Corporate Private Placement Market

Private Placement Market: Q2 2022 private corporate issuance reached an initial total of $19.3 billion, down from $25.6 billion for Q2 2021.3 We expect some upward revision to the 2022 number as numbers are still being compiled. Deal flow was primarily driven by issuance in the REIT and utility sectors. Issuance was led by activity in North America, comprising 66% of total issuance. European volume (primarily the UK) was 24%, Latam 5%, Australia 4%, and Asia 1%. USD currency made up 79% of corporate issuance, EUR 16%, GBP 2%, Yen 2%, and Danish Krone at 1%.3

Delayed Fundings: Delayed fundings continued to be utilized by issuers with 22% of Q2 2022 transactions having a delayed funding.3 We expect this trend to continue as private issuers approach the market for financing opportunities with concerns of anticipated inflation and the continued potential rise in interest rates.

Spreads and Treasuries: Private credit spreads, following public spreads, widened through the quarter driven by increased inflation pressure and aggressive Fed policy. Private spreads have maintained a healthy premium over publics but have continued to contract toward historic averages driven by strong demand for private assets. This was particularly seen with broadly marketed deals from agent banks.

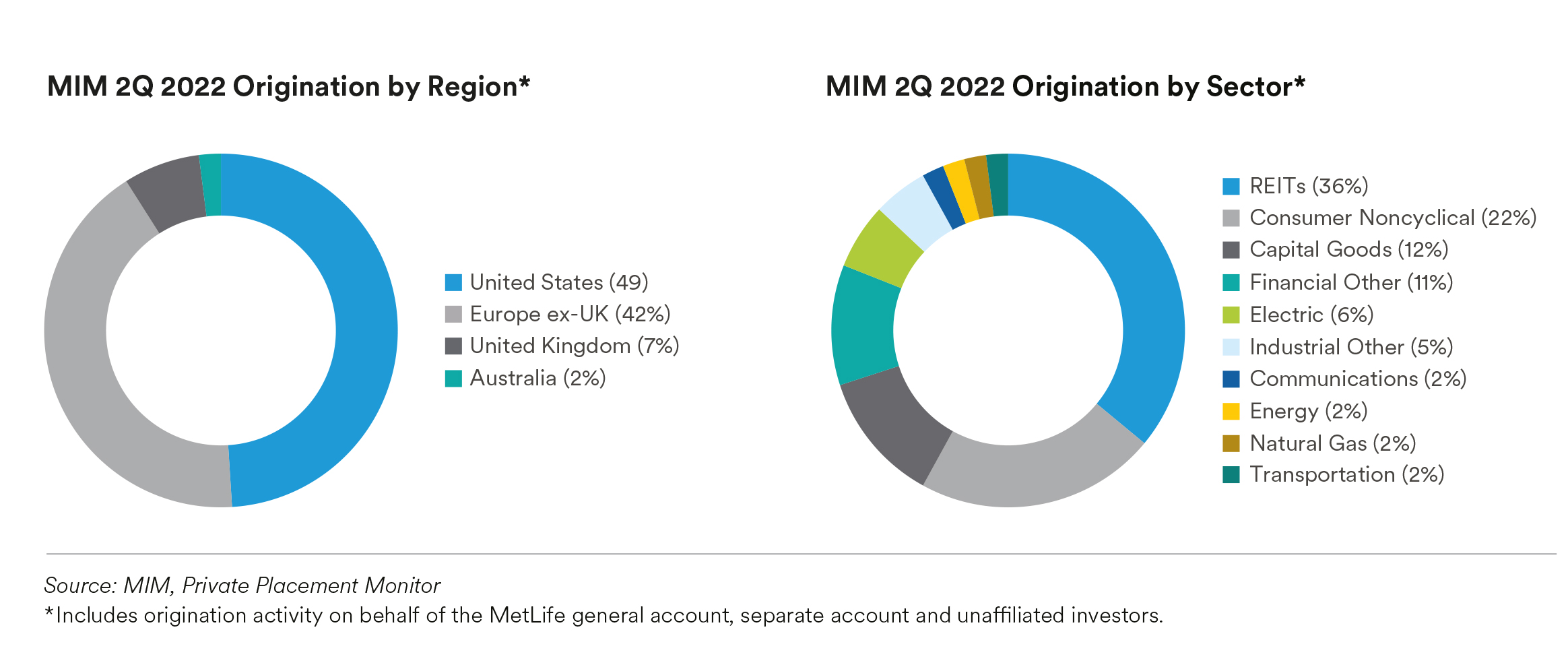

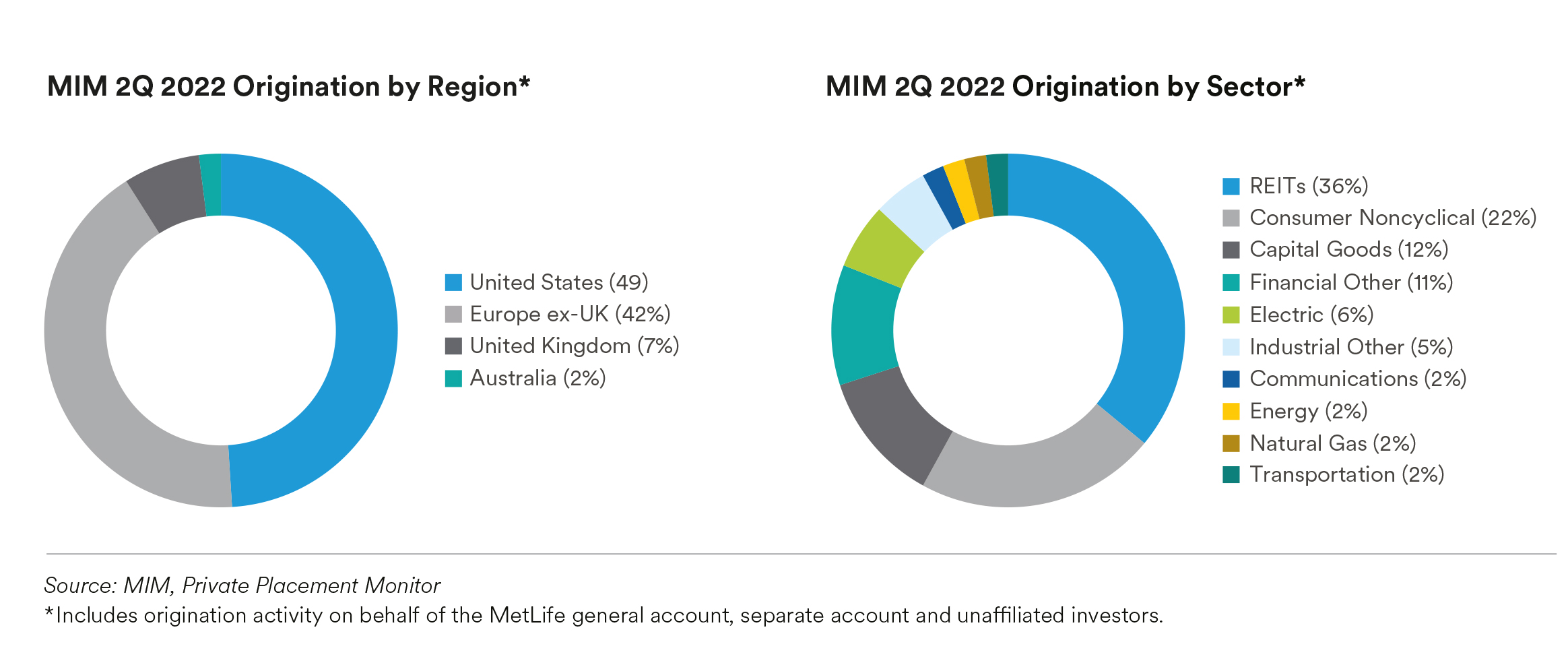

MIM Corporate Private Placement Activity: Coming off a record start to the year, MIM’s origination activity moderated for Q2 2022 to $1.9 billion compared to $2.1 billion in Q2 2021. Year-to-date, origination was $5.4 billion versus $4 billion for the same period in 2021. MIM continues to utilize both direct and club transactions which lead to larger allocations and more diverse deal flow. Origination extended across industries and subsectors, with REITs and Consumer Non-cyclical leading the quarter at 36% and 22% of MIM Corporate origination.

MIM’s 2022 Outlook: As a result of disappointing inflation readings and the Fed’s aggressive response, MIM’s US GDP forecast was revised down to +2.6% growth YoY for the full year 2022 and the forecast for US inflation was revised up to 6.5%. MIM is projecting 10-year UST rates to end the year at 2.75%. Despite the slow down in growth, with still relatively low long rates, MIM predicts 2022 issuance to remain steady. MIM expects the market to remain competitive, with increased investor demand for privates. This may put some pressure on spreads and deal structures, however MIM expects the private market to remain disciplined overall and structures to remain intact. We continue to monitor the portfolio for persistent impacts of inflation. Thus far, issuers have been passing on higher input costs and resulting margins are holding steady. Balance sheets also remain conservative. MIM will continue to utilize our sector specialist approach and relationships in our efforts to uncover the broadest range of appropriate opportunities for our clients.

Infrastructure Debt Market

Infrastructure Debt Market: Year to date, capital markets issuance was down 35% to $27 billion.3 Following an all-time high record for the first quarter, the decrease was mainly driven by a rise in rates and widening in spreads causing Sponsors to slow down long-term issuance. Despite the slowdown, several large scale deals closed within the transportation, energy, and digital space. The broader global infrastructure market for the first half of 2022 increased compared to the first half of 2021. The global market was generally higher coming off a lower pace of investment during the pandemic. Including bank financing, the global infrastructure market was 19% higher at $464 billion compared to $390 billion in the first half of 2021. In the first half of 2022, transportation (25% of total activity) related transactions slightly outpaced energy (24%) followed by telecom (21%), renewables (16%), power (8%), social infrastructure (4%), and other (2%). Activity was focused in EMEA (39%), US & Canada (31%), Asia Pacific (23%), and Latin America (7%).3

Global Sector Highlights:

United States: United States: While the market still waits to realize the impacts from the $1.2 trillion bipartisan infrastructure bill, the broader US market remained active. Many federal, state, and local agencies remain committed to federal grants and public financing channels to finance new projects. In addition, power, renewables, and digital continue to drive the larger capex projects. Given the rising interest rate environment, we remain cautiously optimistic on new refinancing opportunities. Power, energy, public-private-partnerships, and digital continue to provide a strong pipeline for 2022.

EMEA: Activity in Q2 was more subdued than for Q1, however we continued to see interesting opportunities, particularly in the bank loan market as M&A activity continued. We have continued to see a number of opportunities in the digital (mainly fiber) sector across European markets. Renewable deals continue, mostly in Spain and Italy. We expect energy transition assets will pick up pace as Europe battles with a shortage of gas as a result of the Russian war in Ukraine. Leisure-driven airports are reporting a strong rebound in passenger numbers given pent-up demand for summer holidays.

Latin America: Governments continue to advance their PPP programs and support strong growth in renewables to decarbonize their matrixes. The political situation remains noisy in places such as Chile (far left-leaning constitutional assembly, however rejection polling higher), Peru (lame duck President) and Colombia (leftist president elected). 2Q22 remained quiet in terms of new deals, as the market volatility and political situation took a toll, virtually shutting down public bond markets, with spillover effects to private deals. However, the deal pipeline picked up in July, with a couple of large renewable deals launched in Chile. MIM sees a strong pipeline in the Oil & Gas, midstream, power, renewables, and port space.

Australia: New issue activity remained slow to start in 2022, primarily due to Covid and lack of M&A activity. We expect a handful of transactions to launch in the coming months.

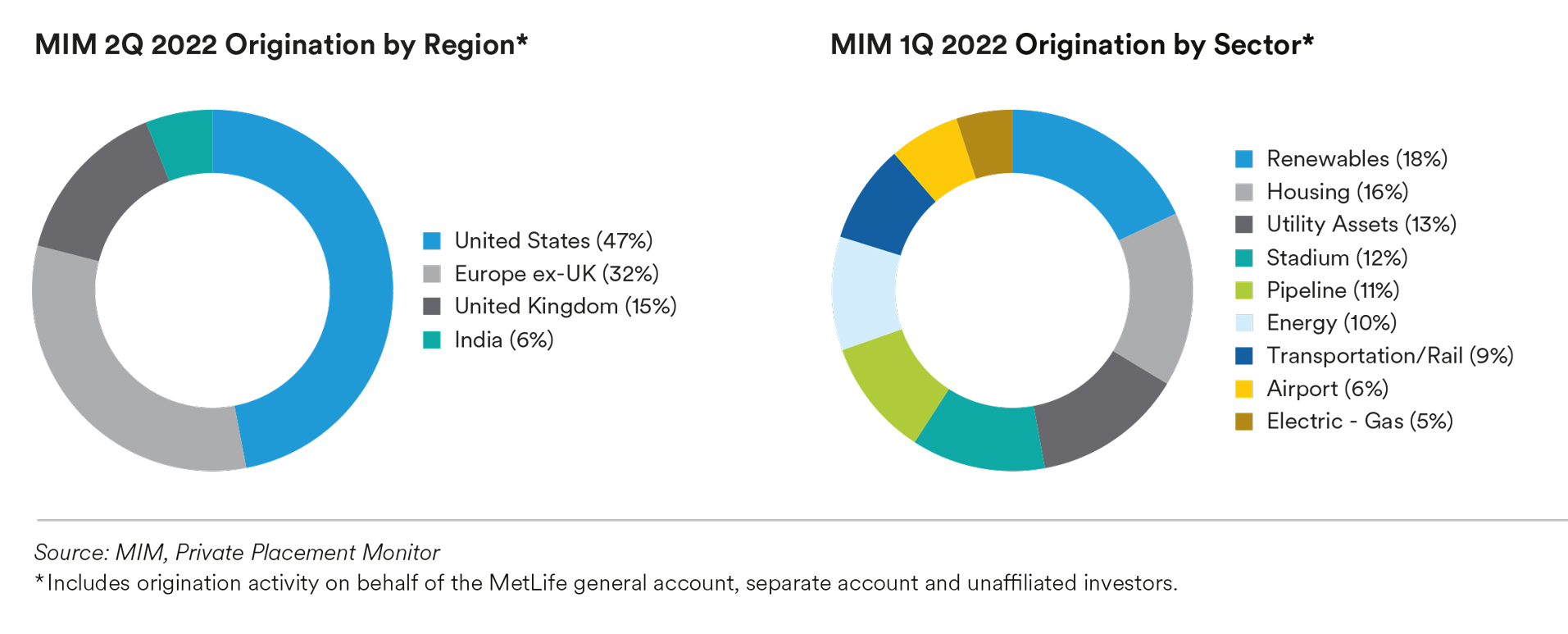

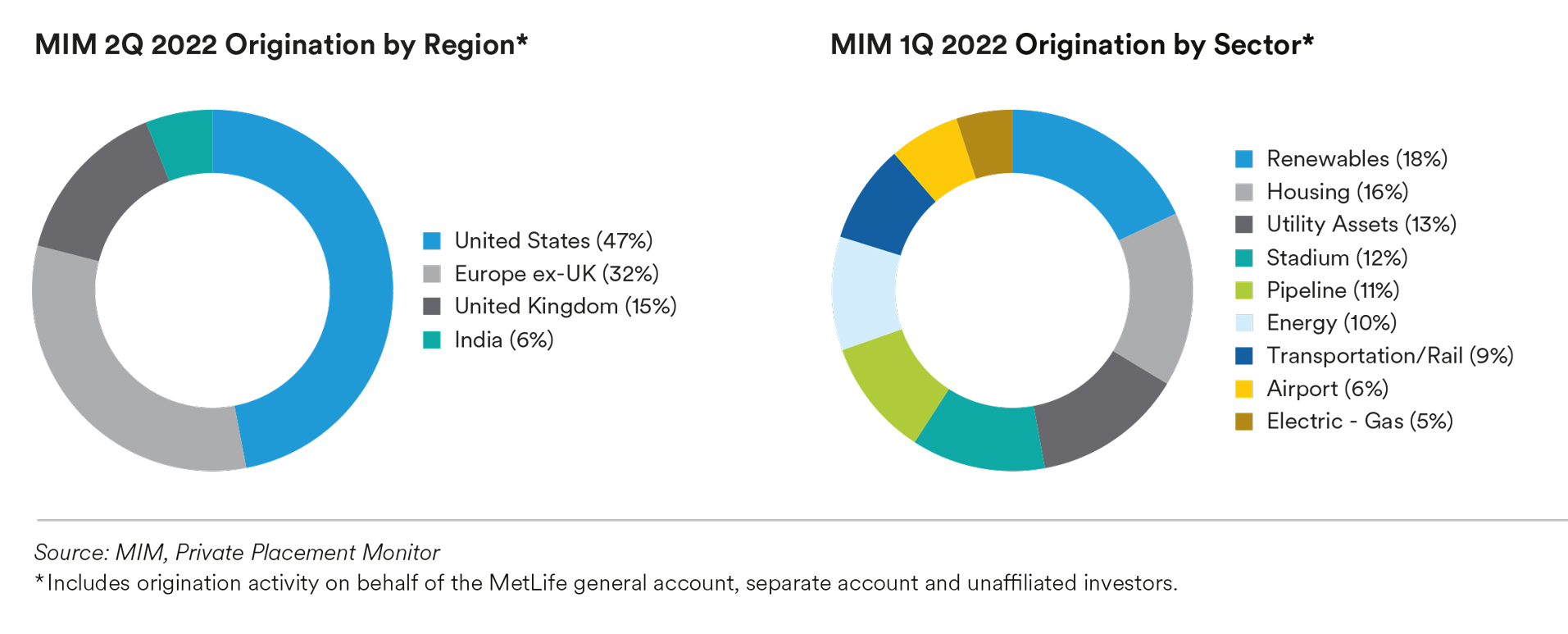

MIM Infrastructure Debt Activity: MIM had another strong quarter with $1.03 billion of origination across 17 transactions compared to $749 million in 2Q 21. Year-to-date, MIM has originated $2.58 billion across 38 transactions. MIM originated notably large transactions in both the US and the UK. MIM received outsized allocations given strong relationships with Sponsors, Agents, and Advisors.

MIM’s 2022 Outlook: MIM is in active conversations with Sponsors and their financing / refinancing strategies given market volatility around inflation and interest rates. MIM expects a continued strong pipeline driven by opportunities focused on renewables, transportation, pipelines, public[1]private-partnerships, digital infrastructure, and energy transition assets.

Private Structured Credit Market

2Q 2022 in Review: Even with market volatility, private issuance remained robust during Q2 driven by strong demand from private credit investors. The continued demand kept pricing spreads at relatively tight levels in Q1 and entering Q2. Spreads have not kept pace with the spread widening seen in the public market. While the spread premium to publics has improved more recently relative to earlier in the year, we continue to see instances of deals where the premium to public markets remains relatively narrow.

Looking to 3Q 2022: While deal performance remains strong across structured finance sectors thus far, higher inflation, rising interest rates, and equity market volatility have the potential to negatively impact both consumer and corporate fundamentals. Within consumer asset classes, we are beginning to notice delinquencies increase from the historical lows post-COVID, although they still remain within long-term historical averages. We continue to believe that structural protections remain strong, helping provide downside support against potential increases in delinquencies and defaults. Volatility in public equity markets will pressure private equity assets. Alternatives financing transactions generally benefit from high collateral diversification, low advance rates, and robust deal triggers providing the ability to withstand very severe declines in asset valuations. We have seen private structured credit deal flow begin to slow recently as issuers are reacting to higher borrowing costs driven by a combination of wider spreads and higher benchmark rates. We remain highly selective focusing on deals that offer compelling relative value compared to their public counterparts along with strong structural features.

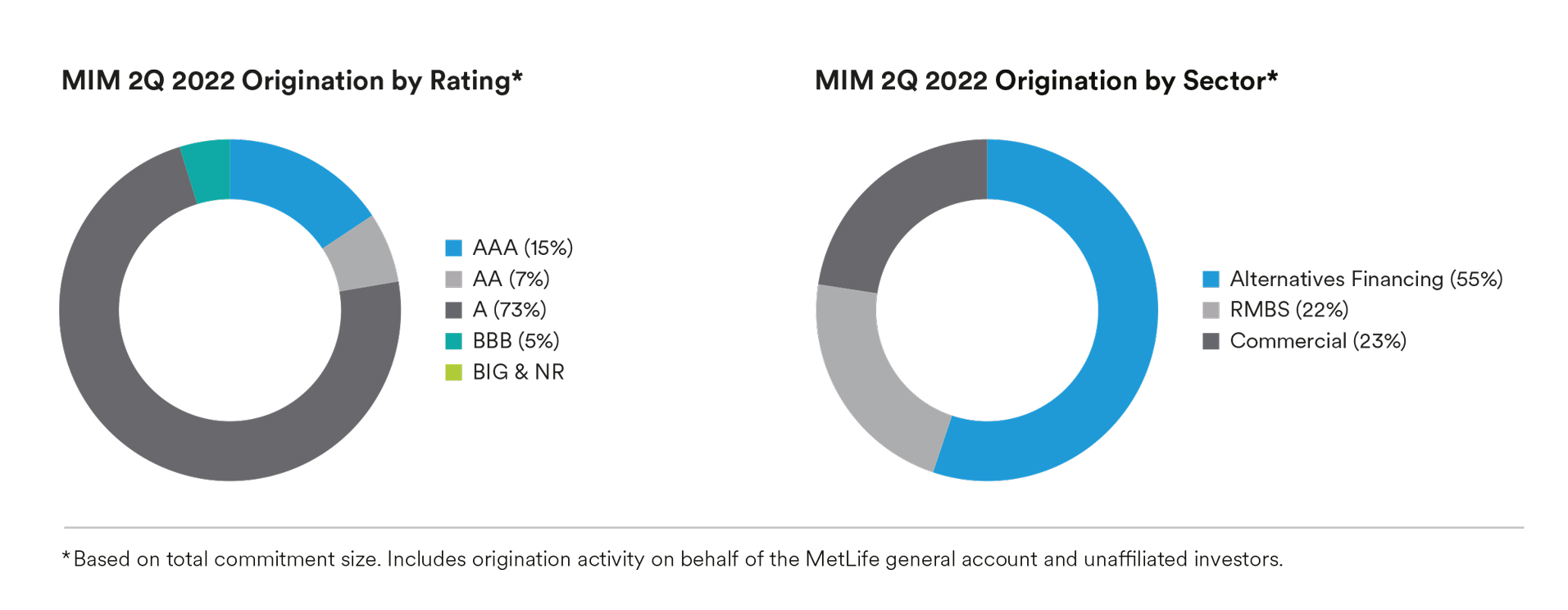

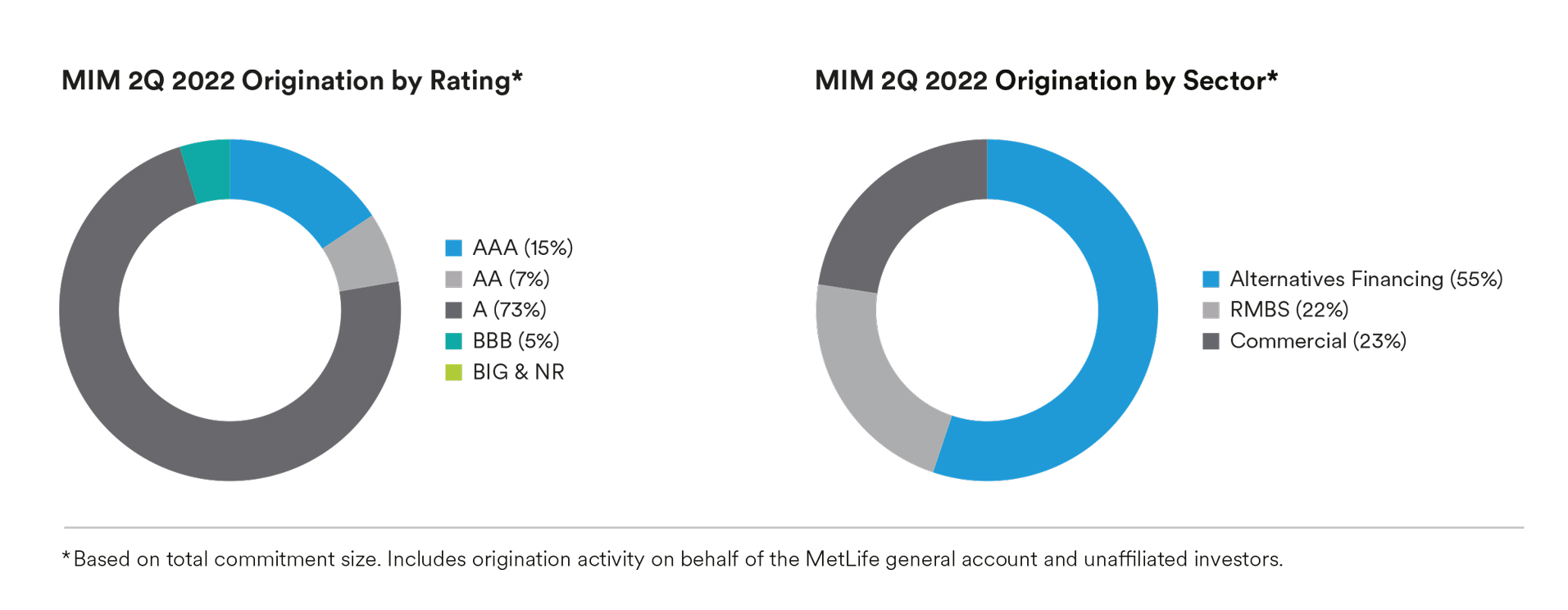

MIM Private Structured Credit Transaction Activity:1 MIM activity for Q2 2022 was strong with $1.1 billion of committed investments

Endnotes

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.

2 At estimated fair value as of 06/30/2022. Includes MetLife general account and separate account assets and unaffiliated/third party assets

3 Metlife Investment Management, Private Placement Monitor

Disclosures

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investing in the strategies discussed herein are subject to various risks which must be considered prior to investing. Below are some of the risks to consider; for a more complete list please contact your sales representative. Investments in private placements include the following risks: Interest Rate Risk; Liquidity risk/Refinance Risk; Inflation Risk; Credit Risk (default and insolvency risk); Currency Risk; Geopolitical Risk; and Regulatory Risk. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/ EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such). For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.