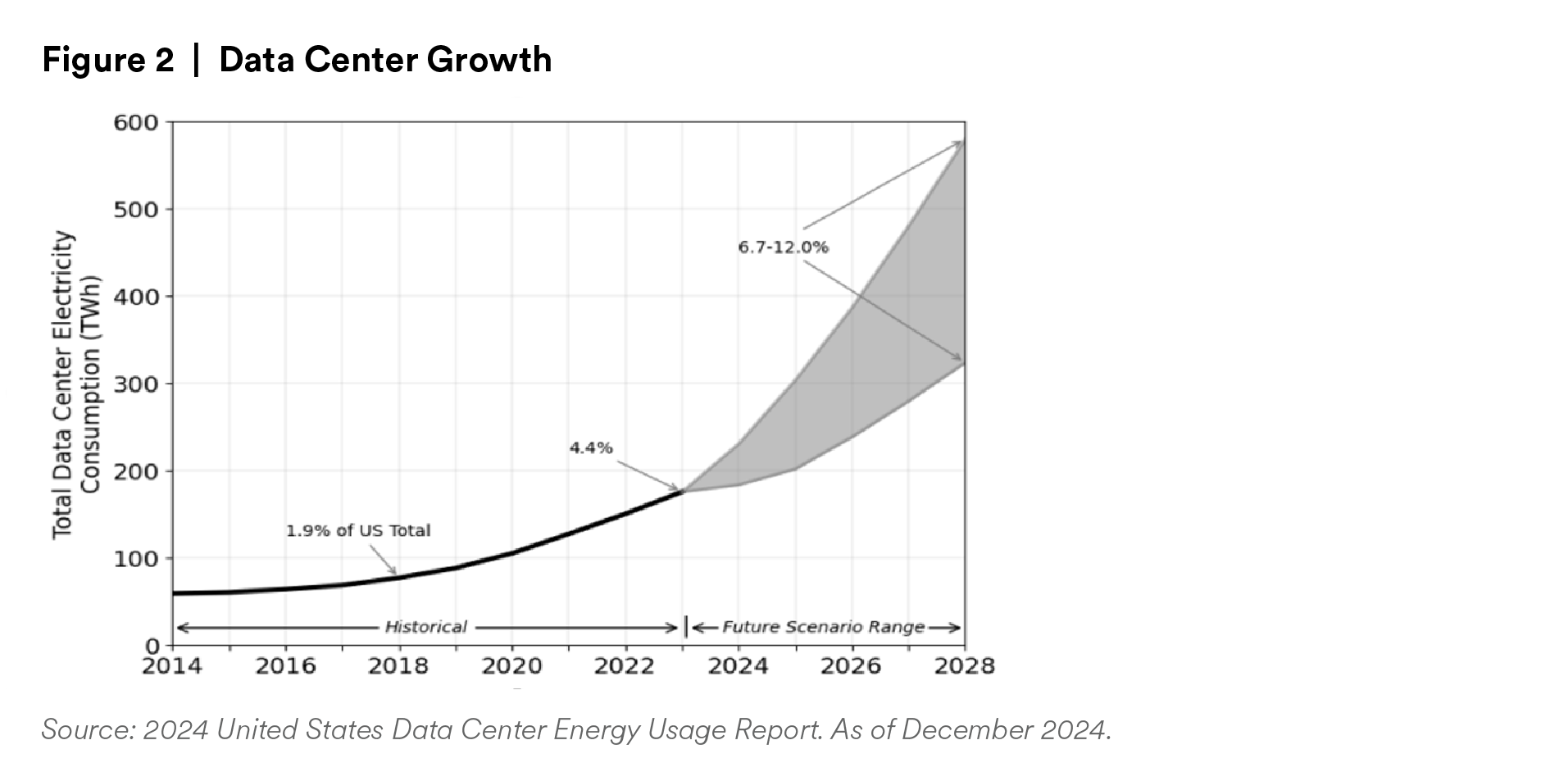

Data center power demand is expected to grow materially as LLMs increase in size and require more advanced infrastructure. A recent study from the Department of Energy indicated that U.S. data centers used 176 terawatt-hours (TWh) of electricity in 2023. That’s roughly 4.4% of total energy demand. They forecast this usage could increase to 325 – 580 TWh (6.7 – 12% of total U.S. energy demand) by 2028 and would require an additional 74 – 132 gigawatts (GW) of annual capacity assuming an average 50% capacity utilization rate.6 Implied is a 13 – 27% compound annual growth rate (CAGR) in data center electricity demand (including equipment, operations and cooling) as AI training consumption surpasses inferencing demand by 2028.7

Recently, a Chinese firm created a new open-source AI model (DeepSeek). Its developers claim DeepSeek produced comparable LLM outputs for a fraction of the energy consumption requirements while using later-generation GPUs. This created significant speculation about the necessary requirements for data center computing and power requirements, as it’s expected that further technological advancements will continue to make AI models more efficient. In addition, economic uncertainty may cause management teams to reevaluate capital expenditure plans going forward. That said, AI data center operators have largely affirmed existing capital commitments to date, citing the economic concept of “Jevon’s Paradox,” assuming that lower barriers to market entry will fuel greater AI proliferation and demand.

Utilities: Powering the Data Boom

Even with some potential haircuts in projected energy demand after the DeepSeek announcement, we expect that increased electricity demand will continue to be transformative for the utilities sector. This increased electricity demand will be driven by still-significant projected usage from data centers and generative AI, as well as from energy transition (further electrification, continued grid investments to accommodate electric vehicle charging demands). Demand will also come from more traditional sources (e.g., industrials moving to states and regions with more favorable tax and labor policies, and population growth in certain regions).

The broader utilities sector has often been seen as more defensive, with less front-page headline news than other sectors. However, significant electricity demand projections have placed the spotlight on all utility subsectors. These include regulated electric utilities, independent power producers (IPPs/gencos), and, to some degree, midstream companies that have significant natural gas pipeline assets. These sectors sit at a crossroads of many market and policy factors.

The expected growth in demand brings benefits and concerns, depending on the subsector. We see winners from this trend emerging from midstream and from IPPs.

- For midstream issuers that sunk a significant amount of capital into already-operational assets like interstate natural gas pipelines, the incremental amount of capital investment needed to build a small lateral (to provide gas supply to natural gas generation situated near the pipeline) is minor. That leads to generally attractive NPVs for these low-execution-risk projects.

- For the competitive IPPs, data center demand can be a profitable opportunity to sell excess, unhedged generation capacity under a long-term contract, also reducing commodity price risk.

Keep in mind, however, that regulated electric utilities are mandated to provide power to those located in their respective service territories. For them, the critical component is fair rate design. Traditionally, each residential customer pays the highest-per-unit retail rate but uses the least amount of power per month. Large-scale industrial customers, on the other hand, pay the lowest-per-unit rate but are the highest-volume customers.

Traditional industrial customers often provide benefits such as additional tax revenue and job creation for the municipality where they’re situated. Data centers have the potential to upend this traditional model. Their high volume of electric demand could potentially qualify for industrial rates but without markedly increasing tax revenues or creating significant job growth.

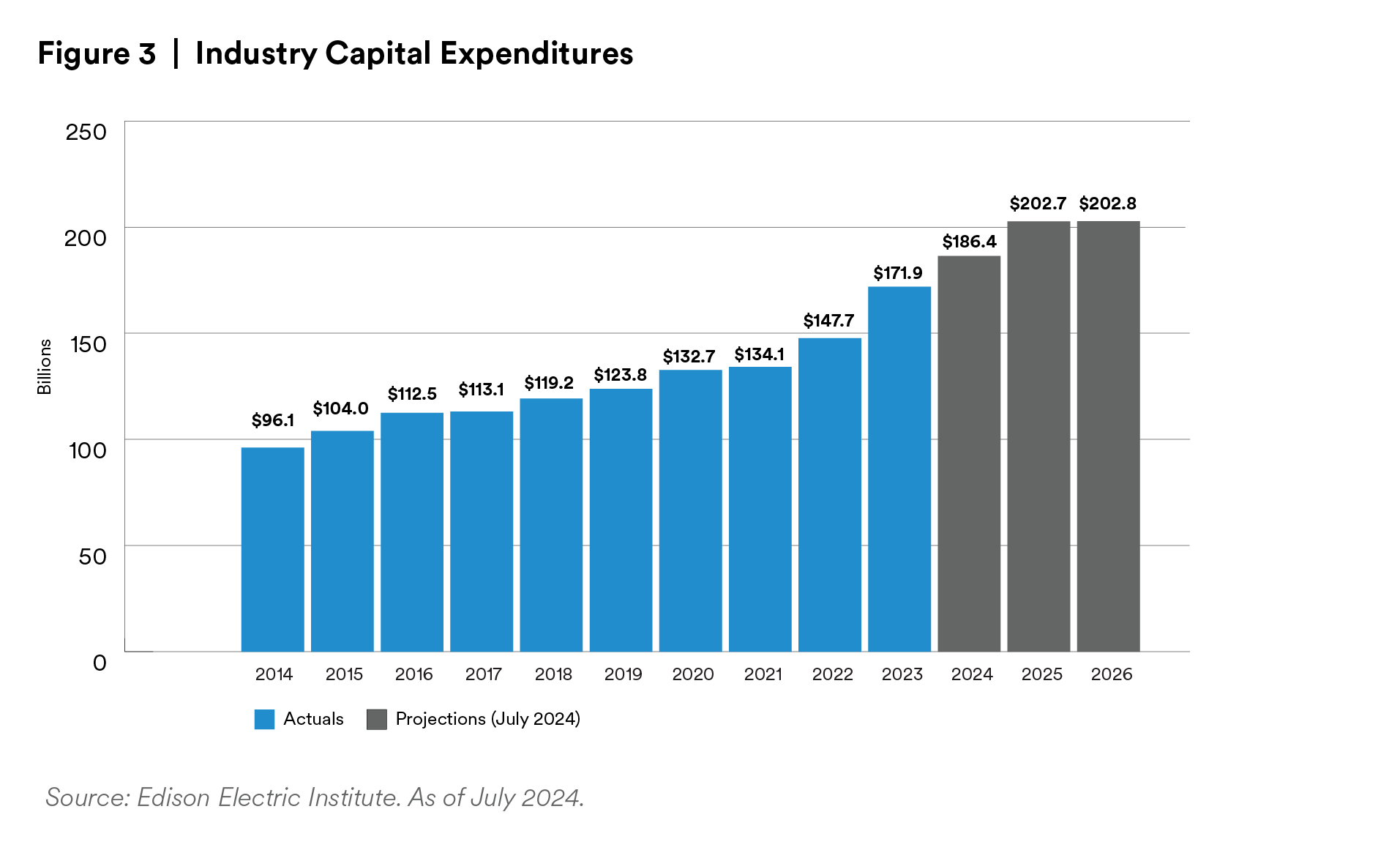

Increased Utility Capex

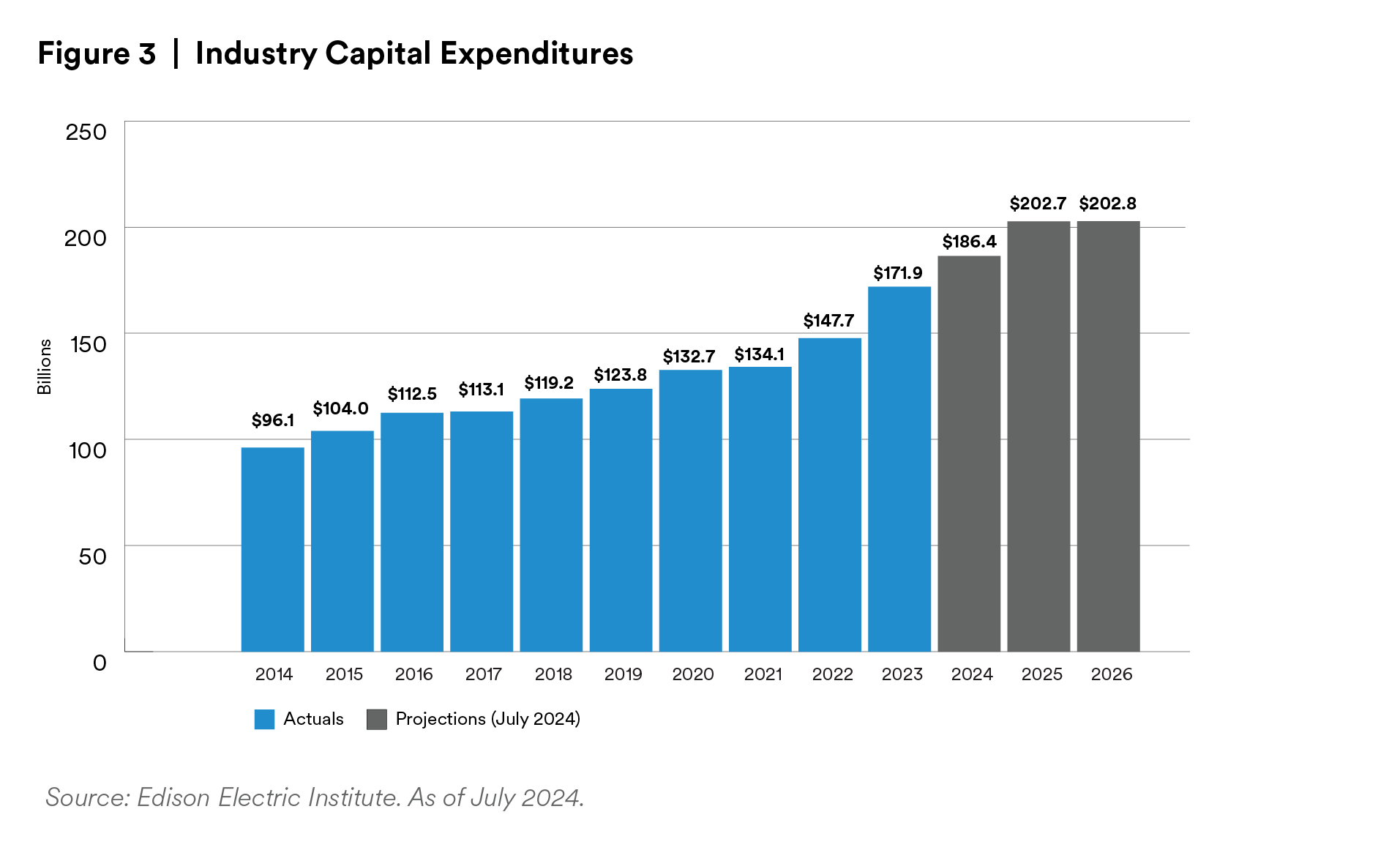

Increased demand from data centers, electrification, reliability and grid updates have driven a significant increase in aggregate regulated utility capital expenditures. This capex will drive the need for capital raising.

Regulated electric utilities have long-lived hard assets and issue public and private debt in a wide range of tenors, from five years or less to 10 years or even 30 years. This subsector receives attractive rates of return (e.g., average returns on equity ~10%) in the U.S. from their respective regulators in order to incentivize high fixed-cost investments with a long development cycle. The fundamental profit-model for regulated utilities is earnings growth, driven by a rate of return times regulated rate base. The rate base is the pool of assets deemed by the regulator to be included in the calculation for returns and tariff-setting.

While these are significant strengths of the sector, regulated electric utilities need to manage regulatory risk. The state regulator would need to determine that the investments made and cash outflows associated with that investment were prudent — and to authorize some rate change (increase) to allow the utility a fair rate of return. The cash outflows for these investments will temporarily create downward pressure on cash flow metrics. Timely regulatory proceedings and favorable regulatory recovery mechanisms would mitigate this pressure.

In determining the cost recovery associated with a project, the regulator will weigh many factors, often focusing on affordability. Affordability for the average residential customer is a critical factor and can become a pressure point if the proper rate design isn’t applied to the investments made to provide electricity to data centers.

For the regulated issuers, if rate design is properly managed, data center-driven demand can present an attractive opportunity for issuers that are transmission and distribution (T&D) only, not owning generation.

With proper rate design and planning, as well as the continued navigation of regulatory, sustainability, public policy drivers and market factors, data center demand can present multiple investment opportunities. These exist primarily in regulated utility, IPP and midstream subsectors (which own and build a wide variety of assets that can benefit from this demand).

While there are some uncertainties around how these opportunities will ultimately develop, investors have time to evaluate the impacts as more data center development agreements are signed. Even for midstream issuers, the timeline from deal announcement to commercial operation of a project can be a multi-year project. For example, a large midstream issuer announced in February 2025, that it would supply up to 450,000 MMBtu/d of natural gas to a data center campus in Texas. Should this proceed according to the timeline, the facility would be expected to be online by 3Q2026.

Social and Environmental Considerations

Several social and environmental factors can also be important when considering data center-related investments. These factors have been increasingly relevant due to the rapid growth in data center capacity and the resulting environmental and social impacts, such as increased electricity demand, water consumption and land use, which can feed into higher rates for consumers and rising property prices.

Data center development can have mixed effects from a social perspective. While data centers are often large and essential infrastructure developments, they don't necessarily generate the local community benefits of other large electricity consumers, such as manufacturing facilities. This contrast between the sustainability impacts of data centers on one hand, and the lack of significant local benefits on another, highlights a growing question around how data center operators manage the social acceptability of their facilities among local residents. The competition for limited resources has often pitted residents against data center projects, with politicians, economic development and tax incentives caught in the middle. In some cases, residents’ concerns have boiled over into outright lawsuits against governments and developers.

At the same time, there’s a wide understanding of the need for data centers. To date, 30 states have approved tax incentives for such projects. Not surprisingly, local policy makers have increased focus on economic activity relating to data centers and impacts to communities. A sharper eye toward the location of data centers has led some metros to institute prohibitions near transit systems or residential areas.

It should also be acknowledged that there are social benefits to the development of data centers. Data centers enable many aspects of modern life as people consume more data and need more access to technology infrastructure at school, work and home. Data centers are also essential for the development of AI. While the development of AI brings social risks such as improper use and impacts on privacy, it is also expected to produce a number of sustainability-related benefits, such as enhancements to:

- Healthcare diagnostics

- Electricity grid management

- Agricultural efficiency

- Natural disaster preparedness

- Sustainable material development

The environmental impact of data centers will be determined by a number of factors. It’s clear that they need significant amounts of baseload-type generation. If this can’t be met by renewables or nuclear power, it could lead to delays in coal-plant retirements and increased investment in natural gas generation. This would increase GHG emissions and potentially lead issuers to miss their decarbonization targets. However, some data centers have a mandate to seek power supply from renewable sources, which could drive additional investment in carbon-free generation. There’s also an increasing focus on energy efficiency to limit the volume of additional electricity demand.

Alongside the energy impacts, data centers have significant water demand, primarily due to their cooling requirements. The impact of increased water demand will become more pronounced as climate change leads to rising water stress in many regions. With these factors in mind, many developers and operators are working to reduce their environmental impacts.

Data center development is still expected to have environmental implications,. This will have knock-on effects for other sectors such as utilities. Utilities’ long-range plans, therefore, address environmental compliance. Some of these plans indicate the companies’ projected timelines for the retirement of fossil fuel generation for integrated issuers (which own generation assets).

Overall, the impact of data centers on GHG emissions will likely be determined by two factors:

- The rate at which data center capacity increases and whether some of this growth is mitigated by efficiency improvements.

- How quickly additional sources of low-carbon baseload electricity generation capacity can be installed and connected to the grid.

Investment Channels

Hyperscale technology companies have made massive investments into cloud and AI infrastructure. This investment is needed to support the growing demand for processing data from global internet traffic, which has grown 60 times from 2010 to 2023. The proliferation of data has driven an explosion in data center demand, and supply has struggled to keep up — resulting in U.S. vacancy of around 2% in Tier 1 markets.

Given the known supply pipeline and current vacancy rates, MIM expects most markets to remain undersupplied through 2028. As a result, we anticipate the average hyperscale data center to realize 7% average revenue growth per year through the end of the decade, leading to more than $1 trillion in investments by hyperscalers in data centers globally.

All of this growth has created four main channels for investors to find opportunities in the data center space: asset-backed securities (ABS), private credit, labeled (including green) bonds, and real estate equity.

Historically, data center projects were primarily financed through bank loans or government development districts, with operators often securitizing cash flows from long-term leases. However, there’s now an increasing shift into the asset-backed securities and private credit markets, offering flexible capital solutions beyond traditional bank loans. The diversification of funding sources reflects the growing institutional appetite for digital infrastructure investments. As demand for data processing and cloud services accelerates, financing opportunities in this sector will continue to expand, attracting both traditional and non-traditional infrastructure investors.

Additionally, within the labeled debt market, there are opportunities to invest in data centers with a sustainability focus. Several data center developers and operators have issued green bonds and green asset-backed securities (ABS) to fund sustainable growth. Green ABS issuances for data centers have been growing, with $57bn in cumulative issuance since 2013.8 Proceeds are typically allocated to:

- Green buildings (to pursue sustainable certifications such as Leadership in Energy and Environmental Design, or LEED)

- Energy efficiency

- Renewable energy sourcing

- Pollution prevention and control

Important considerations for data center-driven green bonds/ABS include the assessment of how energy efficiency is managed, the type of electricity being consumed and water consumption (among other factors).

Finally, investors can access data centers through direct equity investment. As of this writing, target returns for stabilized data centers leased long-term to hyperscaler tenants (such as Microsoft or Meta) are around 7.3% gross-of-fee and unlevered, with levered return targets typically around 11%. For investors willing to take more operational risk, full service multi-tenant facilities are typically being underwritten with gross unlevered return targets of 8.5%, or 12% with leverage.

Unlocking Opportunities with a Holistic View

As demand for data centers continues to accelerate, driven by the rapid evolution and widespread adoption of generative AI technologies, investors face unprecedented opportunities, but also increasingly complex challenges. To capitalize effectively, investors need a holistic, 360-degree approach, encompassing not only technological advancements and market dynamics but also regulatory landscapes, community impacts and environmental considerations.

Bringing Expertise Across Asset Classes to Data Center Investments

MetLife Investment Management (MIM) takes a comprehensive approach to investing and leveraging our expertise across public fixed income, private capital and real estate. The experience and knowledge of our investment professionals allow us to examine market topics such as data centers and apply our analysis and findings to our various investment strategies across asset classes.

In public markets, our credit research team, comprised of more than 65 fixed income professionals, brings deep sector knowledge and rigorous analysis to identify value across the capital structure. In private markets, our infrastructure debt platform is built on decades of experience, with a focus on essential assets underpinned by stable cashflows and strong structures that align with our clients' objectives. Our real estate team of 200+ professionals has an extensive regional office network combined with highly specialized market and sector experts enabling us to underwrite and access property types like data centers. Furthermore, our experience bringing together investment professionals from different asset classes enables us to identify and capture opportunities while constructing a framework to effectively manage risk.

Read another paper we recently wrote on data centers: The Future of Data Centers: Trends, Challenges, and Opportunities

Endnotes

1 Barclays Live — Powering AI: Data Center Insights v2.0

2 Barclays Live — Powering AI: Calibrating US Data Center Energy Demand

3 Generational Growth AI, data centers and the coming U.S. power demand surge

4 AI data center growth: Meeting the demand | McKinsey

5 Data Center Diplomacy: AI Infrastructure and Geopolitics

6 lbnl-2024-united-states-data-center-energy-usage-report.pdf

7 Energy Transfer LP announced a long-term agreements for its Oasis Pipeline to supply natural gas to CloudBurst’s Next-Gen Data Center campus outside of San Marcos, TX

8 BofA Global Research, Bloomberg, Related ABS Deal Docs

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.