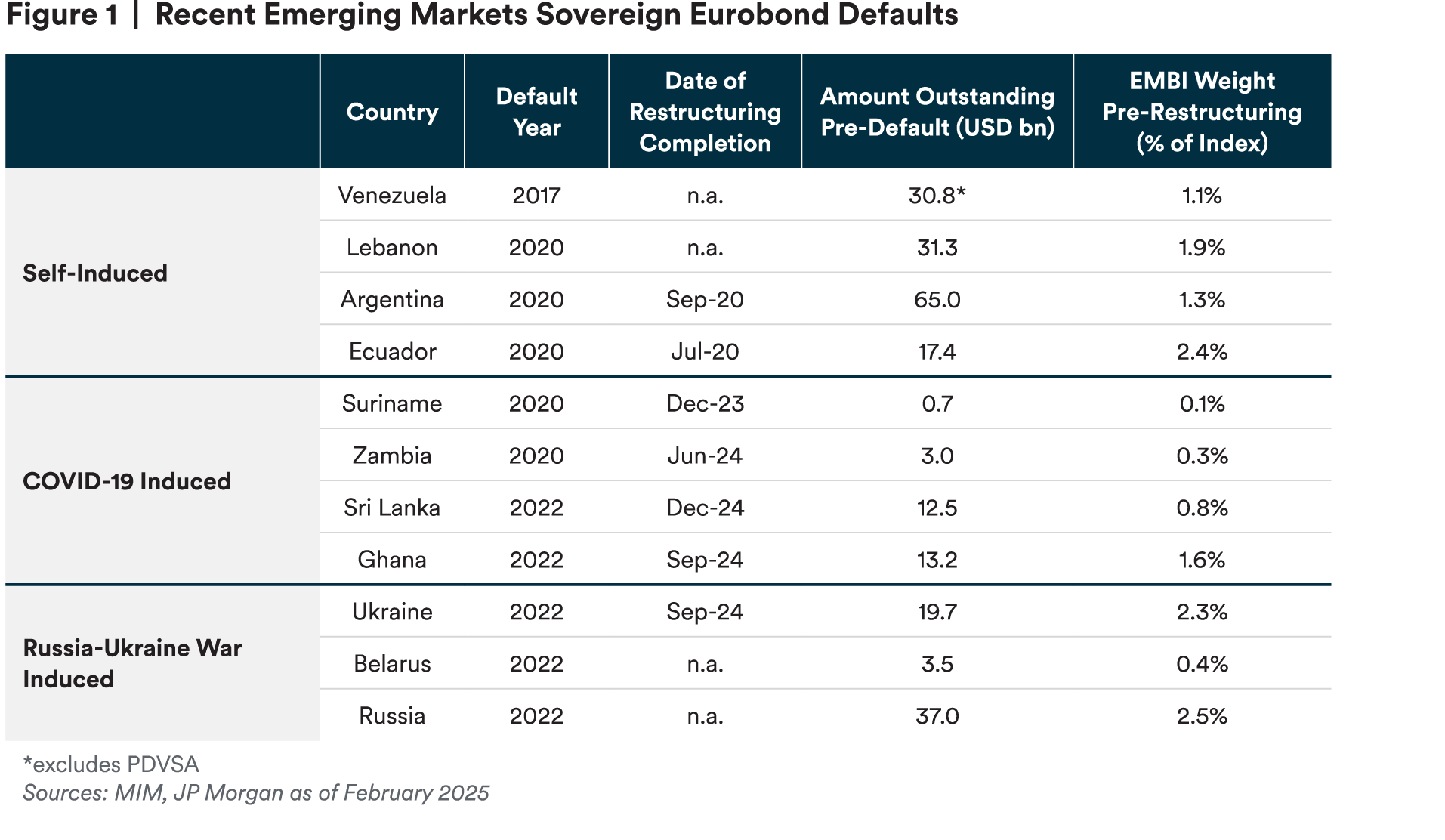

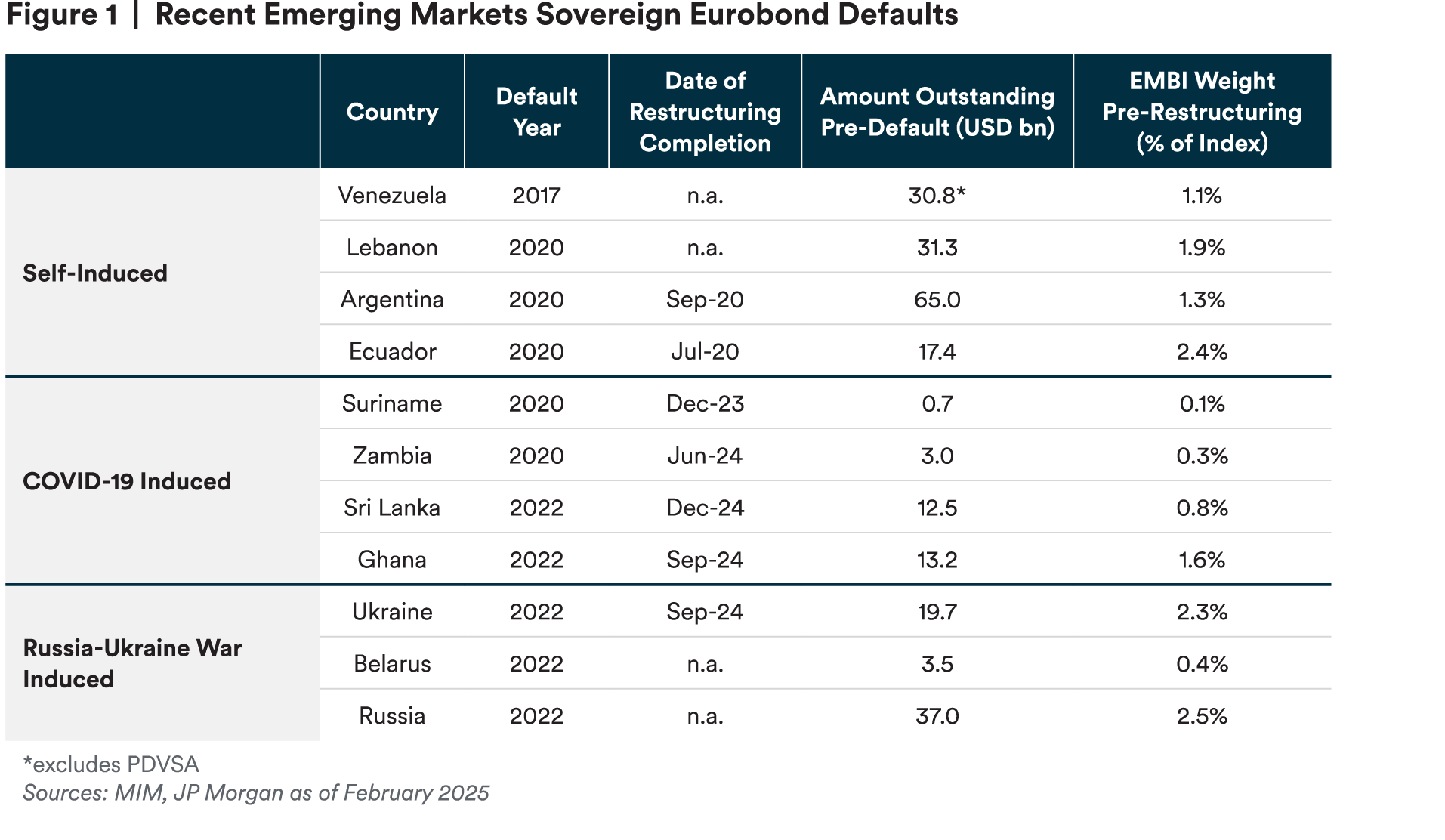

Pre-COVID Self-Induced Defaults: Countries like Argentina, Venezuela, Lebanon and Ecuador faced defaults due to poor policies that made them vulnerable to external shocks such as rising interest rates, a strong dollar or commodity price volatility. High debt levels from fiscal mismanagement and weak external buffers made these countries more susceptible to capital flight.

COVID-Induced Defaults: These defaults occurred in countries with elevated credit vulnerabilities, as reflected in their pre-pandemic credit ratings (all single Bs or lower). The COVID-19 shock was merely a tipping point that pushed their debt into unsustainable territory. This group includes Zambia, Ghana, Sri Lanka and Suriname.

War-Induced Defaults: Ukraine, as the country attacked in the war, shifted its financial priorities to defense and self-preservation, leading to a consensual two-year standstill with investors until August 2024. Meanwhile, Russia and Belarus defaulted entirely due to U.S. sanctions, which made it impossible for them to pay their foreign debts despite their willingness to do so.

Restructuring Progress

By the end of 2024, seven of the 11 defaulted EM countries have successfully restructured their debt. Ecuador and Argentina both restructured in 2020, achieving enough voluntary investor participation to trigger their bonds’ Collective Actions Clauses (CACs). Neither of these restructuring efforts featured a meaningful haircut to the outstanding notional value but instead aimed to create fiscal breathing space by dramatically reducing debt service costs and lengthening repayment terms. Both processes were relatively expedient when compared to the other five restructurings discussed below, perhaps because each country had an incentive to move quickly and take advantage of the very weak market sentiment during the depth of the pandemic to achieve more favorable terms.

The restructurings completed in 2024 (Suriname, Zambia, Ghana and Sri Lanka) took longer due to complex creditor dynamics and concerns over burden sharing and comparability of treatment. There were also challenges with the G20’s untested Common Framework for Debt Treatments (used in Ghana and Zambia). Also, investors seemed to believe they would benefit from the passage of time as each country recovered from the pandemic, and they were generally willing to take a bigger hit today in exchange for some exposure to favorable outcomes in the future. In all these cases, the IMF played a crucial role in determining the magnitude of cash flow relief required from creditors to reestablish long-term debt sustainability, considering each country’s specific economic conditions and political realities.

As of February 2025, four countries remain in default with little hope for imminent progress. Extremely high political uncertainty and gridlock in Venezuela and Lebanon is preventing progress with debt restructuring in those countries, while Russia and Belarus will remain in default while sanctions are in place.

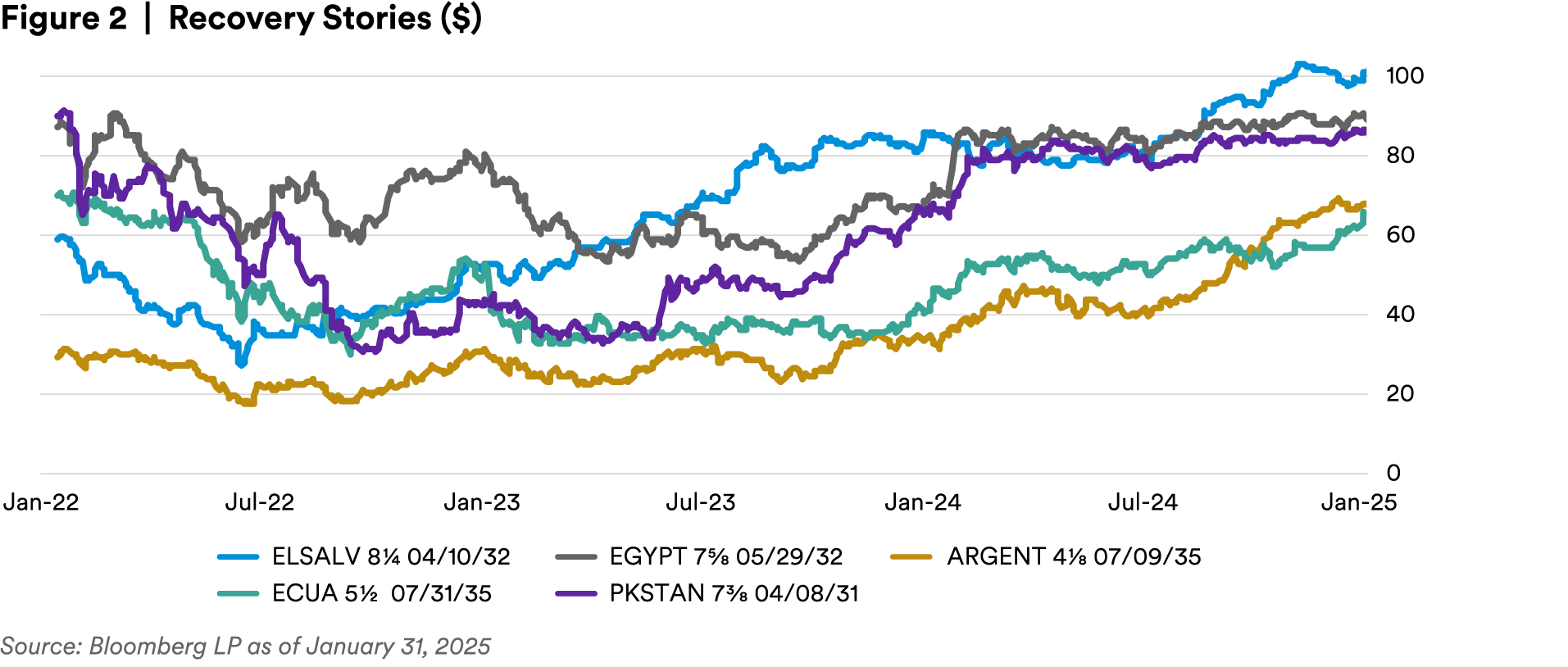

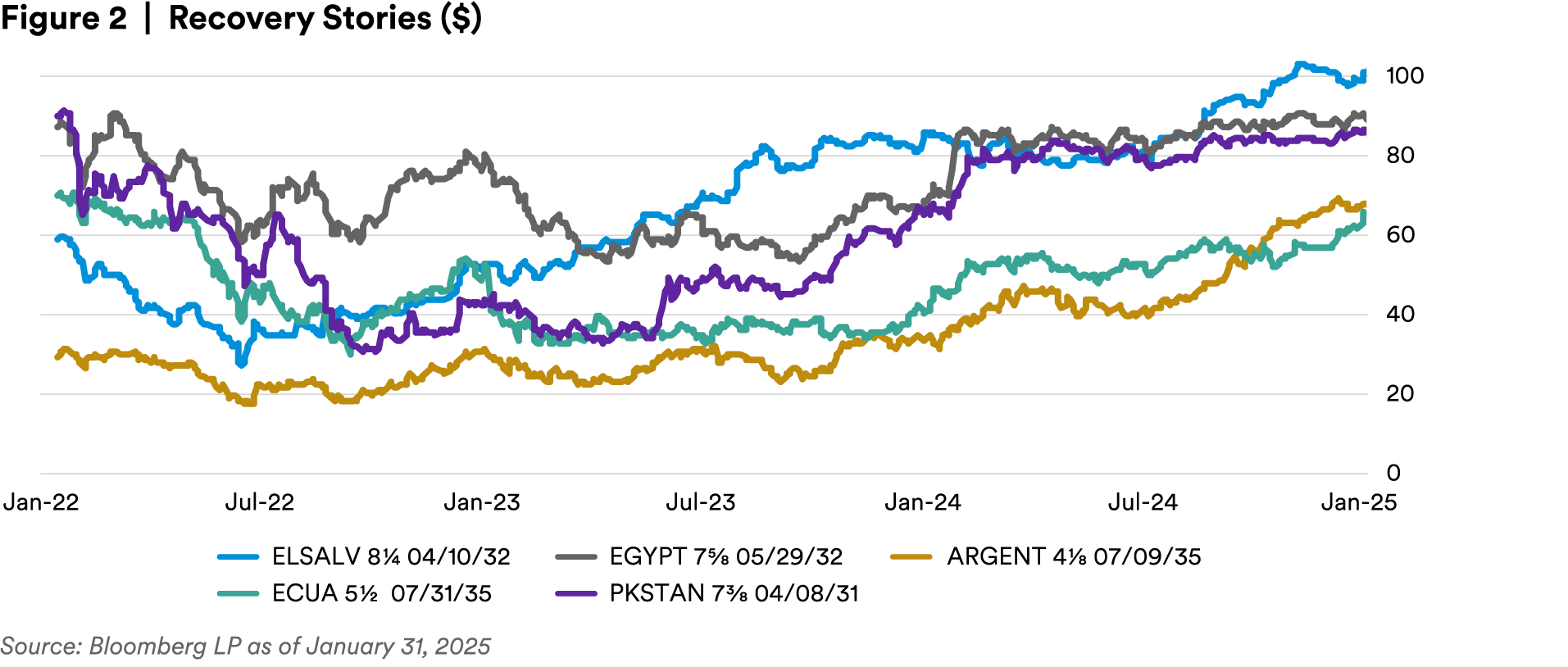

On a brighter note, in 2024, we observed a very positive trend for other EM distressed sovereigns. Notably, several distressed countries avoided default and now look more sustainable due to increased international support and progress with reforms. This group includes Egypt, El Salvador, Ecuador, Argentina and Pakistan. See chart below for price recovery from the 2022 downturn through present.

New Bonds and Innovations

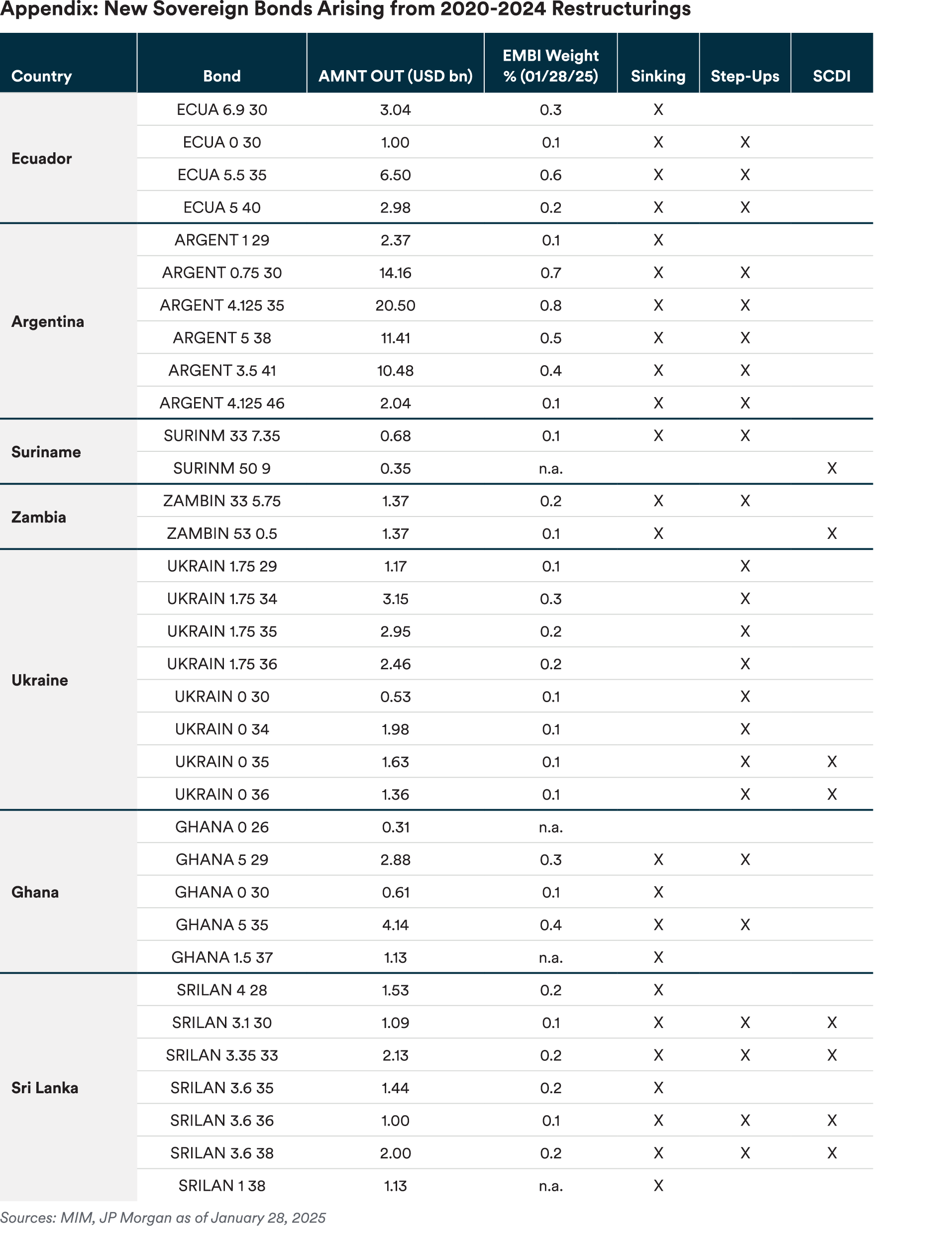

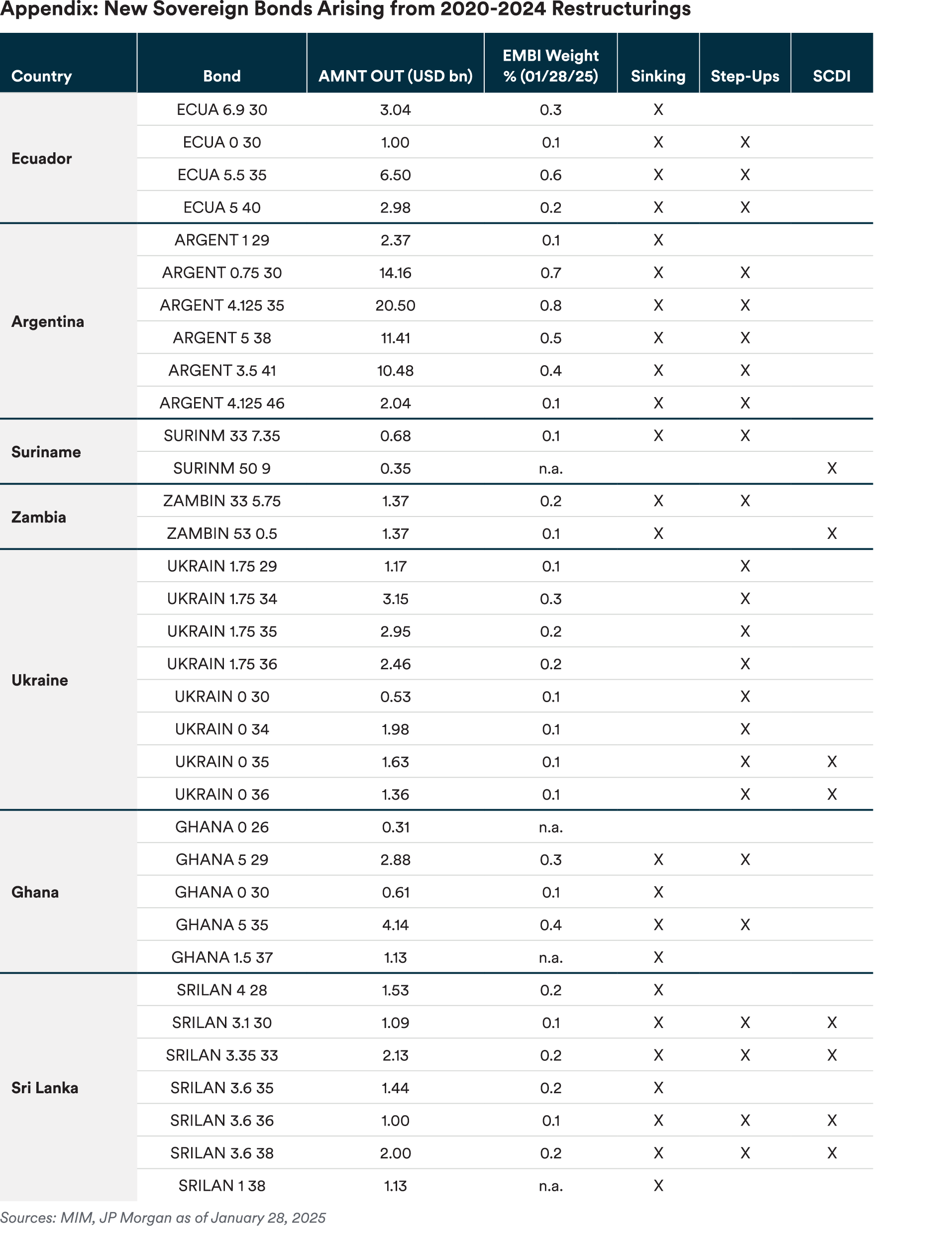

As of January 31, 2025, there are 34 new bonds actively trading on the market settled from the seven restructurings completed over the previous five years. These bonds collectively make up approximately 7% of the EMBI (see complete list in appendix).

Considering the cash flow relief required in each country, and the small haircuts applied to the notional debt stock, the outcome of these restructurings was new bonds with longer maturities and low coupons. However, sinking amortization profiles and coupon step-ups were included to allow some value recovery for investors. Of the 34 restructured sovereign bonds, all but one opted for some combination of sinkers and/or step-ups (Ghana 26s are a zero-coupon bullet).

State-Contingent Debt Instruments (SCDI) became a common feature among the 2024 restructurings, with only Ghana able close its deal without including one. SCDIs offer upside to investors, tying future adjustments to some objective criteria that can be verified on or by a specific measurement date in the future. Valuing these bonds requires complex financial modeling using probabilistic macroeconomic forecasting. For investors to have any confidence in the potential upside offered by these instruments, they should develop a reliable valuation model while regularly updating their macroeconomic forecasts to align with the progress seen in each country. We believe such a model can provide ongoing insight into how the market is pricing the underlying assumptions in each case relative to an investment team’s own baseline expectations.

Below we will focus on the SCDIs issued by each country and visually illustrate their unique features in the accompanying graphs.

Innovative SCDIs: Country by Country

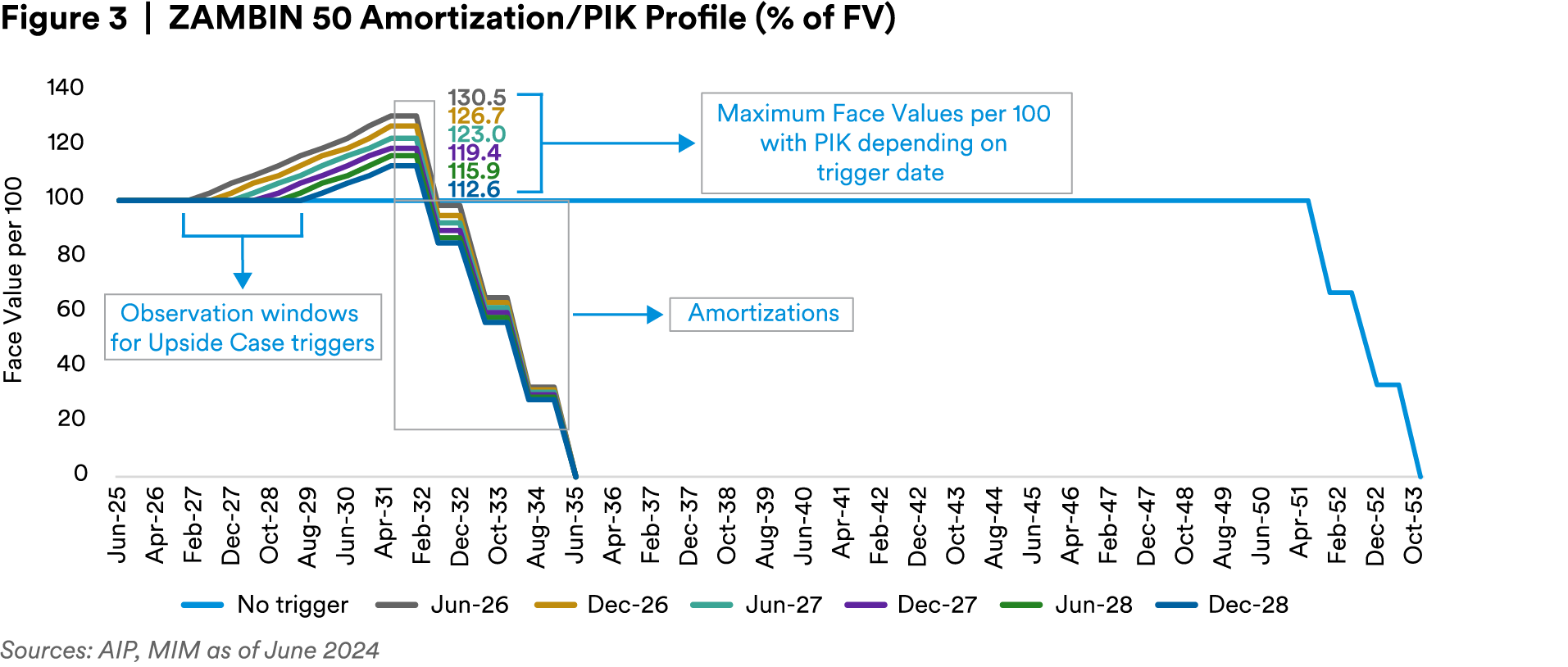

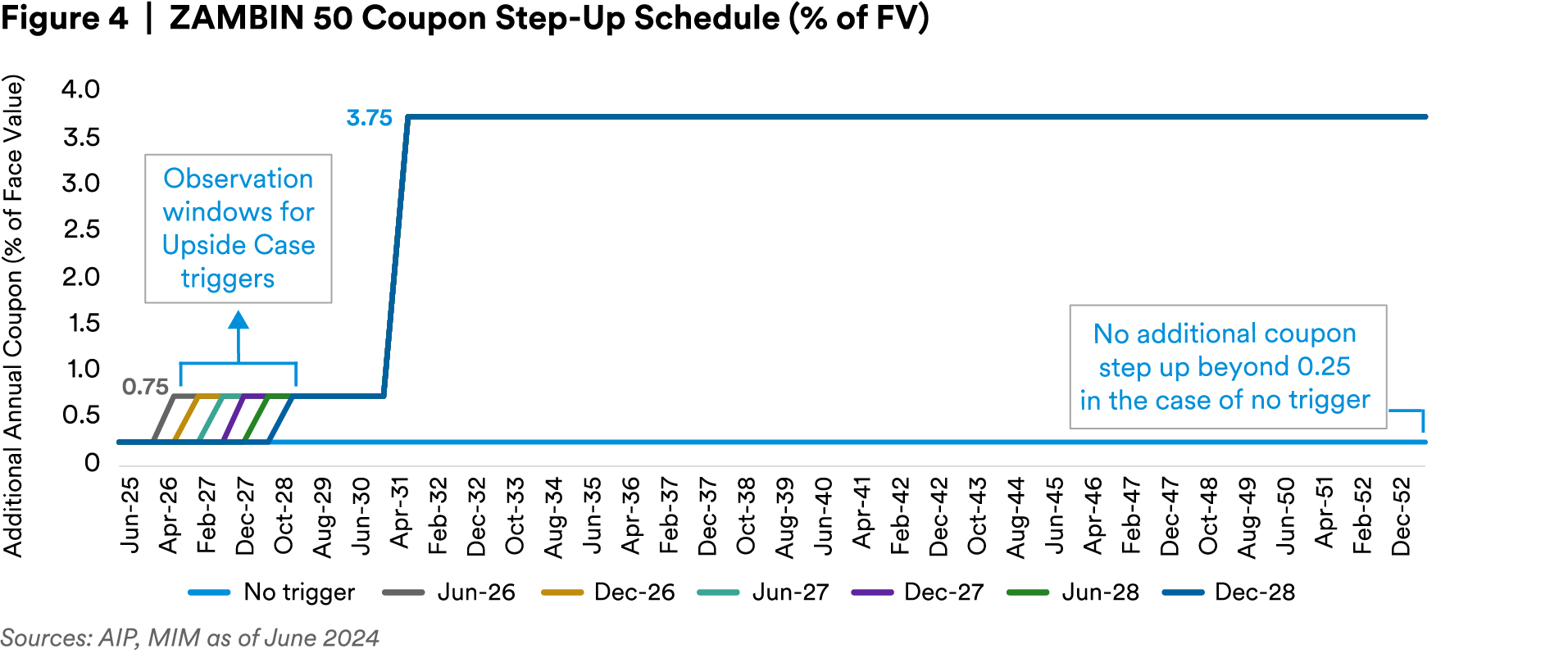

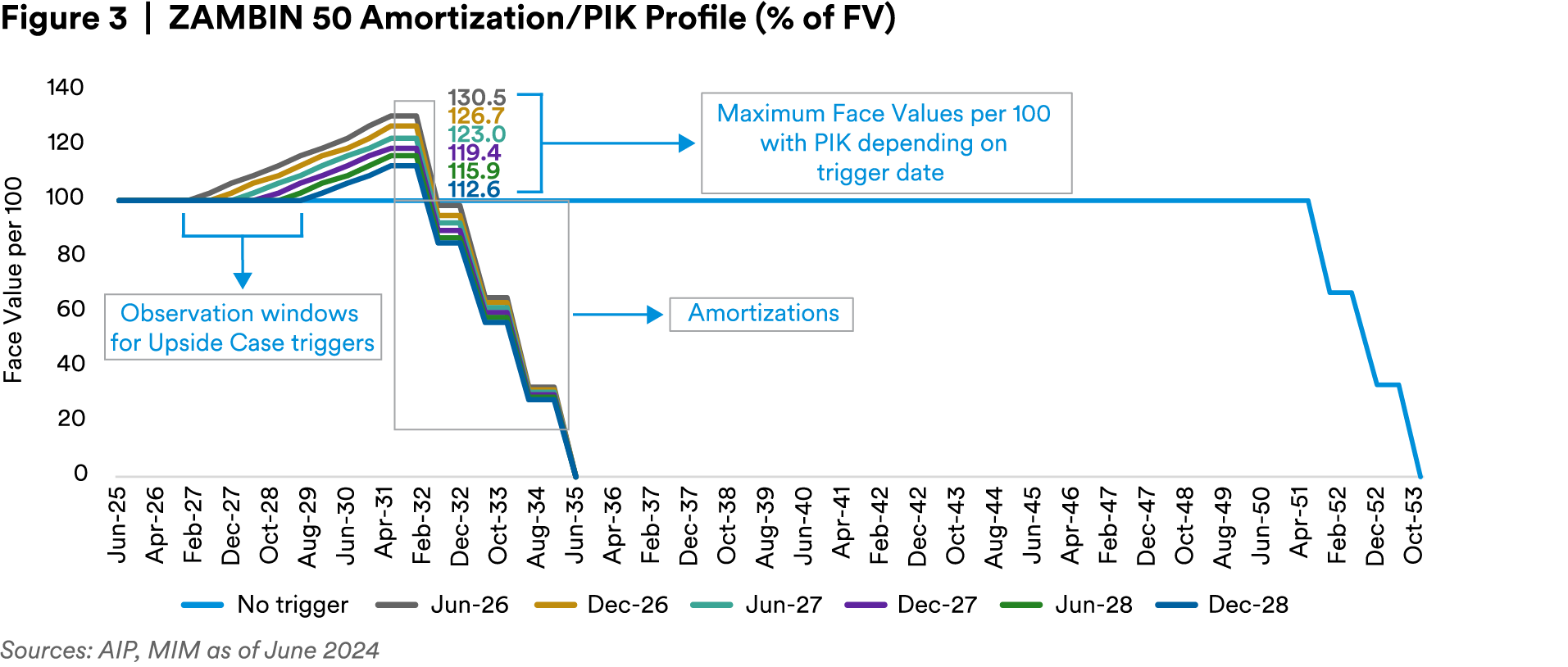

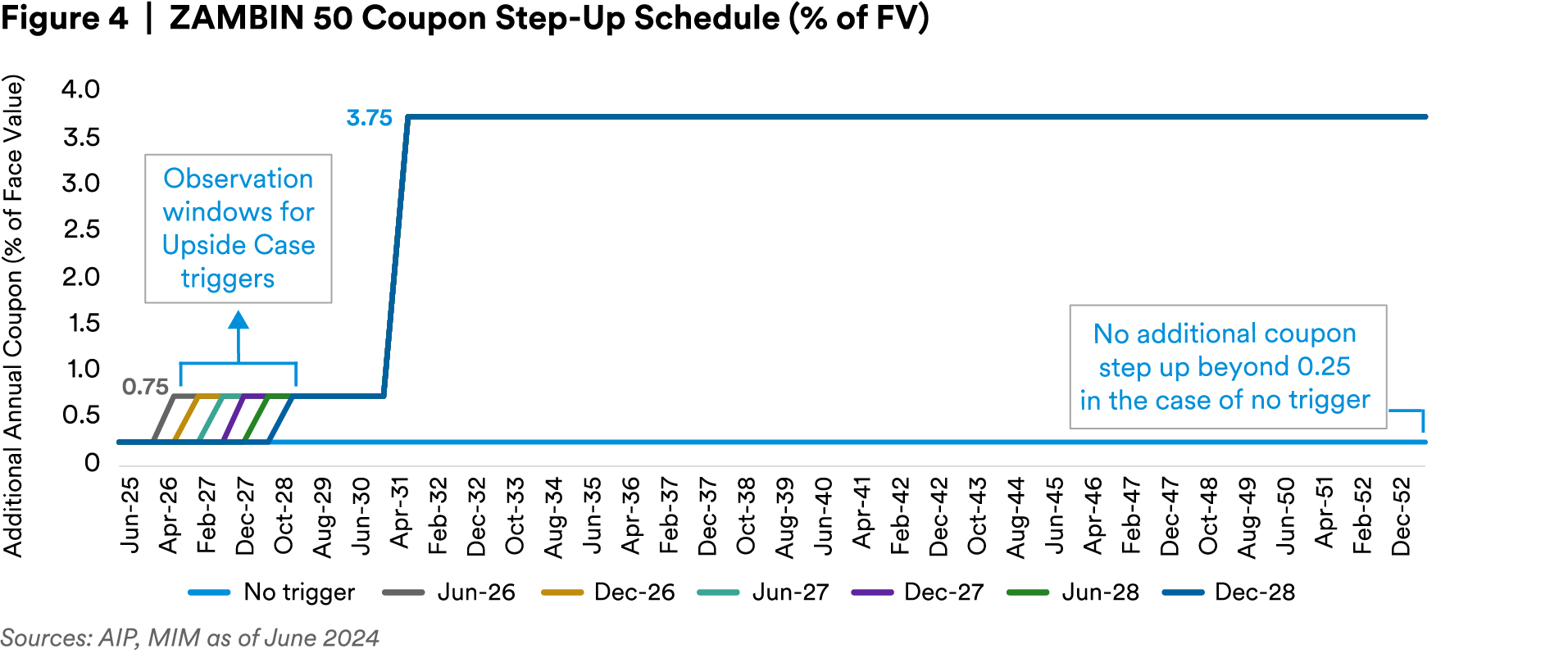

Zambia: The 2053 SCDI bond as issued has a 0.5% coupon to maturity, resulting in a very low present value at Zambia’s prevailing market yield. However, if triggered, the bond's final maturity would be shortened to 2035, its cash coupons would rise materially, and it would receive a sizable capital reinstatement from additional paid-in-kind (PIK) coupons, resulting in a significant increase in net present value (NPV). There are two conditionalities that would trigger these bond enhancements, both measured in eight different windows between 2026 and 2028. The first condition is met if the country's ratio of exports-to-fiscal revenue ratio exceeds a certain level, measured as a three-year rolling average, as referenced in the debt sustainability analysis (DSA) that is part of Zambia's Extended Credit Facility (ECF) with the IMF. The other trigger is related to Zambia's debt-carrying capacity (DCC), which is set by the World Bank's Composite Indicator (CI) score, a measure of a country's capacity to take on debt. Currently, Zambia has a "weak" DCC level of 2.67. The trigger is set at 2.69, which is the threshold for countries with “medium” debt carrying capacity.

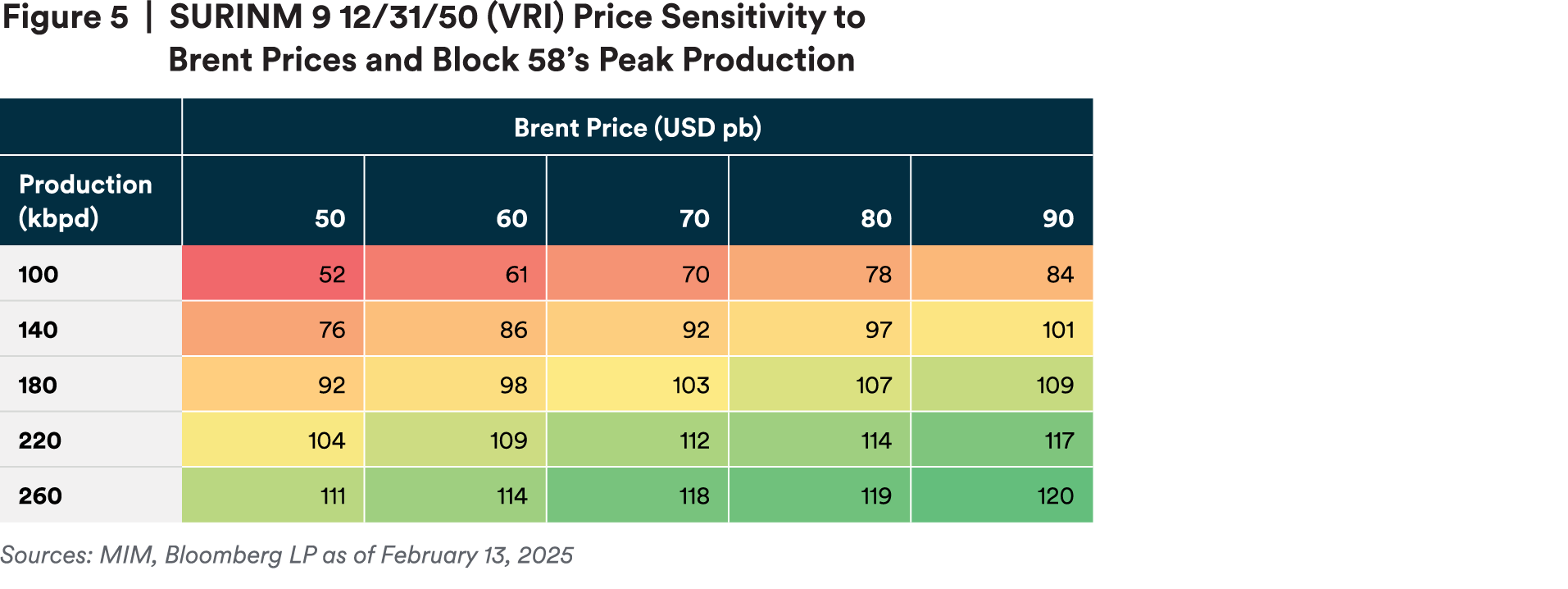

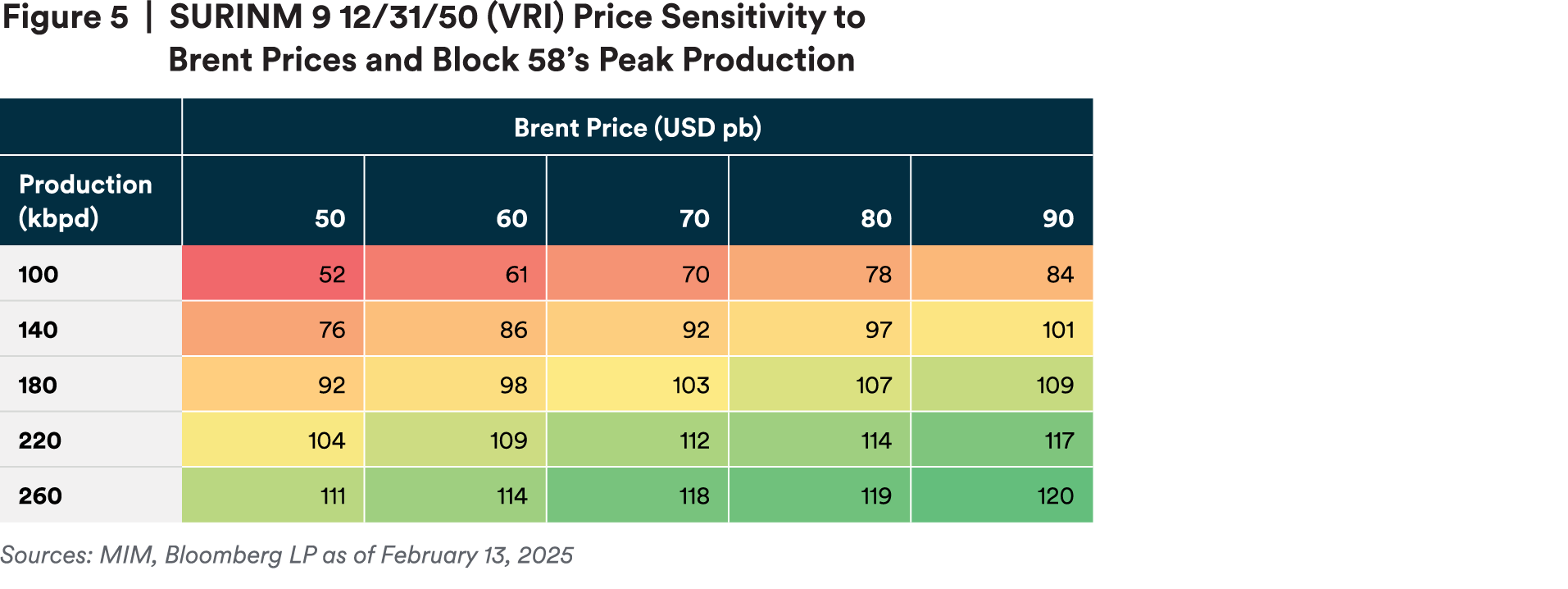

Suriname: The debt exchange featured a Value Recovery Instrument (VRI), a form of SCDI-linked to the potential royalty stream paid by an offshore oil field, Block 58 or GranMorgu. The project, with allegedly 750mn barrels of oil in potential reserves and an expected production of 220k bpd at peak, is scheduled to start producing by 2028. Given that the cashflow stream for the bonds would come from an oil field that is in its initial stages of development, investors would need to assume the conditions for those royalties to materialize — e.g., future oil prices, production estimates, development delays, the rate of reserve decline, etc. In the table below, we show our NPV projections for this instrument based on cash flows using different oil prices and production scenarios and a discount rate of 9.5%. We also assume first oil will occur by 2028, with a two-year ramp-up to peak production that then would be sustained for around six years.

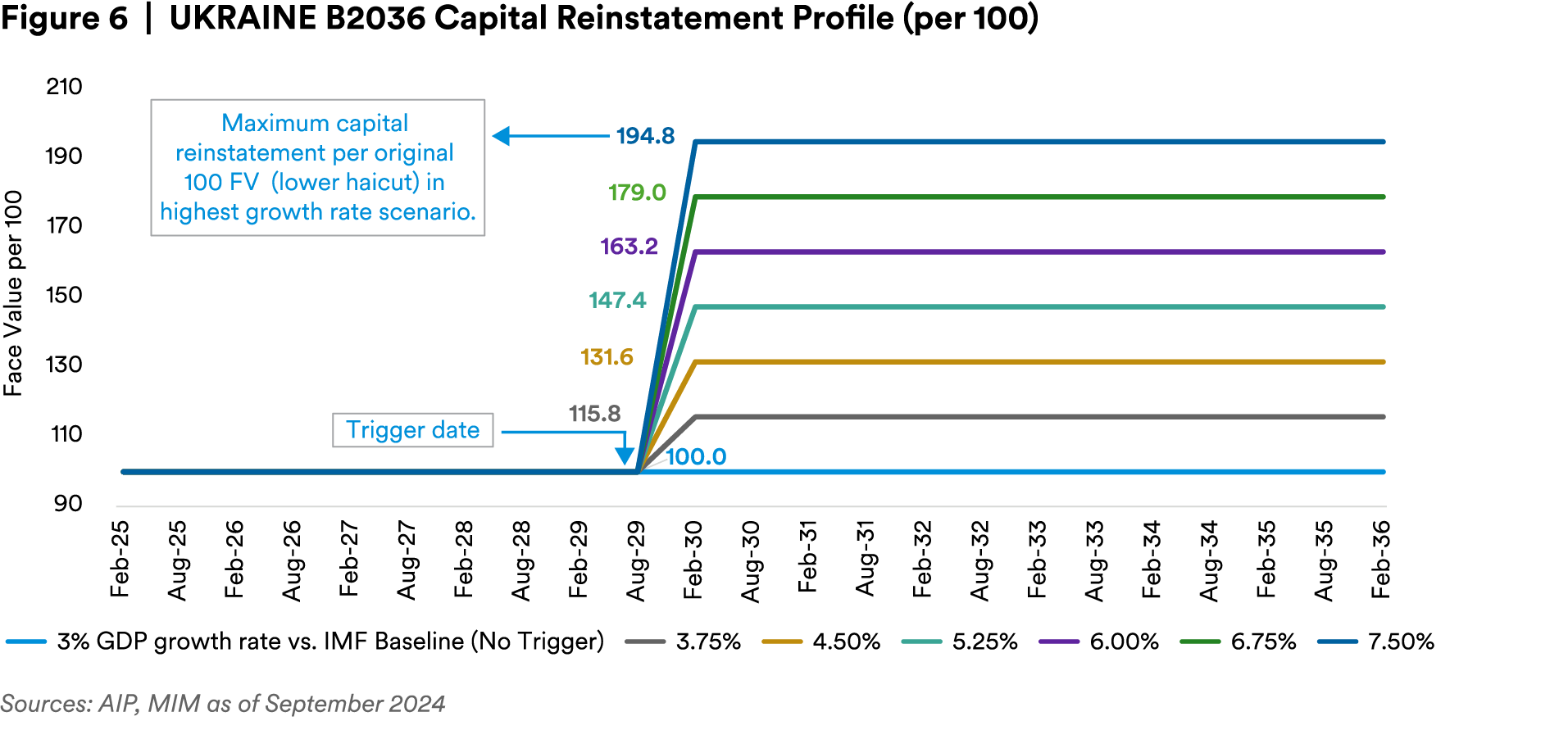

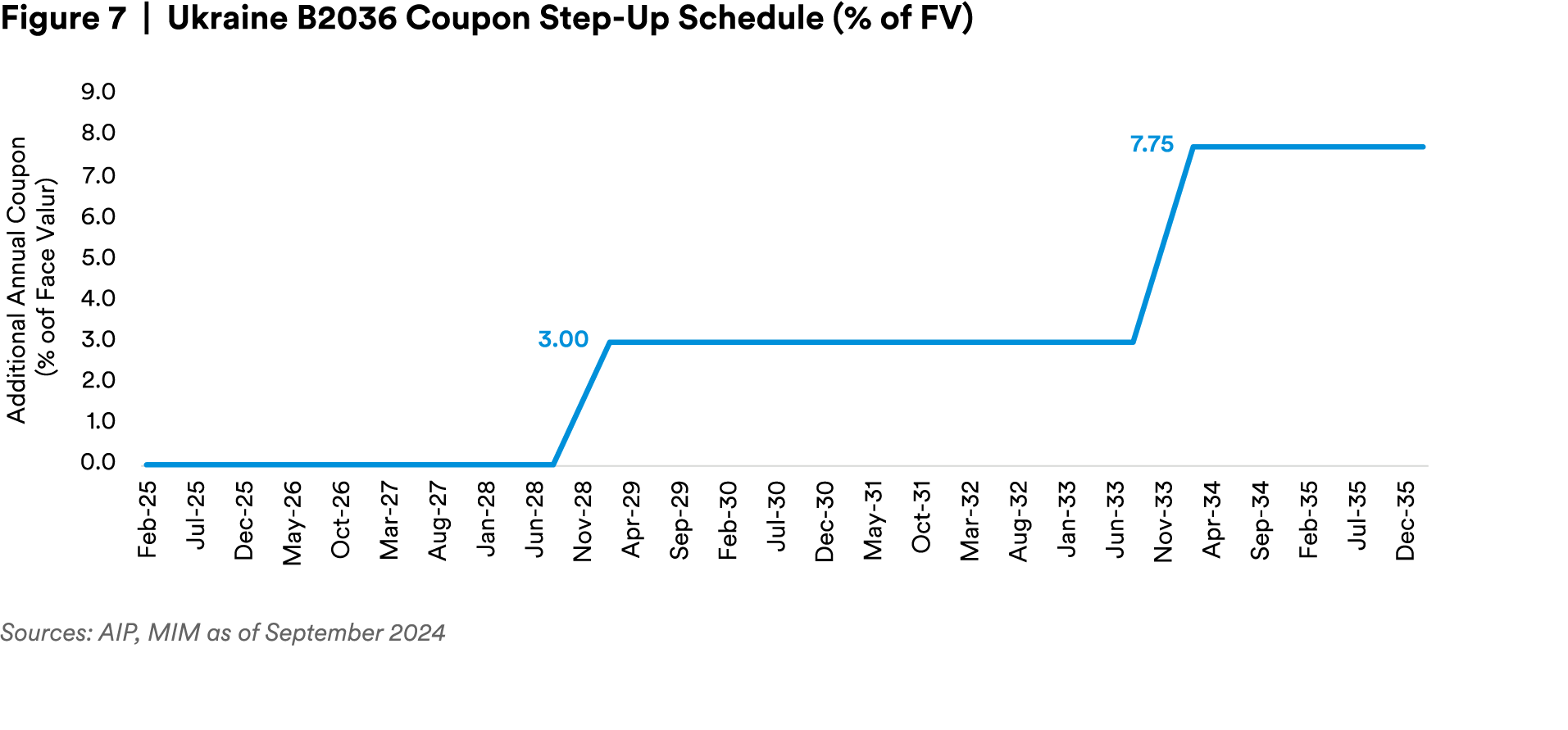

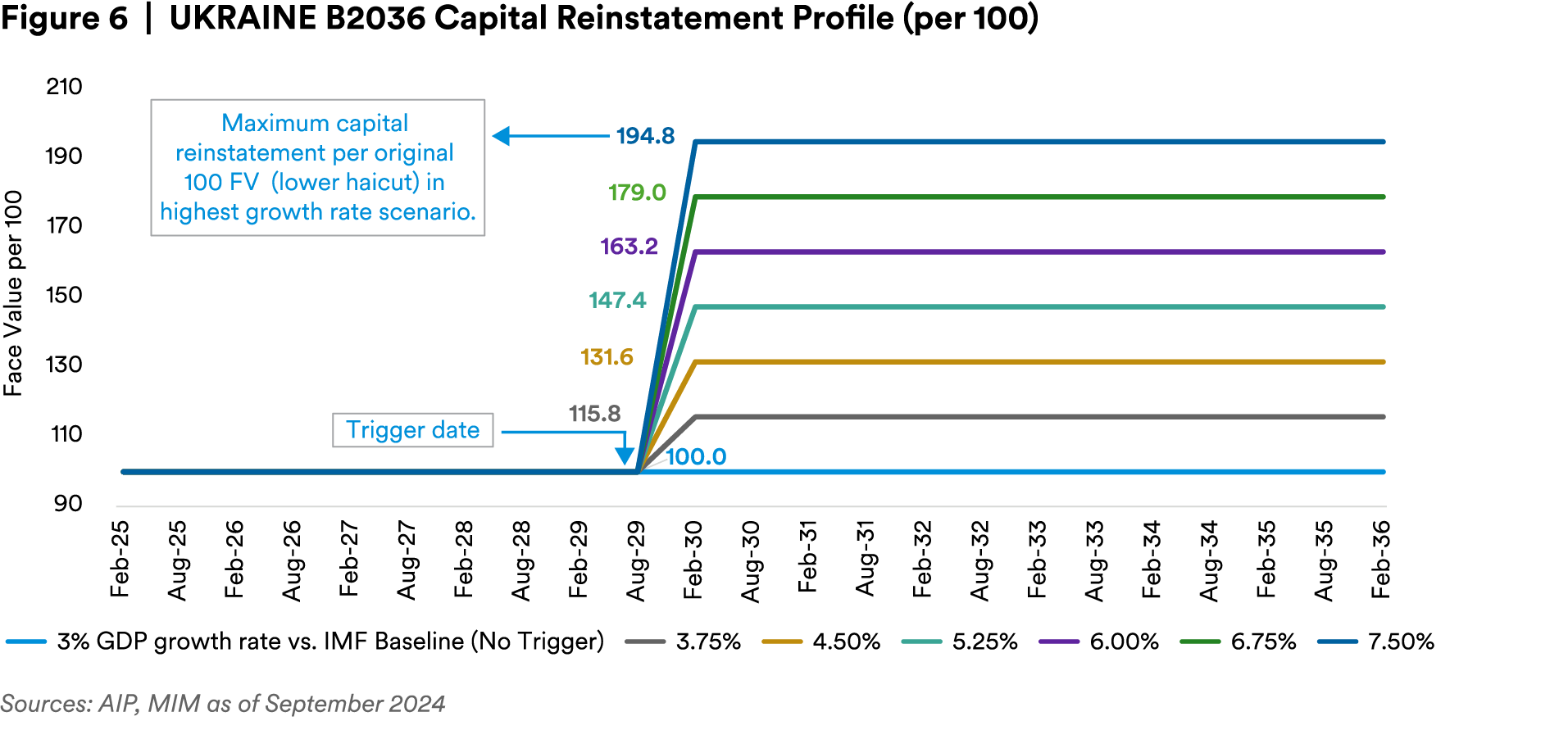

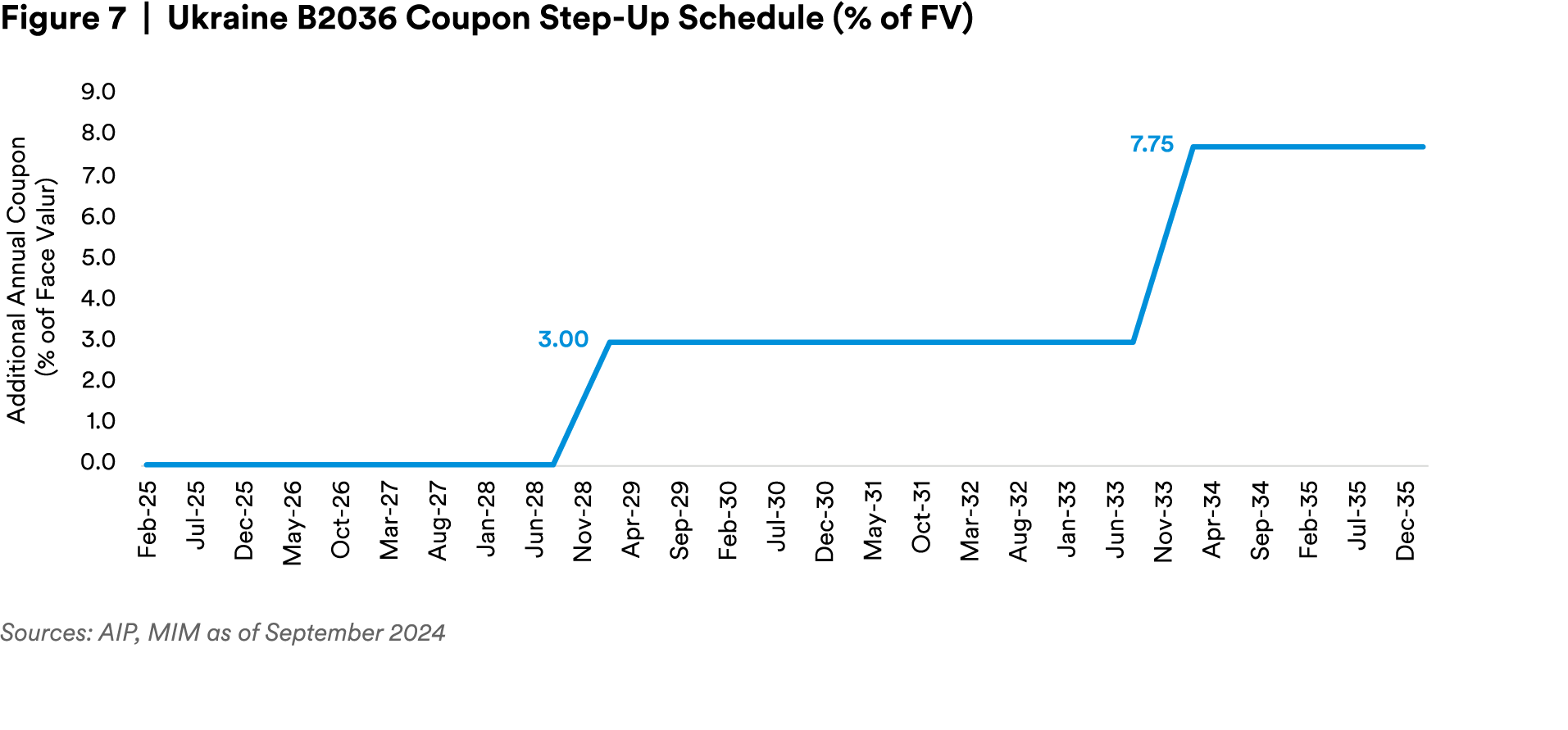

Ukraine: A proactive restructuring of eight instruments included a feature that would increase the principal of the overall restructuring by as much as 12%.2 in 2029 if GDP growth outperforms a certain YE2028 level, as reported in the IMF’s October 2029 World Economic Outlook (WEO) publication. This “uplift” is reflected in just two of the restructured bonds (B35s and B36s) that are imbedded with an SCDI structure. These two securities have a relatively normal base structure with coupon step-ups and bullet maturities that look much like Ukraine’s other restructured notes. However, only the holders of these instruments would receive the newly issued “additional B bonds” in 2029, with the number of bonds received dependent on the magnitude of the economic outperformance, with a maximum number of bonds equivalent to ~95% of PAR value delivered if growth exceeds the target by 7.5 percentage points or more. Conversely, if growth does not exceed the target by more than three points, no new bonds would be delivered. A scaled sample of new bonds to be issued at each level of GDP growth outperformance is shown below.

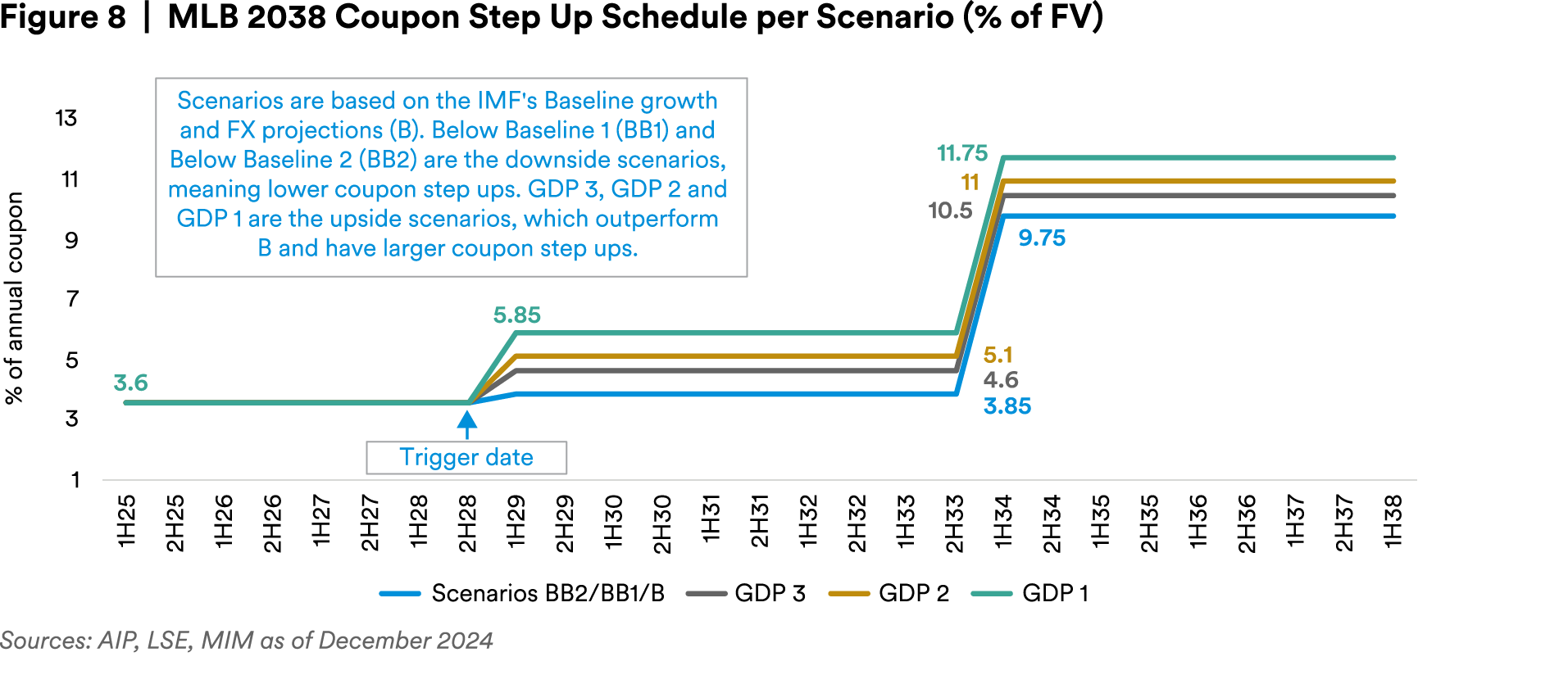

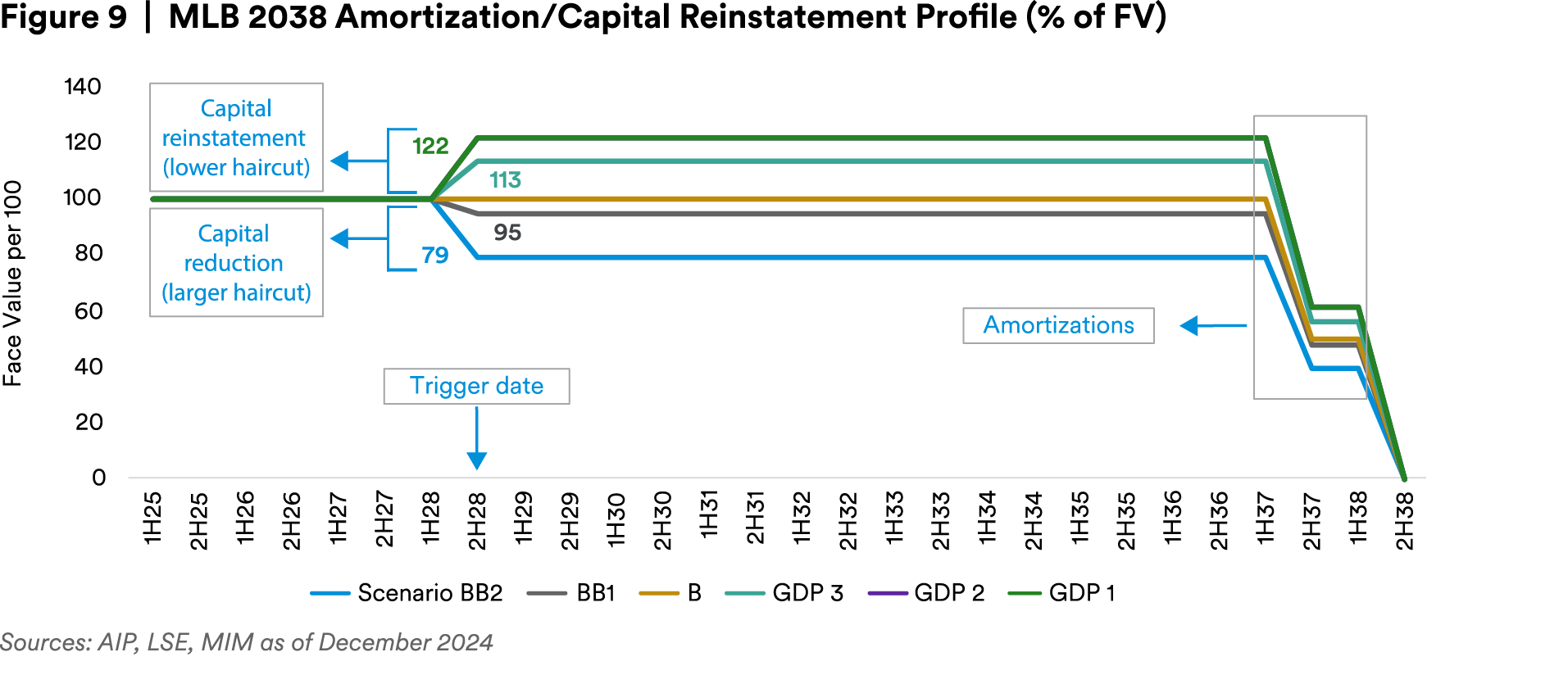

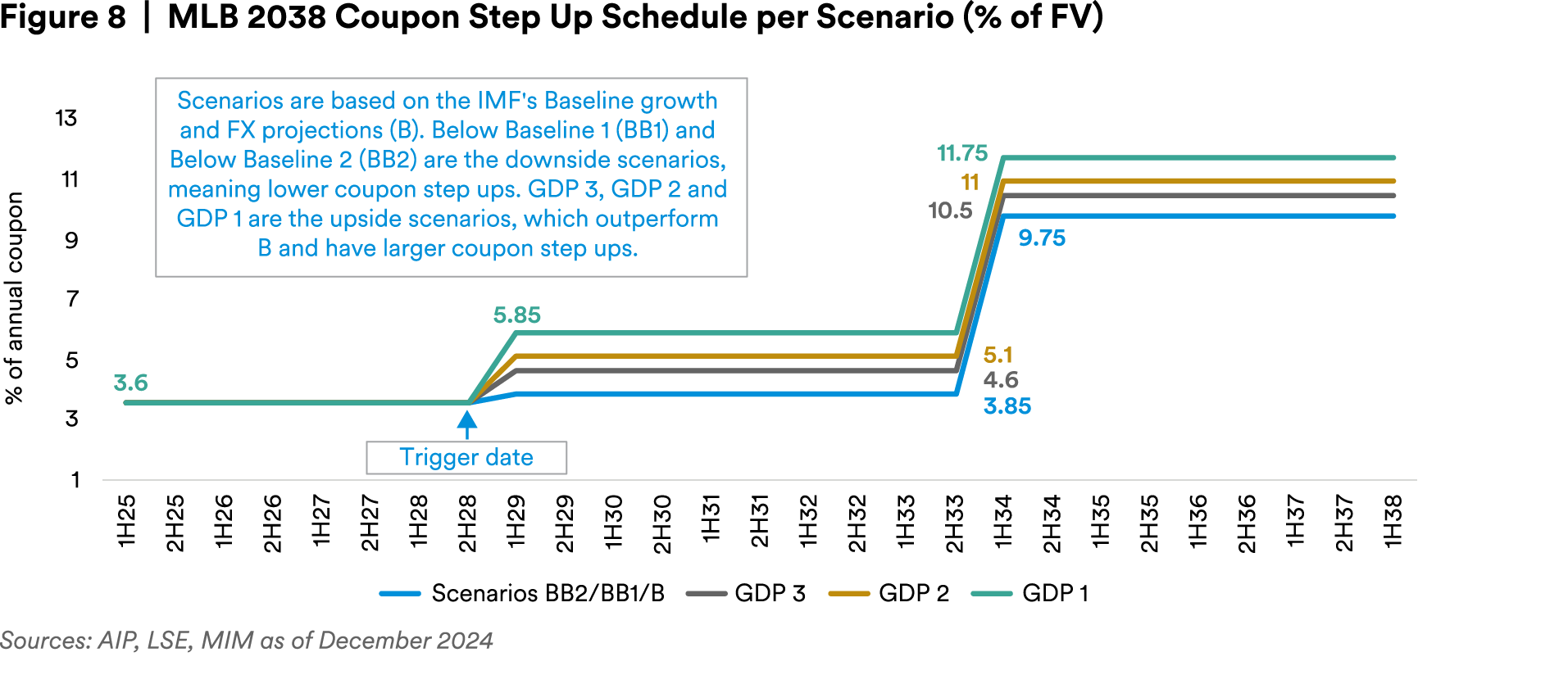

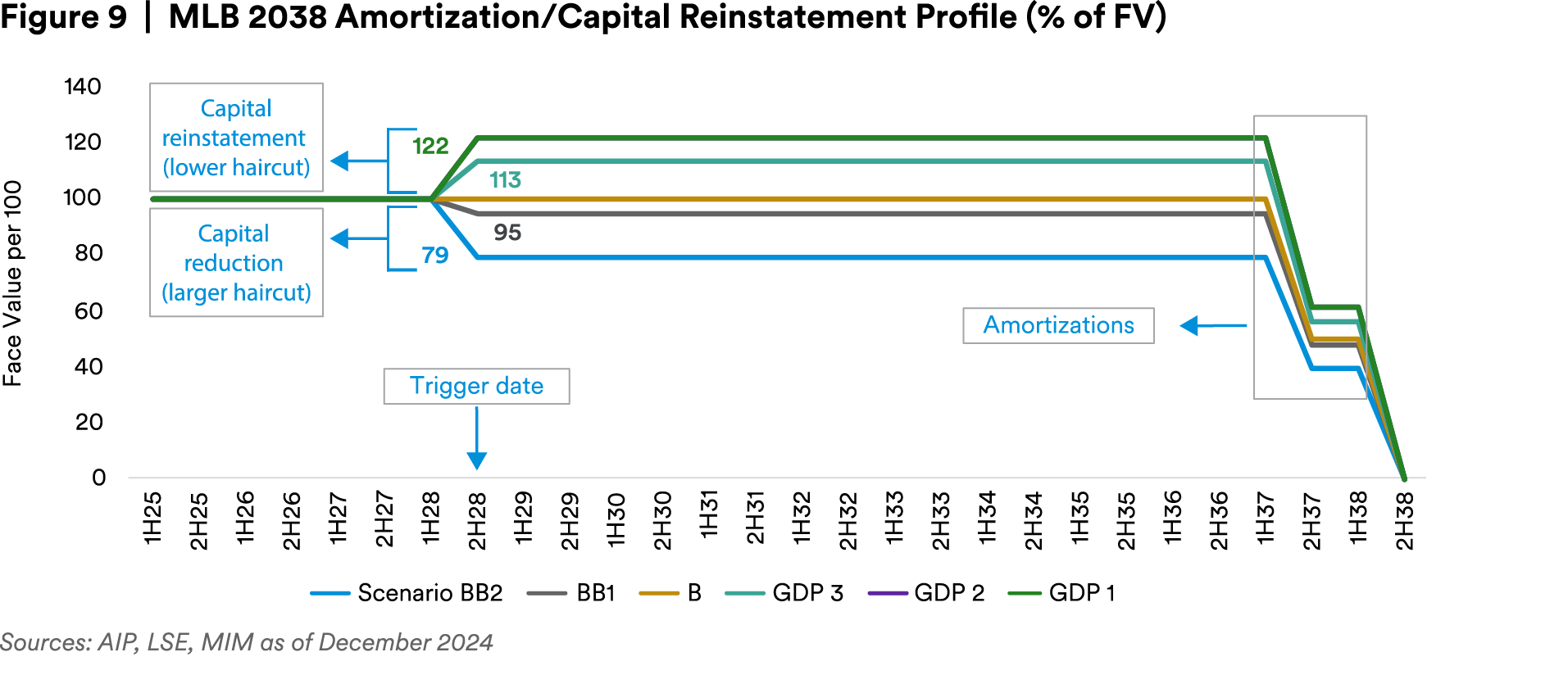

Sri Lanka: The exchange included four SCDIs, called Macro-Linked Bonds (MLBs), that would see a significant coupon step up and a capital reinstatement if certain economic growth criteria are met, which would essentially reduce the original haircut undergone in the restructuring exchange. If both conditions are met, the capital reinstatement could be as high as 122% of each MLB’s par value. However, unlike the other sovereign restructurings, where only upside optionality is imbedded, Sri Lanka’s MLBs protect the sovereign from future hardship by building in an additional haircut if GDP were to fall below a certain level. In this event, the capital adjustment could reduce par value by as much as 21%. The first criteria would be Sri Lanka’s USD nominal GDP exceeding (or falling short) of the IMF’s DSA baseline projection as outlined the country’s EFF program report as a starting point, measured by 2028. The second criteria is the need to outperform a cumulative real GDP growth rate of 11.1% between 2024 and 2027, used as the sovereign’s “protection” variable (against currency volatility, for example). The potential adjustments to capital balances are shown in the graphic below.

Conclusion

The past year has seen significant progress and innovation in EM debt restructurings, with SCDIs offering material upside for investors over the longer term. However, the challenges associated with SCDIs highlight the need for careful consideration and expertise in their implementation and valuation. The variability of these instruments can lead to increased payments that might be too large for the specific country's situation at the time of the "trigger," potentially making the debt unsustainable again. Furthermore, conventional pricing services are ill-equipped to handle the complexities of SCDIs, and so valuing these instruments requires intricate, in-house modeling, typically with a probability-weighted pricing approach. We believe teams with strong modeling capabilities will have a distinct advantage in navigating these complexities and maximizing the benefits of SCDIs.

Endnotes

1 Source: JP Morgan. Data used for calculation based on JP Morgan EMBI Global Diversified; Dates used for calculation:, Venezuela: June 30, 2019, Lebanon: June 28, 2019, Argentina: September 30, 2019, Ecuador: July 21, 2019, Suriname: December 31, 2019, Zambia: June 28, 2019,Sri Lanka: December 31, 2021, Ghana: September 30, 2021, Ukraine: September 30, 2021 , Belarus: March 31, 2021, Russia: March 31, 2021

2 12% in additional principal is $2.8bn in new bonds on a restructured base of $23.5bn

Disclaimers

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of July 22, 2024, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.