Regulations are Costly

Accumulated regulations since 1980 have reduced GDP by as much as 0.8 percentage points per year by 2011. Some regulations may be worth a hit to GDP – for example, workplace safety requirements, healthcare data privacy – but costs to GDP remain.

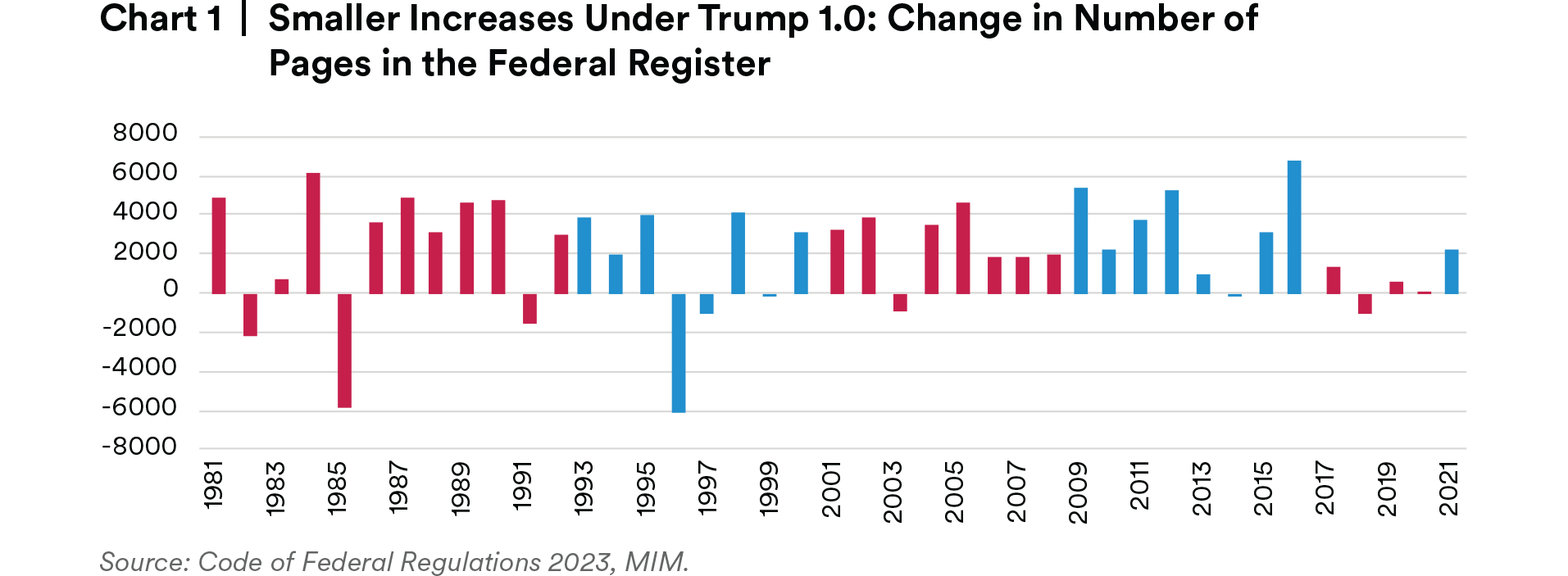

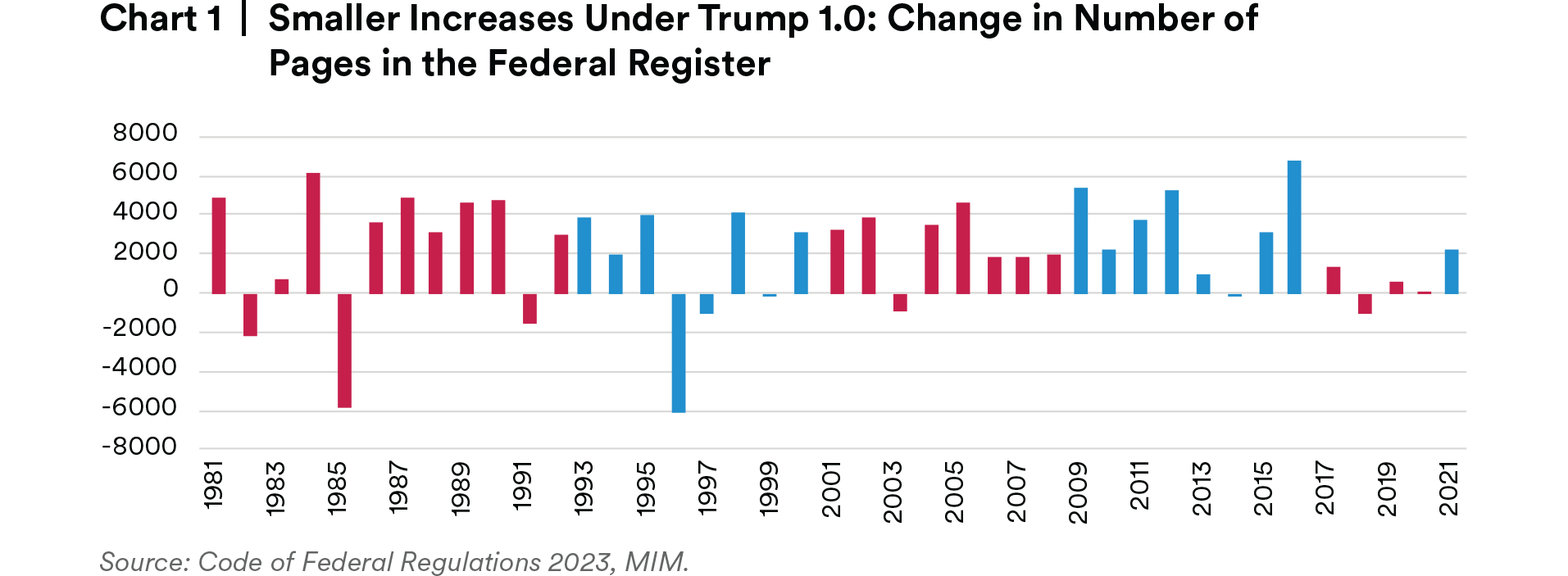

Generally, administrations add significant new rules towards the end of their time in office – likely because they were unable to accomplish their priorities via legislation.

Trump has been forcefully against new regulations. During his first administration, there were fewer net increases to regulations than under other recent presidencies. A “2 for 1” rule was implemented during his presidency, where two regulations had to be eliminated to add a new one. As President Trump’s second term begins, we expect fewer regulations to be passed especially given that the Republicans have also retained the house.

The overturning of the Chevron deference means federal courts no longer must defer to government agencies in cases where a statute is ambiguous, and that is also likely to reduce the number of regulations. A new issue to contend with as a result of this change is a potential proliferation of burdensome and complicated state level regulations.

Trade: Taking on the World?

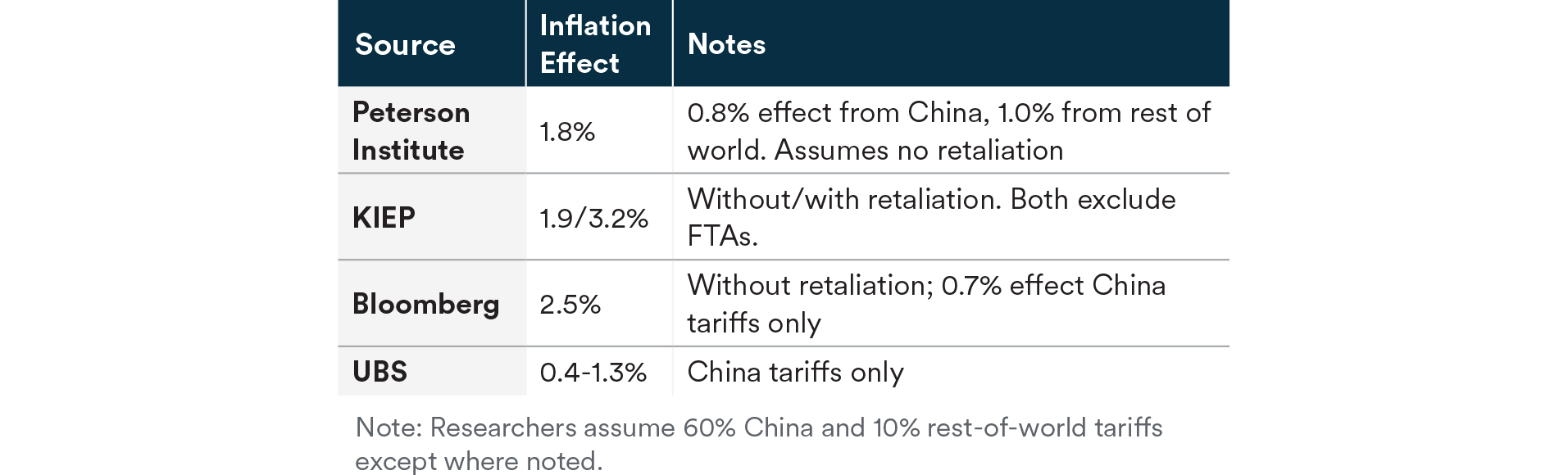

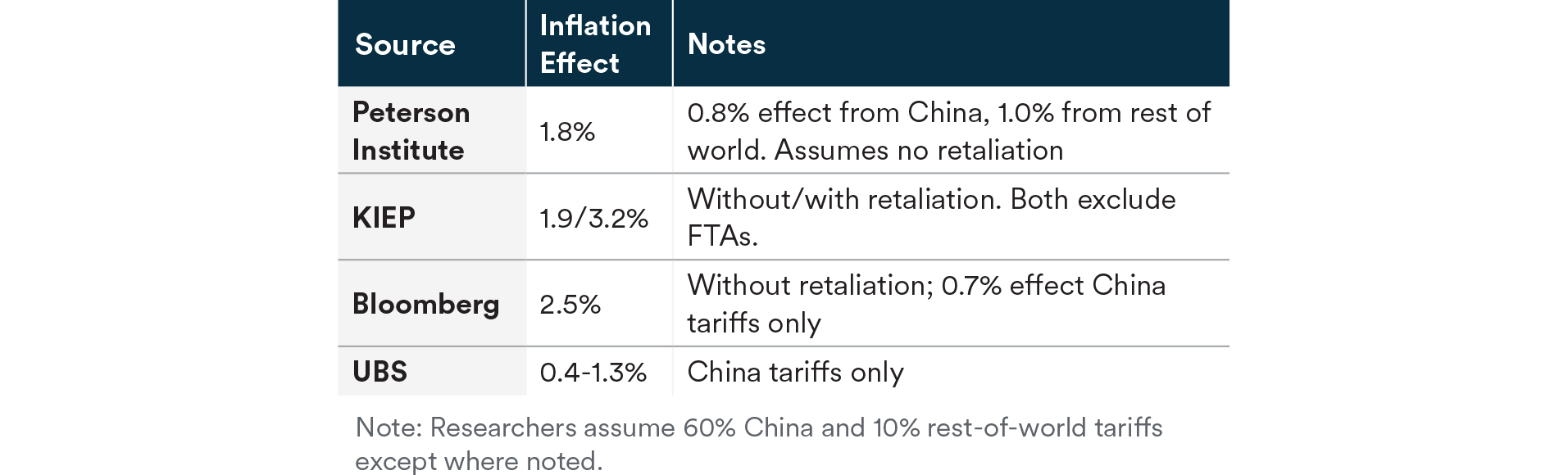

We expect Trump to place substantial tariffs on a wide range of Chinese goods. Raising tariffs on China to 60% is expected to have a moderate one-off shock of 0.4-1.3% on U.S. inflation. We expect the effects to be toward the low end as U.S. consumers are becoming increasingly price sensitive.

Putting across-the-board tariffs on other countries is legally trickier, particularly for countries with Free Trade Agreements (FTAs). Assuming 10% tariffs on most countries aside from China, estimates of one-time inflation shocks are larger, ranging from 1.8-3.2%. GDP effects would be modest at about 0.1 to 0.5%.1

We would expect significant retaliatory tariffs by China and other countries on U.S. exports, but concrete economic effects of retaliation remain highly speculative.

“McKinley tariffs” – tariffs that would substitute for income tax revenue – would have to be substantially higher than current proposals. Given 60% tariffs on China, they would have to be at least 44% on the rest of the world including countries with whom the U.S. has trade agreements, and would have substantially greater ramifications on supply chains, inflation, and GDP.

Fiscal Policy: No Discipline in Sight

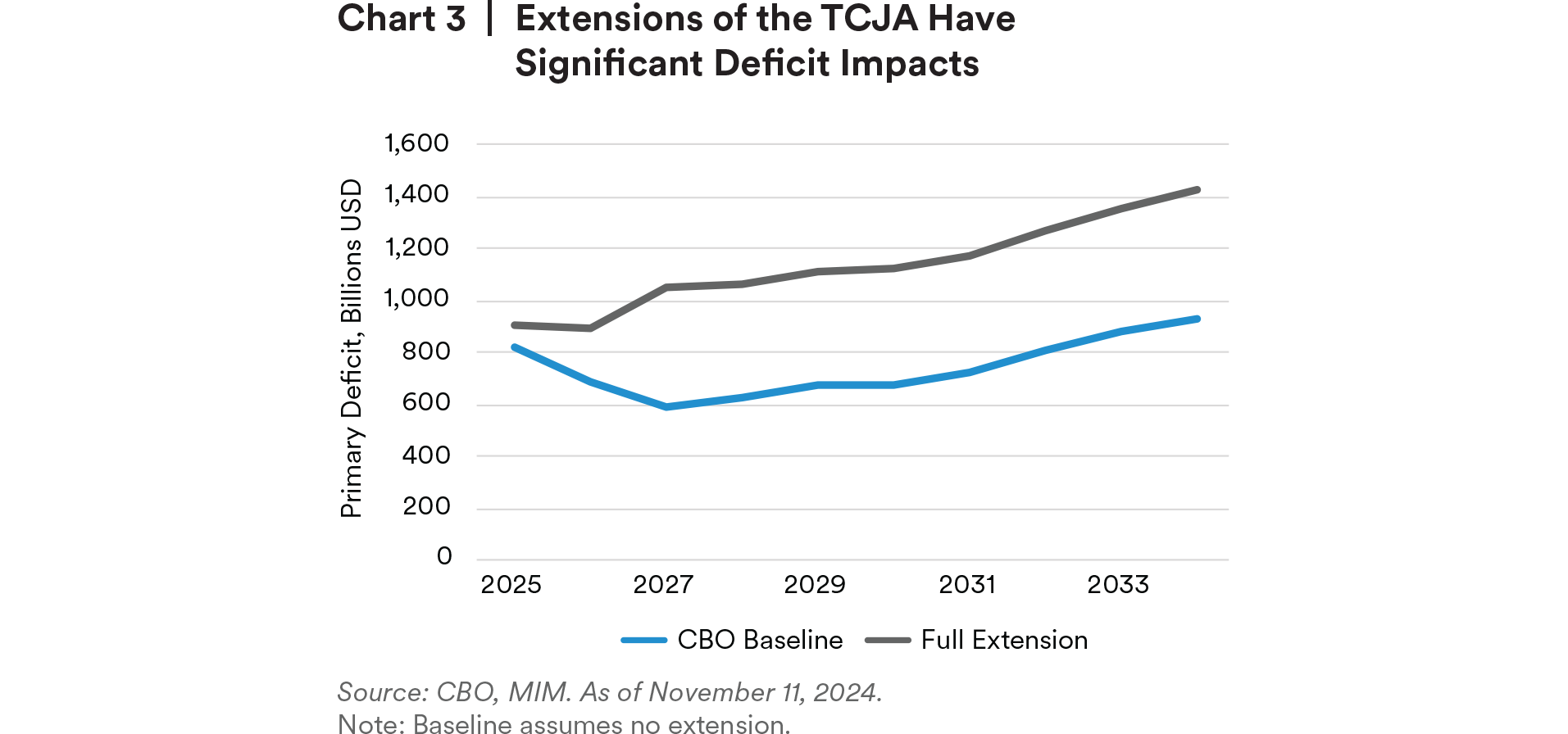

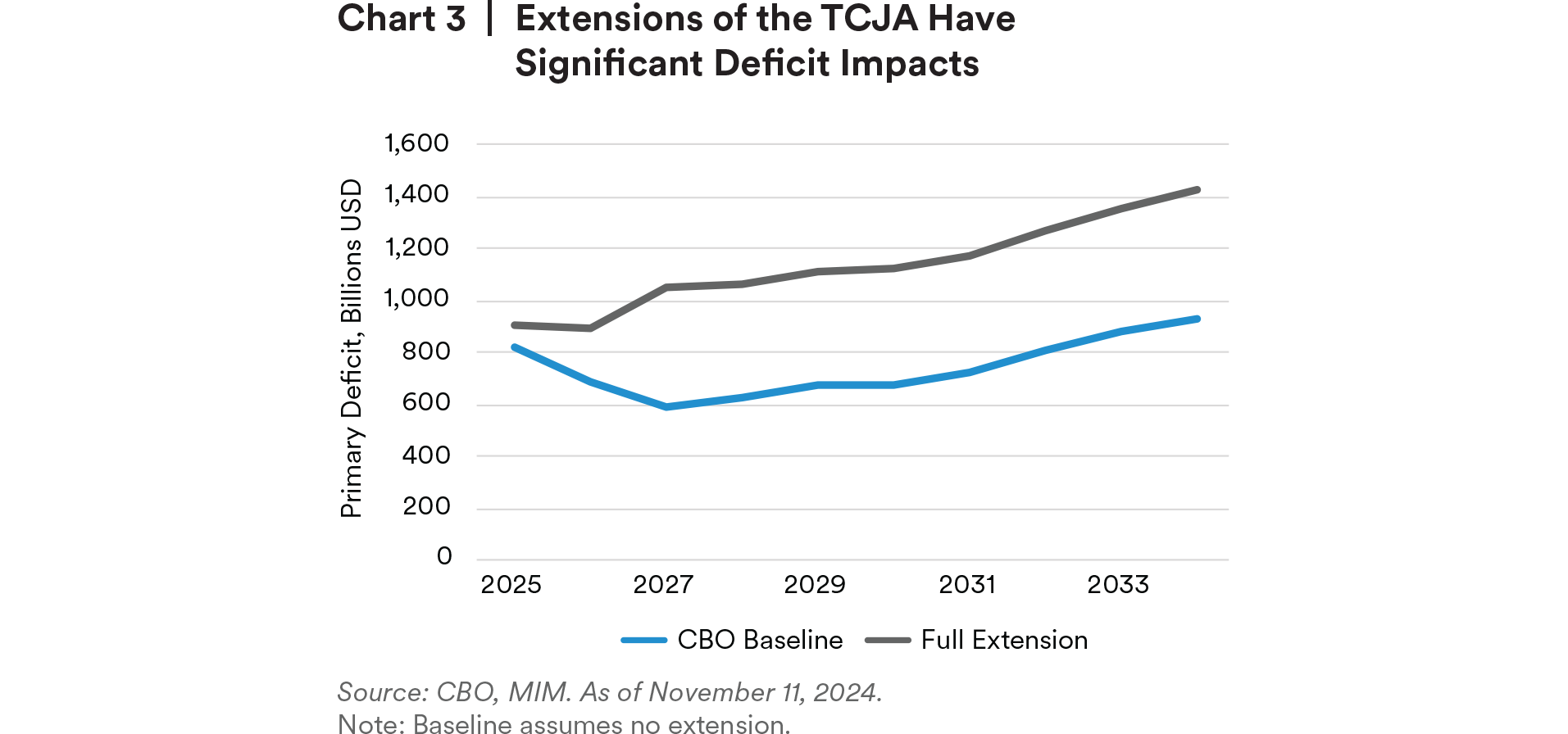

We expect Republican leaders to push for at least a partial extension of the Tax Cuts and Jobs Act (TCJA). A full extension of the TCJA is expected to cost $3-4 trillion, while a partial extension is estimated to cost $2-3 trillion. Effects on GDP are estimated to range from 0.15-1.1% over the next 10 years.2

The provisions of the TCJA that are expiring are weighted towards personal tax cuts, meaning they are less economically significant for future productivity growth and will not pay for themselves: research estimates that renewing these expiring provisions would pay for only 1-14% of their own cost.

Regardless of exactly which portions of the TCJA get extended, the GOP sweep means that we expect higher issuance, higher debt levels, and upside risk to yields going forward as they work to pass their priorities. The Penn Wharton Budget Model estimates President Trump’s policies to raise primary deficits by $4.1 trillion over the next ten years, although estimates may change rapidly as serious workable proposals emerge.

On a more positive note, although the debt ceiling is suspended until January 2, 2025, we do not anticipate a debt ceiling fight in 2025. Historically, debt ceiling debates/crises have taken place under a Democratic president and a Republican House of Representatives. We expect Republicans to raise or suspend the debt ceiling to smooth the way for their own budgets.

U.S. Outlook Summary

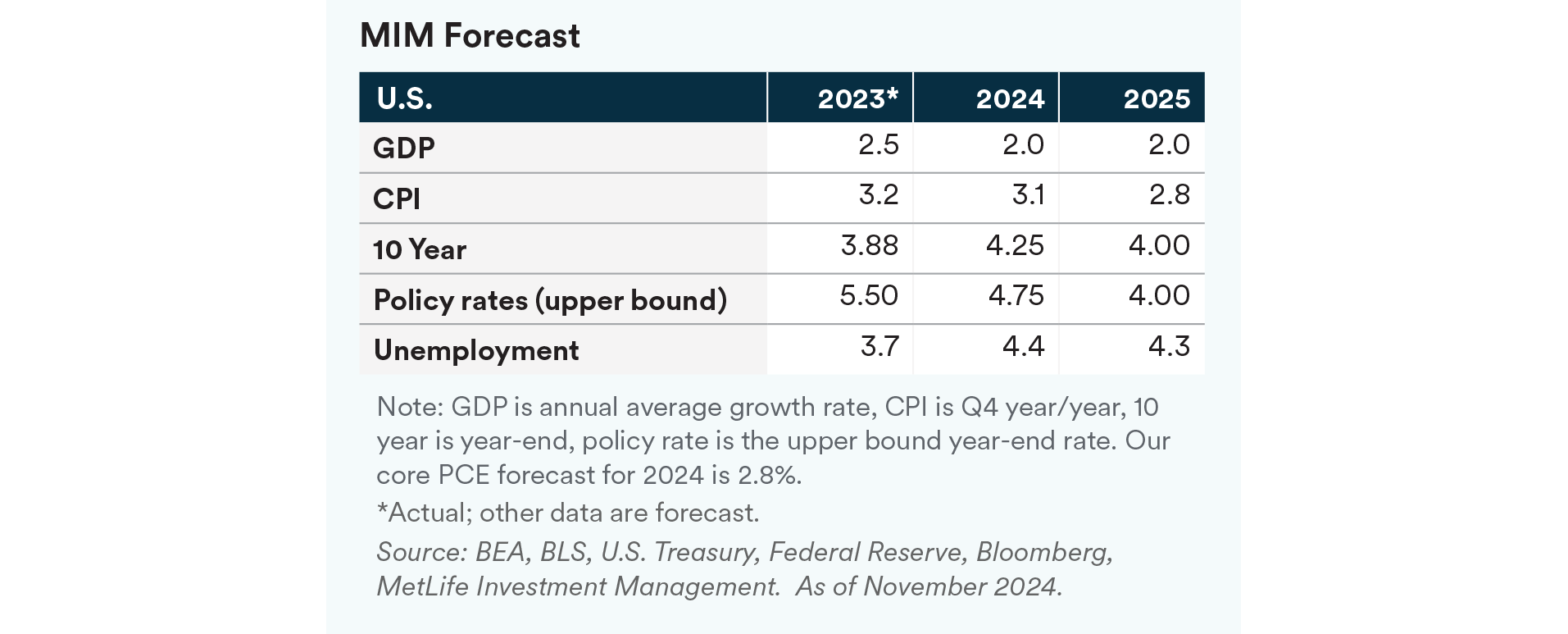

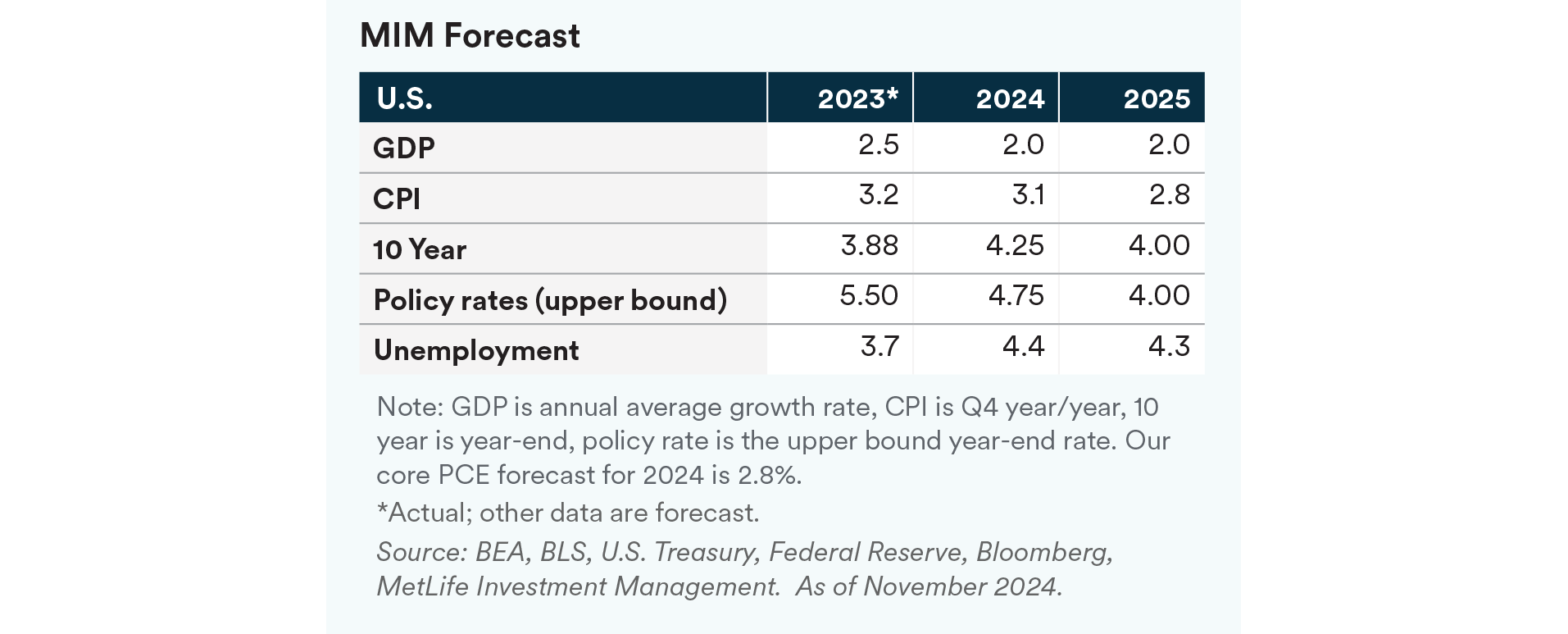

We expect growth in 2025 to be roughly on par with that of 2024, avoiding a recession and remaining at or slightly above long-term trend growth.

On the positive for growth side, with election uncertainty largely behind us, policy uncertainty has reduced, and we expect some improvements in corporate decision-making and investments as a result. Corporate profits remain robust, and could support an increase in investment. The BEA’s recent annual NIPA revisions show consumers are stronger than initially thought. Wages growth has remained stable.

On the negative for growth side, we expect the Trump Administration to begin implementing tariffs, which would likely be inflationary. We would expect government spending – a major supporting player in the recent growth story – to be pared back over the next 6 to 18 months.

On balance, these forces lead us to retain our pre-election forecast with no change.

We expect the Fed to continue to move slowly toward the neural rate by cutting approximately three times by year-end 2025. A deliberate pace fits with the Fed’s considerable uncertainty about where the long run neutral Fed Funds rate is, even as we expect inflation will take longer to converge toward 2%.

Risks

Risks to our forecast include the possibility of fewer cuts by the Fed, and that the 10-year yield remains elevated substantially above 4%. Our key concerns here include inflationary signals from tariffs causing the Fed to move more slowly, and expectations around greater inflation or stronger growth raising long term yields.

Endnotes

1. As calculated by Korea Institute for International Economic Policy.

2. Estimates of deficit and GDP effects from Penn Wharton Budget Model and the Yale Budget Lab. Baseline and full extension from the CBO.

Disclaimers

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK, this document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investmentadvice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”) a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414, a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1. As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.