Reflation expectations and Democrat’s infrastructure plan have driven virtually all commodities higher, many of which are directly impactful on Emerging Market (EM) terms of trade, which disproportionally benefits commodity exporting countries. Developed market central banks around the globe are maintaining rates at record low levels in order to support growth and recovery. However, we have seen a few EM countries tighten policy over the quarter, including Turkey, Brazil and Russia.

Index Performance1

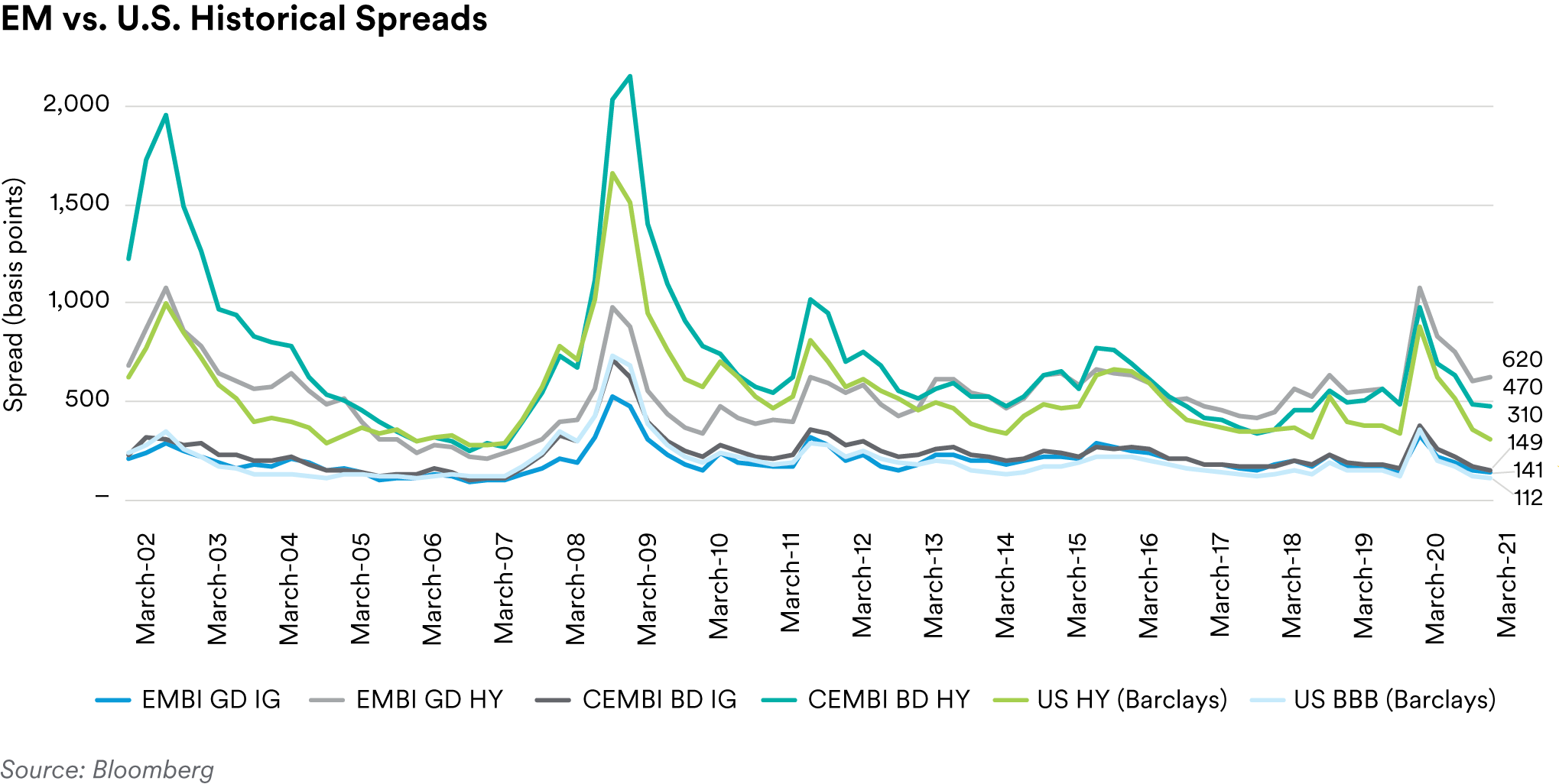

Hard currency sovereign spreads (EMBI Global Diversified) ended the quarter mostly unchanged (+3 basis points to 355) despite enduring a nearly constant selloff in treasuries. Investment grade (IG) names were 7 basis points tighter, while high yield (HY) sovereigns were 12 basis points wider, largely due to the sell-off in Turkey. The EMBI GD saw negative returns of 4.54%. Latin America was the worst performing region, with a large divergence between countries, with Argentina, Ecuador, and Peru underperforming, and El Salvador and Costa Rica outperforming.

Corporate spreads tightened slightly, but returns were still negative for the quarter. The index (CEMBI Broad Diversified) tightened 12 basis points, with investment grade tightening 20 basis points and high yield corporates tightening 15 basis points. After outperforming U.S. credit in 2020 and proving more resilient during the downturn, EM corporates underperformed in the first quarter. The CEMBI BD was the best performing of the JPM EM indices, but still posted negative returns of 0.80% in the quarter, with high yield names returning 0.41% and dragged down by more rate sensitive lower beta investment grade securities. African corporates were the only region posting positive returns, while Latin American corporates were the worst performing. With the strong rally in commodity prices, the infrastructure sector was able to outperform, while oil & gas and transportation sectors detracted from returns.

EM local markets faced another challenging quarter. Returns were -6.68%, with all EM currencies posting negative quarterly returns. The Turkish lira was the biggest underperformer after the drastic tumble in late March. The Brazilian real continues to lag peers as the country struggles to get spending under control with the pandemic continuing to run rampant in the country and failing to agree upon a 2021 budget with little progress made towards a reform. Political uncertainty within the country has also waned on investor sentiment as Bolsonaro’s popularity continues declining and we witnessed a complete overhaul of his cabinet at the end of the quarter.

Technicals

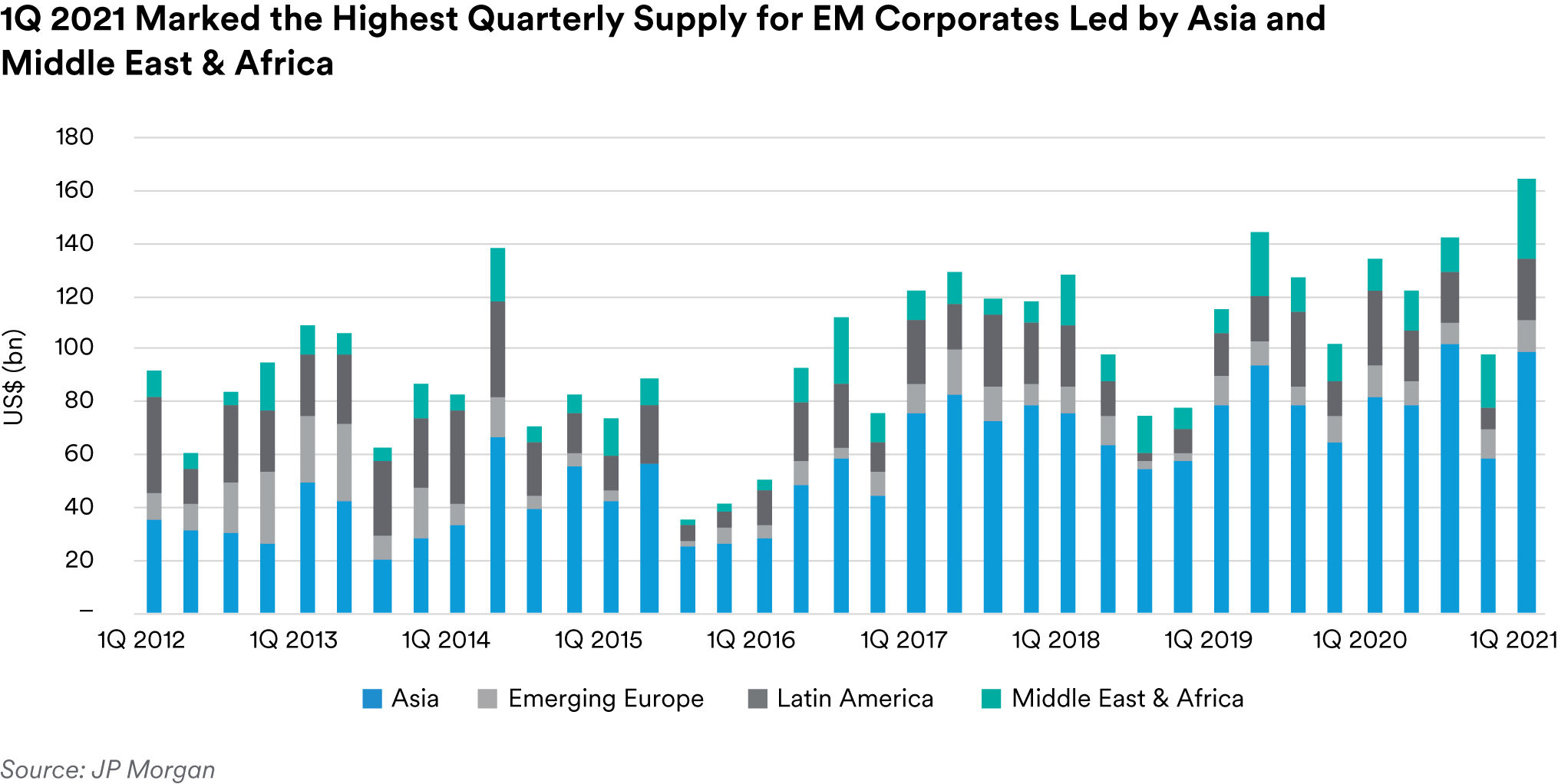

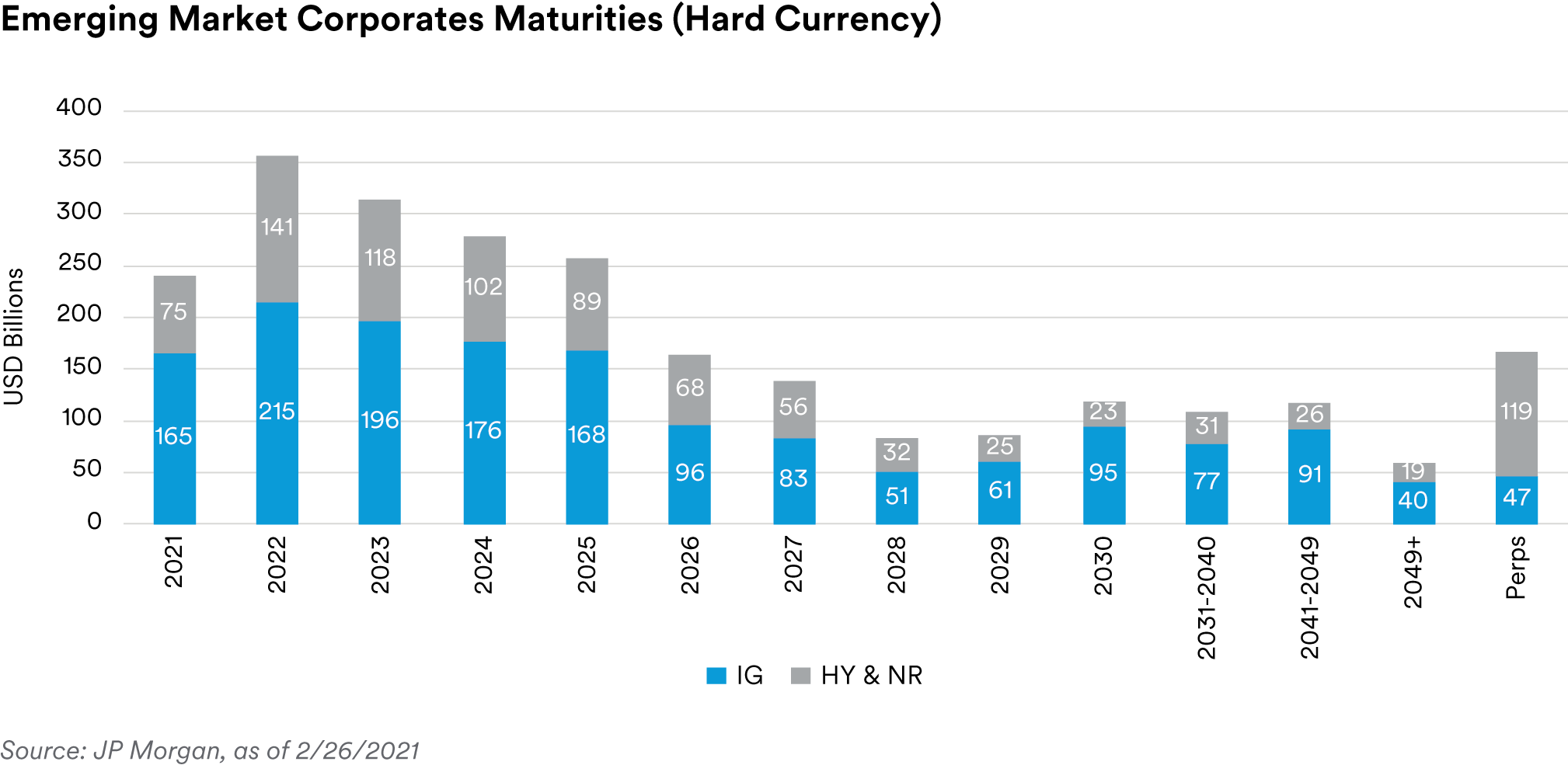

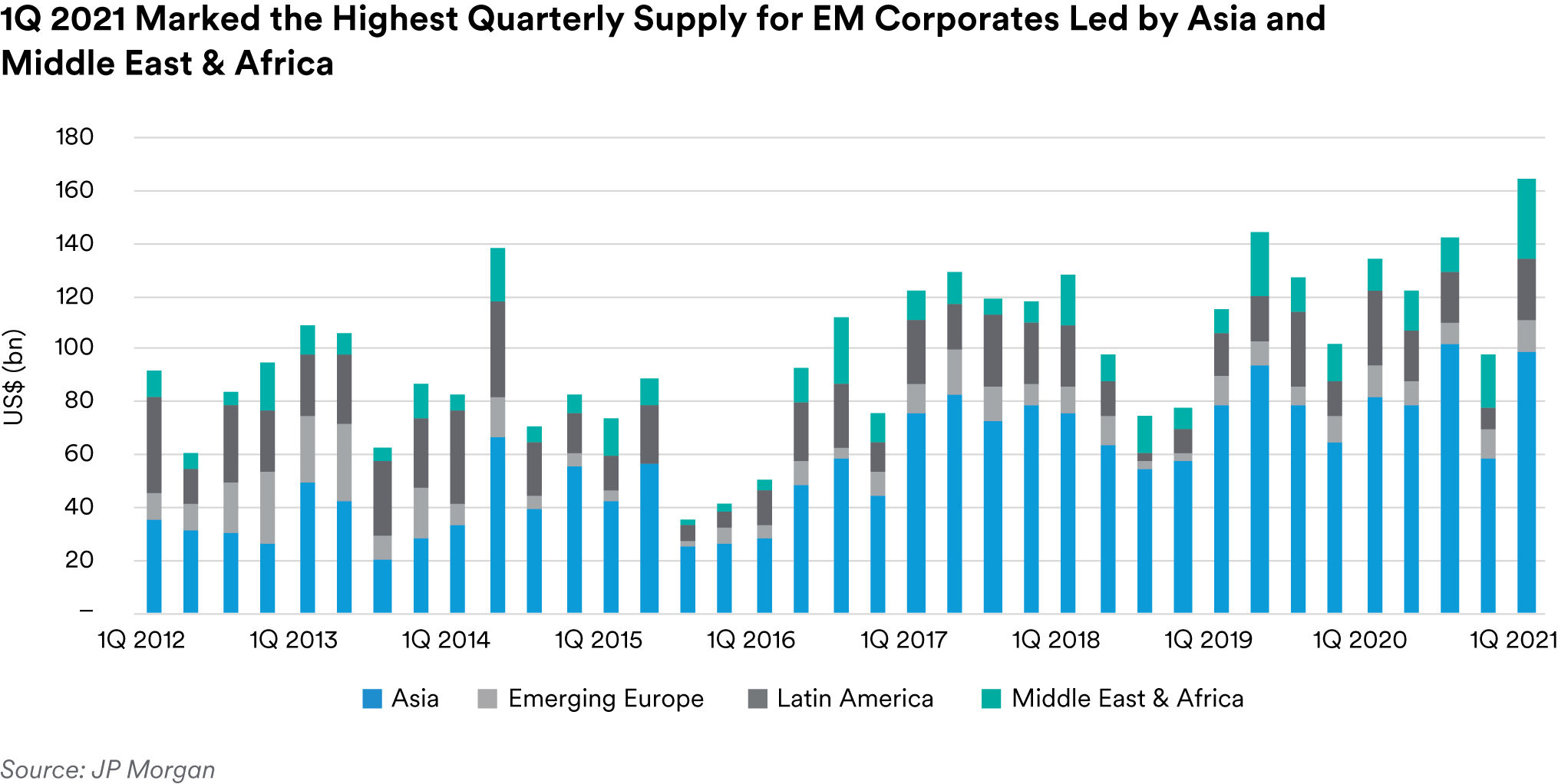

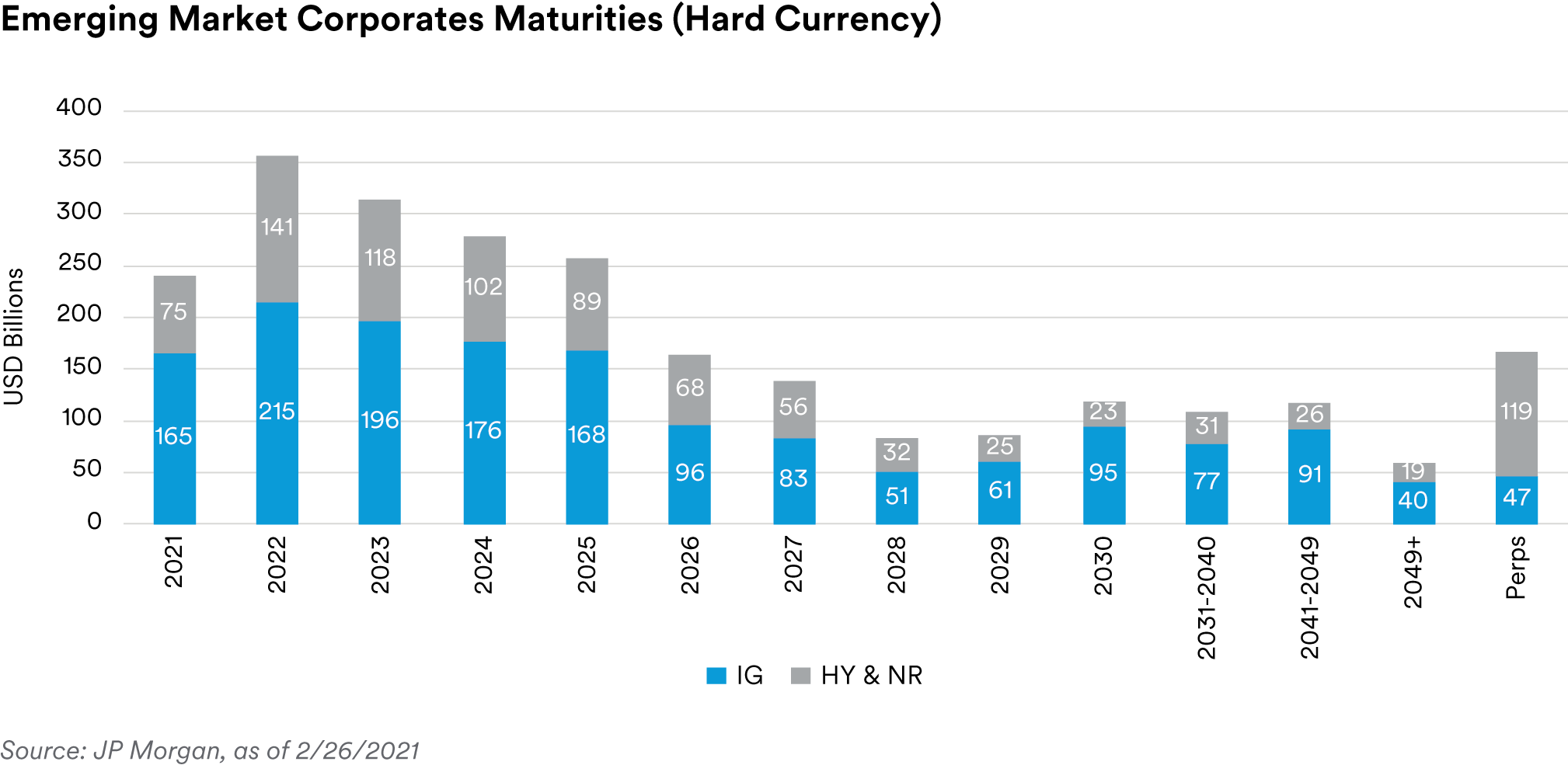

After seeing inflows for seven consecutive months into Emerging Markets, the streak was broken in February as hard currency bond funds saw significant outflows for a month before regaining momentum in March. Hard currency flows ended the quarter at $11.6 billion, while local currency flows were $17.4 billion. Despite the temporary lull in inflows, issuance during the quarter remained robust as a result of corporates continuing to refinance and sovereigns issuing to close fiscal gaps. EM corporates continue issuing at a record pace as we enter the second quarter, with $165 billion coming to market in the last three months. This was led by IG corporates issuing $107 billion, while Asia’s $100 billion of issuance dominated the geographic breakdown for corporate issuance. Sovereigns tapped the market for $67 billion USD, led by Latin America with $25 billion of new deals and closely followed by Middle East & Africa ($22 billion).1

We are seeing a sharp acceleration of EM environmental, social, and governance (ESG) related issuance. In 2020 the AUM of EM ESG credit funds tripled,3 and thus demand for sustainable bonds has risen with it. Sovereign and corporate issuers have been able to issue ESG bonds at tight levels given the small percent of the overall universe that they represent as investors have accepted less spread in order to invest their growing mandates. In Asia alone, green bond issuance in the first quarter was just shy of issuance from full-year 2020, $11.8 billion versus $12.6 billion.4 Sovereigns issued $8.3 billion of ESG bonds in Q1 compared to the $8.9 billion total sovereign issuance last year, with Chile and Hong Kong both coming to the market in the first quarter4. So far, only a small minority of the issuance has included accountability measures such as key performance indicators.

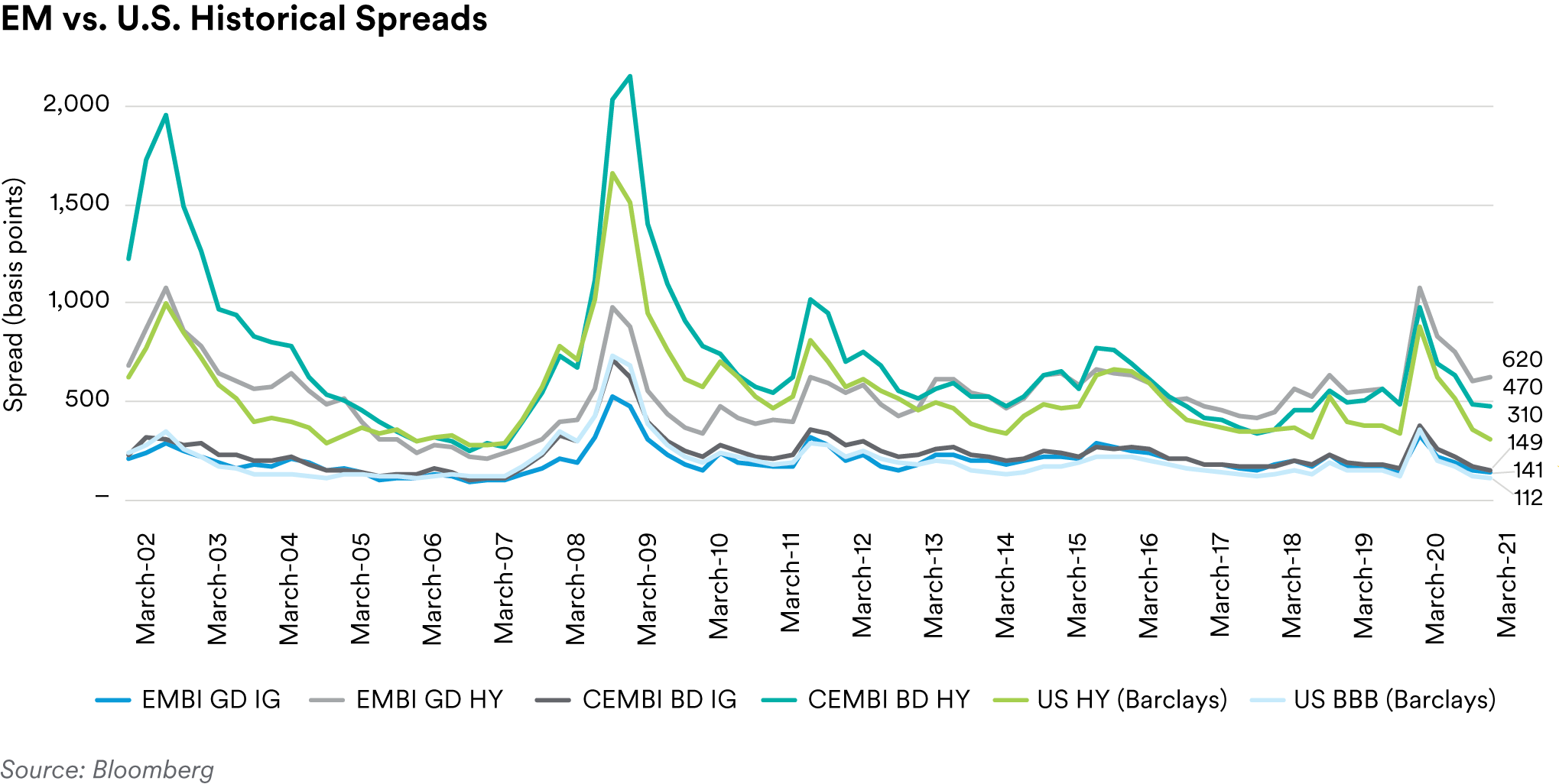

EMBI IG spreads widened out slightly relative to U.S. BBB spreads in the first quarter, while the CEMBI IG remained relatively in line with U.S. BBBs. Meanwhile, EM HY was not able to keep up with the spread tightening seen in the U.S. HY market during the quarter, with EMBI HY now offering an attractive spread pickup to both CEMBI HY and U.S. HY. Across EM, the spread curves saw significant flattening across the board in March, after steepening in late February with rising U.S. rates. Generally speaking, CEMBI spreads outperformed the EMBI with compression across both IG and HY.

Quarterly Events

A primary focus during first quarter was the U.S. foreign policy approach of the incoming Biden administration. We have been expecting a “reset’ in relations with China, without further deterioration of trade agreements. However, Biden has kept the hawkish stance on China, emphasizing human rights issues as a key deterrent to improved relations. While the sanctions placed on purchases of China military related securities went into effect in January, there has been minimal escalation or news surrounding the restricted companies since then. U.S./Russia relations remain strained as fresh sanctions were implemented to punish government officials for the alleged poisoning and jailing of opposition leader Navalny. The U.S. and U.K. are weighing possible additional penalties against Russia over the country’s use of chemical weapons.

In Turkey, following the central bank’s interest rate hike in March to counter the sharp rise in inflation, President Erdogan fired central bank governor Naci Agbal. This action sent the lira and sovereign bonds spiraling as investors fear a return to unconventional monetary policy in the country, just as they were heading in a more positive direction.

Brazil’s President Bolsonaro finds himself struggling to control the pandemic in his country, and as a result has witnessed a complete overhaul of his cabinet and a lack of investor faith in the country. Noise around Petrobras, with the CEO making insensitive comments regarding fuel prices, and management changes within the company also led to added volatility in Brazil this quarter. Mexico’s oil company Pemex continued to draw headlines, with rumors around potential capitalization, a possible departure of the CEO, and uncertainty around the company coming to the market this year.

On the political front, the election in El Salvador went well and the country continues taking positive steps towards reaching a deal with the IMF. In Ecuador, bond prices endured severe volatility just before and after the first round of its elections in February, which should continue until the outcome is determined in April.

Outlook

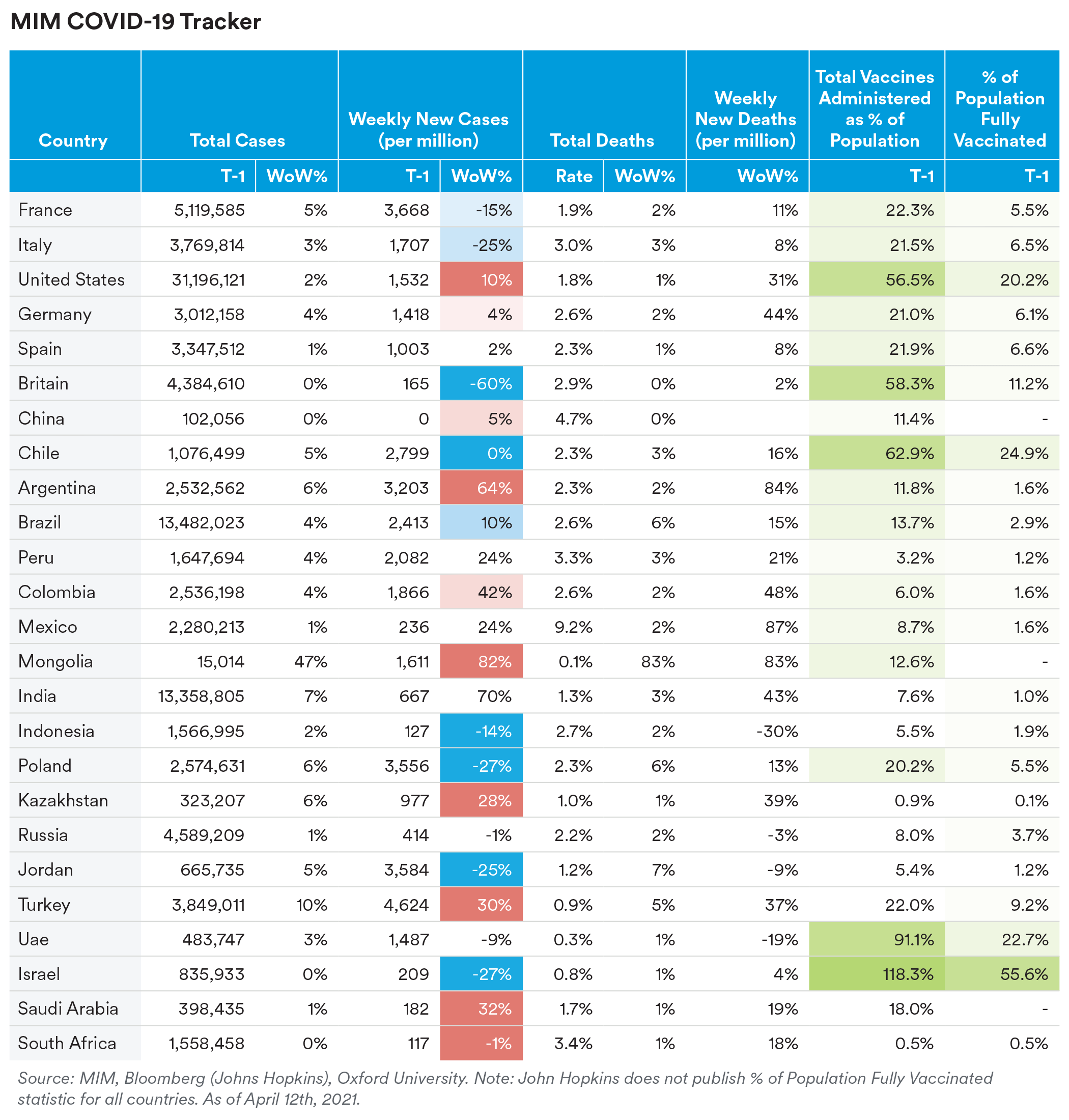

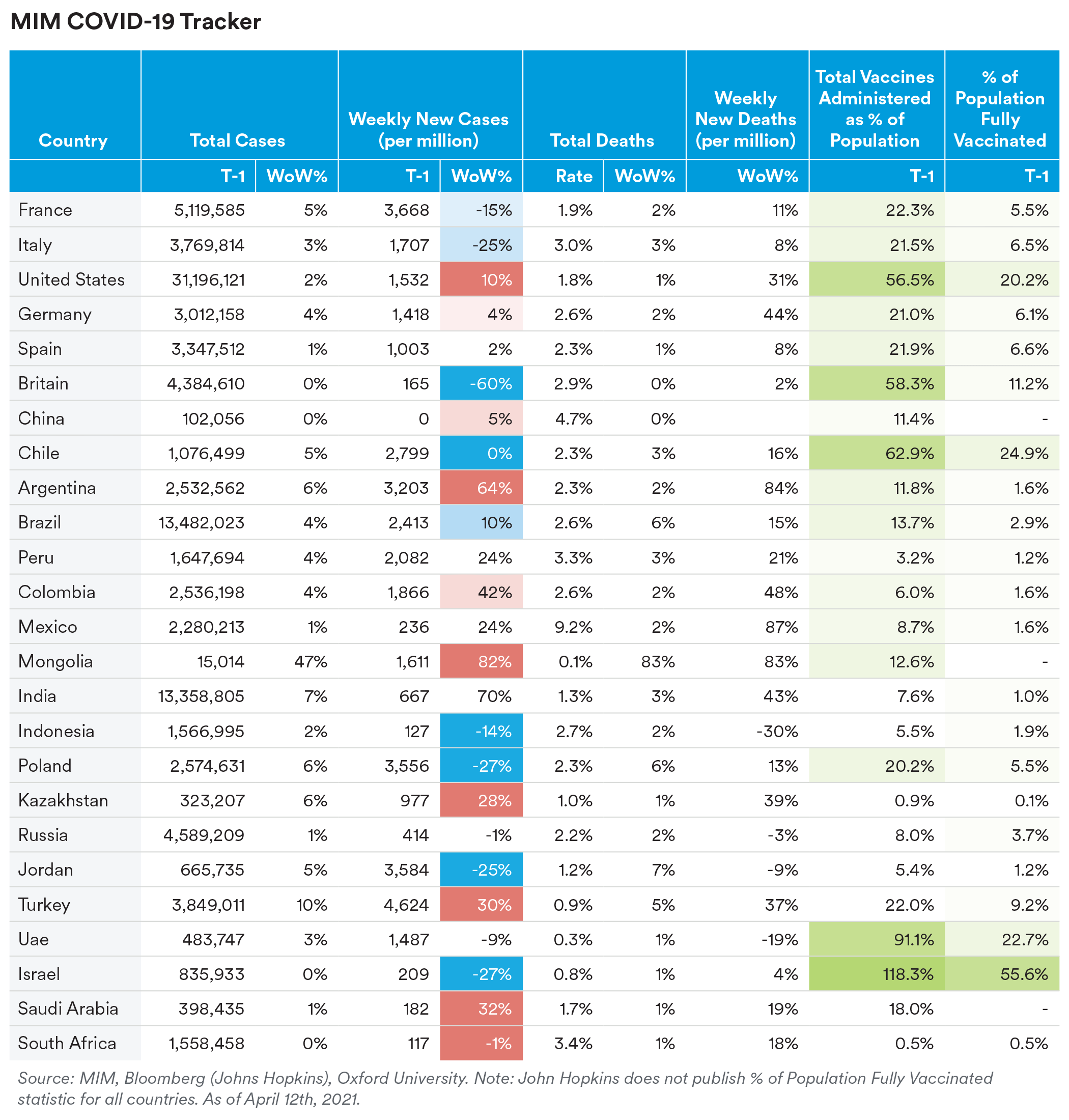

COVID-19 vaccination rollouts in Emerging Markets will play an important role in the EM growth recovery story this year, especially for countries that rely heavily on tourism. Our vaccination tracking points to a meaningful uptake of vaccinations in the second half of 2021 once production and distribution of vaccines to developing countries increases. The global recovery is likely to accelerate in the second half of the year, which should also coincide with higher month over month inflation prints across the world. As inflation moves higher and output gaps compress, central bank’s current overly accommodative monetary stances are likely to be challenged. How this process is managed and communicated will be significant for risk assets, rates and the U.S. dollar.

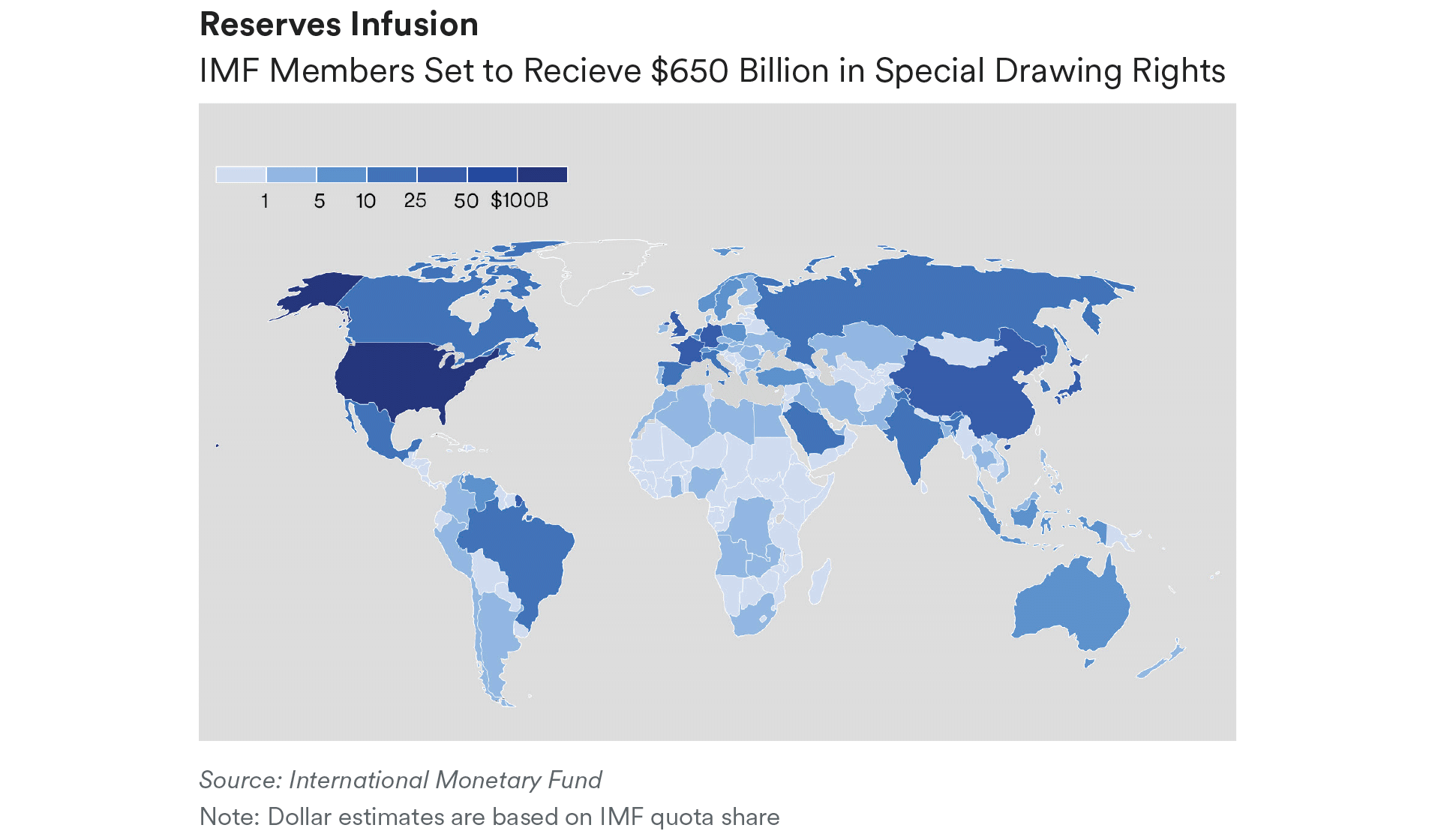

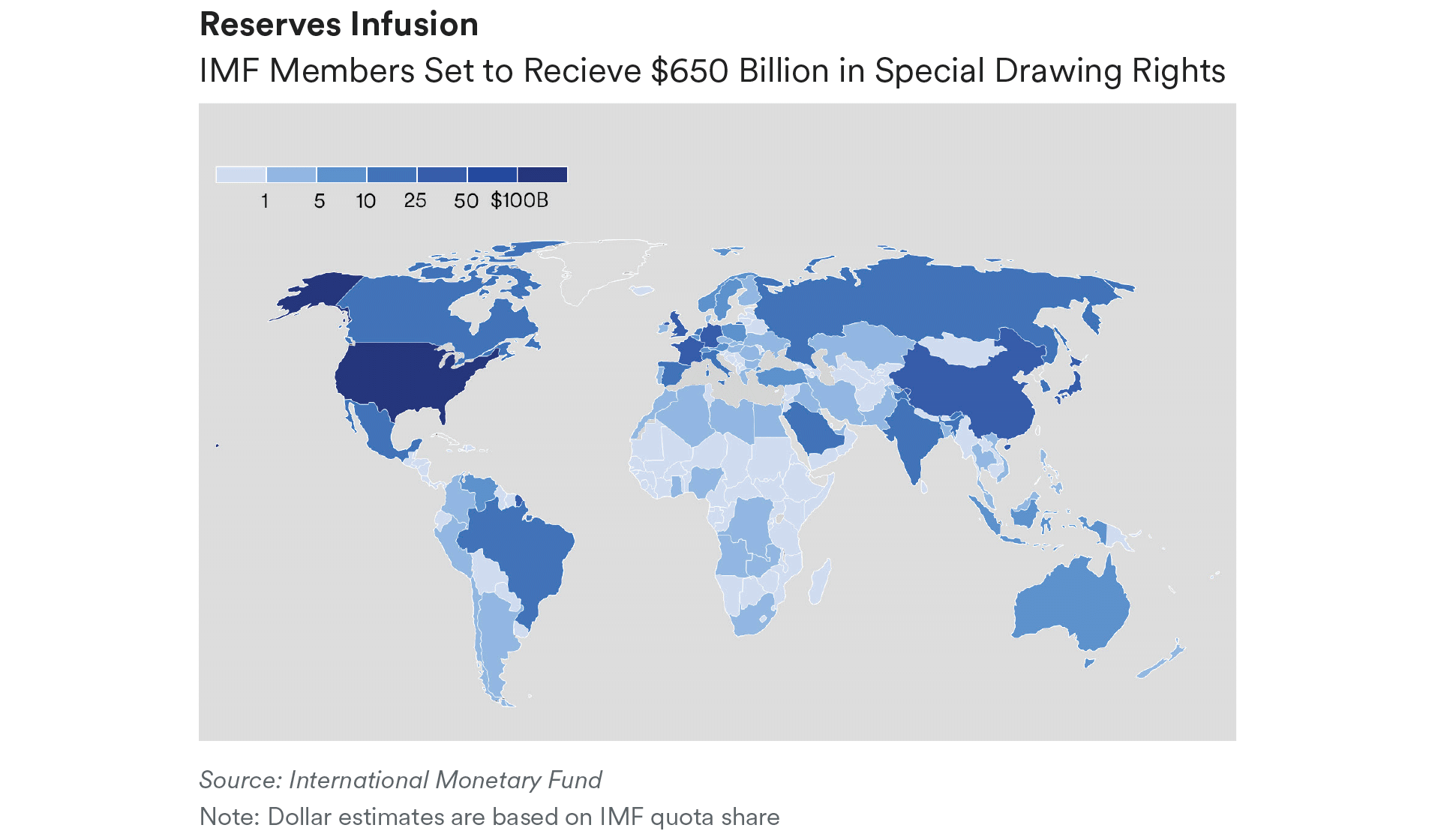

The IMF remains active, with talks ongoing in El Salvador, Costa Rica, and Argentina. The IMF is also pursuing an expansion of its Special Drawing Rights (SDR) reserves by $650 billion, which would give more funds to members still working on financially recovering from the pandemic. If approved, these new reserves, which would be the first expansion of SDRs since 2009, will become available later this year.2 On the political front, upcoming elections in Peru (2nd round), Mexico (legislative), and the Chile constituent assembly are all scheduled for the coming months. Peru polls suggest that left winged candidate Castillo has a possibility of winning, which we believe would be a market-negative outcome. Later this year Zambia, Chile, Honduras, and Argentina (legislative), as well as Colombia and Costa Rica in 2022 will pave the way to potential changes in the governments and influence the likelihood and magnitude of reform.

Turkey’s policy mix will continue to be a closely monitored concern for investors as the new central bank governor steps in. Reform progress is critical for maintaining debt sustainability and ratings in both Colombia and Brazil. As Biden comes up on his first 100 days in office, U.S. foreign policy will remain in focus, especially around ongoing Russia sanctions and the country’s unsteady relationship with China.

The upcoming pipeline suggests that April will kick off another strong quarter of issuance. We project that flows into the asset class will continue as bond yields rise to accommodate the increasing treasury yields and investors continue to get compensated for the additional risk versus U.S. credits. Default rates in EM have seen a return to normalcy after the elevated levels seen in 2020. EM corporate defaults are projected to be 2.5% for 2021, while the U.S. HY default rate has been revised down to 2% for 2021.1

Positioning/Strategy

As we constantly seek attractive opportunities in the market, we currently see value in EM corporates, given companies’ stronger fundamentals, which proved able to withstand the downturn in 2020. With our portfolio’s high yield compression trade, we will look to take some of that trade off and shift into other opportunities across the indices and rating spectrums. We are careful with positioning in the sovereign space, despite the recent spread widening, as countries continue facing headwinds around recovery from the pandemic. We remain alert for special situations within the sovereign space, especially around IMF support and election headlines, where we see upside potential that has not yet been priced into the bonds. With the continued robust pipeline, new deals can offer compelling spread premiums where we see value and potential for tightening.

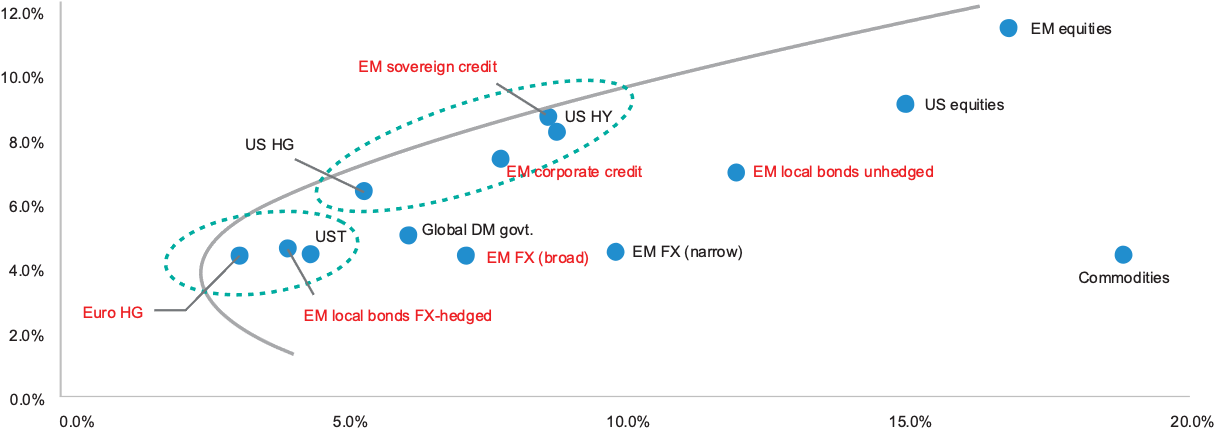

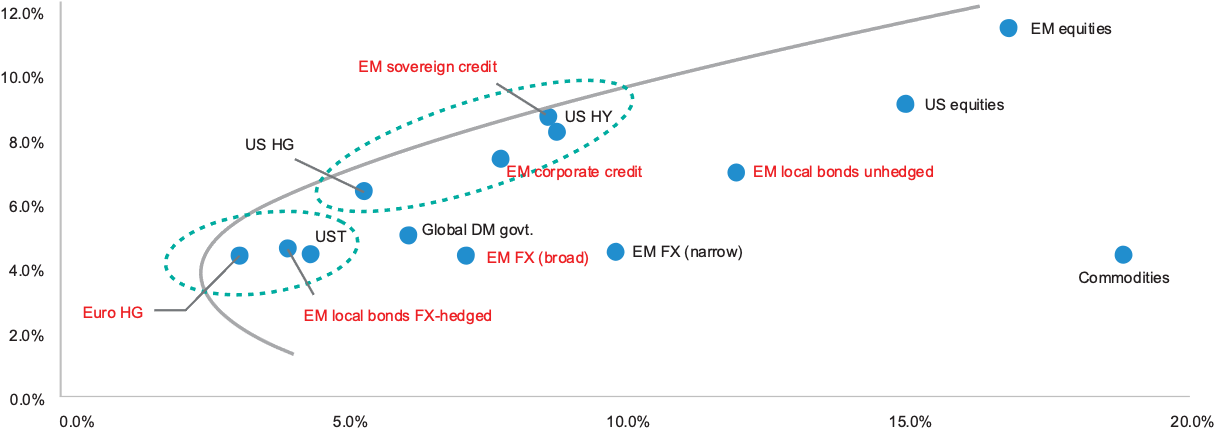

EM Sharpe Ratios Compare Favorable Over the Long Term, Especially on a Like Currency Basis

Source: J.P. Morgan - Sharpe rations since 2003, X –axis, Average Annual Volatility (%), Y-Axis: average annual return (%). As of September 2020.

We maintain the view that 10-year treasury yields will face continued pressure, and therefore remain cautious on low beta, long duration positioning. Another area where we continue to remain watchful is the local currency space. Given the recent underperformance, there is potential value in strongly supported currencies; however, given the recent events in Turkey, we are tactical with our positioning and remain vigilant in our analysis of fiscal responses to differentiate within the local space. We also look for local currencies that may benefit from improving trade dynamics and commodity prices given our view of a continued improving global growth backdrop.

Sources:

1 All index, issuance, and flows data sourced from JP Morgan

2 Bloomberg

3 Barclays

4 Morgan Stanley

Disclosure

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Fixed income investments are subject interest rate risk (the risk that interest rates may rise causing the face value of the debt instrument to fall) and credit risks (the risk that the issuer of the debt instrument may default). International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation, and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are often heightened for investments in emerging/developing markets or smaller capital markets.

In the U.S. this document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address Level 34 One Canada Square London E14 5AA United Kingdom. This document is only intended for, and may only be distributed to, investors in the EEA who qualify as a Professional Client as defined under the EEA’s Markets in Financial Instruments Directive, as implemented in the relevant EEA jurisdiction. The investment strategy described herein is intended to be structured as an investment management agreement between MIML (or its affiliates, as the case may be) and a client, although alternative structures more suitable for a particular client can be discussed.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan - This document is being distributed by MetLife Asset Management Corp. (Japan) (“MAM”), 1-3 Kioicho, Chiyoda-ku, Tokyo 102-0094, Tokyo Garden Terrace KioiCho Kioi Tower 25F, a registered Financial Instruments Business Operator (“FIBO”) No. 2414. For Investors in Hong Kong - This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”).

For investors in Australia, this information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

1 MetLife Investment Management (“MIM”) is MetLife, Inc.’s institutional management business and the marketing name for the following affiliates that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors: Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Asset Management Corp. (Japan), and MIM I LLC.