Looking at recent data, we suggest that high-earning households may have enough strength left to carry the economy for some time. There are a substantial number of relatively high-earners, and they are exhibiting continued strength. Of course, this depends on continued strong asset market performance and continued employment, but for now we see no notable areas of concern among the high-earning group of U.S. consumers.

It Takes Money To Make Money

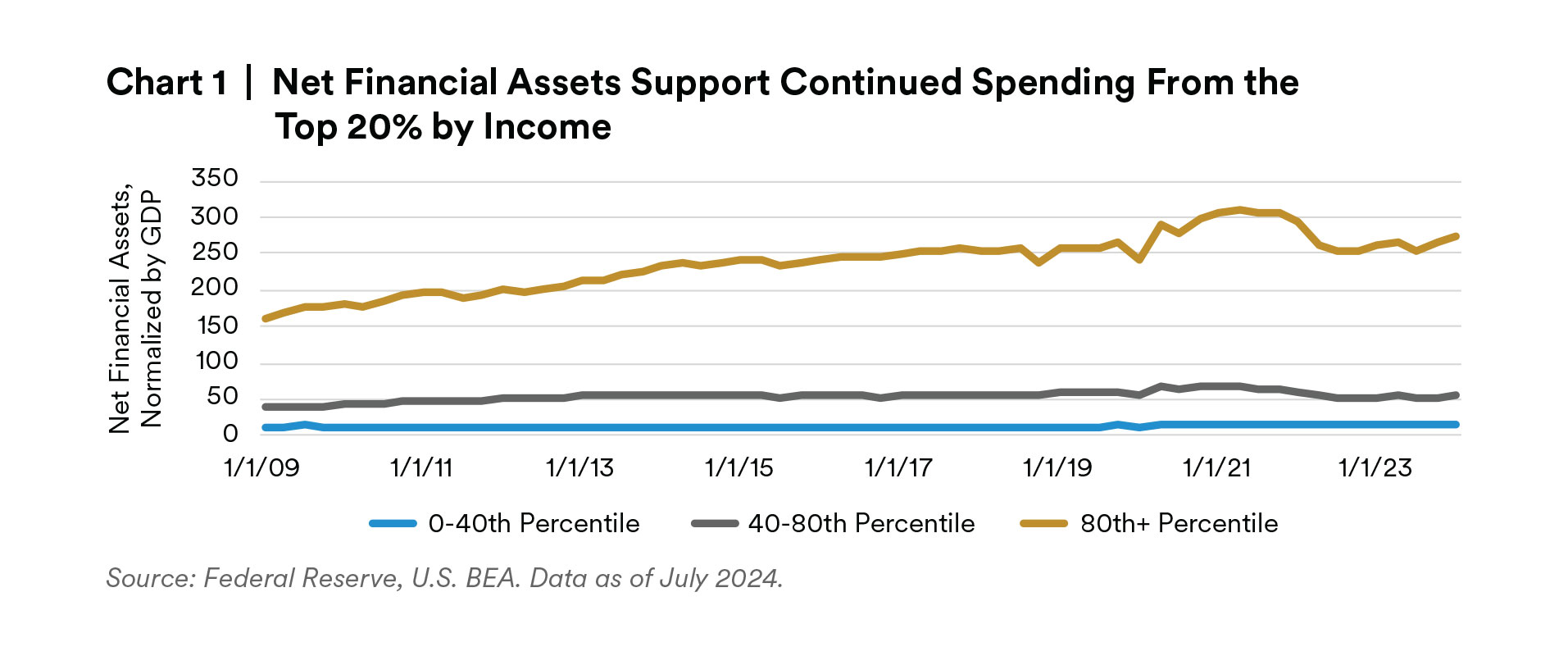

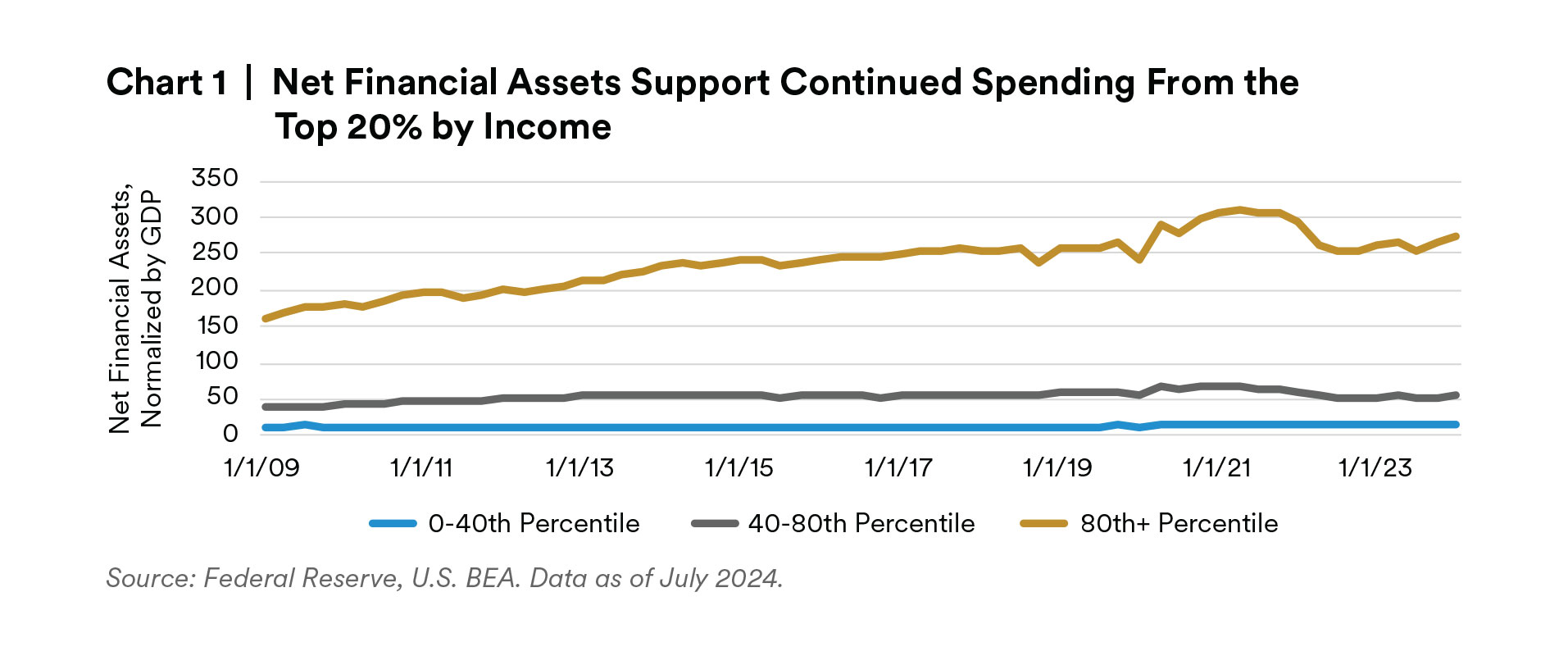

There is an increasing concentration of net financial assets among the top 20% of income-earners, supported both by strong stock market performance and higher interest earnings on savings. The bottom 80% of income earners have also seen unusually high growth of their financial assets.

Those high earners in the 40-80th percentile most recently saw a 2.1% year-on-year growth in their net financial assets, compared with a long run growth rate of 0.4% annualized since 1990. The lowest income bracket, from the 0-40th percentiles, which historically saw a decline in net financial assets of 0.1% annualized, has in the most recent year seen an increase of 0.2%.1

Although strong by historical standards, these growth rates pale in comparison to those in the 80th+ percentiles, who have seen their asset growth rate more than double from 2.0% to 4.5%.

Wealth concentration has been a long-running trend since at least the 2008 financial crisis. However, high earners saw asset balances decline as the Fed began raising rates. The recent re-accumulation by high earners, likely caused by them adjusting their portfolios to a higher rate environment, is likely to improve their spending confidence.

This improvement in net assets could continue to provide a tailwind for spending, particularly for the middle- and high-income populations. The wealth effect driver of spending is obviously somewhat precarious as it depends on continued strength in asset markets. Consumer confidence is also dependent on continued strength in earning power (see next section).

Wage Bill Growth Is Still Strong

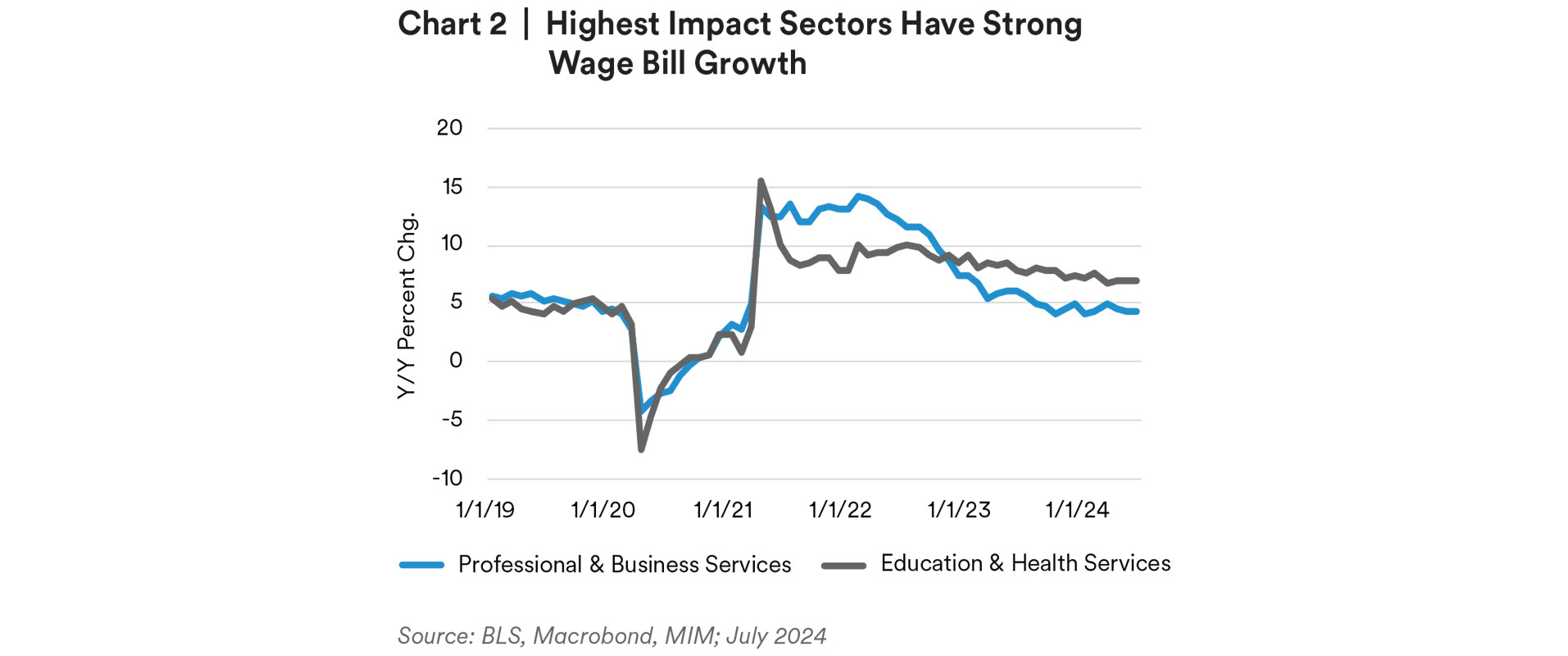

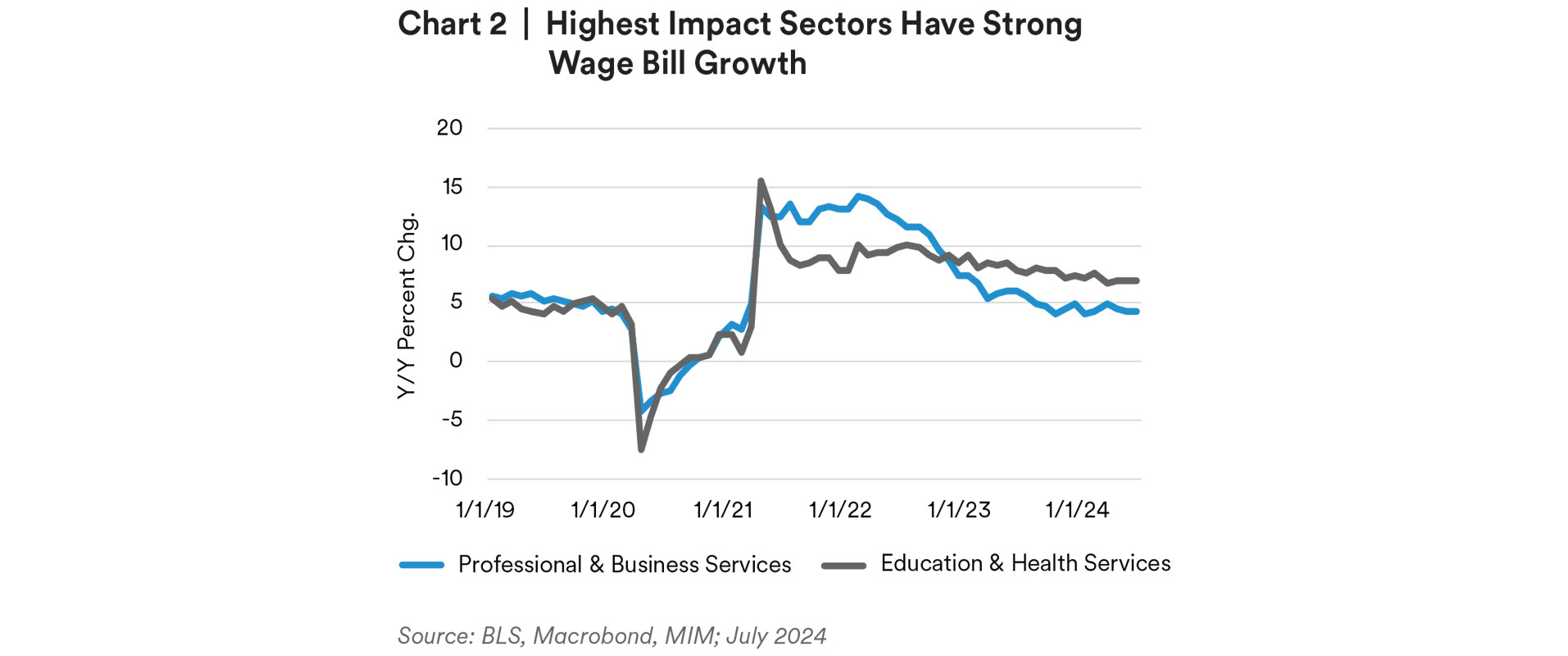

Sectors with large wage bills remain supportive of continued spending. Continuing job and wage growth in business services and private education and healthcare, relatively higher-earning, high-impact services sectors, could bolster consumer spending and smooth bumps in the economy even if consumers employed in other sectors are impacted by an uncertain macroeconomic environment and tighter monetary policy.

BLS data shows that by the end of June, total private non-farm payrolls in the U.S. were 135 million. Of those employees, 49.2 million, or 36%, work at jobs related to business services, healthcare, and private education. The wage bill (i.e., average weekly earnings multiplied by the number of people employed) paid into these two largest sectors make them more impactful on consumer spending. Some sectors have strong wages, but do not employ nearly as many workers. The information sector, for example, has average weekly earnings even higher than the financial sector but employs only three million people. Conversely, the leisure/hospitality sector employs many workers but pay is relatively lower, making it less likely to move the needle on consumer spending.

The wage bill for the biggest two sectors continues to grow at a healthy pace matching or exceeding its pre-pandemic growth rate, meaning consumers employed in higher paying services jobs still have spending capacity. The wage bill for professional and business services has normalized to 4.3% year-over-year, while that of the education/health services sector remains elevated at 6.8% year-over-year.

Relying on the Rich?

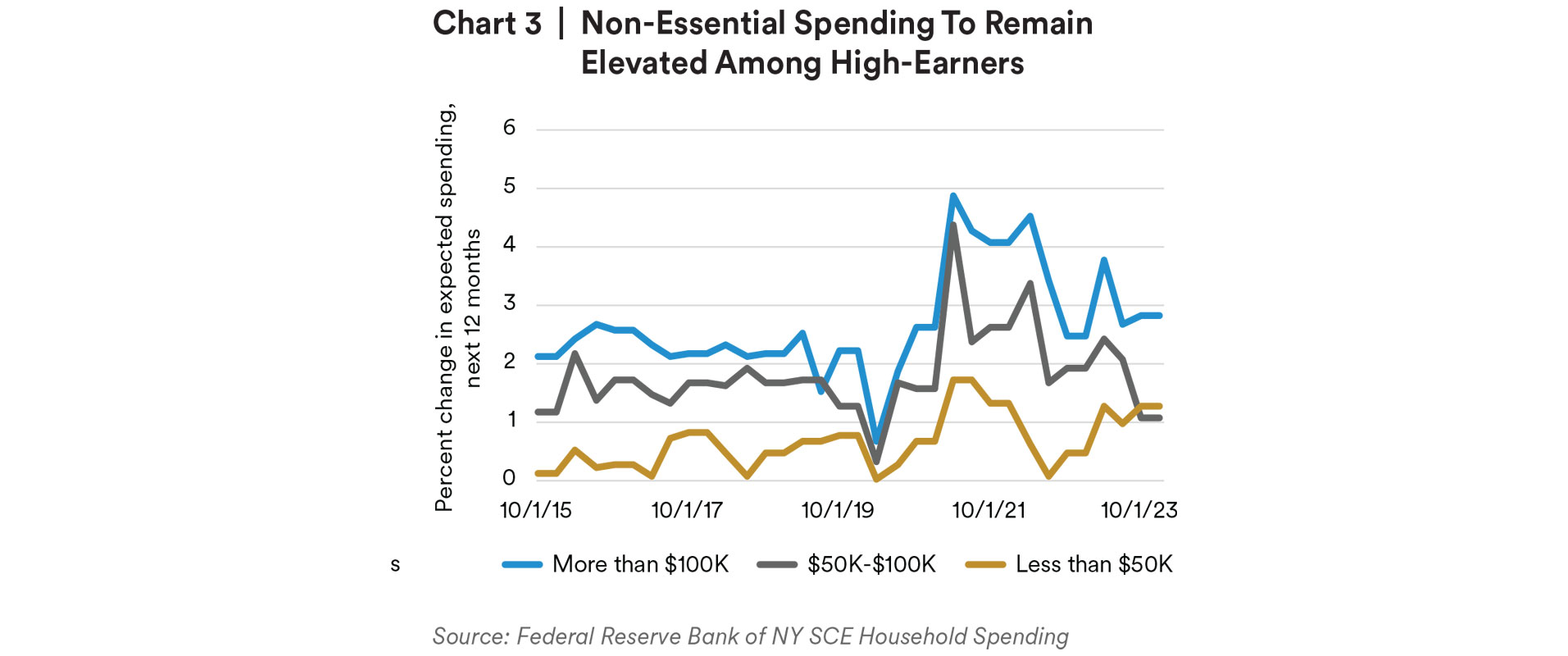

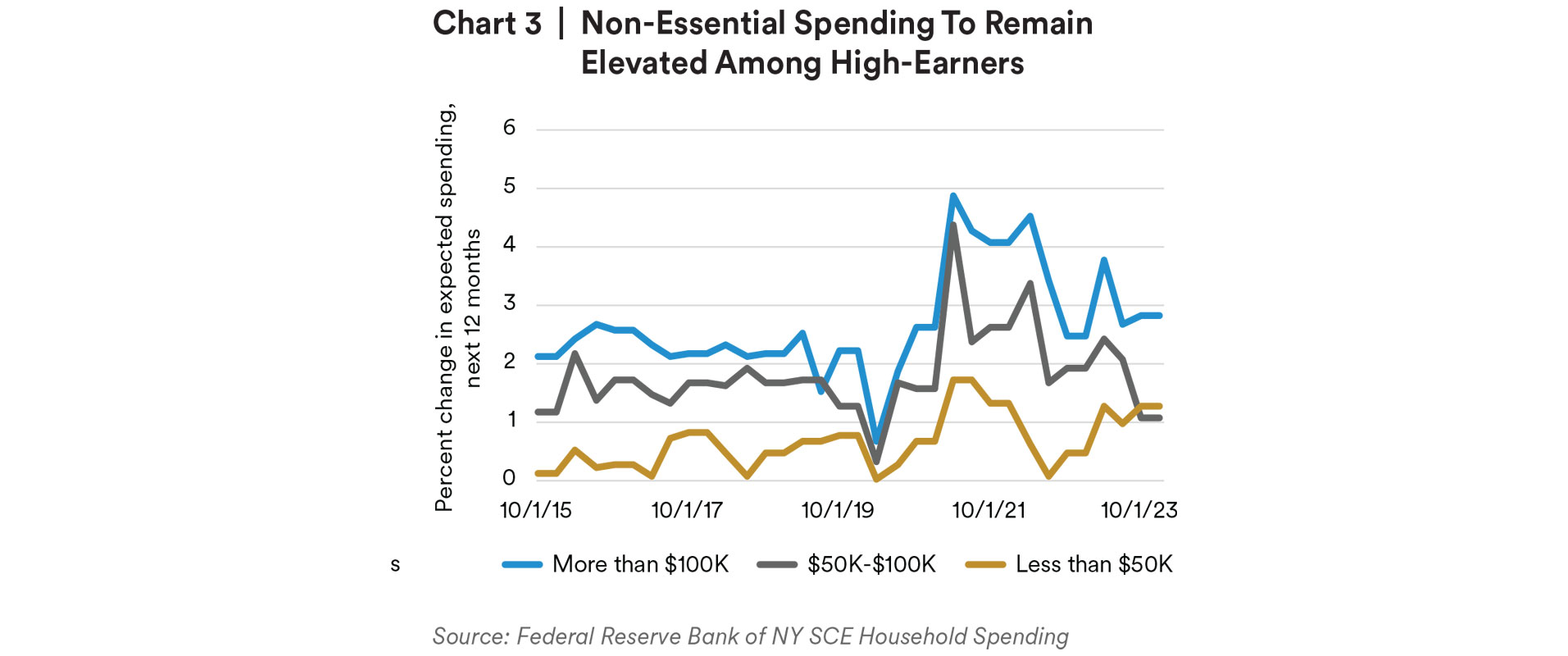

Looking ahead, high-income consumers expect to keep spending at elevated levels. Figure 3 shows the median expected spending by income level on non-essentials. Middle-income households are expecting a sharp decline in discretionary spending relative to the last few years. By contrast, those earning at least $100k are expecting to keep spending at recent rates, or even at rates slightly elevated relative to the pre-pandemic trend.

This effect appears to be a result of greater expected spending power rather than higher prices. Looking at expectations of spending on essentials (not shown) does show inflation effects: lower income earners expect the greatest increase in spending relative to pre-pandemic times, while the highest earners expect the weakest increase in spending.

If high earners are correct that their earnings streams are secure, we can expect to see continued strength in spending from them. And this may even be enough: some 37% of U.S. households fit into this income bucket, and if they continue to spend on discretionary items, this could sustain consumer spending.2

U.S. Outlook Summary

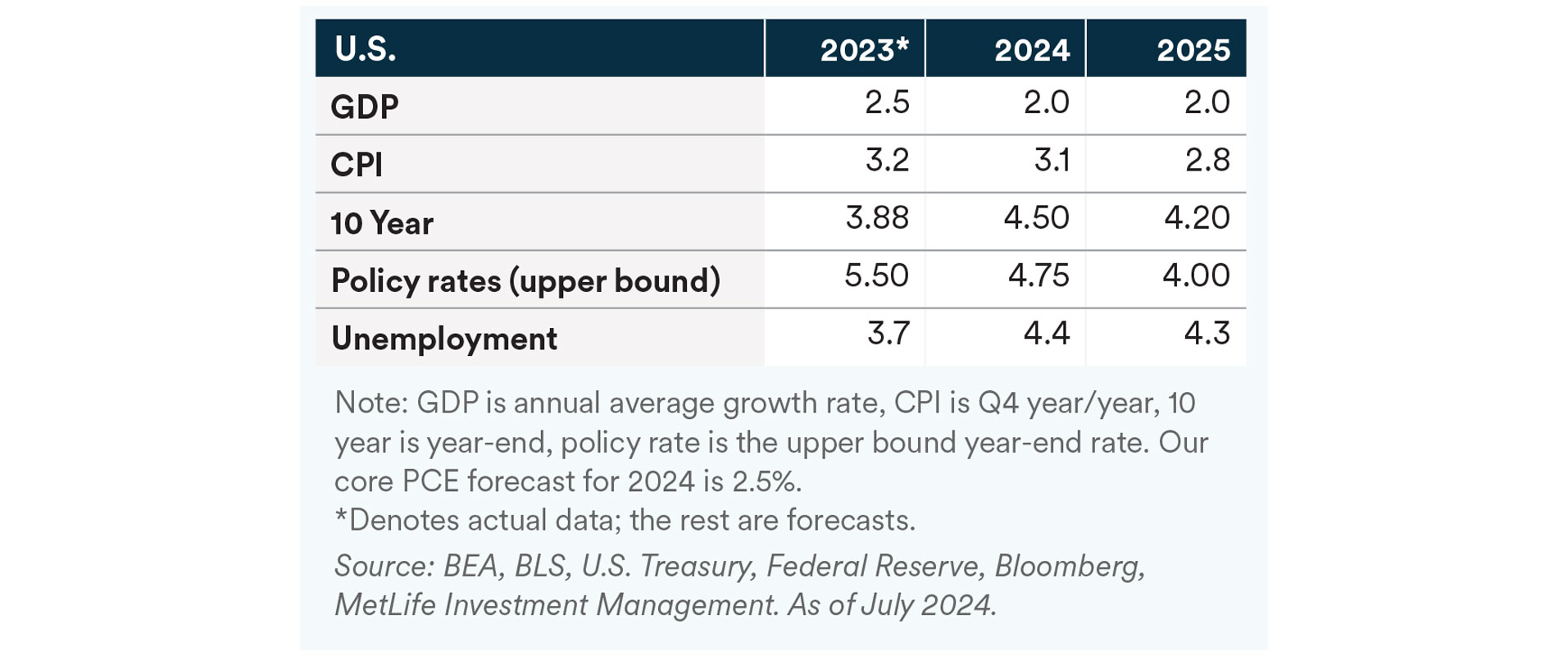

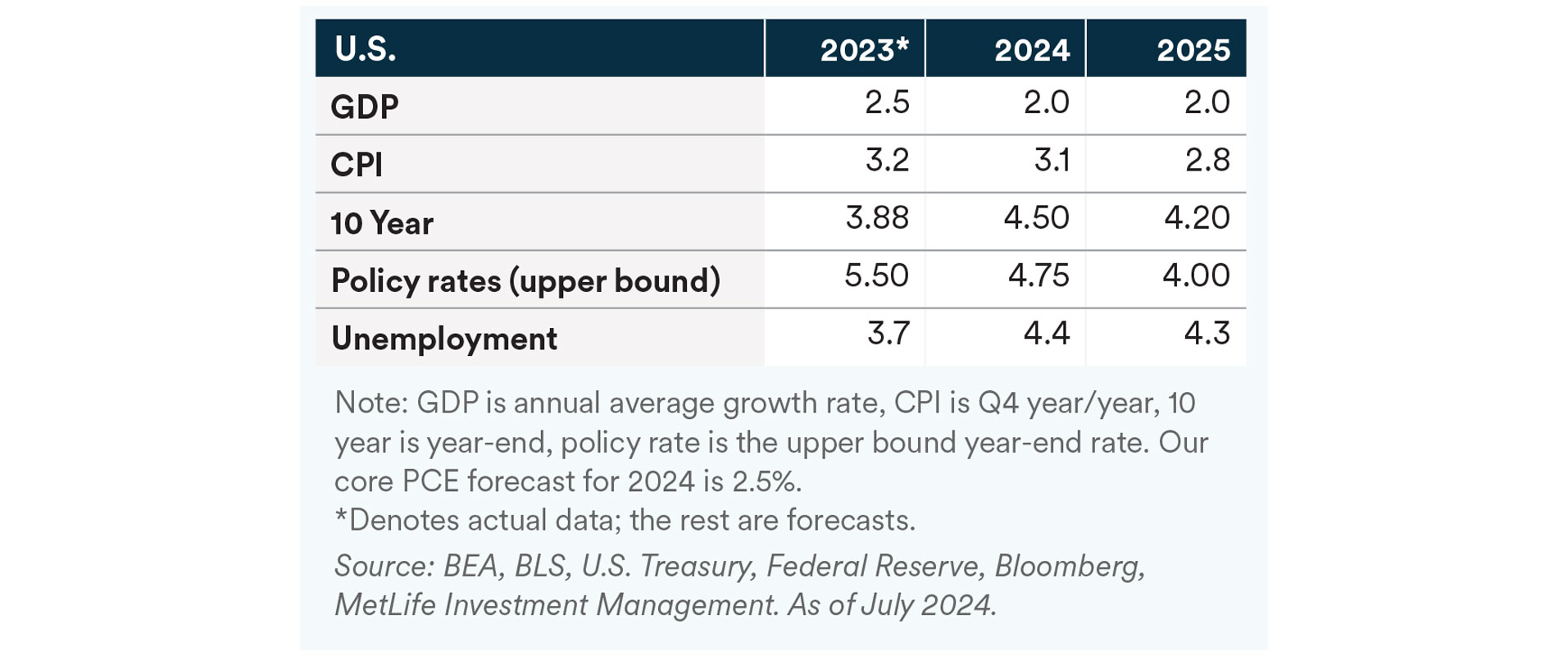

We continue to expect growth in 2024 to be softer than 2023 but remain healthy. First quarter GDP, although lower than expectations, showed strong residential investment and weaker but still healthy consumption, especially in services. Corporate investment has disappointed so far this year in light of strong profit margins. Election uncertainty may keep investment on the sidelines until year-end or 2025. Residential investment has improved since the beginning of the year, increasing in Q1 2024 after contributing negatively to GDP in 2023. The government sector, while pulling back vis-à-vis 2023, is still expected to contribute quite a bit to growth as industrial policies at the Federal level and continued tax revenue growth at the local level induce spending. We expect the Fed to cut rates by a total of 75 bps by year end, although there is an increasing likelihood that this may be as few as 50 bps this year. Some Fed officials have in recent weeks indicated that they are more pleased with recent progress in inflation and further softening in the labor market, although it looks unlikely that they could become comfortable enough by the July 30-31 FOMC meeting to vote in favor of a cut.

Risks to the Outlook

Although we remain optimistic, we acknowledge several factors that keep us cautious. Credit card delinquency rates have risen quite sharply over the last few months, lending standards remain relatively tight, and the labor market has softened. Risks of a re-emergence of inflation remain a possible concern, although these risks are coming into greater balance with downside risks to economic growth.

Both geopolitical and political uncertainty remains elevated even though many of the elections set for this year have already taken place—e.g. in Taiwan, India, U.K. and France. The longer run fallout of these, particularly of uncertainty around the French election outcomes, as well as of the ongoing conflict between Hamas and Israel, are still very unclear.

Perhaps most consequentially, uncertainty around the U.S. elections has increased with President Biden’s much-discussed debate performance on June 27th, and with the failed assassination attempt on President Trump on July 13. Prediction markets show an enormous drop in President Biden’s likelihood of being the Democratic nominee, from 86% on June 26 to 45% on July 10.3 With a change in the Democratic nominee, the range of policy outcomes are likely to expand as both parties maneuver to maximize Electoral votes as well as the number of Senate and House seats.

End Notes

1 Calculated by MIM from U.S. BEA and Federal Reserve data. Data as of July 2024.

2 U.S. Census Bureau as of July 2024.

3 Source: Predictit.org, Macrobond. Data as of July 11, 2024

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/ third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.