Our 2024 thematic engagement focused on scope 3 greenhouse gas (GHG) emissions. This topic has risen in prominence in recent years because, in many sectors, scope 3 can account for the largest share of a company’s emissions.1 Additionally, with new reporting requirements being introduced in places such as the EU, Japan, Australia and California, scope 3 emissions will be an increasingly relevant topic going forward. Issuers face significant obstacles in reporting on their scope 3 emissions as well as reducing them. Through our thematic engagement, we sought to obtain insights into how issuers across both Fixed Income and Private Capital are tackling scope 3 emissions with respect to data availability, reporting, target setting and emissions reductions.

Overview of scope 3 emissions

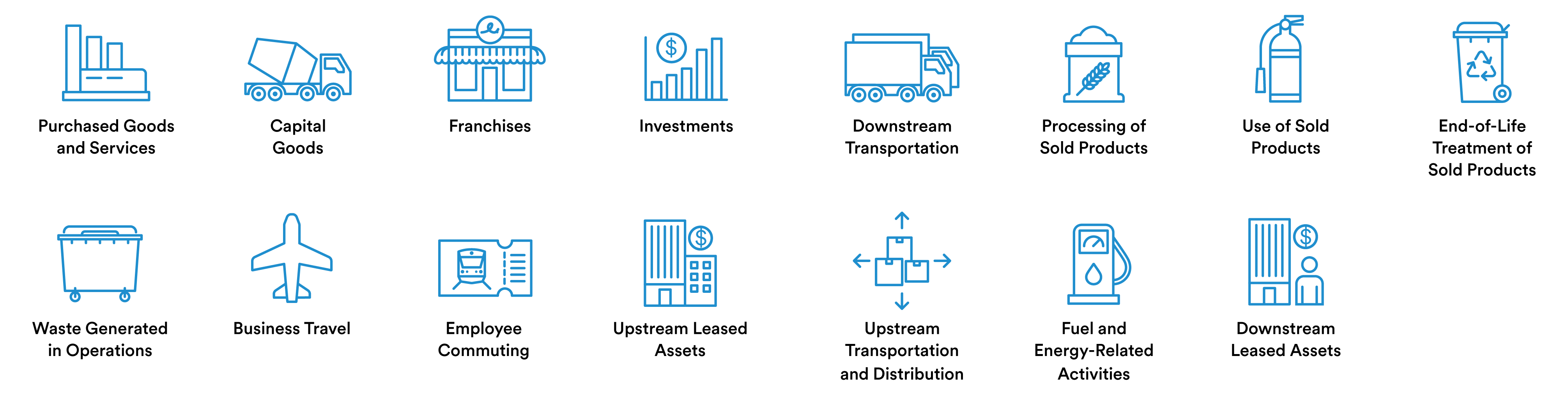

Scope 3 emissions are the indirect emissions that occur within a company’s upstream and downstream value chain, such as the emissions generated in the supply chain or from the use of the products a company sells. For example, for a car manufacturer, these emissions would include the fuel used to power the car once it has been sold to an operator, and the energy used to produce the materials used to make the car. The GHG Protocol’s Scope 3 Standard2 defines 15 categories within scope 3 emissions (depicted below). It is crucial for issuers to understand and quantify these emissions in order to develop robust decarbonization strategies.

The data and reporting for Scope 3 are currently more variable than for scope 1 and 2, as it is more complex to accurately measure emissions across an entire value chain compared to one entity’s own operations. The uncertainty around scope 3 reporting figures means there is currently a general lack of confidence in setting scope 3 emissions reduction targets and adequately tracking progress against these. We were therefore interested in engaging with companies across public and private markets to understand the challenges and opportunities regarding scope 3 emissions.

In this thematic engagement, we engaged with a range of primarily investment-grade public and private debt issuers from different sectors and regions, with a focus on those for whom scope 3 emissions represent the largest share of emissions. These included issuers that have already reported their scope 3 emissions as well as those that are yet to do so, giving us insights from issuers at different stages of data collection and disclosure. Our engagements addressed a common set of scope 3 considerations, along with tailored questions for each issuer. The Sustainability Research teams at MIM engaged with 38 issuers3 during this thematic engagement, and a number of key insights were identified.

Access to GHG emissions data in supply chains varies significantly across sectors and regions

One of the central challenges in reporting scope 3 emissions is the level of data availability. Due to this, issuers tend to use a “hybrid approach,” which prioritizes data collected directly from their suppliers and customers where available, before supplementing this with estimates to fill any gaps. Estimations can rely on i) activity-based data — the more accurate option — which is based on the nature and scale of activities in the issuer’s value chain, such as the tons of steel it procured, or on ii) spend-based data, which is based on the amount being spent on different products and services, such as the total amount spent on steel procurement.

For upstream scope 3 emissions, several issuers we engaged with are able to collect at least some data directly from their suppliers. However, this data is not always used in the scope 3 calculations due to concerns around data quality. As a result, several issuers that we engaged with are setting up processes to validate their collected data, before including it in their scope 3 calculations.

The availability of direct data for scope 3 upstream calculations varies significantly across sectors. It is linked to factors including the complexity of an issuer’s supply chain, its regional distribution and the type of product/service it sells. Some sectors provide a detailed level of emissions-related data. For example, companies in the aviation sector must disclose substantial data on flight time, fuel use and passenger numbers. This makes it easier for issuers to account for flight-related emissions in their value chain. Other sectors have specific challenges for calculating scope 3 emissions. For example, companies in the food and agriculture sector can have highly dispersed supply chains with inputs coming from a large number of small suppliers. This makes it difficult to obtain direct data because smaller companies may not have the resources to prioritize GHG emissions reporting due to the number of entities that need to be accounted for.

Regional differences are another factor driving differences in scope 3 data availability. Issuers whose supply chains are concentrated in regions with stringent sustainability regulations tend to have better access to upstream emissions data. The differences between regions are expected to increase as the Corporate Sustainability Reporting Directive comes into force in the EU, and other reporting regulations are introduced in the U.S., Australia and Japan, but other regions remain at earlier stages. Therefore, while regulation is expected to drive improvements in data availability in some locations, issuers will need to be proactive in order to access data outside of these regions.

Issuers are driving improvements in data quality by engaging with their suppliers and utilizing industry initiatives and technology

Companies aim to source more data directly from suppliers and customers, which is the gold standard in scope 3 data. Expanding the availability of such data requires collaboration between the issuer and entities within its value chain. Some issuers that we engaged with use voluntary supplier surveys to obtain more direct data. Additionally, several now include data requirements in their supplier policies and procurement processes. While these requirements are not always mandatory, they can be a way of starting conversations with suppliers and understanding where to focus engagement efforts.

Knowledge sharing plays an important role in promoting better emissions disclosures from suppliers. This can address the challenges around resource constraints and lack of know-how. Certain issuers we engaged with are supporting their suppliers in measuring and reporting on scope 3 emissions through educational programmes, workshops or other events. These efforts increase issuers’ access to robust data. Issuers noted that they see value-chain collaboration as an opportunity to get ahead on regulation, meet customer data requests and identify decarbonization opportunities.

When direct data is available from suppliers, issuers we engaged with highlighted that this needs to be assessed to ensure it has been calculated using an established methodology. However, some also noted that there can be room for flexibility in terms of what they require, with some data points being essential but others nice to have. This can be a way of obtaining sufficient data at a sooner date, rather than waiting for more advanced reporting further down the line if this is not crucial.

Industry initiatives are another factor driving improvements in data quality and availability. They provide guidance on emission reporting for specific value chains, creating synergies and cost efficiencies across issuers. For example, issuers in the financial sector benefit from established frameworks for calculating financed emissions, such as PCAF, as well as sector-specific frameworks like the Poseidon Principles.4 Other sectors have joined together to gain better disclosure, such as U.S. electric utilities with the Sustainable Supply Chain Alliance, which jointly surveys suppliers on behalf of the 27 alliance members.

Some issuers highlighted the benefit of newer technologies in improving their access to data, such as smart-metering systems for real estate firms. In addition, issuers with more advanced scope 3 estimation methodologies are exploring the use of new tools to enhance the accuracy of their estimation models in cases where direct data is not available. One example noted was the use of cameras and software to monitor the volume and type of transport being used at an issuer’s sites.

Issuers are taking steps to reduce scope 3 emissions, especially in sectors and regions with increasing GHG emissions regulations

Many issuers we engaged with are taking action to reduce scope 3 emissions. Several issuers have set decarbonization targets covering their scope 3 emissions, while others are at earlier stages due to a lack of reporting or data quality issues. Nonetheless, it was encouraging to see that data limitations are not obstructing issuers from addressing their scope 3 emissions.

Leading issuers we engaged with highlighted that internal collaboration across departments is important for achieving scope 3 emissions reductions. Sustainability teams often need to work together with procurement, capital program teams, as well as product design teams and others to access relevant data and prioritize lower carbon inputs. Considering the complexity of scope 3 emissions, a holistic approach needs to be taken to reduce them. This inherently requires contributions from multiple areas across each organization.

To reduce upstream scope 3 emissions, some issuers have introduced responsible sourcing guidelines. Several have also established responsible sourcing teams to focus on greener materials and supplier engagement. Procuring very low-carbon products is not always straightforward, however, as they can entail green premiums, which may be hard to pass on to customers. Issuers highlighted a few ways to address this in the short term. These included working closely with the procurement team to place low-carbon products as a default within product/project specifications wherever possible, collaborating with other buyers to achieve economies of scale and targeting the client segments with the greatest demand for green products. For the most challenging cases, issuers noted that regulation was likely to drive greater uptake of low-carbon products. One such example is the European Union’s Carbon Border Adjustment Mechanism, due to come into effect in 2026, which will impact the price of carbon intensive inputs from affected sectors including iron and steel, cement, aluminium, fertilizers and electricity.5

Issuers are also using engagement as a tool to reduce supply chain emissions. Several issuers are asking suppliers to set science-based targets and to set out their decarbonization strategies. These engagements are met with a variety of reactions, largely determined by the maturity of each supplier’s sustainability strategy. There is recognition from the issuers that, while progress is materializing, it will take time to see large-scale benefits from these engagements.

It is essential to acknowledge that scope 3 emissions are also impacted by external factors such as sector developments, economic cycles, regulations and customer demand for lower carbon products and services. As such, there must be an understanding that these emissions are unlikely to follow a linear reduction pathway. It is important for companies to take steps to measure and reduce their scope 3 emissions, but these actions must be assessed within the boundaries of what can be reasonably expected.

Conclusion

Scope 3 reporting is currently challenging for many companies for a variety of reasons. However, we found that all the issuers we engaged with are working to increase their access to data and ultimately to reduce their scope 3 emissions. Scope 3 is a topic of growing importance and through this engagement, we have identified a number of themes that will be particularly relevant going forward. Firstly, it is important for issuers to engage throughout the value chain and with industry initiatives in order to access scope 3 data and promote data availability. Further, collaboration within companies and between companies is critical for enhancing scope 3 data, disclosure and decarbonization. Thirdly, technology has significant potential to improve data availability and accuracy across a variety of sectors. Regulation is a key factor that is increasing reporting standards, but this is not the case for all regions, and issuers will need to be proactive to obtain broad scope 3 data coverage. Finally, there is a continued commitment from many issuers to measure, report and reduce their scope 3 emissions, and it will be important to monitor how these efforts materialize.

Endnotes

1 https://cdn.cdp.net/cdp-production/cms/guidance_docs/pdfs/000/003/504/original/CDP-technical-note-scope-3-relevance-by-sector.pdf?1649687608

2 https://ghgprotocol.org/corporate-value-chain-scope-3-standard

3 Of these engagements, 18 took place via virtual meetings and 20 were via email.

4 https://www.poseidonprinciples.org/finance/

5 EU carbon border adjustment mechanism

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.