For all the shifts in macroeconomic risk factors that swayed market sentiment last year, most credit markets delivered on expectations for carry-driven returns in 2025. Emerging market (EM) debt was an exception, recording strong excess returns in addition to carry driven by supportive market technicals along with fundamentals that have withstood macroeconomic risks.

In 2026, we expect a continuation of those conditions: resilient exports, declining inflation, and accommodative monetary policy, along with a stable political outlook and fiscal discipline, steady corporate earnings and credit metrics, and demand for bonds that will likely outpace supply – factors that suggest EM can not only deliver carry-driven returns but also outperform other public bond markets once again in 2026.

Global trade volumes were resilient in 2025 despite the seismic change in U.S. trade policy, as many exporters accelerated shipments ahead of tariff deadlines. Growth will moderate in 2026, but various exemptions, bilateral trade agreements, and the ongoing challenge to IEEPA tariffs should make the impact of tariffs orderly and well-contained.

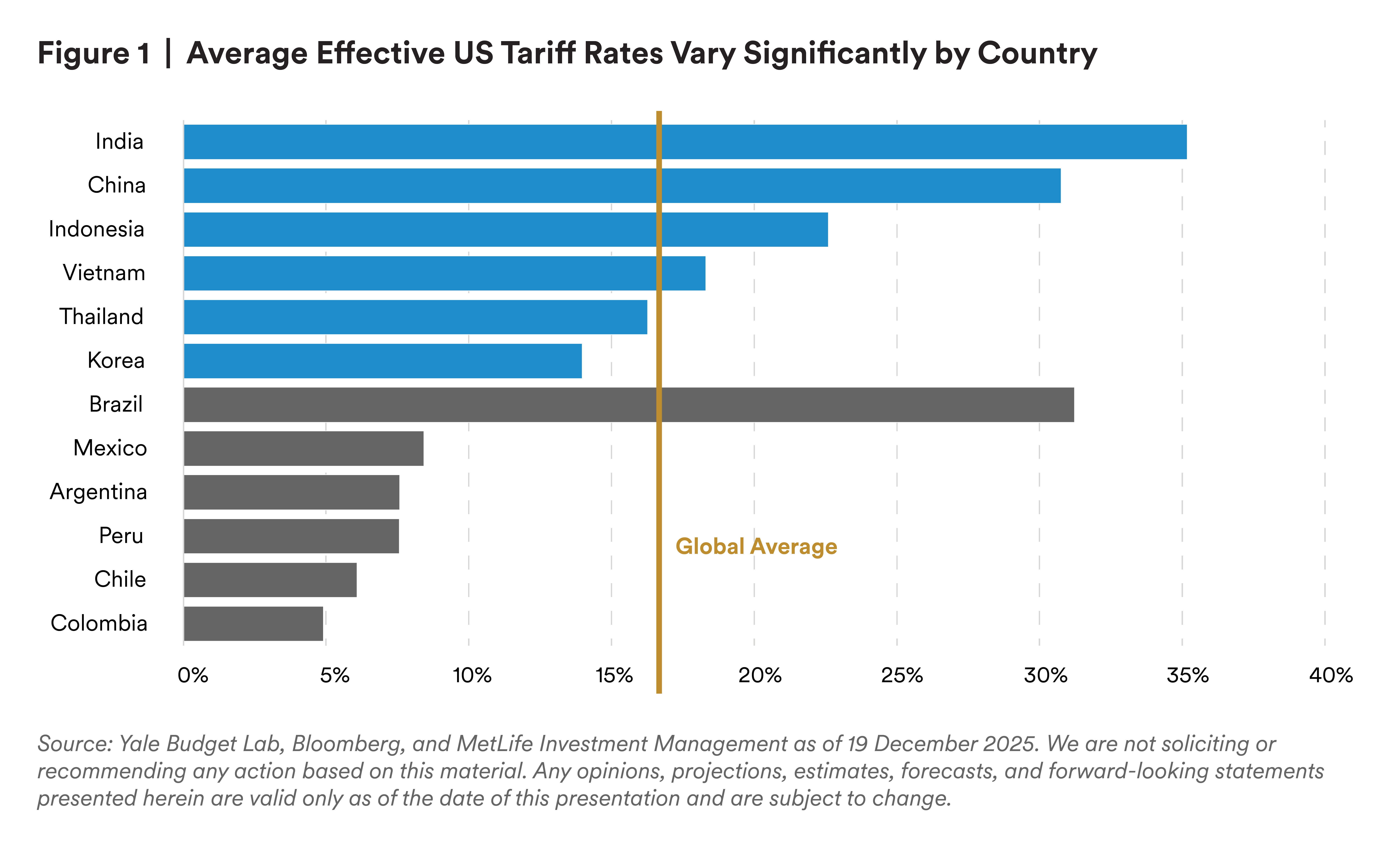

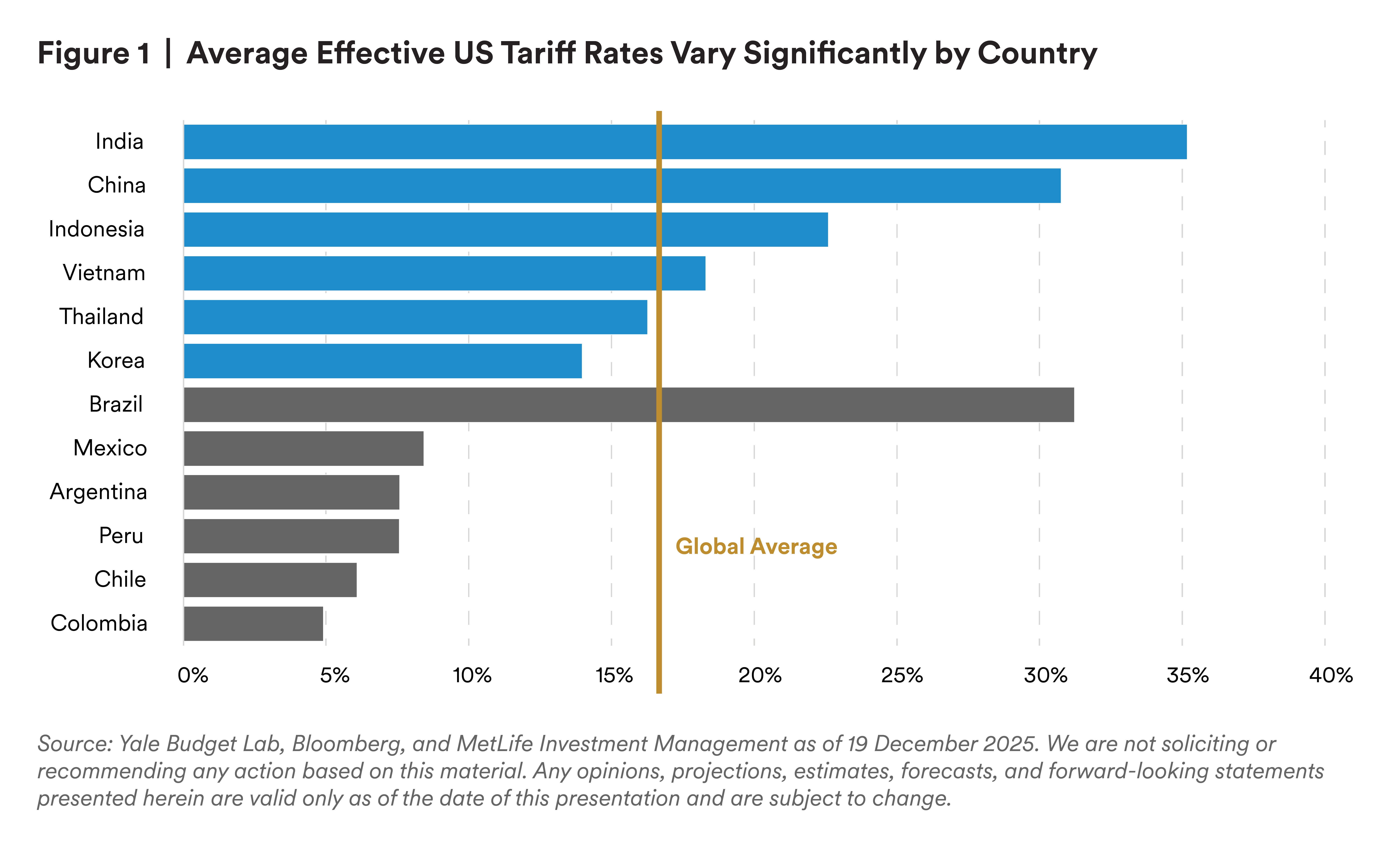

For emerging markets, the impact of U.S. tariffs is as varied as the nations that fall under the EM banner. The focal point of U.S. trade policy is China, and while that relationship will remain competitive, signs of cooperation – such as agreements on fentanyl and rare earth elements – suggest the relationship between the world’s two largest economies could improve. Other Asian countries face elevated U.S. tariffs, the impact of which will hit harder in those for which U.S. exports are a substantial contributor to GDP, such as Vietnam and Korea, while others, like India and Indonesia, are less vulnerable.

While China and its Asia neighbors face elevated tariffs, many countries in Latin America have average effective tariff rates below the 10% universal tariff threshold, the result of various exemptions – including the USMCA for Mexico and product-level exemptions for many other imports from South America. Lower tariffs should support a rise in exports to the U.S. and could also boost investment to meet growing U.S. demand. Latin America should continue to benefit from higher prices on key exports of metals, minerals, and agricultural products as well. Global demand for metals – both precious and industrial – should also support prices and boost growth for countries in Africa and South Asia.

The export outlook may feature crosscurrents of tailwinds and headwinds, but EM economies are more dependent on domestic factors than cyclical global demand.

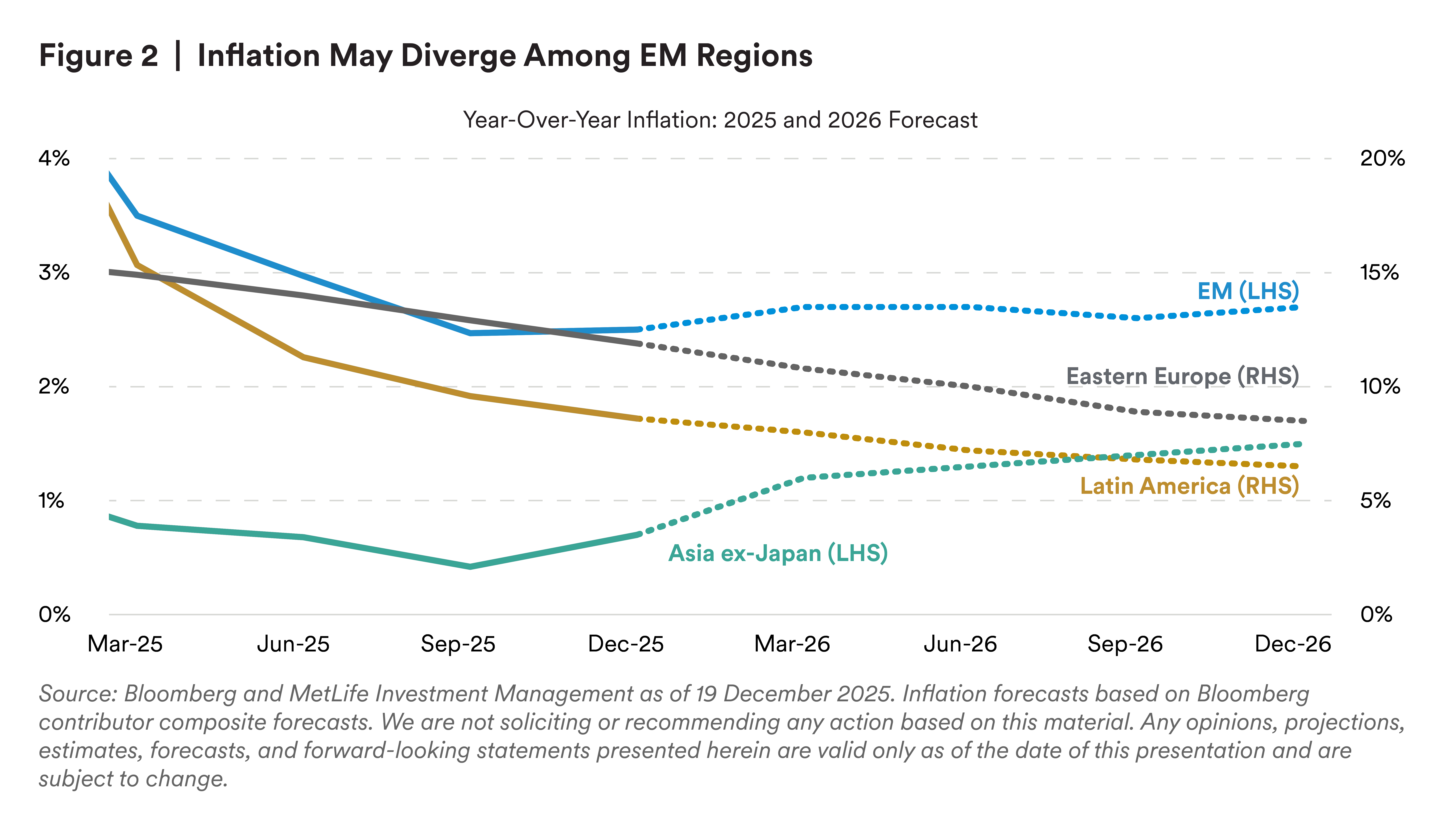

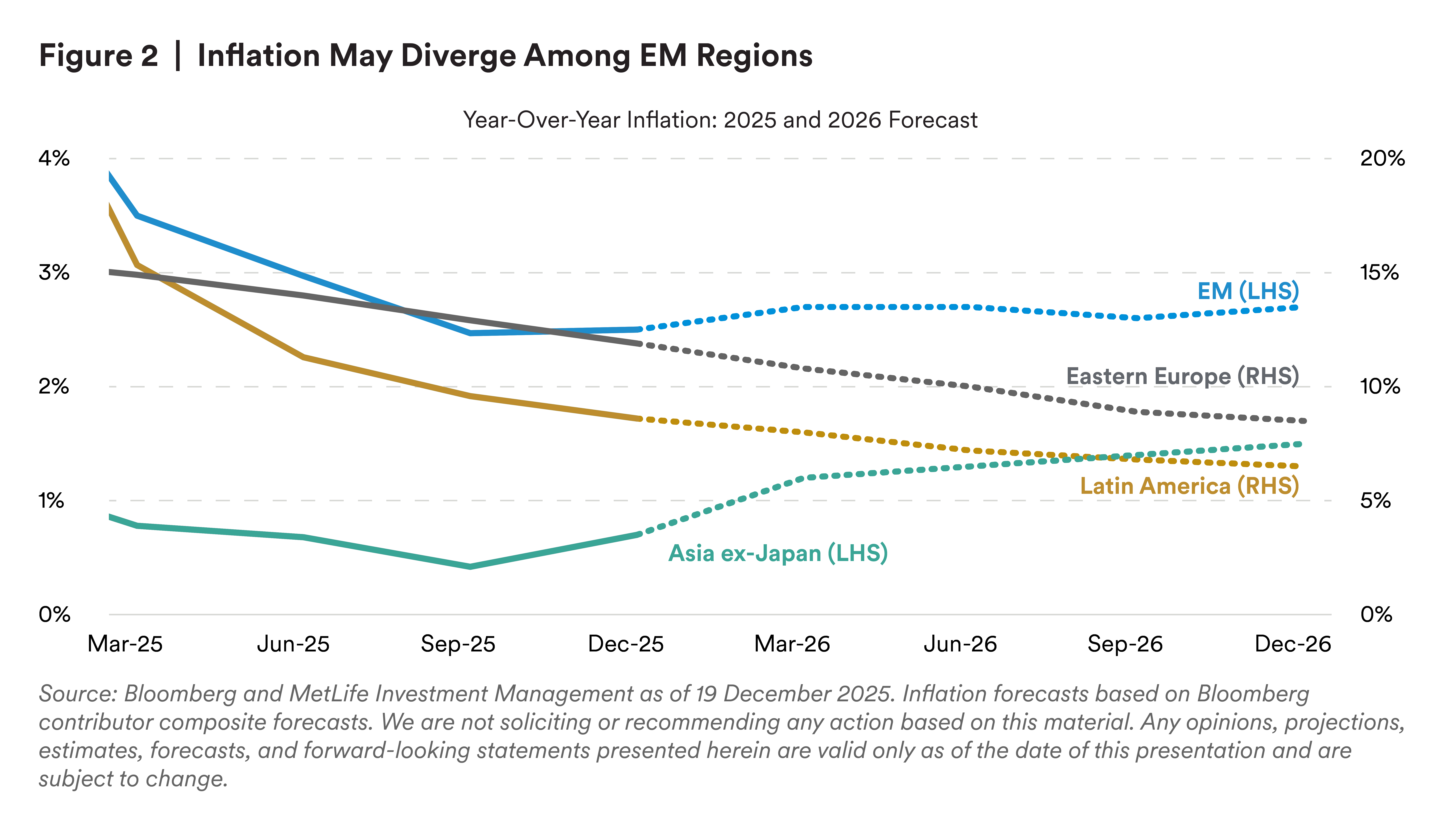

Emerging markets have benefited from a disinflation trend driven by tight real rates and currency strength, and while that trend may stall in some countries, inflation will remain benign for a broad set of EM economies in 2026. The largest moves will come from those with the most room for disinflation. Turkey already achieved a double-digit inflation decline in 2025 and will likely continue this trend, allowing for further central bank rate cuts. Argentina has also engineered a sizable drop in inflation that we expect to continue, enabling rate cuts in 2026.

Other central banks with high real rates and stable to declining inflation are likely to cut rates in 2026, with candidates across Latin America (Brazil and Colombia), Asia (Indonesia and Thailand), and Africa (South Africa and Egypt). The decline in rates in many emerging markets will not only support local bond markets but also improve domestic demand.

Political risks have historically been a source of volatility for emerging markets, but recently these risks have shifted more toward developed markets, with the U.S. enduring a record government shutdown and Europe facing fractured political coalitions that have made government increasingly inefficient.

Latin America is in the midst of an election season that has seen the region’s priorities move toward public safety and closer ties with the U.S. The conservative political shift has brought with it structural reforms and more sustainable fiscal policy. The recent transition of leadership in Venezuela potentially sets the stage for further coordination between the U.S. and countries in Latin America, but may have an influence in elections in the region. This year, Brazil, Colombia, Peru, and Costa Rica will all hold highly competitive elections. The election calendar is less busy outside of Latin America, but not without consequence. Hungary’s parliamentary election will determine whether the country rejoins the EU fold or drifts further from Brussels. Thailand has dissolved parliament, creating uncertainty as the country prepares for early elections in the first few weeks of 2026.

Despite the inevitable political events that will feed headlines this year, we expect the political stability found in many EM countries to have a more meaningful impact – enabling governments to pursue structural reforms that will preserve financial flexibility and improve long-term debt sustainability. Tax cuts in India, for instance, may increase deficits in the near term, but regulatory and labor reforms are expected to make up for lost tax revenue by boosting economic output. Mexico has raised government revenue and curtailed spending following the 2024 election, which we expect to serve as a powerful example for Brazil and Colombia following their elections later this year. China will likely strike a balance between stimulus and reform with the launch of its 15th Five-Year Plan, with one eye toward debt sustainability and another toward its 5% growth target.

EM corporates have delivered consistent earnings throughout 2025, and macroeconomic stability should allow corporations across emerging markets to sustain earnings in 2026.

U.S. tariffs will likely become more settled, either through an affirmation of IEEPA tariffs or a repositioning of tariffs at the sector level, but greater certainty will begin to have a bigger impact on global supply chains. While tariffs will impact imports from Asia, only a small number of issuers within the Asia corporate bond market are dependent on U.S. export revenue. Industrials in Latin America stand to benefit from a western realignment of U.S. trade, with beneficiaries in the property and utilities sectors as well.

A divergence in commodity prices – with strong demand supporting metals and agricultural products, while excess supply is pressuring oil prices – will be felt in corporate earnings. Financials continue to experience solid loan growth and better-than-expected interest margins, despite the decline in policy rates. Real estate remains supported by robust residential development and demand in the Middle East and industrial demand in Latin America. Telecommunications hardware producers in Asia will continue to benefit from the AI investment cycle, while telecom infrastructure continues to expand across Sub-Saharan Africa.

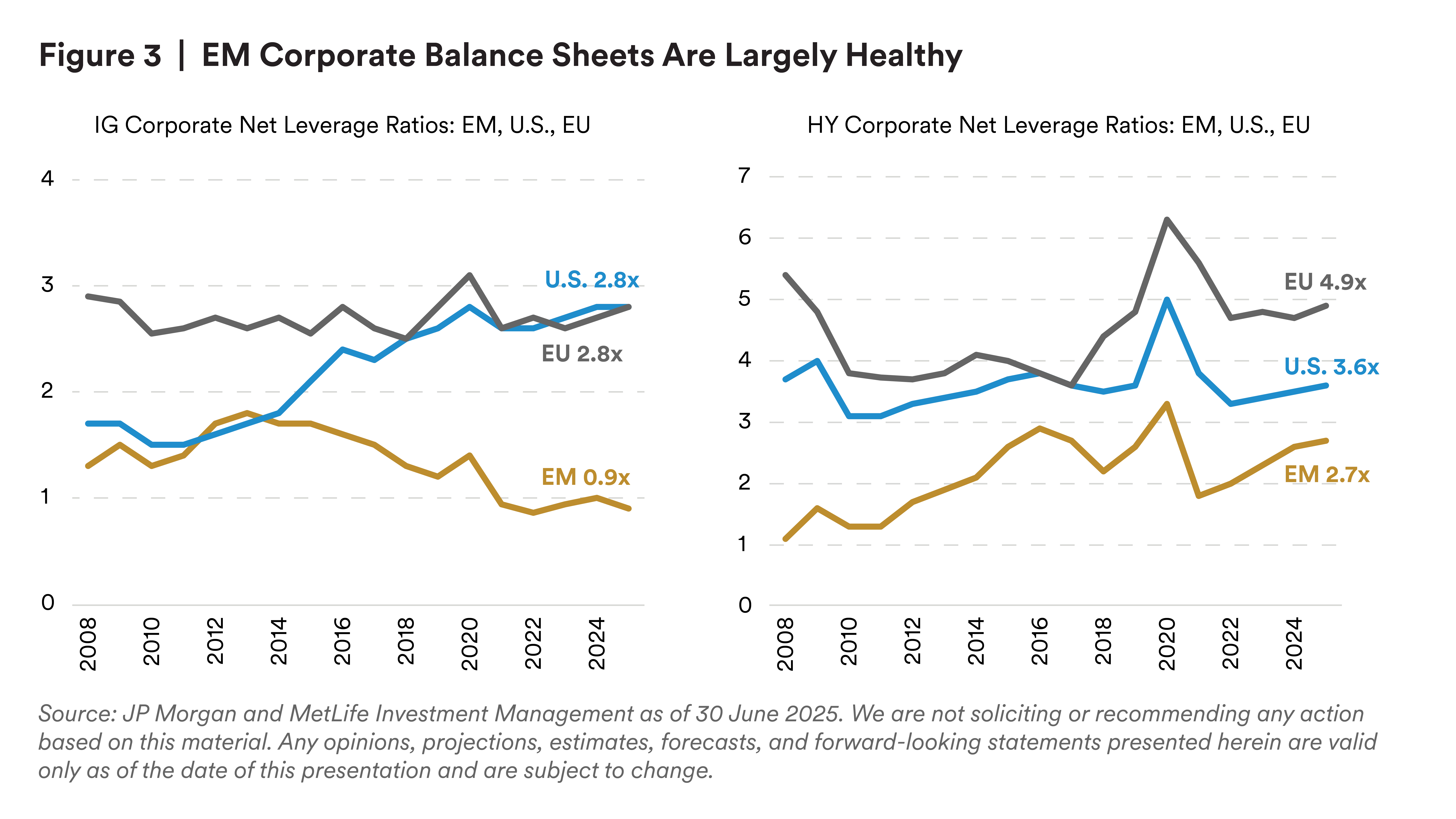

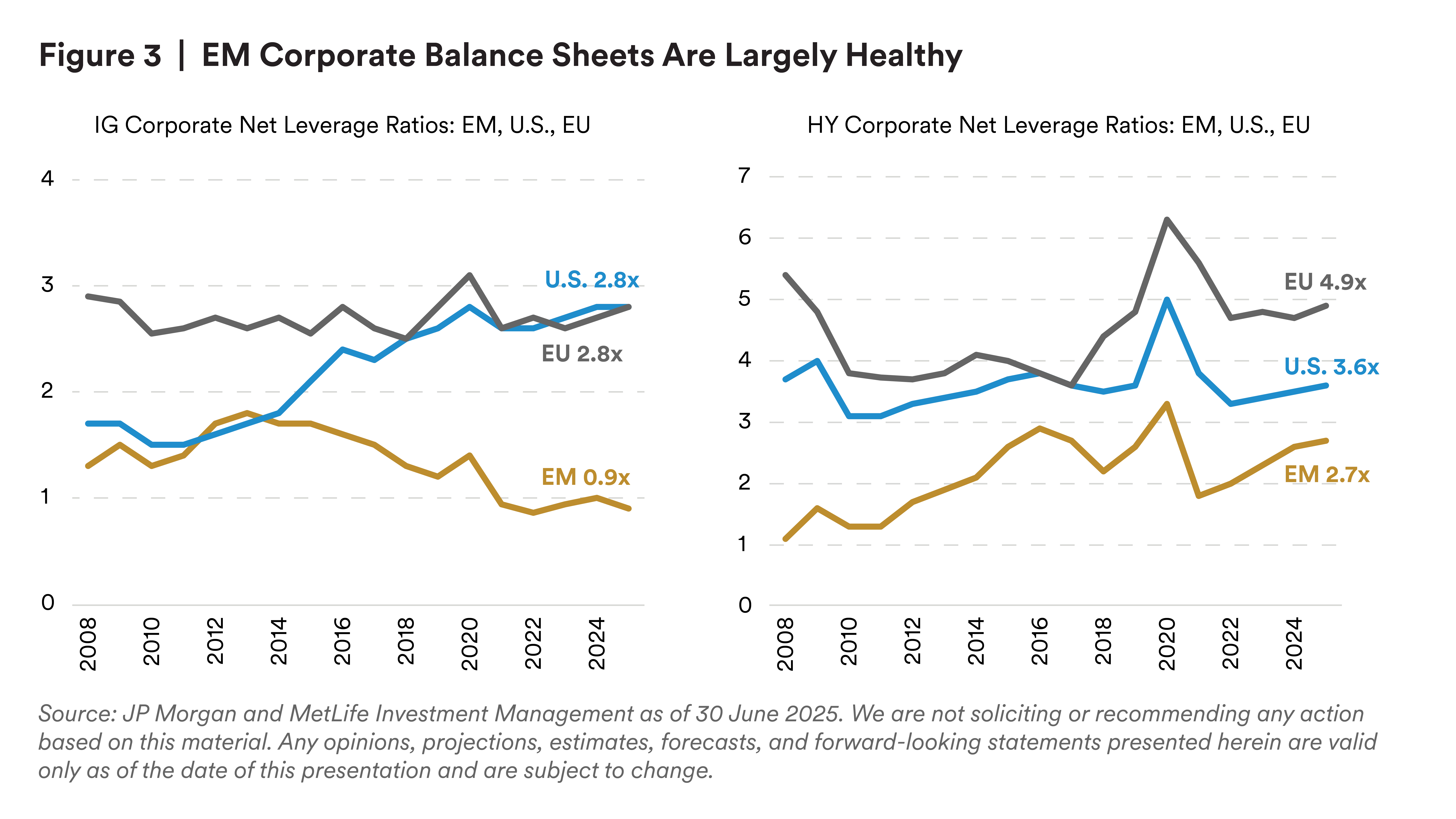

One structural advantage of the EM corporate bond market for investors is its diversity, which should be evident in the breadth of regional sectors that maintain positive credit momentum this year. As the credit cycle extends, EM corporates should also benefit from a generally conservative approach to balance sheet management, in which EM corporates typically carry low leverage and proactively manage liabilities to ensure capital flexibility.

EM bond funds experienced three years of consistent outflows through 2024 and into 2025, in stark contrast with other credit markets, which have been flooded with capital. EM outflows peaked in April 2025, after which investors began to increase EM debt positions, resulting in positive fund flows into both hard and local currency EM bond funds in 2025. Strong performance of EM debt along with U.S. rate cuts should continue to drive flows into an asset class that had been deprived of capital.

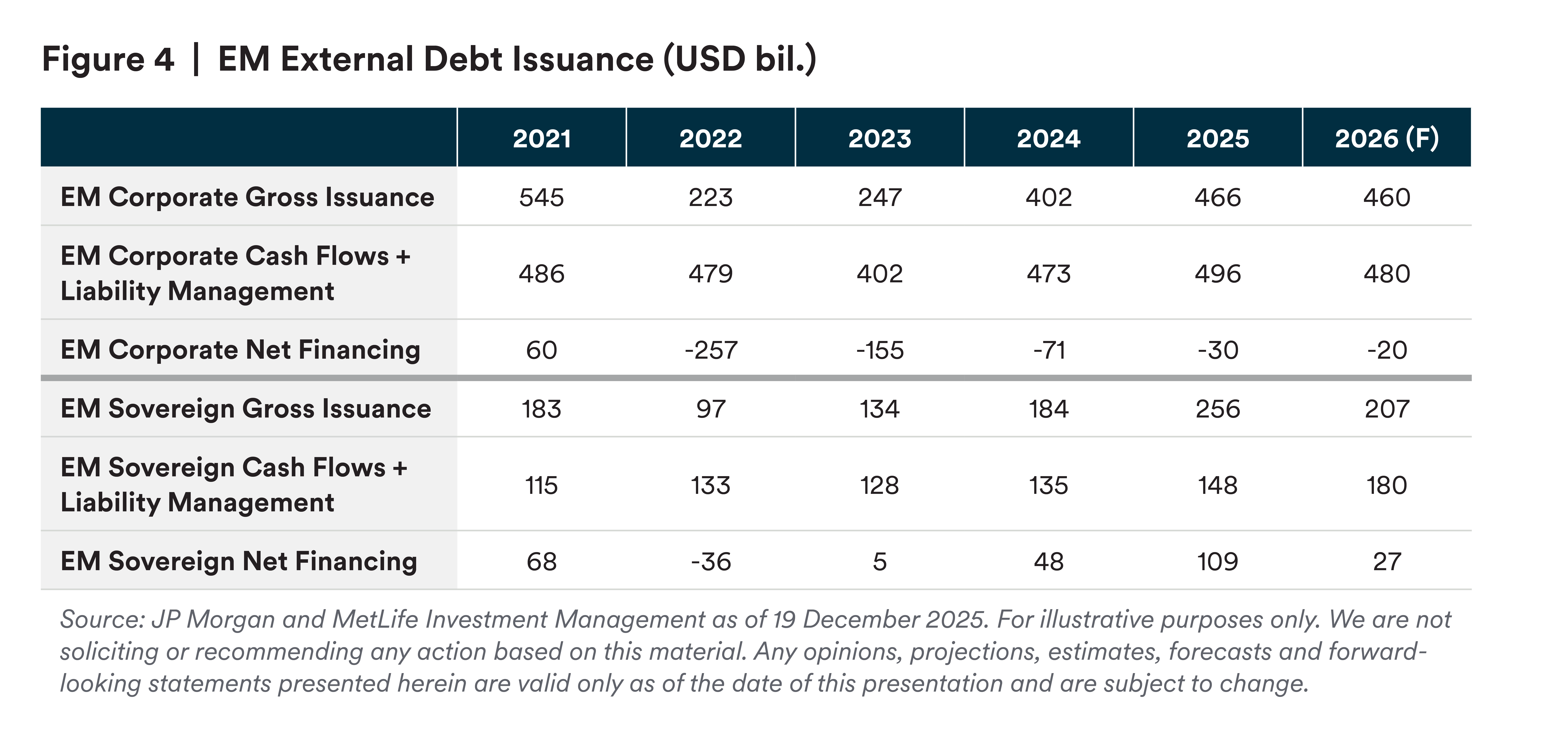

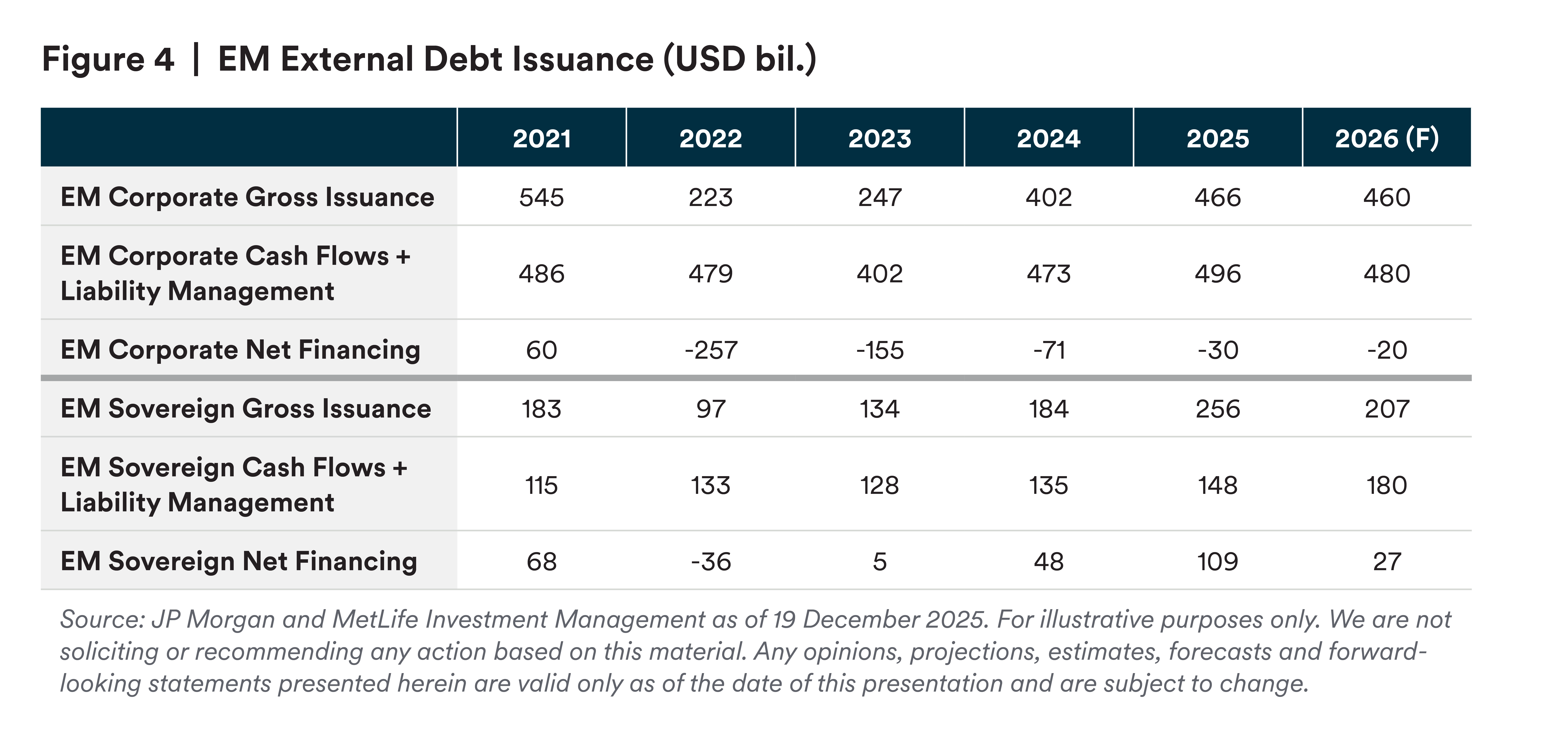

On the other side of the ledger, supply has been strong as well. Last year saw a record level of U.S. dollar sovereign issuance and the second-highest corporate gross issuance post-2020. However, on a net financing basis – subtracting for scheduled cash flows, tenders, buybacks, and calls – the EM corporate bond market saw negative net financing in 2025 for the fourth consecutive year. Gross issuance of U.S. dollar sovereigns is expected to decline in 2026, and while corporate issuance appears set to be in line with 2025 levels, we believe another year of negative net financing is likely.

The combination of flows into EM debt funds and low or negative net financing should create strong technical support for EM bond prices in 2026.

Expectations for a stable macroeconomic environment support positioning in higher carry assets. Higher-yielding EM local debt not only offers carry, but potential rate cuts in several large markets should also contribute to returns; however, foreign exchange volatility will need to be managed. Potential fiscal adjustments in Brazil, Colombia, and Mexico add to the attractiveness of those local markets.

Within the U.S. dollar EM bond market, we are positioning for the outperformance of carry, specifically looking at opportunities in single-B rated sovereign bonds, which broadly offer more spread duration than found in most other credit markets. We prioritize spread duration in an environment of gradual monetary policy easing and stable economic growth, which is expected this year. However, within the lower-rated sovereign bond market, the drivers of high-beta outperformance in 2025 will find it harder to maintain outperformance at tighter spread levels, making differentiation among countries and credits critical to investment success. We are focusing on countries where we expect fiscal consolidation to improve creditworthiness, such as Argentina, Sri Lanka, and Zambia.

Within the high-quality segment of the U.S. dollar EM bond market, we prefer corporate bonds, which provide a broader opportunity set to diversify risk and to source excess returns. We prefer BBB rated bonds with steep credit curves to benefit from carry and curve roll-down, identifying where the market is too pessimistic on curve shape and bonds outperform as they get closer to maturity. Latin America corporates offer value relative to similarly rated corporates globally, particularly utilities, metals & mining, and select consumer and industrial issuers. We also find value in CEEMEA financials and infrastructure names, along with select telecommunications and industrial names in the region. The Asia corporate bond market is high in quality and provides opportunities to reduce risk should the outlook deteriorate.

EM debt performed well in 2025, and though the magnitude of expected returns may be lower in 2026, the factors that have helped EM debt outperform other public bond markets should persist in 2026, giving investors confidence in increasing their EM debt exposures.

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

MetLife Investment Management (MIM), which includes PineBridge Investments, is MetLife Inc.’s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world.

This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

For investors the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities and Exchange Commission (SEC) registered investment adviser. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment adviser.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a "professional client" as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees' pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: This document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.