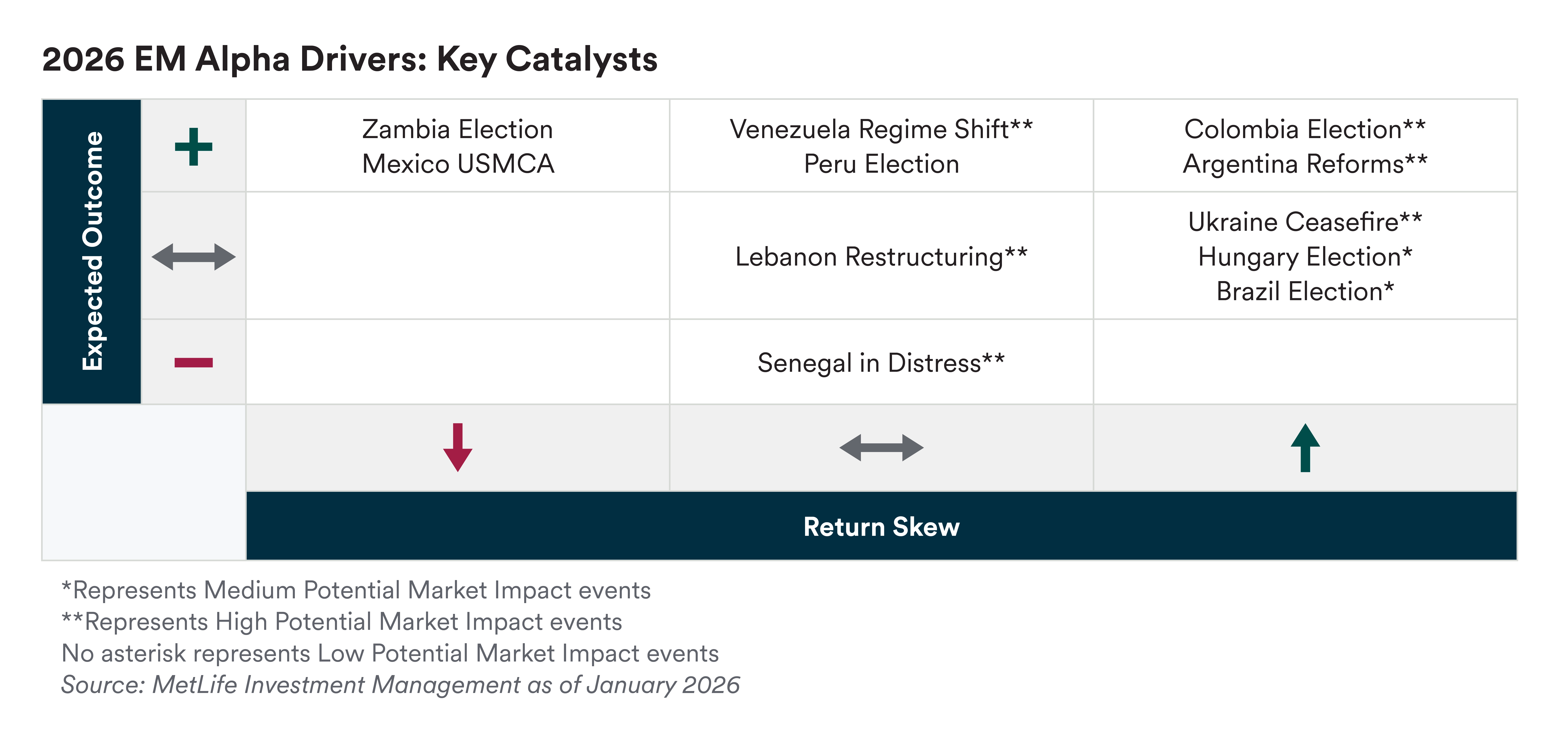

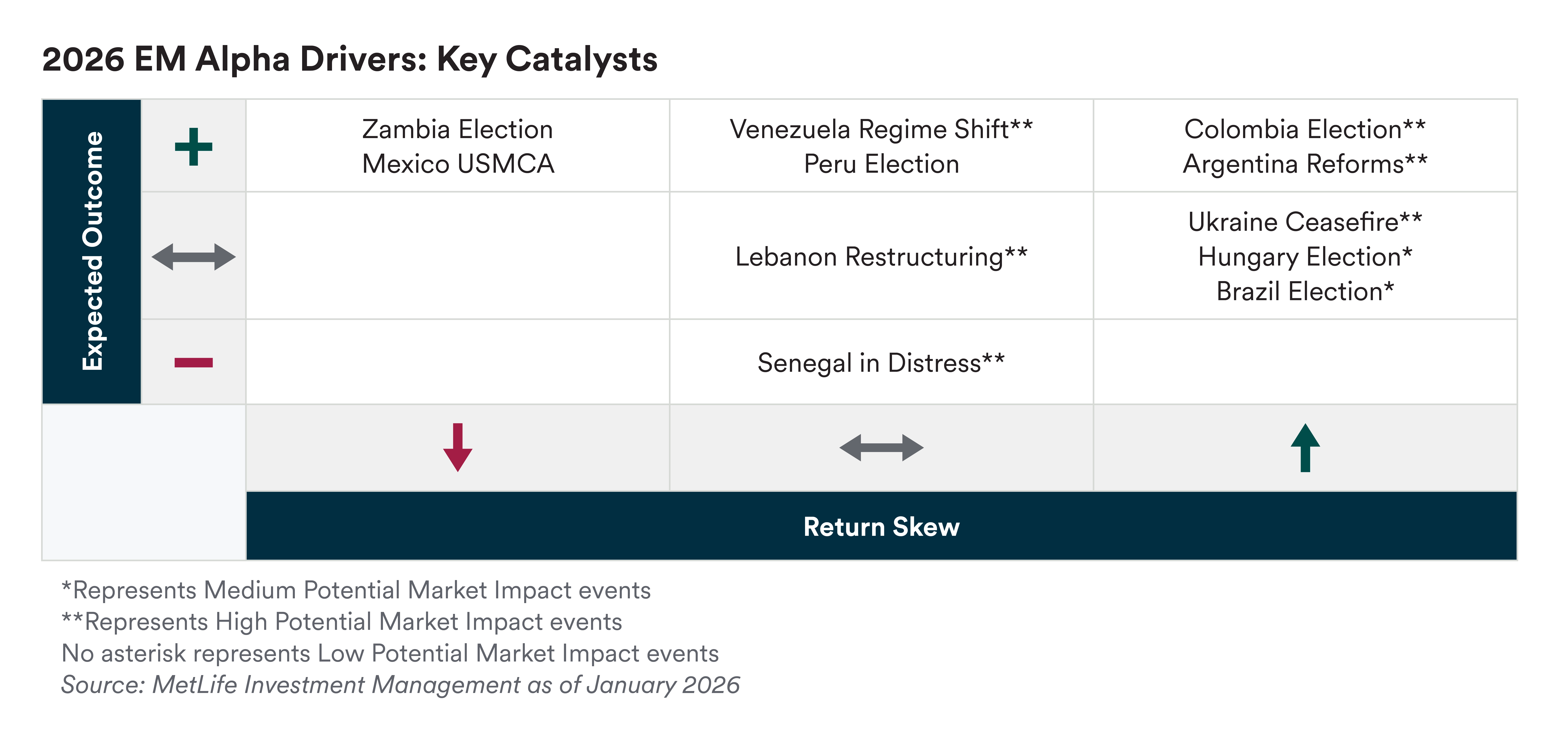

Latin America: Strategic Realignment and Investment Tailwinds

Latin America is emerging as a strategic policy priority for the U.S., marking a major pivot after decades of neglect. This significant geopolitical realignment, led by President Trump, put the region in a favorable position for strategic investment, supported by structural advantages that enable sustained growth. This shift aligns with supply chain resilience and resource security, creating a favorable backdrop for foreign direct investment (FDI). Strengthening U.S. alliances, illustrated by the credit line for Argentina ahead of its mid-term elections, security cooperation with Ecuador and strong ties with El Salvador, bolster stability and investor confidence. In Honduras’ election, Trump’s support for a single candidate underscores Washington’s influence, while Brazil remains an outlier, with strained relations after Bolsonaro’s imprisonment. Mexico remains the anchor for nearshoring under USMCA, attracting manufacturing flows, while Venezuela’s potential regime change and debt restructuring could unlock value. Chile and Peru are critical for copper and lithium amid the energy transition, and Panama’s logistics infrastructure reinforces connectivity.

USMCA: Nearshoring Momentum

The United States-Mexico-Canada Agreement (USMCA) remains central to North American trade integration, driving nearshoring and supply chain resilience. The 2026 Sunset Clause review, scheduled for July 1, will determine whether the agreement is extended for 16 years or subjected to annual reviews until 2036 if consensus fails.2 This could be noisy, as the U.S. will seek to extract additional cooperation from Mexico on key issues like immigration, counternarcotics and trade-related issues like rules of origin. We believe continuity is the base case, and Mexico will continue to benefit from its integration with the U.S., attracting manufacturing investment and strengthening its edge over other markets. Close monitoring of negotiations and political signals will be critical, as failure to reach consensus could trigger recurring uncertainty, including higher and more permanent tariffs.

Venezuela: Regime Change and Restructuring

Venezuela enters 2026 amid a dramatic political shift following Maduro’s removal and Delcy Rodríguez’s interim presidency, signaling renewed U.S. engagement but leaving democratic reforms uncertain. Washington’s multiple transition conditions tie sanctions relief to verifiable progress, meaning comprehensive debt restructuring likely awaits elected leadership. Near-term stability hinges on Rodríguez’s ability to hold Chavismo together and navigate U.S. demands, while internal power struggles and external reactions add complexity. Venezuelan bonds have rallied sharply (30%),3 reflecting optimism but underscoring the risks around governance, negotiations and timelines.

Ukraine: Ceasefire Uncertainty Keeps Risk Premium Elevated

Ukraine’s outlook remains shaped by fragile ceasefire negotiations, which in turn rely upon territorial concessions and credible U.S. security guarantees. Ukraine has signaled openness to negotiate, yet critical issues remain unresolved, and talks with Russia and Washington have repeatedly stalled. Markets are repricing Ukrainian bonds to reflect a higher probability of ceasefire. Meanwhile, reconstruction financing offers long-term support, reducing the risk of a repeated sovereign default.

Argentina: Reform at a Crossroads

Argentina’s reform trajectory has gained momentum following mid-term elections, with the Milei administration signaling pragmatism through cabinet reshuffles and renewed congressional outreach. The government’s commitment to fiscal consolidation is evident in the 2026 budget targeting a surplus with continued public-sector downsizing, while monetary authorities advance plans to stabilize inflation. Other key catalysts include external financing progress, rebuilding of reserves and further elimination of capital controls. Execution risk persists, but successful delivery could unlock meaningful upside in sovereign spreads and local rates.

Senegal & Gabon: Distress Signals

Senegal and Gabon are navigating fiscal challenges amid constrained market access and tighter liquidity conditions. With both countries at risk of default, engagement with multilateral institutions, particularly the IMF, is critical to secure financing and provide a framework to make necessary adjustments that ensure policy credibility. Near-term priorities include improving cash management, strengthening revenue administration and clarifying medium-term debt strategies to restore investor confidence.

Lebanon: Reform Momentum and Complex Recovery Dynamics

There is renewed optimism around Lebanon’s debt restructuring process following a breakthrough in political deadlock, with the election of a new president, formation of a cabinet and appointment of a new central bank governor. Recent legislative progress, including banking resolution laws, set the stage for an IMF-supported program and eventual sovereign restructuring. At current bond prices, there is meaningful upside potential in recovery values, with some reliance on key variables such as the sovereign’s share of banking recapitalization costs, nominal GDP starting levels and the scale of international reconstruction grants. Political challenges, including resistance from vested interests and delays in disarming Hezbollah, add complexity and could extend timelines.

Colombia & Brazil: At a Fiscal Crossroads

Colombia and Brazil both face pivotal elections, but Colombia’s fiscal challenges are significantly more acute. Colombia is on a steeply deteriorating fiscal path, requiring urgent adjustment and structural reforms to restore credibility and stimulate private sector growth. Brazil, while grappling with rising spending pressures and political resistance to deeper reforms, retains comparatively stronger buffers and market confidence. A shift toward reform-minded leadership in either country would boost investor sentiment, signaling commitment to consolidation and growth-friendly policies. Conversely, failure to act decisively would leave Colombia at greater risk of additional downgrades, sharply higher financing costs, and constrained market access, while Brazil would face similar pressures but with more room to maneuver. With real rates expected to remain elevated, clear signals on fiscal strategy will be critical for market confidence across both economies.

Hungary: Policy Balancing Amid Pre-Election Dynamics

Hungary’s upcoming election will be a key catalyst for market sentiment, overshadowing near-term fiscal and monetary signals. While maintaining economic stability and a prudent fiscal policy remains important (deficit targets of 5% for both 2025 and 2026), investors are primarily focused on whether the next government, led by either the incumbent Fidesz candidate or a fragmented opposition, can deliver credible fiscal consolidation and maintain policy continuity. The election outcome will shape Hungary’s stance in EU negotiations, influence foreign investment flows and determine the trajectory of structural reforms.

Peru: Political Transition

Peru is in political transition after Congress impeached President Boluarte, with José Jeri serving as caretaker president until the April 2026 elections. Market reaction has been contained, and pre-election protests appear unlikely. The electoral agenda is set to be dominated by public security; center-right outcomes are plausible, though visibility is low amid 40+ registered parties and potentially 20 presidential contenders. Macro fundamentals remain resilient supported by favorable terms of trade, yet mid-term fiscal risks persist, and pension withdrawals could pressure local rates. Electoral developments and near-term budget signals will be critical for clarity on spreads and FX stability.

FX volatility will remain a key source of opportunities in 2026, driven by divergent monetary policies, commodity price swings and political uncertainty. Local currency debt offers attractive real yields in markets with credible inflation-targeting regimes. High real rates, especially in Latin America, create opportunities in duration and carry in an environment where the immediate direction of the U.S. dollar versus the G10 is more uncertain. Some of our preferred regional exposures are Brazil and Mexico, even with the Brazilian election overhang. Colombia screens attractive, but election volatility will keep premiums elevated and could present a very interesting entry point as the year progresses. Elsewhere, frontier local markets should continue to deliver alpha despite an extremely impressive year in 2025. Countries like Egypt and Turkey are interesting, although investor position needs to be monitored, and areas like Zambia and Uzbekistan remain two of our favorites. Frontier liquidity is always a concern, and appropriate position sizing based on fundamental conviction is critical. Asia offers relative stability, though selective opportunities exist in countries balancing low relative carry with currency stability, such as Indonesia, Malaysia, Thailand and India.

Emerging Markets enter 2026 with strong momentum but heightened complexity. While last year’s performance sets a high bar, opportunities remain for investors who can navigate geopolitical shifts, distressed credit situations and election-driven policy changes with precision. The U.S. strategic realignment toward Latin America offers compelling tailwinds for that region, while select distressed credits and pivotal elections create avenues for differentiated alpha. Against compressed spreads and global uncertainty, active positioning and risk management will be critical to unlocking value in this evolving landscape.

Endnotes

1 Source: Information in this paragraph sourced from JP Morgan

2 JP Morgan

3 Bloomberg LP

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

MetLife Investment Management (MIM), which includes PineBridge Investments, is MetLife Inc.’s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world.

This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

For investors in the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities and Exchange Commission (SEC) registered investment adviser. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment adviser.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.