- The shock scenario – While this is not our base case, we could envision a global recession lasting as long as three to four quarters and driven primarily by weakness in the U.S. and China, with Europe also weak but comparatively less affected. Weak global demand would put downward pressure on commodity prices, particularly oil, with Brent crude sustaining depressed levels of $50 – $60 for this extended period.

- Analytical parameters – At a high level, we define resiliency as a country’s ability to endure the entire downcycle while avoiding significant credit rating downgrades1 and funding difficulties. We considered three additional criteria that are particularly relevant to this specific shock: 1. direct exposure to U.S./China economic malaise; 2. direct impact from lower oil prices; and 3. significant increases in funding needs directly owing to the shock.

Using these criteria, our sovereign analysts assessed each individual country as resilient, vulnerable, or “cuspy”—the latter indicating uncertainty that hinges on the severity and duration of the shock and the strength of a country’s policy responses. As the cycle plays out, we would expect interesting alpha opportunities in cuspy names, either by actively reducing exposure to countries that become more vulnerable or overweighting the ones that become more resilient either through better policy implementation or external support (IMF, etc.).

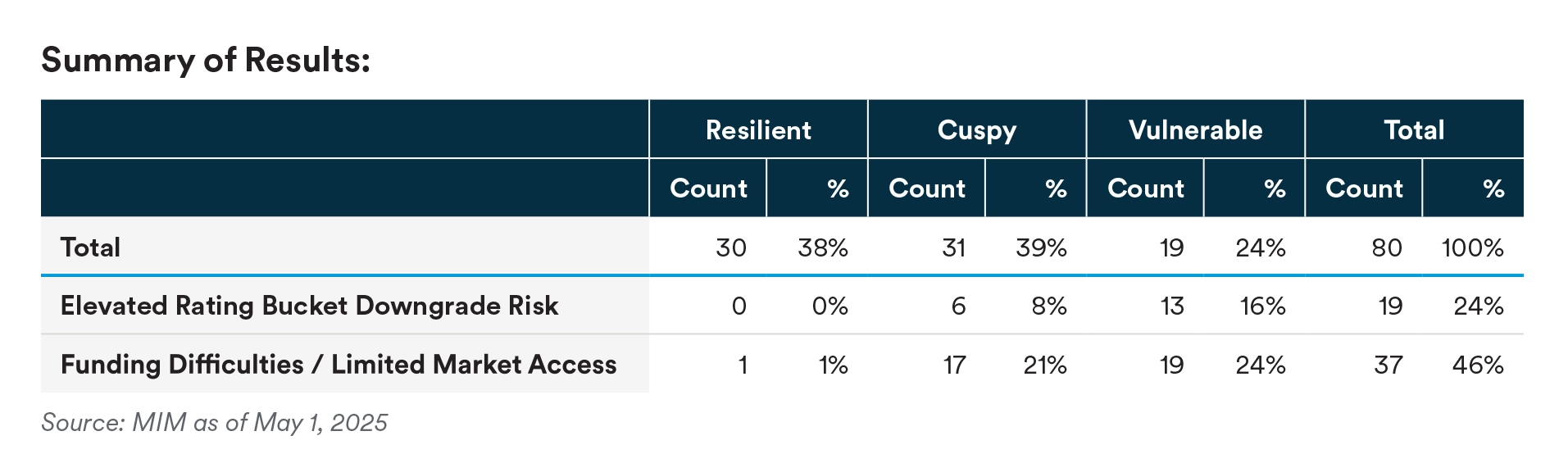

Our analysis revealed that 30 of the 80 EM countries (38%) are resilient and would not experience impactful ratings migration or funding stress. By quality, as one would expect, higher quality tends to be more resilient. In our study, we conclude that 73% of all investment-grade (IG) countries are resilient, versus only 20% of the high-yield (HY) universe. Alternatively, among vulnerable countries, a mere 8% of IG countries were labeled as vulnerable, versus 31% of HY names.

Our analysis suggests that the stress scenario would increase the risk of significant credit rating downgrades in 19 countries, even while the actual timing of the downgrades may play out over a longer period. Some IG-rated issuers would face increased risk of becoming Fallen Angels (e.g., Mexico, Romania, Panama, Hungary), while a few BB sovereigns would risk falling into single-B territory (e.g., South Africa). A number of lower-rated countries, including Ecuador, Gabon, Ukraine, Maldives, Angola, Cameroon, and Senegal, would face elevated default risk.

A country having higher funding needs, in and of itself, does not signify funding distress. Countries with low debt or high fiscal credibility tend to preserve access to markets during times of stress, even if the amounts are significantly larger than during normal times. This is often true in IG-rated sovereigns, where only 8% of the countries in our assessment would face actual funding constraints. However, approximately 65% of high-yield sovereigns would have an issue tapping the market if they needed to. Countries such as Angola, Kenya, Senegal, Ecuador, and Colombia may find access particularly strained or prohibitively expensive.

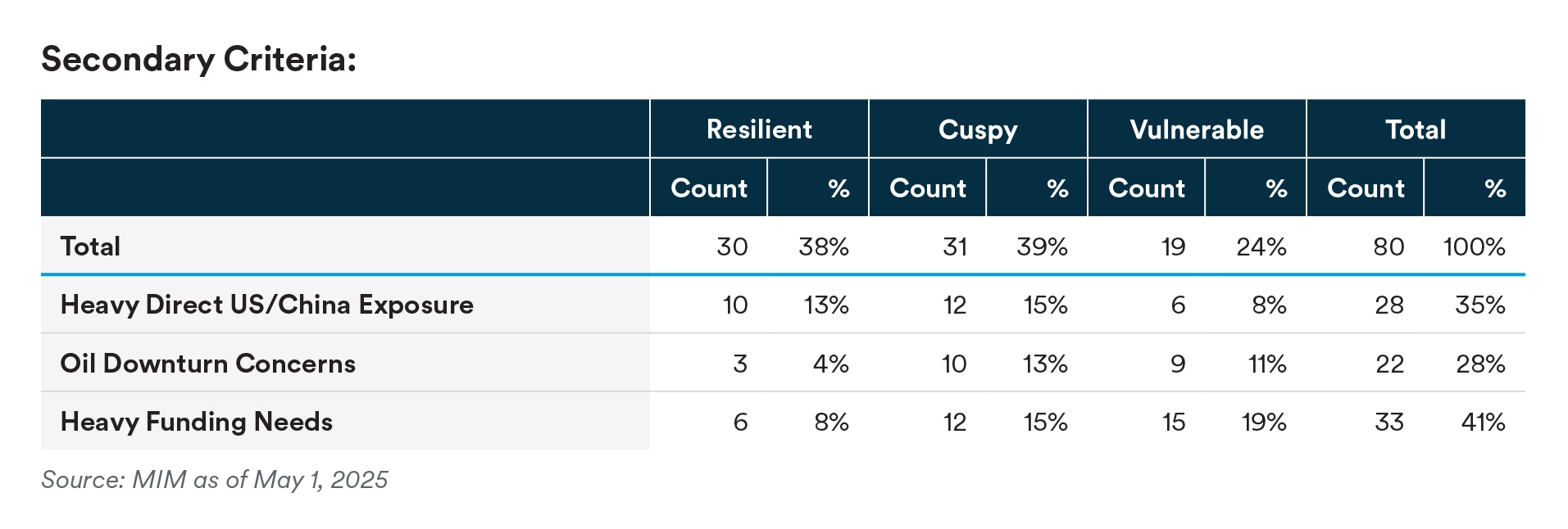

Interestingly, direct exposure to the U.S. and/or China is relatively low in EM, with just 35% of the analyzed countries affected. Of these, there is a skew toward HY countries, but more notable is the regional impact. Latin American countries see the heaviest effect given closer relations between the U.S. and Central American/Caribbean countries including Bahamas, Costa Rica, and Jamaica. Meanwhile, South American countries tend to have closer linkages to China through commodity exports, including some of the region’s bigger economies such as Peru, Mexico, and Brazil.

Given the dependence of some of these countries’ economies on oil exports, we believe that this is an impactful risk factor during this cycle. Out of the 80 countries analyzed, 29 are oil exporters. However, not all oil exporters would be deemed vulnerable in this environment, as some have low production costs, very low debt, or large savings resources to draw down during a shock. We identified seven such names in our survey, leaving 22 others that are indeed vulnerable to oil price decline, representing 28% of the EMBI Global Diversified universe2. Latin American countries are most at risk, with nine of the 21 countries analyzed flagging for this metric, including Suriname, Ecuador, and Colombia.

The economic shock we are envisioning would tend to significantly increase funding needs relative to a normal market environment for 41% of countries, based on our analysis. Notably, these issuers are roughly split between IG (38%) and HY (42%). However, on a regional basis, there is a skew toward Middle East and Africa sovereigns, with 17 of the 29 facing heavy funding needs (mostly oil exporters), spreading across the rating spectrum from Gabon and Nigeria in the single-B and below space—all the way up to Abu Dhabi, Qatar, and Israel in the single-A and above rating bucket.

We always strive to adapt to an evolving global landscape and incorporate new risk factors within our process and in portfolios as seamlessly as possible. Given the current state of trade frictions, most notably between China and the U.S., it feels prudent to go through an exercise to identify new fragilities that will affect every economy in the world through a variety of channels. With a complete framework, we can make portfolio adjustments that feel measured and prudent, which could include investing with greater conviction in the more resilient sovereign issuers, as well as interesting alpha opportunities within the cuspy bucket. This may be seen through underweighting names that become more vulnerable, while overweighting countries that implement policies to help them become more resilient.

Contributors: David Richter, Felipe Perigo, Jose Antonio del Rosal, Svetla Atanasova, Thaddeus Best

Endnotes

1 A significant rating downgrade is a decrease in rating “bucket”, for example from BBB to BB

2 Source: JP Morgan

Disclaimer

This material is intended solely for Institutional Investors, Qualified Investors and Professional Investors. This analysis is not intended for distribution with Retail Investors.

This document has been prepared by MetLife Investment Management (“MIM”)1 solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Property is a specialist sector that may be less liquid and produce more volatile performance than an investment in other investment sectors. The value of capital and income will fluctuate as property values and rental income rise and fall. The valuation of property is generally a matter of the valuers’ opinion rather than fact. The amount raised when a property is sold may be less than the valuation. Furthermore, certain investments in mortgages, real estate or non-publicly traded securities and private debt instruments have a limited number of potential purchasers and sellers. This factor may have the effect of limiting the availability of these investments for purchase and may also limit the ability to sell such investments at their fair market value in response to changes in the economy or the financial markets.

In the U.S.: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities Exchange Commission registered investment adviser. MIM, LLC is a subsidiary of MetLife, Inc. and part of MetLife Investment Management. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment advisor.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being issued by MetLife Investments Asia Limited (“MIAL”), a part of MIM, and it has not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”). MIAL is licensed by the Securities and Futures Commission for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.

1 As of March 31, 2025, subsidiaries of MetLife, Inc. that provide investment management services to MetLife’s general account, separate accounts and/or unaffiliated/third party investors include Metropolitan Life Insurance Company, MetLife Investment Management, LLC, MetLife Investment Management Limited, MetLife Investments Limited, MetLife Investments Asia Limited, MetLife Latin America Asesorias e Inversiones Limitada, MetLife Investment Management Japan, Ltd., MIM I LLC, MetLife Investment Management Europe Limited and Affirmative Investment Management Partners Limited.