Slower Global Economic Growth Continues

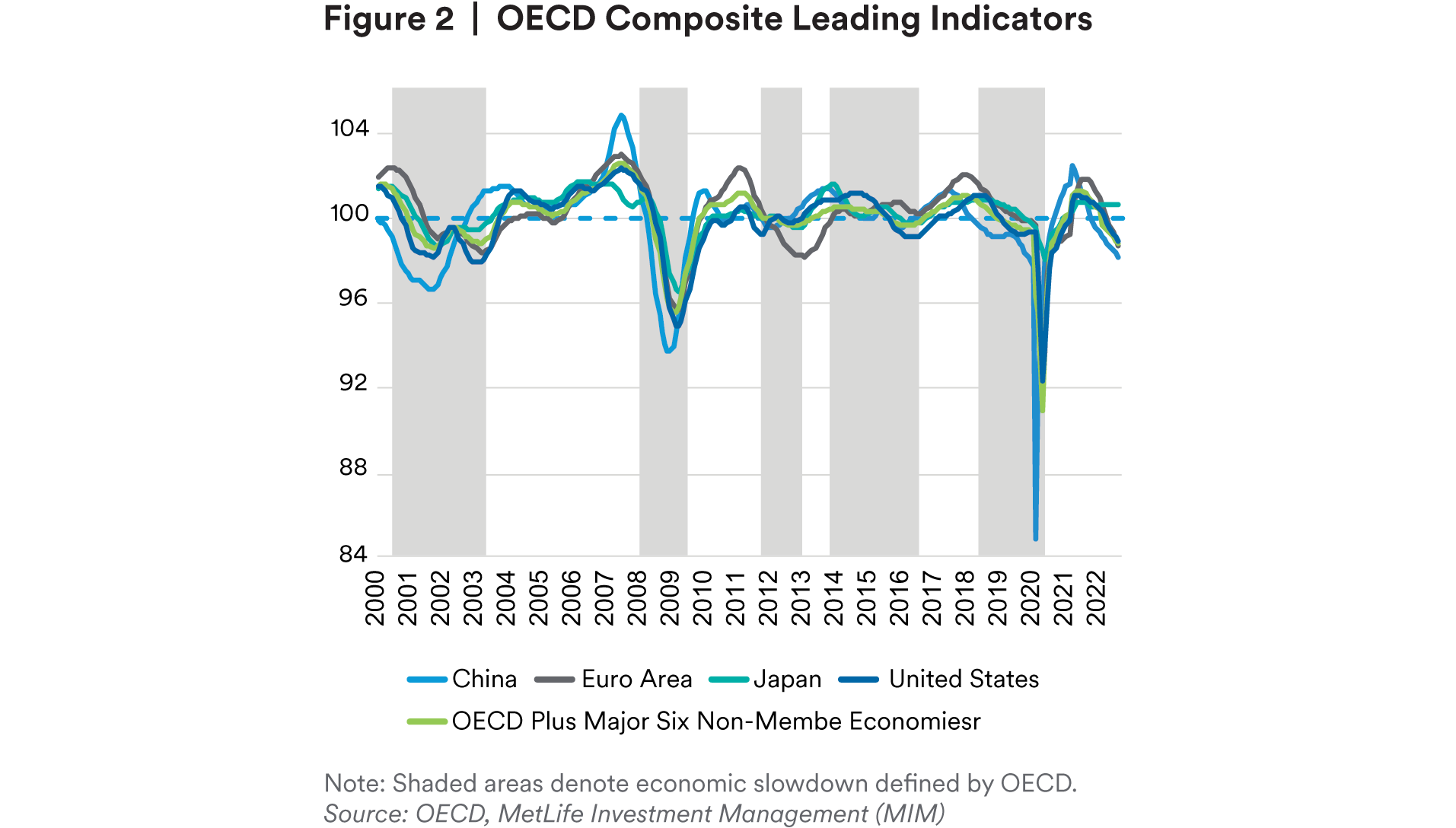

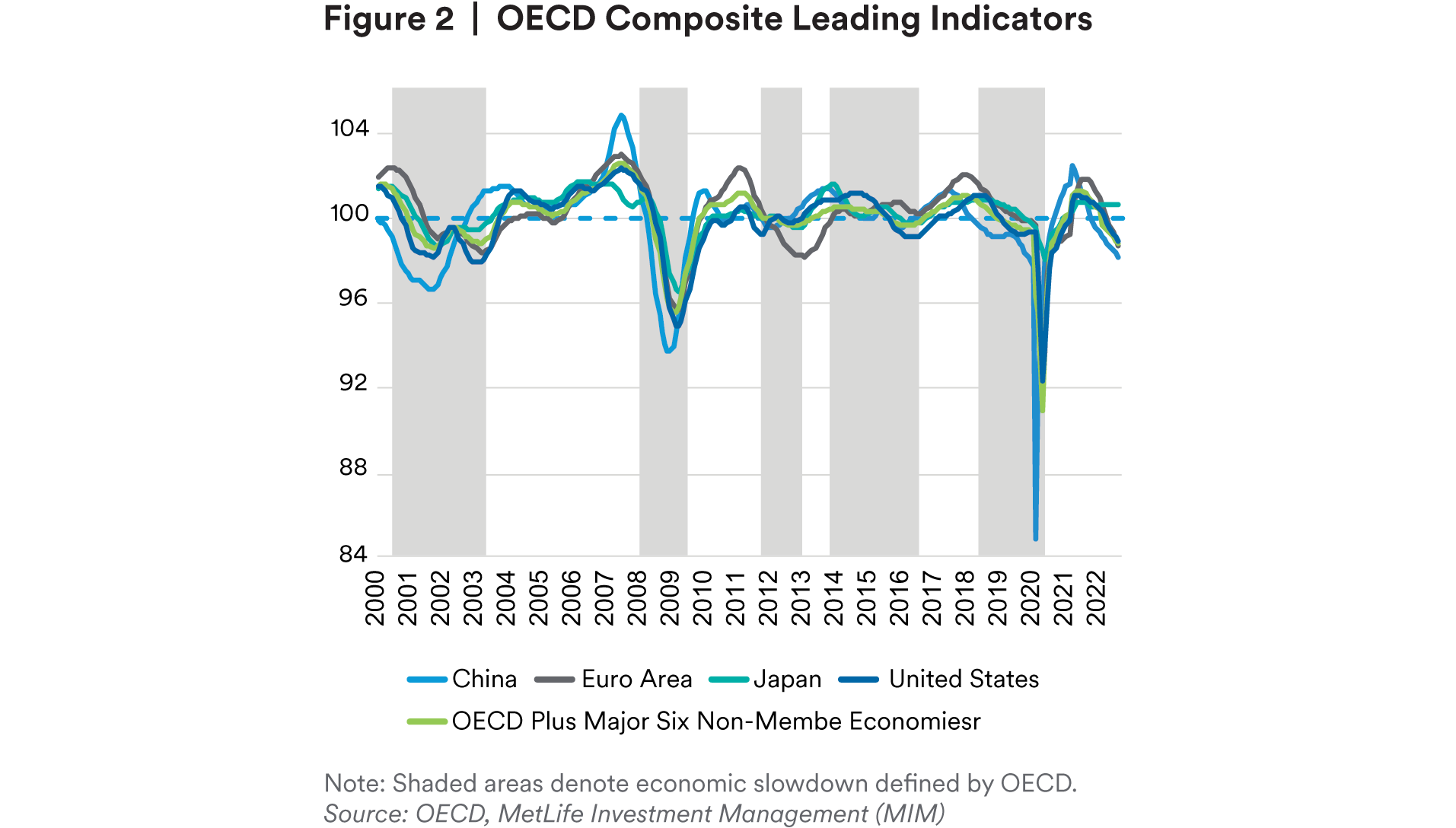

The OECD Composite Leading Indicators Index (Figure 2) shows that the slowdown of the global economy continues. Most central banks continue tightening policy to fight rising inflation. U.S. — A recession in 2023 remains our base call. A slowdown in hiring over the next six months would seem to be a reasonable forecast. 2022 should have seen the peak in long-term yields for this cycle. Europe — The outlook for the remainder of the year and into early 2023 has weakened materially as negative spillovers from Russia’s invasion of Ukraine continue to accumulate, and uncertainty over the region’s energy supplies linger. Asia — Recent data point to a still-decent regional growth backdrop and tailwinds as economies emerged from COVID-19 restrictions earlier this year. However, we are seeing emerging weakness in the more export-oriented economies given the softer outlook for demand in developed markets. Latin America — Economic activity surprised in 1H22, but deceleration is expected for 2H22 and 2023. Commodity prices moderated lately due to concerns about global growth, negatively affecting LatAm currencies.

More Hawkish Fed, Inverted U.S. Yield Curve Likely

U.S. Treasury — We expect the Fed to continue hiking the Fed Funds Rate to 4.25% by year-end 2022. Based on our GDP and inflation forecast for 2022, we expect the 10-year yield to have peaked and to fall to around 3.25% by the year-end. JGBs — Despite moves higher in USDJPY, the JGB market remains relatively calm, moderating over the course of this year. Our baseline remains for no change in the BoJ’s ultra-accommodative monetary policy settings this year, given still-below target core CPI, growing headwinds to the export complex as external demand wanes, and a persistent negative output gap. These factors should keep JGB 10-year yields within the target band. Bunds — We continue to expect further upward pressure on 10-year bund yields over the next three to six months, reflecting the government’s higher net financing needs as it continues to roll out fiscal support packages and the likely pending announcement of the ECB’s quantitative tightening (QT) plans, which would underweight core sovereign holdings in favor of peripherals in the ECB’s balance sheet operations.

Corporate Credit Spreads May Continue to Widen

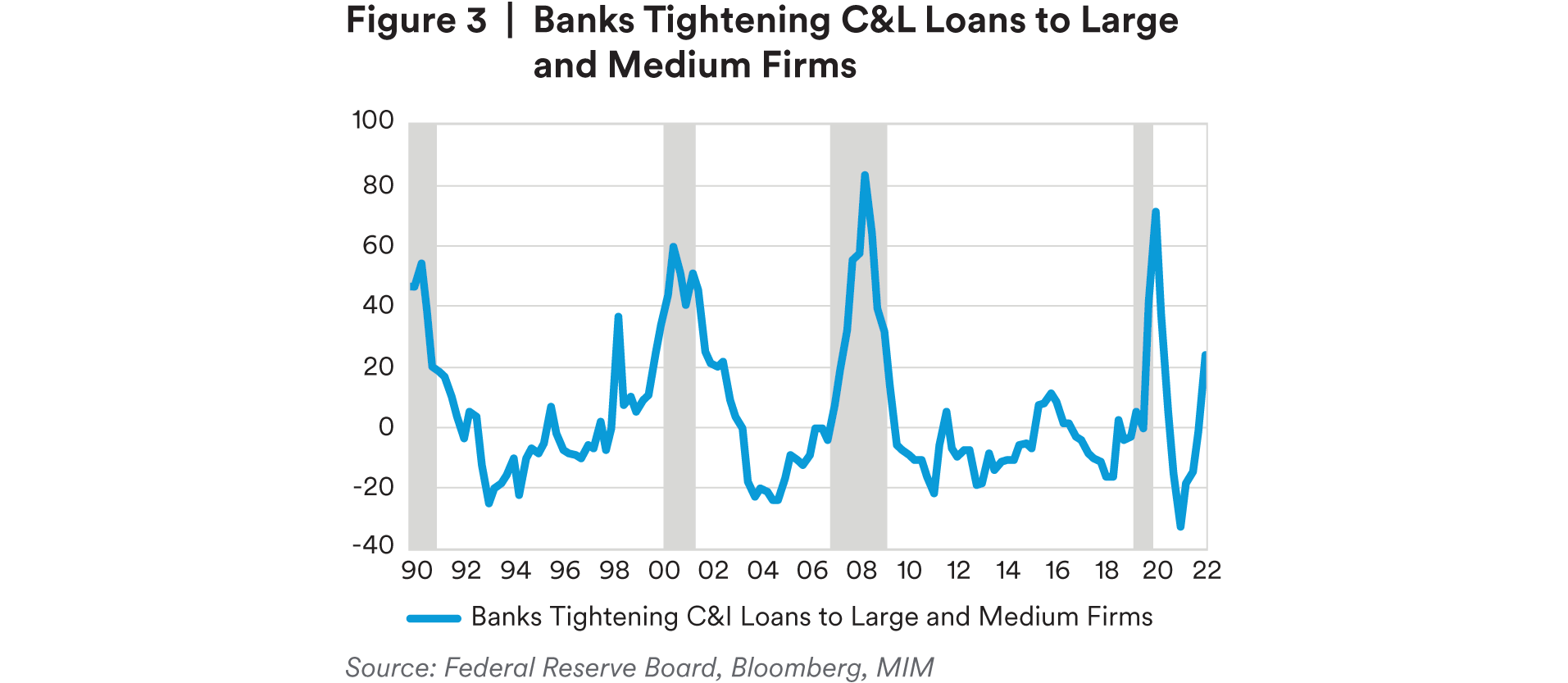

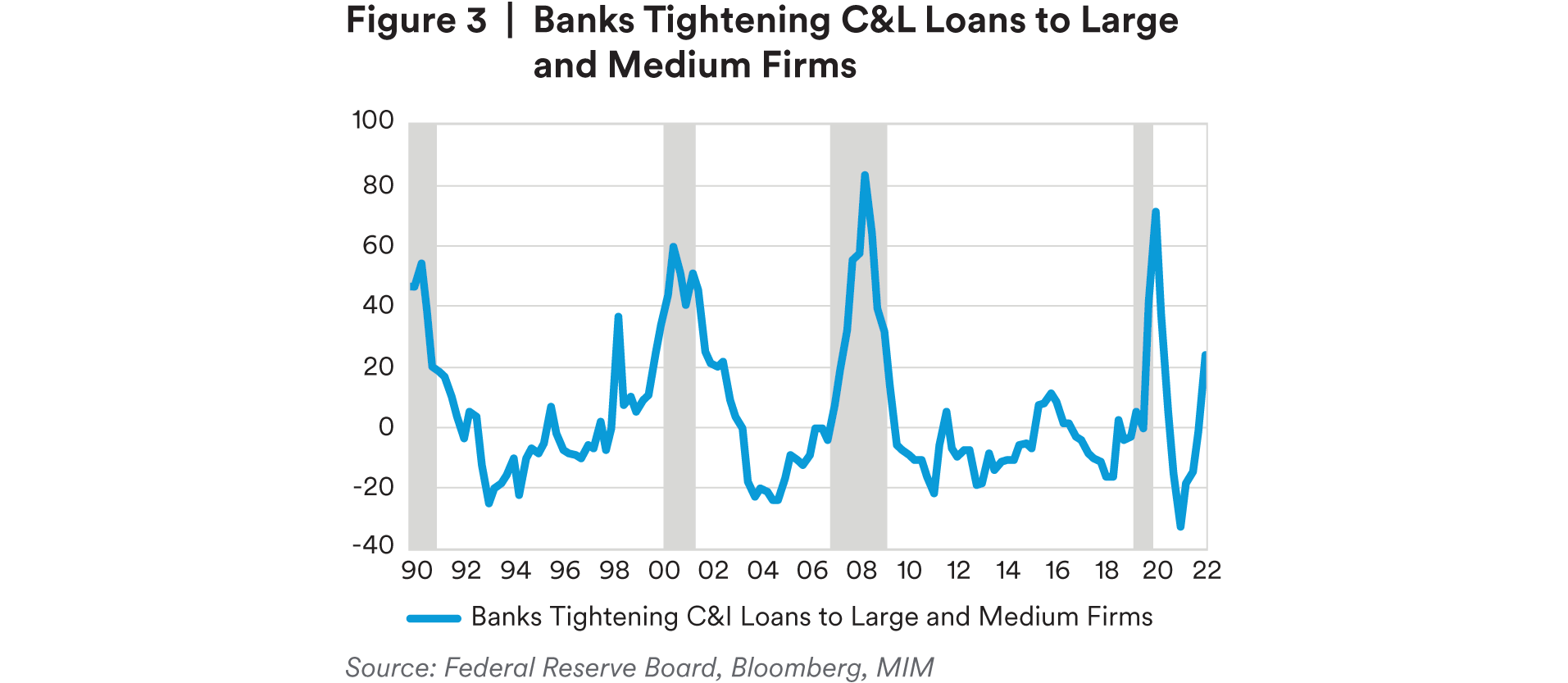

The slowdown in corporate earnings continued in 2Q22. This credit cycle is aging very fast; we changed our credit cycle view to the “overheat” stage from the “expansion” stage on increasingly restrictive Fed policy, curve inversion, and tightening lending standards (Figure 3). We believe that the credit cycle is likely to turn in 1H2023. While valuations improved across credit markets, as spreads are near their historic averages, we do not believe that credit markets have priced in sufficient downside risk. At current spread levels, both U.S. IG and HY markets are pricing in only ~10% recession risk. Looking forward, we expect spreads will trend wider on heightened recession risk in 2023. As a result, we recommend “up in quality” for the remainder of 2022. U.S. Investment Grade (IG) — Although credit fundamentals improved further in 2Q22, the outlook remains neutral on slowing profit growth and margin pressures. Both revenue and EBITDA continued to improve during the quarter while total debt remained stable. Spreads are near fair value, but IG yields rose to the highest levels since 2009.

European IG — Fundamentals continued to improve in 2Q22. 2Q22 earnings surprised on the upside: 74% of Euro Stoxx 600 companies reported a positive top-line surprise, and 52% a positive earnings surprise, based on Bloomberg data as of September 14th. EBITDA growth and margins remained at record highs driven by the energy sector. We think that margins, ex-energy, have peaked, and for the next 12-18 months, it is likely to be a question of how well corporates can protect against declines. High Yield — Defaults remained benign in 2022, but year-to-date total defaults/distressed exchanges already exceeded last year’s full-year total. Although default rates are expected to remain benign (1.4% - 2.5%, according to Moody’s) for the rest of 2022, we expect them to rise to 4.3% by mid-2023. Leveraged Loans — The momentum of positive rating actions has stalled as downgrades outnumbered upgrades again in August, the fourth consecutive time since November 2020. Technicals weakened as we have seen fund outflows for four consecutive months, although year to date, the leveraged loans market still attracted strong inflows. CLO formation also slowed recently. Year-to-date CLO new issuance dropped ~20% YoY to $90bn (data source: Credit Suisse), but is still in line with pre-COVID-19 years. Year to date, the leveraged loan market has been the best performer in credit markets due to sharply rising rates. Spreads are near fair value and are cheap relative to the high yield bond market. Municipals — Both general obligation and revenue bond outlooks remain neutral. Valuations are near fair value, and we believe the taxable municipals market will be more resilient in a challenging macro environment. As a result, we remain overweight on taxable municipals. Emerging market (EM) IG — During 2Q22, EM growth slowed as a result of China’s zero-COVID-19 policy, the Ukraine war, soaring inflation, and the tightening in global financial conditions. EM central banks started tightening earlier than developed market central banks, and many are nearing the likely peak of their hiking cycles. China has begun to ease policy to counter its slowdown and labor market disruption.

Housing Slowdown Has Emerged

Increases in home prices and rents have outpaced the increases in incomes over the last couple of years (Figure 4), which is not sustainable. Residential Credit — The long-awaited housing slowdown has emerged quickly. Mortgage rate increases, along with home price appreciation, have led to a sharp drop in affordability. The primary risk to the housing market is job loss translating into delinquencies, but we feel elevated foreclosures remain a low risk. Borrowers will not voluntary walk away from homes just due to softening prices in our view.

Asset-backed securities (ABS) — COVID-19-driven excess savings continue to allow the consumer to weather inflation, as well as to support higher spending trends, but weaker borrower segments are starting to struggle. Credit card balances are noticeably higher and close to pre-COVID-19 peaks. Delinquencies are increasing in autos, with non-prime delinquencies escalating quickly. Credit card delinquencies have also begun trending higher. CLO — We feel the CLO market should transition to fundamental performance as the era of prolonged and low defaults is in the past. Spreads have already reacted and are pricing in historically wide levels. Deals continue to migrate to static or short tenor as the issuance market is challenged due to the cost of funds. CMBS — A cooling in commercial valuations has begun. With a continued contraction in the lending environment and elevated rates, we expect issuance to slow. Conduit issuance could fall to an 11-year low. Agency MBS — Housing turnover and prepays are a focus for investors. With high mortgage rates, the incentive to refinance is low. Agency MBS risk measures have converged as incentives have eroded. Weighted average life across coupons only vary by 1.5 years. (8.7-10.5 WAL). Fed portfolio sale narratives change weekly, and Fed coupon consolidation efforts have not begun. Private Structured Credit — Over the past several months, deal pricing in private structured credit has re-established a healthy spread pickup to public markets. Deal flow has also accelerated into Q4 across various sectors. Opportunities in consumer credit have also increased and have become more attractive from a risk-reward perspective as pricing moves wider.

Lower Transaction Volume for Commercial Real Estate

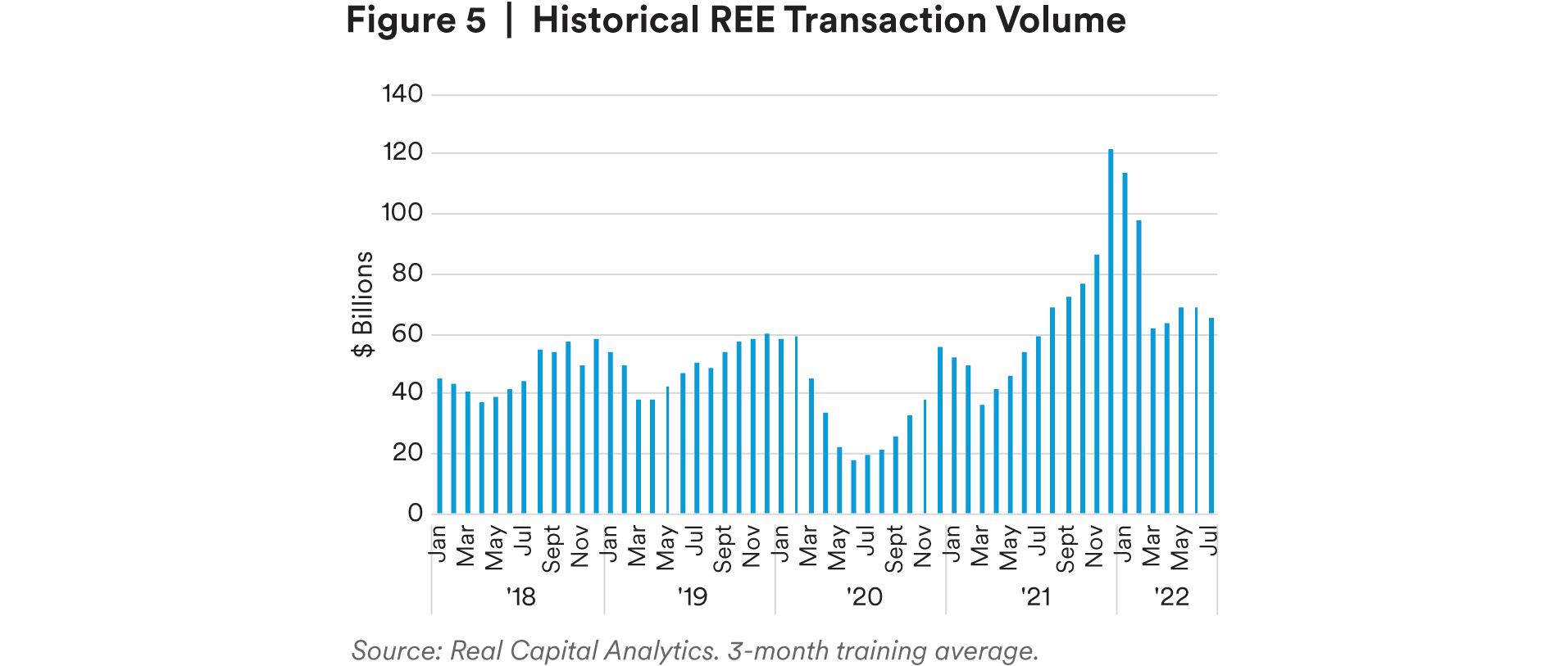

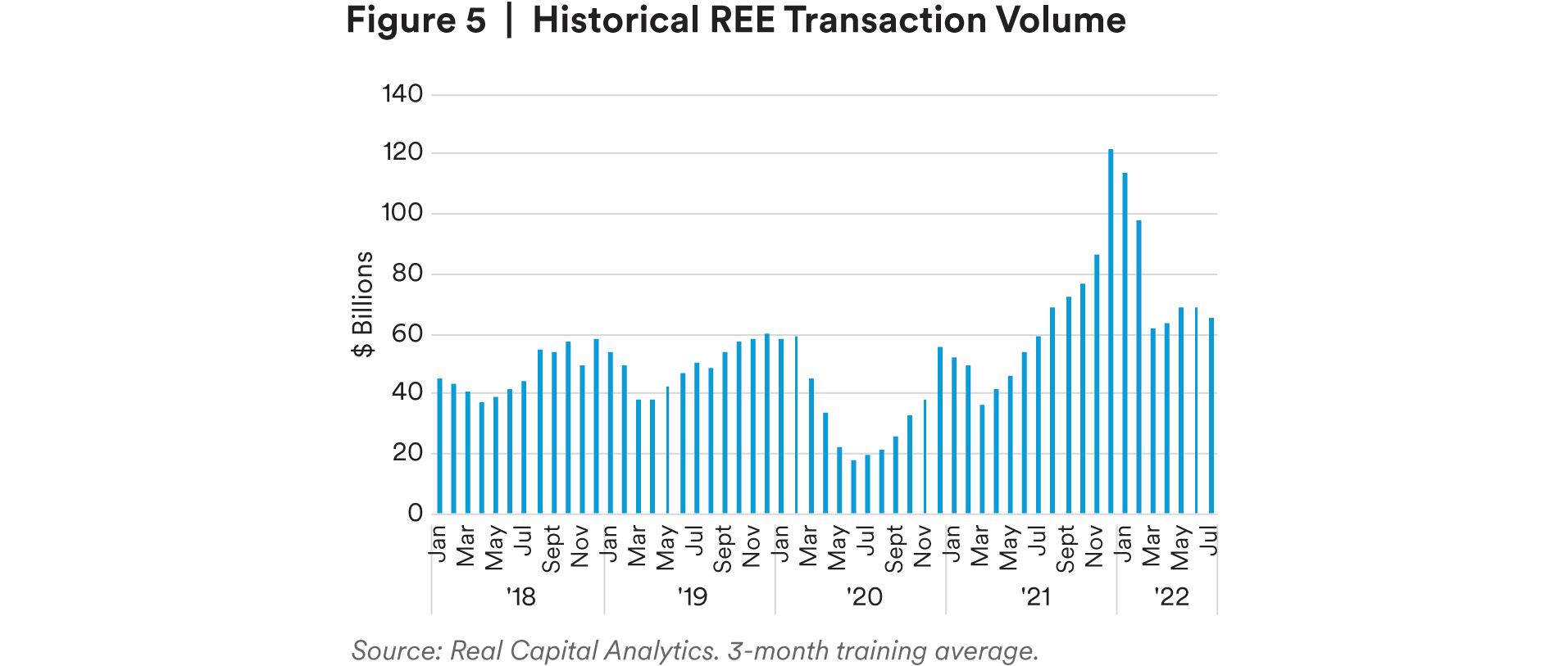

We believe real estate fundamentals remain on solid footing for most property types. Labor market growth and stable consumer spending trends have supported demand, while continued supply-chain disruptions, inflation, and higher interest rates have kept supply growth low. As a result, vacancy rates are near historically low levels, and rents continue to increase. Through the first half of the year, equity transaction volume (Figure 5) was on track to eclipse even the elevated level of activity exhibited in 2021. However, the higher interest-rate environment and uncertain macroeconomic outlook have rapidly cooled transaction markets, and activity in July was nearly 20% below the 2021 level. We expect a relatively modest level of equity transaction activity for the duration of the year.

Agriculture Loan Spreads Likely to Remain Compressed

The U.S. farm economy continues to benefit from strong incomes and profitability. The USDA projects Net Farm Income will increase 5% year-over-year in 2022 to a record $148 billion. Rising farm incomes are largely attributable to strong global demand for U.S. agricultural products. MIM’s 12-month rolling average agricultural spread was 21% lower, as of August compared to last year. There is no publicly available market spread data for agricultural mortgages. However, Federal Reserve data indicate spreads have likely compressed given an increase in benchmark interest rates.

Bearish Sentiment for Public Equity Markets Continues

We continue to underweight equity (i.e., underweight risky assets in general), given the hawkish Fed, slowing global economic growth, and downward pressure on profit margins. Technically speaking, we believe that we are in a bear market, given that both the medium-and long-term trends are downward. A short-term bounce higher is possible, as the market sentiment and market breadth have reached extremes. However, with the rising recession risk and soft earnings outlook, we maintain our risk-off call on equity.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.