Looking ahead, ‘debt overhang’ may act as an ongoing economic headwind to GDP and productive capacity. As government debt servicing costs rise as a percentage of GDP, political tensions could rise further, especially given the rapidly shifting geopolitical landscape. The shift in the cost of capital may also impact business decisions, R&D, social spending, government deficits, supply and demand for securities, the shape of the yield curve and central bank policy decision making.

Our ongoing series will continue to explore key trends across various sectors of the financial markets. In this installment, we examine how geopolitical concerns and regulatory scrutiny will be shaping M&A activity in 2025. While some outcomes can be anticipated, the complexities introduced by evolving anti-trust regulations and shifting market conditions may present both challenges and opportunities for investors. Stay tuned as we provide further analysis on other areas of the credit markets, offering insights into how these trends may help inform your investment analysis moving forward.

In 2025, we expect firms to accelerate their acquisition strategies as the economic backdrop and investment environment favor M&A activity.

Heightened geopolitical and national security concerns mean evolving anti-trust regulations will likely influence deal structures and valuations. We see these as factors to be managed, not significant drivers away from M&A activity.

We examine three critical sectors — technology, food and energy — to illustrate some of the concerns and opportunities that we see in the M&A space going forward.

Changing Lenses to Anti-Trust Enforcement

The United States has periodically incorporated new rules governing M&A and concentrations of power, and we appear to be in the midst of another overhaul.

Significant anti-trust legislation began in 1890 with the Sherman Antitrust Act that aimed to curb monopolistic practices like price fixing and cartels. This was followed in 1914 by the creation of the Federal Trade Commission (FTC) and the Clayton Antitrust Act, which aimed to ensure fair competition including the prohibition of overlapping boards of directors. The 1950s saw the rise of the Harvard School and Structuralism, which incorporated the Herfindahl-Hirschman Index (HHI) as a key tool in measuring market concentration. The Harvard School eventually ceded prominence to the Chicago School and the Consumer Welfare Standard that was officially incorporated into the merger guidelines of the FTC and Department of Justice (DOJ) in 1982.

Today, regulators and politicians appear to be moving beyond the consumer welfare standard by focusing on a transaction’s potential impact on employment, wages, innovation and geopolitics. The 2023 Merger Guidelines, jointly released by the DOJ and FTC, expanded the number and type of transactions that the agencies will consider presumptively unlawful. Both President-elect Trump’s nominee for Attorney General and Vice-President-elect JD Vance have spoken favorably about the FTC’s initial forceful approach.1 The new Administration may choose to issue their own Merger Guidelines, but we do not expect a dramatic reversal.

As geopolitics play an increasing role in M&A, approvals have taken longer, and final outcomes have been more difficult to predict. We have seen some deals face delays and ultimately fail to close. We have also seen other jurisdictions like the EU pass legislation including the Digital Markets Act that provides regulators more authority to prohibit some global M&A. We expect foreign ownership concerns to increasingly influence transaction approvals in areas like steel or semiconductors. Moreover, companies contemplating M&A activity must now consider if a deal is strategic enough to warrant going through an approval process that could extend for up to two years and require structural remedies to close.

The changing environment has meant issuers and institutional investors have begun renegotiating the issuance landscape. We see issuers structuring transactions to account for these extended reviews, including break-up fees with more specific anti-trust terms and conditions. We also see management teams offloading interest-rate risk to bondholders by including special mandatory redemption (SMR) provisions for acquisition-related debt financing that gets redeemed at $101 if a transaction does not close.

On their side, institutional investors continue to push for better terms and conditions, such as improvements in some SMR scenarios where the $101 put remains but bonds are priced below par, which preserves more upside for investors if rates move lower and the SMR provision is ultimately triggered.

The Tech Sector: Scrutiny to Continue

Large technology companies face some of the most significant anti-trust scrutiny due to national security concerns, aggressive business practices, their central role in our everyday lives and their absolute size, which makes even relatively small transactions appear quite large to regulators.

Companies are adapting to the increased scrutiny, and we expect this to continue going forward. Tech firms have learned how to structure deals without triggering a regulatory review. We have seen transactions use various methods to gain influence without having explicit majority control of a target, including board seats/observer rights, and multiple-step transactions with a long path toward greater than 50% ownership. Firms also try and structure deals to avoid the Hart-Scott-Rodino (HSR) review process, which is only required for deals over $119.5 million including earn-outs. We also see firms engaging in “acquihires” or exclusive licenses for new technologies that are functionally equivalent to an acquisition. While large-scale M&A within the large-cap technology space reflects increased barriers to closing a transaction, the sector continues to generate headlines as various anti-trust cases work their way through the court system.

The Food Sector: M&A Opportunities to Expand

Ongoing FTC actions in the sector notwithstanding, we expect increased M&A activity in the food sector. In the food sector, investment-grade credits continue to have strong balance sheets and the ability to seek out acquisition candidates. Recently, M&A opportunities have been approximately twice what they were over the last two years, and we expect opportunities to continue to be numerous for three reasons.

First, consumers have been showing some pullback in discretionary spending and seeking value as food prices remain approximately 30% higher than they were pre-pandemic. Promotional activity has been increasing, and we expect that to be the case at least through the end of 2024. Given that, many food companies are looking to shed lower-growth businesses while seeking acquisitions in higher-growth brands or categories. As such, we can expect a wave of portfolio pruning as funds divest from lower performing assets, while seeking acquisitions in higher-growth brands or categories.

Second, we expect that many private equity funds are nearing the end of hold periods and may sell assets. Finally, lower interest rates and favorable financial markets will help boost acquisition opportunities.

The Energy Sector: Price Sensitivity, For Now

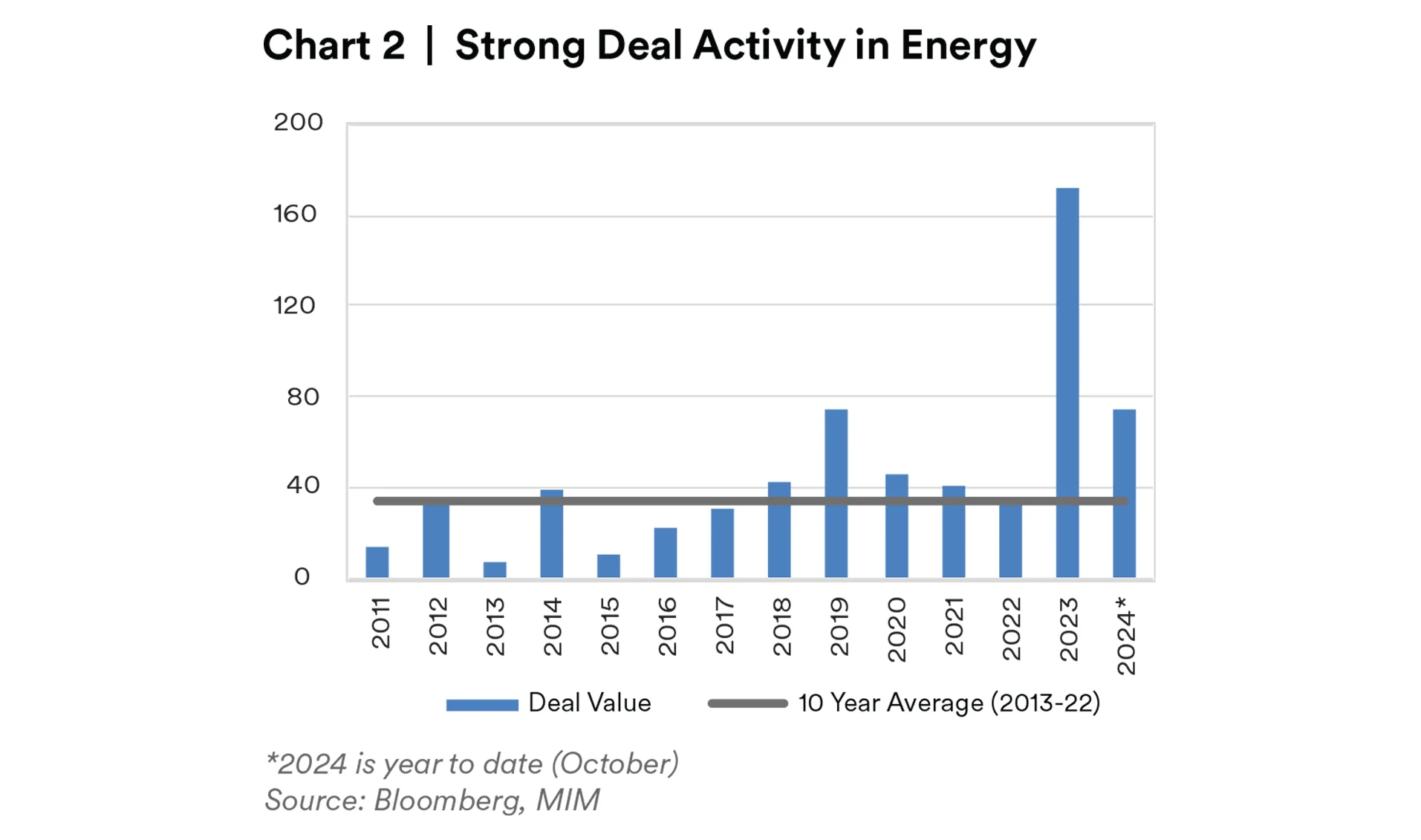

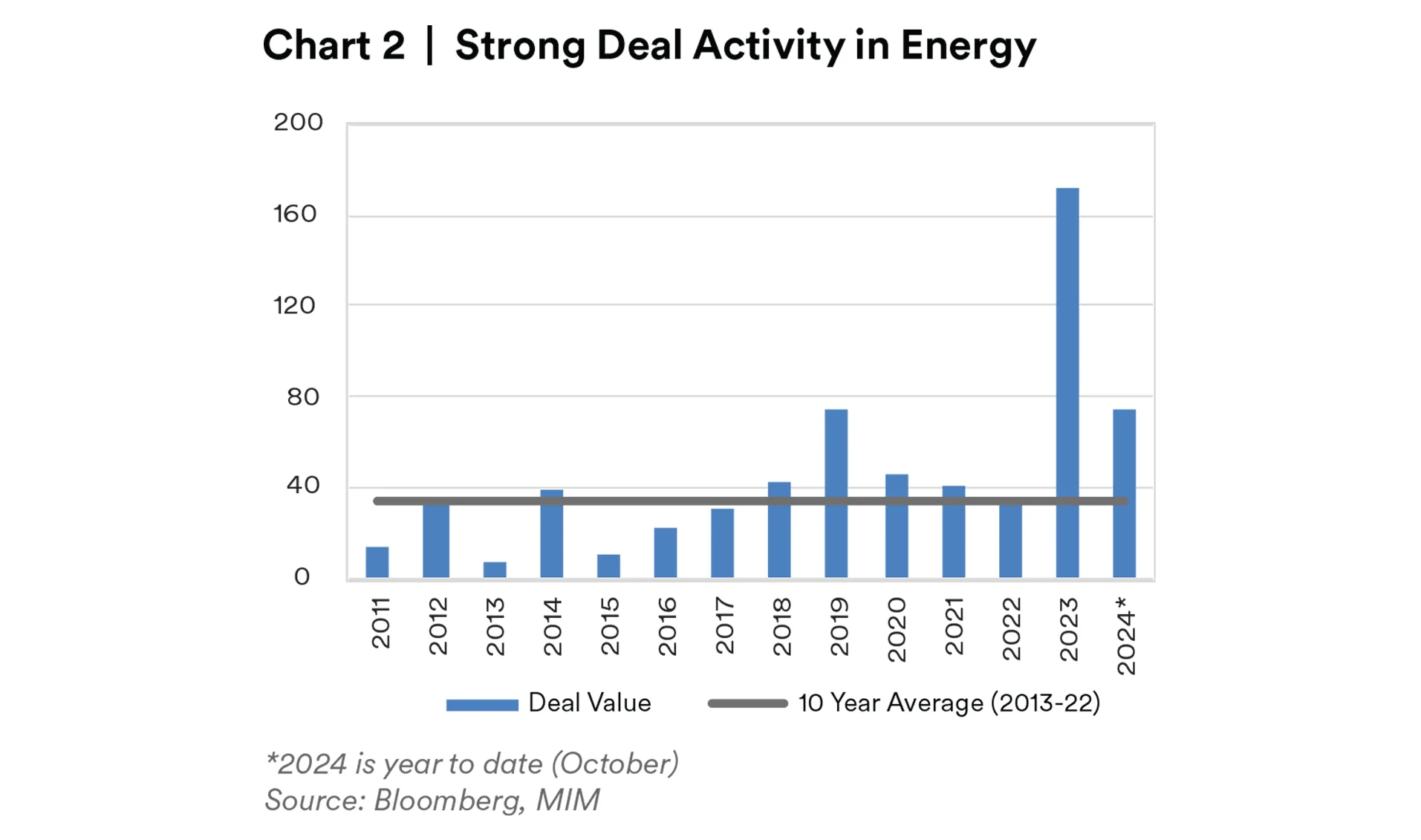

Over the past two years M&A activity sharply accelerated in the energy sector (see chart 2).

Firms that survived the 2020 commodity price downturn started being acquired, setting off a consolidation wave. Acquirors exercised capital discipline to maximize free cash flow and repair balance sheets — scale and efficiency became the drivers of share price performance.

We see consumer price sensitivity and changing anti-trust enforcement attitudes continuing to affect the energy sector substantially. When evaluating energy deals, FTC officials have been explicit about their concern that “consumers shouldn’t pay unfair prices at the pump.” 2

However, we believe this concern is not warranted. Aggregate production from all six of the largest U.S. energy targets (representing 80% of the value of the 26 announced deals) in 2023/2024 was just 1 million barrels per day, not nearly significant enough to affect prices in a 100 million-barrel- per-day global market. These six largest deals were subject to additional FTC investigations. None were ultimately blocked, implying that a strong connection between prices at the pump and perceived anti-trust behavior could not be made.

As long as price concerns remain in the foreground for consumers, regulators are likely to continue to pay disproportionate attention to energy companies. Aside from mega-mergers, we expect that future deals will ultimately continue to pass in this era of heightened regulatory scrutiny.

Looking Forward: Opportunity with a Side of Scrutiny

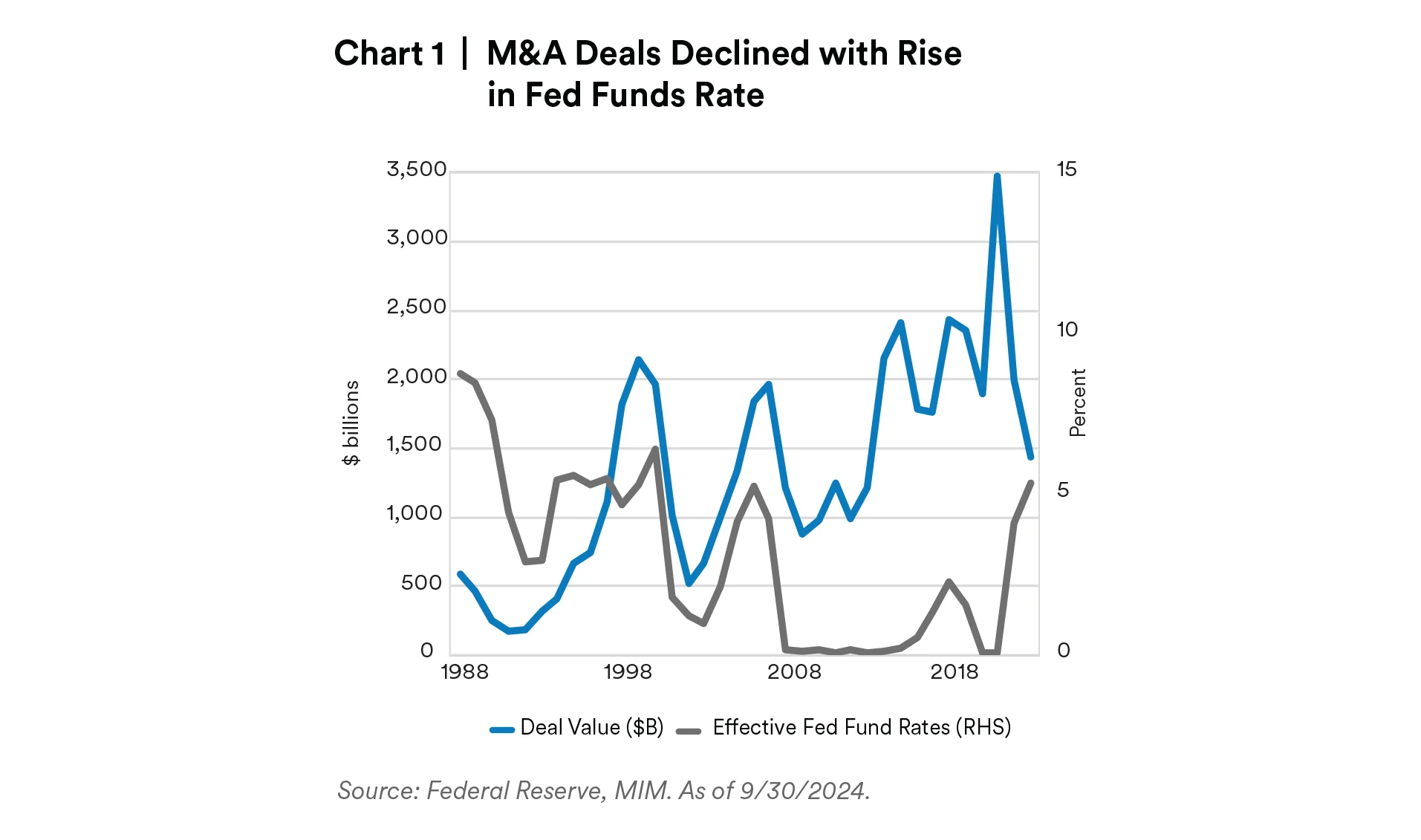

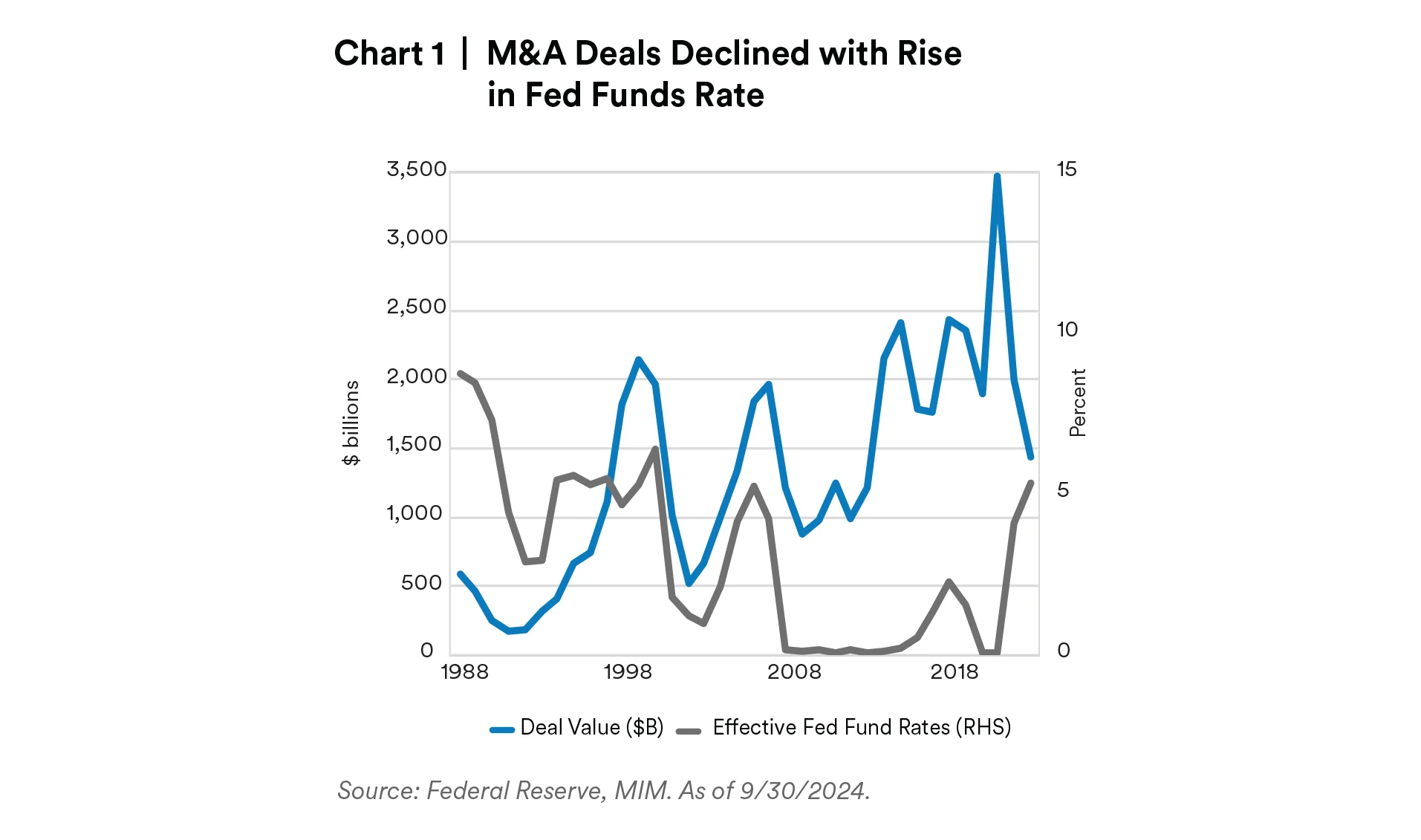

Macroeconomic conditions are likely to be conducive for M&As in 2025. We expect the Federal Reserve to lower rates even as the economy experiences solid growth. This is an unusual — and unusually benign — set of economic conditions. We believe regulatory scrutiny with respect to consumer prices will fade as wages continue to catch up to the new price levels. However, geopolitical and national security concerns are likely to persist. These concerns have made administrations of both parties more cautious. Going forward, we expect companies to continue to pursue deals even as they adapt to these concerns.

Despite the geopolitical hurdles, we expect bondholders to see positive developments, as we see M&A becoming a more significant driver of large new issuance. Over the past five years, most large, new tech sector issuance came with the generic General Corporate Purposes use of proceeds.3 These can include liability management exercises (LMEs) that take advantage of declining interest rates. Going forward, we expect to see fewer LME opportunities, both in the tech sector and more broadly across industries. Strong equity market performance suggests less pressure on management teams to engage in credit-negative leveraged share repurchases. As a result, M&A will likely account for a growing share of new issuance going forward.

Endnotes

1 “The Biden Official with MAGA Admirers,” Claire Heddles and Byron Tau, NOTUS.org, March 20, 2024; “Lina Khan’s Replacement at FTC to Be Vetted by an Aide to Vance,” Josh Sisco and Leah Nylen, Bloomberg, November 9, 2024.

2 FTC Order Bans Former Pioneer CEO from Exxon Board Seat in Exxon-Pioneer Deal | Federal Trade Commission

3 Approximately 75% of new issuances greater than $5bn had General Corporate Purposes use of proceeds; these can include share repurchases, refinancing debt maturities or other liability management exercises. Source: Bloomberg, MIM. Data as of November 12, 2024.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.