Emerging Markets (EM), similar to other risk assets, continue to be impacted by a strong dollar, rising rates to fight stubbornly high inflation, unfriendly market policy decisions out of China along with the Russian/ Ukrainian war. Central banks globally have been aggressively increasing rates to combat soaring inflation which in turn has increased the probability of recession, adding to market volatility and uncertainty. China’s Zero-COVID policy, common prosperity ambitions, and continued commitment to reducing leverage has resulted in slower growth, increased unemployment, and declining asset values that have weakened consumer sentiment and growth expectations. Meanwhile, Europe’s historic reliance on cheap natural gas will prove problematic as the Russia/Ukraine conflict rages on. The impact on growth and inflation this winter remains unknown, with elevated natural gas prices amid tight supply.

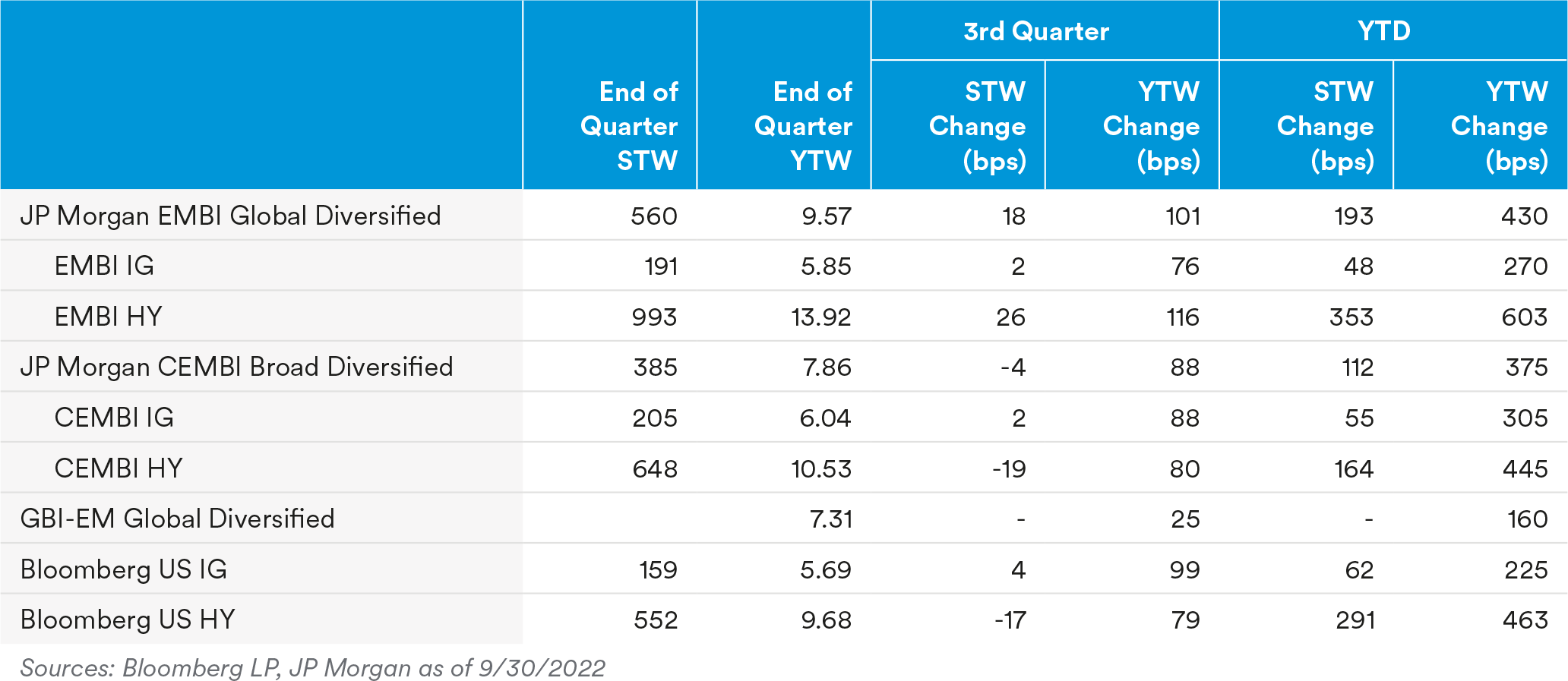

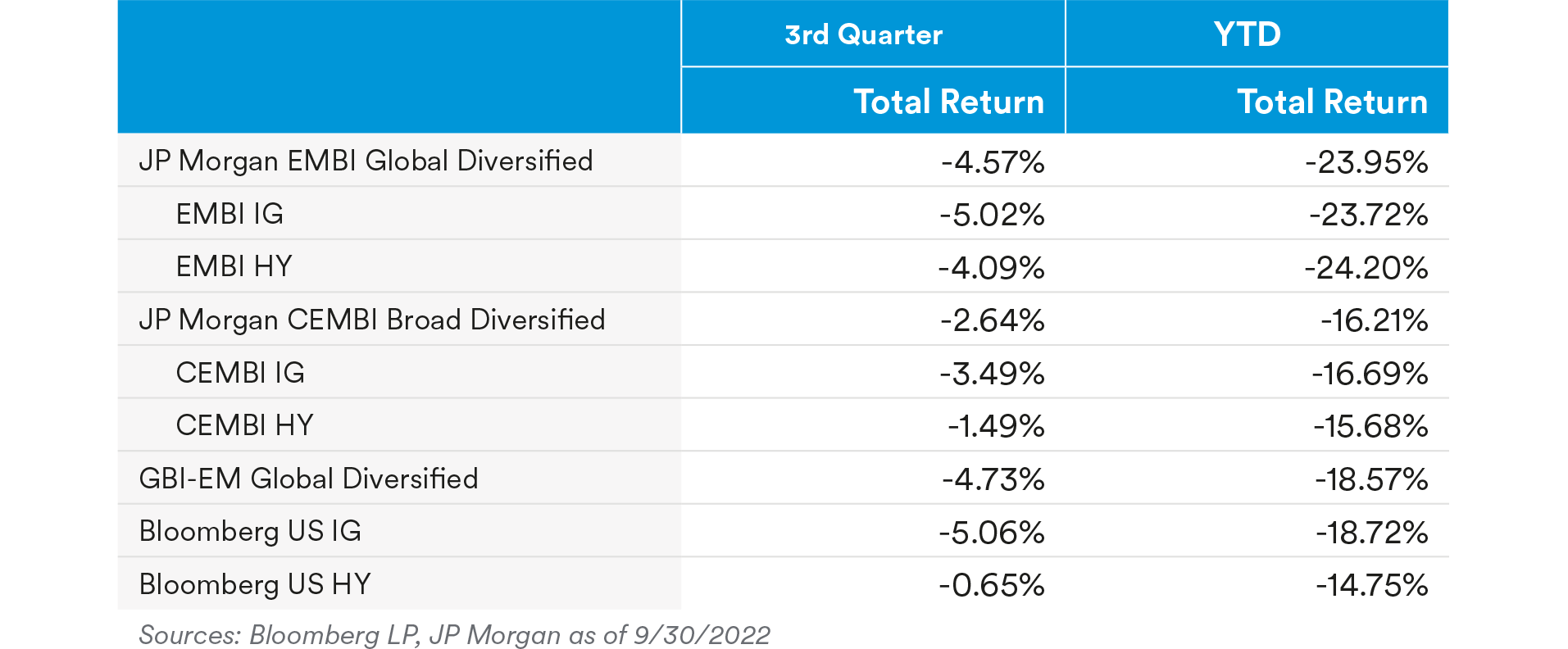

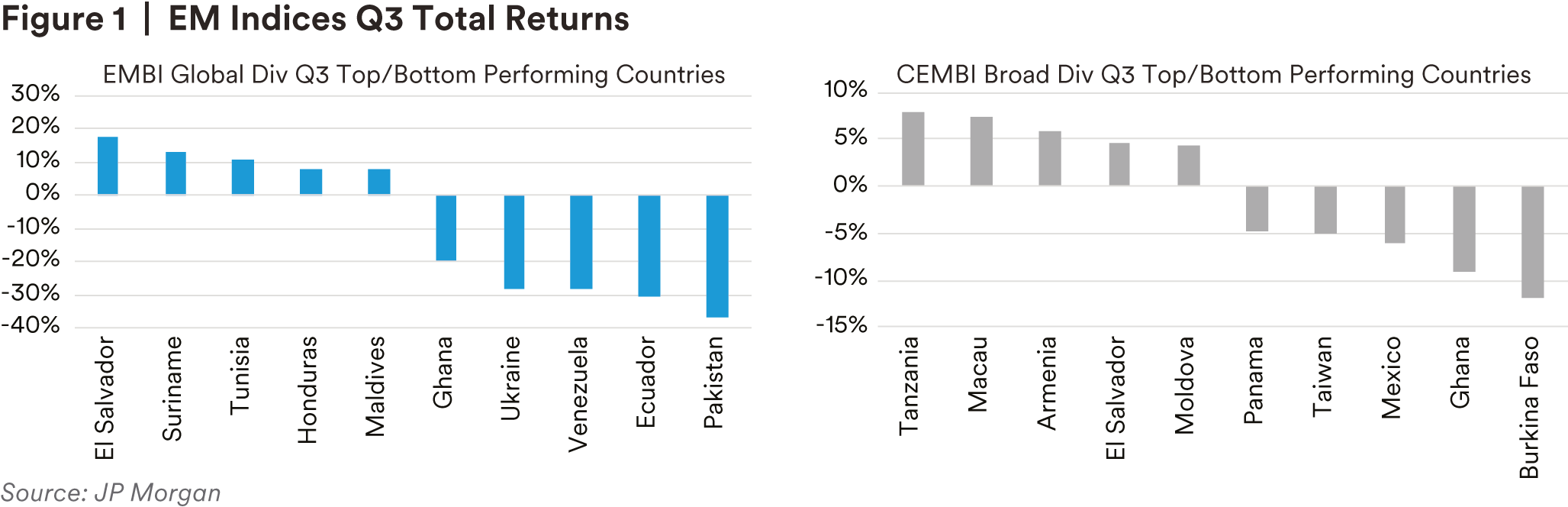

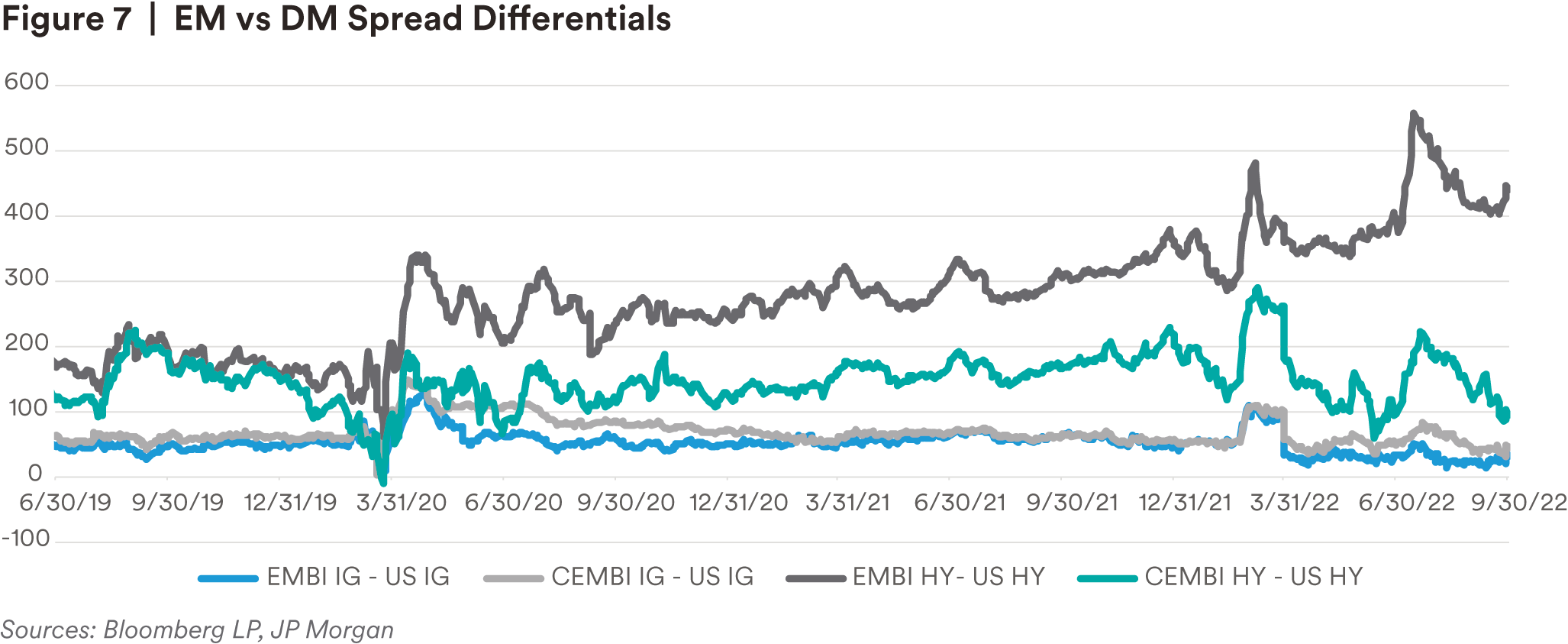

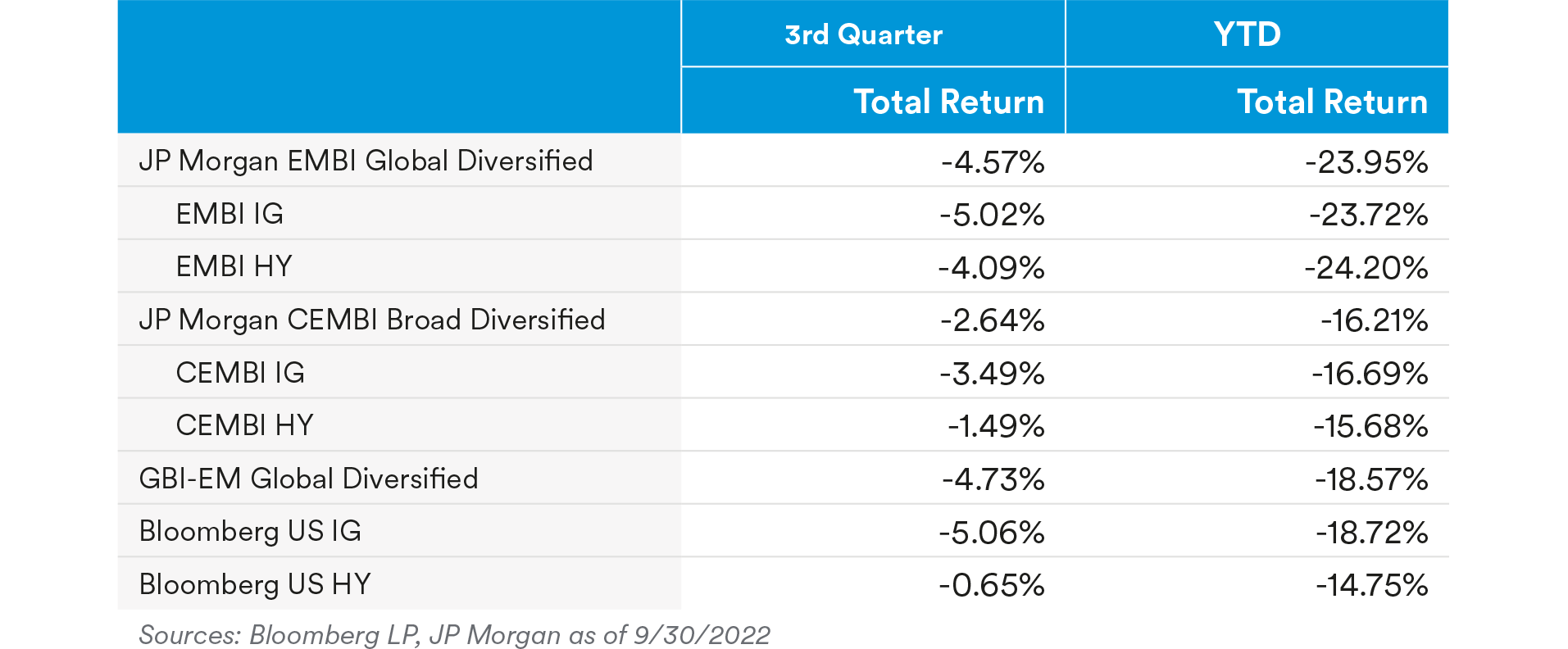

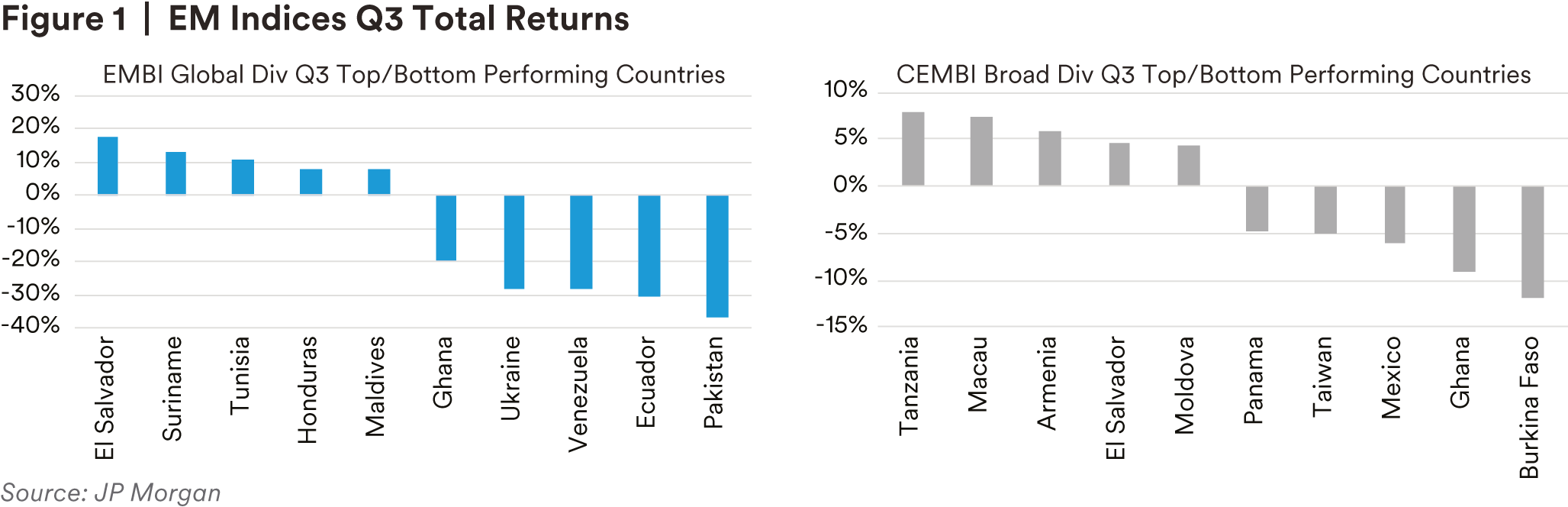

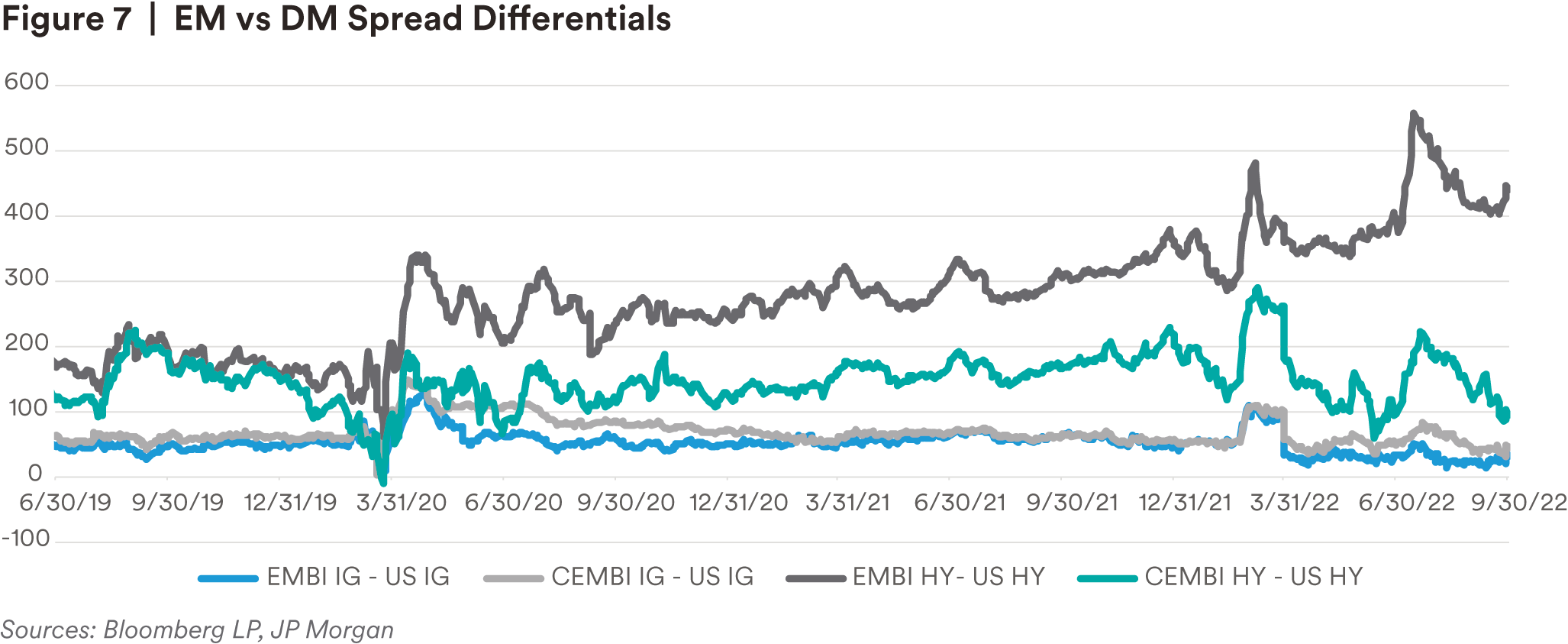

These macro factors continued to negatively impact risk assets during the quarter through a combination of an aggressive treasury sell-off resulting in higher absolute yields along with spread widening. When compared to Developed Markets (DM), the Investment Grade (IG) EMBI Global Diversified (EMBI GD) performed in line, while the IG CEMBI Broad Diversified (CEMBI BD) outperformed driven by less spread widening and shorter duration. Both High Yield (HY) EMBI GD and HY CEMBI BD underperformed DM. The overall EMBI GD returned –4.57%, with high grade pressured by rates while high yield experienced more extreme spread widening. This spread widening was driven primarily by single-B and below rated sovereigns that face the most pressure as slowing global growth and a dysfunctional financing market keeps pushing them to seek more external support to meet financing needs. Strong balance sheet fundamentals in the EM corporate space, along with a significant decrease in net financing have been relatively supportive for the asset class. The CEMBI BD returned –2.64%, mostly attributable to the rate move that was partially offset by spread tightening in high yield. The risk off market tone during the quarter resulted in a strong dollar and a further widening of local rates driving down the GBI-EM Global Diversified –4.73%.1

IMF support has continued to be robust across distressed countries. Ukraine has received immediate support from the IMF as well as working on a long-term program to address the war-stricken country’s needs. Countries like Kenya, Ecuador and Costa Rica remain well engaged with the fund while others like Ghana, Egypt, and Sri Lanka are in the process of negotiations with the Fund. With the approval of the food shock window, the newest emergency-finance instrument, nations will receive support with urgent balance of payments needs. This measure comes after the IMF warned that the world is facing the worst food shock in over a decade, and likely to worsen due to supply bottlenecks, challenges to Ukraine’s crops, and high prices of fertilizers and energy.

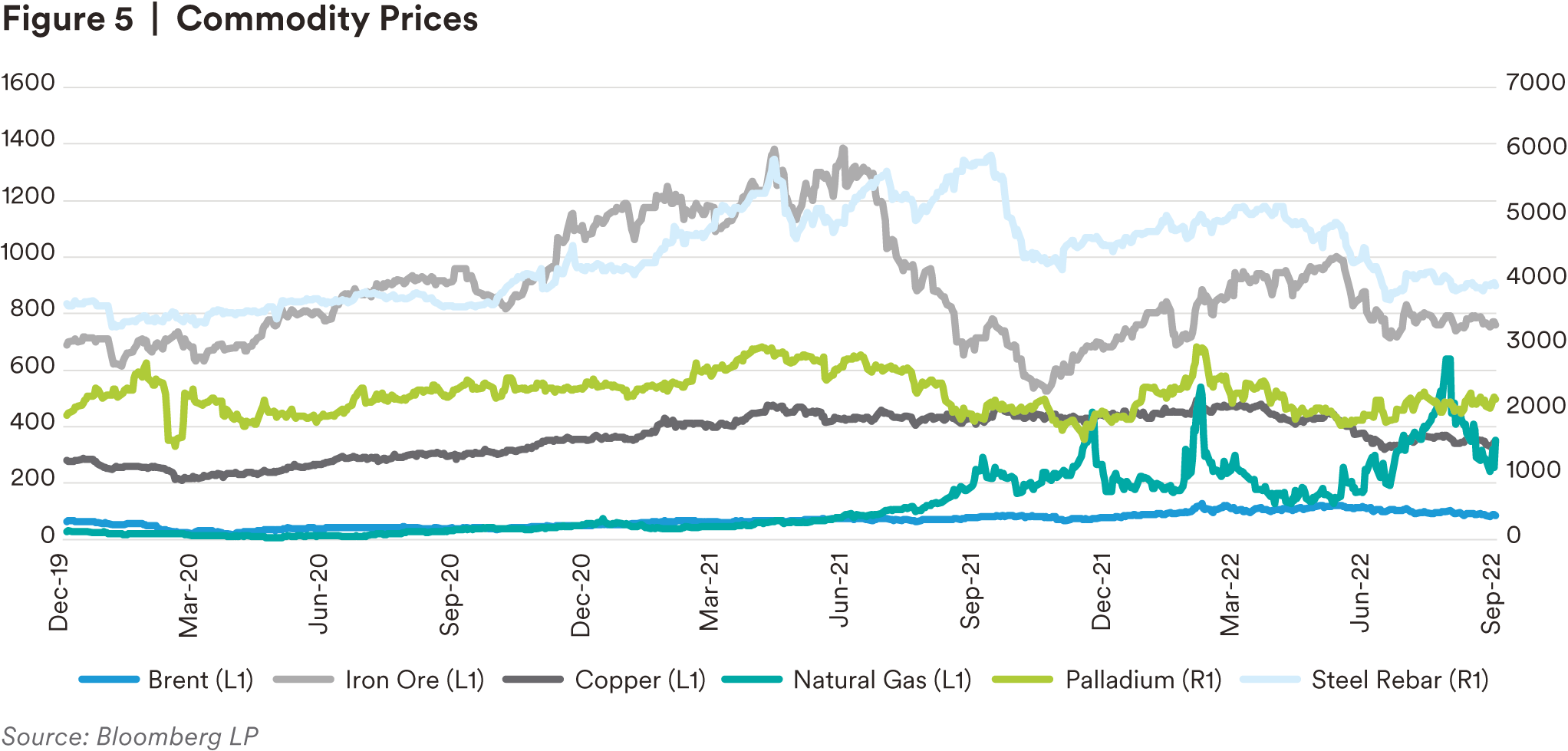

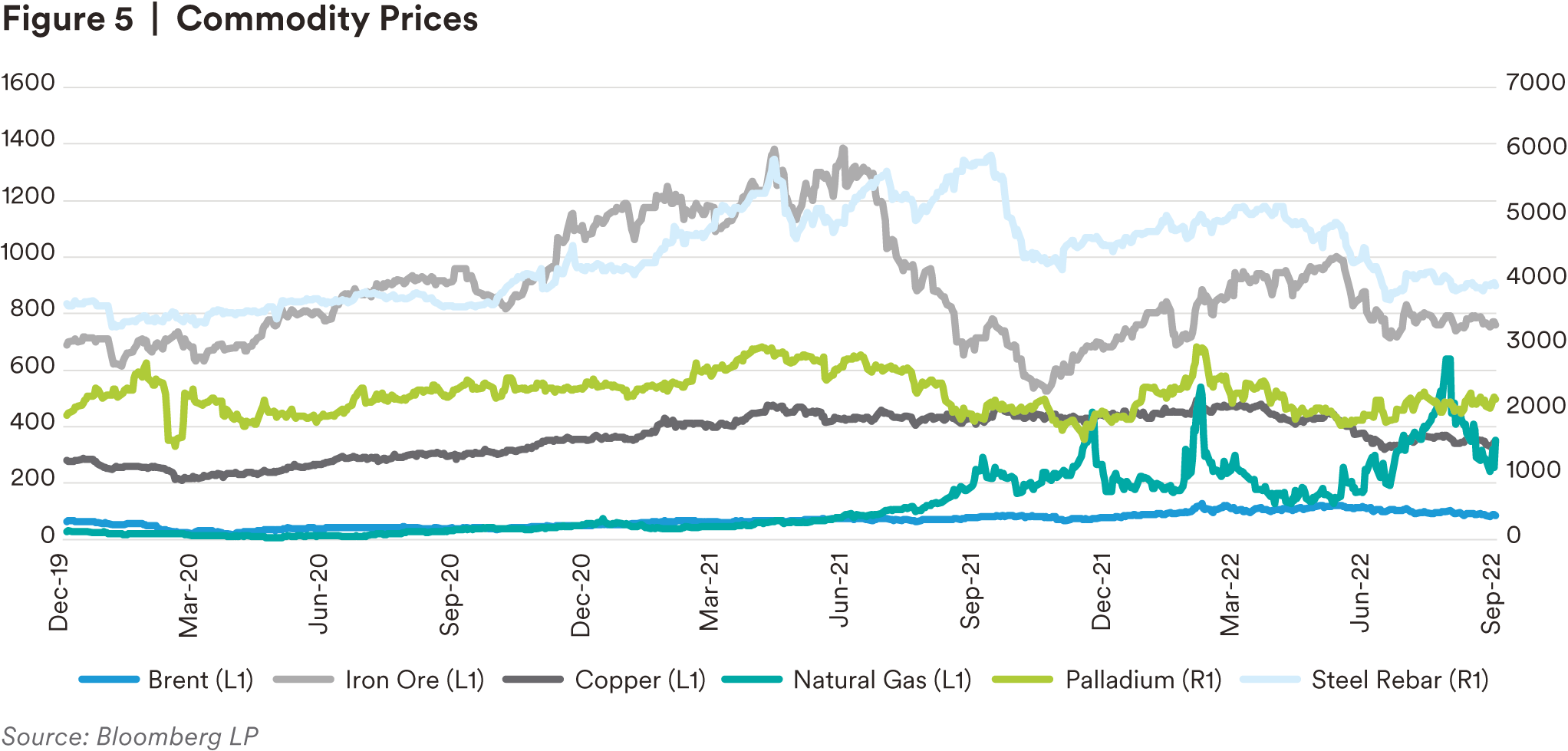

We have seen dampening of commodity demand due to recession concerns, with commodity indices down 25% from their peaks in June. Fed rate hikes, EU’s gas crisis, and the Zero-COVID policy-related malaise in China all point to a weaker cyclical outlook. This has reversed some previous strength that commodity exporting countries recently experienced. Yet, with Brent still sitting above $80/barrel, EM energy exporters’ current accounts are continuing to benefit. OPEC+ recently announced a cut to oil output by over 2 million barrels/day in order to support oil prices, sending yet another signal of slowing global growth concern.

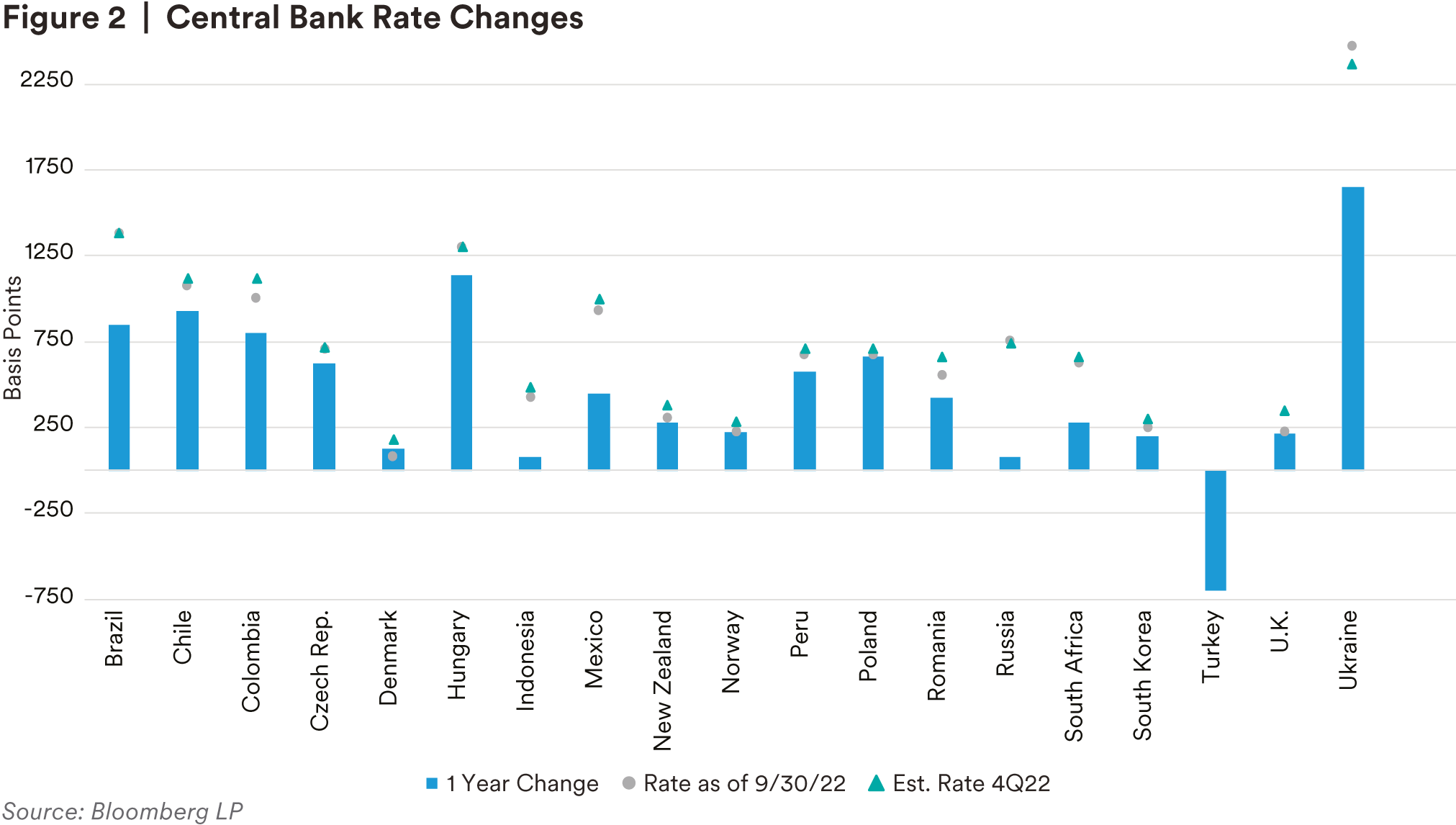

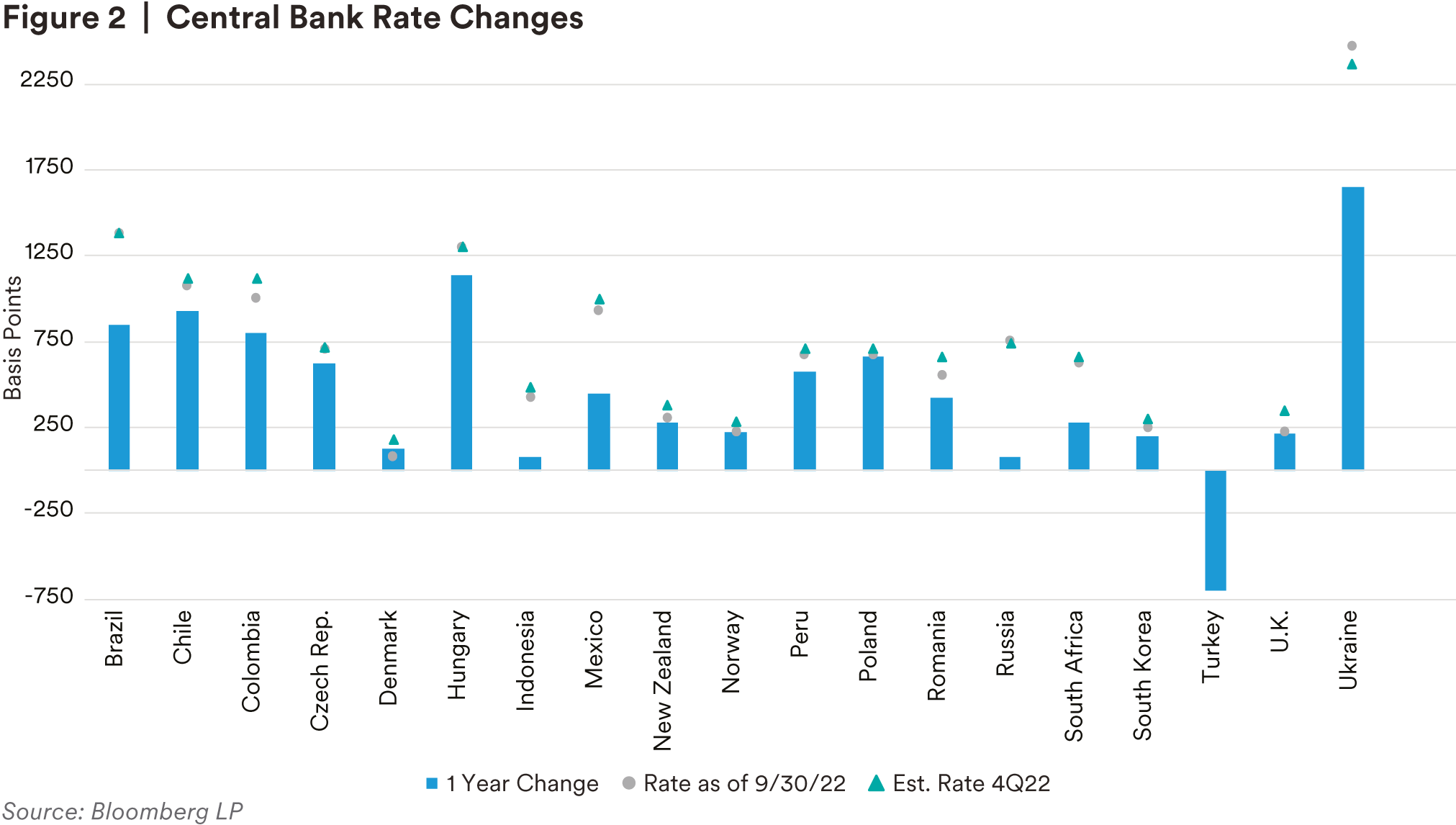

Both DM and EM countries aggressively hiked rates during the quarter as inflation levels failed to subside. The Fed has continued a hawkish stance, promising to continue hikes for the time being. Alternatively, other DM countries have been somewhat more dovish, with the Bank of England fearful of pushing the fragile European economy into a recession. The Bank of Japan has remained dedicated to their yield curve control, which has presented consequences amid rising costs, a weakening currency and slowing global demand. The low interest rate strategy has contributed to rising prices and dramatically decreased the value of the yen. In Emerging Markets, which were quicker to start hiking during the COVID-19 recovery, we have seen signs from central banks that hiking cycles are nearing their end. Some countries are now implementing measures to avoid FX depreciation rather than more rate hikes as pressure is placed on policies.

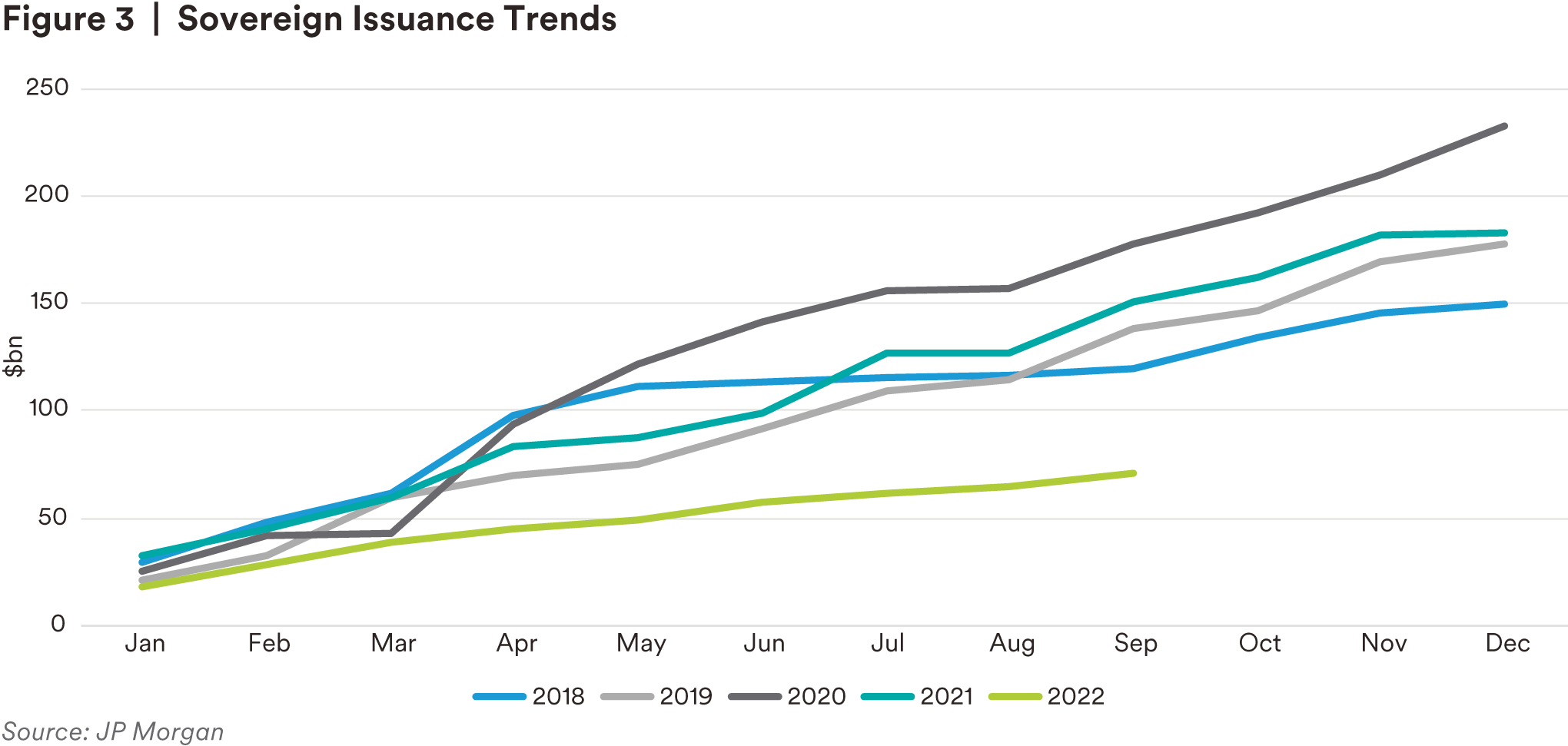

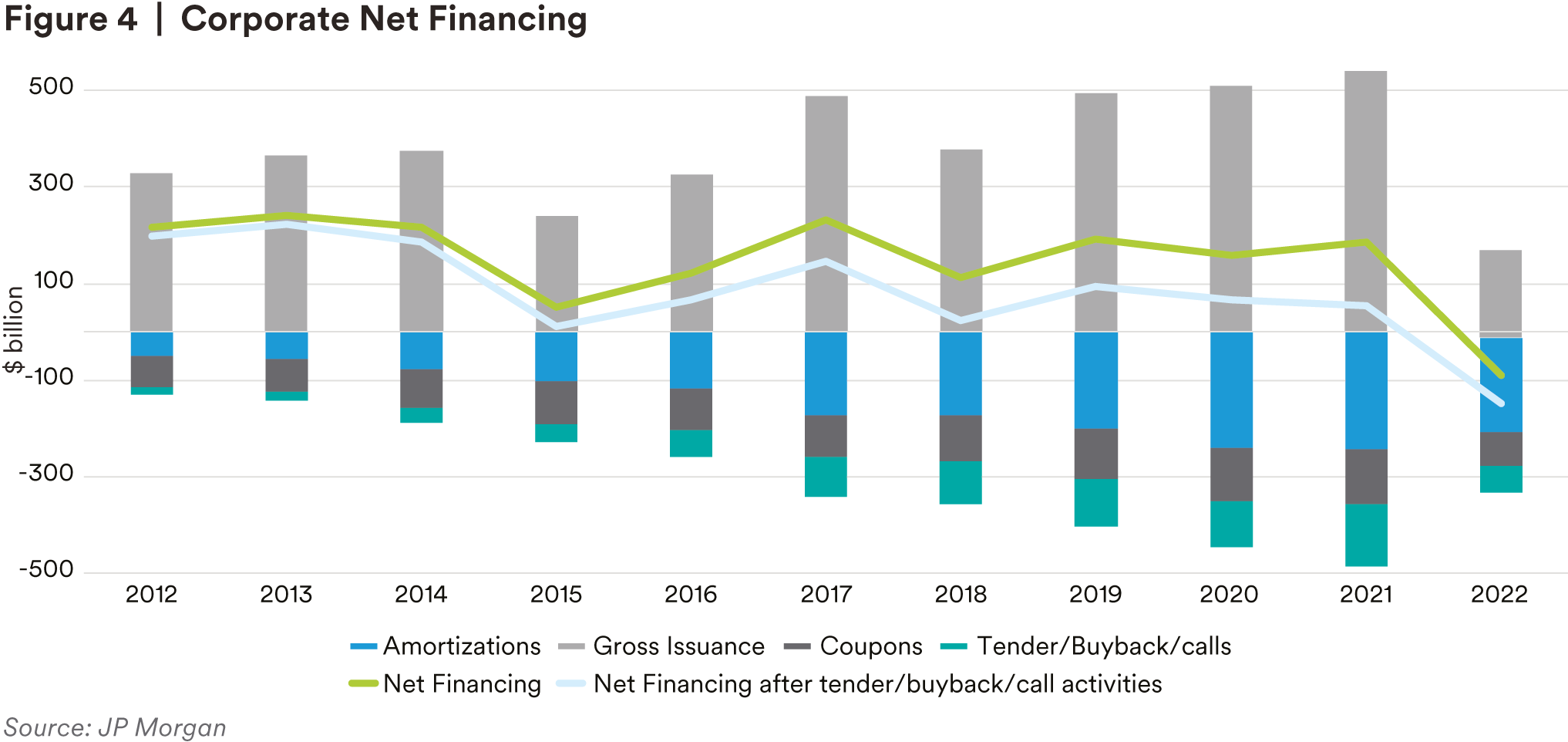

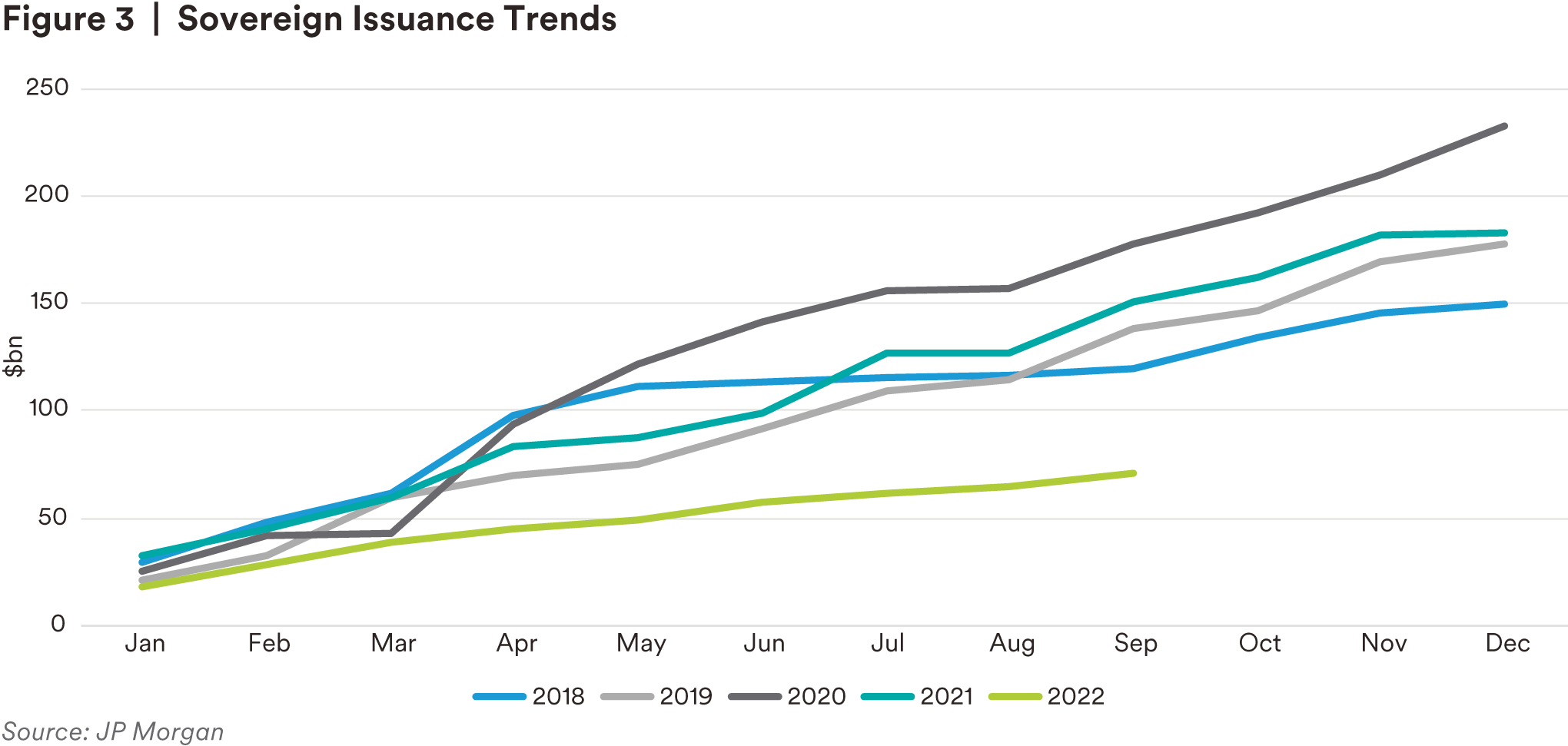

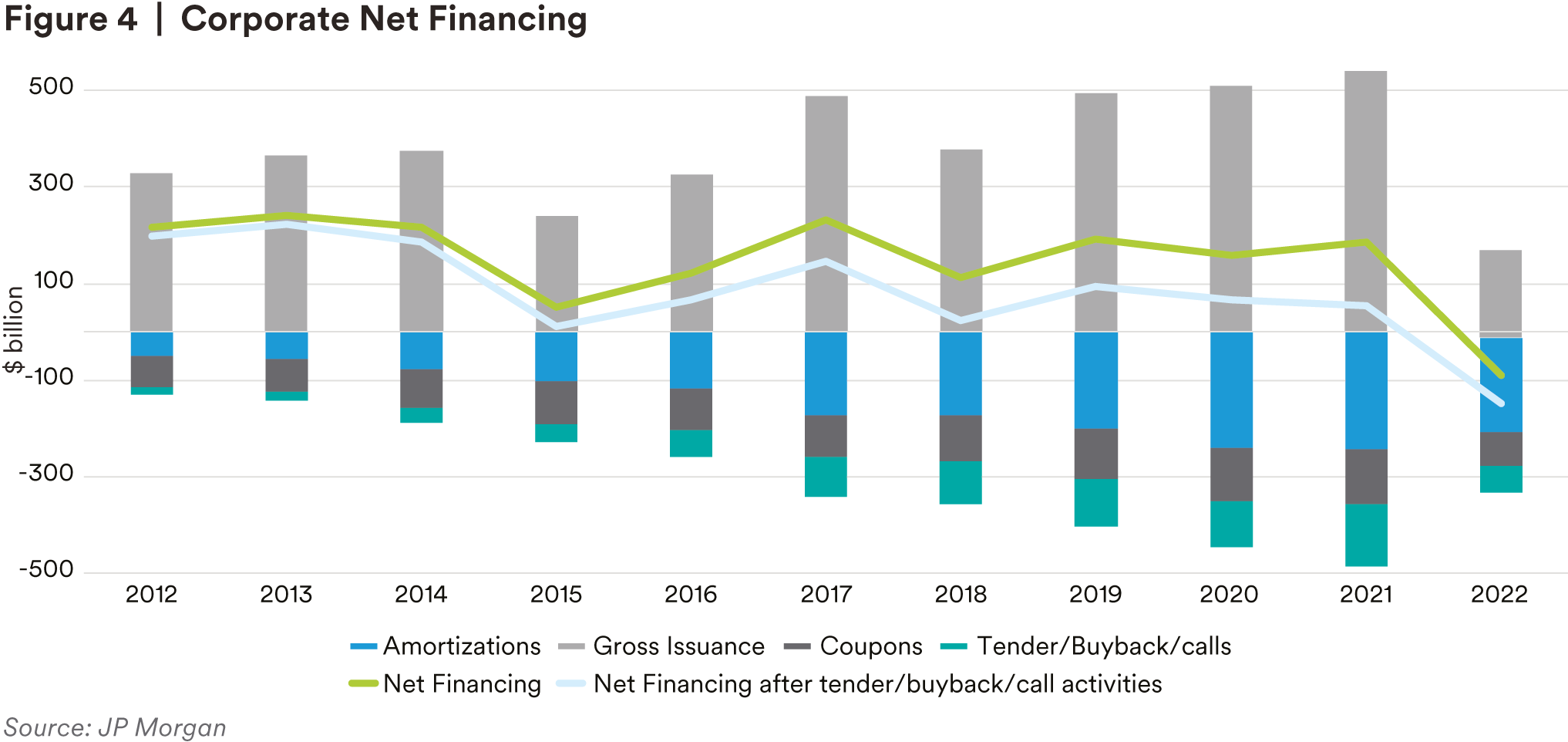

As we head into the final quarter of the year, issuance has not kept pace with expected annual levels. The lack of primary deals since the end of summer has been exacerbated by volatility and the rising rate environment. Issuers have remained selective on coming to the primary market, with some lower quality issuers currently losing access to the market and the cost of issuance becoming more expensive. Year-todate (YTD), HY EM sovereign issuance is at the lowest level since 2008 with only $19.8 billion of issuance, and total issuance is on pace for the slowest year since 2015. Corporate gross supply is running at an 11-year low, with net financing reaching a new all-time low. IG EM corporate issuance is at a record high of 79% of total issuance YTD, further supporting the inability of lower quality issuers to come to market in this environment. Positively, corporates are not as strained for funding given their continued work on liability management over recent years. Sovereigns have been able to access local market funding as an alternative to issuing in the dollar market, reducing their external financing needs, but at a higher cost and potentially crowding out local private sector issuers. Additionally, commodity exporters, including the large majority of GCC countries, do not need to issue as oil remains above their fiscal budgets. Outflows continued to pressure EM bond prices as investors were forced to raise cash to fund client drawdowns. Hard currency funds have witnessed YTD outflows of $36.3 billion and local currency outflows of an additional $33.7 billion.2

Despite overall slow supply, Green, Sustainable, and Social (GSS) issuance continues to be top of mind. YTD corporate GSS issuance has risen to 30% of total issuance, while sovereign GSS supply has slightly declined to 13%. This trends well above the US High Grade level of 4.8% of total issuance. Historically “greeniums” on GSS bonds have existed over traditional securities; however, when markets are under pressure this premium has been slightly diluted, giving investors opportunities to participate in GSS securities at more attractive levels than historically. More traditional EM investors are involved in GSS investments than ever before, with the share of GSS EM corporate bonds in traditional portfolios growing to 8.4%, up from 6.4% at the end of 2021.3

Chileans rejected the proposed New Constitution by a wider-than-expected margin of 62% vs. 38%. The participation rate of 87% of registered voters was notably larger than the already high rate from the 2nd round presidential elections in 2021, showing broad disapproval of the proposal across the country. Chileans want a stronger welfare state that guarantees wider access to better public services including healthcare, education, and pensions. The Brazilian first round presidential election resulted in a better turnout for Bolsonaro than expected, depriving Lula of a first-round victory. Lula took 48% of the votes, while Bolsonaro reported 43%. This will likely force Lula to moderate his positions further going into the October 30th second round.

The China growth story continues to leave markets uncertain, coupled with the stress on the China property space. Recent liquidity enhancements coupled with reopening announcements and relaxation of travel requirements for the country have been positive indicators for economic recovery. China recently announced a tax incentive to spur home purchases, with residents who buy a new home within one year of selling their old home receiving refunds for personal-income tax. In the property space, companies received state guarantees on local debt sales that helped temporarily ease some concerns; however, no further signs of support have caused bonds to reach new lows as pressure on issuers continues.

Russian President Vladimir Putin’s move to draft 300,000 reservists to reinforce his troops in Ukraine triggered protests around the country, the biggest since the early days of the war, and conscription-age men rushed to find ways to flee. A week later, Putin delivered a speech announcing the annexation of four regions of Ukraine, a dramatic step in the opposite direction of a path to peace. In the most anti-Western rhetoric yet, he criticized the West and called on Ukraine to stop fighting and negotiate, reiterating that the four annexed oblasts would be forever Russia’s.

Outlook:

Investing in EM in the current environment remains challenging, aggravated by limited liquidity and a hawkish Fed. Macro factors led by the Russia/Ukraine War, global inflation, and China growth are driving recent risk-off appetite, steering asset valuations, and overshadowing EM fundamentals. These macro headwinds are significant for assets; however, the buffers across many EM corporates and sovereigns are substantial and underrealized. Corporates have priced in downside risk but remain hostage to elevated sovereign spread levels that are weighed down by global factors. As we begin to see clarity on the macro side, we expect stability in spreads and a repricing to better reflect fundamentals, supporting the overall EM asset class and risk appetite. We believe that the macro landscape will remain the primary driver of a bullish or bearish course for EM fundamentals and asset returns over the coming 2-3 quarters.

Latin American countries are being forced to moderate their political tone to receive enough support from both sides to get policies passed. The Brazilian presidential candidates are likely to moderate their stance further before the October 30th second round election in order to gain more center votes. The Chilean New Constitution has gone back to the drawing board to appeal to a broader audience to get the approval votes needed. Balance of power in Peru has limited leftist president Castillo as he lacks support from his congress on more radical proposals. It remains important to monitor how this leftist shift develops in the region, paving the way for sovereign political and economic stability.

The recent weakening of foreign currencies has exerted downward pressure on commodity cost curves. With US interest rates at high levels, commodities have been caught in a negative loop between higher US rates, US dollar appreciation, and weaker non-US economic growth largely from Europe and China.4 Commodities including nickel and aluminum will likely continue to face near-term pressure from slowing demand, rising supply, and inventory dislocations. Yet we believe that supply constraints in most commodities should support fundamentals, especially in grains, crude, and copper, further supporting EM exporters. The energy crisis in Europe has added additional pressure to energy levels as Europeans brace for the winter months, with uncertainties over Nord Stream pipeline supplies from Russia persisting.

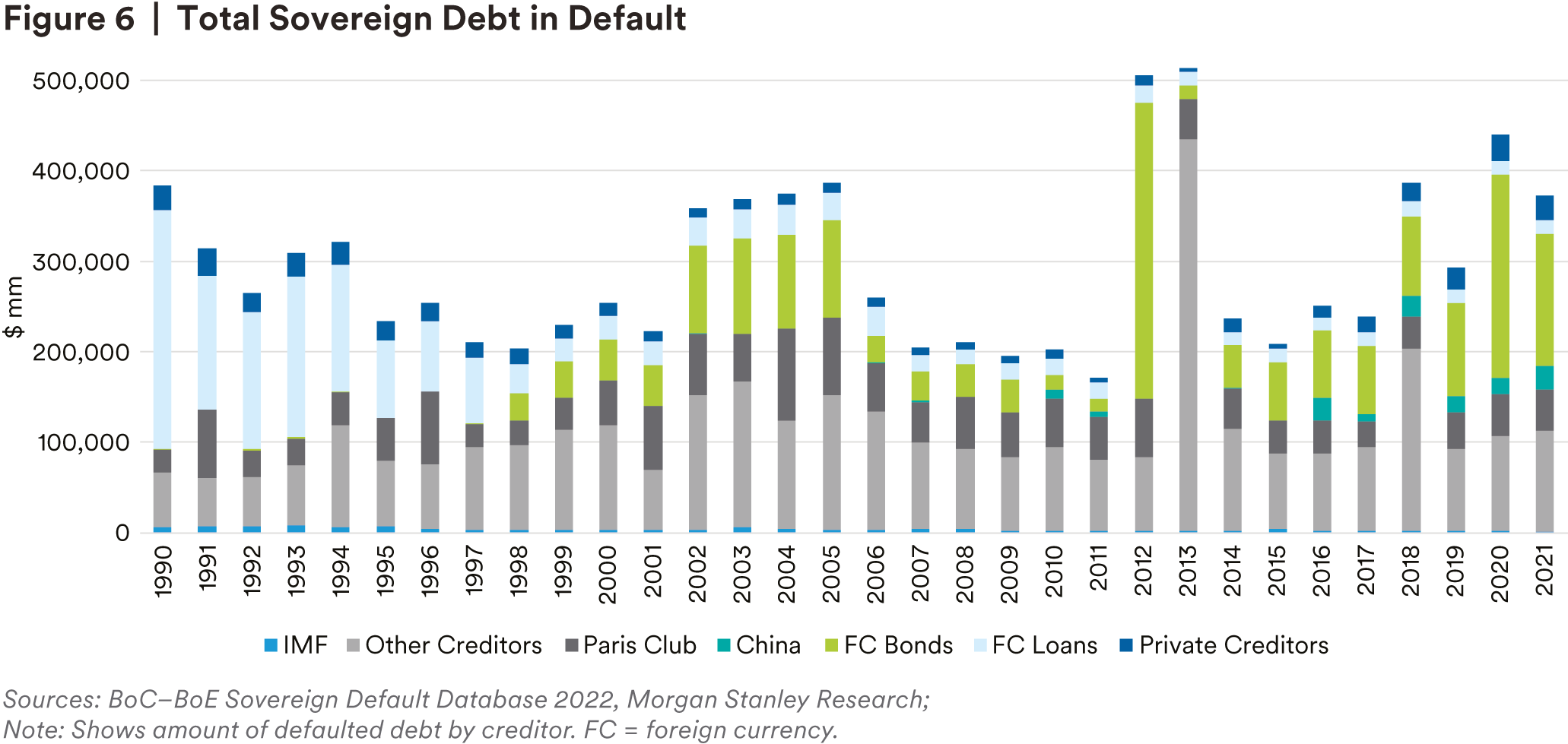

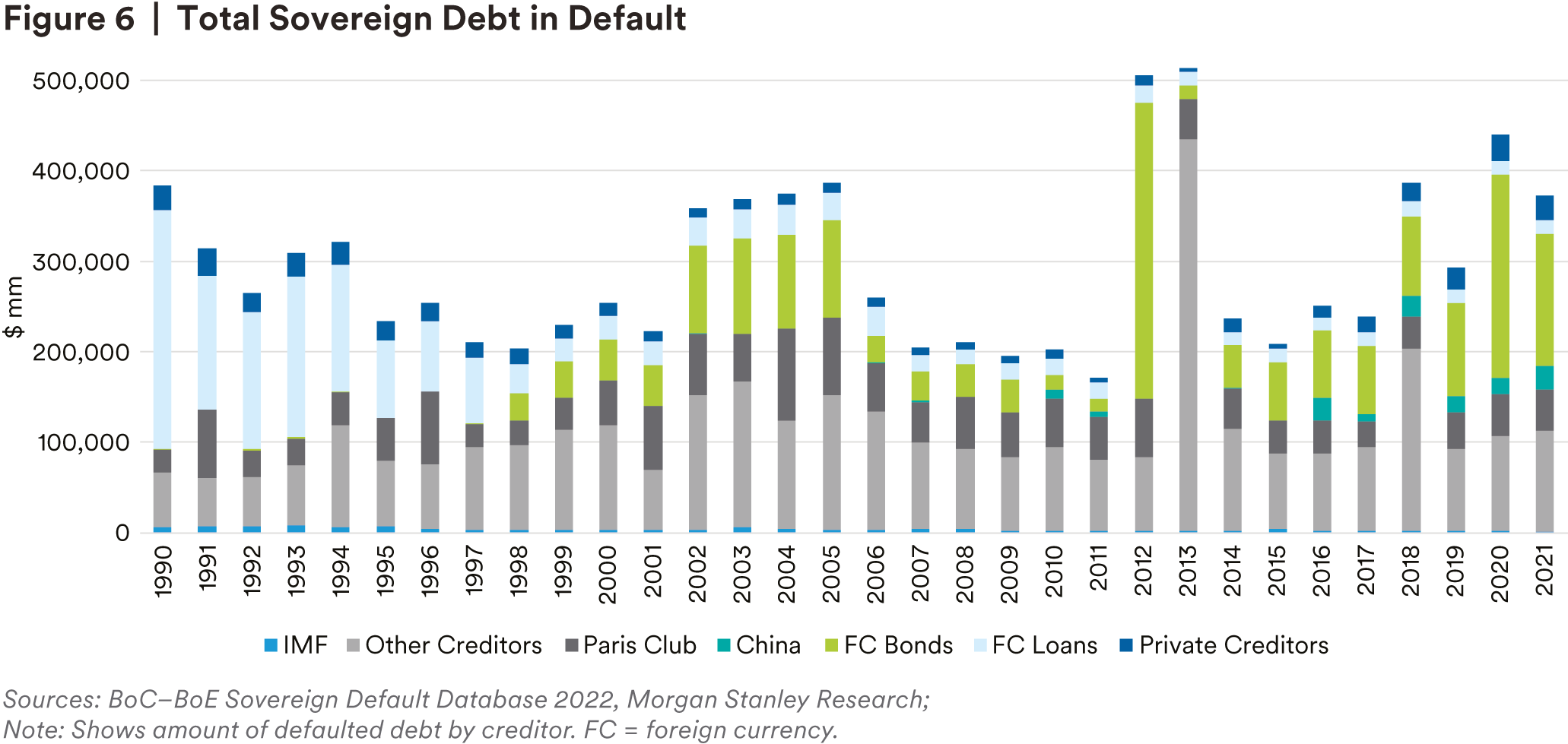

We expect to see a steady rise in defaults and downgrades across the EM space in the coming months. Despite continued robust fundamentals, a weaker macro backdrop and persistent inflation will likely continue to deteriorate corporate balance sheets from current peaks. We feel defaults will continue to be led by the China property space, as well as Russian and Ukrainian corporates. We are also prepared for a stretch of sovereign defaults as a handful of countries with weaker fundamentals face debt trading at distressed levels and elevated restructuring risk.

Security selection has proven to be more important than ever in identifying issuers with strong fundamentals despite a sell-off due to market technicals. We believe this current environment presents opportunities for EM securities, where yields on the indices are at levels not seen since 2009. With double digit negative performance YTD, this weakness could drive performance over the next year horizon.

Despite its own idiosyncratic risk factors, EM has historically remained highly correlated to DM credit, with EM historically outperforming later in the cycle. As the current market cycle continues unfolding, as expected EM has underperformed relative to DM thus far. Signs of China growth recovery and a peak in inflation would be positive drivers where we would expect to see spread compression between EM and DM securities, with EM catching up and outperforming.

In the sovereign space, we see duration risks more balanced as the 10-year US treasury hovers near 4%. We see potential opportunities in some energy-based high yield sovereigns including Oman and Angola as energy remains at comfortable levels. In the low beta space, we continue to like stable names such as Indonesia and Mexico. Mexico continues to be attractive based on relative fundamentals versus the rest of Latin America. With distressed countries receiving meaningful external support from the IMF, we look for idiosyncratic stories where we believe potential restructuring scenarios offer more upside than current levels.

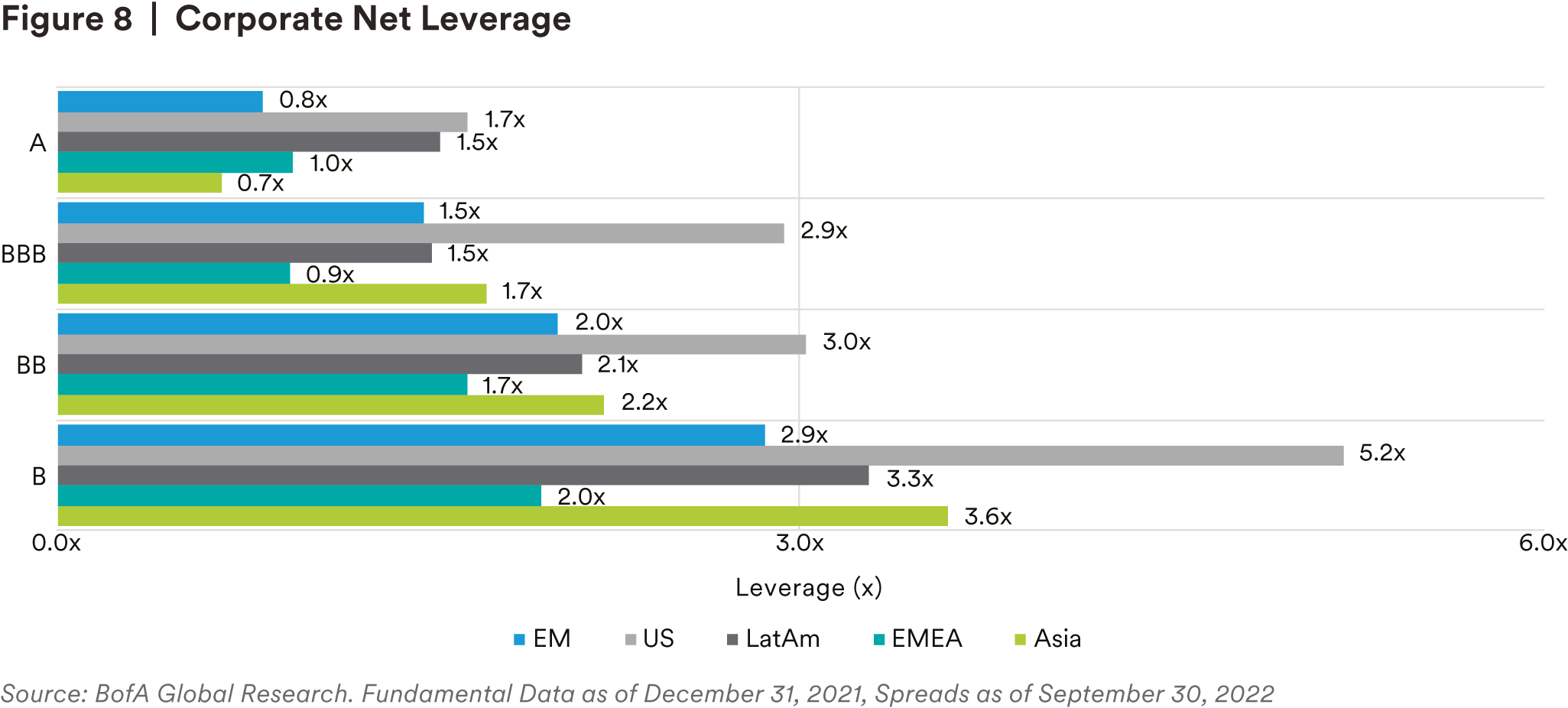

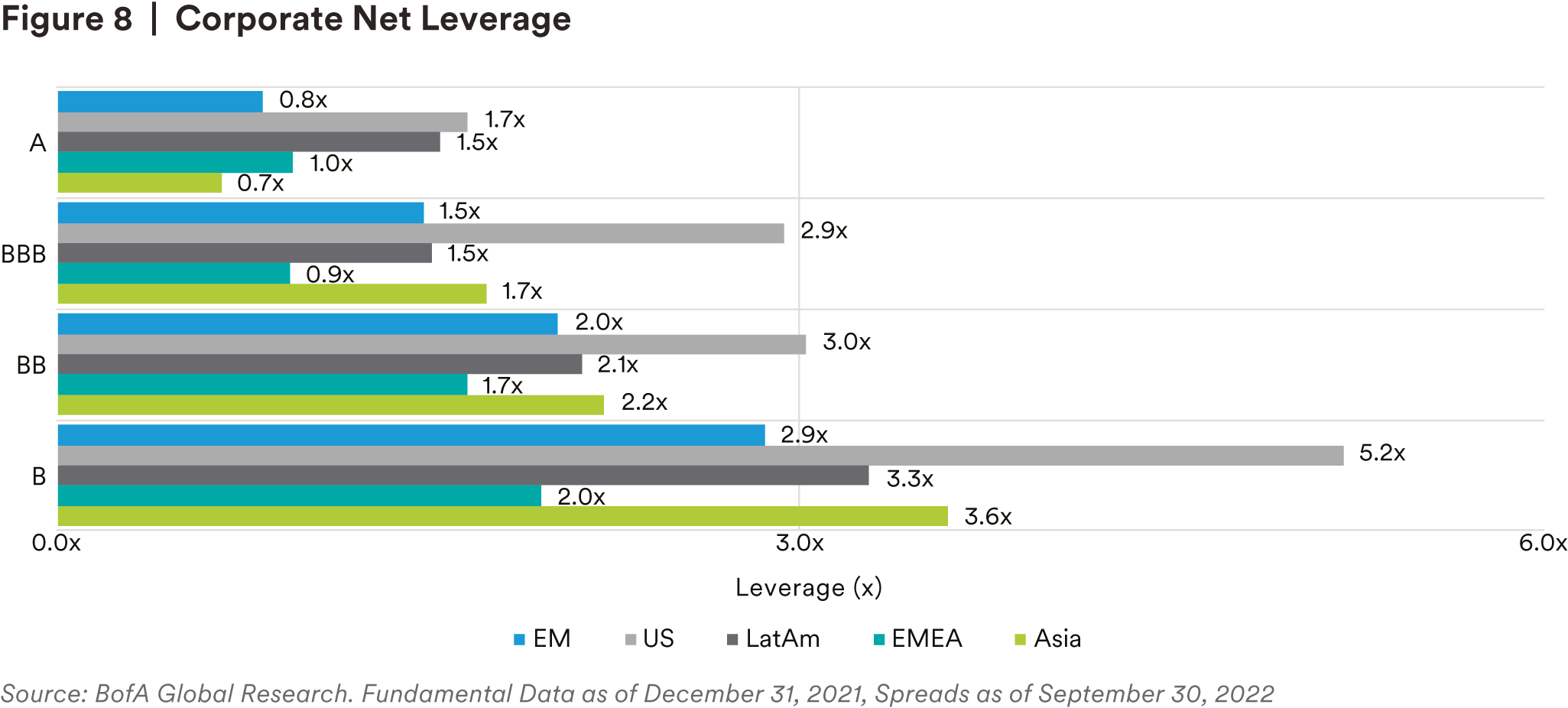

Given a lingering global slowdown, we do expect for corporate fundamentals to see some reversal from recent strength. However, even with this, we believe that EM issuer balance sheets will remain well positioned relative to DM. Recent asset price moves of corporates look exaggerated in our opinion, driven by forced selling and low liquidity, even if fundamentals do weaken going forward. We see opportunities in the telecom and consumer staples areas, in addition to our bias towards hard asset companies that are free cash flow positive. We will look to add risk in the shorter maturity bucket following recent curve flattening. Latin America and commodity-based African securities are places where we are more comfortable owning active risk, as commodity exporters’ current accounts continue benefiting from elevated levels.

We believe we are nearing the peak of the inflationary environment where EM central banks could slow the pace of tightening. This environment could present opportunities for non-dollar assets; however, market volatility continues to cause near-term weakness. We are focusing positioning within countries that have been aggressive with rate hikes and are nearing the end of the cycle, along with commodity exporting countries. The lingering recession fears in Europe coupled with uncertain energy supply may pose challenges in the coming months, and we remain cautious in that region.

Endnote

1 Data in this paragraph sourced from JP Morgan

2 Data in this paragraph sourced from JP Morgan

3 Data in this paragraph sourced from BofA

4 Goldman Sachs

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border license, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyodaku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC and MetLife Investment Management Europe Limited.