The first five months of the second Trump administration have been a historic turning point in global trade.

The scale of the hike in average U.S tariffs is shaping up to be material, regardless of where they wind up. We continue to see risks of longer-term tariff effects. Universal tariffs are perhaps the most important policy change, as they represent a shift by the U.S. from a baseline of trade liberalization to one of protectionism.

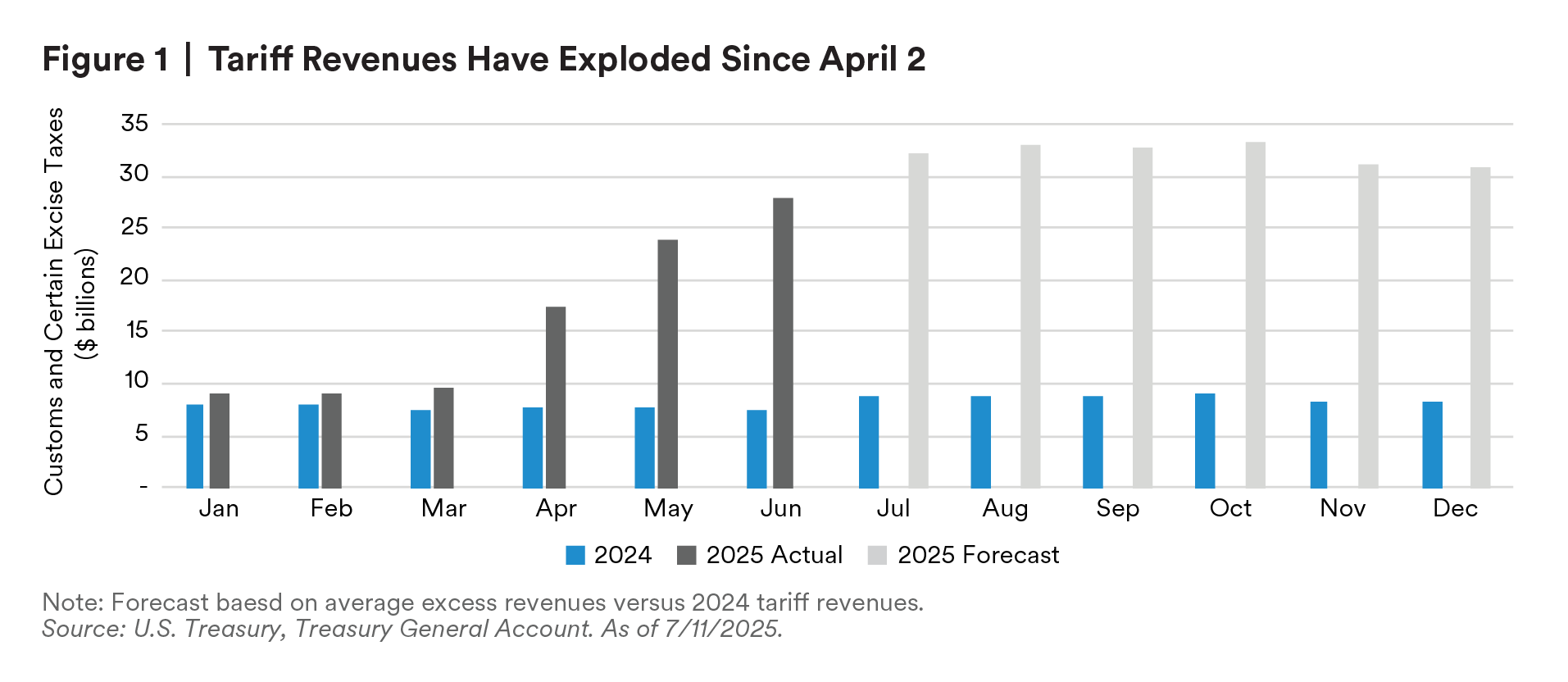

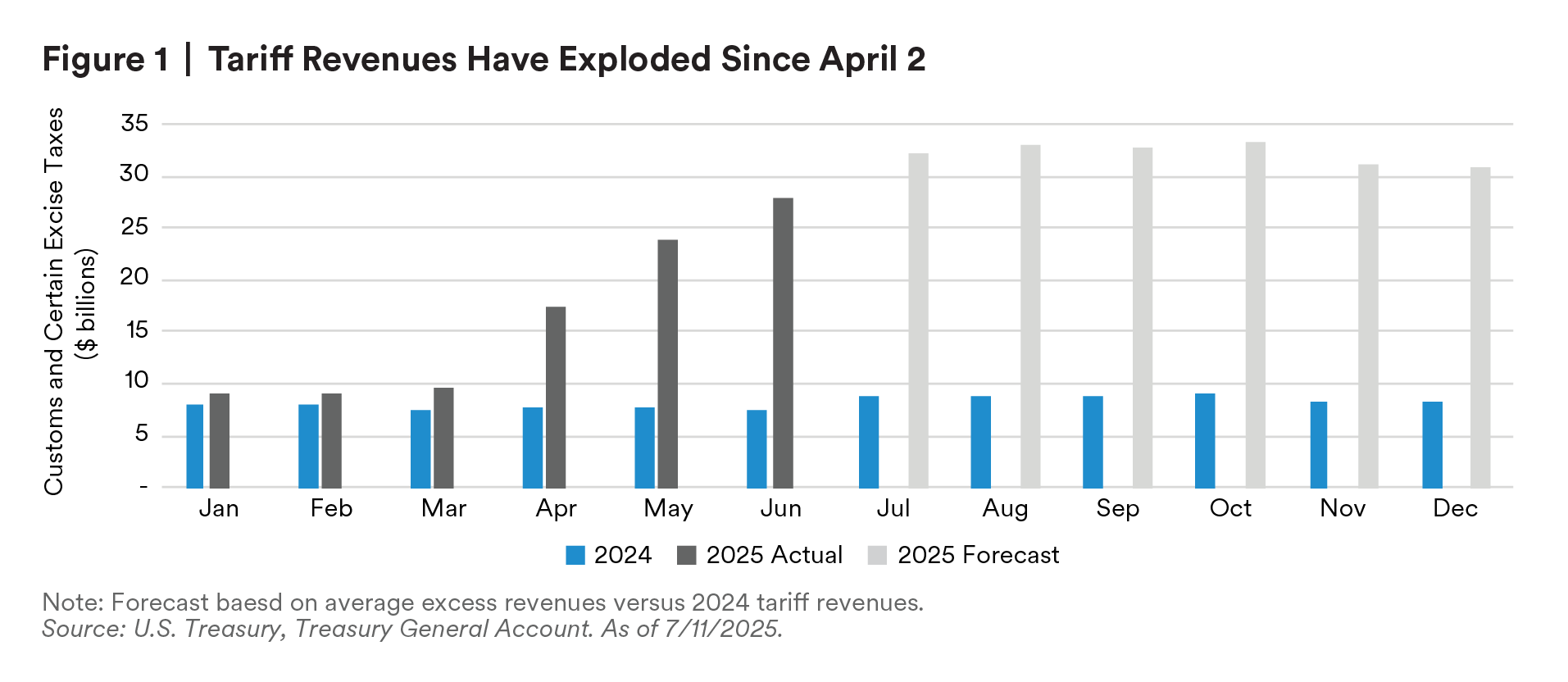

Tariffs have become a significant revenue source: We estimate an excess $180 billion in tariff revenues this calendar year and substantially more over a full fiscal year. This is both an enormous additional cost burden for businesses and ultimately consumers to absorb and creates inertia around reducing tariffs rates in future administrations.

The biggest surprise by far has been the Trump administration’s aggressive stance against historical allies such as Canada, Japan and the European Union (EU), which together make up one-third of U.S. goods imports. While we would expect an eventual resolution, particularly with Canada and Mexico as USMCA negotiations continue into next year, we also have substantial concerns about how favorable the terms will ultimately be for U.S. and global economic conditions.

Negotiations between the U.S. and the EU are proving particularly difficult, with the Trump administration in mid-July threatening a baseline tariff rate of 30% on EU imports from 1 August (10 percentage points above the “Liberation Day” announced level) should an agreement not be reached. The EU is hoping to negotiate a 10% baseline tariff level with the U.S. and get carve-outs from some of the higher sectoral levies, e.g., the 25% tariff on car imports and 50% tax on imported steel and aluminum. We ultimately think that a negotiated settlement between the EU and U.S. will be reached, but fear that relations could get worse before then, and that the EU may well eventually implement some of the counter-tariffs on imports from the U.S. that it has so far delayed while negotiations are underway.

For now, markets appear to be taking comfort from the relatively less chaotic tariff environment that has prevailed since the beginning of May, when the U.K. and U.S. announced the first tentative framework trade agreement. However, we worry that markets have become either complacent or exhausted and are not fully reckoning with longer-term tariff effects. In other words, we see the mid-year benign market environment as tenuous.

Fundamentally, however, the greatest risk that we see is that the U.S. presidency has broad unilateral authority over tariffs. Although there has been pushback,1 authority remains largely with the President. Unless this authority is wrested back by Congress, the possibility of sudden and capricious changes to tariffs remains — not just in a Trump administration but in any future administration that wishes to modify tariff policy to suit their priorities.

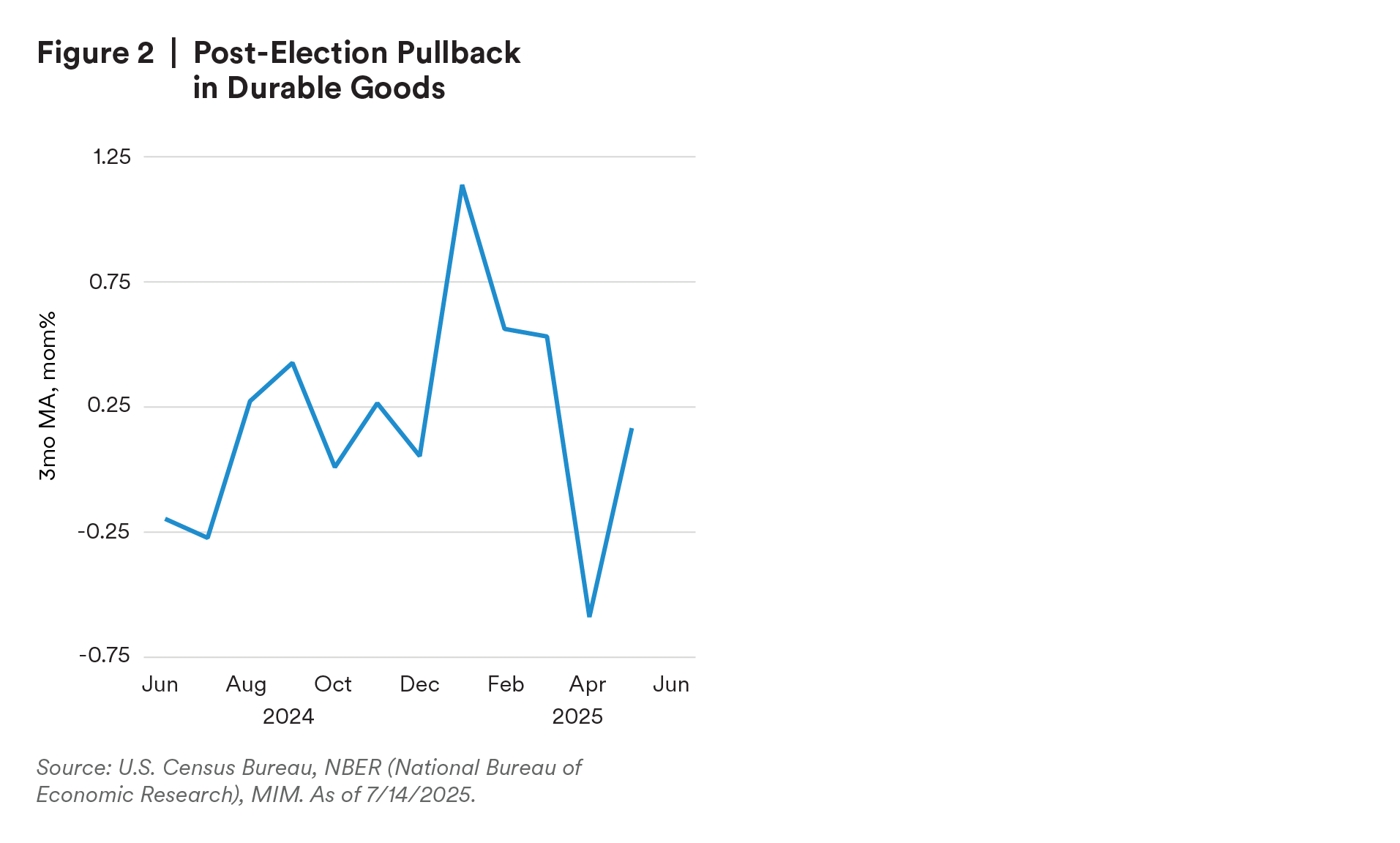

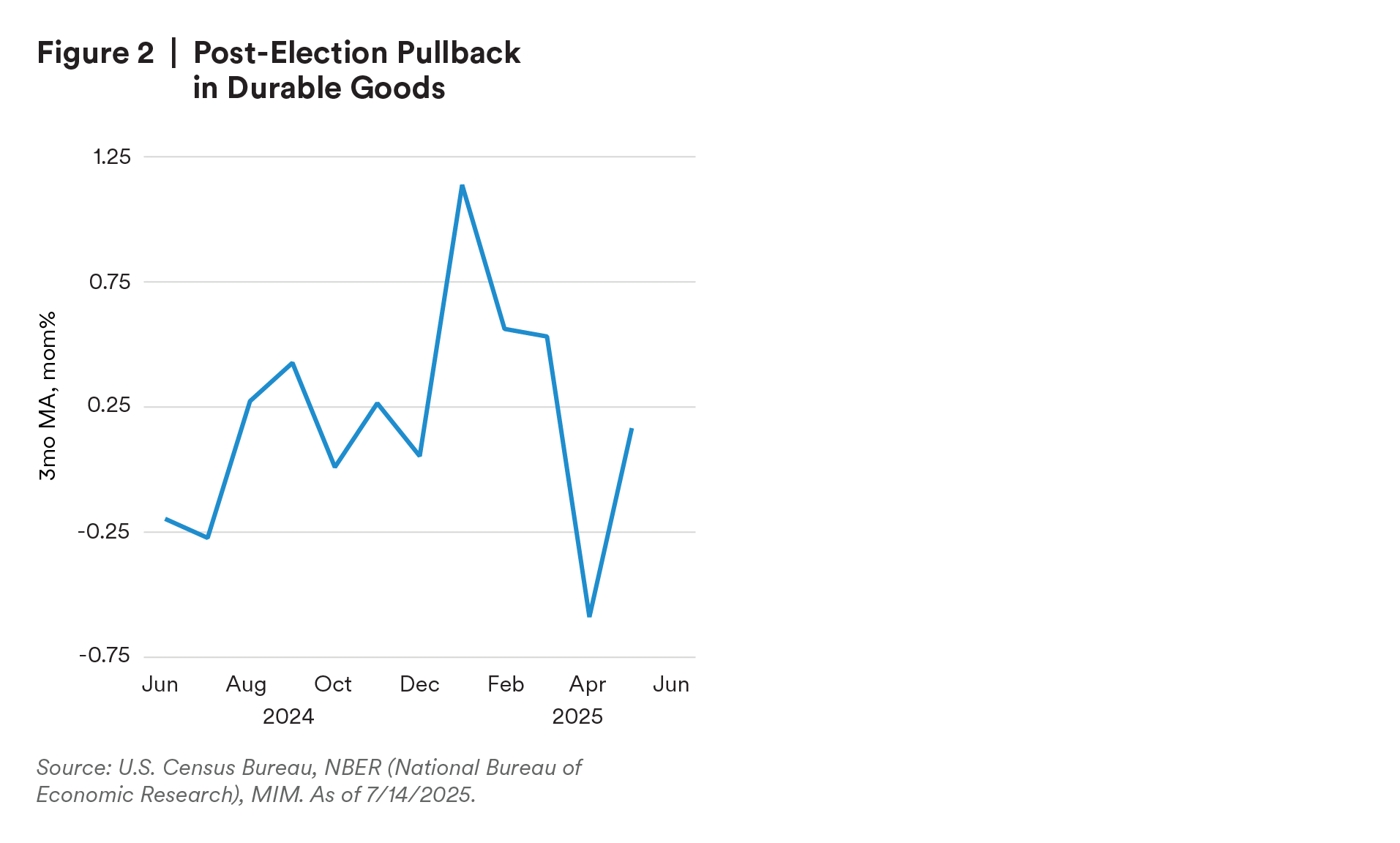

The two off-base-case risks we raised in our Global Outlook 2025 piece — investment and inflation — remain relevant, and both are influenced by the President’s fluctuating priorities. Our base case included a rebound in investment, which had been on the sidelines ahead of the presidential elections. There was indeed a spike in investment following the election. But this fell off rapidly as major trade announcements started coming in March 2025.

This highlighted our first off-base case risk of investment failing to reignite following the election. National account data from the BEA show that in the first quarter of 2025, investment grew a massive 24%, as firms tried to preempt tariffs on equipment. So, while investment may not have disappointed, it arguably grew for the “wrong” reasons — and it is unlikely that firms can continue purchasing at that pace going forward.

The One Big Beautiful Bill Act (OBBA) also reduces some provisions of the Biden administration’s Inflation Reduction Act, designed to incentivize private investment but permits expensing of R&D investment. Thus, the net effect on investment remains to be seen, but we do expect companies to start ramping up R&D spending.

In our December outlook, we also discussed upside risks to inflation. Our base case was that inflation would moderate. In the current high tariff regime, we continue to believe that tariffs are not likely to lead to a very substantial increase to consumer prices.

However, the risk remains. Tariffs take time to work through the supply chain; increased government spending may be inflationary; and new immigration policy could tighten the labor market and raise average wages. With inflation higher than the 2% target for more than four years, risks of unanchored inflation expectations continue to mount.

Going forward, fiscal policy will continue to be a key risk for investment and inflation. Even though the 2026 midterm elections seem far away, political strategists and candidates of both parties have already started planning and taking action to prepare. The administration’s policy between now and the elections may be more cooperative or pro-growth as the Republican party tries to maintain its control of the House and Senate.

Risks are still posed by the administration needing to pass the appropriations bills to keep the government funded after October 1, when the March continuing resolution expires. The appropriations process will be made more complicated because lawmakers will have to decide whether to formalize cuts made by DOGE, which may have further implications for investment and inflation. History and prediction markets favor Democrats2 in the midterms, but we see the possibility of continued Republican control, which would mean continued, unfettered policy risk emanating from the White House.

There has been no pause in the monetary policy loosening cycle in Europe. The European Central Bank (ECB) continued to cut rates gradually in 2025 for a total of 100 bps during the first half of the year. We expect another 50 bps of cuts by year-end.

The Bank of England (BoE) has cut rates twice since the start of the year for a total of 50 bps. Our central expectation is for another 75 bps of cuts by year-end, albeit with the balance of risks tilted to 50 bps, should underlying inflationary pressure prove stickier than expected.

In Japan, after a single 25-bp hike in January, the BoJ has paused it tightening cycle. We expect the pause to continue through year-end.

In the U.S., we have indeed seen a pause. However, we expect cuts to resume later in the year, which would bring Federal Reserve policy in sync with the ECB and BoE.

For the U.S., the greatest risk is markets believing that President Trump has found a path to get the Federal Open Market Committee (FOMC) to cut more than economic conditions warrant. That may not cause immediate economic damage, but — like the Liberation Day tariffs — would shake markets and gradually undermine the U.S.’s position as the global center of economic activity.

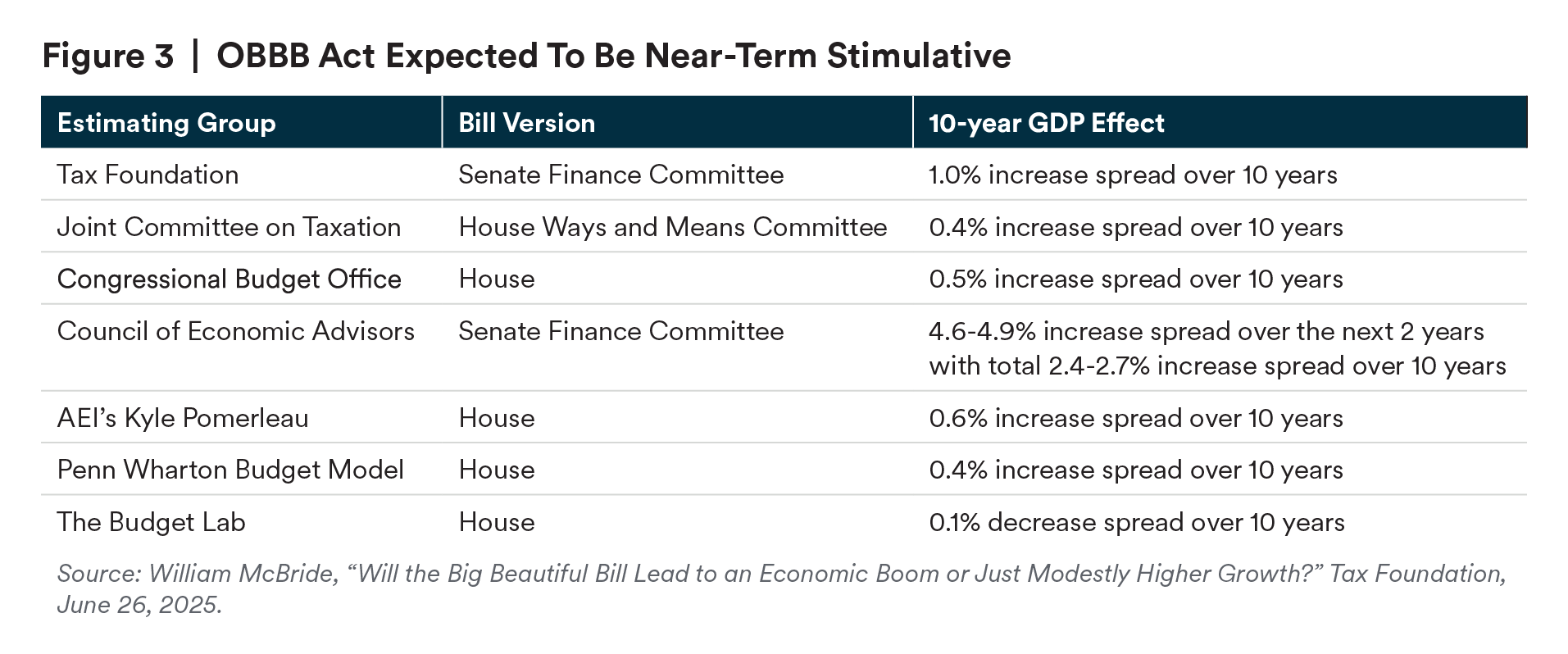

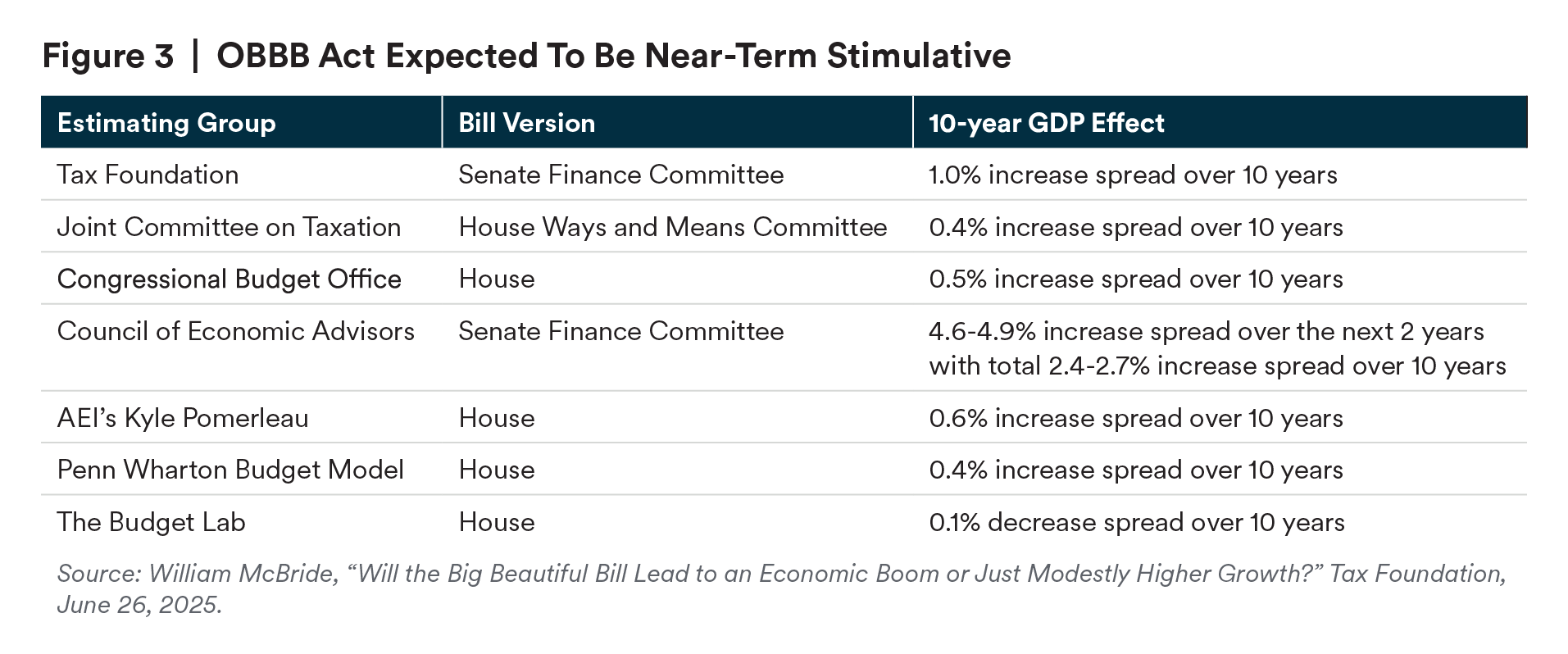

Ironically, better-than-expected economic growth could exacerbate the risk of conflict between President Trump’s avowed low-interest-rate inclinations and appropriate monetary policy. The passage of the OBBBA is unlikely to help President Trump’s cause of lower rates. It is broadly expected to be stimulative. Although it would be implemented next year, it could help provide reassurance to businesses that the economy is stabilizing.

Our U.S. forecast faces upside risk of stronger economic growth. One feasible scenario is a positive growth story driven by the stimulative nature of the OBBBA, a less variable and more business-friendly policy direction heading into the midterms, continued strong margins at large businesses that fuel continued consumption, a tighter labor market, given lower supply from immigration measures, as well as burden sharing of tariffs across the supply chain.

In our view, the U.S.-China trade negotiations remain the most economically significant, near-term geopolitical quandary.

The Geneva Accord — including a 90-day tariff reprieve — and subsequent London framework agreement have provided an anchor for ongoing U.S.-China trade negotiations. Subsequent talks have codified commitments made in Geneva and London, particularly on the countries’ respective export restrictions. Beijing recently announced tighter controls over two fentanyl precursors, reflecting its strong desire to reduce fentanyl-related tariffs (20% of the total 40% at present). U.S. Ambassador David Perdue is also engaged with Chinese officials on the ground, serving as a key interlocutor for President Trump. The U.S. and China each have strategic chokepoints on the other, due to export restrictions on rare earths and high-end semiconductors, effectively serving as a deterrent against further tit-for-tat retaliation.

Our baseline is for a “fragile truce” to persist ahead of the August 12 Geneva Accord expiration date, although with ongoing headline risks. For example, Beijing has promised to resume exports of rare earths and magnets in exchange for the same on U.S. semiconductors. China contends that it has reduced the licensing approval timeframe from 90 to 20 days; however, there is no proof of these flows normalizing yet, nor has Beijing offered any detail on how fast and at what scale these approvals will occur. China’s export restrictions on the more politically sensitive rare earths magnets used for the U.S. military complex are likely to remain in place, which could be an additional source of tension.

Finally, we believe there is general complacency in the market that the current 40% tariff will hold come August 12, given myriad points of contention in the U.S.-China relationship, including on issues such as Taiwan.

Endnotes

1 E.g., when a court pushed back on the International Emergency Economic Powers Act (IEEPA).

2 E.g., on the Kalshi betting site. Historically, a party with Senate, House and Presidential control has lost control of at least one legislative body in the subsequent midterm elections.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of June 30, 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.