Corporate Private Placement Market3

Private Placement Market3: Q1 2022 private corporate issuance reached an initial total of $21.4 billion, relatively in-line with $22.3 billion for Q1 2021, as the current quarter will likely be revised upward given numbers are still being compiled. Deal flow was primarily driven by issuers opportunistically seeking financing opportunities ahead of anticipated rising rates as global economies continue to normalize, as well as more pronounced issuance in specific sectors including REITs and Consumer Non-Cyclicals. The average deal size for Q1 2022 was $208 million across 103 transactions, similar to Q1 2021 that included 101 transactions with an average deal size of $221 million. Issuance was led by activity in North America, comprising 74% of total issuance. European volume (primarily the UK) was 20%, Africa 3%, Asia 2%, and Australia 1%. USD currency made up 82% of corporate issuance, with GBP at 11% and EUR at 7%.

Delayed Fundings3: Delayed fundings continued to be utilized by issuers with 23% of Q1 2022 transactions having a delayed funding. We expect this trend to continue as private issuers approach the market for financing opportunities with concerns of anticipated inflation and the continued rise ininterest rates.

Spreads and Treasuries: Private credit spreads, following public spreads, initially widened driven by increased inflation pressure and then combined with the crisis in Ukraine, but have partially tightened back given largely solid corporate balance sheets and continued strong investor demand. Private spreadshave maintained a healthy premium over publics but have continued to contract some towards historic averages driven by strong demand for private assets. This was particularly seen with broadly marketed deals from agent banks.

MIM Corporate Private Placement Activity: MIM’s origination activity for Q1 2022 was strong at $3.4 billion compared to $1.9 billion in Q1 2021. MIM seeks to invest in both direct and club transactions which can help lead to larger allocations and more diverse deal flow. Origination extended across industries and subsectors, with REITs and Consumer Non-cyclical leading the quarter at 26% and 20% of MIM Corporate origination.

MIM’s 2022 Outlook: MIM’s US GDP forecast calls for +3.8% growth YoY for the full year 2022. MIM’s 2022 US inflation rate forecast is to peak mid-year and retreat to an overall 3.3%. MIM is projecting 10-year UST rates to climb to mid-year a high and then settle back down closer to 2% than 3% driven by slower second half economic growth. Despite the second half slowdown, with continued economic growth and still relatively low long rates, MIM predicts 2022 issuance to remain steady. MIM expects the market to remain competitive, with increased investor demand for privates. This may put some pressure on spreads and deal structures, however MIM expects the private market to remain disciplined overall. We continue to monitor the portfolio for persistent impacts of inflation. Thus far, issuers have been passing on higher input costs and resulting margins are holding steady. Balance sheets also remain conservative. MIM will continue to use our sector specialist approach and relationships in our efforts to uncover the broadest range of appropriate opportunities for our clients.

Infrastructure Debt Market

As first quarter figures are still being compiled, we believe global infrastructure activity continues to reach new all-time highs. The Capital markets – which represents the majority of MIM’s investible infrastructure market - had strong quarterly issuance as equity sponsors looked to private capital to finance infrastructure projects. The growing global demand to finance projects that provide essential services, the energy transition and the digitalization movement, all represent significant tailwinds for the asset class.

Global Sector Highlights:

United States: The impacts from the $1.2 trillion bipartisan infrastructure bill remains to be seen. The bill includes an allocation to transportation, power, broadband, water, and energy transition and we expect an increase in activity across all the sectors. In a recent evaluation, the American Society of Civil Engineers identified a $2.59 trillion shortfall in government spending on infrastructure projects. While the bill will help bridge some of the shortfall, there is still a significant gap in US infrastructure needs. Equity sponsors continue to focus on core and core-plus infrastructure assets. Given the rising interest rate environment, we remain cautiously optimistic on new refinancing opportunities. Power, energy, public-private-partnerships, and digital continue to provide a strong pipeline for 2022.

EMEA: Activity in EMEA led MIM’s origination this quarter, contributing roughly $900 million of transactions. Transactions across the region have been very competitive with large oversubscriptions on bid books and significant scale-backs on final tickets. There has been strong activity in the digital space, with some mega transactions in fiber, as well as some M&A opportunities in wireless communications. Transportation and transportation-related names have returned to the market, with the obvious exception of airports who continue to seek extensions of the covid-related waivers. Looking ahead, we expect a strong pipeline of issuance in digital, power, transportation, and energy assets.

Latin America: After a very active 4Q21, 1Q22 was quiet in terms of new transactions, consistent with the peak vacation season. The pipeline picked up in mid-March with several renewable transactions in Chile, alongside midstream and M&A related opportunities. We are also seeing port and rail transactions in Peru, Colombia and Uruguay. Governments remained focused on advancing PPP programs and continue to decarbonize their matrixes, with a strong emphasis in expanding renewables. Conversely, the political situation remains noisy in places such as Chile (far left-leaning constitutional assembly), Peru (potential impeachment of President) and Mexico (push for Electricity reform).

Australia: Infrastructure new issue activity remained slow to start 2022, primarily due to Covid and lack of M&A activity. We expect a handful of transactions to launch in the coming months.

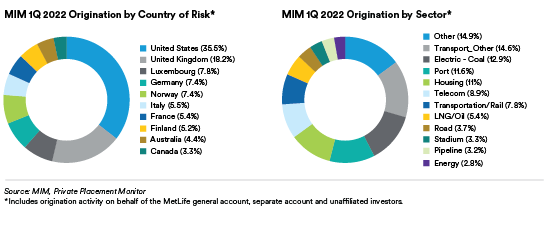

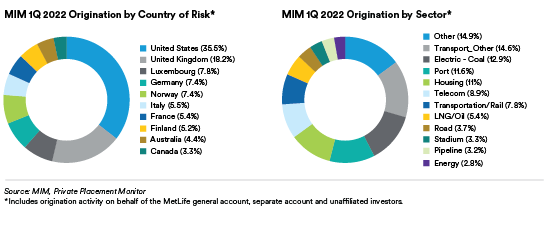

MIM Infrastructure Debt Activity: MIM had a record first quarter with $1.55 billion of origination across 21 transactions compared to $765 million in 1Q 21. The increase was driven by stronger direct origination and higher bank loan activity. MIM originated notably large transactions in clean energy, social housing and the port space.

MIM’s 2022 Outlook: MIM is in active conversations with Sponsors and their financing/refinancing strategy as inflation and interest rates continue to increase. MIM expects a continued strong pipeline driven by opportunities in renewables, transportation, pipelines, public-privatepartnerships, digital infrastructure, and energy transition assets.

Private Structured Credit Market

MIM Private Structured Credit

Despite significant market volatility in Q1, private issuers remained steadfast with continued strong issuance in part due to strong technical support from private credit investors. It is worth noting that this dynamic has served to keep pricing margins at relatively tight levels which are not fully reflective of the broader market volatility that caused public market spreads to widen. Given this pricing reset lag, MIM PSC declined deals that we felt did not offer attractive relative value when compared to public market transactions. Rapid rate moves also made spreads volatile from the time of pricing to the actual deal closing.

Looking to 2Q 2022: We expect strong investor demand for private assets to continue into Q2 and may limit spread widening. The US economy is expected to post modest growth in 2022 given low unemployment and healthy consumer and private sector balance sheets, however, risks remain. Widespread inflationary pressures in both goods and services, Fed tightening, and geopolitical uncertainty could weigh on markets and shift sector fundamentals more neutral. It remains to be seen if the pressures observed in the mortgage market due to rapid rate increases, spill over into broader market stress as firms are forced to refinance at significantly higher yields. Given the public equity market volatility, we continue to monitor private equity portfolio valuations. Although, we anticipate the performance of our alternatives financing portfolio to remain within our expectations as transactions are well-structured with low LTVs.

We anticipate origination opportunities in private structured credit sectors to be robust in Q2. There is a strong pipeline with over $1 billion in deal flow across consumer, commercial, residential mortgage and alternatives financing sectors – including over $350 million closed quarter to date. We have also observed manifestations of late cycle behavior on the margin with a small subset of deals getting pitched with more aggressive deal terms and weaker investor protections. The MIM PSC team continues to decline weak transactions and focus on deals we feel offer the optimal combination of strong structural features and attractive pricing.

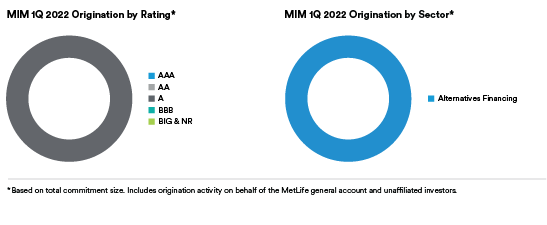

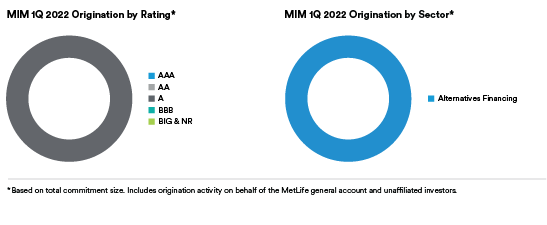

MIM Private Structured Credit Transaction Activity1 : MIM activity for Q1 2022 was $107 million of committed investments.

Endnotes

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

2 At estimated fair value as of 03/31/2022. Includes MetLife general account and separate account assets and unaffiliated/third party assets

3 Metlife Investment Management, Private Placement Monitor.

Disclosur

Disclosur

This material is intended for Institutional Investor, Qualified Investor, Professional Investor and Financial Professional use only and may not be shared or redistributed. This material is not intended for use with the general retail public.

All investments involve risks and there can be no assurances that any strategy will meet its investment objectives or avoid significant losses. Investments in private placements involve significant risks, which include certain consequences as a result of, among other factors, issuer defaults and declines in market values due to, among other things, general economic conditions, the condition of certain financial markets, political events or regulatory changes, and adverse changes in the liquidity of relevant markets. Investments may be subject to periods of illiquidity, and such securities may be subject to certain transfer restrictions that may further restrict liquidity. Accordingly, no assurance can be given that, if MIM were to seek to dispose of a particular investment held by an account, it could dispose of such investment at the previously prevailing market price. Any person contemplating corporate private placement investments must be able to bear the risks involved and must meet the qualification requirements of the underlying investments.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herei n are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs.

The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The assets under management presented herein include assets managed by MIM on behalf of the MetLife general accounts (the “GAPortfolio”) and unaffiliated investors. The GA Portfolio is a portfolio constructed using actual investments in private structured credit assets that were made by MIM solely on behalf of the MetLife insurance company general accounts for the time periods shown. The GA Portfolio includes all private structured credit investments (as categorized by MIM in its discretion) in which the MetLife general accounts invested for the relevant time periods. The MetLife general account portfolios are not managed using a private structured credit-specific investment strategy and are typically structured to match the liabilities of its insurance business, and its underlying holdings consist of positions from multiple asset classes. In addition, the MetLife general accounts are subject to insurance regulations and applicable insurance risk-related requirements. All of the past information displayed for the GA Portfolio relates only to the MetLife general accounts, and is reflective of MIM’s management capabilities for MetLife’s general accounts only. Accordingly, although the characteristics shown herein are derived in part using actual investments made by the MetLife general accounts, such characteristics of the GA Portfolio were not of an actual account managed solely in this specific strategy. Had the GA Portfolio been a stand-alone account managed solely in this strategy, MIM may have made different investment decisions which may have led to differences in the characteristics presented herein. There can be no assurance that these or comparable characteristics will be true of any third party account or that such account will be able to make investments similar to the existing and historical investments made, including in terms of size, industry type, credit rating and other material investment factors. Such differences may arise due to, among other things, economic conditions and the availability of investment opportunities. The ultimate characteristics of a third-party account will depend on numerous factors that are subject to uncertainty. There is no indication, and none is meant to be conveyed, that the same results would apply, or that performance would be better if such risk-related requirements did not apply, to a third party account that is not subject to the same regulations and requirements on investment decisions made by MIM on behalf of the MetLife general accounts.

In the U.S. this document is communicated by by MetLife Investment Management, LLC, a U.S. Securities Exchange Commission (SEC)- registered investment advisor. This document is intended only for investors who are accredited investors as defined in Regulation D under the U.S. Securities Act of 1933, as amended, and “qualified purchasers” under the U. S. Investment Company Act of 1940, as amended. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor..

For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane 8th Floor London EC4R 3AB . This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK. communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: this document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: this document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MAM provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees of a pension fund based in Japan, business owners who implement a defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory.

For Investors in Hong Kong: this document is being distributed by MetLife Investments Asia Limited (“MIAL”), which is licensed by the Hong Kong Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities and has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is an affiliate of MIM LLC, which offers the strategies listed herein. MIM LLC is not licensed in Hong Kong. In Hong Kong, MIM operates through MetLife Investments Asia Limited. The investment strategies listed herein may be offered by MIAL through sub-investment management arrangements with other MIM affiliates solely in accordance with the laws of Hong Kong S.A.R. The contents of this document have not been reviewed by any regulatory authority in Hong Kong. You are advised to exercise caution.

For investors in Australia: this information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under U.S. law, which is different from Australian law.If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. The following information is relevant to an understanding of our assets under management (“AUM”). Our definitions may differ from those used by other companies.

1 As of March 31, 2022, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/ or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

Disclosur

Disclosur