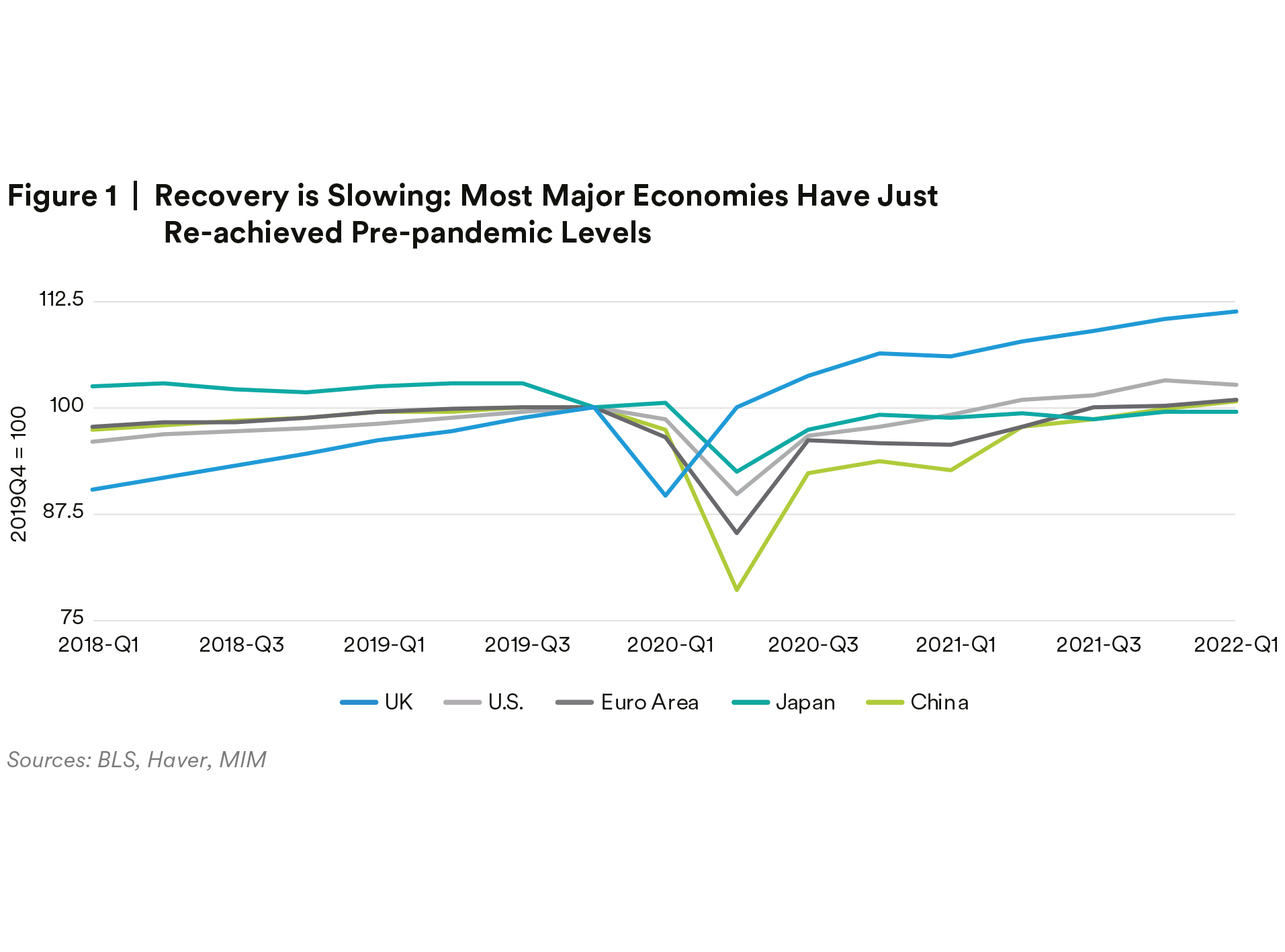

Although they have substantially stronger balance sheets and lower debt levels than before the pandemic, confidence indicators have plummeted, and some consumption indicators show retrenchment by consumers. A third accelerant would be continued or exacerbated problems on the supply side to deliver goods and services—this goes beyond supply chains to include labor mismatches and inventory overaccumulation. The continued supply-demand mismatches also make economies particular vulnerable to exogenous shocks. A fourth possible accelerant would be new fallout from the Russia-Ukraine war, principally via higher energy prices.

In Europe, the main risk to our growth outlook comes from the higher energy prices facing the region and the potential for an interruption to its energy (particularly gas) supplies from Russia in the second half of the year. Both are linked to the ongoing aftermath of Russia’s late-February invasion of Ukraine. Any material interruption to EU energy supplies as it enters winter 2022/23 would trigger a recession, with energy supplies likely rationed and industrial output declining sharply in this scenario. The negative spillover effects via lower European demand and weaker confidence would be negative globally, albeit relatively less so for the U.S. (a relatively closed economy) and potentially partially offset by a recovering China.

Risk #2: Insufficient Relief From Inflation

The risk: Inflation doesn’t decline sufficiently.

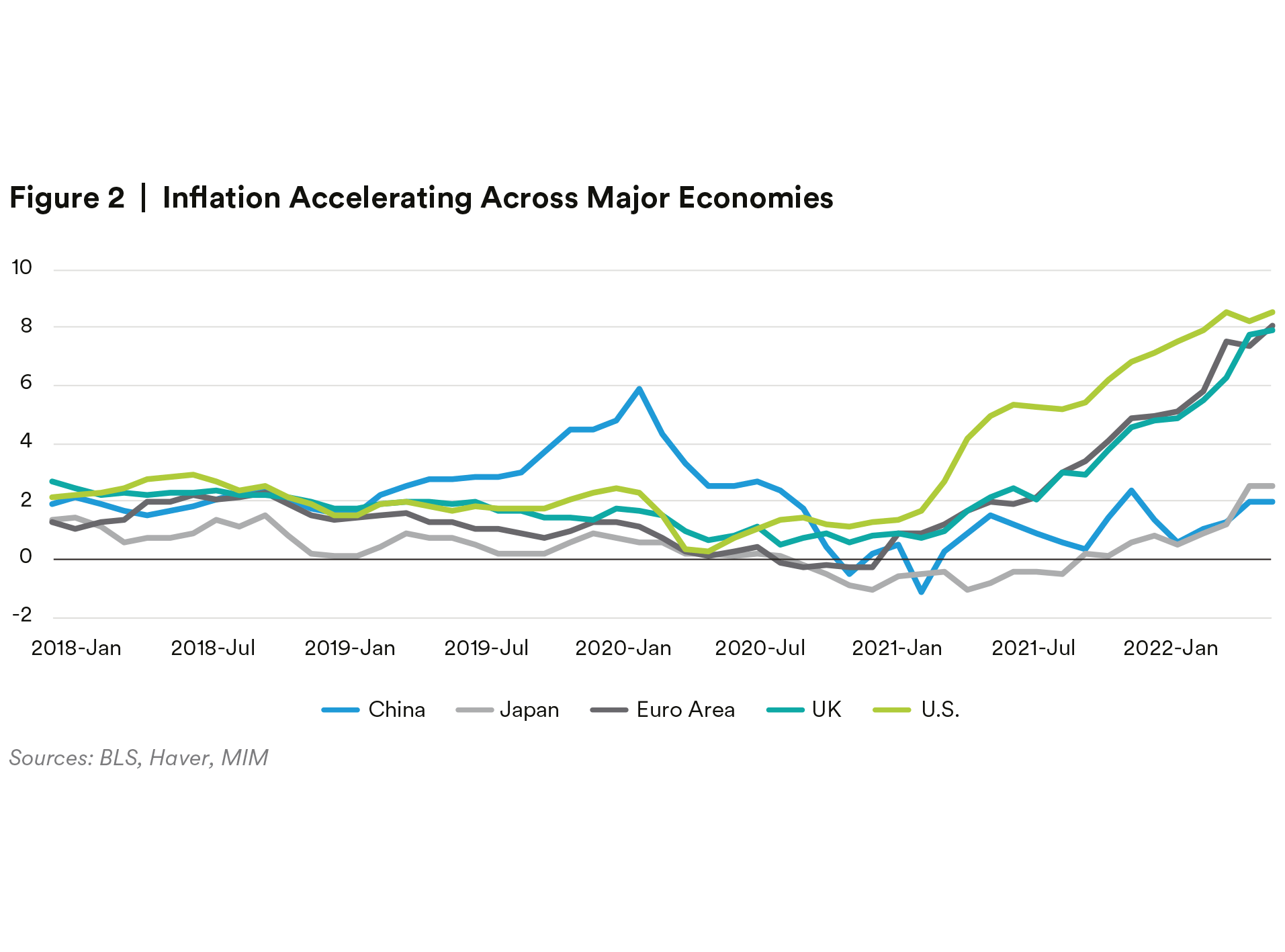

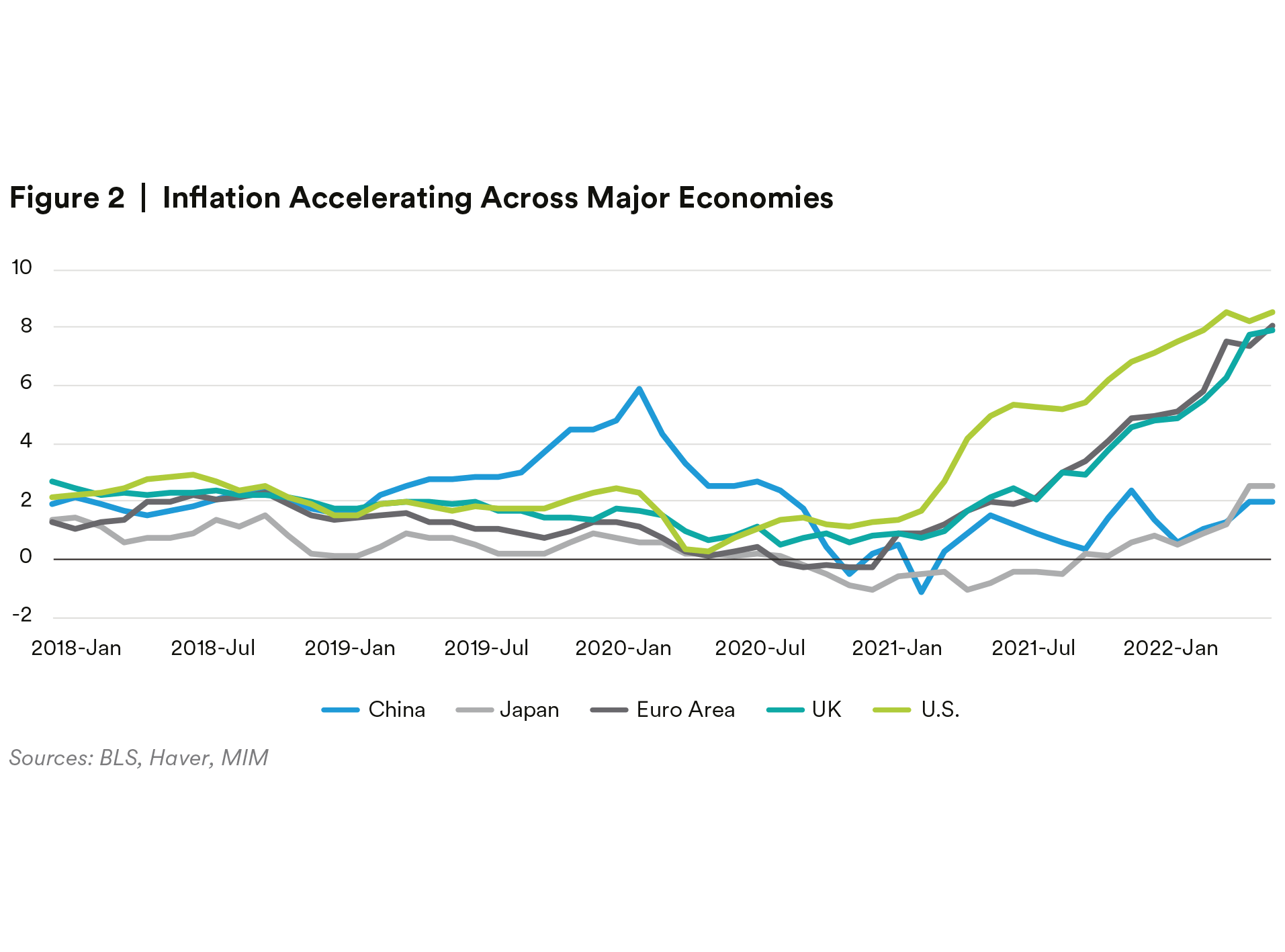

in response to central bank policy tightening, recovery from the supply-chain and demand distortions caused by the pandemic, and slowing economic growth in the U.S. and Europe, inflation may not let up. Inflation, particularly in those sectors that are global and for which demand is inelastic, like food and energy prices, may remain high even if central banks manage to reduce demand via tighter policy settings.

In the U.S., we expect that inflation will have peaked in mid-2022, with a moderating pace of inflation toward year end as Fed hikes cool the economy. However, risks remain that inflation is more persistent than expected, or additional inflation pressures come to bear on global commodities and offset Fed-induced cooling demand.

In Europe, inflation is not expected to peak before late-Q3/Q4, and the balance of risk is tilted toward inflation peaking at a higher-than-currently-expected level later this year and for inflationary pressures to linger for longer going in to 2023. The ECB has been slower to tighten policy than other major central banks, like the Fed and BoE, and is only planning to begin raising its policy rates from early Q3. Financing conditions have nevertheless tightened in the euro area and will likely tighten further as the ECB raises rates.

Energy and food prices continued to exert upward pressure on rates of headline inflation in Europe into mid-year, which also saw further increases in global oil, and particularly European gas prices, as concerns grew around the security of the region’s gas supplies after Russia cut off some smaller EU countries and reduced flows to larger economies like Germany and Italy. Even absent any further interruption to Russian gas supplies, energy prices may remain high. The EU’s plan to reduce imports of Russian oil by 90% by year-end 2022 (alongside G7 proposals to cap Russian oil prices) and phase out its use of Russian gas imports in coming years risk further destabilizing global energy markets, adding impediments to the smooth operation of global supply chains and keeping overall inflation higher for longer. While that could necessitate a faster pace of tightening from the BoE and ECB, they will likely need to balance this against a correspondingly weaker economic situation.

We see the major sources of risk coming from a number of sources. One is possible further increases in oil prices. Although recessionary behavior would cool demand for oil, upward pressure remains on oil prices including the Q4 reduction in Strategic Petroleum Reserve releases by the U.S., the December effective date of the European embargo on Russian seaborne oil, the supply constraints of refining capabilities, and the approaching production limits from Gulf countries that have already increased production. In addition to these supply effects, if China gears back up and manages to avoid additional major COVID-19-related shutdowns, this would stimulate more oil and commodity demand, also pushing prices higher.

A second risk to our inflation forecast is renewed strength in consumer spending. Consumers globally appear worried about the possibility of recession. However, in the U.S. and Europe, consumers still have cash and debt capacity well beyond their pre-pandemic levels; if they choose to spend down their assets or go into debt, they have the capacity to continue to spend, which could keep inflation from declining as rapidly as hoped.

A third risk is the escalation of supply-side constraints in the form of supply chains, labor market tightness, and in particular, China’s zero COVID-19 policy, which could mean renewed price pressure on certain products and sectors.

A fourth risk is unanchored inflation expectations, which could stymie inflation-fighting efforts. Although market expectations of longer-run inflation (specifically the 5 year, 5 year forward) remain well-anchored in the U.S. and Europe, in the U.S., the University of Michigan consumer sentiment survey points to a rising inflation forecast by consumers. In Europe, wage negotiations in the fall will be an important indicator of whether higher inflation is materially raising labor costs in the region. If inflation expectations remain high (or rise further), and consumers act on these expectations by demanding raises or purchasing goods as stores of value, inflation could persist despite the currently expected tightening paths of key central banks.

Finally, there is the risk of insufficiently aggressive central bank policy. Inflation generally responds to central bank policy with a lag; if central banks stop tightening prematurely under the assumption that inflation will continue to decline, this could extend the inflation episode beyond current expectations. Lingering inflation with higher unemployment and substantially lower growth is a possible, although less likely, outcome.

Risk #3: Economic Warfare Escalation by Russia

The risk: The Kremlin escalates its economic warfare by halting energy supplies to Europe.

Our baseline assumption is that the war in Ukraine continues through the summer. However, the currently high rate of battlefield attrition is unsustainable, and we expect a significant reduction in intensity (or even a pause or ceasefire) in the fall as both sides seek to consolidate and regroup forces. We view a more durable ceasefire with an accompanying diplomatic roadmap as a less likely outcome. Over the medium term, the conflict—or threat of conflict—is likely to continue to cast a shadow over Europe.

A major escalation in the form of the conflict spilling over into neighboring NATO countries is an outcome that we see as a tail risk and do not examine in detail here. Rather, the main macro risk stemming from the war for Europe centers on energy prices and security of supplies, particularly gas. Russia has already halted gas supplies to some EU countries, and the Kremlin seems to have little incentive to maintain a positive business relationship with Europe in the energy markets after the EU has already outlined plans to phase out its reliance on Russian energy imports. This includes EU plans to reduce imports of Russian oil by 90% by year-end 2022, which has contributed to the rise in the price of Brent crude. Gazprom has been progressively reducing gas supplies to EU countries this year under various pretexts with the intention of inhibiting the ability of EU countries to build up sufficient gas storage levels going into the winter. Gas prices in Europe have risen sharply in response, with month-forward contract prices ending June 2021 at €145/MWh, 375% higher than a year earlier.

Pre-invasion, Russia accounted for about 40% of EU gas imports, with the figure much higher for some member states. Relatively exposed economies include Germany, Italy, Netherlands, Hungary, Czechia, Slovakia, and Bulgaria. Less exposed economies include France, UK, Belgium, Spain, Portugal, Sweden, Austria, and Ireland. However, the impact of higher global energy prices is high everywhere, while the spillover effects of any decision by Russia to cut gas flows to the EU would be large even for countries with low, direct gas-import dependence due to negative impacts on demand and confidence.

The risk scenario of a full cutoff from Russia would entail a sharp leg down to GDP growth with a 2pp-6pp shock to 2022-23 cumulative growth (the wide range across different forecasters reflecting the high degree of uncertainty around such an unprecedented shock). In this context, the challenge for European central banks would be tackling high inflation, while at the same time preventing financial fragmentation across the euro area and supporting growth. The supply shock would push up headline inflation, but a severe recession would temper core inflationary pressures, which central banks would probably place more emphasis on, at least initially pausing their tightening cycles. Credit conditions would deteriorate, potentially necessitating central bank liquidity operations. We would assume a coordinated fiscal loosening would be executed, worth at least 1%-2% of GDP in aggregate, with the EU channeling more fiscal support to more vulnerable countries.

Risk #4: China Weakening Growth

There are several downside risks to our baseline 2022 GDP growth forecast of 3.5% emanating from: 1) recurring COVID-19 outbreaks requiring more stringent Zero COVID-19 Policy (ZCP); 2) insufficient policy support; 3) delayed recovery in the property sector; and 4) collapsing external demand hitting China’s exports.

The key downside risk for GDP growth relates to potential new domestic outbreaks of Omicron or related strains in 2H22, requiring more aggressive Zero COVID-19 Policy (ZCP). Given still low vaccination rates among the elderly and the absence of a home-grown mRNA vaccine, Beijing will have to retain its ZCP in some shape or form in 2H22. Beijing has streamlined some restrictions where possible in recent weeks to minimize collateral damage to growth; however, new outbreaks would see them reimposed, causing renewed disruption to consumption, services, supply chains, and manufacturing. This would, in turn, limit the effectiveness of ongoing policy easing, given stalled economic activity and deteriorating market sentiment.

Another downside risk would be policy misstep, in this case, insufficient support for the economy, stemming from policy hesitancy, lack of interagency coordination, and/or poor implementation at the local government level. There has been general reluctance in Beijing to unleash policy support into a still weak economy, given more limited ammunition and the CCP’s longer-term structural derisking goals. Local governments have been dissuaded from resorting back to large-scale, creditdriven infrastructure stimulus, given declines in land sales, constrained fiscal positions, and more limited funding sources. The pool of qualified projects offering sound productive returns has also dwindled, raising implementation risks, even despite available funding in some cases.

The property sector remains weak on several fronts, although green shoots have begun to appear. A delayed recovery has major implications for broader GDP growth, as the sector directly and indirectly accounts for about 25%-30% of GDP. Beijing’s efforts to streamline ZCP in recent weeks should help to support economic activity, lifting household and business sentiment, and in turn, underpinning property-related activity, albeit at a very gradual pace in 2H22. Should new outbreaks materialize requiring the reinstatement of ZCP restrictions, the property sector recovery will be delayed yet again.

A more pronounced slowdown in the U.S. and Europe is another downside risk to our forecast. Should U.S. recession risks materialize sooner and/or Russia cuts energy supplies to Europe, China export growth would slow on weaker external demand, providing little to no offset for sluggish domestic demand.

GDP growth of 2%-3% would be disruptive to an already weak labor market. The official urban unemployment rate was 5.9% in May, just slightly off its 6.2% peak in February 2022. A key risk lies in unemployment among youth, which has been on an upward trend since 2019, and which reached a historical high of 18.4% in May. Youth unemployment will rise further this summer as graduating students enter the job market. If sequential growth slowed in 2H22 and put China on track for 2%-3% full-year growth, the risk to the labor market would trigger more meaningful policy support from Beijing to minimize potential social disruption—a risk the CCP would prefer to avoid with the 20th Party Congress fast approaching in November 2022.

Conclusion

Risks to economic forecasts have been elevated since the beginning of the COVID-19 pandemic. The risks have changed, but the level of risk remains extraordinarily high. The economic situation remains precarious, with a 2022 recession and poorly controlled inflation through year end both possible. China faces multiple risks to growth. The geopolitical situation is, if anything, more fraught now than during the pandemic. The Russia-Ukraine conflict remains a dangerous situation, both politically and economically. High food prices and scarcity, while perhaps less damaging for the global economy, could create social unrest and political instability. While not likely to be globally economically significant, this creates economic risks for a number of countries, particularly emerging markets.

In short, we see numerous ways in which economies could stumble this year, both via declining growth and elevated inflation.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”) solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor. This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.