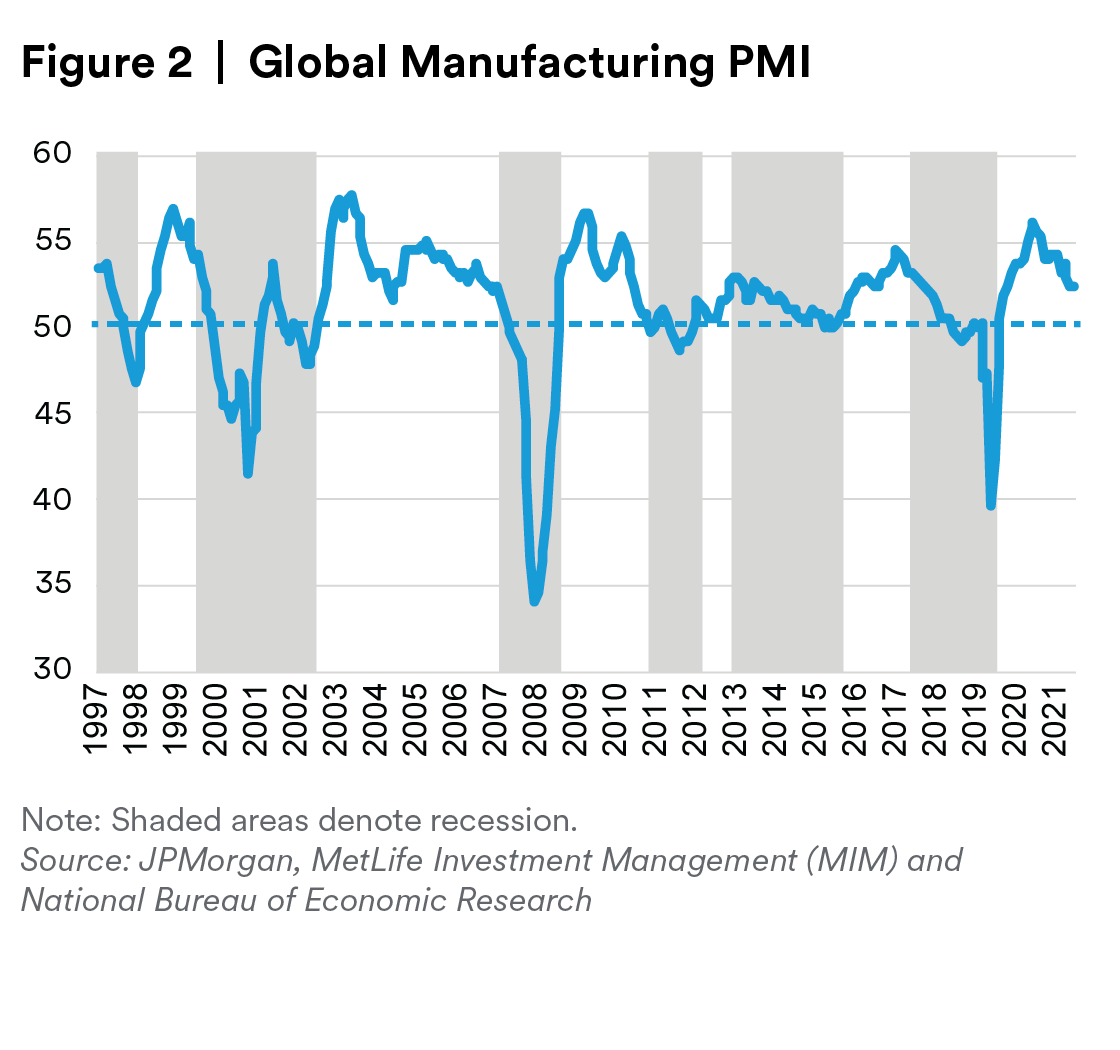

Slower Global Economic Growth:

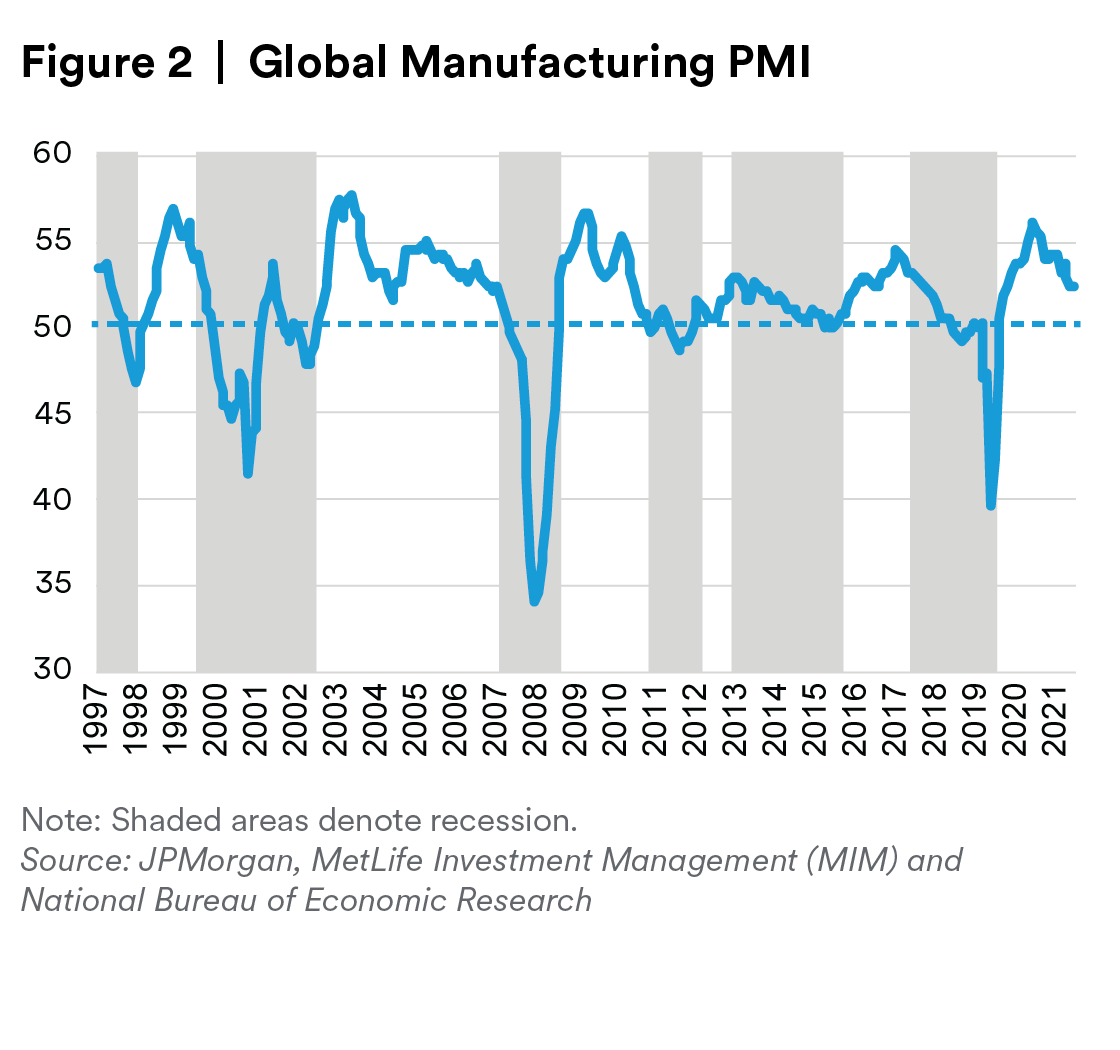

The global manufacturing Purchasing Managers’ Index (“PMI”) index (Figure 2) suggests that global economic growth could be slower. Most central banks are tightening their policy to fight rising inflation.

U.S. – Signs that inflation will ebb have not been arriving fast enough and, despite the impact of noncore items on overall inflation, the Fed has shifted to a more aggressive stance despite signs of a more fragile consumer and increased risk of recession.

Europe – Short term indicators like PM surveys have softened but remain consistent with positive growth momentum in Q2. However, the outlook for the region over H2 2022 and in to 2023 has deteriorated due to numerous negative shocks.

Asia – Domestic demand should help to offset softening external demand in coming months. Inflation pressure has finally arrived in Asia, with still considerable upside food price pressure ahead even if energy inflation stabilizes.

Latin America – Commodity prices are supportive to external and fiscal accounts, but higher rates in developed markets and domestic politics pose risks.

More Hawkish Fed, Flattening U.S. Yield Curve:

We expect the Fed to move more aggressively this year and for 10-year yields to decline to 2.75%. Aggressive Fed action to restrain inflation is likely to slow growth more sharply than we previously expected even as high inflation in certain sectors is acting as a brake on consumption. Consumers appear increasingly stressed, relying more on credit and decreasing their rate of savings. Additional rate hikes in combination with stillhigh inflation will likely further pressure consumers and negatively impact growth, this year and next. Economywide margins have begun to decline, and it seems likely that firms would begin to reduce labor demand and investment as CEO confidence in the economic outlook falters, echoing the decline in consumer confidence measures. Layering in the delayed impact of 2022 rate hikes into this environment, we think it likely the economy could dip into recession around mid-to-late 2023

Corporate Credit Spreads May Continue to Widen:

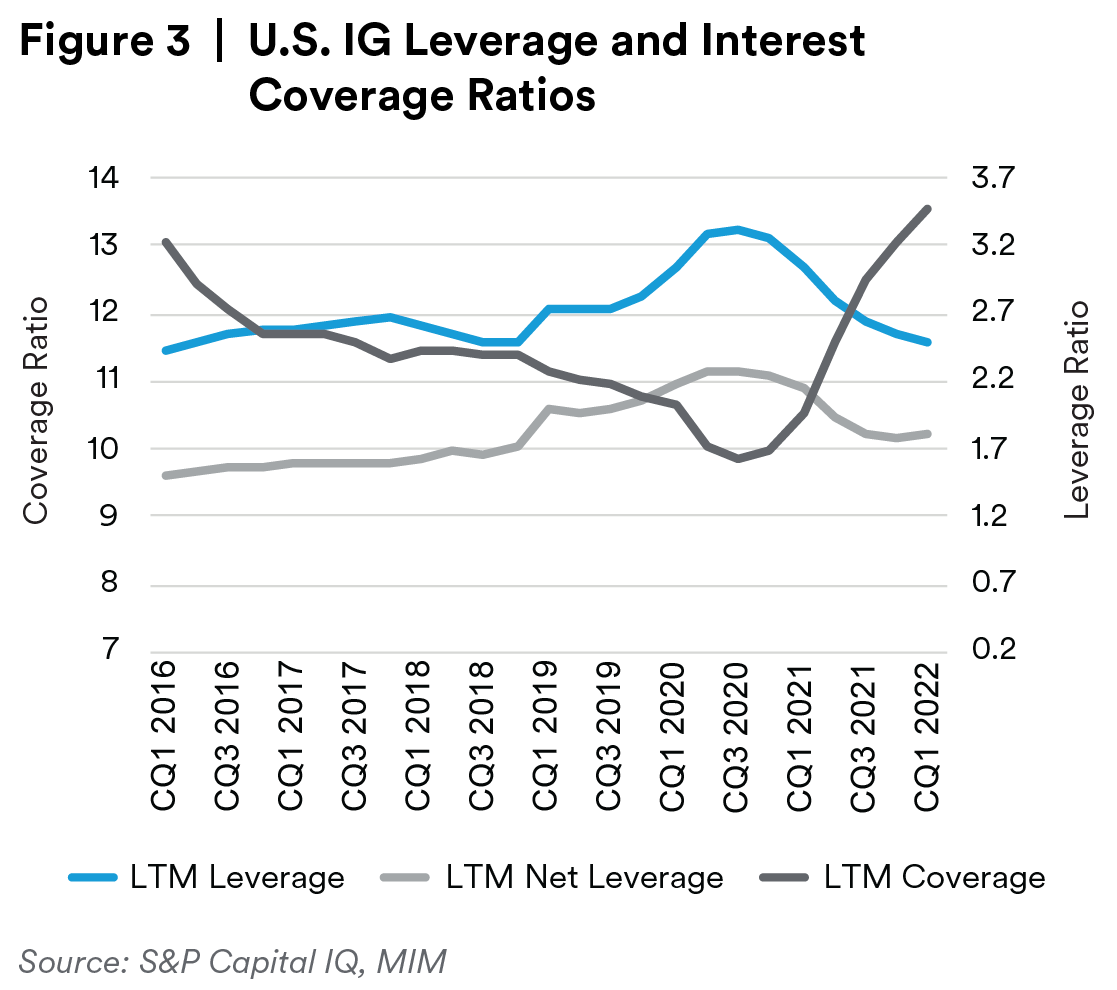

Corporate earnings slowed down significantly in 1Q22. U.S., European, and emerging market fundamentals continued to improve on profitability and stable debt. While we expect credit metrics will continue to improve marginally in the coming quarters, we lowered fundamental outlook to neutral for U.S. markets on mounting macro headwinds. We expect spreads will trend wider on heightened uncertainty of Fed policy, stubbornly high inflation, and the repercussions of the Ukraine war.

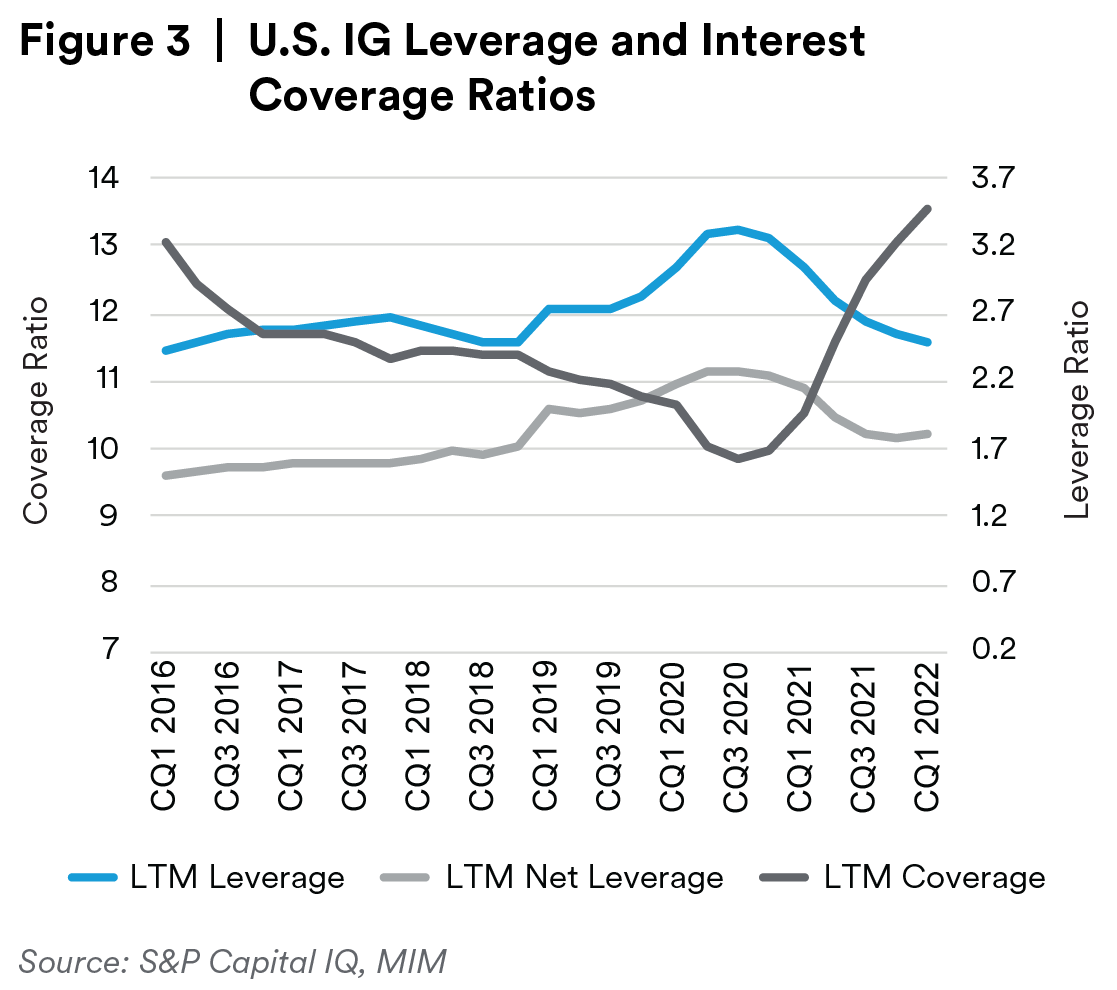

U.S. Investment Grade – Both revenue and EBITDA continued to improve during the quarter while total debt remained stable. The gross leverage ratio declined to 2.48x in 1Q22 from 2.54x in 4Q21 while the coverage ratio improved to 13.56x from 13.05x (Figure 3). Both the leverage and coverage ratios are better than pre-pandemic levels. Spreads are near fair value, but investment grade yields rose to the highest levels since 2010 and we believe current yield levels are attractive.

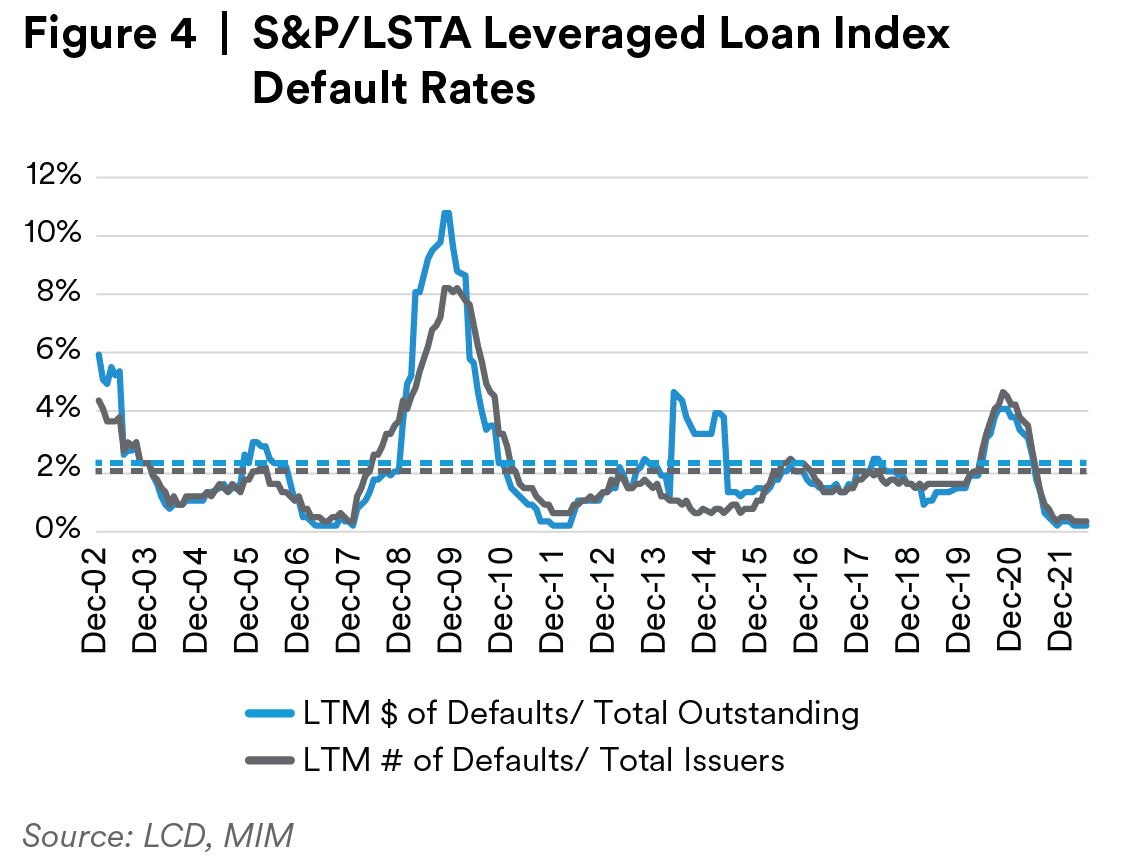

High Yield – Defaults remained benign in 2022. Valuations improved given the most recent spread widening, but we believe that the high yield market has not fully priced in adequate downside risk yet and expect that spreads are likely to widen further.

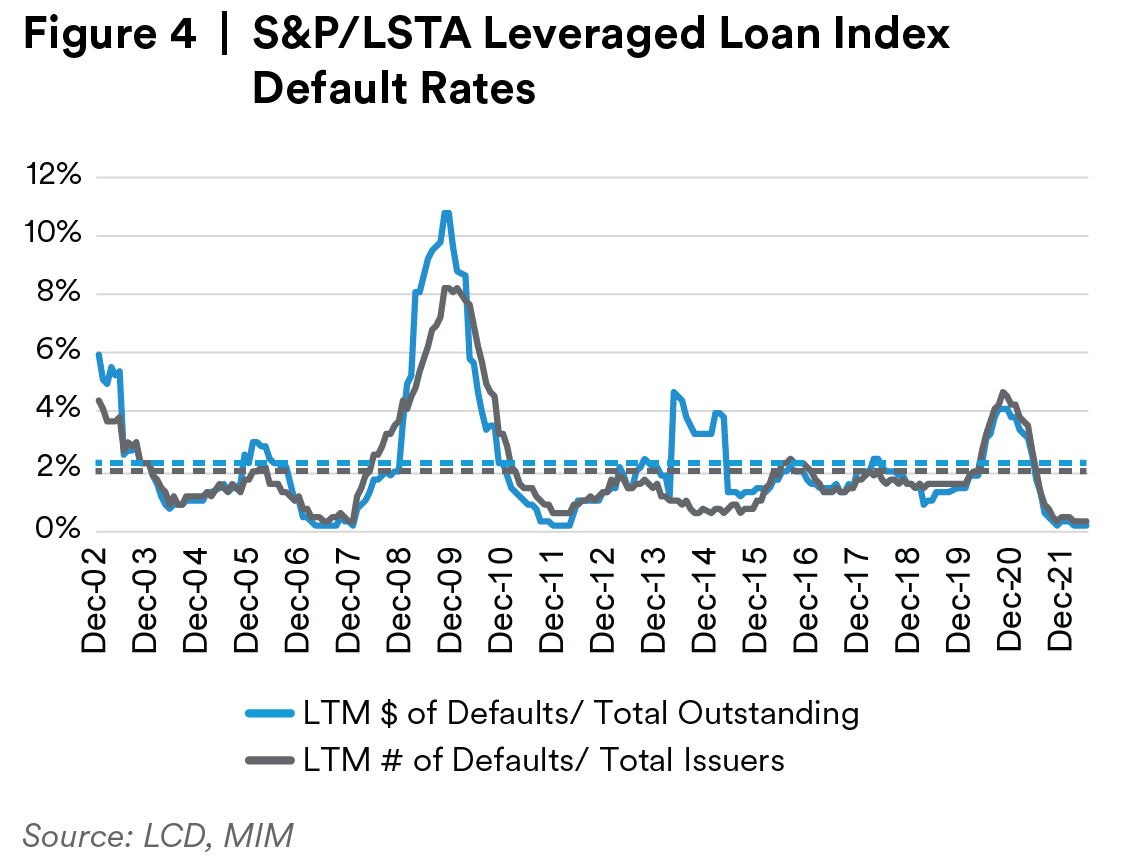

Leverage Loans – Although the default outlook remained benign (Figure 4), we feel the best is already behind us as the distressed ratio (price < 80) rose in May. In addition, the momentum of positive rating actions also stalled as downgrades outnumbered upgrades in May, the first time since November 2020. Technicals weakened as we have seen first fund outflow since October 2020 and CLO formation has also slowed.

Municipals – For general obligation bonds, we expect continued growth of total state and local government tax revenue but likely at a more moderate pace through FY22. For revenue bonds, the federal government continues to provide financial support to hospitals. Air traffic continues to recover from the 2020 lows. Toll road revenues have largely recovered to pre-pandemic levels. Valuations improved due to recent spread widening, and we believe taxable municipals market will be more resilient in a challenging macro environment.

Emerging Market (EM) Investment Grade – Emerging market sovereign outlook remains neutral. However, 2Q growth is set to be lower on China’s zero- Covid policy, Russia’s recession and soaring inflation along with the tightening in global financial conditions. For EM corporates, our outlook remains positive as revenues and EBITDA remained very strong in 1Q22. While we don’t expect overall debt levels to increase, leverage ratios may level off. CAPEX stability and improving EBITDA should lead to slightly increased free cash flow levels in upcoming quarters.

Housing Market Remains Sound, But Less Affordable:

After weakness in May, a positive tone emerged for structured finance products in June. However, concerns persist regarding fundamental performance. Valuations look more attractive now. Delinquencies among weaker borrowers are growing as consumers spend down their excess savings. Concerns about persistent inflation and its impact may continue.

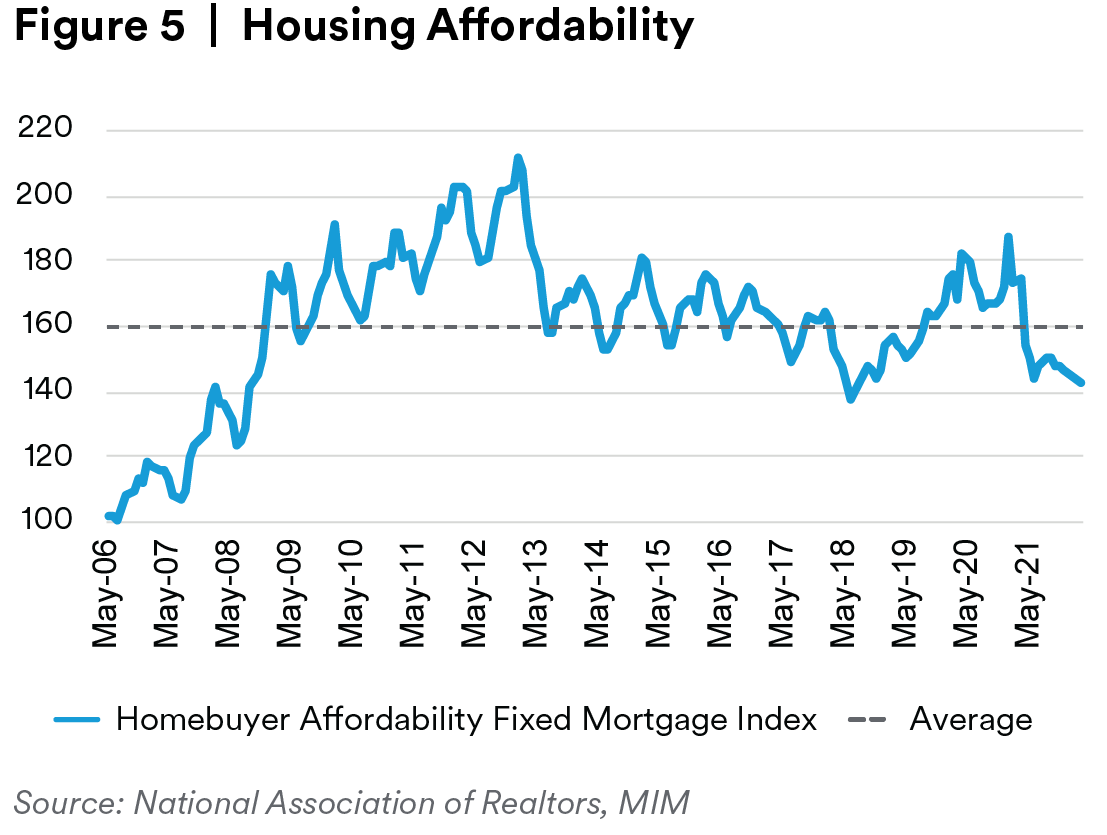

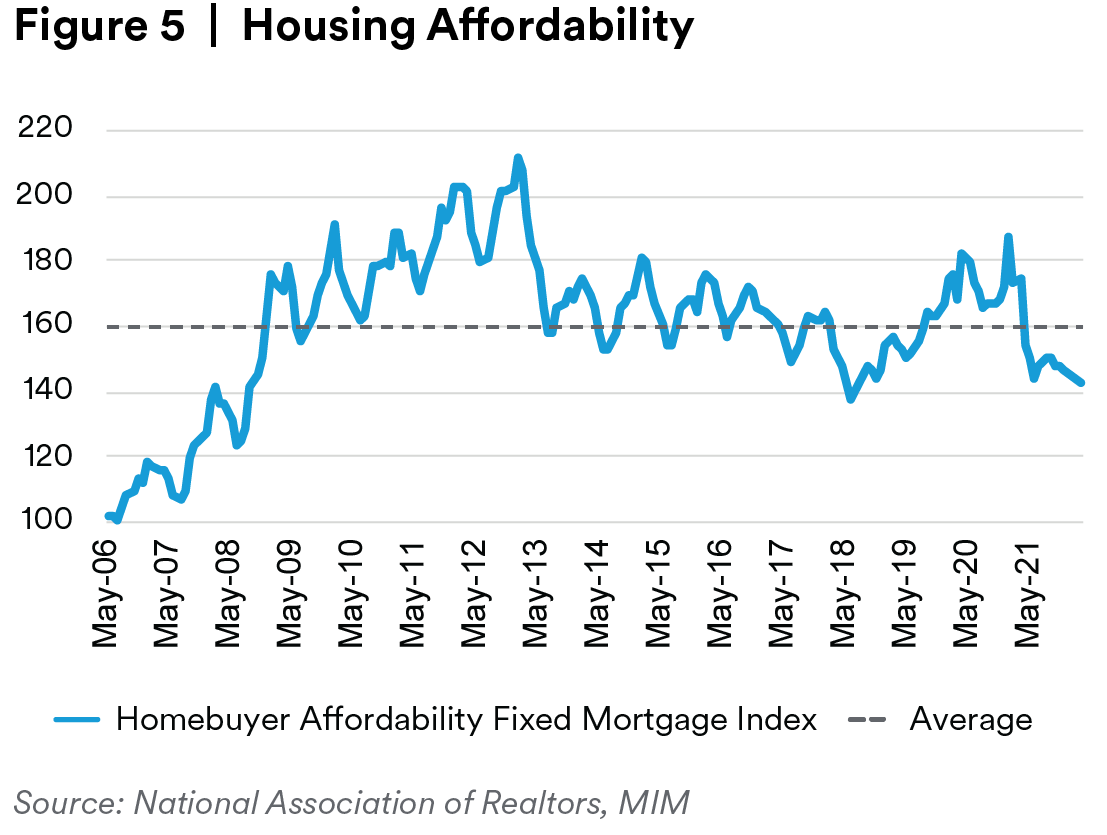

Residential Credit – All eyes have shifted to deteriorating affordability of home buying (Figure 5). While a national decline in home prices is not expected, regional differences will likely emerge. Many forecasters still skew towards positive home price appreciation through 2023. Borrowers are expanding their tools to manage home prices. Adjustable- rate mortgages are returning, but with significantly stronger credit profiles to help reduce risk.

Asset-backed Securities (“ABS”) – Select ABS metrics are showing weakens. The Kroll Bond Rating Agency Tier 2 consumer loan index shows delinquencies for weaker borrowers increased significantly compared to few quarters ago. Higher quality consumers are significantly more stable with surprisingly high prepays indicating inflation has not yet impacted stronger borrowers.

Collateralized Loan Obligations (“CLOs”) – CLO formation is running at 64% of 2021 pace for New Issue (non refi/reset). There has been a noticeable increase in “financial engineering” to distribute deals. While risk measures (e.g., weighted average rating factor and defaults) remain low, the widening spreads confirm to us the deteriorating bank loan fundamentals.

Commercial Mortgage-Backed Securities (“CMBS”) – While residential price appreciation has slowed, commercial valuation has continued to accelerate. Industrial, which has enjoyed strong tailwinds from COVID/on-line needs has also attracted private equity firms. This is leading to faster valuation expansion. However, we do not believe that trends are sustainable.

Agency Mortgage-Backed Securities (“MBS”) - MBS spreads have adjusted to heightened fed activity and widened through most of Q2 2022. The current allin yield looks attractive. Softness in the public RMBS market this year is likely to bring more opportunities with lenders that previously sold to securitization aggregators.

Private Structured Credit - Spreads have finally started to widen in Q2 after lagging public structured markets for much of the prior quarter. Alternatives financing transactions generally benefit from high collateral diversification, low advance rates, and robust deal triggers providing ability to better withstand severe declines in asset valuations.

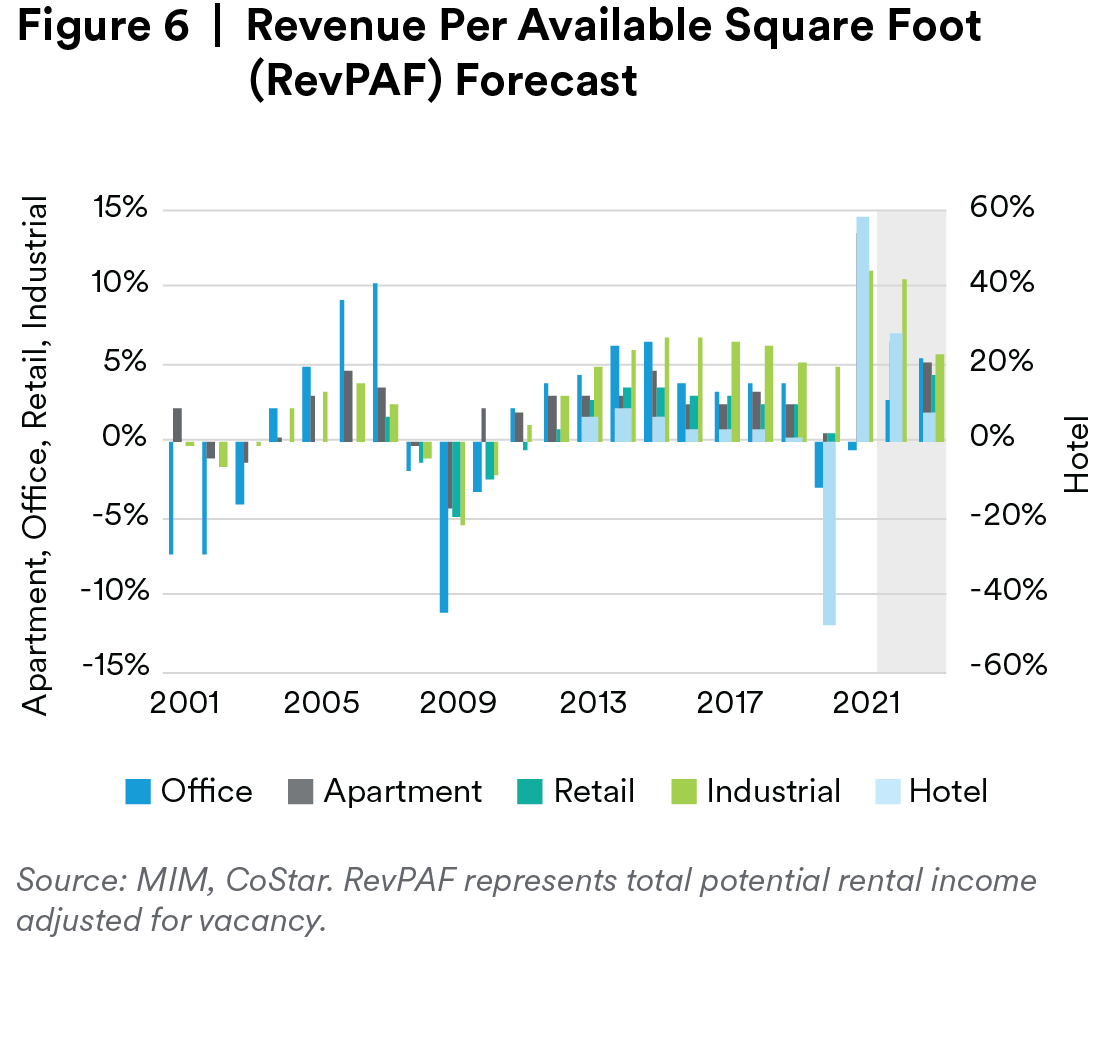

Commercial Real Estate Likely Benefits from Higher Inflation:

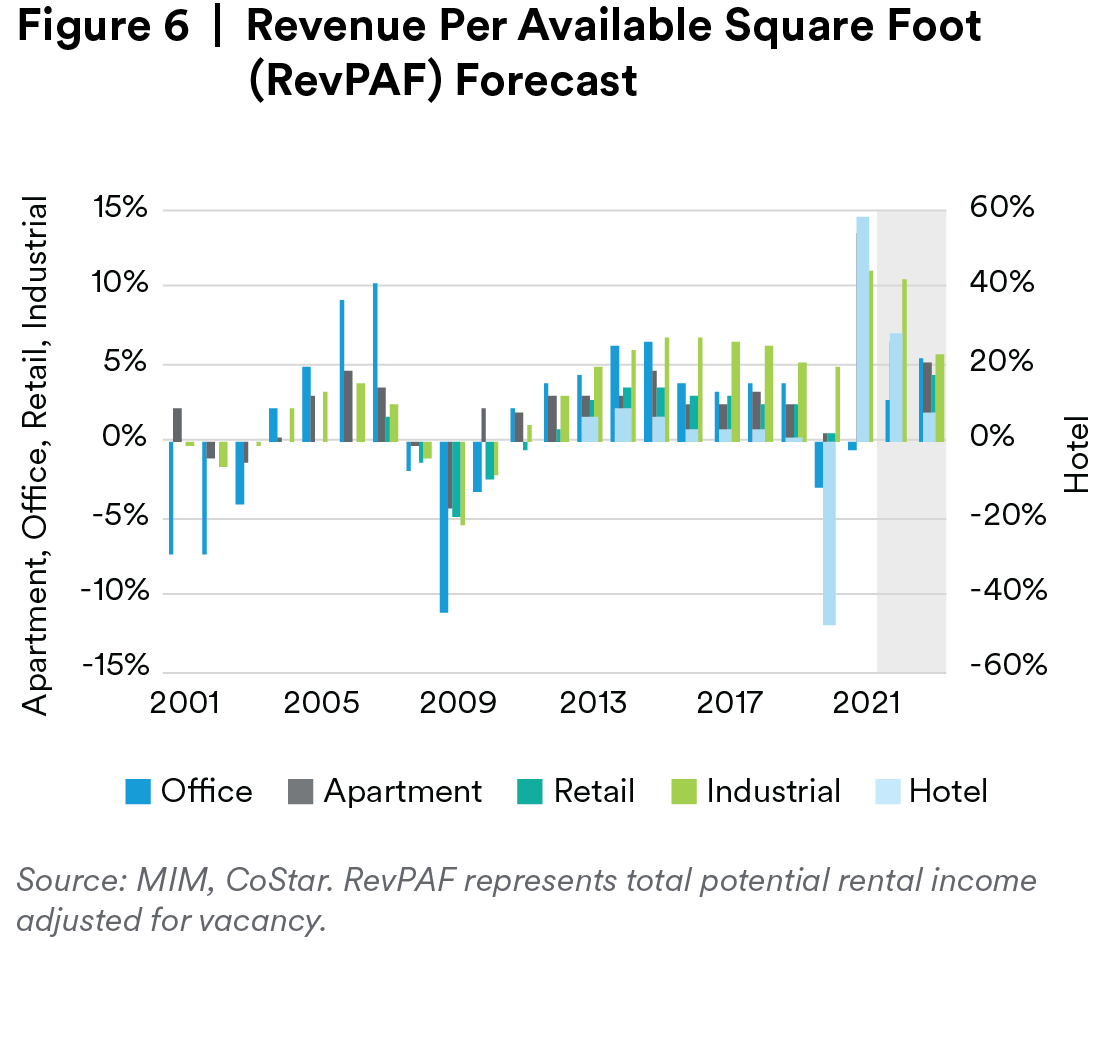

Real estate fundamentals remain strong (Figure 6), in our view. Inflation has run above expectations, which has generally benefitted property income growth. Additionally, the labor market remains healthy. Equity buyers employing higher leverage are beginning to be priced out due to both higher borrowing costs and low starting cash yields. The hotel and retail sectors have surpassed pre- COVID levels of occupancy. While these property types are performing well, they may also have more downside risk if inflation (and higher energy prices) materially weaken consumer spending patterns later this year.

Strong Commodity Prices Are a Positive for Agriculture Mortgages:

U.S. farm incomes likely to remain elevated in 2022 due to historically strong commodity prices. Valuation is rich relative to history. Federal Reserve data indicates spreads have likely compressed given an increase in benchmark interest rates.

Equity Downtrend Remains:

Higher interest rates, earnings per share growth is expected to slow, profit margins are under pressure, and portfolio positioning for a downturn all have contributed to the continued U.S. equity downtrend. Equity valuation is becoming attractive, as the S&P 500 trailing P/E ratio is at a current level of 16.6 down from 27.1 - the 2020 peak. Given the rising recession risk, soft earnings outlook and the continued downtrend, we underweight equity.

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, London, EC$r 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK. MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such). For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414. For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing insecurities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities. For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.