As the quarter continued, markets saw a significant uptick in volatility as tightened monetary policy worked its way through the system witnessed by the ICE BofA MOVE index, a reference for fixed income treasury volatility, increasing from a level 110 basis points on February 14th to 198 basis points on March 15th—an 80% increase and a level not seen since 2008. The indicator considerably increased on March 9th as markets digested unsettling news around liquidity challenges in the banking sector which culminated with the collapse of Silicon Valley Bank (SIVB) on March 10th. In an effort to quell liquidity fears, the Federal Reserve in coordination with the US Treasury, Federal Depository Insurance Corporate (FDIC) and President Biden created the Fed’s Bank Term Funding Program (BTFD) to help support liquidity and enhance the protection of uninsured depositors at Silicon Valley Bank and Signature Bank. Furthermore, we believe, the facility was created to help contain potential contagion across the banking sector by limiting forced sales of securities’ books to deal with liquidity needs and lower the likelihood of another potential bank run.1

The Banking sector turmoil bled over to Credit Suisse, with FINMA, the Swiss Financial Market Supervisory Authority, ushering an acquisition by UBS in a historic moment for the Swiss banking industry. Shortly thereafter, the FED followed through on their guidance with another 25 basis point rate hike at the March FOMC meeting in the wake of the recent financial turmoil as they reiterated their fight against inflation. It is worth noting that the recent stress in certain pockets of the banking system around deposit bases have, in our view, altered the FED’s view on additional rate hikes as there is a belief that tightened credit standards may constrain growth more than previously thought. Over the course of these bouts of volatility we saw the 2s/10s invert by as much as 107 bps before flattening to -43 bps as investors reassessed their views on the interest rate outlook. Additionally, as shown in Figure 2, the 10s/30s credit curve remains flat, while 5s/10s continue to normalize from historically steep levels.

Over the quarter excess returns, as shown in Figure 3, were generally supported by the Industrials space as Financials detracted. The recent events in regional banks of the banking sector spilled over broadly into the Finance sector and put the spotlight on weaknesses in Commercial Real Estate and REITs. More specifically, Office REITs was the largest detractor from excess returns as vacancies climbed in higher rent districts affected by an underwhelming return-to-office cohort. Like Office REITs, we also saw Retail REITS detract from the quarterly excess returns. Life Insurance was another underperformer during the period as concerns mounted over the asset side of the balance sheet due to contagion risk from banks and their exposures to commercial real estate. Of note on Banks, the bail-in of the CS Additional Tier 1 Contingent Capital Notes (AT1 / CoCo’s) put pressure on all Financial sectors before they re-traced some of the widening into quarter-end. On the bright side, the high beta Communications sector was a strong performer despite high volatility during the period. The sector in general was able to withstand the market widening that was driven by the Financials sector. Additionally, the Airlines sector outperformed as US and International travel continued to recover, prompting US carriers to raise first and second quarter capacity guidance.

More broadly throughout the course of the quarter, non-corporate credit outperformed corporates. Within the index, the Long Corporate segment (+0.34% excess) outperformed the Intermediate Corporate segment (+0.12% excess) and its shorter-dated counterparts, while BBB spreads converged closer to single-A credit.2

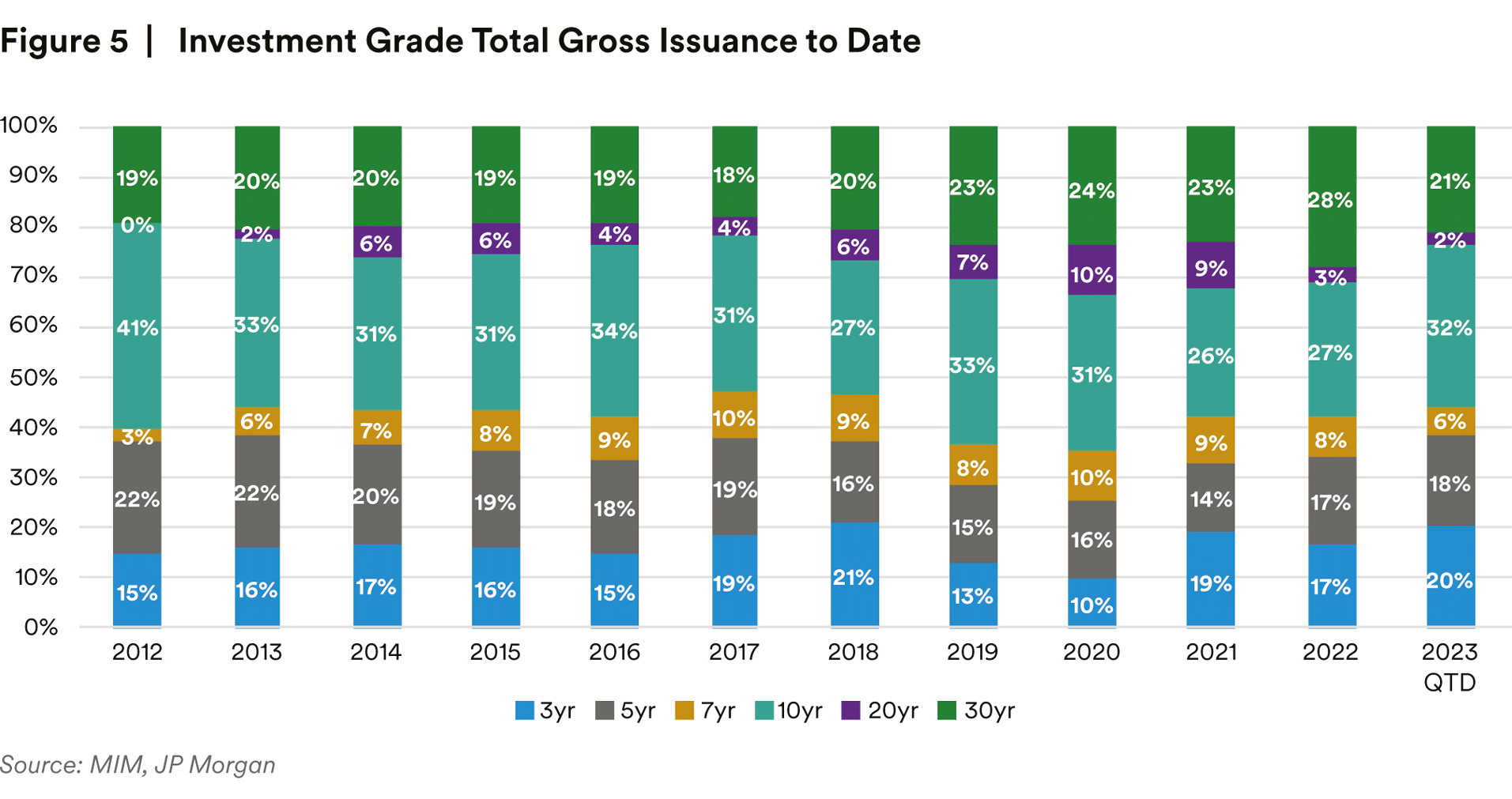

First quarter supply, as shown in Figure 4, totaled $396bn—only down 5% compared to the past four-year average of $417bn as issuers secured their funding needs in January and February. February posted its highest issuance on record for the calendar month, making up $151bn of supply, while March issuance was the lowest since 2012 as the primary markets were fully closed for a week following the regional banking turmoil. Within Financials, Yankee Banks led the way with $88bn in new issuance while US Banks lagged, posting $30bn of total supply. In Non-Financials, Utilities and Healthcare/Pharma made up the largest share of supply with $45bn in new issuance.3

It has long been our view that the Fed’s unrelenting focus on dampening inflation would have unforeseen consequences, and ultimately result in something “breaking”. This has been the backbone of our more cautious stance on valuations and the above average allocation to Treasuries as a source of liquidity for a spread widening event. We did not, however, envision the well-capitalized and highly regulated Banking sector would become the source of the break. The spate of bank failures, culminating with Credit Suisse’s absorption by UBS, clearly has introduced a more complex headwind to the already uncertain macroeconomic backdrop. As a fundamental credit manager, this variable is particularly uncomfortable, given that depositor psychology does not dovetail nicely alongside a more traditional framework of credit analysis. At the time of this writing, tensions in the sector seem to be cooling as the Regional and Yankee banks are finding more solid footing. Nonetheless, we are keenly aware that in the age of digitization and social media-induced hysteria that further flare-ups could be just a mere “tweet” away. Undoubtedly, our positioning within Financials will remain of paramount focus, as increasing bifurcation in the sector is creating significant opportunity (of course, not without its attendant risks).

More broadly, we believe the banking crisis is inherently deflationary and will likely lead to tighter lending standards, which should aid in the Fed’s mission to reduce inflation. This dynamic may pull forward the timing of a recession and certainly impacts how we are thinking about portfolio positioning. At a high level, finishing the quarter a mere six basis points off the year’s starting option-adjusted spread (OAS) level, it is difficult for us to get too excited about the prospects for credit. We still believe that valuations are too frothy for an economy on the brink of recession amidst a likely steady deterioration in credit fundamentals. Against what we would deem to be an asymmetric risk/reward profile for high grade corporates, we still believe it makes sense to maintain a sizeable Treasury allocation that we can deploy into progressively wider levels of spread—acknowledging the difficulty in calling the bottom and aggressively allocating at such a point in time. As we wrote more extensively about last quarter, we still believe a more durable bid for fixed income given the healthy yield environment will put a lower ceiling on spreads than we have seen in previous recessions.

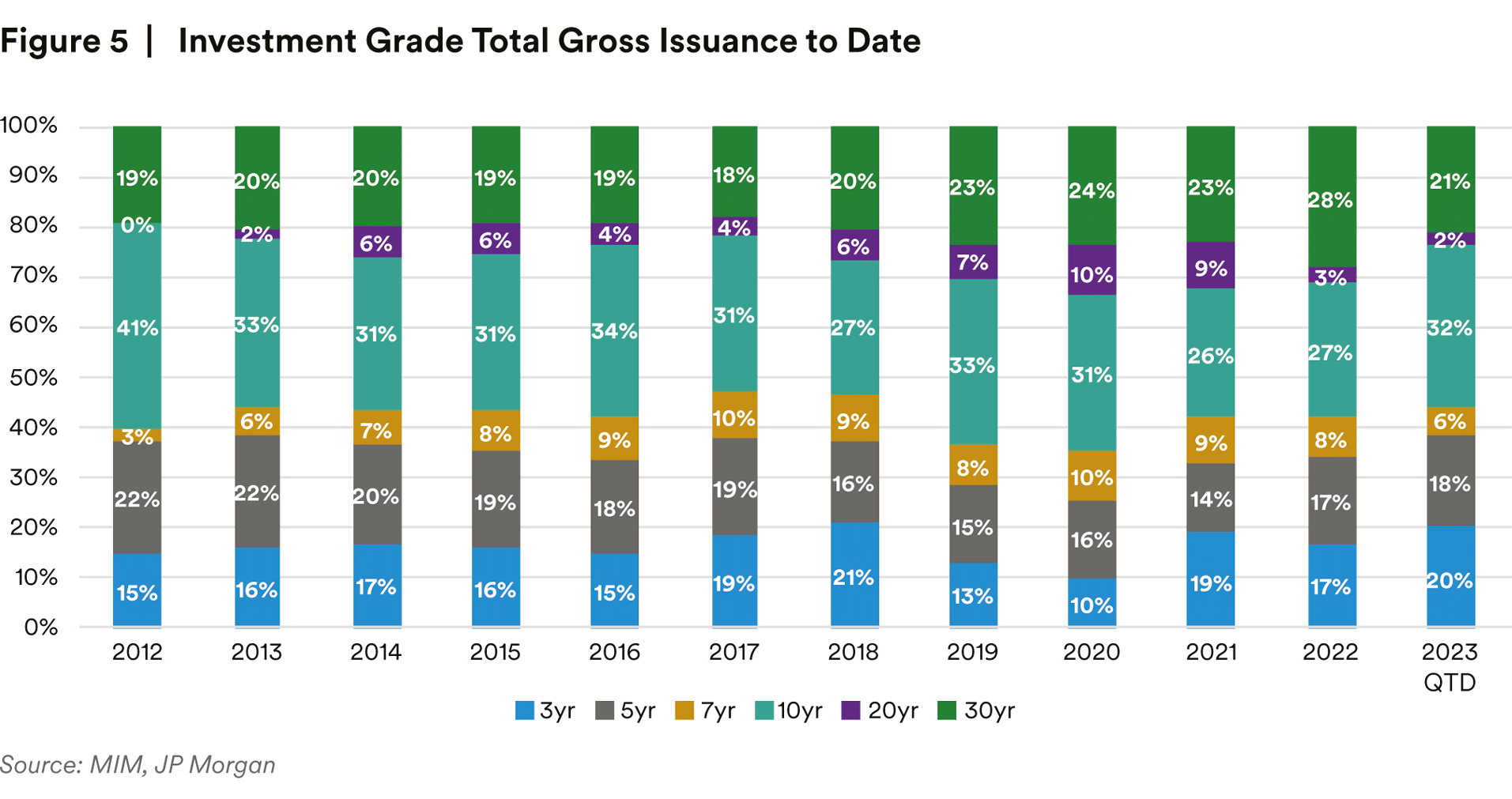

Meanwhile, we continue to find opportunities to do something that we are often vocal in cautioning against, and that is, upgrading portfolio quality. We find such trades to often be accompanied by excessive transaction costs, but those costs have greatly diminished now as it is the more defensive issuers who are frequently patronizing the new issue market. Sectors like Pharmaceuticals, Healthcare, and Utilities are among the subsectors seeing the biggest year-over-year changes in issuance (and which you may be hard pressed to find us espousing the virtues of in previous outlooks). We are finding value in the more inflation-resistant issuers who are coming to market during a volatile time and paying elevated concessions to do so. We welcome the elevated liquidity offered by these new issues, as off-the-run issues continue to lag their on-the-run peers. Meanwhile, sector dispersion remains high and with investors still willing to differentiate sectors based on fundamentals, rather than traditional beta stereotypes, we are finding opportunities to rotate exposures away from more cyclical sectors and better protect portfolios against a recession without a meaningful sacrifice in yield.

Away from our conservative positioning, we are still finding value in the front end of the credit curve. Inverted Treasury curves and flat credit curves (depending on tenor) are still offering a historically attractive opportunity to shorten spread duration without sacrificing yield. While we do not expect a substantial tightening of spreads, we believe building this portfolio level yield advantage allows us the patience and flexibility regarding the timing of a spread widening event.

For those portfolios that allow “plus” sector allocations, we do not believe now to be an optimal time to increase our exposure in those areas. High yield in particular is a tool in the tool kit that we find most valuable when we are highly constructive on risk—a view we do not hold today. High yield can also be quite additive as a way to bolster our yield advantage when a dearth of such opportunities exists in the high grade market. That is not how we would describe today’s market, where the higher yielding segments of the high grade market compete quite favorably with many BB issuers. Additionally, current conditions do not seem ripe for a wave of rising stars that could drive further spread compression. None of the above is to suggest individual situations within these “plus” sectors do not warrant consideration as we are always looking for such opportunities, but broadly we are inclined to eschew high yield until we see a material cheapening of valuations.

Above all, the events of the first quarter have proven once again the importance of security selection, and how not only issuer selection, but individual securities within an issuer’s capital stack can have a meaningful impact on performance. We continue to believe security selection will remain of paramount importance, and avoiding the losers will be just as critical as identifying the winners. As challenging as the first quarter was, we recognize—to borrow a well-worn but apt cliché—this is marathon not a sprint, and we have great conviction that our portfolios are positioned to do well in what we believe will continue to be a challenging period for credit.

Endnote

1 Bloomberg L.P.

2 Bloomberg L.P

3 JP Morgan

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors.

This analysis is not intended for distribution with Retail Investors. This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address 1 Angel Lane, 8th Floor, London, EC4R 3AB, United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK and EEA who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as implemented in the relevant EEA jurisdiction, and the retained EU law version of the same in the UK.

MIMEL: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102- 0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) under the registration entry Director General of the Kanto Local Finance Bureau (FIBO) No. 2414.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 As of December 31, 2022, MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), MetLife Investment Management Europe Limited, MIM I LLC and Affirmative Investment Management Partners Limited.