Where Are We Today?

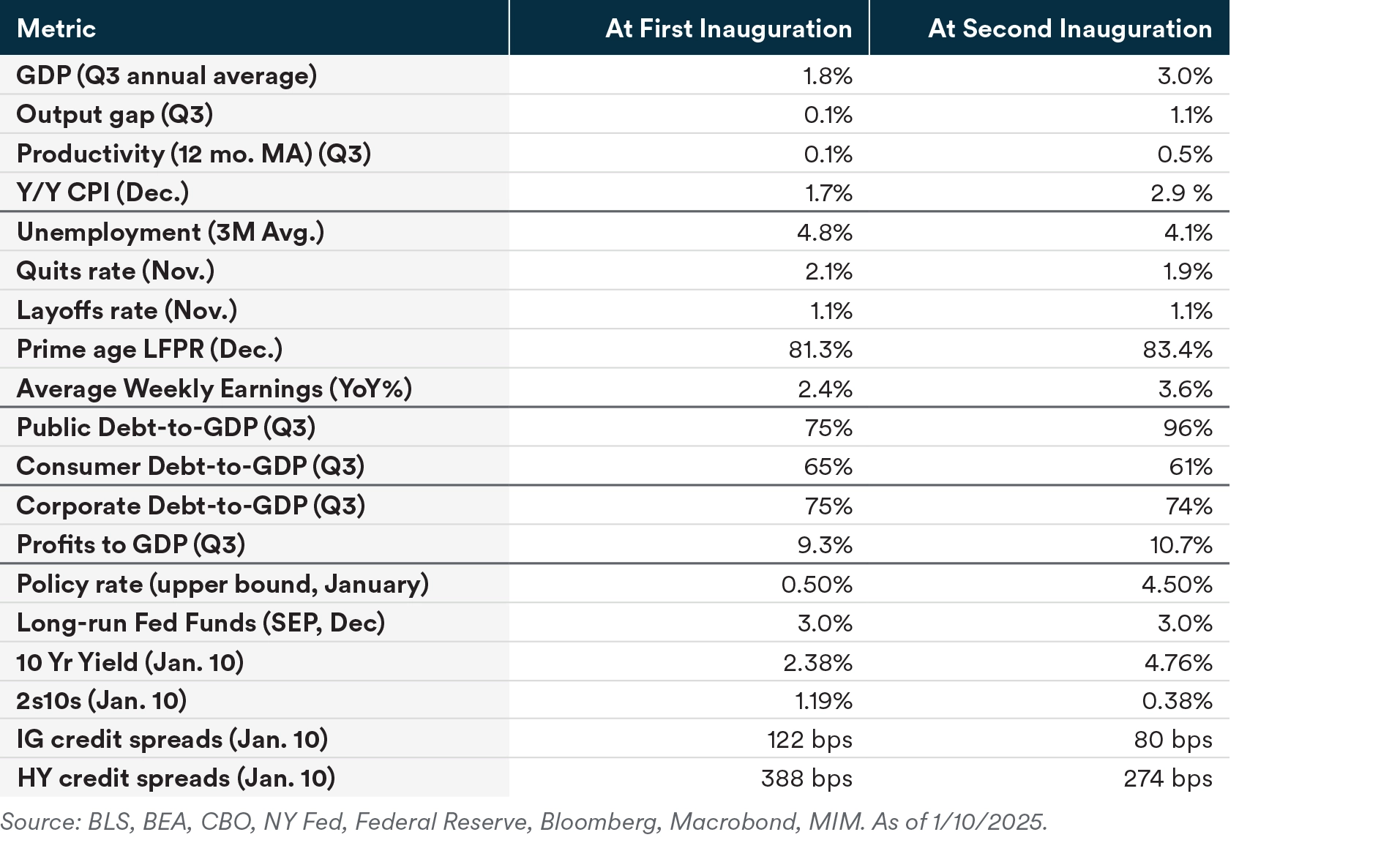

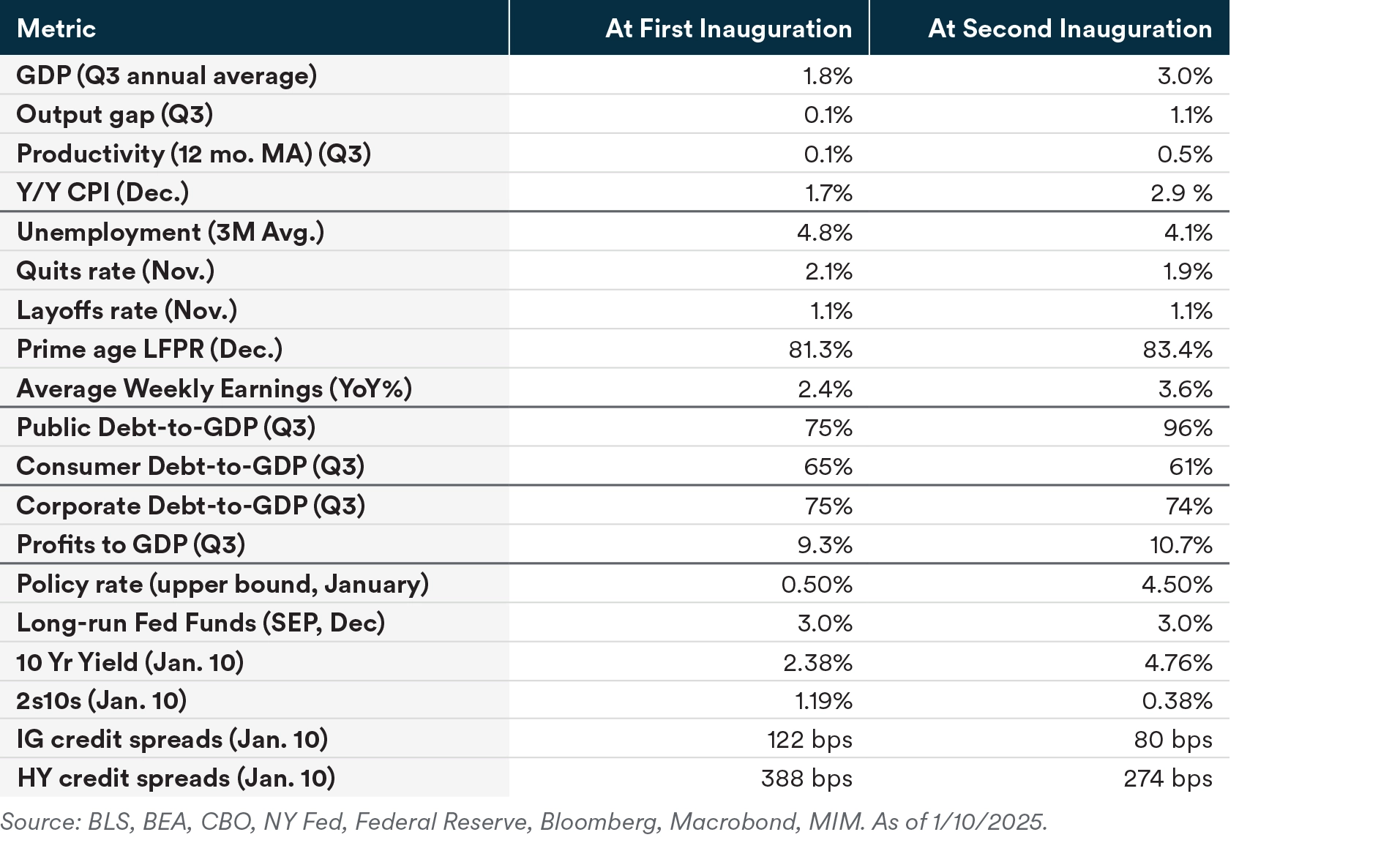

Aside from a strong labor market, the economy of today has little in common with the economy of eight years ago, when President Trump was inaugurated for his first term. We point out a few key differences and how these are likely to interact with President Trump’s second term agenda.

From Cold to Hot

In 2017, the economy was still struggling to emerge from the Great Financial Crisis (GFC) doldrums. Productivity was low, the output gap was at neutral, and GDP growth was sluggish.

In the current environment, the output gap — aka the “inflationary gap” — is very positive, and GDP and inflation are both running relatively high.

In the former environment, the Tax Cut and Jobs Act (TCJA) stimulated activity with little risk to inflation. In the current economy, an extension of the TCJA could be both stimulative and inflationary.

Trade policy also poses more inflationary risks than it did in 2017. The trade war with China during the first administration took place under low-inflation conditions. Now, after a period of inflation and already high price levels, consumers appear to be more price sensitive and more likely to push back against price increases. Companies have been having increasing difficulties passing cost increases on to shoppers. Firms face a bigger risk of margin compression from tariffs than they did in 2017.

Increasing tariffs to a global scale would exacerbate this effect, and it is not clear that markets and companies would tolerate the uncertainty and volatility after taking steps to “tariff-proof” their supply chains.

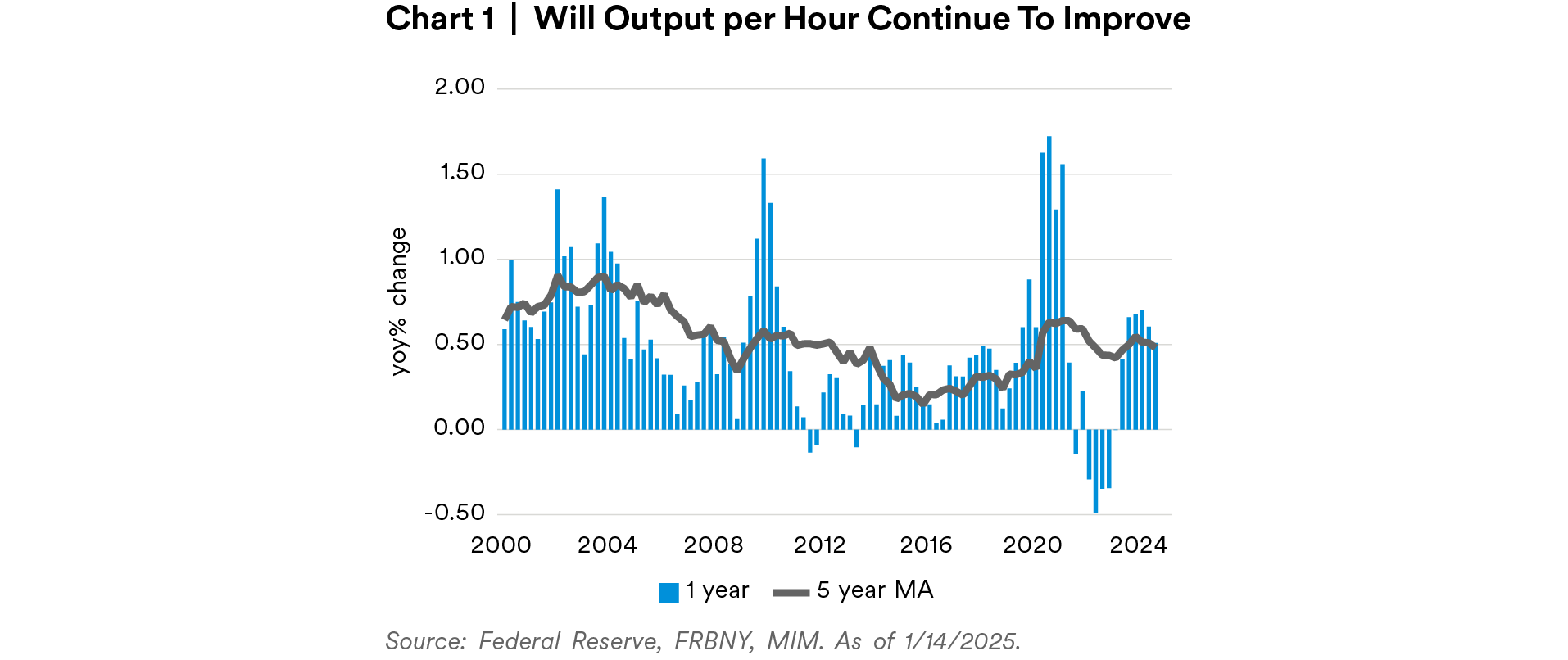

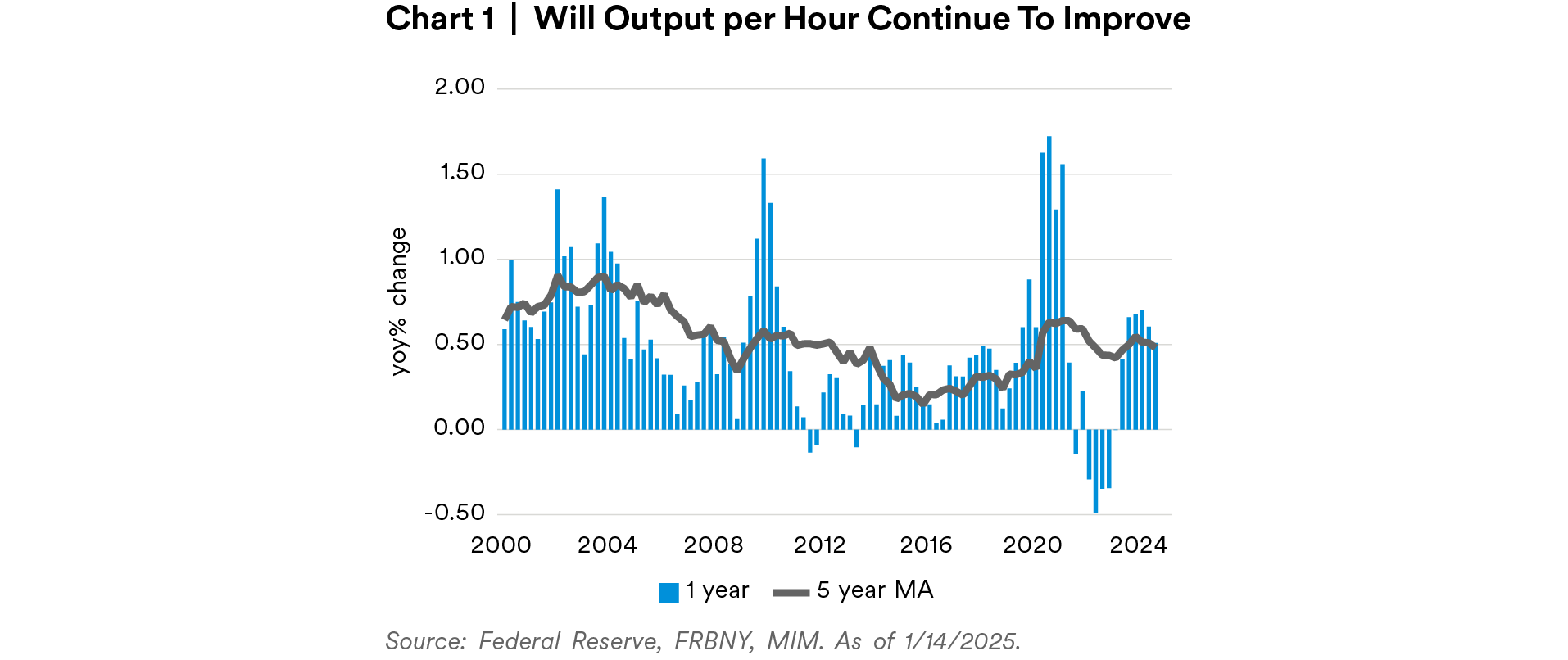

Productivity growth is a wildcard. If productivity growth continues to improve, as it has over most of the last decade, aggregate supply could accelerate to meet aggregate demand and raise growth without increasing inflation.

From Placid to Volatile

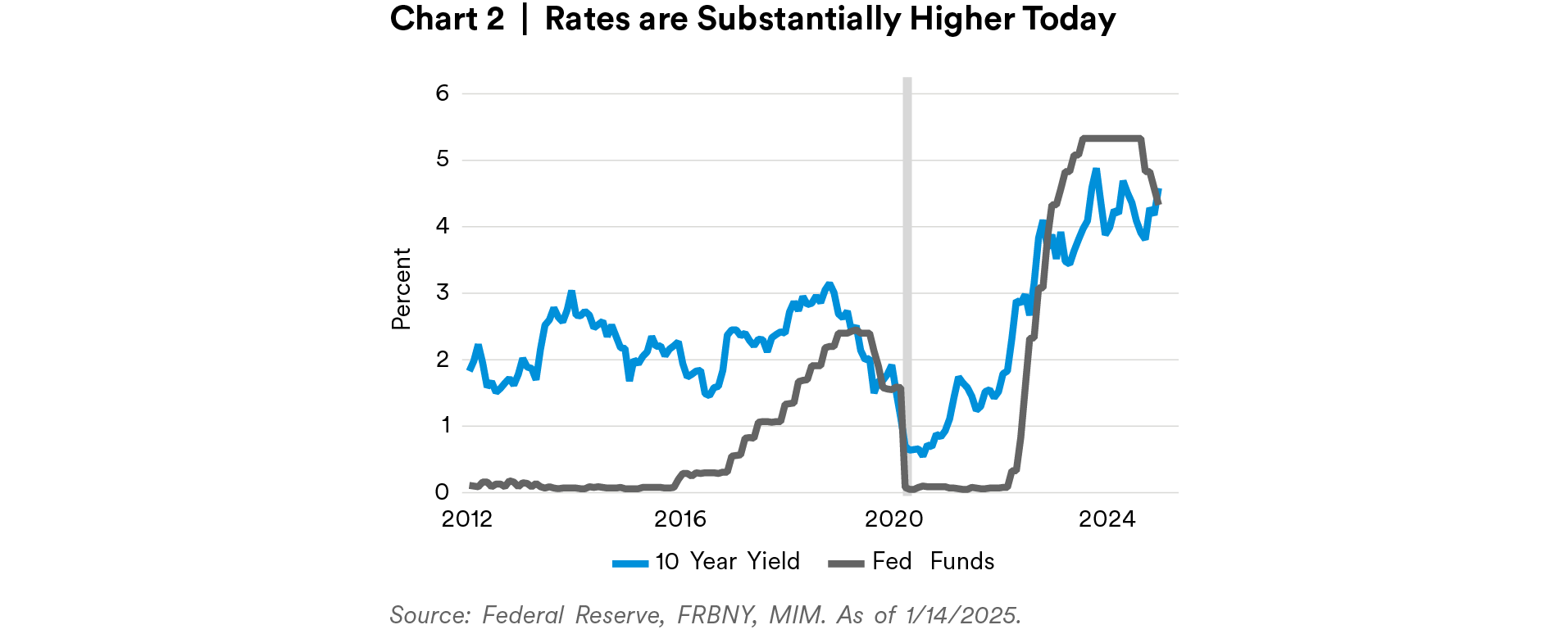

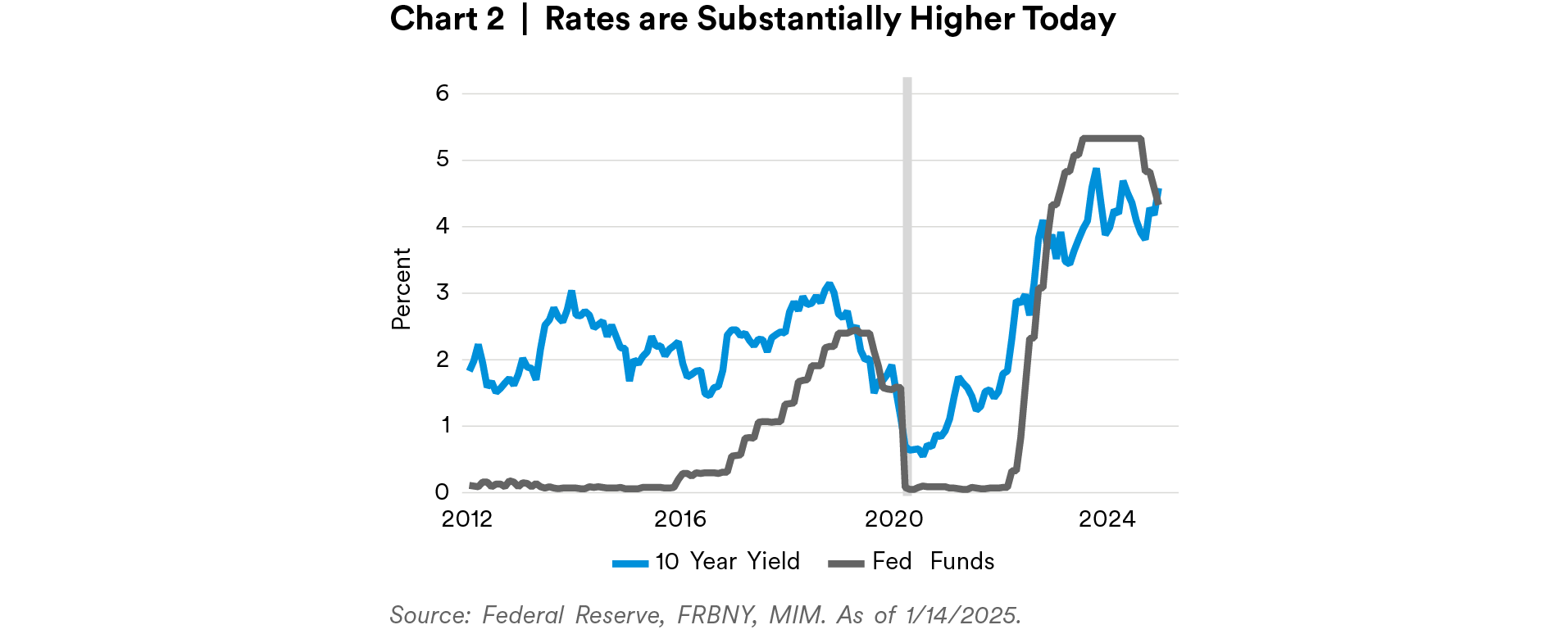

President Trump entered office in 2017 in a very different interest rate environment than this time around, which could further constrain his policy.

In 2017, rates were very low and the zero lower bound was a preoccupation. The yield curve term premium was solidly positive. And the Fed had clear directionality: upward and away from the zero lower bound.

In 2025, we have both nominal and real rates that are substantially higher. The zero lower bound has disappeared as a concern. Term premiums are barely positive — although they are normalizing.

Most importantly, the Fed no longer has a well-defined path: although most observers expect a pause or cuts, only one cut is priced into the market at the moment. The entire range of Fed options — cut, pause, hike — is in play, at least in the medium term. Globally, central banks are diverging, with most countries looking considerably weaker than the U.S. and creating a more difficult U.S. export environment.

The new administration and Congress, much to the dismay of the markets, don’t appear likely to focus too heavily on fiscal restraint. With higher rates, any tax cut extensions, new industrial policies, or technology-neutral tax credits will happen with increasingly higher cost to the government (and ultimately the taxpayers). Combined with an already strong economy, expansionary fiscal policy may further complicate the Fed’s monetary policy choices.

U.S. Outlook Summary

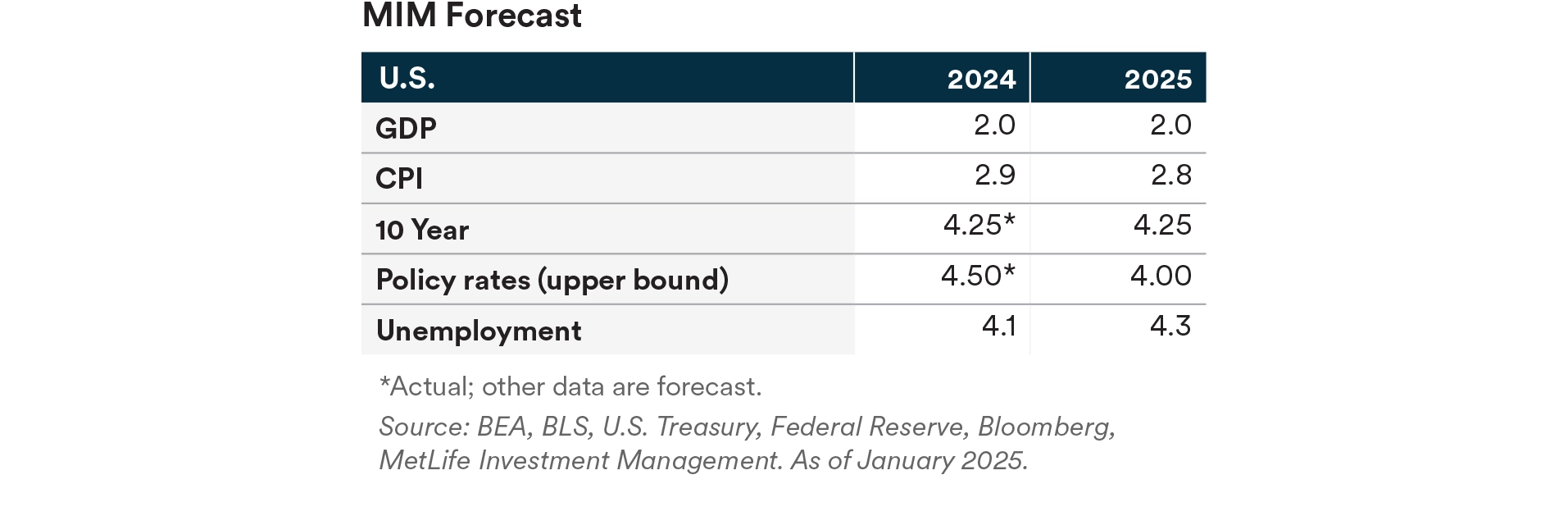

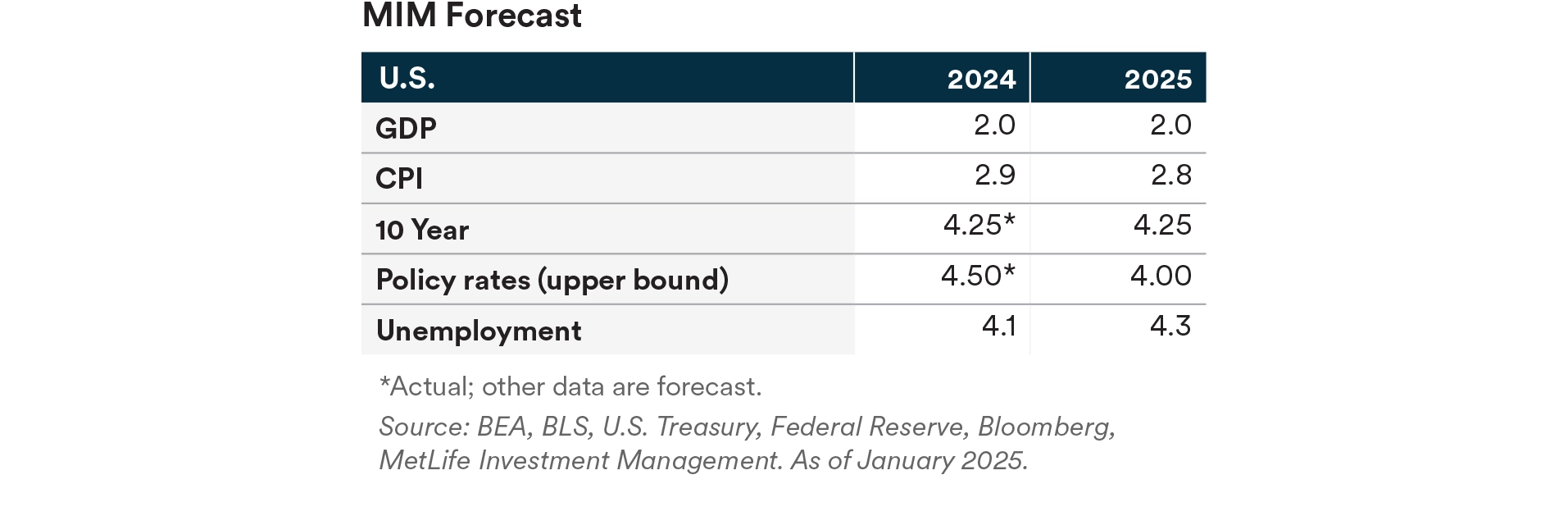

We expect growth in 2025 to be roughly on par with that of 2024, avoiding a recession and growing slightly above trend.

Consumer balance sheets remain comfortable, and the labor market looks to be stabilizing after a period of softness. Wage growth has remained solid. Corporate profits remain robust and could support an increase in investment.

With the incoming Trump administration, we expect the noise-to-signal ratio to be very high, providing continued volatility across markets. We expect tariff policy increases early in the second Trump administration, although inflation effects are likely to be muted, with margin compression a greater concern.

We would expect government spending — a major supporting player in the recent growth story — to be pared back over the next six to 18 months. Stimulative effects and fiscal deficit increases could arise from an extension of the Tax Cuts and Jobs Act.

We expect the Fed to continue to move slowly toward the neutral rate by cutting two more times by year-end 2025. A moderate pace fits with the Fed’s considerable uncertainty about where the long-run neutral Fed Funds rate is, even as we expect inflation will take longer to converge toward 2%.

Risks

We see a risk that the Federal Reserve doesn’t cut the Fed Funds rate in 2025. If inflation and the labor market continue on their recent path, additional cuts might become harder to justify — particularly if the data indicate that the neutral rate is (even) higher than the Federal Open Market Committee (FOMC) currently believes it is.

President-elect Trump’s stance on tariffs, immigration, and other matters could create a range of escalatory economic situations including a tit-for-tat trade war and the labor effects of new immigration policies. Pro-growth strategies by the incoming administration, particularly in the context of an already strong economy, could create overheated conditions.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.