Summary

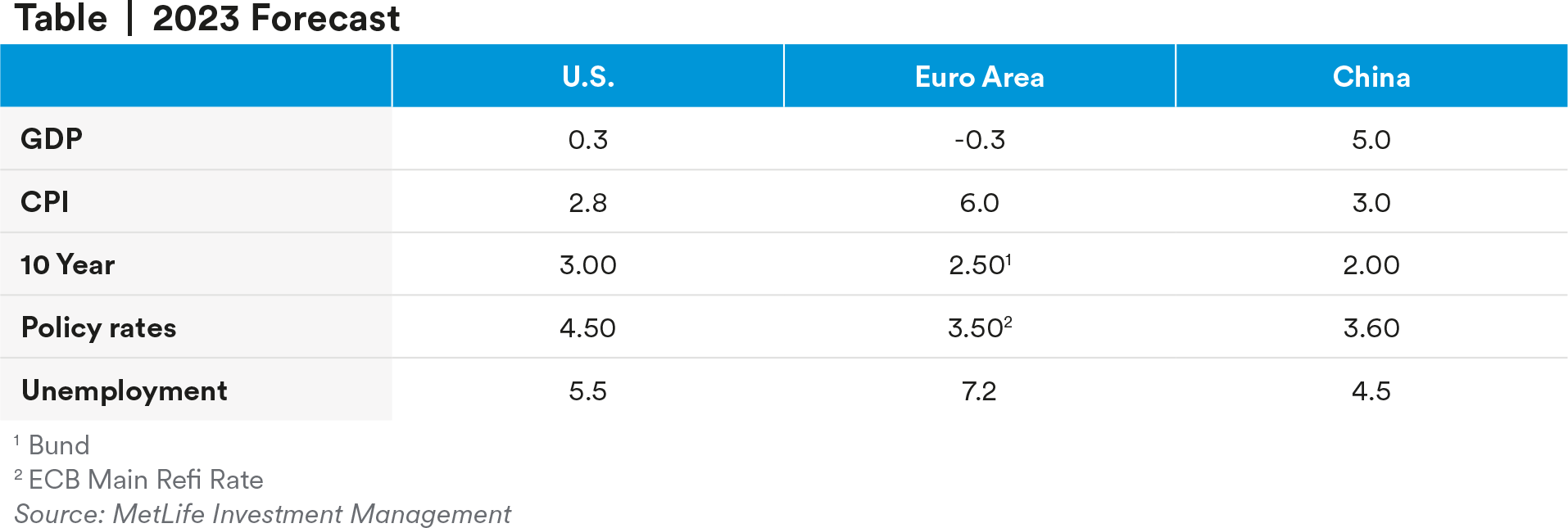

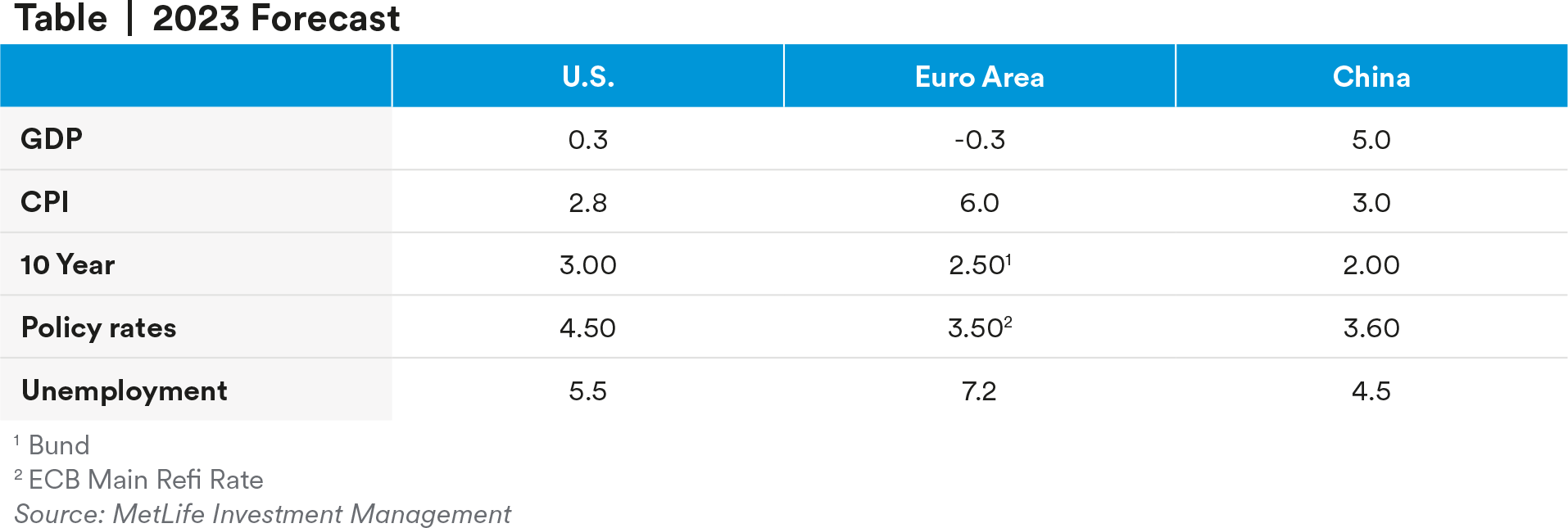

Although our base-case forecast is a global recession in 2023, with United States inflation falling below 3%, there are a number of risks to our view.

First, central banks may have difficulty taming inflation. For the Fed, United States consumers have significant excess savings and may continue spending as prices rise. Another potential channel of difficulty (although we believe the chance is small) is if unemployment rises faster than inflation falls, resulting in a stagflation scenario. In Europe, the ECB is balancing a delicate situation by raising rates to control inflationary forces that are predominantly external (food and energy), while trying to avoid too sharp an economic slowdown and renewed stress in euro-area debt markets as yields rise. Central banks could also make policy mistakes and overtighten, unnecessarily weakening the economy; the Fed’s recent data-dependence creates a risk of holding high rates for too long, resulting in a more severe recession. Upside risks are also possible. If the Fed manages to execute a soft landing, United States GDP growth will come in higher than expected.

Risks are also present in financial markets. Treasury market liquidity is at historic lows, and market volatility is high. This is simply a sign of uncertainty and should not cause a recession by itself. However, these market conditions could cause a conflict with the Fed’s tightening objectives: if the market fails to function, the Fed will have to intervene and buy securities (similar to the BoE’s gilt market intervention in late 2022), which conflicts with its rate policy. Hidden leverage and large outstanding FX swap debt, along with the lack of transparency on those debts, could also increase risk by amplifying any shocks to the financial system.

We also face commodity risks. We expect the Russia-Ukraine conflict to continue through 2023, hence geopolitically induced, higher oil prices are a risk. In natural gas, Europe may struggle to replace flows if Russia reduces its supplies further, and China’s demand increases. The risk of a global slowdown and the continuing Russia-Ukraine conflict also place further upside risk for our base case of high food prices through 2023, with the effect of lower global supply outweighing the effect of lower demand.

Finally, in Asia, we see risks around Chinese economic growth and the political relationship between China, Taiwan, and the United States. Although we expect growth in China to accelerate in 2023, more (or longer) COVID-19 outbreaks may result in reimposition of mobility restrictions, delaying the reopening and GDP recovery. We believe the probability of a conflict between China and Taiwan is low but increasing over the decade. Additionally, we see a risk of further escalation as the United States and China attempt to “out-hawk” each other, potentially increasing headline risks.

Risk 1: The Fed Fails to Tame Inflation

In the United States, the Fed remains in a difficult position. Although our base case is that the Fed will be able to bring inflation down below 3%, there are a number of risks to our view.

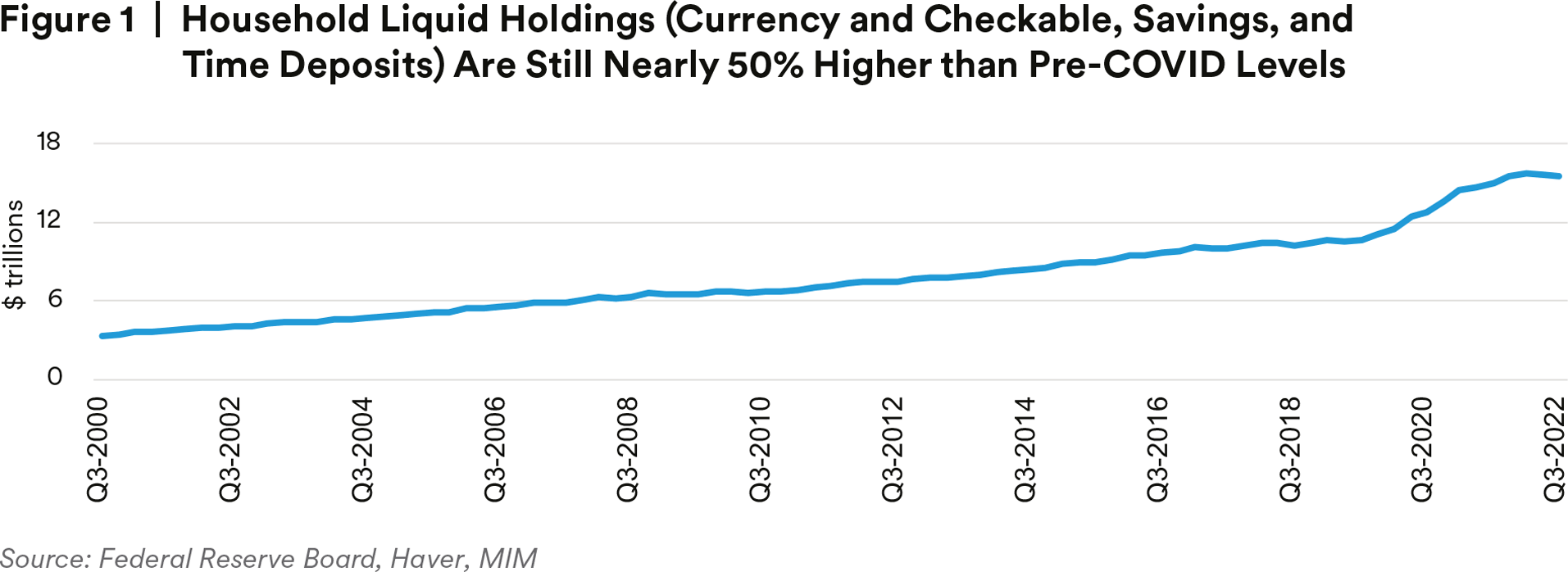

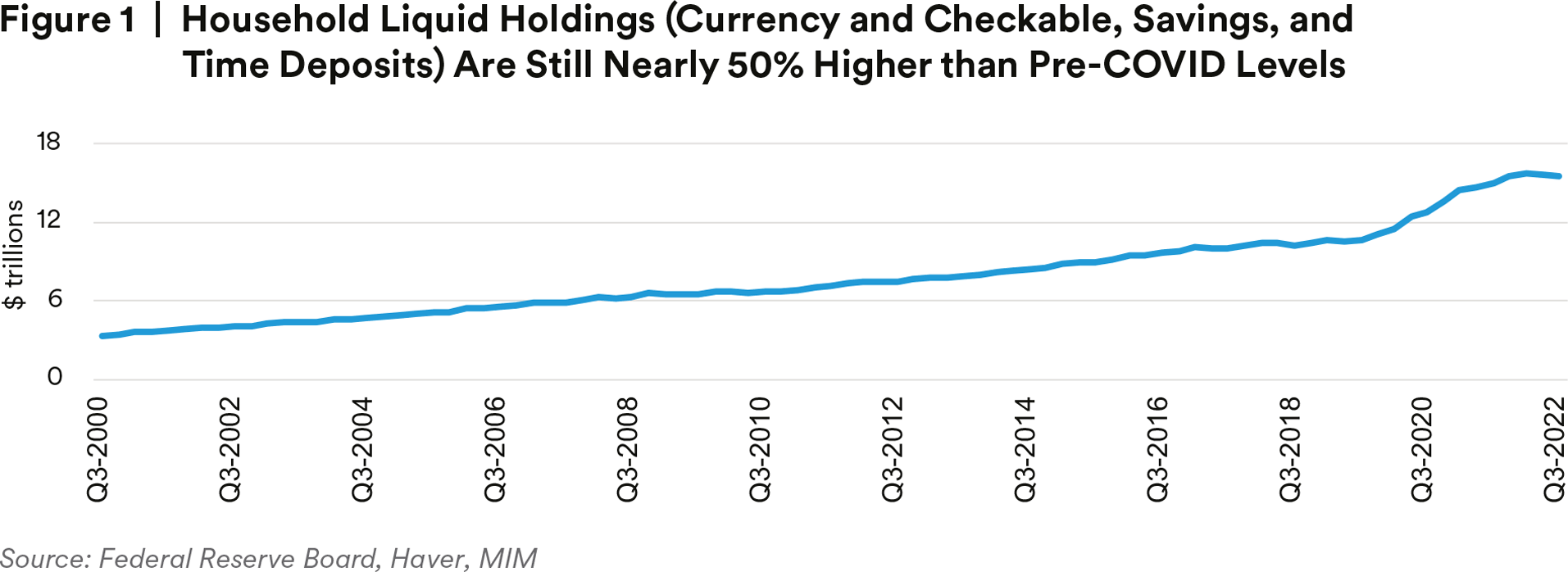

One risk is that United States households have a tremendous accumulation of liquid assets. They have $16 trillion in cash, checking and savings accounts, which is $5 trillion more than they had pre-pandemic. Consumers have continued to spend, with only a modest deceleration in demand despite substantial tightening by the Fed. Because of their large liquid balances, households are—on average—somewhat buffered against rate hikes, and fed funds rate hikes may not hinder spending as much as the Fed hopes they will.

A second concern is households’ potential response to a deceleration of inflation.

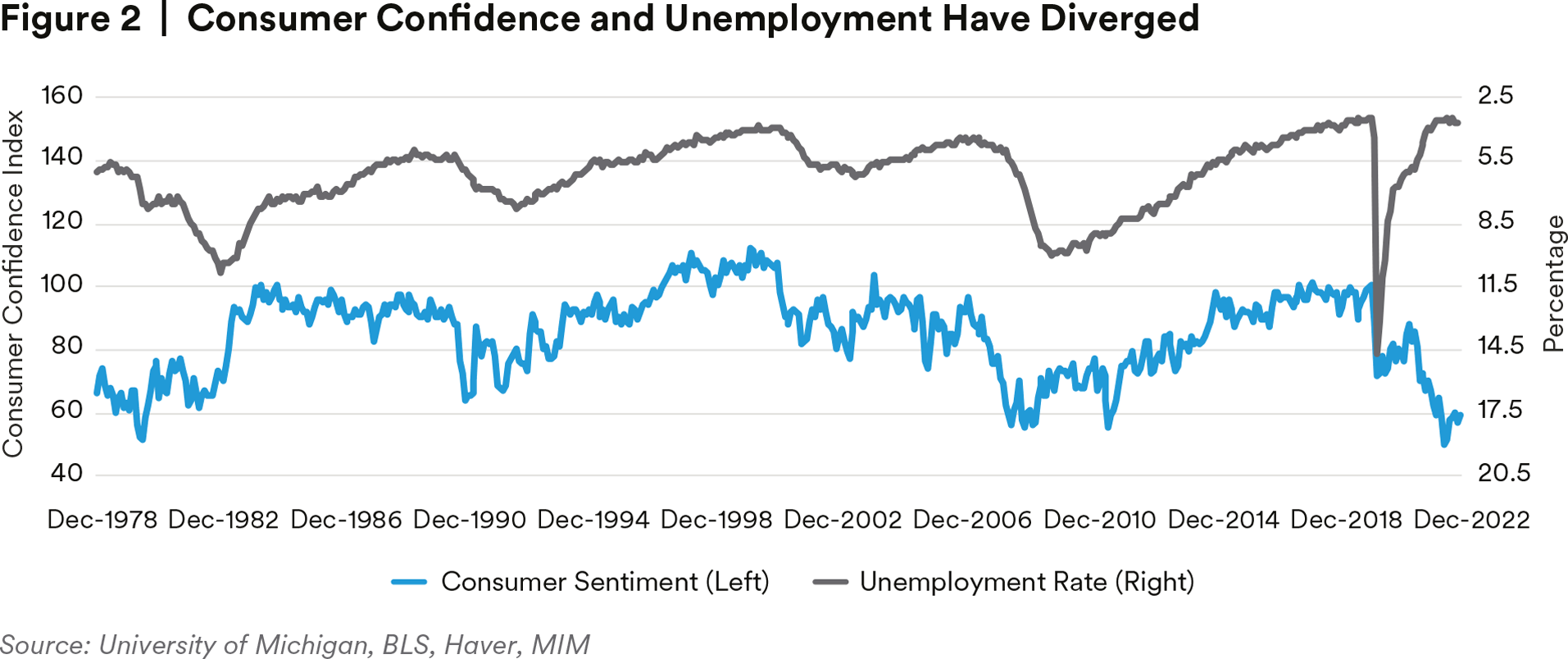

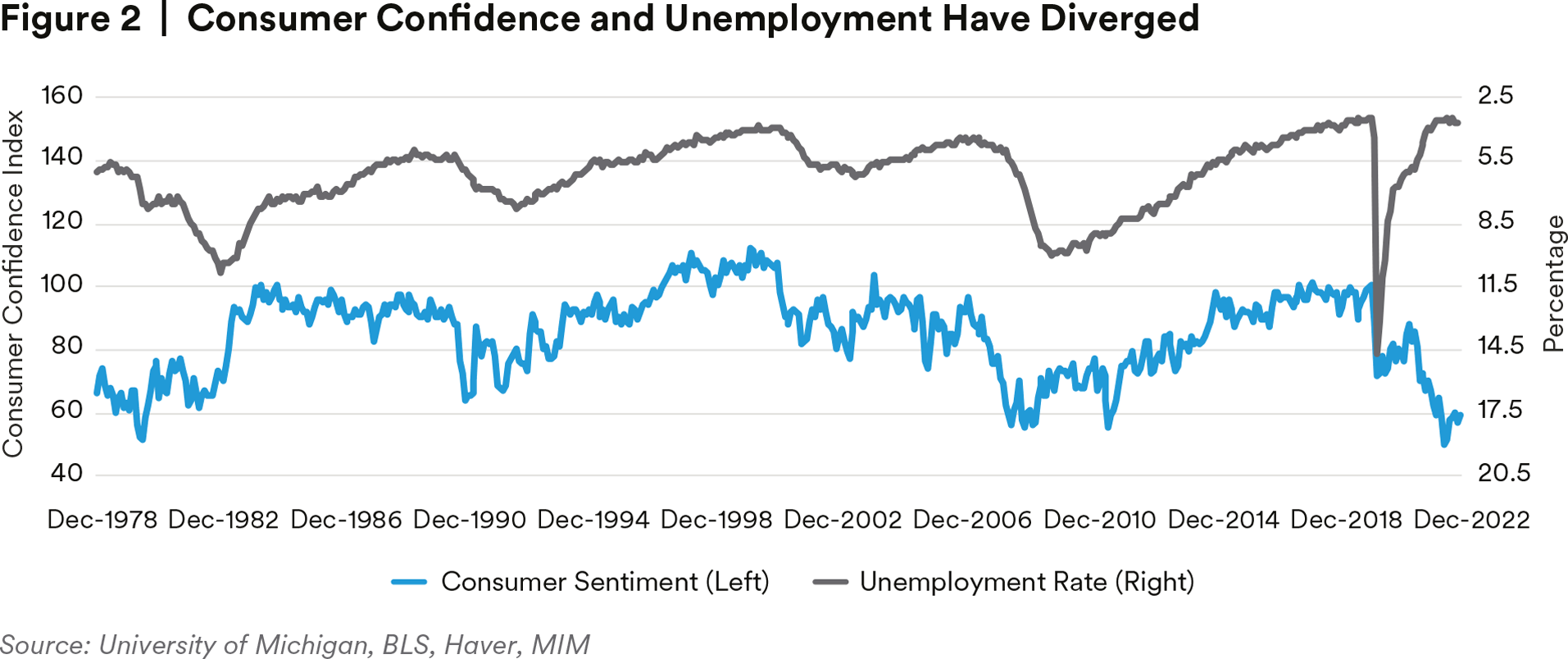

Consumer sentiment normally tracks unemployment (using an inverted axis) because the threat of unemployment creates worries about future earnings (see figure 2). In the current situation, consumer sentiment is at recession levels even while unemployment remains low—likely because of worries about inflation-adjusted future earnings.

This worry has stymied some consumption. The risk is that as inflation decelerates, household sentiment and consumption rebounds, countering the Fed’s tightening and raising inflation.

This unexpected consumer resilience would extend the amount of time the Fed would need to maintain tight monetary policy and/or increase the number of hikes required beyond markets expectations. This could mean that inflation remains relatively higher further into 2023 than expected. It could also mean that the recession is pushed out further toward year-end 2023 or even to 2024.

A separate risk is that the Fed’s monetary tightening may cause unemployment to rise faster than inflation falls. This would lead to a stagflation-like situation with high unemployment and high inflation. The Fed would be then forced to choose between controlling inflation or combating unemployment. It would likely choose to control inflation at least until it has forced inflation below 3% and raise the fed funds rate more sharply than expected.

The additional fed funds hikes would most likely lead to higher unemployment rates and a sharper contraction.

In the most extreme case, if unemployment rises so high that the Fed is forced to ease monetary policy before inflation falls below 3%—while there still remains a question about how well-controlled inflation has become—the threat of higher inflation may hang over the economy for some time.

This scenario is unlikely given the large buffer of job openings. But unemployment tends to rise very rapidly once it starts rising, and the Fed would likely struggle to act fast enough to rein it in.

This risk would likely lead to higher equilibrium inflation, with anything above 3% potentially problematic for longer-term economic stability. It could lead to an economic slump without materially decreasing inflation and could require a subsequent round of fed funds hikes to regain control of inflation.

In Europe, the ECB is expected to continue to tighten policy into 2023, but it is a tricky balancing act to manage rate hikes in response to food and energy inflation (and supply) shocks that are predominantly external, while not triggering renewed bouts of stress in euro-area debt markets.

Risk 2: Unfavorable Bond and FX Market Environments

There are several stressors that pose risks to financial markets in 2023.

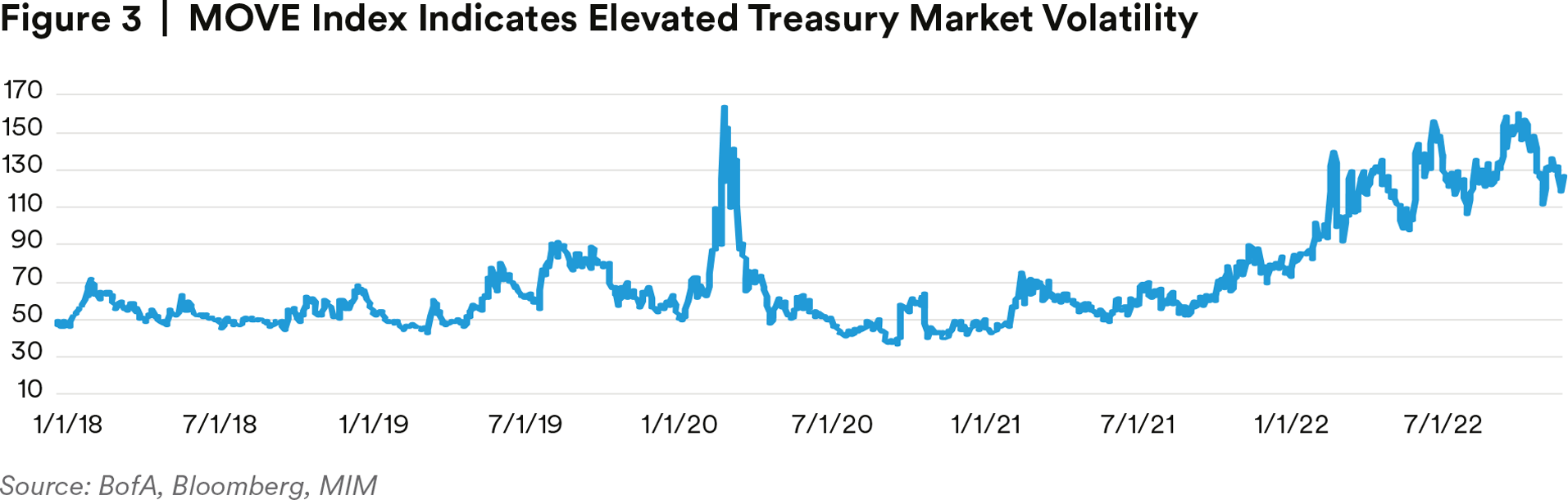

One source of risk is market illiquidity in the context of quantitative tightening. The Federal Reserve officially outlined its plan for quantitative tightening in May 2022, with rollover caps in place beginning in June and raised in September. From a peak of $8.97 trillion in April 2022 to $8.58 trillion through December 7, 2022, the Fed has managed to reduce its balance sheet holdings by just over 4%. However, even this relatively modest contraction of the balance sheet has had a significant effect on Treasury-market liquidity. In Europe, the ECB plans to begin a QT program in March 2023 by no longer fully reinvesting maturities in its €3,257bn Asset Purchase Program (APP) portfolio, initially allowing €15bn of roll-off per month through June. While this is a relatively moderate amount, there is uncertainty around its impact on markets and liquidity at a time when the ECB is continuing to raise policy rates, and when energy support packages will increase net government financing needs materially in 2023.

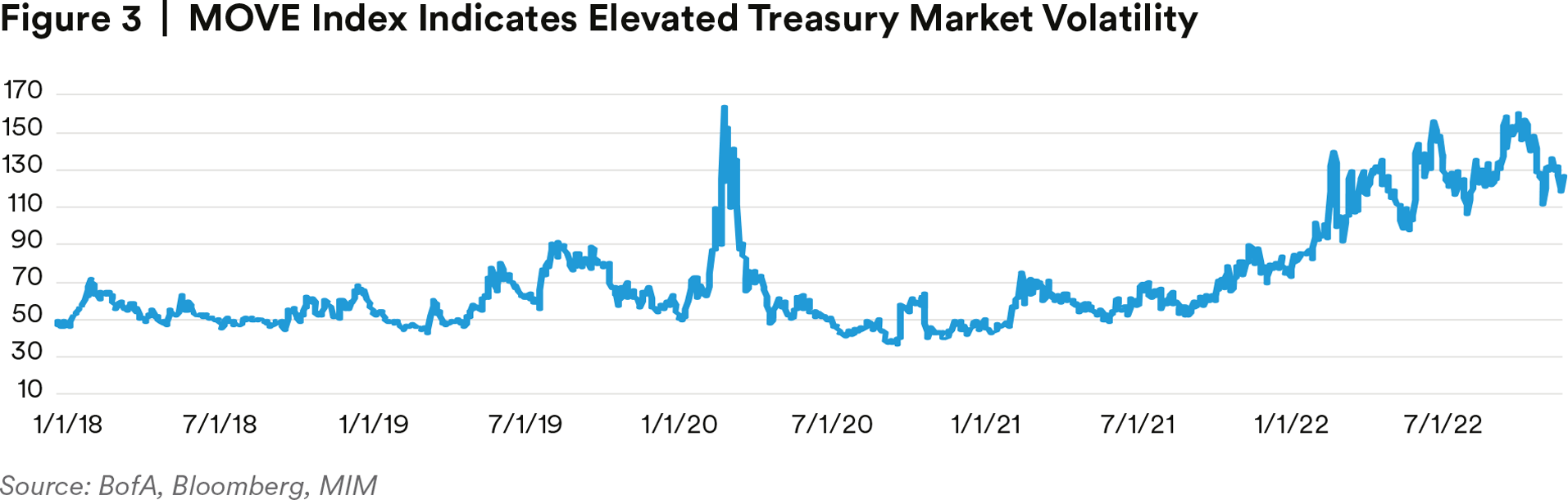

Since early 2022, Treasury-market volatility has been higher, and market depth and price impact are at their worst levels since March 2020, even as trading volume has held up. Although there have been past episodes when low liquidity coincided with high trading volume (both are conditions associated with uncertainty), the situation makes it harder for the market to smoothly handle large order flows, and liquidity shocks could have outsized effects.

There is a school of thought that suggests that QE and QT are asymmetric: that extending credit, as done in QE, can be done more quickly than reining in credit.1 This line of thinking is consistent with the observed liquidity struggles in the market. It could imply both that QT may be less effective than QE, and that liquidity concerns could impede the Fed’s monetary tightening program through the quantitative tightening channel. This may force the Fed to intervene in markets, slowing or halting QT. The Fed may even need to nominally reverse QT to maintain liquidity. This could force the Fed to raise fed funds rates higher to compensate for the needed tightness that cannot be achieved via QT. It could lower yields below market expectations, as the Fed purchases or ceases sales of Treasuries, and could make it more difficult for the Fed to rein in inflation. An analogous episode of stress recently occurred in the UK gilt market. Sharp price moves followed the late-September mini budget, triggering higher collateral calls and a liquidity crunch in the UK’s pension fund industry. The Bank of England was temporarily forced to intervene and buy gilts at a time when the monetary policy division had begun QT, creating a conflict of objectives and communication challenges. We would not expect a similar type of situation in the United States to induce a broader crisis per se, but it could create a more difficult tightening path for the Fed.

Another related financial risk is increased “hidden” leverage and continued liquidity mismatches in parts of the nonbank financial sector. The Federal Reserve’s November Financial Stability Report highlighted the elevated risks of this sector. Hedge fund leverage remains somewhat above its historical average, although data is only available with a lag. Bank lending to nonbank financial institutions (NBFIs) continues to grow rapidly, reaching a record high of almost $2 trillion in 2022 Q2.2 The Bank of International Settlements (BIS) estimates that NBFIs globally have more than $80 trillion of off-balance-sheet debt in FX swaps. There is a lack of transparency about the scale of the swaps, and the blind spot could catch policymakers off guard as the swaps are not included in standard debt statistics. The Federal Reserve had to intervene with dollar swap lines in March 2020, and the FX market continues to be vulnerable to funding squeezes.3

More generally, the lack of transparency of certain NBFIs’ funding sources is a risk—if such firms are using more leverage, adverse shocks could be amplified, as was seen in March 2020. While the credit lines to NBFIs, which can help form a picture on the amount of leverage being used, are healthy, there is less information on other sources of funding (and therefore risk and leverage) used by the firms. Leveraged positions financed with short-term funding are especially vulnerable.

The key risk is that the Fed “breaks” the liquidity transformation mechanism of a systemically important part of the economy. We believe this risk is relatively low, but if such an event were to happen, we would likely see a rapid decline in fed funds rates as the Fed provides liquidity, and a sharp decline in Treasury yields as investors flee risky securities, as well as a heightened possibility of a financial crisis.

In Europe, there is a tail risk that further rate increases and QT by the ECB could trigger fragmentation in Euro-area debt markets, including an unsustainable widening of peripheral spreads over core (e.g., BTPs over bunds) that again raise concerns of sovereign debt sustainability. However, this is not our base case due to the ECB’s sensitivity to such risks, its tentative and flexible approach as it begins QT next year, and its antifragmentation tools (e.g., Transmission Protection Instrument and full and flexible reinvestment of its €1.7 trillion PEPP QE portfolio at least through year-end 2024).

Risk 3: Central Banks Make Policy Mistakes Causing Further Economic Weakness

As was true last year, there is a heightened risk of a central bank policy mistake. At this moment, the most likely policy mistake in the United States appears to be the Federal Reserve dragging its feet in loosening monetary policy.

Given the Fed’s avowed data dependence and its focus on inflation as a near-term priority, it is feasible that they are late in shifting toward easing.

There have been several false alarms regarding the decline of inflation in recent months. For example, we have seen three separate months of 0.3% month-on-month core inflation, with the first two followed by a renewed spike in inflation. As a result, the Fed may be inured to early indicators of a let-up in inflation and may take longer to be convinced that inflation has eased.

If the Federal Reserve leaves policy rates too high for too long, the subsequent recession would be deeper and possibly longer with higher unemployment and lower growth. Vulnerabilities in financial markets may be exacerbated.

On the positive side, overtightening might be one of the few ways in which inflation could reach 2% in the near term. Greater demand destruction would aid in restraining prices, possibly even enabling them to decelerate to 2%.

In Europe, the risk lies on the side of the ECB tightening too much in the face of a weakening economy and inflationary forces that have been largely external (energy and food prices), distinguishing its challenge from that of the Fed (where inflationary pressure has been predominately domestic).

Risk 4: The Fed Manages to Execute a Soft Landing

Although we regard it as unlikely, it is feasible that the Fed manages to steer the United States economy into a “Goldilocks” scenario: just enough rate cuts to pull inflation down but not enough to create a recession. This would involve a great deal of luck and would likely be enabled by the unusually tight labor market.

This scenario would represent upside risk to our GDP forecast. It would also likely imply that our year-end 2023 10-year yield forecast is too low. The 10-year yield tends to decline during a recession and rebound somewhat thereafter. If the United States can avoid a recession, then yields may stabilize at a higher level toward year-end rather than dipping as we expect.

Risk 5: Increasing Food and Energy Prices

The Russia-Ukraine war, which we expect to continue well into 2023, will continue to pose risks to commodity prices globally. Before the conflict, the EU imported around 60% of its energy needs, with Russia being the largest single source. For oil, 67% of total use was imported, of which 25% was from Russia; for gas, 27% was imported, with 41% of that from Russia. The sharp transition away from a longstanding (and formerly relatively cheap) Russian gas supply is expected to entail a painful economic adjustment for the continent over the medium term under our baseline. We see a small upside risk that the EU could reverse some energy sanctions on Russia in the event of a ceasefire, leading to a resumption of gas imports from Russia and an easing of the oil embargo on Russia. More pertinently, there is a risk that Russian actions could worsen the commodity-price environment further.

Higher oil prices are a risk for next year. The EU embargo on Russian oil kicked in on December 5, 2022 (an embargo on refined products will enter force on February 5, 2023), alongside a G7 prohibition on provision of insurance services to tankers carrying Russian crude above a price cap. In terms of supply implications, most of the roughly 1 million barrels per day (mbpd) shipped to the EU will be diverted to other markets. However, Russia has publicly claimed it will prohibit domestic companies from selling Russian oil under any price cap, and that it is willing to cut supply to do so. As the cap’s level ($60) is not dissimilar to the price Russia is paid for its crude (Urals trades at a steep discount to Brent), our base assumption is that the global-supply implications from such a threat will be relatively limited in the near term. However, there is a tail risk that Russia decides to hold back significant supply (e.g., 1-2mbpd) to add pressure on the G7. A 1-2mpd drop in supply could add $25-$50 to the price of a barrel of oil, all else equal, although an OPEC response could partially mitigate this.

For gas, were Chinese demand to increase significantly, Europe would struggle to fully substitute lost Russian flows given the expected LNG export-capacity bottlenecks over the coming years. The situation would be exacerbated if we saw Russia cut their remaining supplies to Europe (already at roughly 20% of its pre-war supply). The structural price of gas in Europe would be pushed even higher, leading to additional reassessments of industrial demand and a deeper and more prolonged recession than currently forecast.

Food prices are another source of risk. Wheat prices have settled down following the UN-brokered Black Sea Grain Initiative, signed in July by Russia, Ukraine, and Turkey, and renewed in November for four months. The deal enabled the resumption of exports of grains and other foodstuffs from key Ukrainian ports on the Black Sea. However, the deal is fragile (Russia briefly pulled out in October, for example). Russia scuttling the deal permanently would push up global food prices and increase food insecurity for lower-income, net-food-importing countries. For reference, wheat prices were, on average, 30% higher than current levels in the period between the initial invasion of Ukraine and the grain deal being struck.

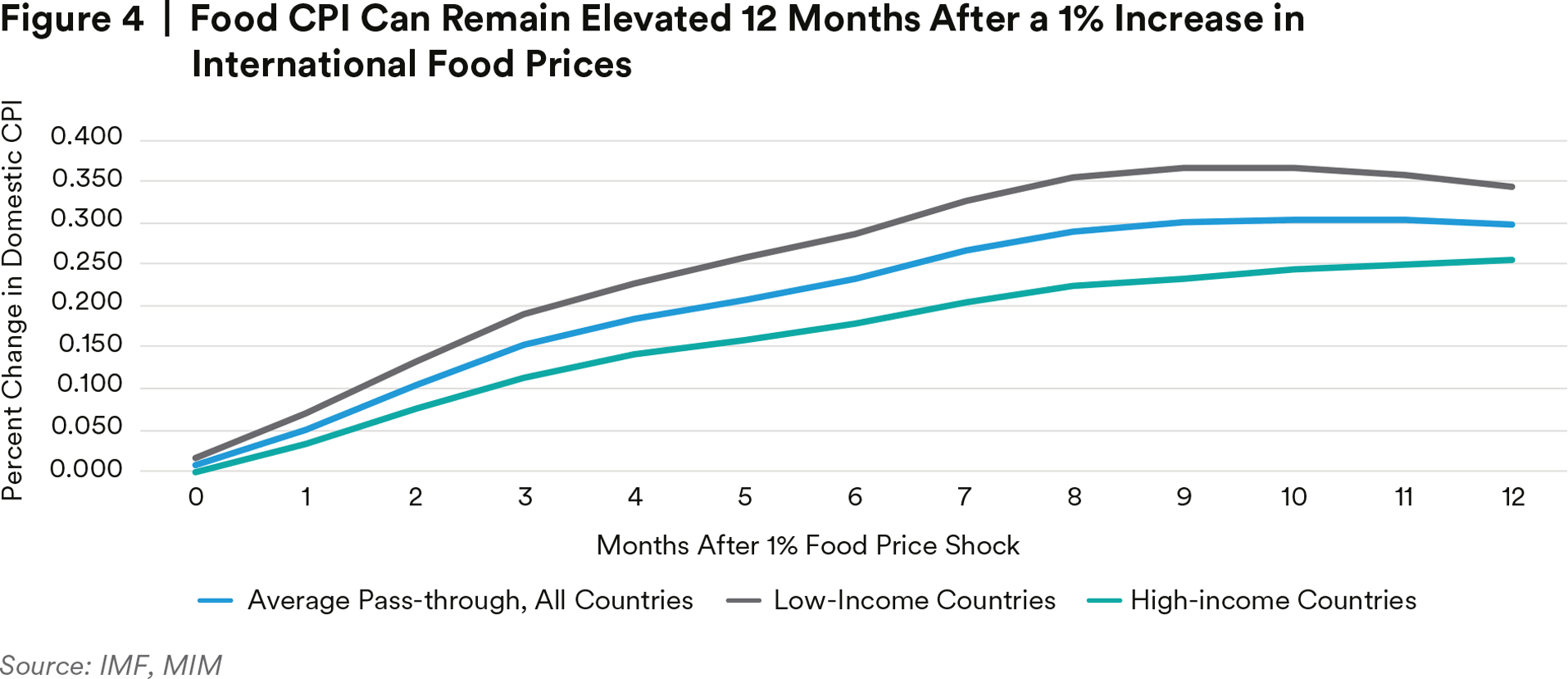

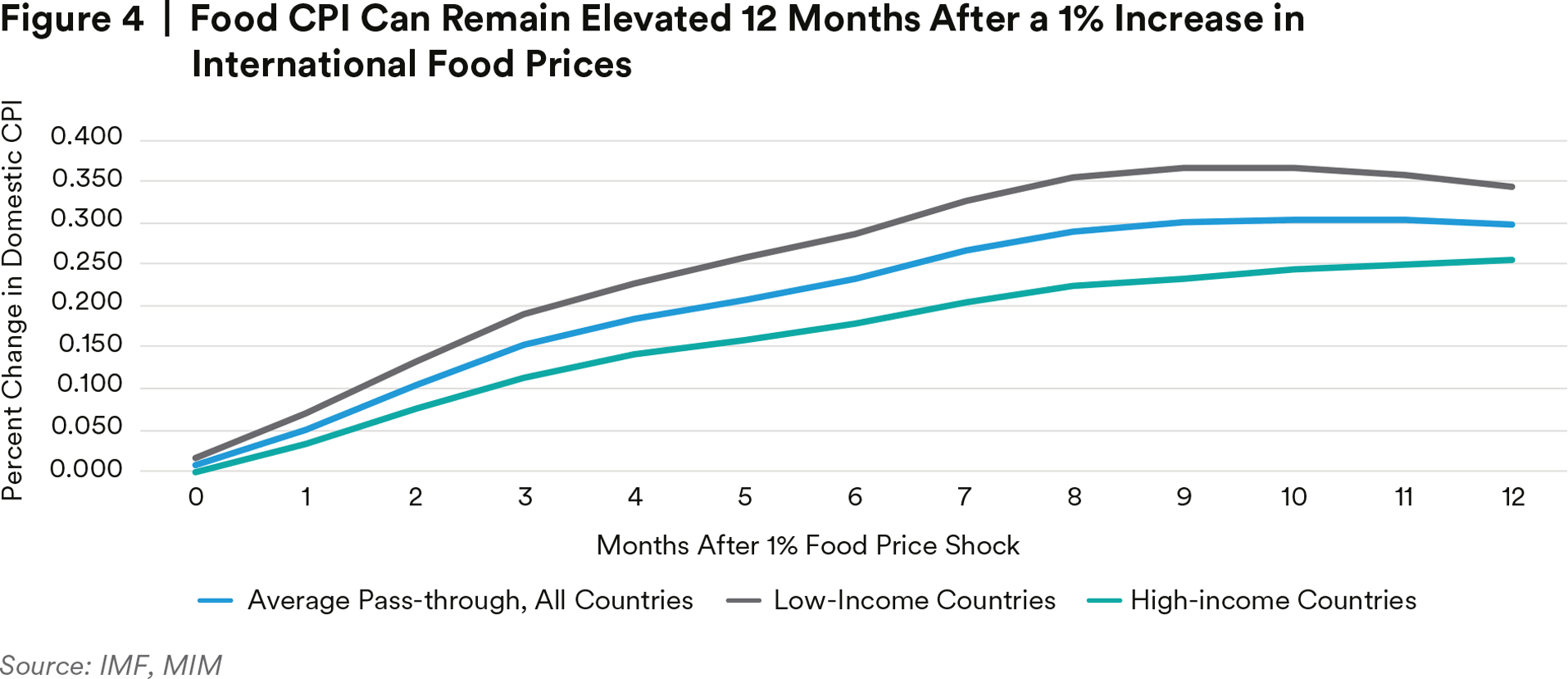

Concerns about high international food prices continue despite the recent slowdown in global inflation. Notable price increases in basic staples throughout 2022 gave way to protests, mostly in developing countries but also in pockets across developed economies. In 2022, the IMF estimated that high global food prices added about six percentage points year-over-year to prevailing food inflation for end-consumers.4 In our view, agricultural commodity prices in 2023 will remain elevated. Ongoing, tight global supply in food commodities (particularly the grains complex) is likely to support high food-price levels, outweighing the effect of softening demand from a slowing global economy. Risks to our expectations for global food prices come from slower global growth (50% chance to influence agricultural commodity prices), Russia-Ukraine conflict escalation (15% chance), rising input costs (15% chance), extreme weather events (10% chance), and renewed export restrictions (10% chance).

Risk 6: Protracted COVID-19 Outbreaks Causing Slower-Than-Expected Recovery of Chinese GDP

Our baseline assumes stronger growth traction from 2Q23 onwards as China’s elderly population is more fully vaccinated, a fourth booster is rolled out, and health care-system capacity is further improved.5 Although we expect that the relaxation of restrictions will lead to more outbreaks in coming months, our baseline assumes no return to blanket lockdowns. We thus forecast accelerating GDP growth in 2023, particularly in the second half of the year.

A key downside risk to our 2023 re-opening baseline is delayed growth recovery due to protracted outbreaks. The broad-based easing of COVID-19 restrictions will likely trigger record new cases across the country in coming months, as local governments continue to balance the trade-off between promoting economic growth and preventing stress within their local health care systems. The 30–40-day period in late January around the Lunar New Year will be a particularly risky period as millions of people travel and congregate for the holidays. Any significant strains on local hospitals due to a rise in severe cases and deaths would likely trigger some reimposition of mobility restrictions, including social distancing measures such as work-from-home, online schooling, and suspension of non-essential services. This would cause confusion and frustration on the ground, potentially delaying China’s re-opening process by a few months and triggering downgrades in our 2023 GDP growth forecasts.

Risk 7: Increasing Headline Risk from Political Tensions Between the United States and China

In one of the only areas of political bipartisanship, both the White House and Congress are taking increasingly assertive action toward China to protect U.S. economic and national security interests. The Biden Administration has stepped up efforts to contain China’s technology advancement, including expanded restrictions on exports of advanced semiconductors and manufacturing equipment to China. Congress announced the formation of a Select Committee on China to address economic and security challenges, among other issues.

Possible further measures could include adding quantum computing to the next wave of exportcontrol measures. A long-in-development Executive Order on outbound investment that would constrain U.S. investment in Chinese semiconductors, quantum computing, and AI also continues to enjoy bipartisan support. The Biden Administration has also charged the National Economic and Security Councils with drawing up policy proposals to further address technology competition with China

Within this context, there is a risk that U.S. measures against China could increase in frequency and aggression if Congress and the White House attempt to “out-hawk” each other. As any such measures from the United States are likely to result in tough rhetoric and potentially some form of retaliation by China, the market will be vulnerable to more headline risk emanating from U.S.-China bilateral tensions next year.

Risk 8: Increased Political Tensions Between China and Taiwan Causing Regional Economic Disruption

Our base case remains for no military conflict or security crisis (a military-related confrontation that presents a significant risk of escalation) over the next decade, although the likelihood will rise over this timeframe. Our assessed current probabilities of a military conflict or security crisis rise from 10% and 20%, respectively, in 2024 to 35% and 45%, respectively, in 2035. Even in the absence of conflict or crisis, we anticipate that China will exert economic and political pressure on Taiwan if it is provoked by Washington and Taipei, causing potential financial and economic disruption in the region as well increasing the risk of miscalculation or accident.

Various tail risks would increase our probabilities for military conflict over our 10-year time horizon, such as passage of new United States legislation changing the United States commitment to its One-China policy or a Taiwan vote on independence. Neither figures in our 2023 baseline, but broader headline risks around other issues will persist, such as a reaction to the Taiwan Enhanced Resilience Act or more visits to Taiwan from high-level United States officials.

Endnotes

1 Acharya, Viral, et al. “Liquidity Dependence: Why Shrinking Central Bank Balance Sheets is an Uphill Task.” Kansas City Fed Working Paper, August 2022.

2 United States, Board of Governors of the Federal Reserve System. “Financial Stability Report.” November 2022.

3 McGuire, Patrick. “Dollar debt in FX swaps and forwards: huge, missing and growing.” BIS Quarterly Review, December 2022.

4 International Monetary Fund. “World Economic Outlook.” October 2022.

5 UBS estimates that only 65.8% of those aged 80 and above were fully vaccinated as of November and only 40.4% have received a booster.

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. Unless otherwise stated, none of the authors of this article are regulated in Ireland.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.