MetLife Investment Management expect a more moderate decline in economic activity as the shock from “Liberation Day” tariffs fades and, as policy evolves toward an end state, consumers and businesses begin to behave more normally after initially pulling back sharply in response to the volatility. Nevertheless, the damage has been done. We will be watching the behavior of the savings rate relative to yields, consumer sentiment, and corporate profit margins to refine our outlook for growth over the next few quarters.

We expect ongoing volatility in both the real economy and financial markets as shifts in tariff policies and the potential impacts, both positive and negative, of any tax policies become evident to financial market participants.

The rising geopolitical risk in the Middle East would disrupt the crude oil supply chain, adding further pressure to U.S. inflation, which may further delay any Fed’s action.

U.S. — The U.S. growth outlook remains negative, but given inflation concerns and the potential impact those concerns could have on longer-term yields should the FOMC act preemptively, we expect any response from the Federal Reserve to lag as they wait for evidence of slowing in the economy before acting. Furthermore, ongoing volatility is expected in both the real economy and financial markets, as shifts in tariff policies and the potential impacts, both positive and negative, of any tax policies become evident to financial market participants.

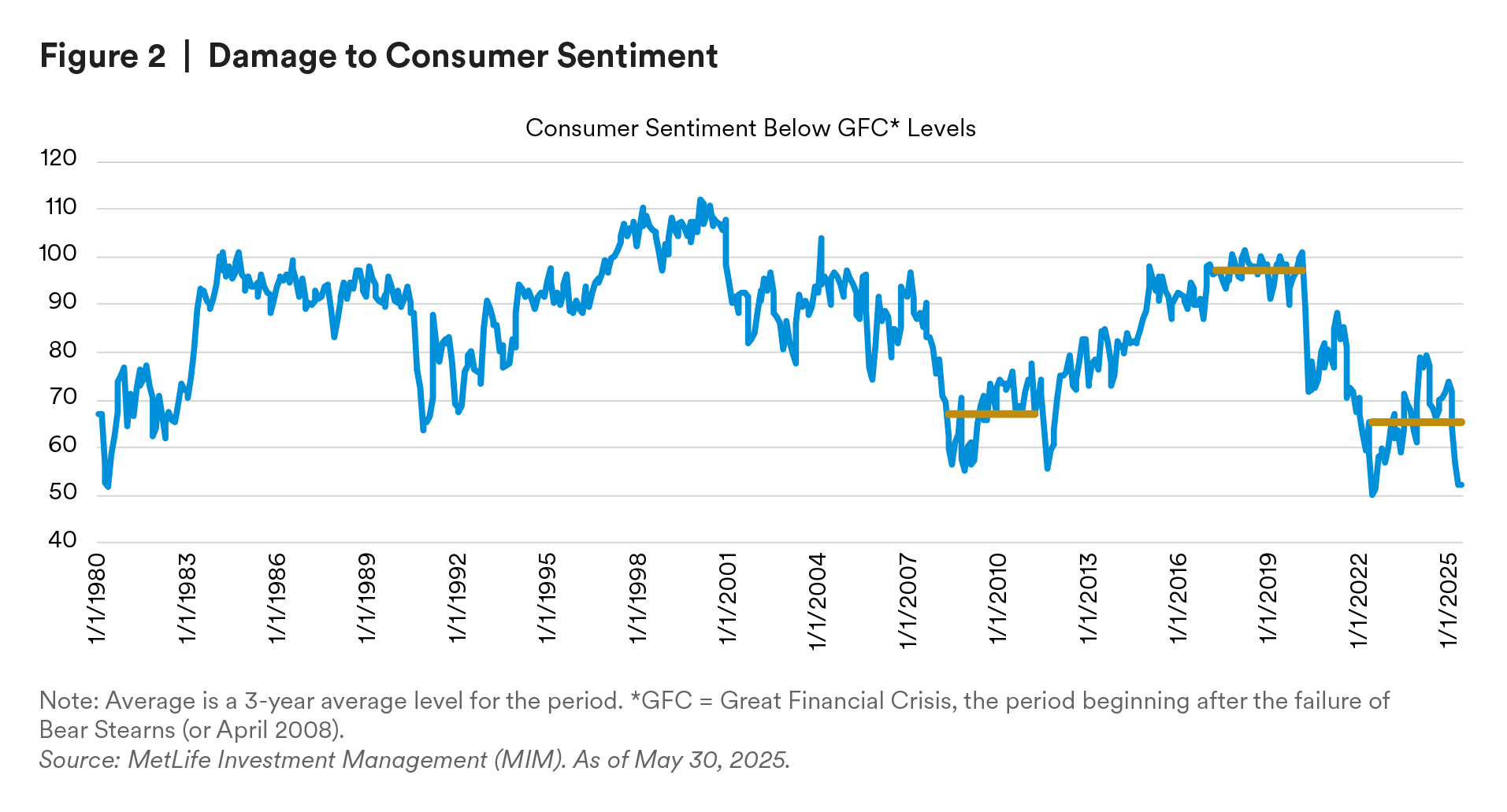

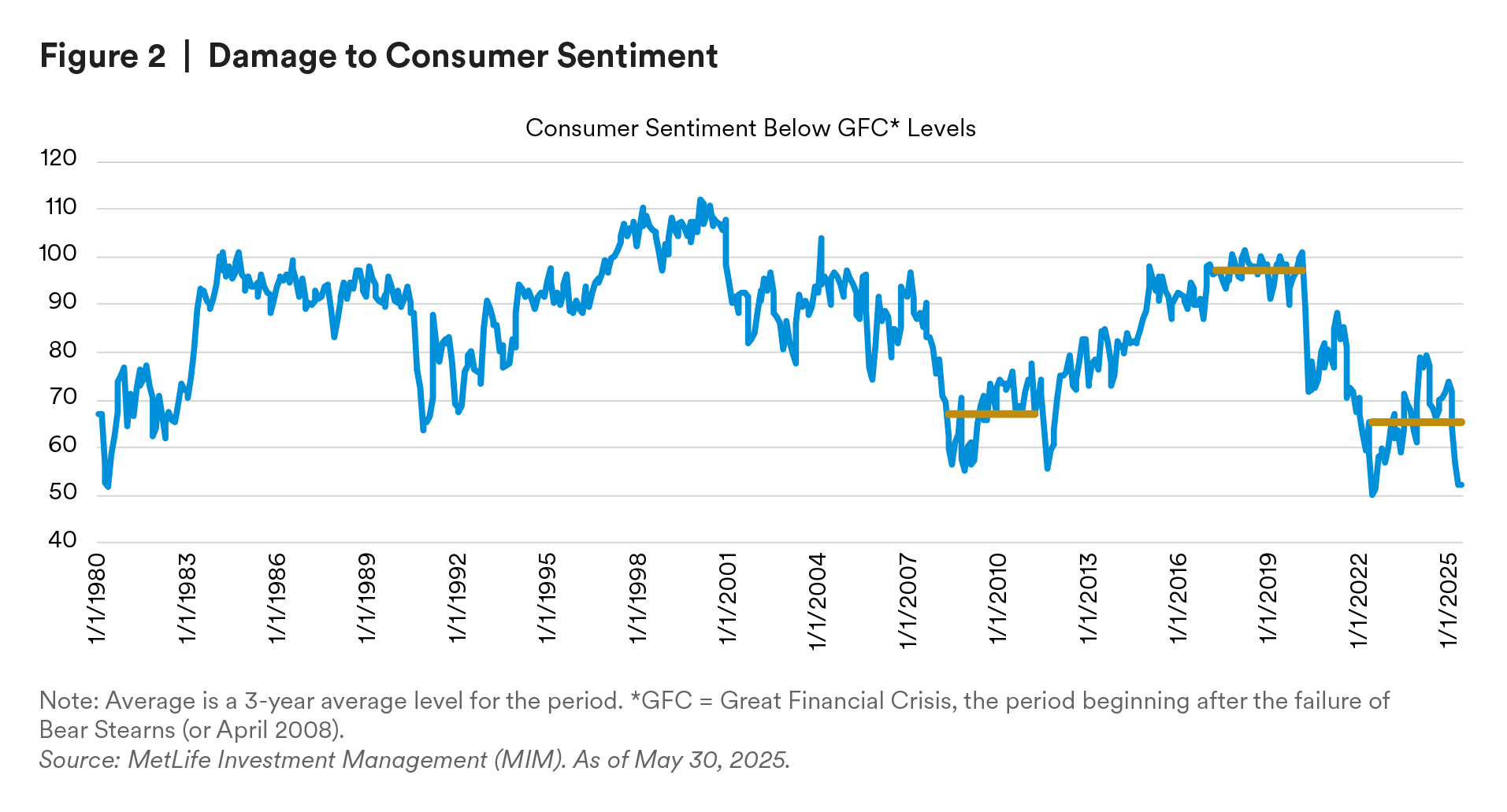

We see tariff policy volatility impacting business investment, prompting a slowing of activity until the impact on any investment is more settled than the ongoing trade negotiations allow. Similarly, the equity market volatility created by the noise around tariffs is likely to reduce the amount of equity wealth that higher-income consumers are willing to spend. With inflation still high and uncertainty beginning to weigh on the jobs outlook across all income levels, U.S. consumer sentiment is below pre-GFC levels (see figure 2). It is likely that consumers will boost their savings at the expense of spending. This should have negative consequences for labor demand and could result in higher unemployment, causing a further reduction in spending. While inflation seems likely to be sticky as companies continue to face high labor costs and also have to consider the impact of tariffs on their margins.

The greatest downside risk to activity is if consumer inflation expectations drive higher yields despite any Fed policy actions. A scenario in which a reduction in the policy rate boosts inflation expectations, which, in turn, pushes 10-year yields higher, would leave the Federal Reserve with few options.

Europe — In Q1, euro area (EA) GDP grew by 0.6% QoQ, but this figure was boosted by Ireland’s erratic national accounts and front-loading of exports ahead of higher U.S. tariffs. Excluding Ireland, EA GDP grew by 0.3% QoQ. Net exports contributed significantly to growth. However, the growth rate is expected to slow sharply from Q2 due to the unwinding of front-loaded exports and the negative impact of higher U.S. import tariffs on European exports and confidence.

High frequency indicators such as PMIs show weakening momentum in Q2, with the euro area composite PMI barely above 50 in April and May. Germany and Italy are particularly vulnerable to reduced U.S. import demand, while France and Spain are less exposed.

The ECB has continued to cut rates in 2025, with the deposit rate reduced to 2.00% in June. President Lagarde mentioned uncertainties such as the evolution of U.S. tariffs and German fiscal policy. MIM expects moderate easing from the ECB over the remainder of the year.

Disinflation continues in the euro area, with headline inflation at 1.9% YoY in May and core inflation at its lowest since January 2022. Factors like euro appreciation and lower commodity prices support further disinflation. MIM expects the ECB to implement two more rate cuts in H2, taking the deposit rate to 1.50% by year-end.

UK — The UK’s real GDP growth forecast for 2025 remains largely unchanged at 1.0%. The first quarter saw strong growth of 0.7% quarter-on-quarter, driven by the front-loading of exports and increased activity in the services sector ahead of higher taxes. However, GDP fell by 0.3% month-on-month in April after modest growth in March and February. The Purchasing Managers’ Index (PMI) indicates a slowdown in growth momentum in the second quarter.

The UK economy is somewhat insulated from the U.S. goods market but is vulnerable to weaker growth in its main EU export markets. Inflation jumped to 3.5% year-on-year in April, up from 2.6% in March, due to higher taxes and administered prices. Core inflation also rose to 3.8%. This has made the Bank of England cautious about accelerating its rate-cutting path. The Bank Rate has been reduced by 100 basis points to 4.25% since August 2024, and it is expected to end the year at 3.50%, with a possible delay in the final rate cut to early 2026.

Asia — We have lowered our growth, inflation, terminal rate, and government yield forecasts across the region with only a few exceptions. Upward revisions in China’s GDP growth and terminal rate reflect recent tariff de-escalation and guardrails emerging from the Geneva truce to avoid worst-case outcomes. That said, myriad sticking points continue to undermine relations, implying more headline risk ahead. Although tariff levels have declined, a continued high level of uncertainty emanating from erratic U.S. policy is denting business confidence, leading to slower capex and hiring, and slowing economic activity in the region. There is also the emerging theme that export front-loading YTD to avoid potentially higher U.S. tariffs could lead to some payback in coming quarters, leading to slower growth. Fortunately, a weaker USD backdrop should help ease financial conditions, allowing regional central banks to cut policy rates more, providing some offset for trade headwinds. Smaller trade-intensive economies are most exposed to trade frictions (Vietnam, Taiwan, Korea, Malaysia, Thailand) while domestic-driven economies are more buffered (India, Philippines). Vietnam and Malaysia are being targeted by the U.S. as key transshipment routes for China, potentially undermining negotiations.

Latin America — The past quarter has seen mixed economic performance across Latin America, with Brazil showing strong activity in 1Q25 but facing a slowdown due to tighter monetary policy, while Mexico’s economic activity has weakened, leading to a projected GDP contraction of -0.5% YoY in 2025. Inflation remains a concern, with consumer prices rebounding due to FX depreciation and volatile food and energy prices. Brazil and Uruguay have maintained high interest rates to manage inflation expectations, while Mexico and the Andean countries continue monetary easing. Long-term interest rates are influenced by fiscal risks and U.S. rates, with local interest rate curves expected to steepen as Central Banks cut policy rates in Mexico, Colombia, Chile, and Peru. The economic outlook is clouded by domestic and external risks, including political uncertainties and fiscal policy challenges. For the next quarter, Brazil and Uruguay are expected to keep rates high, while Mexico is likely to continue cutting rates. Chile and Colombia may resume easing in 2H25. Overall, the sentiment for the region is negative due to the uneven growth outlook, persistent inflation, and fiscal risks.

U.S. Treasury (UST): After the turbulence in April, we returned to our previous view: The Federal Reserve will continue cutting policy rates as it transitions toward a neutral policy rate, which we estimate at near 4% by the end of 2025. We expect the UST yield curve to steepen further in the next quarter or two, with short-end interest rates decreasing slightly as the long-end holds near 4.25%.

Japanese Government Bonds (JGBs) — MIM retains end-year 10Y JGB yield forecast of 1.4%. Following Liberation Day announcements, we removed our expectation for one further rate hike by the BoJ this year, given the expected negative effect on the U.S. and global economies. We remain comfortable with this view, although it will remain subject to incoming data, the outcome of trade negotiations on July 9, and the outlook for the U.S. and global economies. At its June meeting, the BoJ kept the policy rate unchanged. Governor Ueda maintained the policy of rate hikes but did not provide clear indications regarding the timing or conditions. We stick to our view of a hold this year, with resumption of rate hikes next given ongoing inflation traction. We remain fundamentally constructive on wages and inflation. Should U.S. trade tensions ease and global growth conditions hold up better than expected, we would contemplate reverting back to our original baseline of one more policy rate hike this year. Any welcome trade breakthroughs between the U.S. and Japan would also support this move.

Chinese Government Bonds (CGBs) — Liquidity and monetary easing have improved, but tariff uncertainty may still further damage the economy. The absolute yield of CGB is still at a historical low level — neutral liquidity for 20+ yrs. MIM moved the CGB yields forecast lower to be around 1.5% by the end of 2025.

German Bunds — German Bunds are supported by Germany’s sound governing institutions, the country’s strong relative fiscal position (particularly its moderate level of gross debt), and resilient market demand for the highest quality euro-denominated sovereign paper in a much larger common currency area, especially during periods of heightened uncertainty. Borrowing requirements are expected to increase materially in the coming years after the new administration effectively suspended the constitutional debt break rule that had previously severely limited the scale of deficits that the federal government could run. While the scale and timing of fiscal loosening remain uncertain, an increase in the government’s issuance needs in the coming years is expected to place some upward pressure on bund yields, particularly at the 10-year-plus end of the maturity spectrum. We see some scope for a moderate rally at the short end of the bund curve, assuming that MIM’s call for a slightly more aggressive ECB easing cycle over the remainder of this year than currently assumed by consensus materializes. Uncertainty around the scale and timing of the upcoming loosening of Germany’s fiscal position, primarily to fund higher spending on defense and infrastructure, and the associated schedule of higher related bund issuance to fund this, clouds the outlook for the longer end of the bund curve. However, MIM expects some upward pressure to materialize as these plans become clearer in the second half of the year.

Credit Macro — The current credit cycle condition remains tight; the majority of the credit indicators that we monitor worsened in the second quarter. U.S. fundamentals remain resilient, but the impact of U.S. tariffs hasn’t yet been reflected in the fundamental data. Credit metrics remained stable during 1Q25. For IG, LTM Net Leverage ratios saw slight downticks both QoQ and YoY and are still below long-term averages. For HY, LTM Net Leverage ratios also saw slight downticks YoY but flat QoQ. Both were still below long-term averages. Coverage ratios also improved for both IG and HY. However, we saw heavy downward revisions for earnings expectations from equity market participants.

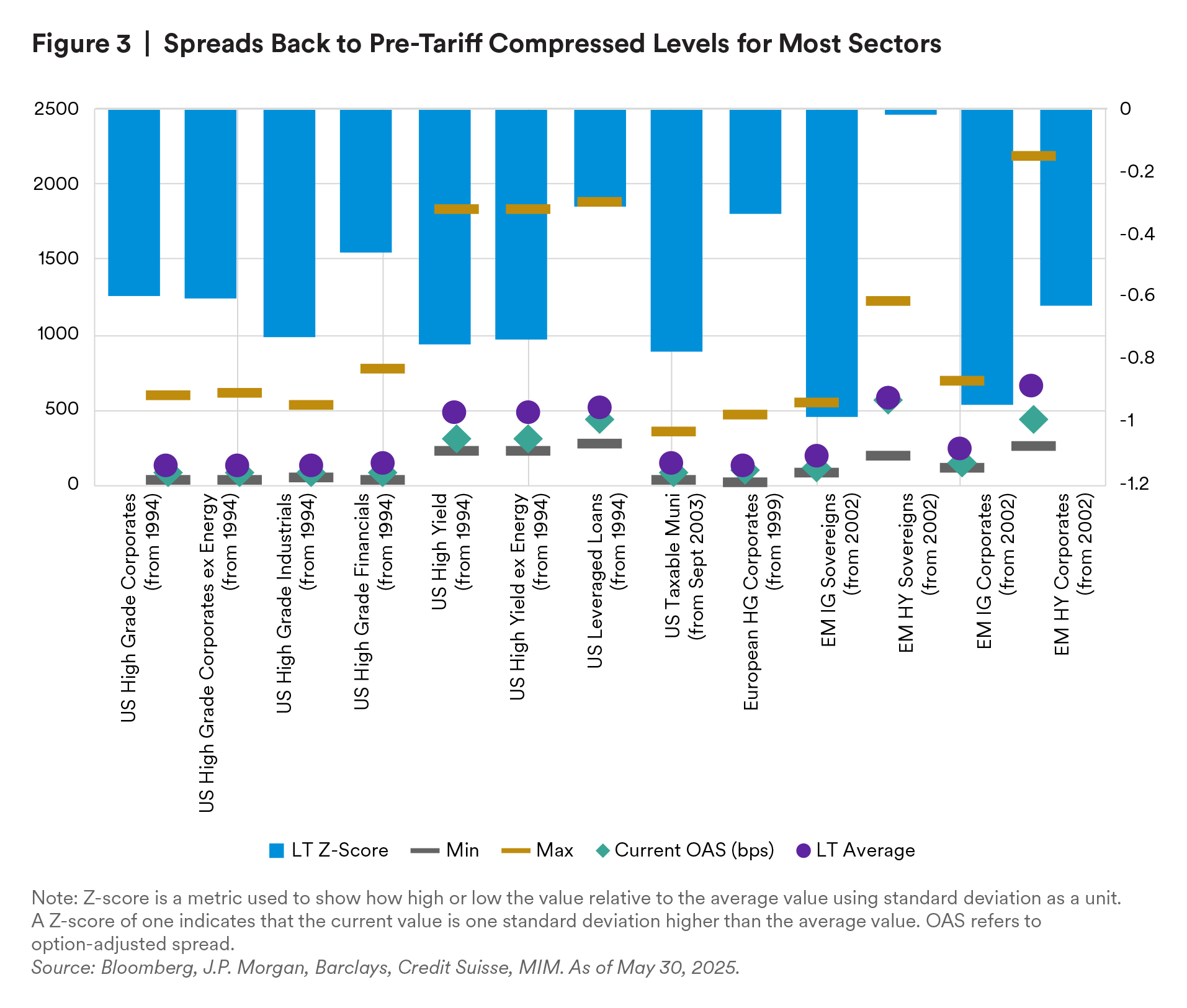

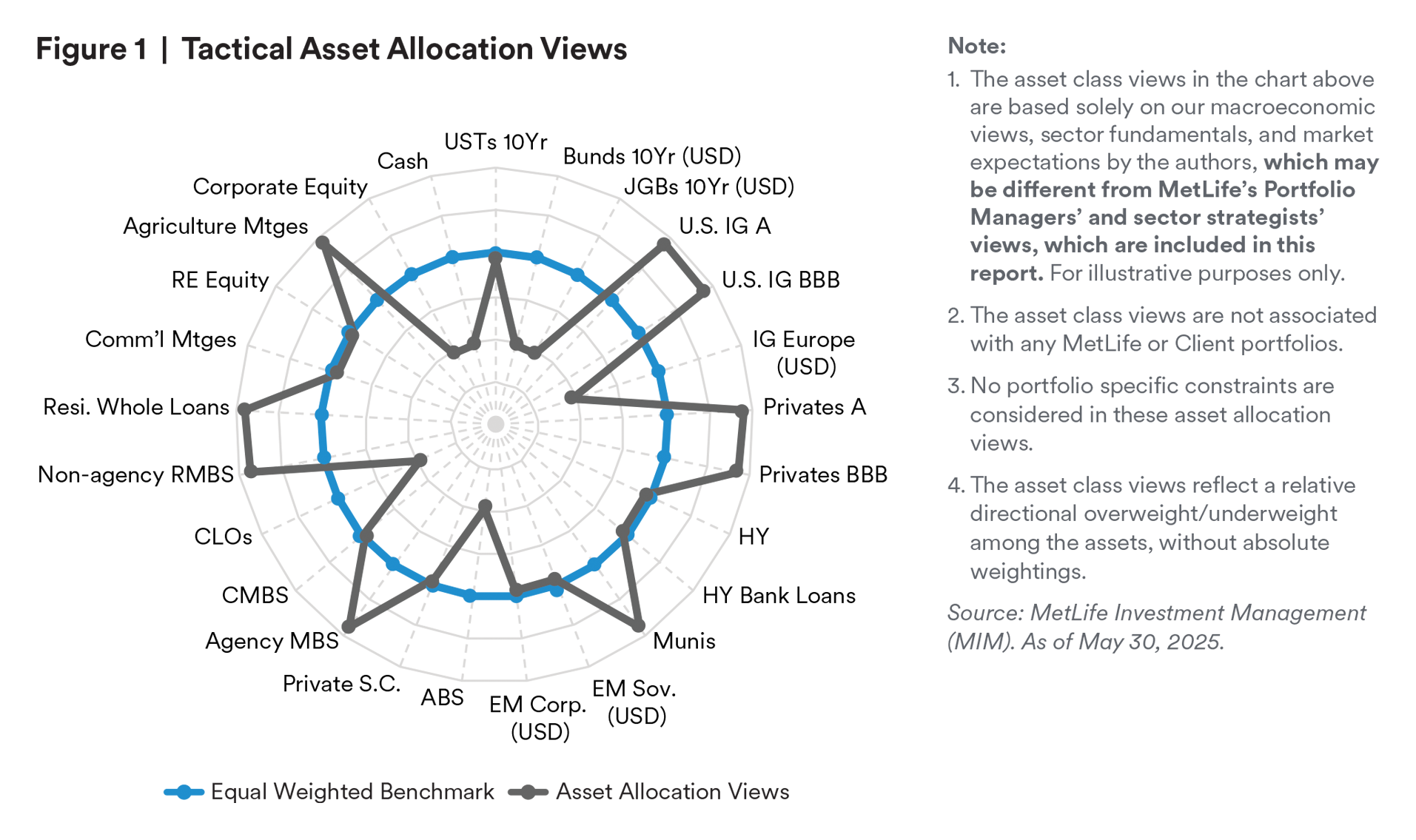

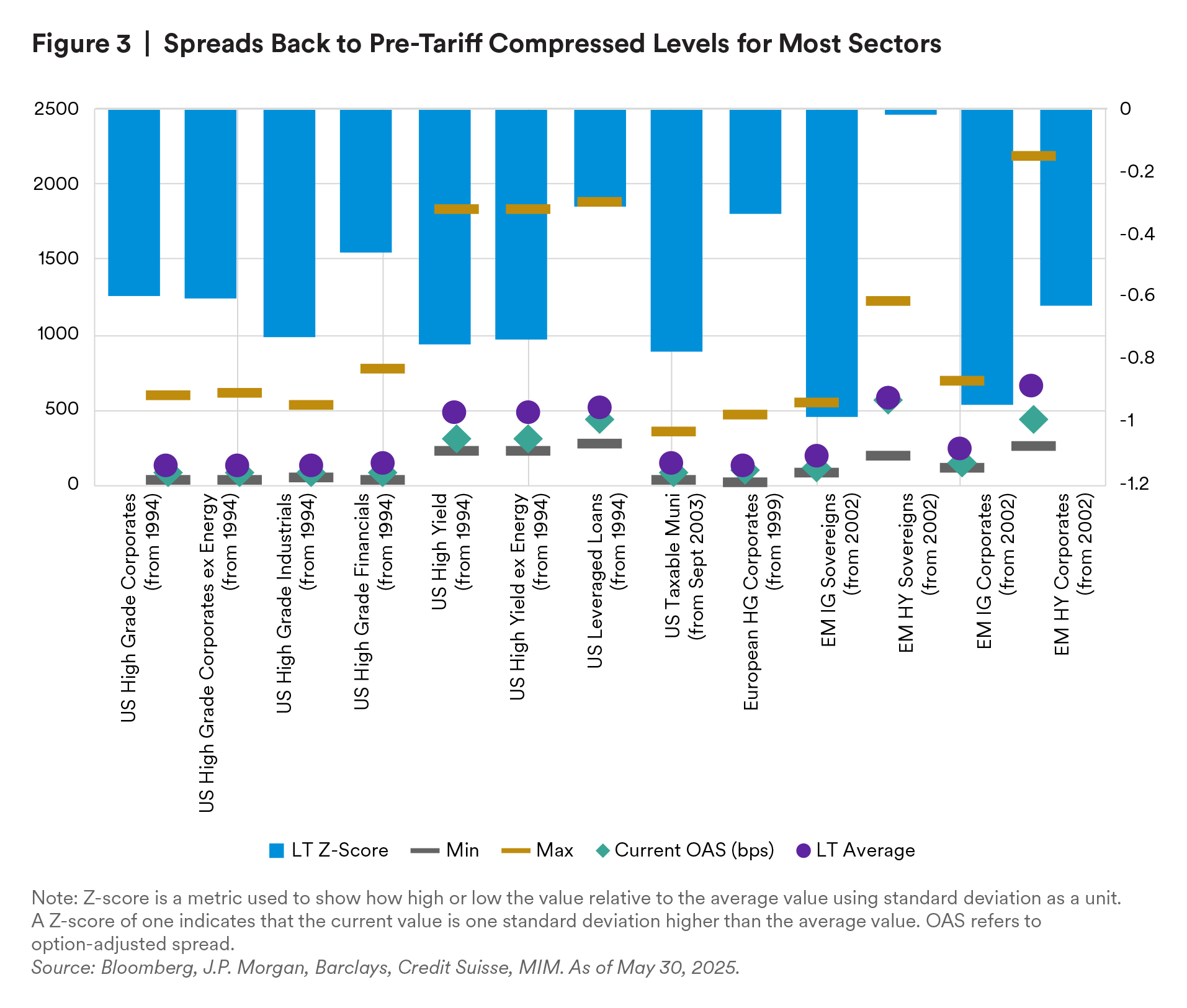

On the technical side, we saw a significant outflow in April due to market volatility stemming from tariff noise, and the overall bond inflow only recovered less than 30% from the March-April outflow. Spreads had almost reversed back to the pre-Liberation Day tight level across sectors (see figure 3). All-in yields are higher, except for HY Bank loans, and valuation has become slightly better than last quarter for most sectors.

U.S. Investment Grade (IG) — Credit markets continue to grapple with the evolution of the Trump administration’s trade policies with large trading partners such as China and the EU. On the heels of positive commentary on these trade negotiations, recessionary fears have faded and helped improve risk sentiment. Whether this is real or superficial remains a larger debate, as the uncertain effects of tariffs and higher real rates still loom over markets. For the moment the macro backdrop highlights an economy with job growth - albeit nowhere near robust - and moderating inflation, along with PMI surveys across both services and manufacturing near breakeven levels. Credit fundamentals for 1Q 2025 remain healthy, with the EBITDA Margin and FCF/Total Debt ratio slightly worse than in 4Q 2024, but still above the historical average level. However, due to the data delay, the impact of the April tariff on credit fundamentals hasn’t yet been apparent. We maintain a defensive posture in portfolios as we believe the risks are tilted towards spread decompression with no real catalysts in the near term for further compression. That said, it is also possible that spreads will continue to hover around these tight levels, given a strong economic backdrop. In terms of Index characteristics, corporate spreads today have traded back into around 85 basis points (+/- 2/3 bps), which is 34 basis points tighter than the brief credit spread dust up related to tariff and trade policy indigestion. Overall, MIM recommends overweight on U.S IG

European IG — The second quarter saw mixed earnings across sectors, with Energy, Communications, and Consumer Discretionary underperforming due to lower energy prices and softer consumer demand. Conversely, sectors like Real Estate, Healthcare, and Utilities, which are more insulated from macroeconomic challenges, have outperformed. Tech and Industrials continue to show strong performance, bolstered by trends in AI and automation. Euro IG spreads experienced volatility, with initial tightening reversed post Liberation Day, although AA spreads have outperformed other ratings. The primary market is robust, setting a record issuance of €211 billion in Q1, with ‘Reverse Yankees’ gaining attention as U.S. companies leverage the favorable European market conditions. Sovereign bonds in the eurozone remain in demand, driven by local real money allocations and a zero capital-regime. Peripheral bonds, particularly those from Italy and Greece, have outperformed their core equivalents, aided by sovereign rating upgrades that have spurred improvements in corporate ratings. The scarcity of fallen angels further underscores the sector’s stability. After considering the FX hedge, the overall yield in EU IG is less attractive compared to the other sectors.

High Yield (HY) — High yield bonds posted a strong comeback in May as a de-escalation of the trade war suppressed recession risks and increased risk sentiment. After a challenging April, investors started the month canvassing corporate earnings for impacts of tariff-related cost increases and changes in consumer appetite. Risk appetite resumed on positive trade headlines, resilient economic data, and solid earnings. Rates were higher, with 5y and 10y Treasuries up 24bp and 24bp, respectively. High-yield capital market activity resumed after April’s pause. Specifically, 35 bonds priced for $32.0 billion during the month, which compares with April’s $8.6 billion and a 2024 average volume of $24.1 billion. There were seven payment defaults in May, totalling $4.5 billion in bonds ($1.7bn) and loans ($2.9bn), and two distressed transactions totalling $673 million in bonds. Including distressed exchanges, the par-weighted U.S. high yield bond and loan default rates increased 8 bps and decreased 36 bps m/m to 1.33% and 3.62%, respectively. High yield funds reported the largest inflow since November of 2023 following the largest monthly outflow since March of 2020. OAS has tightened 23 basis points quarter-to-date to 332 bps (05.31.25). High yield continues to be supported by resilient fundamentals. We would expect the market to remain firm throughout the year; however, due to the broader market volatility, MIM is neutral on the HY.

Leveraged Loans — We maintain our preference for an up-in-quality approach within bank loans as we expect macro moderation to remain supportive of loans in 2025. While spreads are near tights the elevated base rate and all-in high yields continue to encourage buyers to chase loan yields. Strategists are calling for a 6-7% return expectation for 2025 as robust refi activity and a revival of animal spirits provide a backdrop for the leveraged loan market to grow again after a modest shrinkage last year. We expect more corporate M&A behavior due to falling debt costs, a rebound in earnings, and potential tailwinds from deregulation and lower corporate taxes. This sets the stage for more corporate deal-making, capital raising, and comfort around more balance sheet leverage. We believe that an up-in-quality approach in loan investing continues to mitigate as corporate animal spirits grow, and the range of economic outcomes widen. MIM recommends being neutral and cautious for the leveraged loan sector.

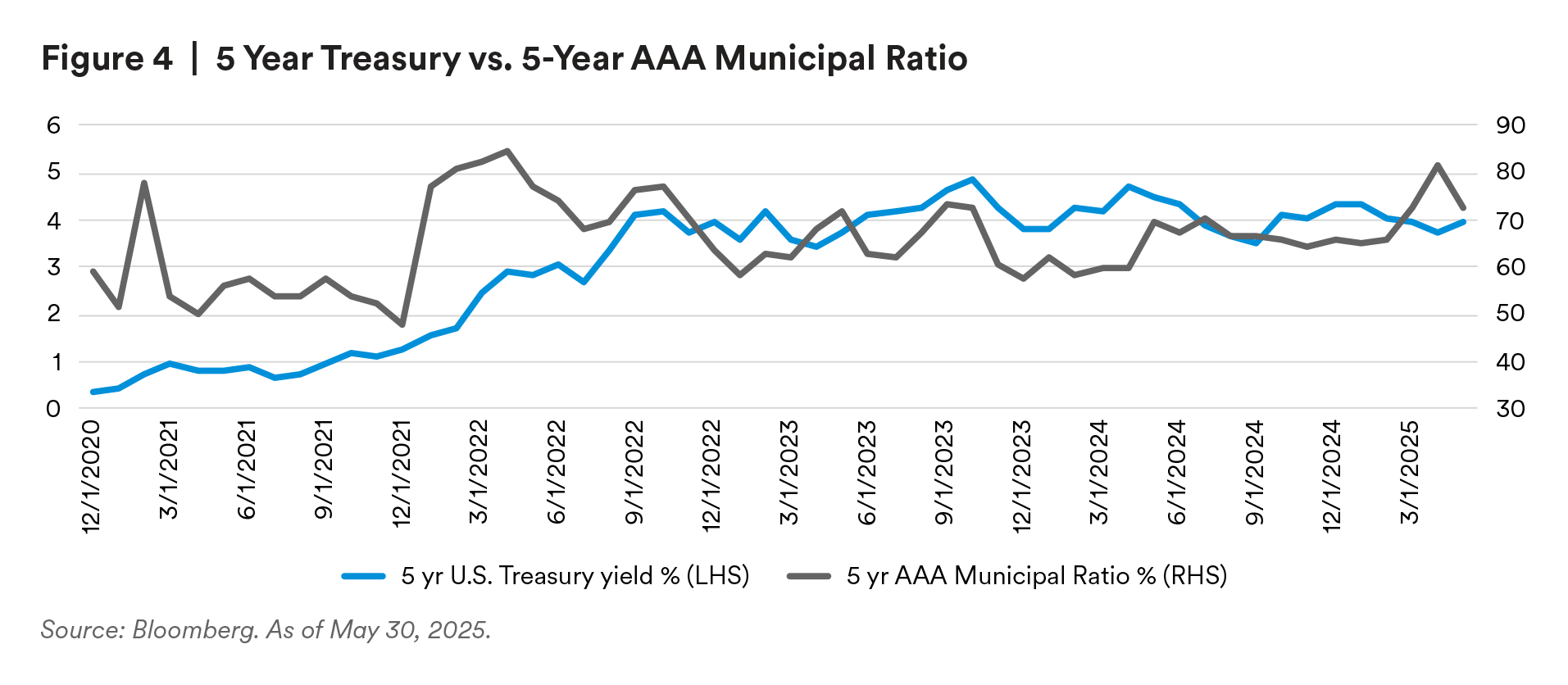

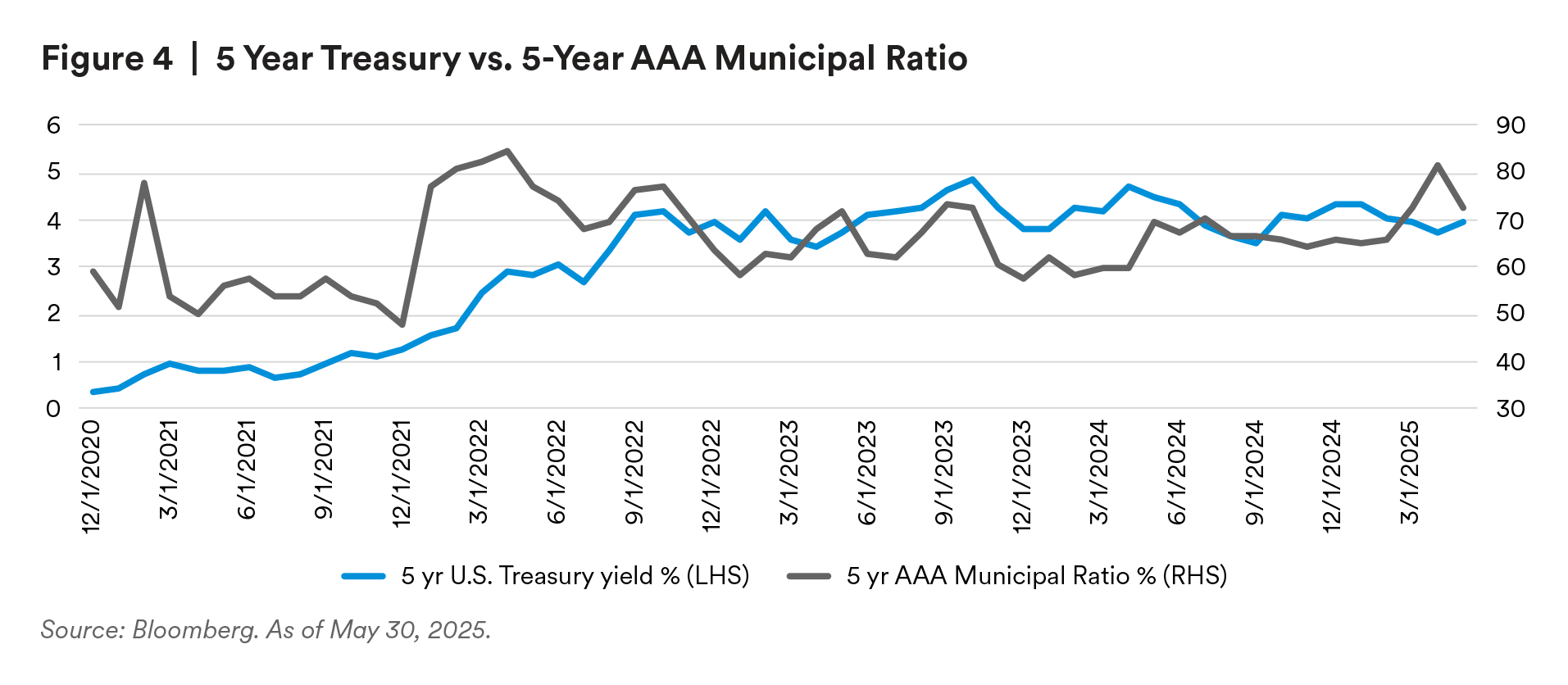

Municipals — Municipal bonds experienced a mixed performance in the second quarter of 2025, driven by market uncertainties related to tariffs, growth, and inflation. Taxable municipals recorded solid returns, with the Bloomberg Taxable Municipal index returning 2.99%, outperforming the U.S. Corporate Investment Grade index and the broad tax-exempt Municipal Bond index. The flight to safety led to a decrease in Treasury yields, which offset the widening spreads. Tax-exempt municipals underperformed due to heavy supply, weaker seasonal technicals, and fund outflows, particularly at the long end of the curve. Looking ahead, the forecast for municipals remains cautious amid potential policy changes that could impact tax exemptions. The risk of a full repeal of the tax exemption is considered low, but limitations such as a cap or elimination for Private Activity Bonds are plausible. However, despite the risks, Municipals are regional entities, by definition. As such their exposure to international trade issues is a second or third order credit impact. The biggest driver of municipal credit quality is likely to be macroeconomic in nature, away from idiosyncratic issues. Whether tariffs on global trading partners are 10% or 145%, traffic on Texas toll roads isn’t likely to change sufficiently to alter the credit profile. Similarly, hospitals will continue to treat patients that require care, and households will still pay their utility bills to have access to electricity and clean drinking water. Munis Yields are relatively high (see figure 4), taxable supply is likely to remain relatively muted, demand for high-quality assets with spread and duration continues to be robust, and we expect municipal fundamentals to remain resilient. We believe opportunities to buy at attractive spreads are likely to be short-lived due to robust demand. Overall, MIM recommends a higher allocation to Municipals.

Emerging Markets (EM) — The past quarter has been characterized by a complex macro environment influenced by significant policy shifts from the Trump administration, particularly in foreign policy and trade relations. Despite these uncertainties, EM sovereigns and corporates have demonstrated resilience, with a substantial portion of Investment Grade (IG) countries showing stability in the face of potential global recession scenarios. EM corporates continue to exhibit strong fundamentals, with attractive spreads and lower default rates compared to Developed Markets. Market technicals remain robust, supported by subdued net issuance and renewed investor interest. Looking ahead, the forecast for EM credits is cautiously optimistic, with opportunities in BB and BBB corporates, especially those generating hard currency revenues or managing FX liabilities effectively. The team is strategically positioning portfolios to capitalize on attractive yields amid expected market volatility, with a focus on sectors such as utilities in Latin America and infrastructure in the Middle East. Overall, MIM upgraded EM from underweight to neutral, driven by strong fundamentals and strategic diversification despite geopolitical uncertainties.

Asset-backed Securities (ABS) — The ABS market is experiencing a slight decrease in supply, with notable declines in cards and auto sectors, while data and fiber issuance have increased. Fundamentals are weakening due to macroeconomic risks, with rising delinquencies among consumers. Despite higher credit card balances, utilization rates are stable, and lending standards remain unchanged. Valuations are shifting to a neutral or attractive stance, with wider spreads making ABS cheaper compared to corporates. The focus is on corporate over consumer ABS, favoring data and enterprise fiber ABS due to increased issuance. Utility rate reduction bonds are seen as a good corporate alternative, while exposure to sectors linked to discretionary spending is limited. Overall, we remain cautious about the sector due to the upcoming pressure on U.S. consumers.

Collateralized Loan Obligations (CLOs) — CLO supply is trailing 2024 volumes, with new issue deals down significantly. Fundamentals are weaker, with macro risks in focus, although credit metrics remain stable. Moody’s default rate is elevated but improving, and recovery rates are returning to average levels. The ETF space is experiencing dislocation due to outflows during risk-off periods. Valuations are neutral to attractive, with AAA spreads having sold off but partially retracing. Demand for floating rate products is driven by uncertainty surrounding the Fed’s path. MIM finds floating rate products are less attractive compared to the other sectors.

Commercial Mortgage-backed Securities (CMBS) — The supply outlook for CMBS is outpacing 2024, with a much heavier pace of issuance compared to last year. The conduit space remains five-year heavy, up by 40%, and there has been another strong year for SASB, up by 90% compared to this point last year. The fundamentals are weaker, with office delinquencies having steadied near 11% but remaining elevated. There are $20 billion of deals up for refinance in 2025, likely leading to continued stress in this space. Multi-family, lodging, retail, and industrial sectors are all trending higher quarter-over-quarter. Economic stress is a headwind for most sectors, depending on how the trade situation is resolved. Less travel is a headwind for the lodging sector, higher prices and spending slowdown could hit retail, while lower trade volumes could negatively impact the industrial sector. Valuations are neutral to attractive, with AAA spreads in the 90s, well off the mid-60s area at the end of February. The focus is on 10-year LCF, AA, and JR AAA, and high-quality SASB. There is a recommendation to refrain from single A and deals with the risk of extension. We believe CMBS offers comparable yield, and MIM is neutral on CMBS.

Agency MBS — The Agency MBS spreads have been relatively stable, remaining range-bound in the 150-160 spread to Treasury range. As for the Mortgage Index OAS, it is currently at 38, which places it right in the middle of the year-to-date range. This suggests that supply is quite manageable, especially with mortgage rates hovering around 7%. Both mortgage refinancing and purchase indexes continue to be subdued, which is reflective of the current market conditions. However, technical factors do pose a challenge for MBS. Volatility remains high, and both bank and overseas demand have been limited. Additionally, positioning across dealers and money managers is quite elevated at this point. Despite these headwinds, we believe that the sector holds potential. Though it may take some time for MBS valuations to revert to their long-term relationships with rates and corporate bonds, we see the sector as one of the most attractive in the current environment.

Non-Agency MBS — The supply outlook for Non-Agency is outpacing 2024, with total issuance up by 30% compared to last year. Prime and non-QM are up by over 25% year-over-year, while RPL and SFR remain flat. The fundamentals are neutral, with prime borrowers in a good position despite delinquencies inching higher. Non-QM delinquencies are rising and are being closely monitored. National home prices are increasing but at a slower pace, and there are pockets of weakness in certain regions, like Florida, due to taxes, insurance, and supply issues. Inventory is picking up, with new homes inventory rising and existing home months supply at 4, back to pre-pandemic levels. The market is more balanced, although underbuilding remains a longer-term tailwind for home prices. Valuations are attractive, favoring subordinates (AA/A) of prime and RPL. Deep discount, seasoned prime deals offer solid spread, duration, and convexity. SFR/CES are also favored. However, there are risks associated with convexity in prime, rally in rates, and a refinancing environment. Affordability strain is a concern for both first-time homebuyers and existing homeowners. There is a recommendation to avoid new issue BBB prime paper due to higher DTI concentration above 45%, but overall, MIM is overweighting on Non-Agency MBS.

Asset Based Finance (ABF) — During the second quarter, the U.S. tariff announcements briefly disrupted the private ABF market, causing a slowdown in new issuance and a widening of spreads by 25-30 basis points. However, as the outlook on tariff impacts improved, market activity quickly resumed, and pricing returned to pre-tariff levels. Looking ahead, unless another unexpected event occurs, spreads are expected to remain flat or tighten. The influx of new entrants in broadly syndicated private ABF deals is pushing pricing below fair value, accompanied by weaker credit terms. We are maintaining a disciplined approach, avoiding deals with unappealing credit and relative value. Recent reports of potential impairments in several private ABF deals underscore the importance of rigorous credit underwriting, which we have adhered to by passing on these deals due to credit concerns.

Residential Whole Loans — The housing market has demonstrated resilience despite the prevailing higher interest rate environment. A persistently low supply of homes for sale has contributed to stable home prices, with few catalysts expected to significantly alter the supply landscape in the near term. Delinquency rates remain consistent with pre-pandemic levels, as homeowners prioritize safeguarding the equity accumulated in their properties. In terms of financing, spreads for residential whole loans and single-family rental debt continue to present strong relative value compared to public residential credit opportunities, with loss-adjusted spreads in the low to mid 200s. Looking ahead, the sector is expected to maintain its stability, supported by these favorable financing conditions. MIM finds the sector as one of the most attractive in the current environment.

The past quarter has seen a stabilization in commercial real estate fundamentals. The multifamily sector has experienced some pockets of supply risk, which are now beginning to moderate. Construction completions are projected to plummet to levels last seen in 2013. This should support rents in 2025 and beyond. Sunbelt apartment markets are over-supplied, but leasing and household formations are exceeding expectations. In the industrial sector, supply growth has pressured fundamentals, but new completions are falling sharply. Rent growth is expected to remain healthy, but we expect divergences in performance based on proximity to ports that are disproportionately impacted by tariffs. Retail vacancy of 6.6% is near lows since data became available in 1990. Limited new construction and a significant amount of demolition of non-competitive stock has played a significant role in bringing retail fundamentals into a steady equilibrium. Hotels are expected to see revenue grow 1.3% this year, down from 1.9% in 2024. Hotels are more operation-intensive than most other property types, and elevated labor costs could face additional pressure from immigration restrictions. However, the consumer trend of spending on experiences over goods remains a long-term tailwind. Office fundamentals are challenged, but office vacancy increases have moderated, staying at roughly 19.0% over the last year. Remote work is no longer causing vacancies to increase. U.S. cities have widely divergent performance. NYC is leading in terms of vacancy declines across Gateway markets. Across the Sunbelt, Florida markets are near a full recovery in vacancies.

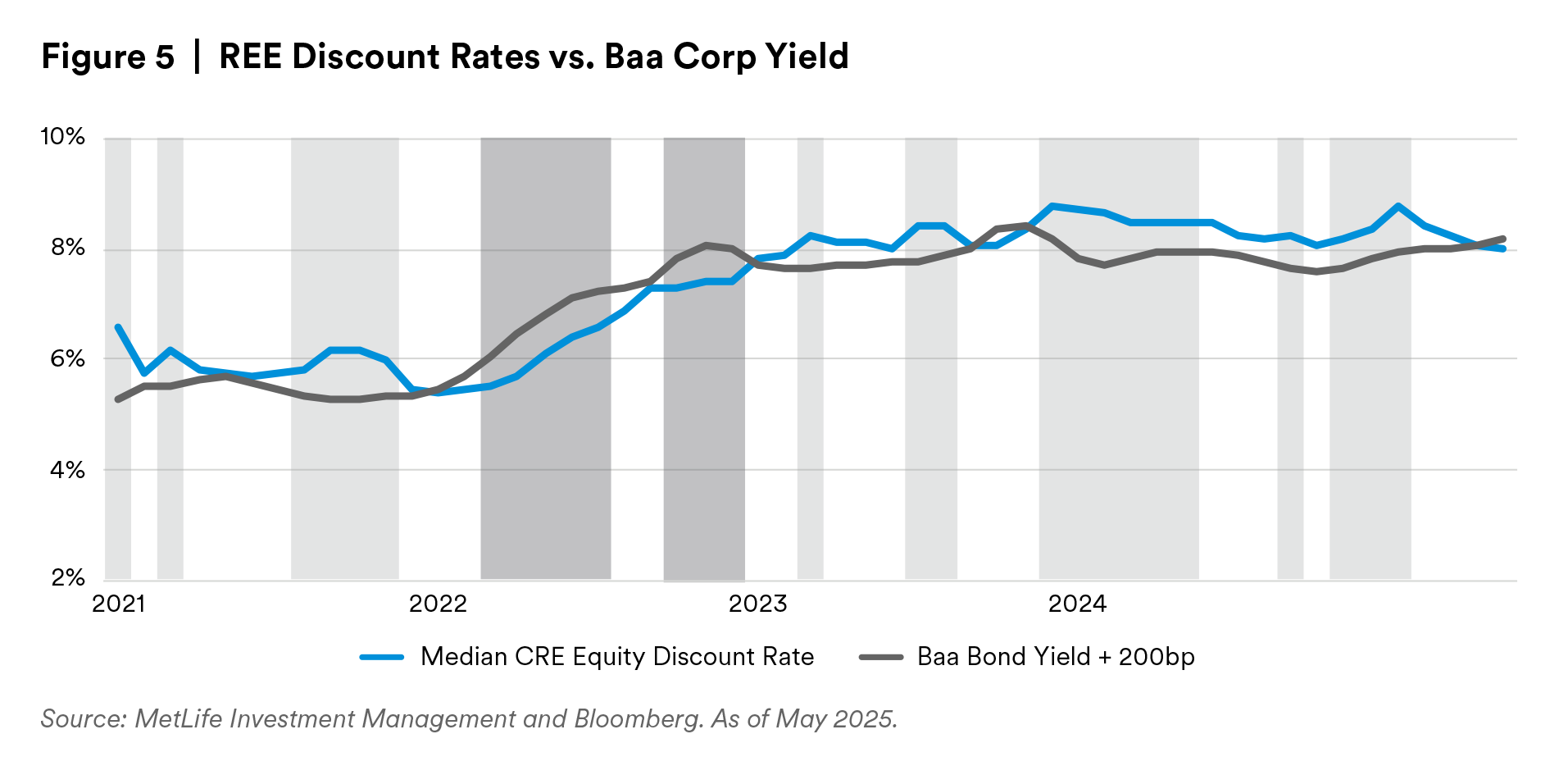

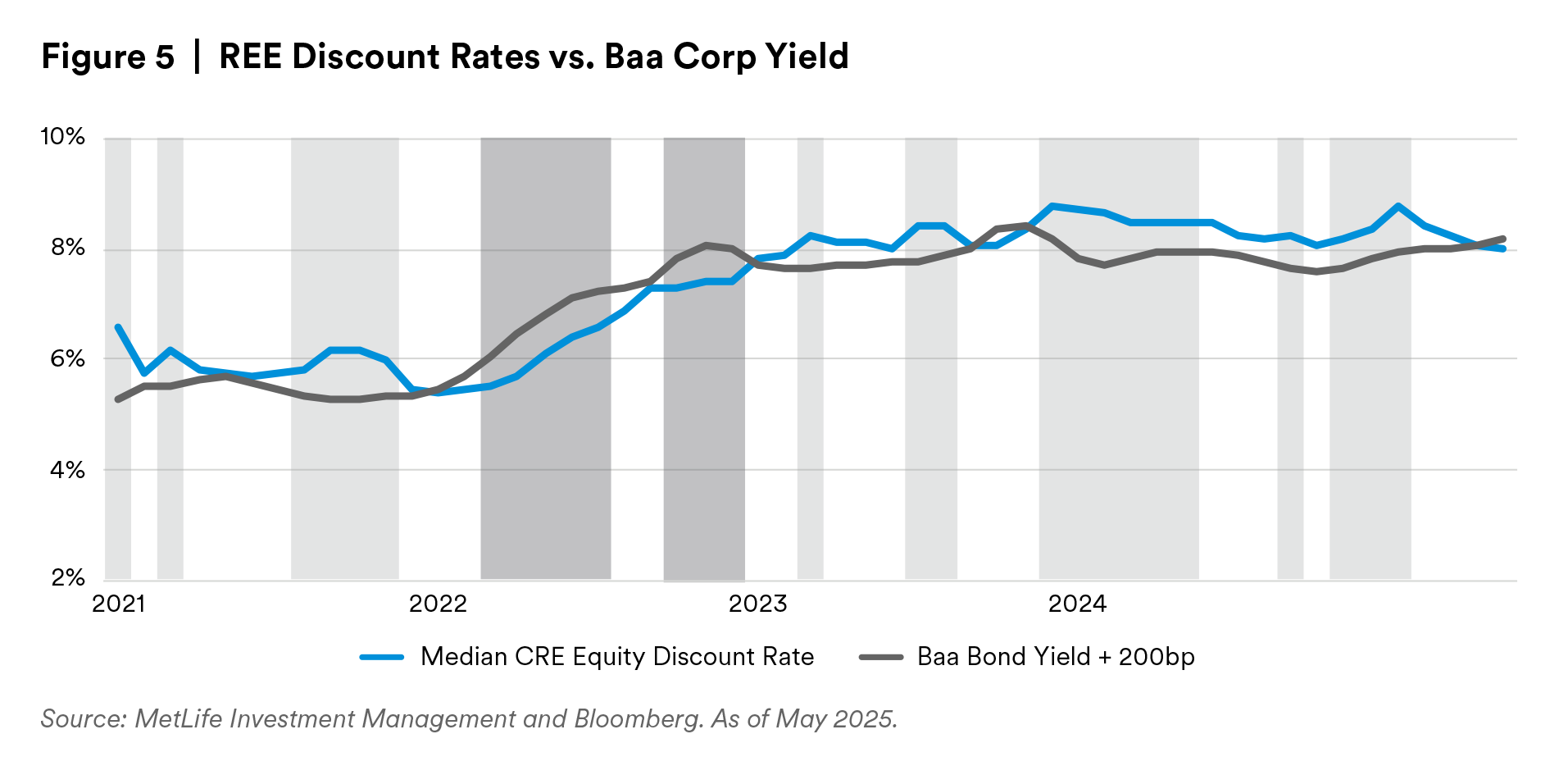

Historically, for Real Estate Equity, unlevered equity yields (discount rates) align with Baa corporate bond yields plus 200 basis points. This measure compares the relative value of real estate equity at various market stages. Figure 5 shows discount rates on commercial real estate (CRE) equity transactions underwritten by MIM from January 2021 to May 2025. The data suggests a risk-on strategy was apt for most of 2021-2022 due to attractive relative value, transitioning to risk-off by late 2022 through 2023. Currently, discount rates reflect stable capital market conditions, implying fair pricing of real estate. U.S. commercial real estate transactions began to moderately increase in the latter half of 2024, but remain low compared to recent years. In 2024, total deal volume was $436 billion, up 13% from 2023. We expect 2025 to be consistent with 2024.

For Commercial Mortgage Loans (CML), there has been minimal change in the more liquid segments of the CML sector. However, higher-yielding debt faces liquidity challenges, offering attractive relative value. Recent quarters have shown rising new debt originations as capital market stress has eased. According to the American Council of Life Insurers (ACLI), life insurers issued $14.3 billion in commercial mortgages in Q1 2025, a 50% increase from Q1 2024. We expect further recovery and increased transaction activity in 2025. MIM is neutral in both Real Estate Equity and Commercial Mortgage Loans.

The agricultural sector is experiencing a significant increase in Net Farm Income (NFI), projected to rise by 30% year-over-year to $180 billion in 2025, primarily driven by government payments from the American Relief Act. Despite this increase, producer margins remain thin due to elevated input expenses and moderated crop prices. Livestock producers are benefiting from favorable price-to-input cost ratios, while almond prices are recovering due to halted acreage expansion. Agribusiness, particularly food manufacturing, is seeing above-average profit margins, expected to persist through 2025. Timberland values remain stable, supported by long-term demand fundamentals despite declining housing starts. Agricultural mortgage spreads have slightly decreased, with farmland values expected to appreciate modestly. Delinquency rates are rising towards historical averages, and mortgage volume growth is rebounding as credit demand increases. MIM finds the agricultural sector attractive.

The consequences of a trade war stoked by President Donald Trump will peak in the second half of this year. While cracks are already appearing, the full impact will be seen in the coming months with potential payroll drops and rising inflation, which would add more pressure on consumers and businesses. Factors such as the expiration of tariff pauses, tax bill disputes, and the approaching debt ceiling could affect stocks. The weakening labor market and rising jobless claims add to the concern. Fed Chair Jerome Powell has indicated preemptive cuts aren’t an option during the trade war.

Concerns about the escalating Israel-Iran conflict caused traders to anticipate further downside. The volatility risk premium widened, indicating higher expected volatility. Before recent strikes on Iran, the VIX was rising even as the S&P 500 climbed, driven by fund managers increasing their equity exposure. This demand for downside protection raised put/call skew, affecting the VIX.

Despite all the uncertainties, the S&P 500 is inching close to a record again. The valuation is close to the beginning of Q1 2025, which MIM finds on the rich side. Even if the S&P 500 retests its all-time high, the downside risks outweigh the upside potential at current valuation levels.

The private equity sector experienced mixed performance in the first quarter of 2025, with U.S. buyout activity totaling $82.9 billion, marking a 36% increase compared to the same period in 2024. However, deal count decreased by 11%, reaching its lowest level in over six quarters. Large deals dominated the landscape, representing 87% of deal value, the highest percentage since 2007. Despite geopolitical tensions and trade tariffs impacting some portfolio companies, the sector remains well-positioned to leverage the current market environment. Asia saw a rise in private equity investment, particularly in Japan, while technology investments hit their lowest level since 2014, with healthcare taking the lead. Global exit value increased by 38% quarter-over-quarter, driven by large exits, although exit volumes declined. The investment-to-exit ratio rose to 2.6x, indicating higher uncertainty and hesitation among sponsors to exit, especially through IPOs. Fundraising showed resilience, with U.S. PE fundraising driven by large funds, while European and Asian markets also saw notable activity. Despite the liquidity drought in venture capital, long-term themes such as tech innovation and digital adoption continue to support the industry. MIM is cautiously optimistic about the sector.

In the second quarter of 2025, the USD experienced a sharp depreciation driven by heightened trade policy uncertainty, leading to a reassessment of its role as a safe-haven currency. This decline was steeper than anticipated, with increased volatility and deteriorating liquidity conditions following Liberation Day. Safe-haven currencies like JPY and CHF outperformed, while risk-sensitive currencies gained as market sentiment stabilized. Additionally, Moody’s downgrade of the U.S. sovereign credit rating to Aa1 added pressure, citing concerns over long-term debt sustainability. The reduction of U.S. tariffs on Chinese imports helped avert major trade disruptions, though uncertainty remains high, affecting corporate confidence and capital expenditure. The TWD rallied significantly, influencing broader regional FX markets, driven by exporters selling USD. Europe saw the EUR benefit from USD weakness, supported by reallocation flows out of U.S. assets and Germany’s announcement of a €500 billion infrastructure fund. LATAM currency performance varied due to domestic policy dynamics, with the MXN outperforming due to a well-telegraphed monetary policy stance and clean positioning, while the COP underperformed due to fiscal concerns and weaker macro fundamentals. The outlook for Asian, European, and LATAM currencies remains broadly constructive, underpinned by a favorable external environment, though idiosyncratic political and fiscal developments will continue to drive dispersion.

Contributors: David Heslam , David Richter, Felipe Perigo, Brad Gottenberg, Jean-Luc Eberlin, Pierre-Pascal Lalonde , Sara Strauch , Michael Brown, Paul Carroll , Alfred Chang , Jacob Kurosaki, David Williams, Agata Praczuk , Carrie Biemer, Stephen Driscoll

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For Investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of 31 March 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.