Investors would be forgiven for worrying that credit issues may be looming. Recent isolated but high-profile bankruptcies have raised alarms that more such “cockroaches” may be hiding in the banking and private credit sectors — and have spawned fears of a more widespread “termite problem” eating away at the underlying financial system. Yet we think concern about these potential bugs in the system are likely overblown, and that the credit problems are indeed idiosyncratic and not a broader systemic concern. The one apparent common thread relates to the utilization of structured asset-backed and off-balance-sheet financings.

Our more optimistic, if still cautious, view is that credit markets and their infrastructure remain solid and will be buoyed by improving economic conditions in 2026, driven by supportive fiscal and monetary policy, U.S. tax cuts and deregulation, and, critically, ongoing AI expansion — a key area to watch.

While current tight valuations can limit upside potential in fixed income in 2026, we believe investors should stay calm and stay invested, focusing on maintaining yield and carry in portfolios rather than seeking outsized excess returns. That said, we think it’s critical to maintain a level of dry powder to deploy in the event that a pullback creates compelling opportunities.

Here we share our views on what investors should be watching across fixed income markets in 2026.

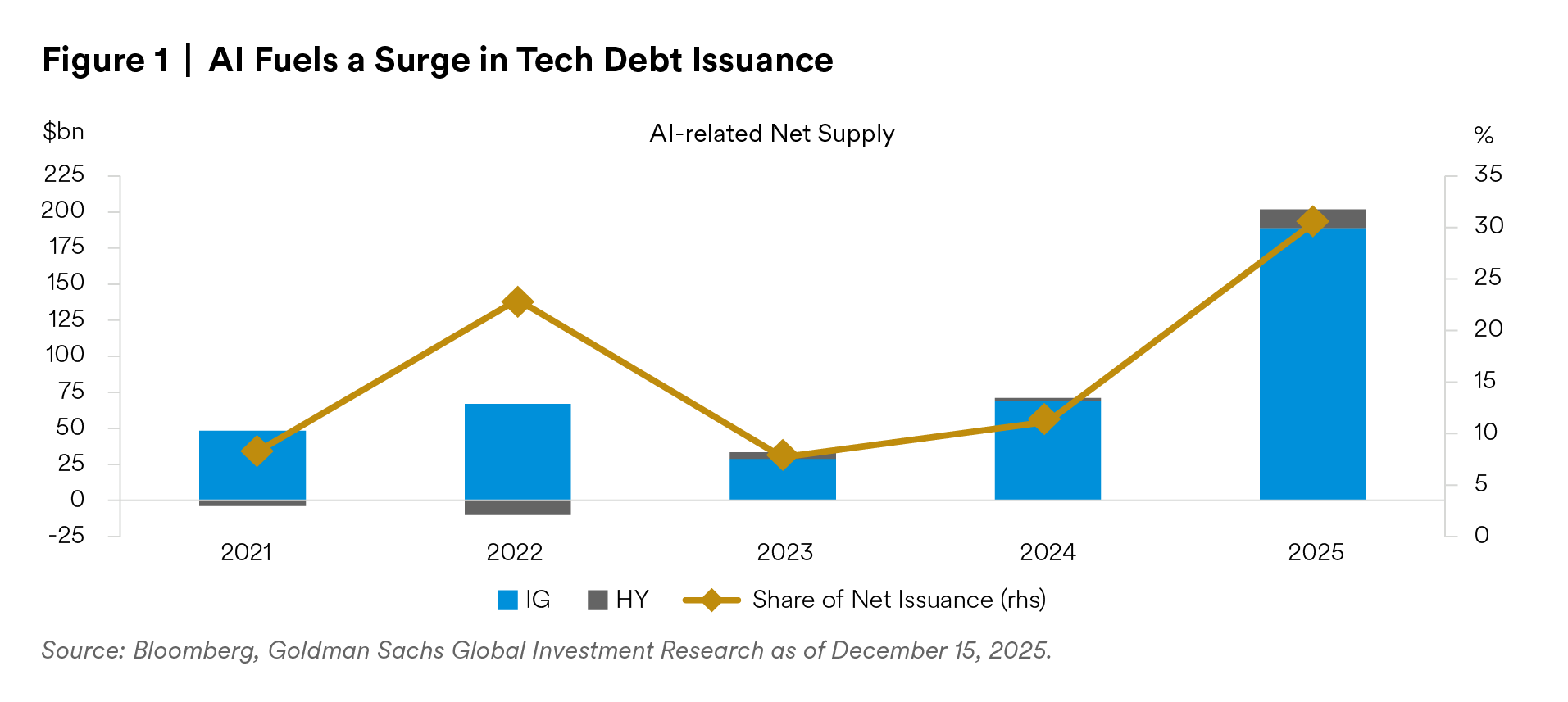

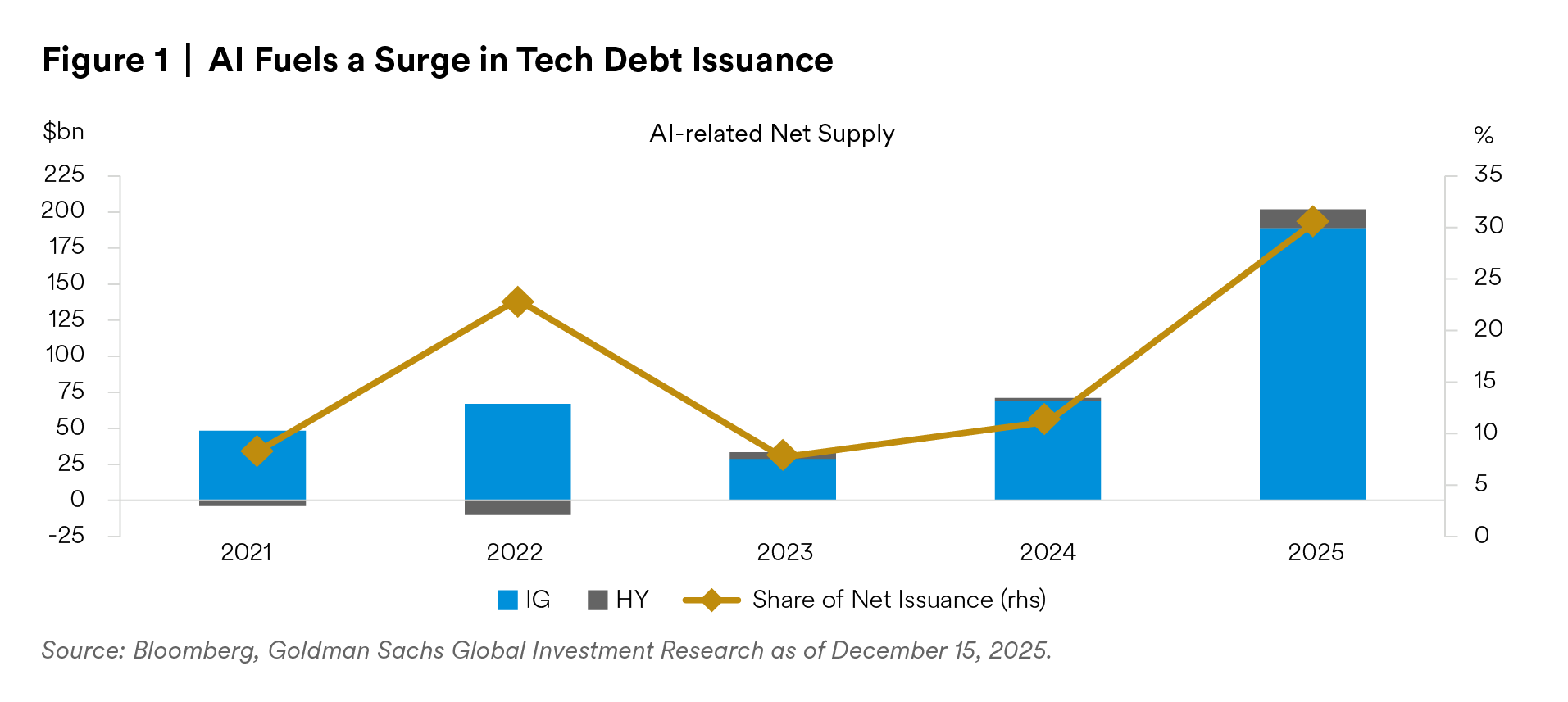

We have recently witnessed a marked shift within investment grade (IG) issuance, from the financial companies that had long dominated the market to a steep rise in tech-oriented issuers. Big Tech is beginning to fund AI build-outs with debt (particularly at the very long end) rather than relying solely on internal cash flow — a trend that could continue among technology titans and introduce correlation risk with equities due to the concentrated nature of AI investments. The explosion in AI-related issuance introduces both challenges and opportunities for investors, requiring careful fundamental security selection to identify the winners and to manage the increased risk, and we expect this theme to gain prominence as tech becomes a much larger part of the U.S. IG index.

Looking into 2026, we favor maintaining investment grade (IG) credit exposure at more neutral levels, particularly in the intermediate portion of the U.S. IG curve, which we prefer over longer durations. While U.S. credit and its underlying fundamentals have long been viewed as superior to other developed markets, the differential has been shrinking — and given the tight valuations, we think it prudent to reduce any substantial overweights to the U.S. and move toward more neutral exposures. Furthermore, the favorable credit profile and stability of investment grade, emerging market corporates could make such allocations a de-risking proposition on a strategic basis over the medium term, contrary to the false perception that they add risk.

Indeed, investors may be well served to diversify beyond U.S. government debt to include U.K. gilts, long-end Japanese government bonds, and select European and emerging market local currencies — particularly in Latin America (Brazil, Colombia, Mexico and Chile). EM investment grade debt has outperformed in 2025 and remains relatively cheap going into next year, which suggests it could offer select opportunities for attractive excess returns compared to pure U.S. credit. Notably, the banking sector across emerging markets is generally well-positioned to withstand downside risks in the global economy, and while rate cuts have reduced profitability, these cuts factor into a stable economic outlook that supports loan quality and liquidity across the system.

Our outlook on leveraged finance is broadly neutral, with high yield bonds and leveraged loans fairly valued overall, and we continue to emphasize balanced and diversified risk exposure. We believe it’s important for investors to maintain some dry powder that can be deployed opportunistically during potential market pullbacks — for instance, by holding assets such as single-A-rated CLO tranches, which offer yields comparable to those of BB-rated high yield bonds but with lower credit risk.

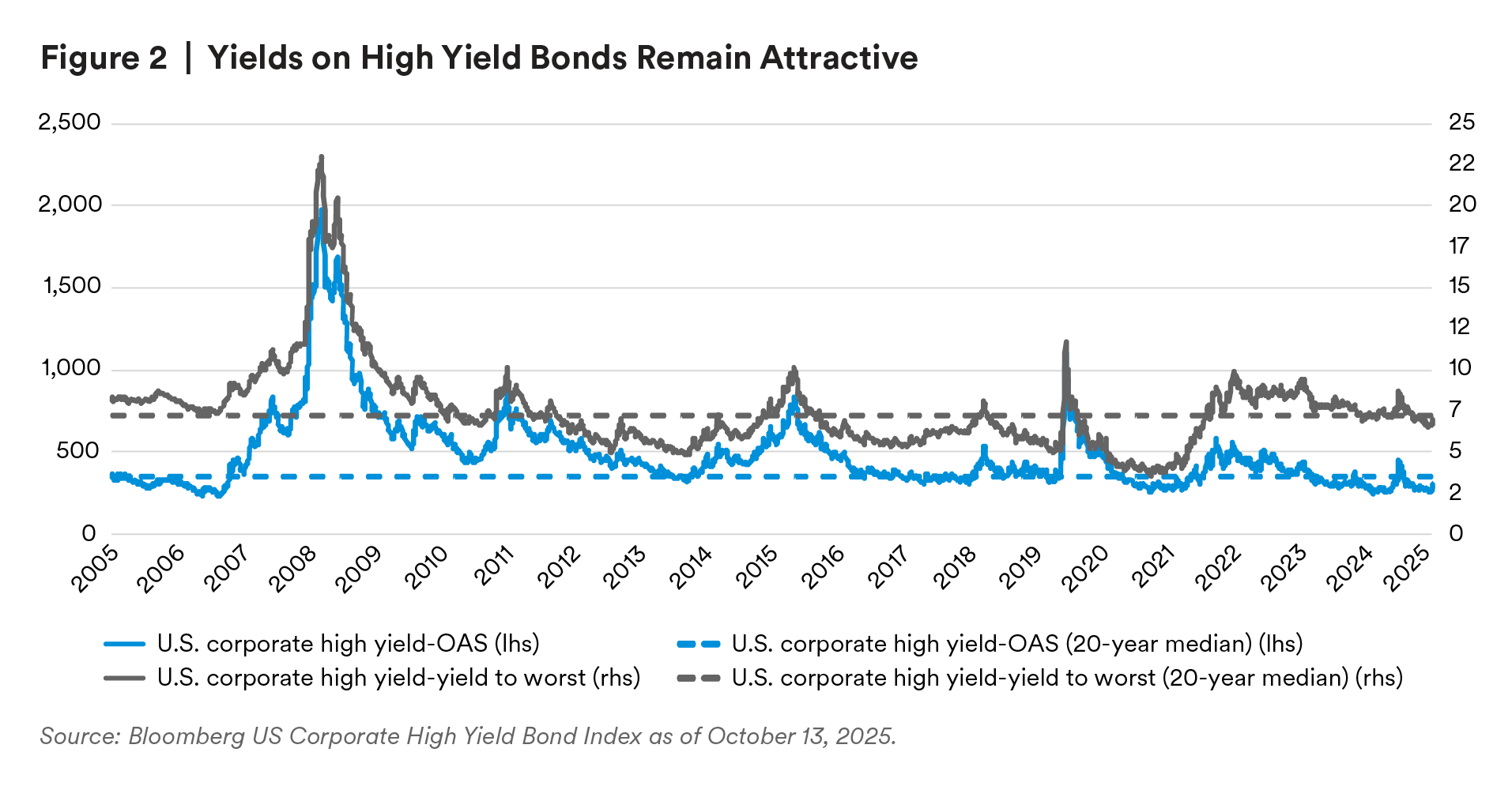

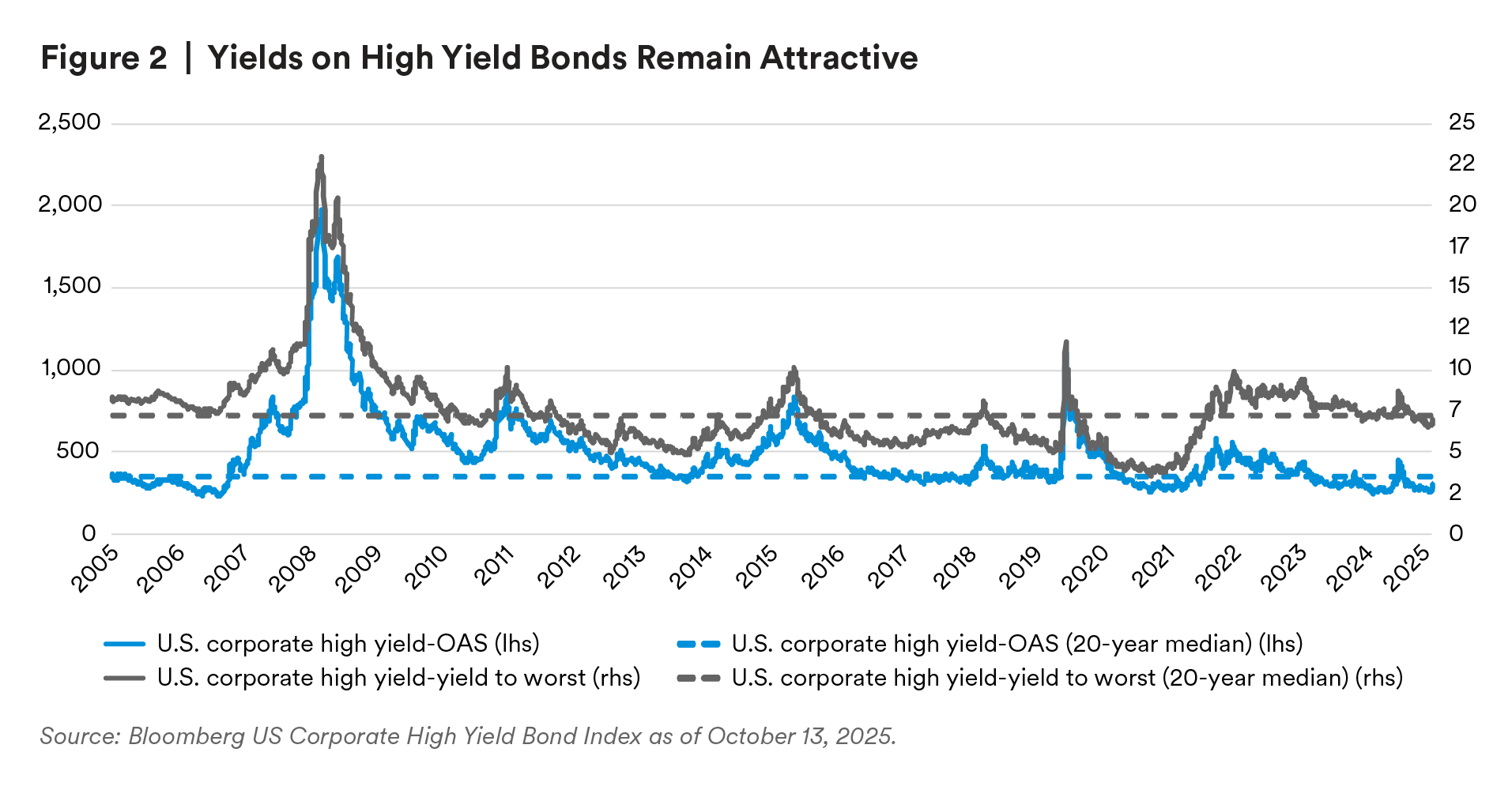

We believe high yield bonds remain an attractive asset class in a diversified portfolio, with all-in yields adequately compensating investors for credit risk amid moderate default expectations. We view valuations as broadly fair in the context of our 2026 economic outlook, which would be supportive of reasonably tight valuations.

High yield continues to offer attractive risk-adjusted yields relative to equities, where price/earnings ratios remain elevated; volatility is likely to persist; and earnings growth and capital expenditures are concentrated in a small cohort of companies. With its more compelling yields, we view the belly of the high yield market — low-BB to mid-B-rated bonds — as a sweet spot for investors, and we believe default risk remains low in aggregate and is concentrated in select companies and industries facing secular or structural pressures.

We are becoming more cautious on issuers tied to lower-income consumers, which may experience more pressure in the current K-shaped economy. Overall, we expect positive, carry-based total returns for high yield bonds (but muted excess returns) and believe defaults could tick a bit higher in 2026, albeit from low current levels.

Leveraged loan issuer fundamentals remain relatively stable, with leverage and other credit metrics on a healthy footing after multiple quarters of stable revenue and earnings growth. That said, performance for the asset class could be susceptible to shifts in top-down views on the economy’s expected trajectory due to the growth in the mid-to-low single-B segment of the market. However, the default rate, including liability management exercises (LMEs), are expected to dip slightly in 2026, and issuer fundamentals will be aided by recent and expected Fed rate cuts. However, this will reduce coupon yields and erode the current yield advantage over comparably rated high yield bonds.

The increasing dominance of CLO-related demand for loans also results in a demand gap for issuers that are downgraded to CCC, along with the emergence of a K-shaped market appetite for loans. If loan spreads were to widen more broadly — for instance, as a result of severely negative sentiment related to the job market or consumer health — we would expect increased opportunities to generate alpha through credit selection. However, any downside surprises in economic activity versus current forecasts would most likely justify further rate cuts, providing additional relief for issuer fundamentals.

While loans underperformed other fixed income assets in 2025 due to the lack of yield curve benefit, our expectation is that loans will be among the top fixed income assets once again in 2026.

In European loans and high yield, the underlying picture is more nuanced, with dispersion widening as the market increasingly splits between resilient issuers and a growing tail of credits under pressure. Weakness is most evident in sectors such as chemicals and building materials, where earnings softness persists, and among highly leveraged names facing the prospect of a default or LME. Yet despite increasing idiosyncratic volatility, we expect the broader market to continue to tick along steadily, and limited refinancing pressure should keep defaults contained. European loans plot as among the most attractive fixed income assets for 2026, but challenging liquidity and negative convexity for a sizable portion of the market persist.

We believe CLOs offer attractive opportunities to maintain carry relative to other equivalently rated, fixed income assets amid current conditions. Institutional demand for CLOs remains robust, and CLO ETFs saw more than 20 consecutive weeks of inflows through mid-October before experiencing some reversals heading into year-end. Despite likely headline-driven volatility in the coming months, we believe risks are balanced, though tight valuations tilt us toward an incrementally more defensive bias. We believe a nimble and robust bottom-up approach to security selection is paramount, given the dispersion in the loan market, in which certain CLO portfolios holding weaker credits may eventually experience impairments to the lowest-rated debt tranches — which could result in attractive opportunities to move down the capital stack.

Fixed income markets tend to thrive in periods of low and steady growth, without extremes — conditions that align with our supportive central-case scenario for 2026.

While we will be keeping an eye to structural shifts and emerging risks in credit markets — particularly the impact of AI-related issuance and stress in lower-income segments — we think investors need not be alarmed by idiosyncratic credit issues, or fear that they portend a credit cycle explosion. We view such an outcome as highly unlikely barring a major economic downturn (which we likewise don’t expect).

In a market that we view as fairly priced and stable, fixed income investors will benefit from a cautious but constructive approach that balances yield retention with diversification across geographies and sectors.

Disclaimer

MetLife Investment Management ("MIM"), which includes PineBridge Investments, is MetLife, Inc.'s institutional investment management business. MIM is a group of international companies that provides investment advice and markets asset management products and services to clients around the world. The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risk, including possible loss of principal; no guarantee is made that investments will be profitable. This document is solely for informational purposes and does not constitute a recommendation regarding any investments or the provision of any investment advice, or constitute or form part of any advertisement of, offer for sale or subscription of, solicitation or invitation of any offer or recommendation to purchase or subscribe for any securities or investment advisory services. The views expressed herein are solely those of MIM and do not necessarily reflect, nor are they necessarily consistent with, the views held by, or the forecasts utilized by, the entities within the MetLife enterprise that provide insurance products, annuities and employee benefit programs. The information and opinions presented or contained in this document are provided as of the date it was written. It should be understood that subsequent developments may materially affect the information contained in this document, which none of MIM, its affiliates, advisors or representatives are under an obligation to update, revise or affirm. It is not MIM’s intention to provide, and you may not rely on this document as providing, a recommendation with respect to any particular investment strategy or investment. Affiliates of MIM may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives) of any company mentioned herein. Views may be based on third-party data that has not been independently verified. MIM does not approve of or endorse any republication of this material. This document may contain forward-looking statements, as well as predictions, projections and forecasts of the economy or economic trends of the markets, which are not necessarily indicative of the future. Any or all forward-looking statements, as well as those included in any other material discussed at the presentation, may turn out to be wrong.

The various global teams referenced in this document, including portfolio managers, research analysts and traders are employed by the various legal entities that comprise MIM.

All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results.

For investors in the U.S: This document is communicated by MetLife Investment Management, LLC (MIM, LLC), a U.S. Securities and Exchange Commission (SEC) registered investment adviser. Registration with the SEC does not imply a certain level of skill or that the SEC has endorsed the investment adviser.

For investors in the UK: This document is being distributed by MetLife Investment Management Limited (“MIML”), authorised and regulated by the UK Financial Conduct Authority (FCA reference number 623761), registered address One Angel Lane 8th Floor London EC4R 3AB United Kingdom. This document is approved by MIML as a financial promotion for distribution in the UK. This document is only intended for, and may only be distributed to, investors in the UK who qualify as a “professional client” as defined under the Markets in Financial Instruments Directive (2014/65/EU), as per the retained EU law version of the same in the UK.

For investors in the Middle East: This document is directed at and intended for institutional investors (as such term is defined in the various jurisdictions) only. The recipient of this document acknowledges that (1) no regulator or governmental authority in the Gulf Cooperation Council (“GCC”) or the Middle East has reviewed or approved this document or the substance contained within it, (2) this document is not for general circulation in the GCC or the Middle East and is provided on a confidential basis to the addressee only, (3) MetLife Investment Management is not licensed or regulated by any regulatory or governmental authority in the Middle East or the GCC, and (4) this document does not constitute or form part of any investment advice or solicitation of investment products in the GCC or Middle East or in any jurisdiction in which the provision of investment advice or any solicitation would be unlawful under the securities laws of such jurisdiction (and this document is therefore not construed as such).

For investors in Japan: This document is being distributed by MetLife Investment Management Japan, Ltd. (“MIM JAPAN”), a registered Financial Instruments Business Operator (“FIBO”) conducting Investment Advisory Business, Investment Management Business and Type II Financial Instruments Business under the registration entry “Director General of the Kanto Local Finance Bureau (Financial Instruments Business Operator) No. 2414” pursuant to the Financial Instruments and Exchange Act of Japan (“FIEA”), and a regular member of the Japan Investment Advisers Association and the Type II Financial Instruments Firms Association of Japan. In its capacity as a discretionary investment manager registered under the FIEA, MIM JAPAN provides investment management services and also sub-delegates a part of its investment management authority to other foreign investment management entities within MIM in accordance with the FIEA. This document is only being provided to investors who are general employees’ pension fund based in Japan, business owners who implement defined benefit corporate pension, etc. and Qualified Institutional Investors domiciled in Japan. It is the responsibility of each prospective investor to satisfy themselves as to full compliance with the applicable laws and regulations of any relevant territory, including obtaining any requisite governmental or other consent and observing any other formality presented in such territory. As fees to be borne by investors vary depending upon circumstances such as products, services, investment period and market conditions, the total amount nor the calculation methods cannot be disclosed in advance. All investments involve risks including the potential for loss of principle and past performance does not guarantee similar future results. Investors should obtain and read the prospectus and/or document set forth in Article 37-3 of Financial Instruments and Exchange Act carefully before making the investments.

For Investors in Hong Kong S.A.R.: This document is being distributed by MetLife Investments Asia Limited (“MIAL”), licensed by the Securities and Futures Commission (“SFC”) for Type 1 (dealing in securities), Type 4 (advising on securities) and Type 9 (asset management) regulated activities in Hong Kong S.A.R. This document is intended for professional investors as defined in the Schedule 1 to the SFO and the Securities and Futures (Professional Investor) Rules only. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are licensed by the SFC to carry on regulated activities in Hong Kong S.A.R. The information contained in this document is for information purposes only and it has not been reviewed by the Securities and Futures Commission.

For investors in Australia: This information is distributed by MIM LLC and is intended for “wholesale clients” as defined in section 761G of the Corporations Act 2001 (Cth) (the Act). MIM LLC exempt from the requirement to hold an Australian financial services license under the Act in respect of the financial services it provides to Australian clients. MIM LLC is regulated by the SEC under US law, which is different from Australian law.

For investors in the EEA: For investors in the EEA, this document is being distributed by MetLife Investment Management Europe Limited (“MIMEL”), authorised and regulated by the Central Bank of Ireland (registered number: C451684), registered address 20 on Hatch, Lower Hatch Street, Dublin 2, Ireland. This document is approved by MIMEL as marketing communications for the purposes of the EU Directive 2014/65/EU on markets in financial instruments (“MiFID II”). Where MIMEL does not have an applicable cross-border licence, this document is only intended for, and may only be distributed on request to, investors in the EEA who qualify as a “professional client” as defined under MiFID II, as implemented in the relevant EEA jurisdiction. The investment strategies described herein are directly managed by delegate investment manager affiliates of MIMEL. Unless otherwise stated, none of the authors of this article, interviewees or referenced individuals are directly contracted with MIMEL or are regulated in Ireland. Unless otherwise stated, any industry awards referenced herein relate to the awards of affiliates of MIMEL and not to awards of MIMEL.