Inflation Vanquished?

Monthly inflation over the last two months has, according to the BLS, tracked at 1.9%, below the Fed’s 2% target.

BLS data also show goods prices have deflated over the past two months. Services, aside from shelter, have fallen below their long-run average inflation rate. Even rent has seen deflation over the past two months. But we don’t expect outright headline deflation in the near term.

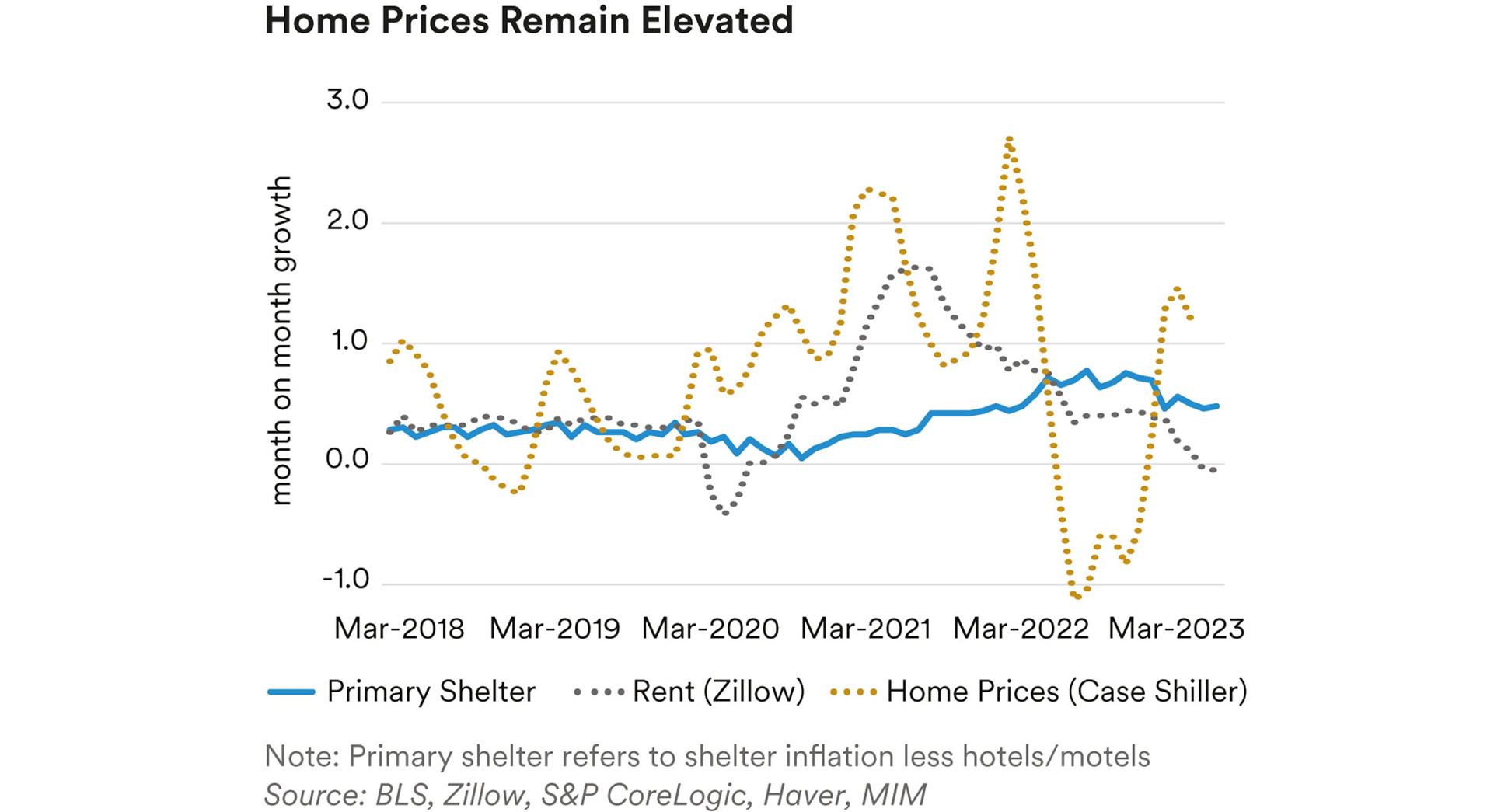

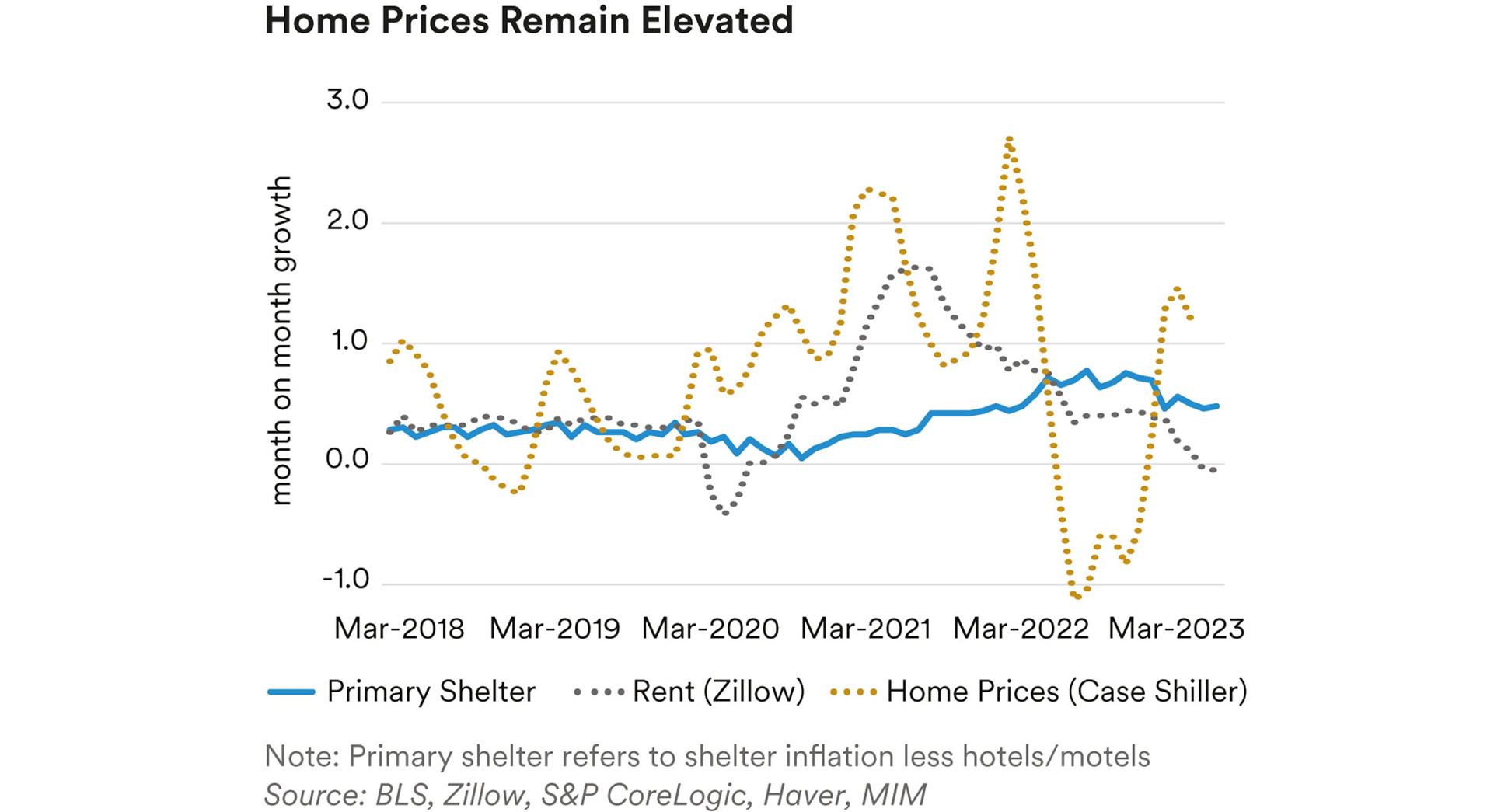

The main concern is housing. Housing shortages and lack of inventory have led to a rebound in home price growth since January, with the Case-Shiller home price index coming in at an annualized average of 13%, compared with its long-run average of 5%. The Housing Affordability Index, which considers price and mortgage rates, shows housing is at its least affordable since July 1985.

Looking forward, it’s unclear how the situation will be alleviated. Housing construction hasn’t had a robust response to the shortage, with Census data showing minimal growth in units under construction.

Credit Still Tightening

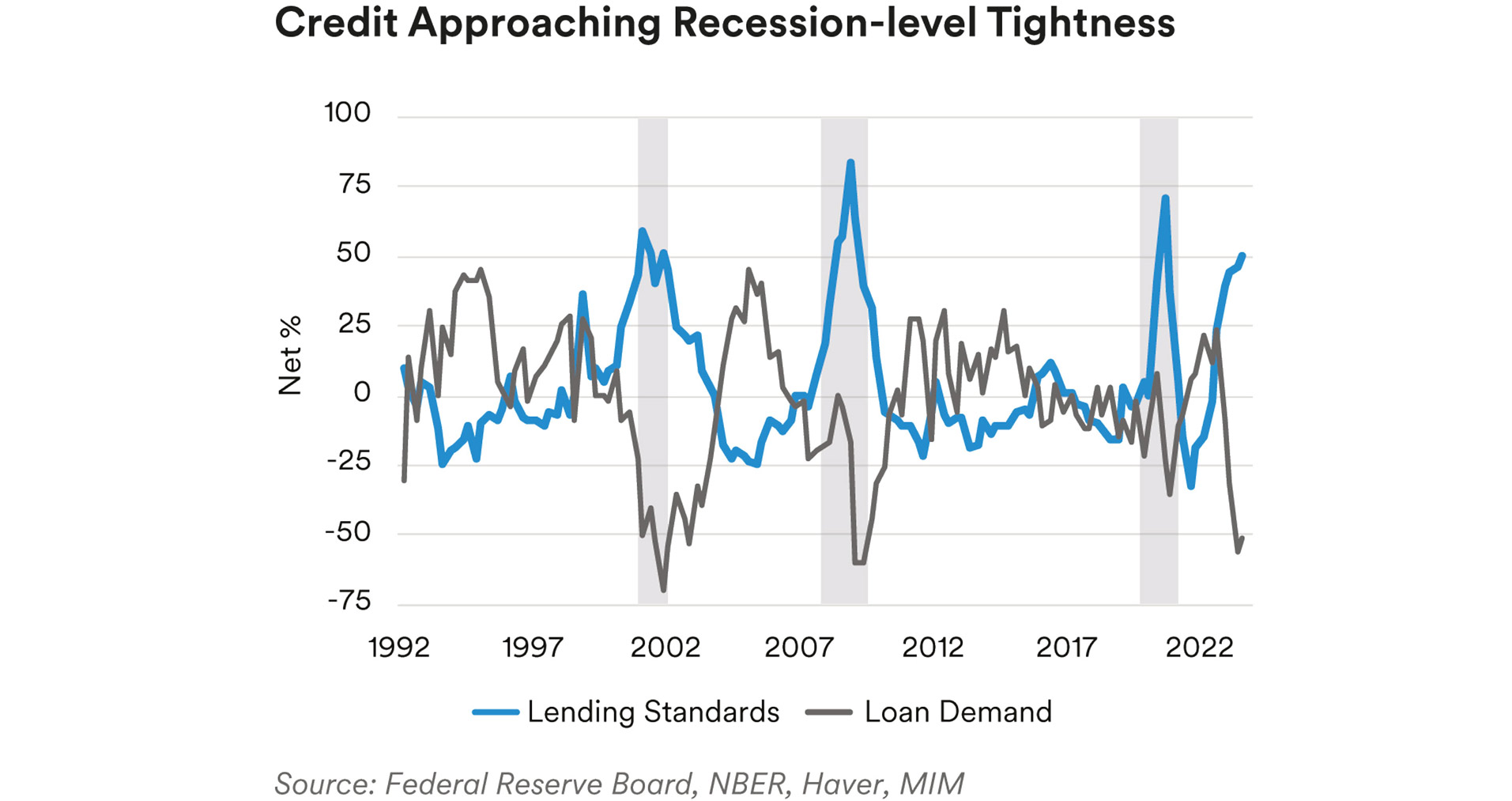

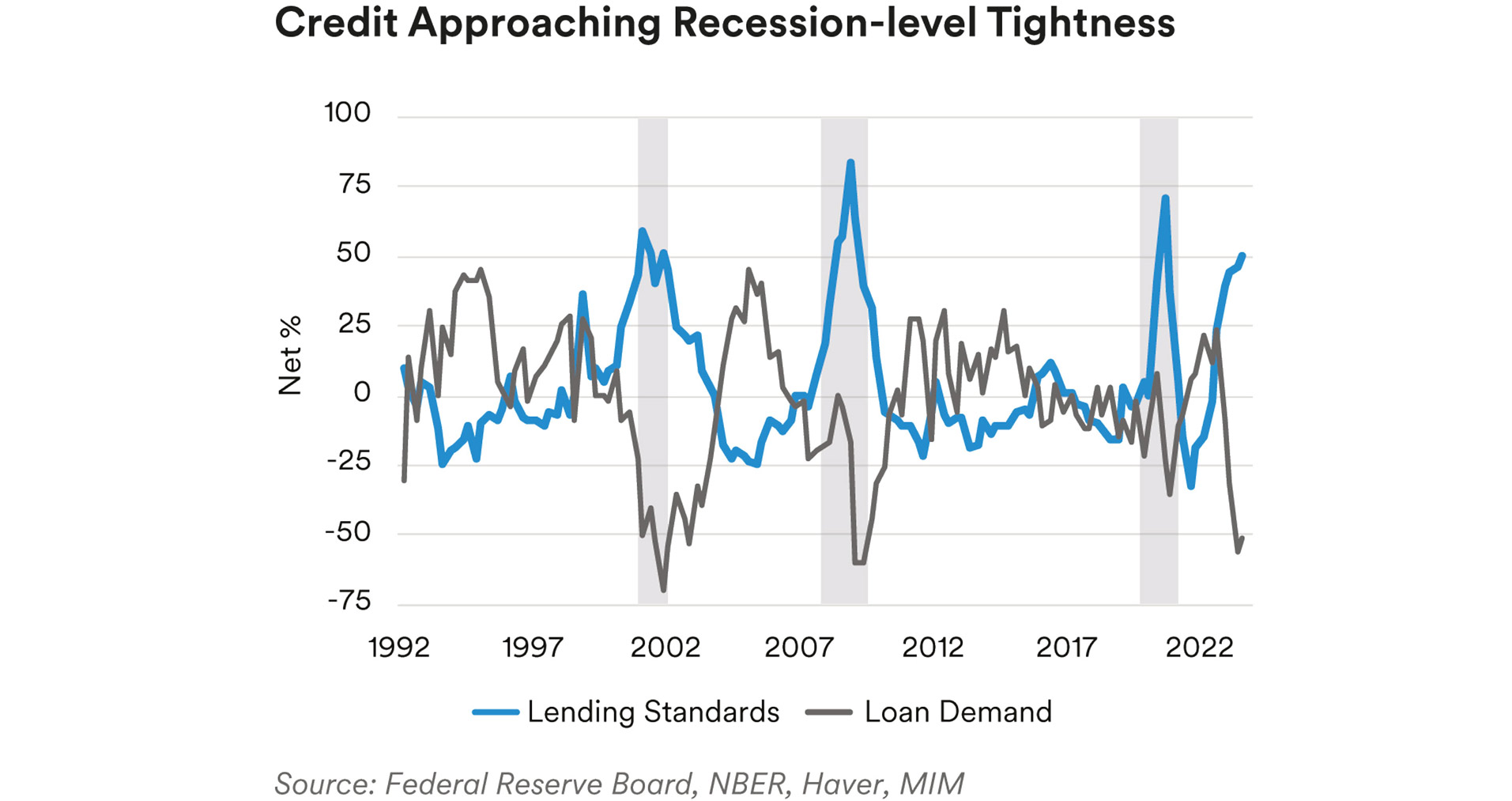

We expect the ongoing tightening of bank lending standards to continue for some time.

The most recent Senior Loan Officer Survey suggests that lending standards are close to recession levels. Loan demand remains weak. We believe recent bank downgrades will only exacerbate any unwillingness to lend.

On the consumer side, Federal Reserve data shows credit growth has declined from its peak of 7.6% in 2022 to 4.3% in June as consumers increased their debt burden more slowly. It has some ways to go before becoming contractionary but appears to be weakening.

Consumers Remain Optimistic

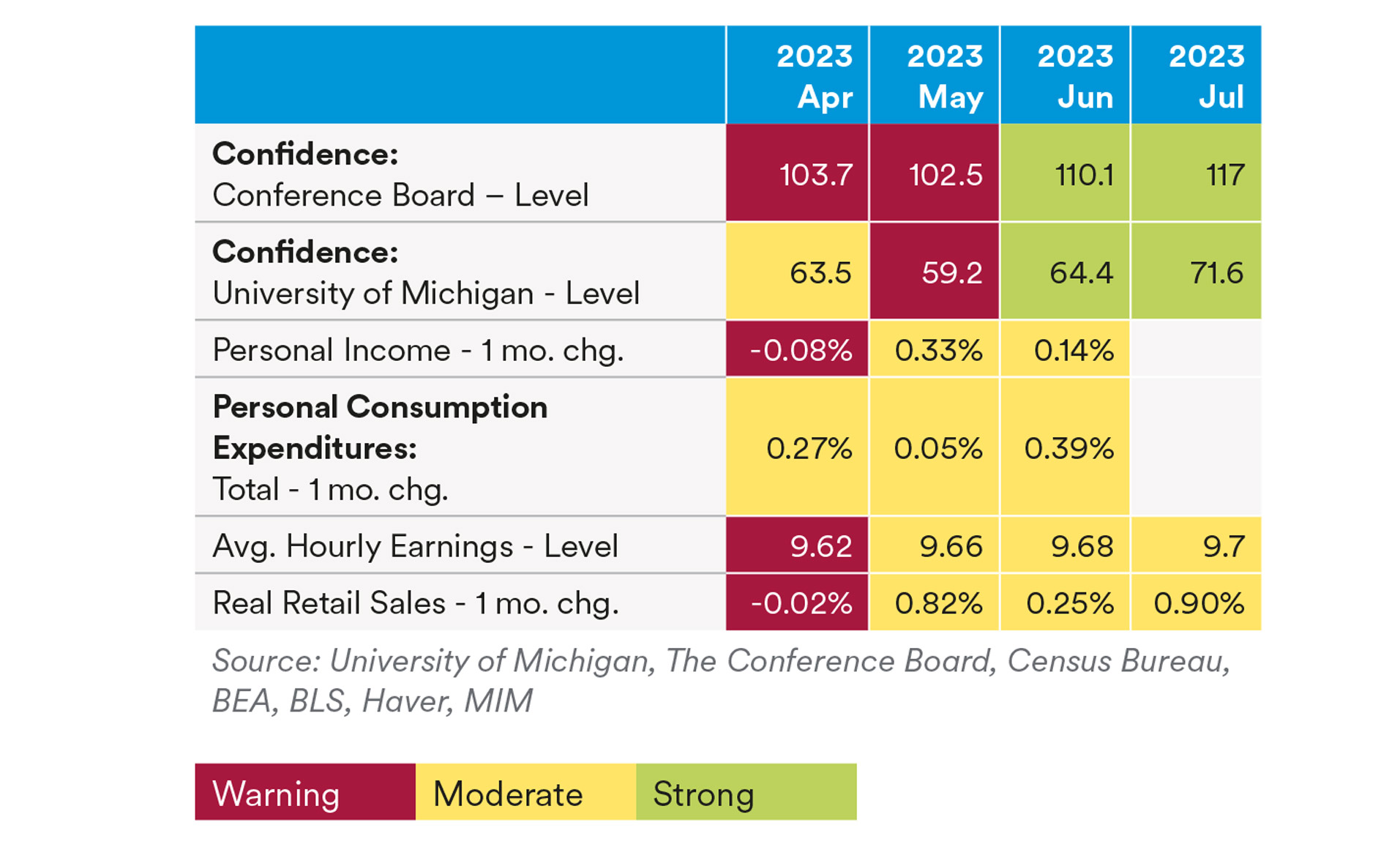

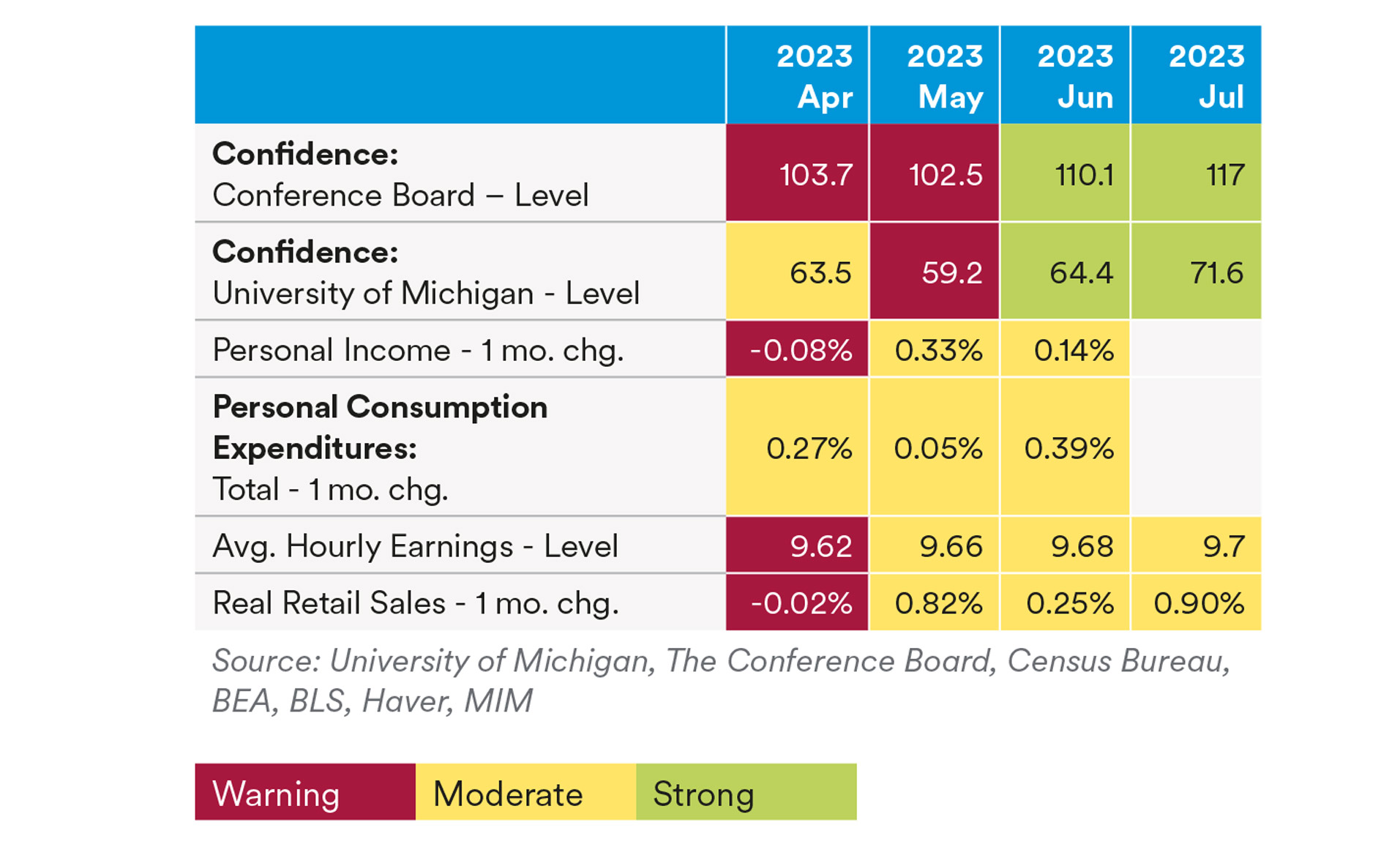

Consumers continue to reap the benefits of a tight labor market and moderating inflation, and consumer confidence has had two months of surprising improvements — moving the indicators from red to green in our table. We expect consumers to continue spending on services, and also increase goods purchases as prices fall due to goods deflation. Given the behavior of consumers postCOVID-19, continued strong consumption expenditures and the upcoming holiday season, we do not expect consumers to willingly slow down spending going into the fourth quarter.

However, higher credit usage, low savings rates and restarting student loan payments may cast a shadow on the sustainability of consumer strength and spending, especially if the labor market weakens.

Risks to the Outlook

The risks to the outlook remain significant. The U.S. fiscal situation is concerning and has deteriorated in recent months as the growth in interest payments accelerates, claiming an increasing share of tax revenue.

We do not expect substantial near-term effects from the U.S. credit downgrade, but a longer-term concern is the potential for other credit ratings to reset relative to the new debt rating.

Heading into the fall, we are likely to hear more about a potential government shutdown, which would increase market volatility, particularly in light of the credit downgrade.

U.S. Outlook Summary

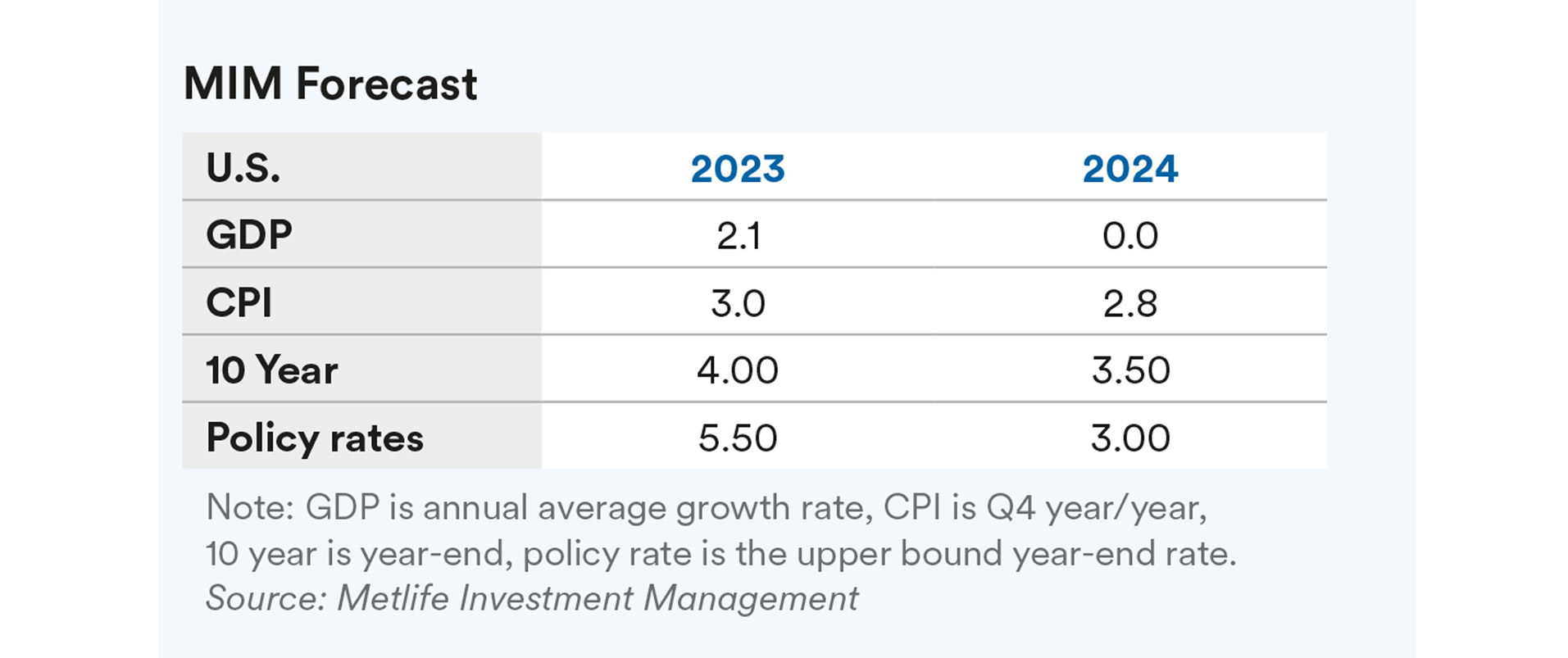

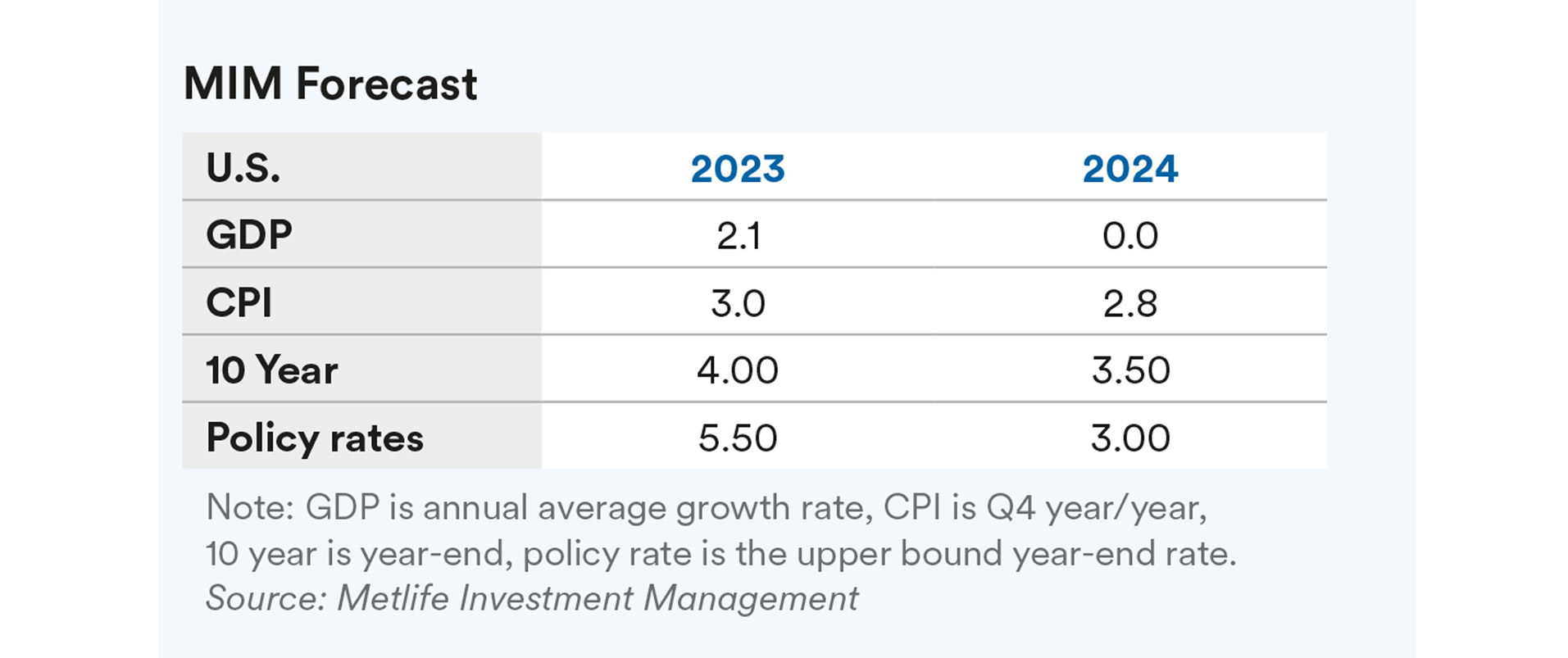

We expect that a recession will likely be avoided until 2024. We have raised our U.S. growth forecast to 2.1% in 2023 on the back of an unexpectedly high Q2 GDP print. We have also raised our 2024 forecast to 0.0% (from -0.2% previously). Despite the improvement, we still expect at least two quarters of negative growth in 2024.

We believe the Fed has completed its hiking cycle with the July rate hike. We expect a rate cut cycle to begin in 2024, whether or not a recession takes place.

We foresee a 10-year U.S. Treasury yield of 4.00% at year-end 2023. We believe, the downgrade to U.S. debt is unlikely to lead to an enduring rise in rates, although they are approaching cycle highs.

As noted in our Q3 2023 Relative Value Allocation, we still do not think credit markets have priced in sufficient downside risk yet. Looking forward, we expect the credit cycle to turn in the coming quarters, with spreads widening further on continued recession risk. As a result, we continue to recommend “up-in-quality.”

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors.

This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2023, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MIM I LLC, MetLife Investment Management Europe Limited, Affirmative Investment Management Partners Limited and Raven Capital Management LLC.