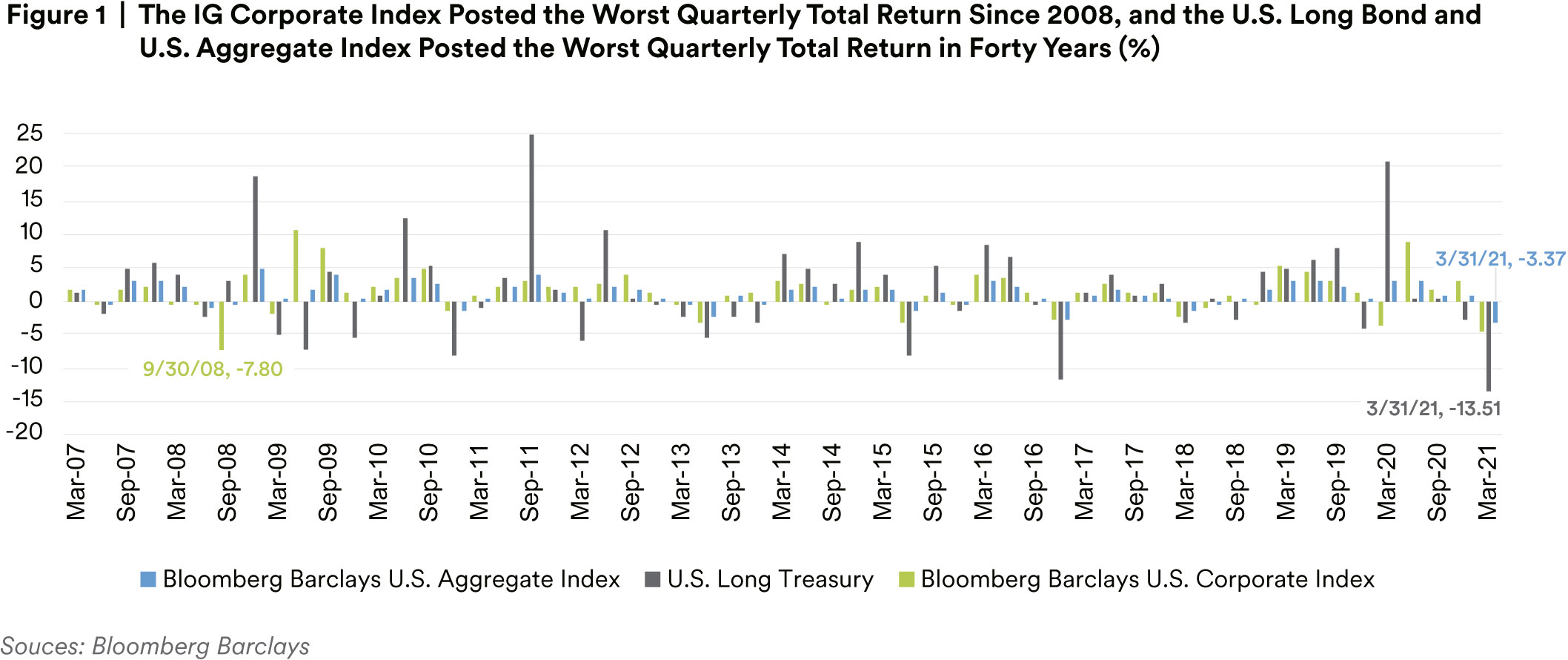

Overall, the first quarter of 2021 has exhibited stark changes in the landscape for investors.

In early January, dual Democratic wins in the run-off Georgia elections resulted in a blue majority in the U.S. Senate giving the party of the administration full legislative control, albeit by the narrowest of margins in the House and Senate. As a result, while the party in control of the White House transitioned in January, the Biden administration lacks carte blanche power to enact the progressive agenda fully. Political power has shifted to the middle, with Senators Manchin, Collins, Sinema and Murkowski wielding significant influence in legislative negotiations, tempering the more ideologue wings of both parties. One major force in the market that has not changed is the constant drumbeat of deficit financed

MMT-esque fiscal and monetary stimulus. While many of the emergency facilities have expired quietly without market impact, notably the Corporate Credit purchase program, the Federal Reserve spigots remain wide open with monthly purchases of $80 billion treasuries and $40 billion MBS3. On the fiscal side, the late 2020 $900 billion package passed by the previous administration was quickly followed in March with an additional $1.9 trillion wide-ranging stimulus program. Notably, the most recent bill passed the senate with a 50/49 vote via the process of reconciliation and only after the controversial federal minimum wage, not supported by Democrats Manchin or Sinema, was removed. Elsewhere in the markets, commodities soared as supply bottlenecks combined with extreme demand from manufacturing and homebuilding sectors pressured prices higher. Oil and copper rose 21.9% and 13.5% respectively in the quarter. Prices in soft commodities such as lumber, corn and soy also rose markedly. Equities ended the quarter higher amidst falling volatility, but results were mixed. The bellwether S&P500 rose 5.8%, however as investors exhibited concern about rising rates and nosebleed valuations, the NDX100 was only able to rise 1.6%. The small cap Russell 2000 returned a strong 12.4% on reopening optimism4.

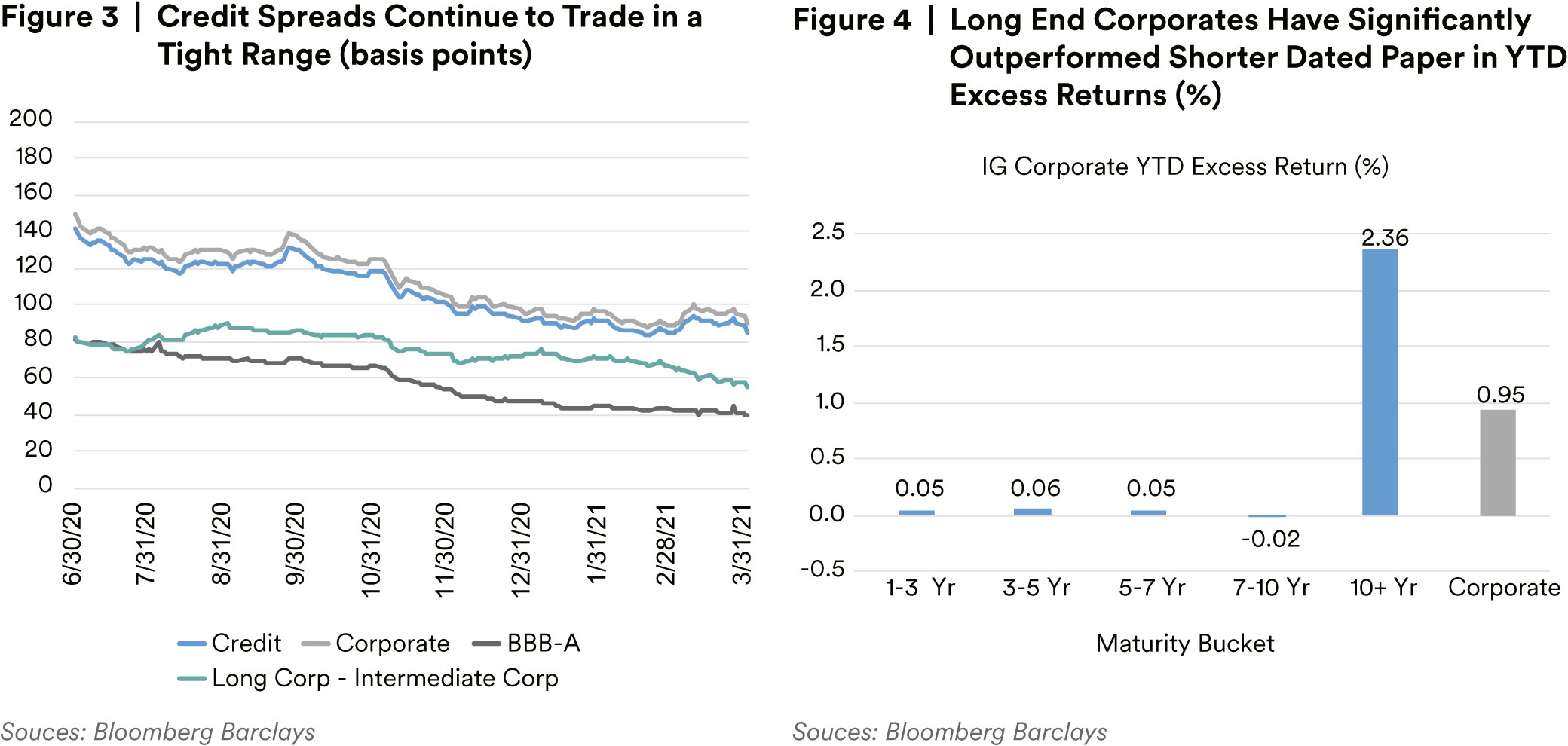

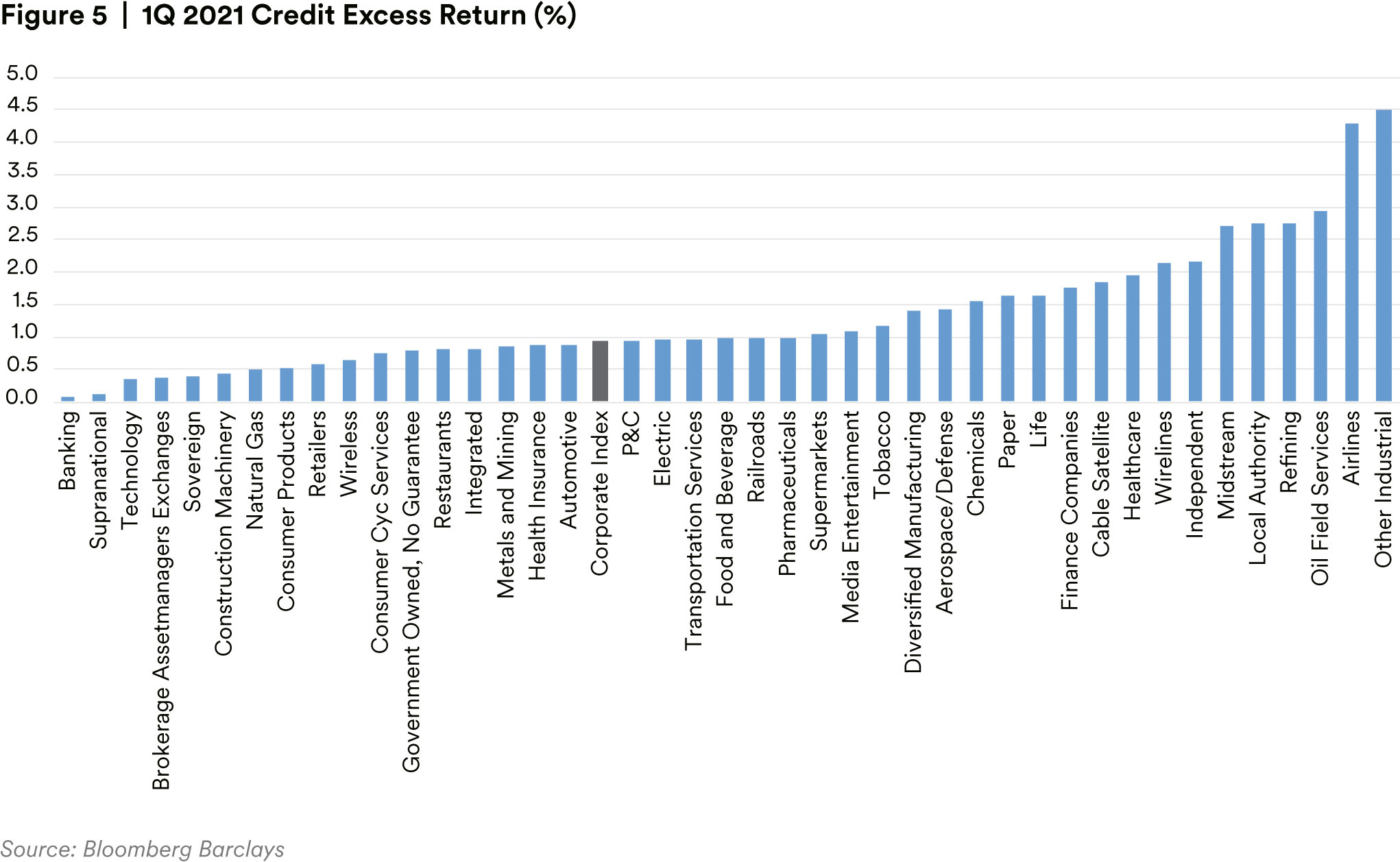

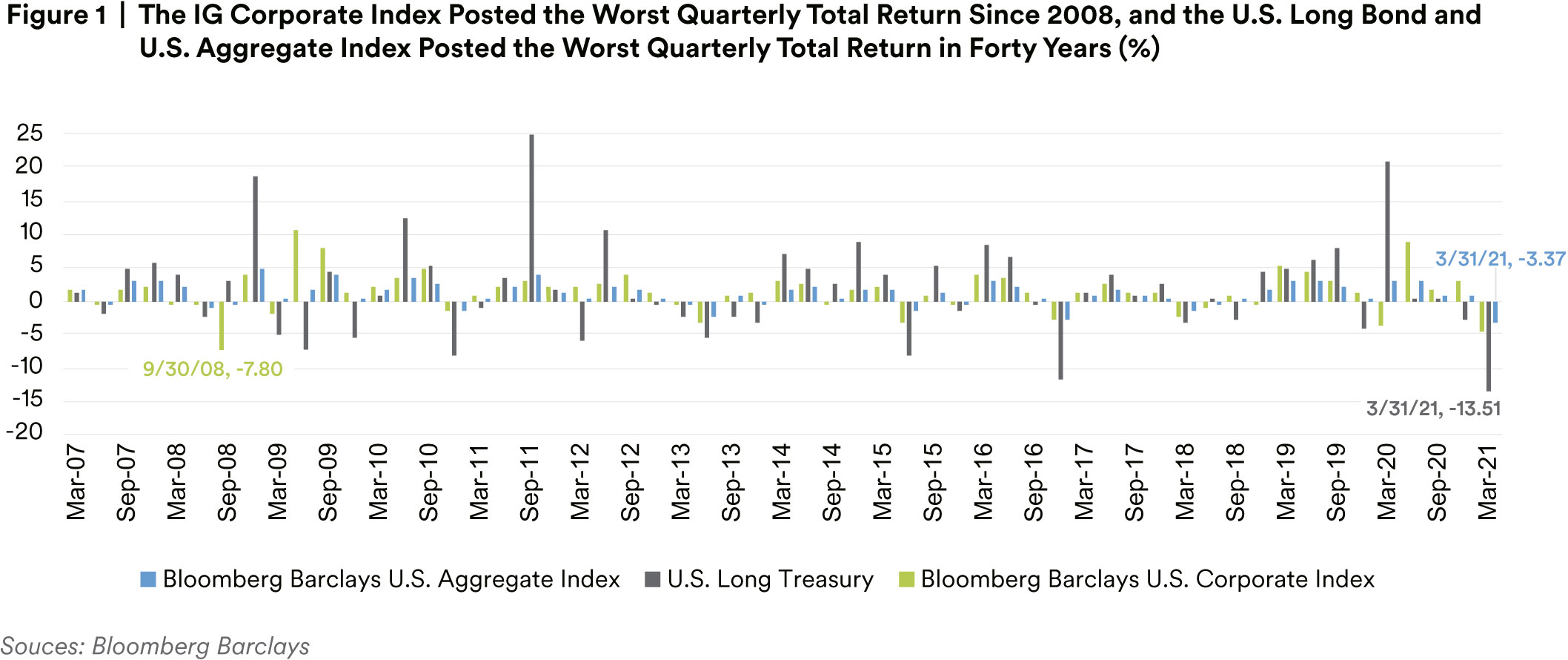

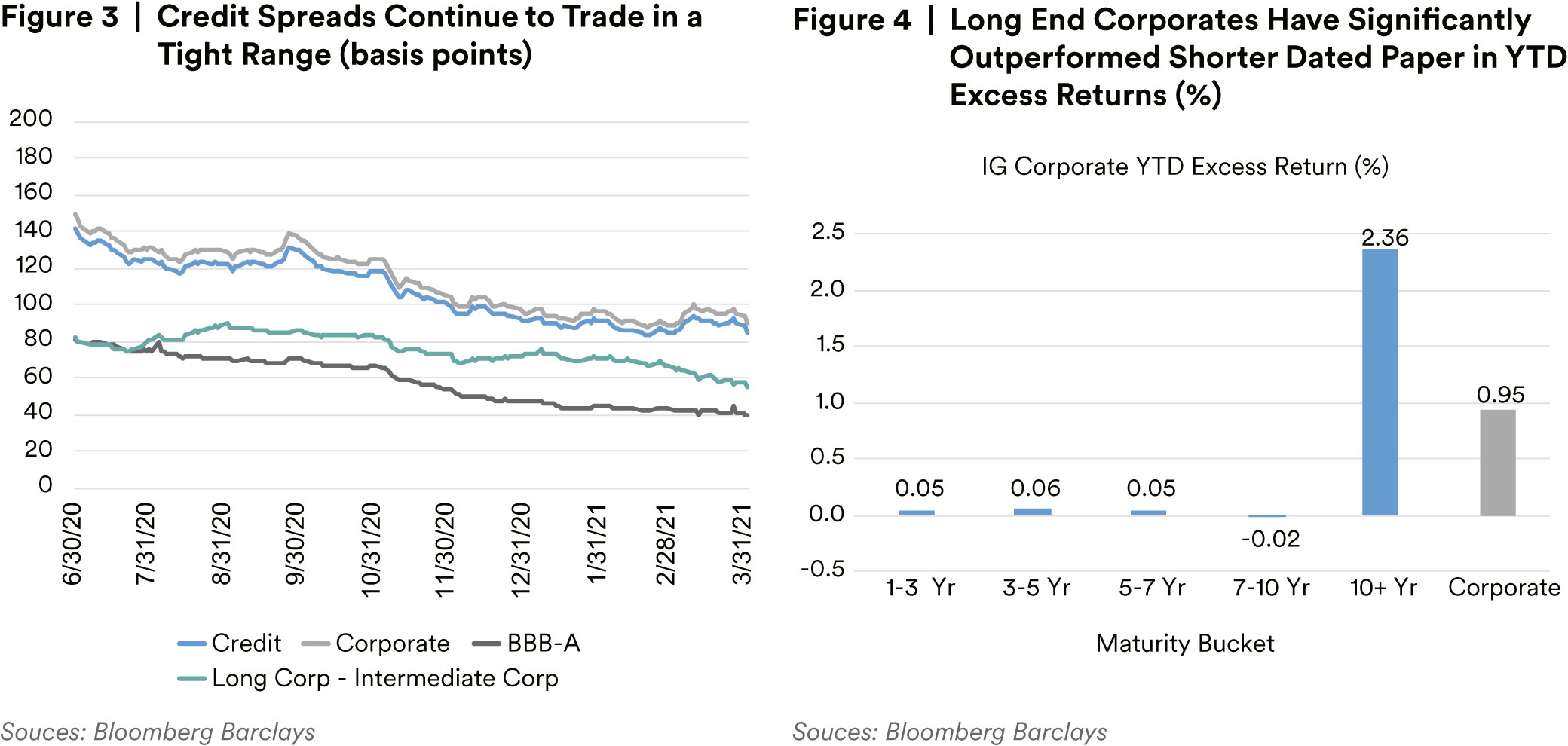

Investment grade credit spreads traded in a narrow range with the Bloomberg Barclays U.S. Credit Index OAS ending the quarter six basis points tighter to close at 86 basis points. On a total return basis, the index plunged into negative territory with a -4.45% total return. Credit outperformed equal duration treasuries with 93 basis points excess return. The yield on the index ended the quarter 51 basis points higher at 2.19%. The source of positive excess return for the quarter primarily came from the long end as it significantly outperformed the rest of the curve posting an excess return of 2.36%. Overall, Corporate credit outperformed Non-corporates with excess returns of 0.95% and 0.82% respectively.5

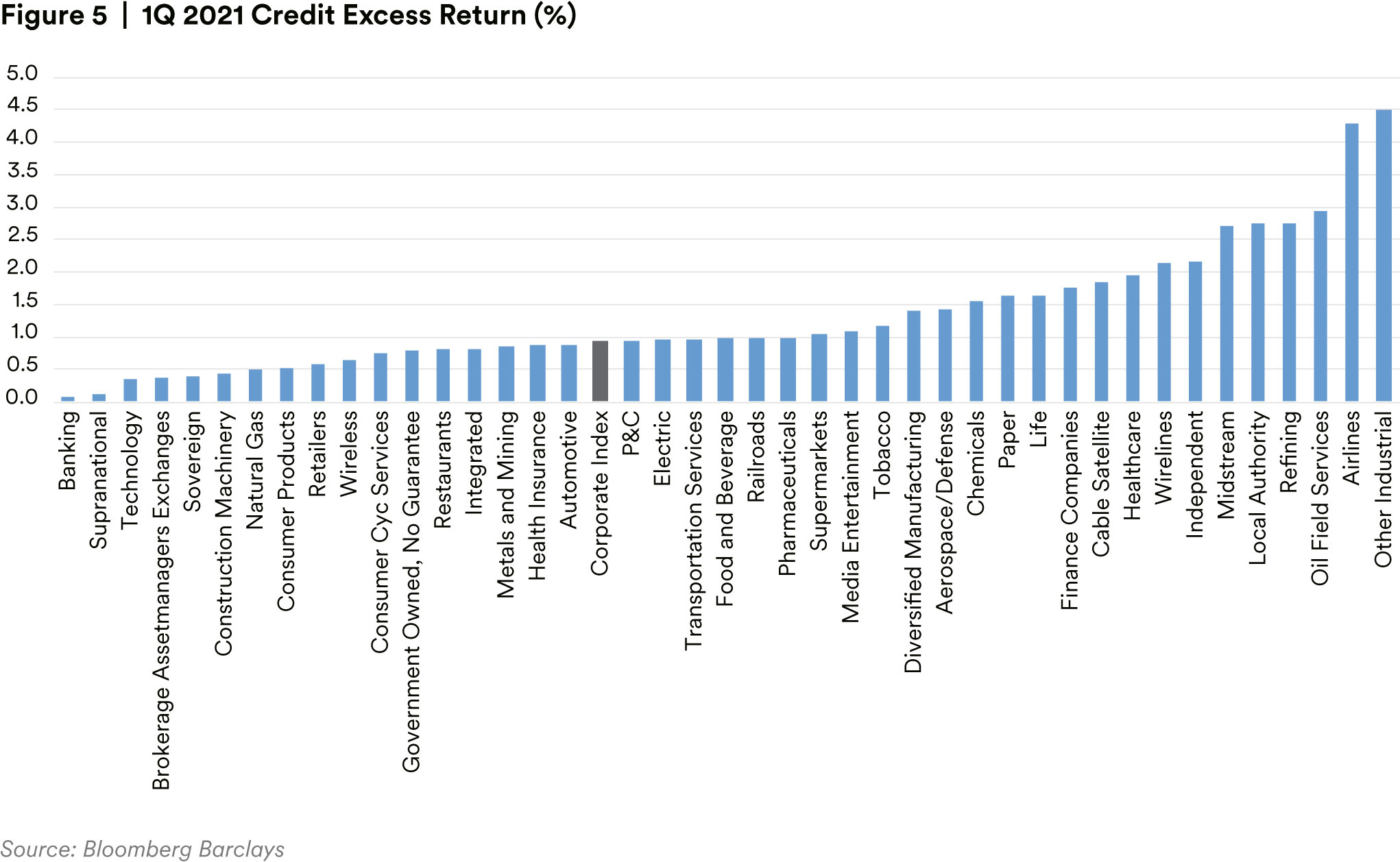

With the exception of Packaging, all of the corporate sub-sectors outperformed equal duration Treasuries despite posting negative total returns. Similar to last quarter, commodity-related and COVID-19 impacted sectors continue to outperform on improving economic expectations and vaccine progress. Airlines, Oil Field Services, Midstream, Refining and Wirelines led the gains, while Banking, Technology, Consumer Cyclicals, REITs apart from Retail, and Wireless underperformed but still generated positive excess returns. Corporate BBBs continue to outperform higher quality credits posting an excess return of 1.36% versus 0.45% for As6.

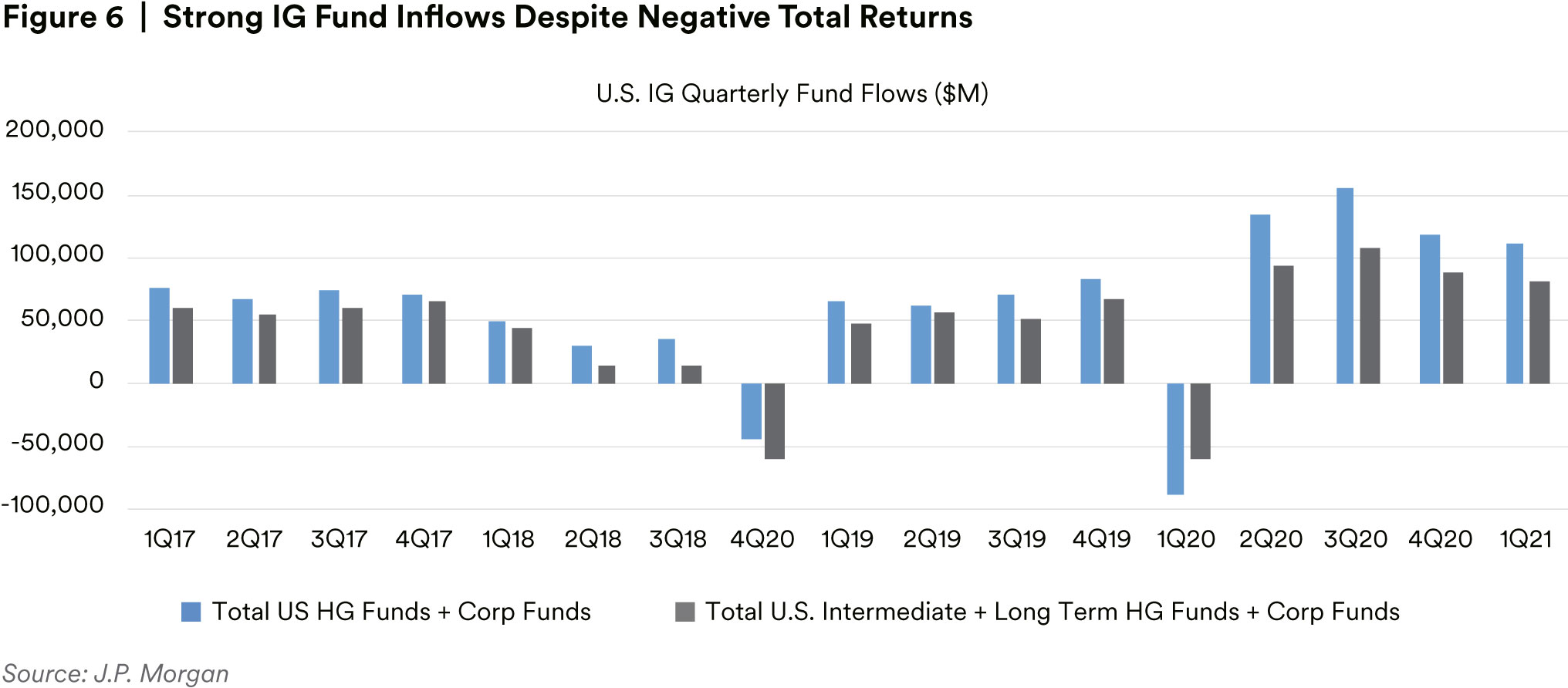

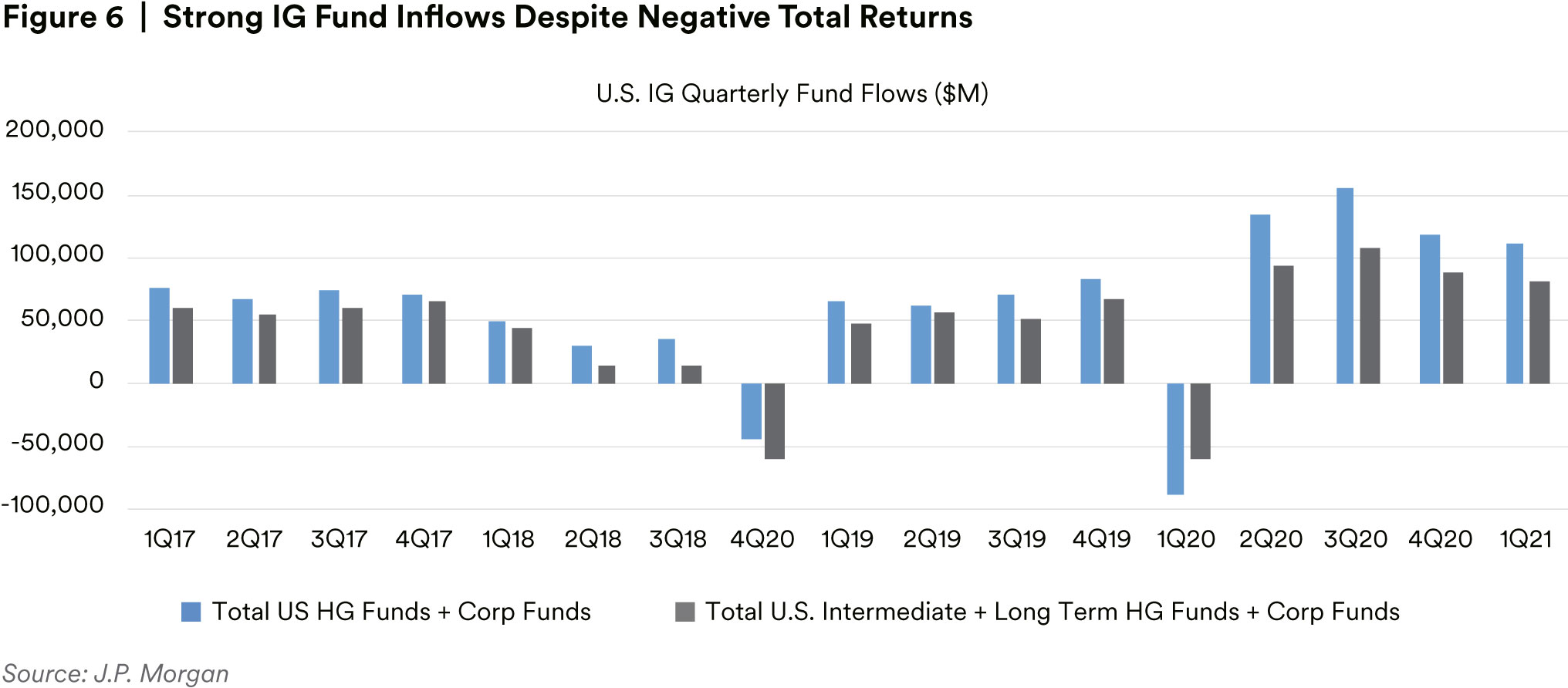

Primary market activity in IG corporates remained elevated in the quarter. With the exception of 2020, supply has surpassed all previous first quarter levels by 10%, totaling over $400 billion. The fast pace of new issuance was driven by a surge of M&A financing in March, which was double the amount issued in January and February, bringing total issuance to $75 billion for the quarter. Further, despite negative returns, as shown in Figure 6, demand remains robust with solid net inflows of over $100 billion into U.S. investment grade funds7.

Several key themes loom large on our radar screen as we look towards the rest of the year. Front and center is certainly the COVID-19 pandemic entering a new phase of global vaccine distribution, and economic activity returning to normal amid relaxed restrictions. We anticipate vaccine administration to continue apace, and by mid-second quarter the entire country should be free of business and social restrictions that currently remain in place. We caution however that the “reopening” narrative may not ultimately provide as much of a growth boost as hoped, mainly because many areas of the U.S. are currently open and have largely returned to normal. Local perspective of investors in the northeast is likely clouded by local COVID response and lingering restrictions. However, much of the south of the U.S. has resumed normal economic activity, and thus, there is less of a reopening boost to be had.

As noted in our previous quarterly outlook, the economic data is about to literally jump off the charts. As we lap the most severe data points of the early pandemic, rate of change and year over year data will break records. Additional tailwinds remain in the form of continued and persistent central bank stimulus and the recent $1.9 trillion fiscal response. Furthermore, there is potential for additional fiscal spending in the form of infrastructure, however that legislation is in its nascent stages. The Federal Reserve has openly moved to an average inflation target framework and won’t be moving rates this calendar year. While much ink has been spilled recently about inflation and rising prices in certain parts of the economy, and we are keenly watching wages and employment to ascertain whether durable inflation is taking hold amidst ultra-powerful disinflationary forces of demographics and technology.

From a fundamental perspective, pandemic depressed earnings and record issuance has left investment corporate balance sheets over-levered for their ratings with debt ratios more than a full turn higher than pre-pandemic highs. While a negative on the surface, the current state of balance sheets could limit bondholder unfriendly activity as shareholders and lenders are aligned with respect to balance sheet repair. That being said, the siren call of M&A and return of cash to shareholders may be too strong to resist. We wouldn’t be surprised to see continued M&A announcements and are closely watching for continued migration into the BBB cohort. In fact, in the first quarter, a historically strong single A issuer opted to migrate to the BBB bucket, returning a slug of cash to shareholders and issuing billions in additional debt. Additionally, previous deleveraging trends in the wireless space have stalled out as these issuers will be taking on more debt to finance C-Band auction purchases. At current valuations, we believe avoiding re-leveraging or leveraging M&A situations will be key to generating alpha for the foreseeable future. In the aggregate however, against the backdrop of already stretched balance sheets and a pick-up in economic activity, we are hopeful to see fundamentals trending in a positive direction from a bondholder perspective.

We also find technicals to be supportive of credit spreads. Last year’s record new issuance was easily absorbed by the market, both domestic and foreign. As noted in the review, and surprising to us, flows into IG corporates remained strong in the first quarter in the face of dismal total returns. U.S. credit markets also remain attractive globally from a relative value perspective, and even more so given the recent increase in yields. Market forecasts for 2021 are for $1.2 trillion in new issuance, but as rates have increased, many issuers have accelerated liability management exercises (LME) to retire higher coupon debt sooner than previously expected, which could result in higher volumes. We expect LME trends to remain a key theme in 2021 and look to position portfolios in securities and parts of the credit curve that may benefit. The increased liquidity in 15 to 20 year maturities, largely due to the growth of the 20 year Treasury, is an area of focus and provides opportunities to both extend from 10 year and shorten from 30 year holdings into more attractive bonds. Elsewhere on the curve, we continue to look for roll down opportunities provided by the steepness of the 2s/5s and 2s/10s curves.

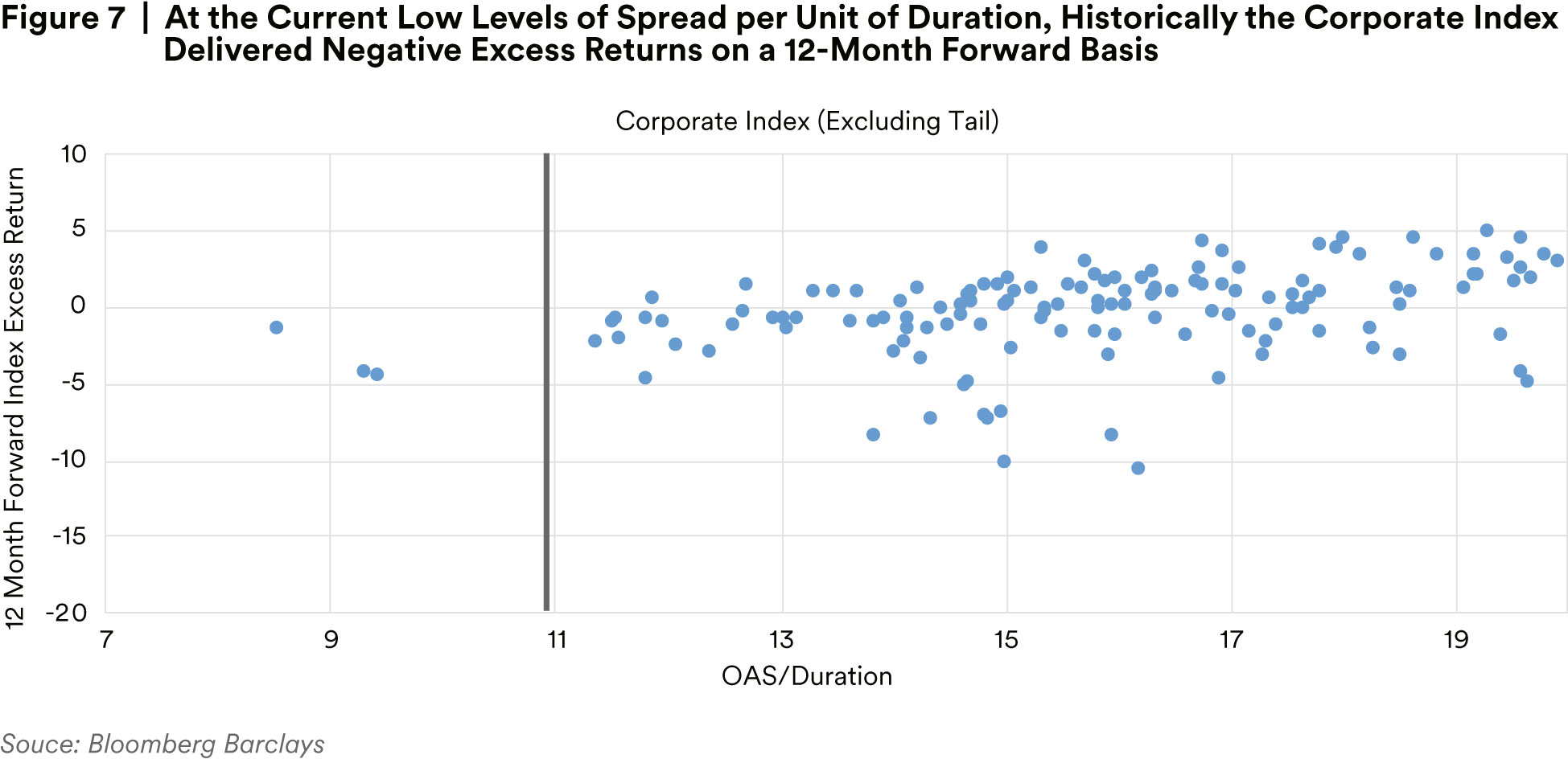

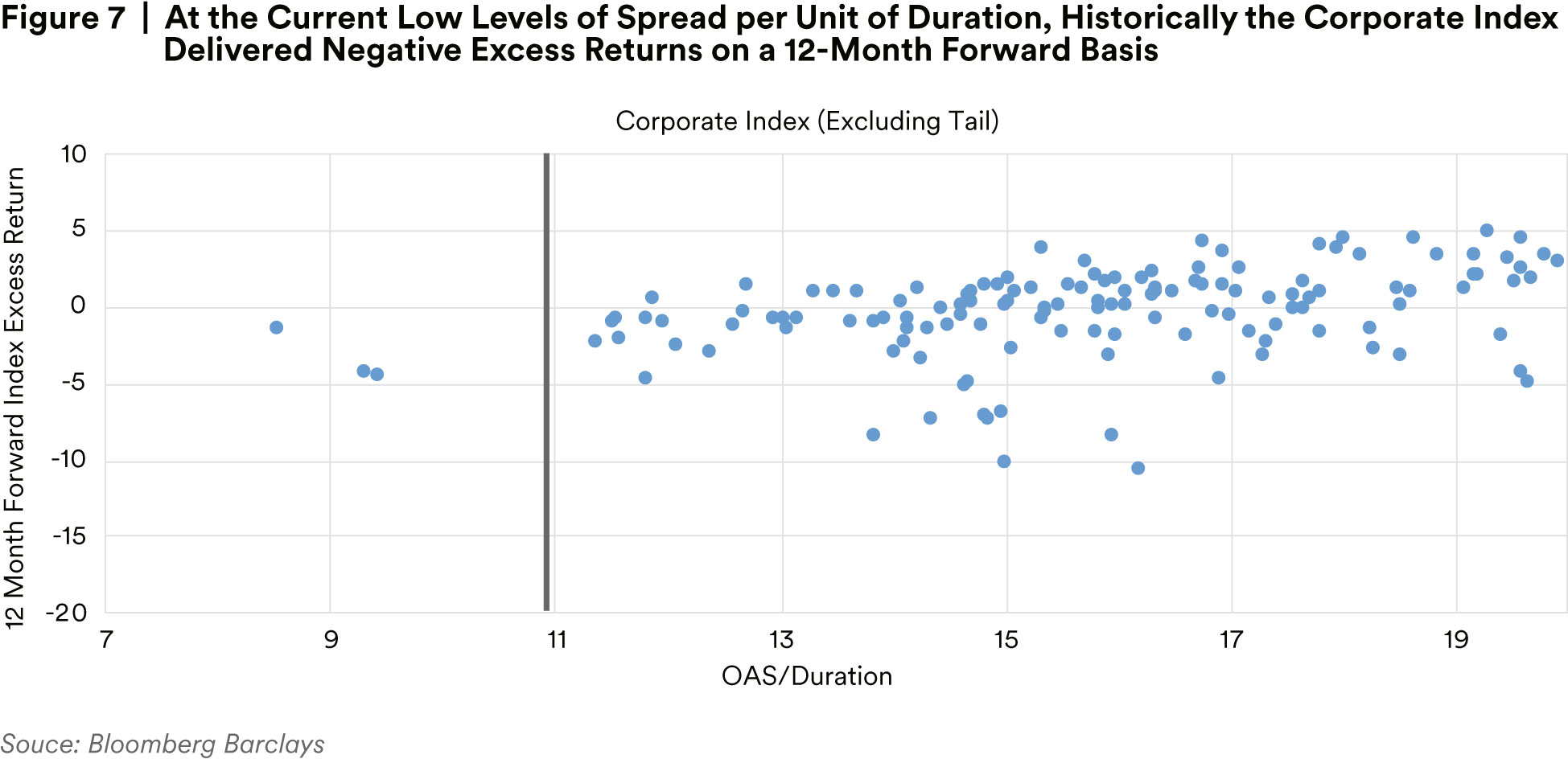

While technicals remain supportive of investment grade corporate spreads, valuations remain less compelling. Because of the significant downward move in rates in 2020, the duration risk in markets is significantly greater than it was when we last saw these spread levels; and adjusting for credit quality and duration, spreads are well through historical tights. From these valuations, as shown in Figure 7, there has never been a 12-month forward positive excess return as measured by spread compensation per unit of duration. Furthermore, any recovery is likely to be uneven and the longer lasting impact of the pandemic on sectors such as travel related, Retail, Technology, and Energy remain to be seen; whereas more resilient sectors are likely to perform better as consumer spending and corporate profits pick up. Of course, the bifurcation does not stop at the sector level, and performance is likely to vary widely across names, within ratings cohorts, and across the curve. Therefore, we believe security selection will continue to play a crucial role in portfolio construction and alpha generation will likely be driven by opportunistic positioning in select names and at select points on the curve; and not through beta trades and large-scale sector themes.

We came into the year conservatively positioned on the view that valuations were stretched and did not adequately compensate investors for the multitude of risks in the market. This positioning has allowed us to actively participate in the healthy new issue market and selectively add to opportunistic positioning. Outside of the index, we continue to monitor the relative value between investment grade issuers and fallen angels in comparable sectors to identify High Yield opportunities, and in non-corporate credit, the supportive macro backdrop and weaker U.S. dollar have presented opportunities in select Emerging Market Sovereign/Quasi names to pick up additional yield. Overall, our focus continues to be on seeking out opportunities in select intermediate and longer duration bonds, while taking advantage of robust new issuance, market dislocations, and further volatility to uncover attractive entry points.

Endnotes

1 Bloomberg

2 Bloomberg Barclays

3 Bloomberg

4 Bloomberg

5 Bloomberg Barclays

6 Bloomberg Barclays

7 JP Morgan

8 Bloomberg

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default). International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is only intended for, and may only be distributed to, investors in the EEA who qualify as a Professional Client as defined under the EEA’s Markets in Financial Instruments Directive, as implemented in the relevant EEA jurisdiction. The investment strategy described herein is intended to be structured as an investment management agreement between MIML (or its affiliates, as the case may be) and a client, although alternative structures more suitable for a particular client can be discussed.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan - This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), a registered Financial Instruments Business Operator (“FIBO”).

For Investors in Hong Kong - This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia, this information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for subsidiaries of MetLife that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors, including: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.