With the debt ceiling no longer an issue, the Treasury is set to increase issuance to raise the cash balance in the general account. Treasury intends to use more bills instead of coupon financing. This shift in strategy may pressure the Federal Reserve to adjust its portfolio, which currently holds a much lower proportion of bills than the overall Treasury market. July saw a record $27.7 billion in tariff revenue, yet tariffs remain a minor part of federal government receipts.

The Treasury General Account (TGA) ended Q2 with a cash balance of $457 billion. With the debt ceiling resolved by Congress, the Treasury aims to boost the TGA balance to their target level of $850 billion by the end of September. Thus, the Treasury is estimating $1.007 trillion of borrowing in Q3 of which $393 billion will go towards restoring the cash balance. The remainder will go towards the deficit.

Going forward, the Treasury intends to rely more on bills instead of coupon issuance for financing. Auction sizes for short-dated bills, which increased in July, are anticipated to increase again in October. Meanwhile coupon issuance is expected to stay stable for the near future.

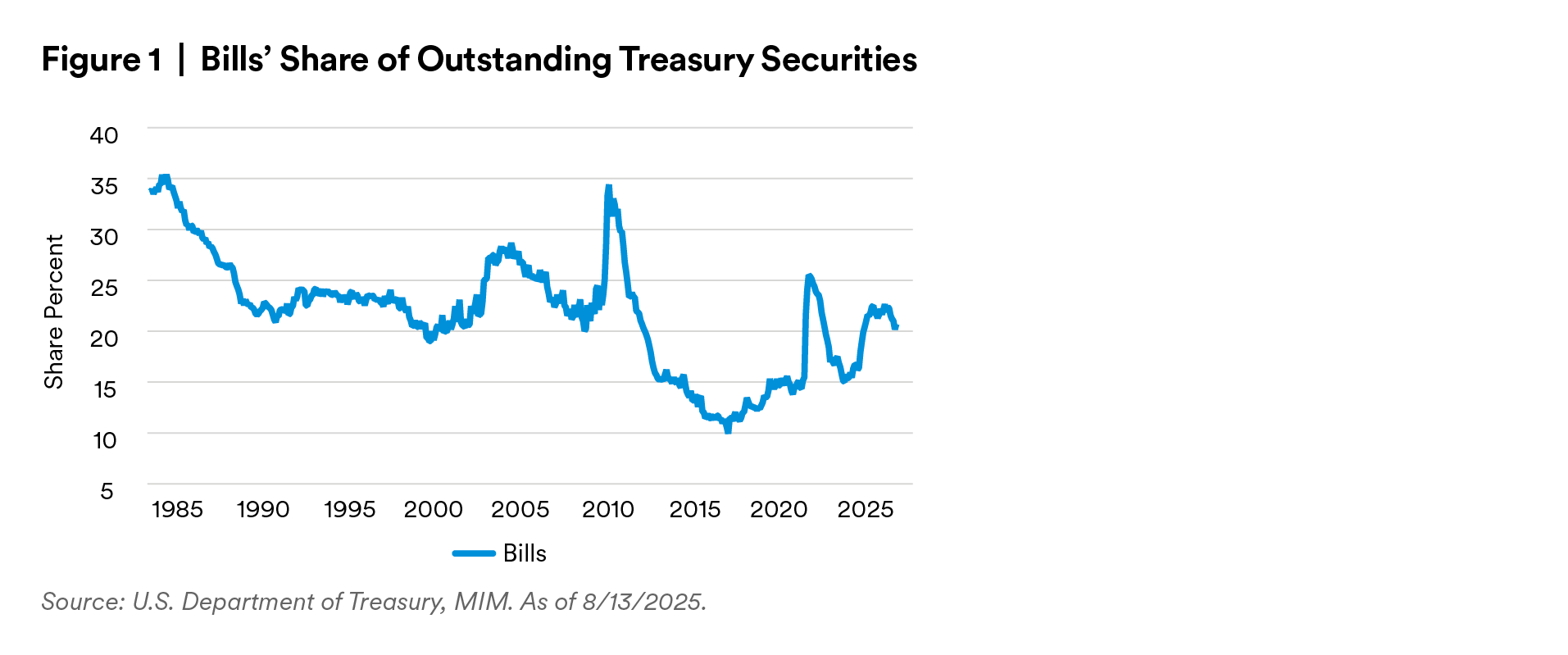

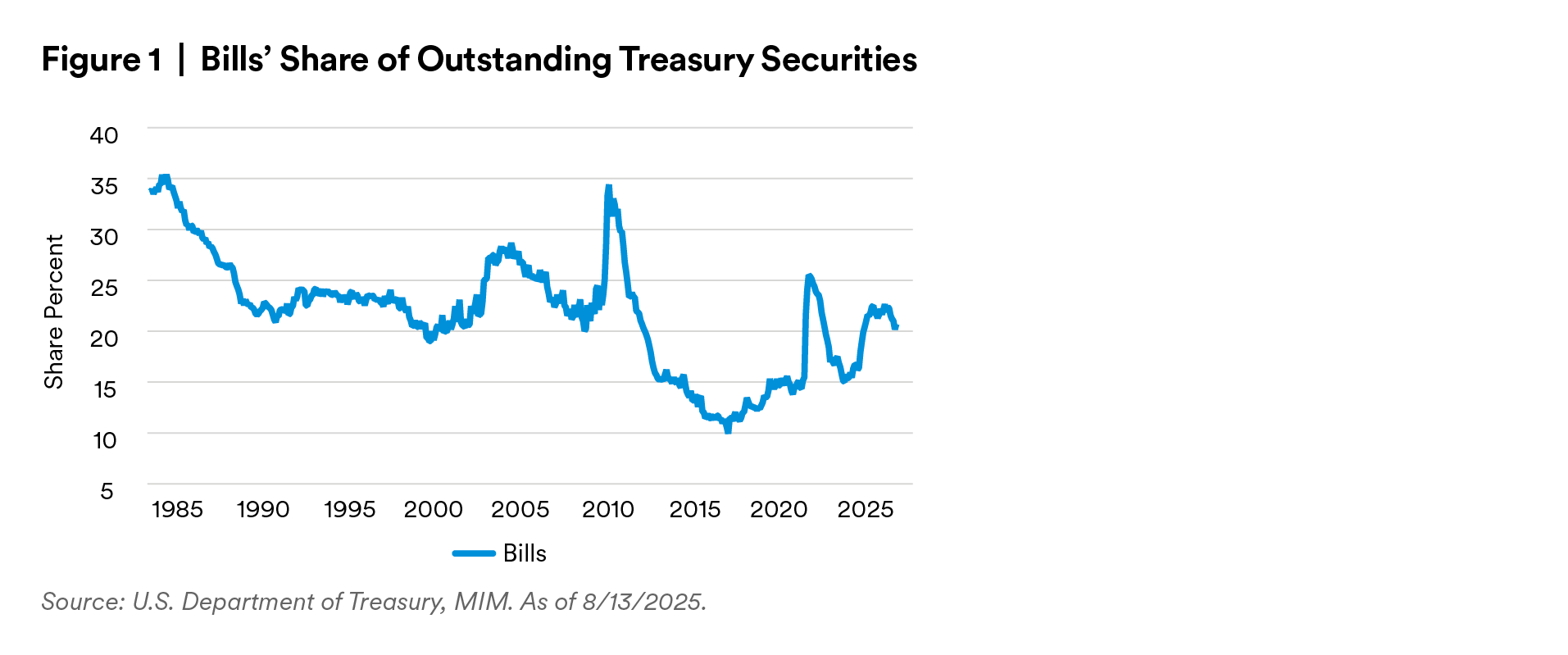

As a result, the share of bills, which currently make up about 20% of the marketable Treasury debt outstanding, will likely rise 1-2 percentage points over the next 12-24 months.

Feedback from primary dealers indicated that Treasury could issue $600 billion of bills in Q3 without meaningful cheapening. However, if using short-term bills is going to be a longer-term strategy for the Treasury, then we can expect yield curve flattening from higher front-end rates as the deficit gets bigger and the share of bills increases. Curve flattening is a medium-term concern: the CBO projects relatively smaller deficits for FY 2026 and FY 2027 with a subsequent ramp up.

Finally, the shift to shorter-term financing also puts pressure on the Federal Reserve to buy more Treasury bills. One of the Fed’s stated goals is to match its own portfolio holdings with the overall composition of Treasuries outstanding. Currently, the $4.2 trillion of Treasury holdings in the SOMA portfolio contains just $195 billion bills, a 5% share. An increase in bill usage by Treasury pushes the Fed portfolio further away from this objective.

Using the same assumption of ideal portfolio size that we used in our previous pieces on QT implies the Fed would need to buy almost $900 billion of bills to grow its holdings to match the current share of 20.2%. They would need to buy over $1.3 trillion if Treasury raises its bill issuance to 25% of outstanding debt.

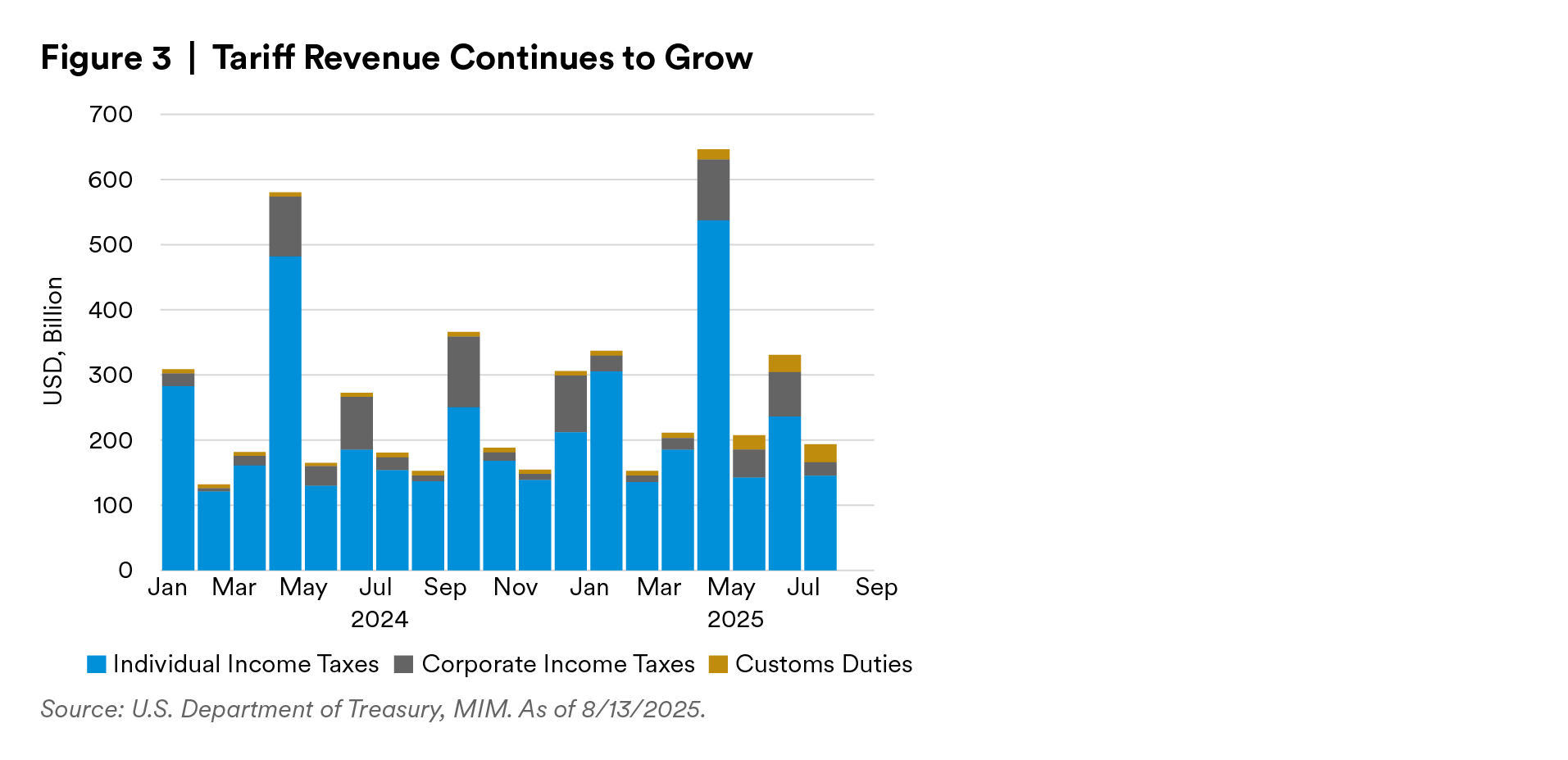

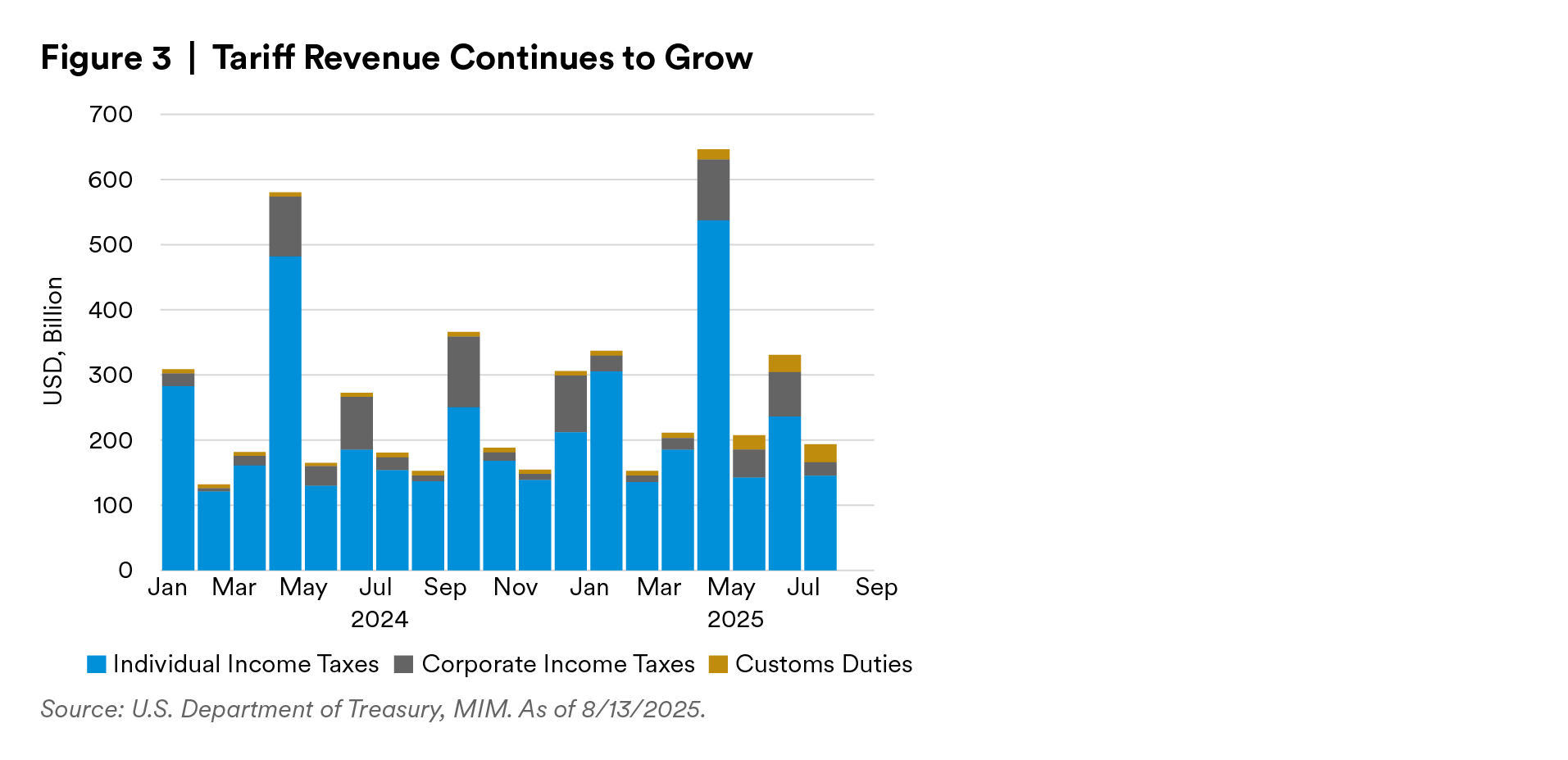

The latest monthly data from the U.S. Treasury shows that tariff revenue in July reached a new high of $27.7 billion, an almost four-fold increase from the $7.1 billion of customs duties collected in July 2024

We expect tariff revenue to increase in the coming months, but it seems implausible that tariffs will be a significant source of revenue for the Federal Government. Out of the $193 billion dollars of receipts taken in by the government in July from income taxes and tariffs, the record high tariff intake makes up a relatively small 14% share. The bulk of the revenue, 75% in July, comes from individual income taxes.

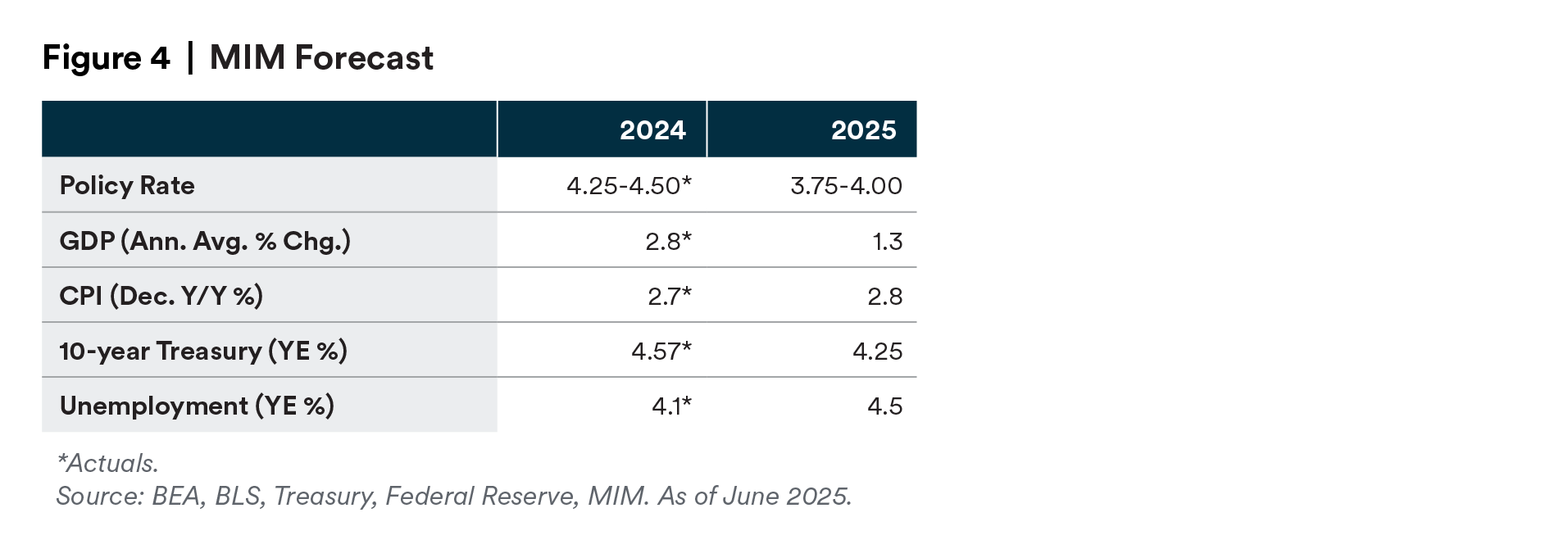

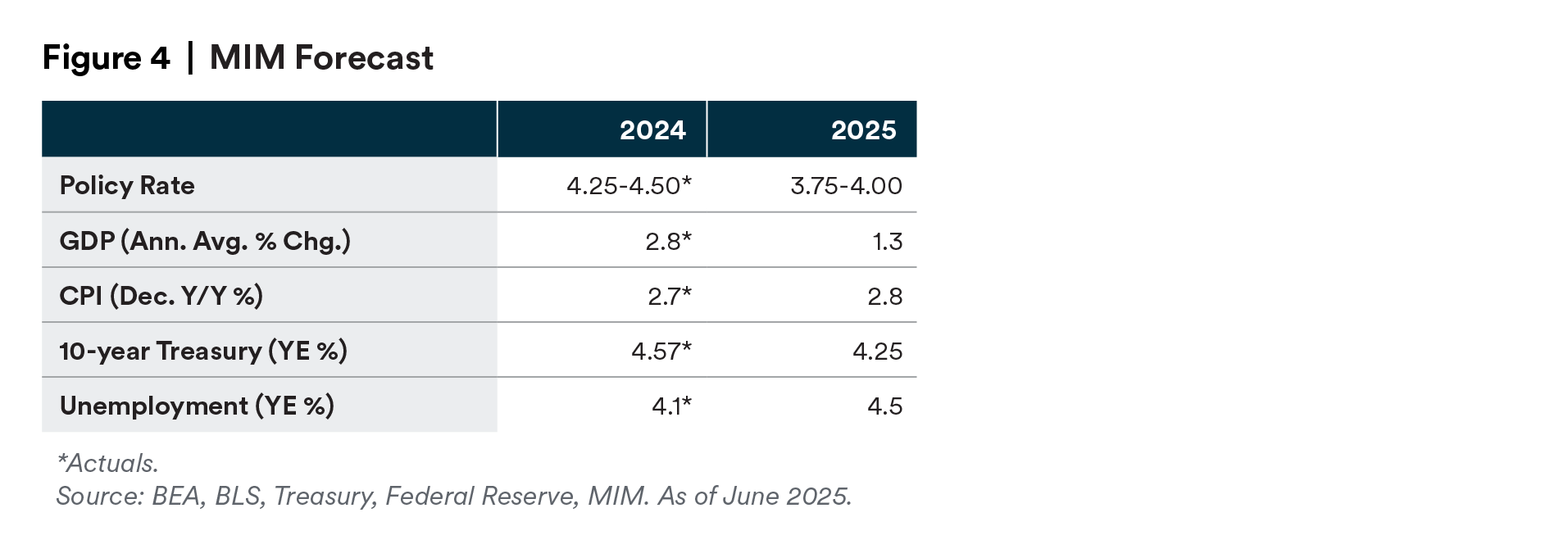

We have revised our growth forecast upward from 0.7% to 1.3% for 2025 to bring it in line with strong second quarter GDP growth. At the same time, Q2 GDP received a massive boost from falling imports. Therefore, we still expect some economic weakness in the U.S., although risks of a strong recession are fading.

Our biggest concern remains with investment. Volatile polices and valuations are causing some firms to slow investment and hiring decisions, as well as deal-making. Despite the announcement of a handful of trade deals, tariff related volatility and uncertainty are prevalent and have the potential to cut into profit margins. The August 1 deadline has passed, but trade deal negotiations are far from complete. Margin pressure is likely to particularly affect smaller businesses, who have less pricing power, lack the deep pockets to accumulate inventory, and are less likely to be diversified against shocks.

Chair Powell, in the last press conference, reiterated that the FOMC has room to wait before acting on policy rates. However, there is growing dissent among FOMC members, and the recent jobs data indicated the labor market may be much weaker than previously thought.

We maintain our view that the Fed will start cutting in September, and the market is now in line with that view.

The recent downward revisions in payrolls growth presents strong downside risks to growth and upside risks to our unemployment forecast. If unemployment spikes and the labor market shows even more weakness, the Fed may also have to cut more than twice. Before the August 1 employment release, most of the pressure on the Fed’s dual mandate was coming from an upside inflation risk from tariffs. Now, there is strong pressure on both sides of the Fed’s mandate that the FOMC will have to balance.

If the labor market stays stable and an off-base case growth scenario does begin to prevail, however, we would expect it to go hand in hand with greater inflation as producers would be better able to pass on price increases to consumers.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors.

This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK. © 2025 MetLife Services and Solutions, LLC

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also subdelegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.