Portfolio Trading Improves Liquidity in the Bond Market Through Several Mechanisms:

Aggregation of Liquidity: Portfolio trading allows for the simultaneous execution of multiple bonds, effectively aggregating liquidity across different issues. This is particularly beneficial for less liquid bonds that might be challenging to trade individually.

Speed of Execution: By executing large baskets of bonds in a single transaction, portfolio trading reduces the time to transact that would occur if these bonds were traded separately. This is especially valuable for institutional investors managing large portfolios who now have the ability to efficiently reposition portfolios either adding or reducing risk almost instantaneously.

Improved Price Discovery: The ability to trade multiple bonds at once enhances price discovery across the market. Traders can more easily identify relative value opportunities and arbitrage between different bonds, leading to more efficient pricing.

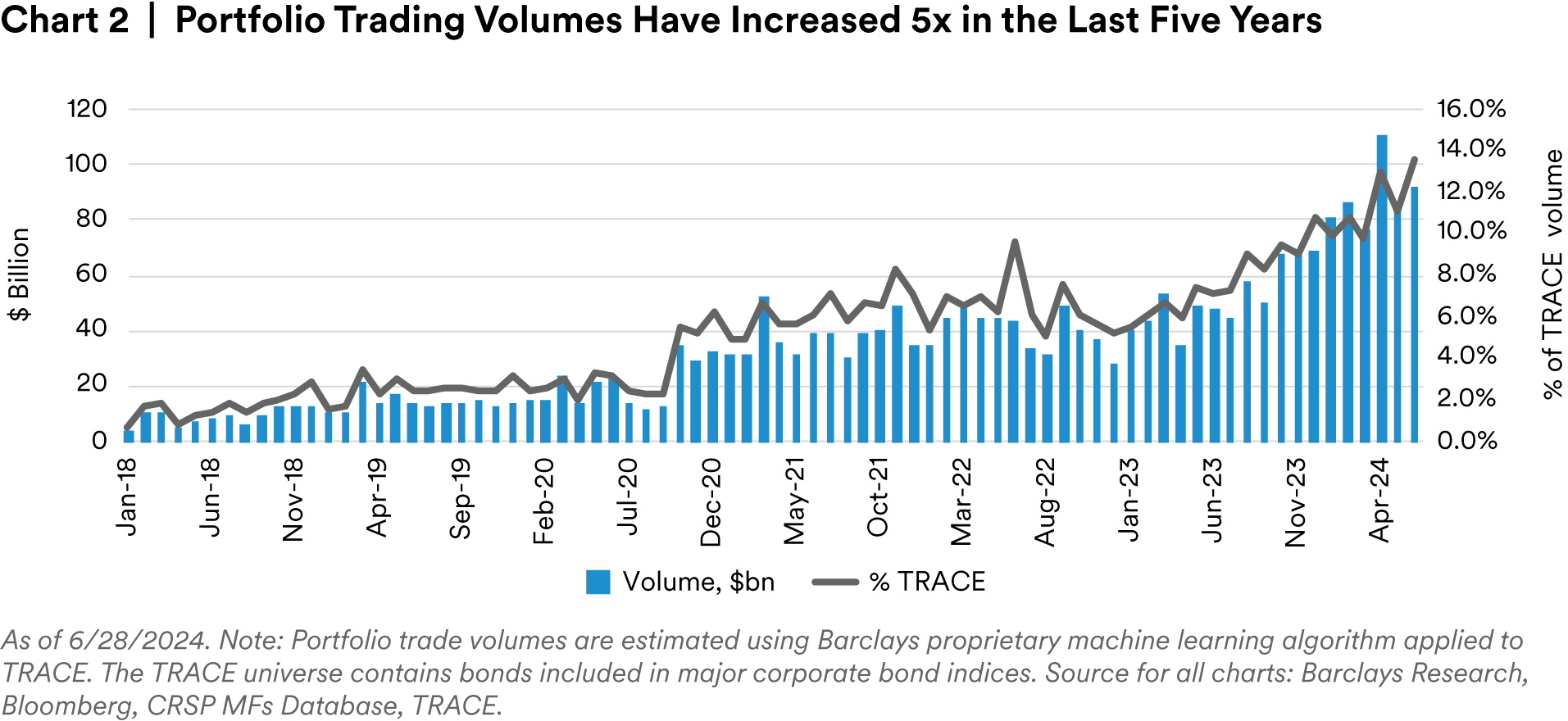

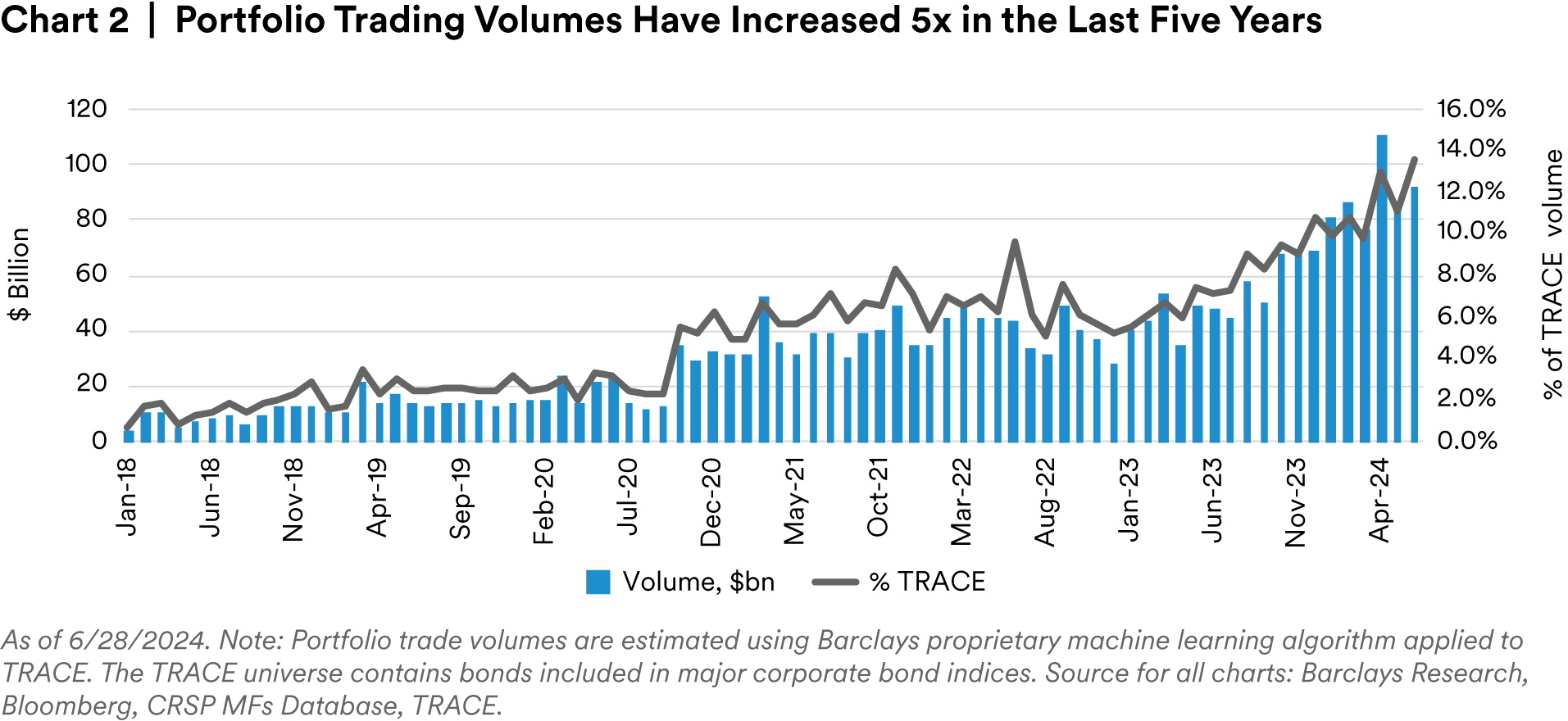

Increased Trading Volumes: Portfolio trading facilitates larger trade sizes, which can increase overall trading volumes in the bond market. This increased activity can attract more participants, further enhancing liquidity.

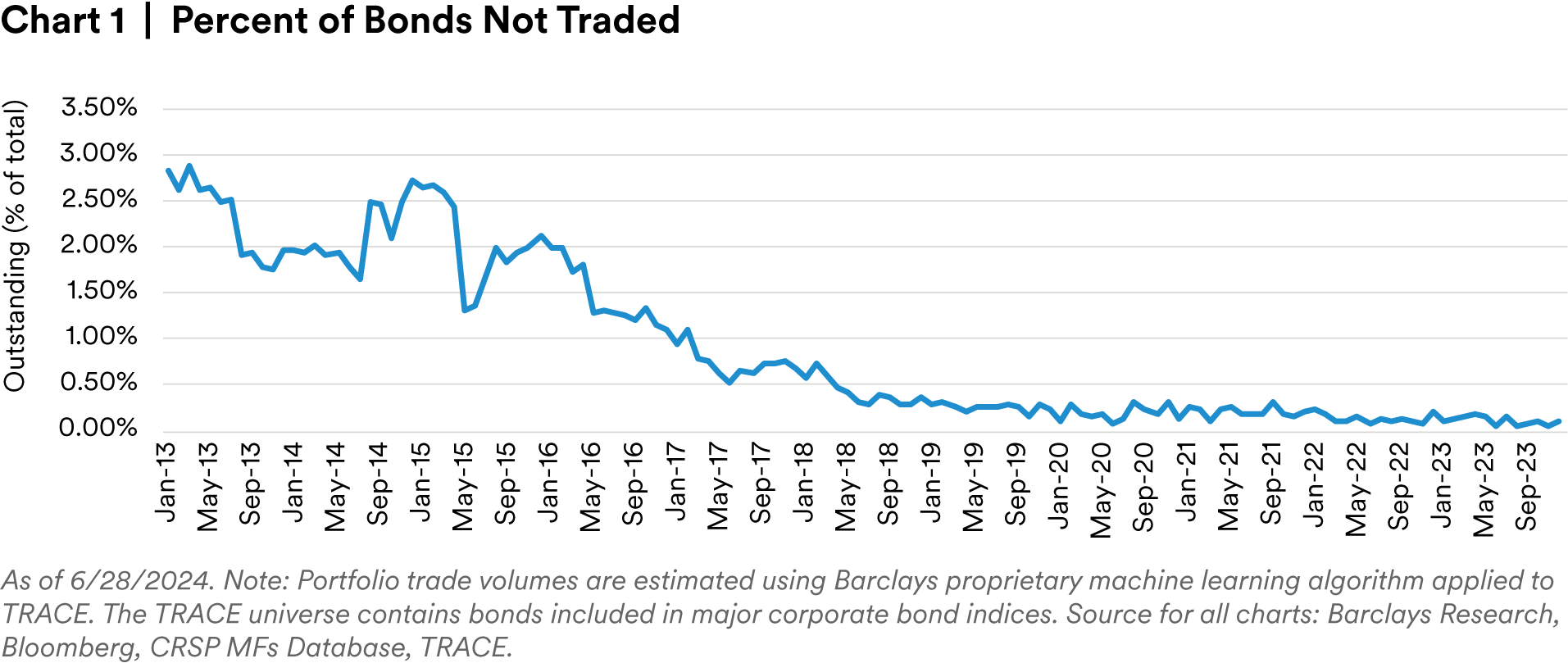

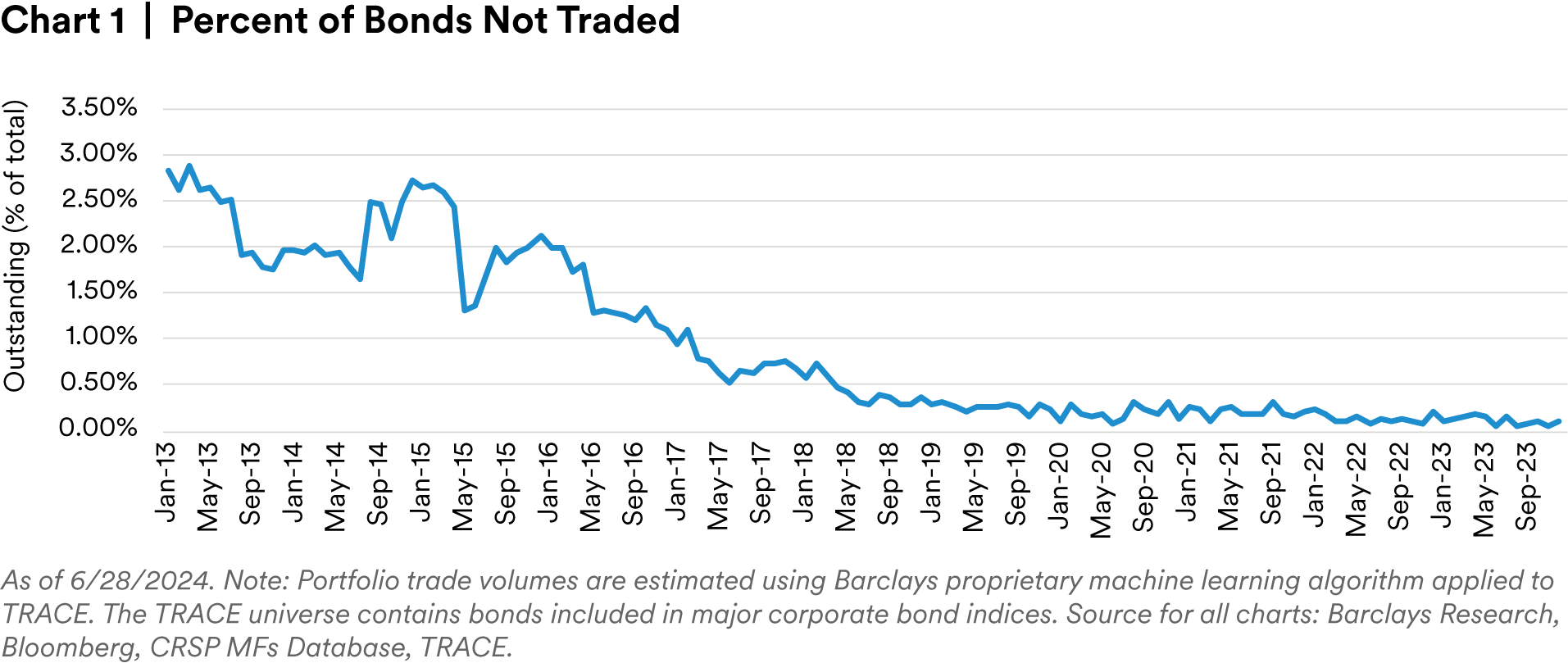

The increased trading volumes has also translated to more individual CUSIPs trading, with the number of issues not traded on steady decline. The percent of bonds outstanding that have not traded has declined to 10 basis points from 70 basis points in 2018 – an 85% decline in just over 5 years. Looking back even further to 2013, it’s declined 97% from the highs of 2.90% of outstandings not traded.

As a testament to the importance and continued growth of portfolio trading (PT), on May 15, 2023, FINRA instituted a requirement for dealers to report their portfolio trade transactions to TRACE along with implementing a flag to denote ‘Portfolio Trade’. This new flag bolsters transparency in the market and has provided another tool to help analyze developments in fixed income markets through more transparent execution. For example, in April 2024 PT volumes reached $110bn which represented nearly 14% of total TRACE volume, also the highest PT market share since the reporting has been in place. In our view, this underscores the theme that the market is growing more comfortable with the evolution of electronic fixed income trading.

In practice, we find ourselves participating in the uptick of portfolio trading along with the industry. Depending on market conditions, portfolio trading can often provide an efficient method for funding new portfolios from cash. An even more cost effective application of portfolio trading is transitioning portfolios that are funded in-kind with corporate bonds. For example, we have found that executing a bi-directional portfolio trade has the potential to reduce transaction costs given the net notional risk to the dealer is de-minimis. For less liquid securities, we have often found that including these securities on a portfolio trade with more liquid issues results in improved pricing. In a similar vein, we also may find ourselves as an opportunistic acquirer of securities which have may been mispriced through a PT. The use cases for portfolio trading are diverse, and at MIM, we deeply value our trader’s acumen, relationships, and ability to quickly identify and react to these potentially mispriced or stranded securities for the benefit of our clients’ portfolios.

Conclusion

The integration of portfolio trading with traditional fixed income over-the-counter investing represents a significant opportunity for asset managers to efficiently maneuver risk, while simultaneously providing another tool to enhance liquidity. While challenges remain, particularly around data quality, standardization and pricing distortions - the synergies between these areas are likely to drive innovation in both trading technology and portfolio management practices. Asset managers who can effectively leverage portfolio trading capabilities to implement investing strategies will be well-positioned to meet the growing demand for avenues to generate alpha in the fixed income space. As this integration continues to evolve, it will be crucial for market participants to stay informed about technological advancements, regulatory developments, and best practices in innovative portfolio construction and trading.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of December 31, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.